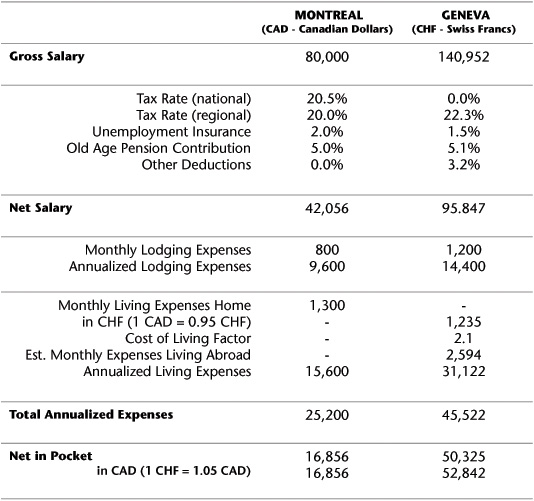

Table B.1 Example of Using the Cost-of-Living Calculator

The appendix gives you a basic tool to compare the real value of salary offers in two cities by taking into account differences in tax structures and the cost of living. In Table B.1, I use two cities I lived in as an example, with Montreal acting as the “home” city and Geneva as the “host,” but you can easily substitute places relevant to your move. The following sections describe each of the items in the table. Because the main challenge is not making the calculation but rather collecting all the information, I indicate possible sources for each item. I used the metric system for the calculations since it is commonly used around the world and makes an easier basis for comparison.

Gross salary. Usually your employer will give you this information in your contract. However, if you are trying to estimate before getting the details of your offer, especially as a new hire, you can consider looking at the salary data provided by the leading business school in the region you are heading to. Most business schools provide a detailed online report of the salaries their last year’s graduates are earning and organize it by country and industry. For the purposes of this exercise, I used salary data from INSEAD 2003 placement reports (www.insead.edu/mba/careers/fulltimejobs.htm) to estimate the income in Geneva (the data is for Switzerland in general), and 2003 employment statistics from McGill Management (www.mcgill.ca/management/career/mba/stats) to estimate the income in Montreal.

Gross salary. Usually your employer will give you this information in your contract. However, if you are trying to estimate before getting the details of your offer, especially as a new hire, you can consider looking at the salary data provided by the leading business school in the region you are heading to. Most business schools provide a detailed online report of the salaries their last year’s graduates are earning and organize it by country and industry. For the purposes of this exercise, I used salary data from INSEAD 2003 placement reports (www.insead.edu/mba/careers/fulltimejobs.htm) to estimate the income in Geneva (the data is for Switzerland in general), and 2003 employment statistics from McGill Management (www.mcgill.ca/management/career/mba/stats) to estimate the income in Montreal.

Taxes. You should be able to get information on the tax structure from your employer, from your relocation consultant, or from your country’s embassy or consulate in the host country. I found the Canadian and Swiss tax information online. In Canada, income tax is collected by both the federal government (20.5% on a salary of $80,000) and the provincial government (20% on the same). In Switzerland, income tax for foreigners is only collected by the Cantonal (regional) authorities, and it amounts to 22.3% on a salary of 140,000 CHF. While both countries automatically deduct unemployment and old age pension benefits from the paycheck (the rates are available online), it is important to note one major difference: Canadian taxes include health insurance, while in Switzerland this must be purchased from a private provider.

Taxes. You should be able to get information on the tax structure from your employer, from your relocation consultant, or from your country’s embassy or consulate in the host country. I found the Canadian and Swiss tax information online. In Canada, income tax is collected by both the federal government (20.5% on a salary of $80,000) and the provincial government (20% on the same). In Switzerland, income tax for foreigners is only collected by the Cantonal (regional) authorities, and it amounts to 22.3% on a salary of 140,000 CHF. While both countries automatically deduct unemployment and old age pension benefits from the paycheck (the rates are available online), it is important to note one major difference: Canadian taxes include health insurance, while in Switzerland this must be purchased from a private provider.

Other deductions. These are everything you need to consider to arrive at a comparable Net Salary number. In this case, I included the amount I would have to spend on private health insurance in Switzerland, which is about 450 CHF/month with a 500 CHF annual deductible (for a person about 30 and in good health), or about 3.2 percent of the gross salary. This is information you could get from a relocation consultant in Geneva or by searching Swiss insurance companies online.

Other deductions. These are everything you need to consider to arrive at a comparable Net Salary number. In this case, I included the amount I would have to spend on private health insurance in Switzerland, which is about 450 CHF/month with a 500 CHF annual deductible (for a person about 30 and in good health), or about 3.2 percent of the gross salary. This is information you could get from a relocation consultant in Geneva or by searching Swiss insurance companies online.

Net salary. Only after having considered taxes and all the separate deductions do you arrive at a Net Salary figure that is actually comparable. Still, this is not the end of your calculations. You must also take into account the difference in the cost of living in your home and host countries before you can actually know what will remain in your pocket at the end of the day.

