CHAPTER

17

TREASURER

CHAPTER CONTENTS

As treasurer, you are the officer entrusted with custody of the organization’s funds, which you spend only by authority of the society or as the bylaws provide. In many organizations, it is also your responsibility to bill and collect dues from members. [RONR (12th ed.) 47:38–39.]

B. TREASURER’S REPORT

At each meeting, the chair may ask for a “Treasurer’s Report,” which may consist of your oral statement of the cash balance on hand, or of this balance less outstanding obligations. No vote or other action is taken by the group on this sort of treasurer’s report.

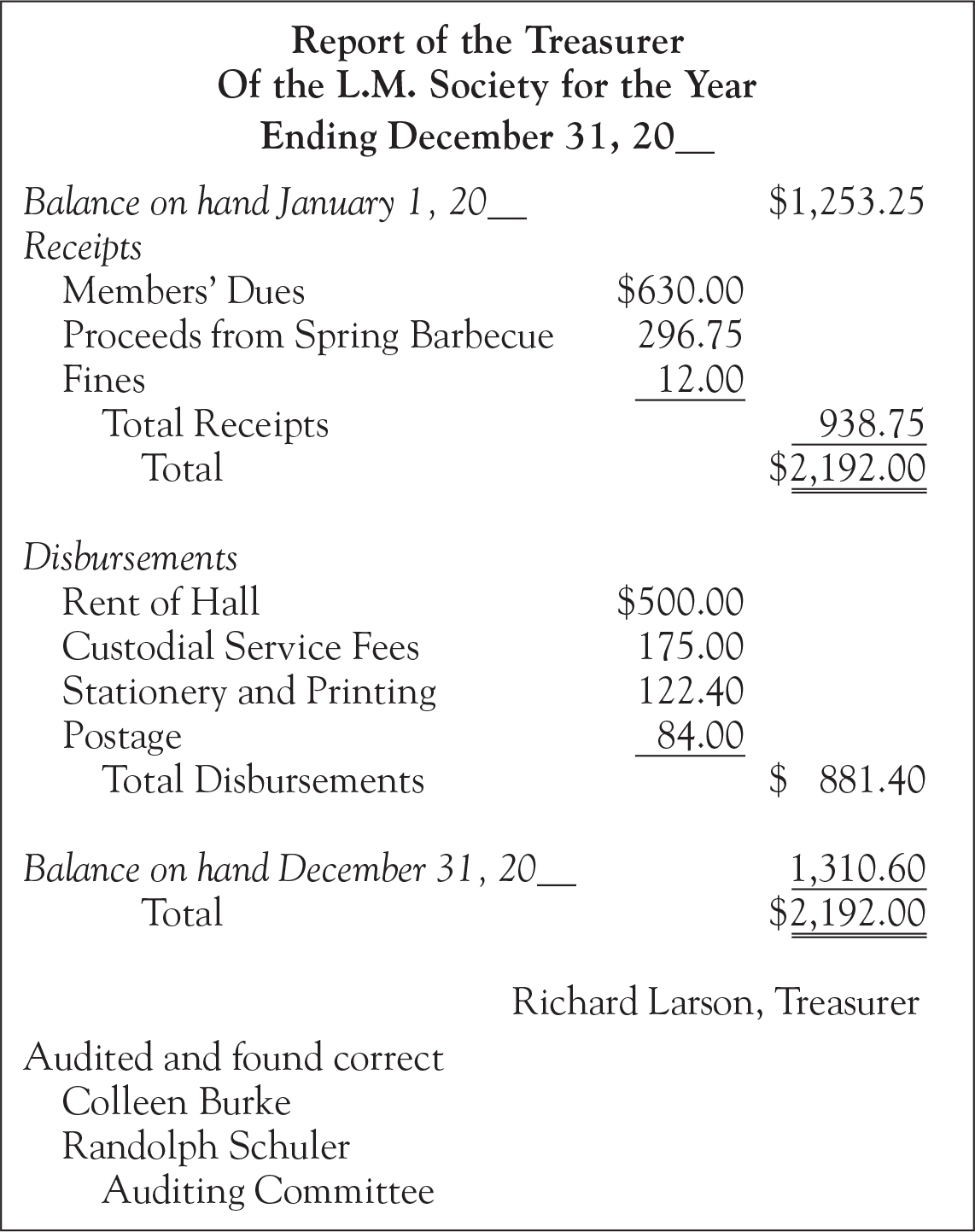

Annually, however, you must submit a full financial report, dated as of December 31 (unless the organization has a different “fiscal year,” in which case it is dated as of the last day of the fiscal year). For a small group with simple financial affairs primarily involving cash, a suitable form is illustrated on the next page. Of course, many other organizations use more complex bookkeeping systems, and then the sort of report submitted should be in accord with standard accounting procedures.

This annual report is referred to auditors, and the auditors’ report is submitted to the assembly for a vote of approval. An unaudited treasurer’s report is itself never directly subject to action by the assembly, except to be referred to the auditors. [RONR (12th ed.) 48:20–24.]

In many organizations, audits are done by independent certified public accountants (CPAs). An audit is an examination and verification of the treasurer’s accounts and financial statements. In those whose size or nature does not justify the expense of audit by CPAs, an auditing committee of two or more members is created to examine the financial accounts and certify whether the treasurer’s report based upon them is correct. This may either be a standing committee or a special committee created each year.

It is preferable to provide your annual report to the auditors for them to complete their review before the annual or other meeting at which you give it to the assembly. In that case, if they find no irregularities, it is endorsed “Audited and found correct” with the names of the members of the auditing committee, and you read out this certification as you conclude your presentation. The chair then immediately states the question on adopting the auditors’ report. Its approval by the assembly relieves you of responsibility for the period covered by the report, except in case of fraud.

If, instead, you present an unaudited annual report, the chair, without waiting for a motion, says, “The report is referred to the Auditing Committee [or “to the auditors”].” If no auditing committee or auditors have been previously selected, however, the assembly then adopts a motion to refer the report to an auditing committee, specifying how it is to be appointed. When the committee has finished its work, its chairman submits the committee report to the assembly, which then votes whether or not to approve it. [RONR (12th ed.) 48:24–26.]