15.6 Invoice Verification

In the Invoice Verification component (MM-IV), you compare the conditions of the purchase order with the invoice you received from the vendor with an eye for content, price, and figures. The SAP system determines possible deviations, which must then be coordinated with the vendor. The material document of the goods receipt tells you which quantities were actually delivered. The following conditions must be met to perform ideal invoice verification:

- A purchase order is created in the SAP system.

- Goods receipt is posted in the SAP system.

- The vendor’s invoice is available.

The SAP system has three types of invoice verification:

-

PO-based invoice verification

In this case, all items of the preceding purchase order are settled. A goods receipt isn’t necessary. -

GR-based invoice verification

Here, every goods receipt is settled separately. -

Invoice verification without purchase order reference

No preceding document exists in this process, so after invoice verification, a post is made directly to a material account, fixed asset account, or G/L account. Consider, for example, a purchase order by telephone, which doesn’t directly enter a purchase order into the SAP system without additional steps.

Let's use a short example to understand invoice verification. The data from the previous purchase order example is used here.

Follow these steps:

- Start Transaction MIRO by entering it in the command field or selecting Logistics • Materials Management • Logistics Invoice Verification • Document Entry • Enter Invoice.

-

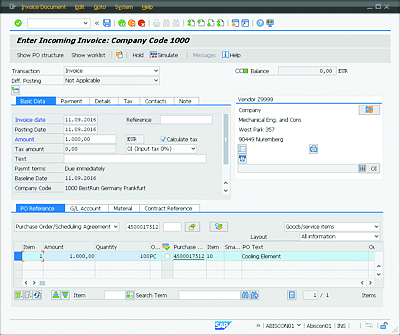

Enter the following information in the invoice verification:

- Invoice date: invoice document (current date; here “11.09.2016”)

- Amount: gross amount of invoice (here “1.000,00” EUR)

- Tax amount: 0I (Input tax 0%)

- Enter the document number of the entered purchase order in the Purchase Order/Scheduling Agreement field on the PO Reference tab.

-

Press (Enter), and make sure that the indicator 0I (input tax 0%) is set for the item (Figure 15.23).

Figure 15.23 Invoice Verification

-

If you get a balance of 0.00 EUR, no deviations were found, and you can post the invoice by clicking the Save

button. The message Document No. 5105608681 has been added is displayed in this example.

button. The message Document No. 5105608681 has been added is displayed in this example.

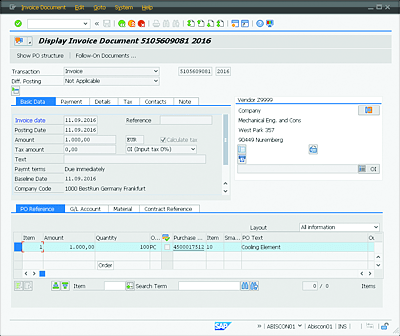

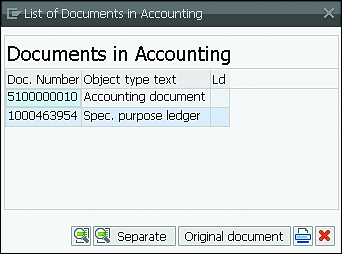

Invoice verification results in two documents: logistics invoice document (see Figure 15.24) and accounting document (Figure 15.25).

Figure 15.24 Invoice Document (Transaction MIR4)

Figure 15.25 Accounting Document

[»] Display Invoice Document Again

Using Transaction MIR4, you can display the invoice document again. From there, you can also navigate to the accounting document.

IV-MM is closely integrated with the adjacent components, FI and CO. It forwards the information required to settle the invoice amount and to post to FI and CO.

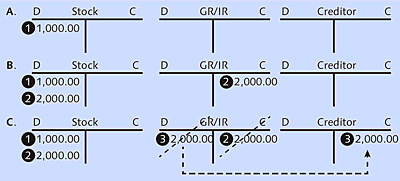

Sometimes goods are delivered for which no invoice exists yet, and sometimes the goods haven’t been delivered yet when the invoices are received. In this case, a goods receipt/invoice receipt clearing account (GR/IR account) is used. After the missing goods or invoices are received, the GR/IR account is credited. The corresponding items aren’t cleared.

Let’s discuss an example to clarify this (Figure 15.26):

-

A. Initial Situation

The opening balance of the material stock account 1 is $1,000. -

B. Goods receipt for purchase order

Goods are ordered for another $1,000, and goods receipt occurs. The material stock account 2 and the GR/IR account 2 are posted to. -

C. Invoice receipt (invoice verification)

After the invoice has been entered, the GR/IR account is cleared, and the vendor account receives the posts until it, too, is cleared after the outgoing payments of accounts payable accounting are made.Figure 15.26 Account Movements for Goods Receipt and Invoice Receipt

The invoice of the vendor is entered into the SAP system. It doesn’t have any deviations from the purchase order, and the correct materials were delivered in the correct quantity. The GR/IR account 3 is cleared, and the vendor account 3 is posted to. The vendor account is cleared when the invoice is paid.