Net salary. Only after having considered taxes and all the separate deductions do you arrive at a Net Salary figure that is actually comparable. Still, this is not the end of your calculations. You must also take into account the difference in the cost of living in your home and host countries before you can actually know what will remain in your pocket at the end of the day.

Monthly lodging expenses. This is easiest to find out during your Look-See trip as you visit potential apartments. However, it is also quite easy to find on the Internet by searching the classified ads in a local paper. The numbers I use in my chart are the approximate monthly rents for a one-bedroom apartment in downtown Montreal and Geneva, including heating but excluding utilities such as phone, cable TV, Internet, electricity, and gas.

Monthly lodging expenses. This is easiest to find out during your Look-See trip as you visit potential apartments. However, it is also quite easy to find on the Internet by searching the classified ads in a local paper. The numbers I use in my chart are the approximate monthly rents for a one-bedroom apartment in downtown Montreal and Geneva, including heating but excluding utilities such as phone, cable TV, Internet, electricity, and gas.

Monthly living expenses at home. When trying to establish your monthly living expenses at home, it is useful to look at a period of time, ideally six months or a year. That ensures that you account for things you would probably forget to consider when creating a budget, like the cost of repairing your computer or dry cleaning a spaghetti stain off your leather pants. By far the easiest way is to take your annual net income, adjust it for any increase or decrease in savings, and divide by 12. If this is not feasible, then you can try tracking your spending for at least three months. This can be a useful exercise to do anyway, as it can give you a breakdown of your spending. In my case, living in Montreal was approximately $1,300 CAD, excluding rent.

Monthly living expenses at home. When trying to establish your monthly living expenses at home, it is useful to look at a period of time, ideally six months or a year. That ensures that you account for things you would probably forget to consider when creating a budget, like the cost of repairing your computer or dry cleaning a spaghetti stain off your leather pants. By far the easiest way is to take your annual net income, adjust it for any increase or decrease in savings, and divide by 12. If this is not feasible, then you can try tracking your spending for at least three months. This can be a useful exercise to do anyway, as it can give you a breakdown of your spending. In my case, living in Montreal was approximately $1,300 CAD, excluding rent.

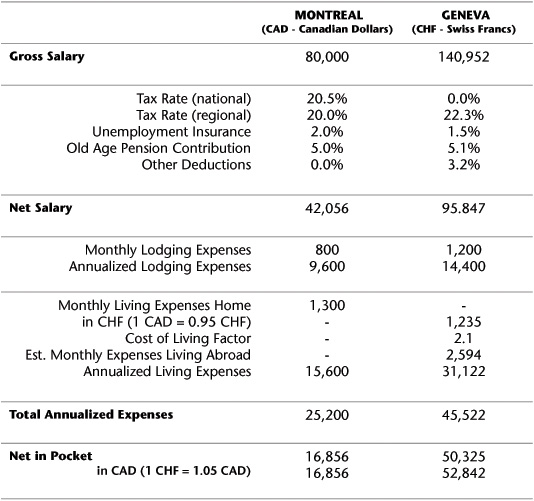

Cost of living factor. This item translates your monthly expenses at home into a reasonable number abroad. Many relocation companies provide this kind of data to employers, at a fee, for use in designing expat compensation packages. Unfortunately, if you are a new hire trying to evaluate a local offer abroad, you are not likely to have access to this information, so you have to devise your own way of comparing the cost of living between your home and host countries. My approach involves three pillars. The first pillar is the famous Big Mac index, a comparison of the cost of a Big Mac in countries across the world conducted by The Economist magazine. You can access the results online at www.economist.com/markets/Bigmac/Index.cfm. Table B.2 uses data from the May 2004 issue of The Economist. According to this, the cost of living in Switzerland is 2.1 times the cost of living in Canada.

Cost of living factor. This item translates your monthly expenses at home into a reasonable number abroad. Many relocation companies provide this kind of data to employers, at a fee, for use in designing expat compensation packages. Unfortunately, if you are a new hire trying to evaluate a local offer abroad, you are not likely to have access to this information, so you have to devise your own way of comparing the cost of living between your home and host countries. My approach involves three pillars. The first pillar is the famous Big Mac index, a comparison of the cost of a Big Mac in countries across the world conducted by The Economist magazine. You can access the results online at www.economist.com/markets/Bigmac/Index.cfm. Table B.2 uses data from the May 2004 issue of The Economist. According to this, the cost of living in Switzerland is 2.1 times the cost of living in Canada.

Table B.2 Comparing Costs of a Big Mac in Canada and Switzerland

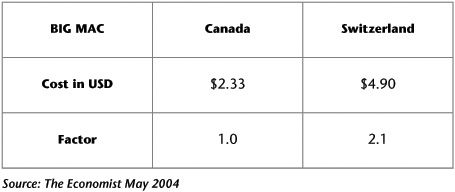

The second pillar involves getting a sense for the cost of labor or services. A good measure is the cost of a five km taxi ride in your home and host countries, which is very easy to do verify during your Look-See Trip. As you can see in Table B.3, according to this measure the cost of living in Geneva is 2.4 times that in Montreal, which reflects the high cost of labor in Switzerland. This means that services like getting a haircut, getting a pair of pants hemmed by a seamstress, or hiring a technician to repair your washing machine will be very expensive.

The second pillar involves getting a sense for the cost of labor or services. A good measure is the cost of a five km taxi ride in your home and host countries, which is very easy to do verify during your Look-See Trip. As you can see in Table B.3, according to this measure the cost of living in Geneva is 2.4 times that in Montreal, which reflects the high cost of labor in Switzerland. This means that services like getting a haircut, getting a pair of pants hemmed by a seamstress, or hiring a technician to repair your washing machine will be very expensive.

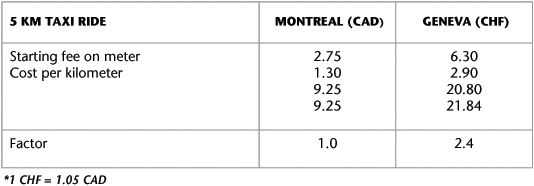

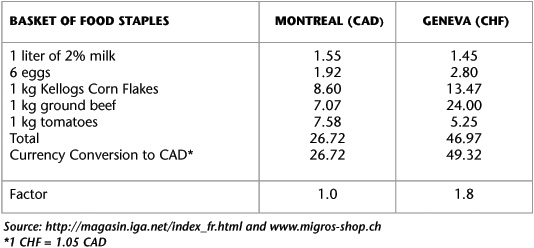

The final pillar involves getting an idea of the cost of groceries, both local and imported, for a cross-section of food types. Again, you can easily collect this data by visiting a food store on your Look-See trip. As you can see in Table B.4, the cost of living in Geneva is only 1.8 times that in Montreal.

The final pillar involves getting an idea of the cost of groceries, both local and imported, for a cross-section of food types. Again, you can easily collect this data by visiting a food store on your Look-See trip. As you can see in Table B.4, the cost of living in Geneva is only 1.8 times that in Montreal.

Table B.3 Comparing Taxi Rides in Montreal and Geneva

Table B.4 Comparing Costs of Groceries*

The final pillar involves getting an idea of the cost of groceries, both local and imported, for a cross-section of food types. Again, you can easily collect this data by visiting a food store on your Look-See trip. As you can see in Table B.4, the cost of living in Geneva is only 1.8 times that in Montreal.

The final pillar involves getting an idea of the cost of groceries, both local and imported, for a cross-section of food types. Again, you can easily collect this data by visiting a food store on your Look-See trip. As you can see in Table B.4, the cost of living in Geneva is only 1.8 times that in Montreal.

Averaging the Big Mac, taxi, and grocery factors arrives at a cost-of-living factor in Geneva that is about 2.1 times that in Montreal.

Averaging the Big Mac, taxi, and grocery factors arrives at a cost-of-living factor in Geneva that is about 2.1 times that in Montreal.

Estimated monthly living expenses abroad. This means that my monthly expenses in Montreal of about $1,300 (1,235 CHF, after currency conversion) translate to an estimated monthly spending of 2,594 CHF in Switzerland.

Estimated monthly living expenses abroad. This means that my monthly expenses in Montreal of about $1,300 (1,235 CHF, after currency conversion) translate to an estimated monthly spending of 2,594 CHF in Switzerland.

Annualized living expenses. Multiply the monthly living expenses in Montreal and Geneva by 12 to arrive at the annual figures (15,600 CAD and 31,122 CHF, respectively).

Annualized living expenses. Multiply the monthly living expenses in Montreal and Geneva by 12 to arrive at the annual figures (15,600 CAD and 31,122 CHF, respectively).

Total annualized expenses. Add the annualized lodging expenses to the annualized living expenses in Montreal and Geneva to arrive at the total annualized expenses (25,200 CAD and 45,522 CHF).

Total annualized expenses. Add the annualized lodging expenses to the annualized living expenses in Montreal and Geneva to arrive at the total annualized expenses (25,200 CAD and 45,522 CHF).

Net in pocket. Subtract the total annualized expenses from the net salary numbers to figure out how much will be left in your pocket at the end of the day. In my example in Table B.1, I wouldhave 16,856 CAD left in Montreal and 50,325 CHF left in Geneva (52,840 CAD after currency conversion). Clearly, it is more advantageous from a financial perspective to live in Switzerland.

Net in pocket. Subtract the total annualized expenses from the net salary numbers to figure out how much will be left in your pocket at the end of the day. In my example in Table B.1, I wouldhave 16,856 CAD left in Montreal and 50,325 CHF left in Geneva (52,840 CAD after currency conversion). Clearly, it is more advantageous from a financial perspective to live in Switzerland.