17 SAP ERP Financials

Everything started with financial accounting! The SAP ERP Financials (FI) component that was developed in the 1970s is the first and oldest SAP software product. This chapter introduces financial accounting with SAP and the central component.

This chapter discusses the following:

- Primary tasks of FI

- Critical organizational structures

- SAP General Ledger (G/L) accounting functions

- Managing open payables for vendors in accounts payable (AP) accounting

- Managing open receivables of customers in accounts receivable (AR) accounting

- Reports and evaluations available in FI

17.1 Financial Accounting Tasks

Financial accounting includes all information concerning the enterprise. This naturally includes information that directly refers to the financial situation. In addition, logistics and HR processes are also relevant for accounting; the data from these processes are incorporated in FI in real time.

The task of financial accounting is to document all available data and figures (historical values) and map them in accounting. Here, a business’s accounts must be kept in such a way that third parties can get an overview of its financial situation (transparency). Transparency and traceability are achieved with the document principle; that is, every business transaction of an enterprise is linked with a document in the IT system. In this context, every process that can be entered with numeric values, for example, goods movements, operating costs, or payments, constitute a business transaction.

Document Principle

Because documents are the link between the business transaction and posting, there must be a document for every posting to check each posting for accuracy. Documents include receipts, incoming and outgoing invoices, checks, bank statements, and other items. Because of its important role, the document’s structure is defined strictly. Every document is identified by a unique document number in the SAP system and has a document header (which contains the type of business transaction), the date of the document and posting, posting period, reference, currency, and descriptive text.

The information that is gathered in financial accounting isn’t only documented transparently but also evaluated and interpreted. This evaluation of historical values takes place at specific points in time, for month-end closing, end-of-quarter closing, and particularly year-end closing, when you create the financial statement. The following questions need to be resolved:

- How much capital does the business have at time of closing?

- Has the enterprise gained profits or suffered losses in the previous period?

- Is the enterprise solvent?

Based on the evaluated historical values, you can derive statements on the enterprise’s current status: amount of assets, profits or losses, amount of open receivables, and amount of open payables.

The results of the evaluations are made available by FI to the authorities, creditors, investors, and banks. Because financial accounting presents the business’s financial status to the outside world, it’s also known as external accounting. Internal accounting, that is, controlling, is discussed in Chapter 18.

External accounting is bound to national and possibly international commercial and tax laws and regulations. The tasks of external accounting include the provision and disclosure of information about capital, financials, and profits, which are used as the basis of taxation. This information is presented in the financial statement as well as the profit and loss (P&L) statement. The financial statement provides information about its existing resources by comparing capital (assets) and debts (liabilities) in account form. The P&L statement gathers a list of all expenses and profits in the course of a fiscal year.

FI is closely integrated with the remaining components of the SAP system because all transactions that are relevant for accounting and come from logistics and human resources management (see Chapter 19) are posted in FI in real time and sometimes forwarded to Controlling (CO).

Financial accounting is responsible for opening accounts at the beginning of the fiscal year, keeping postings current during the year, and preparing the year-end closing. The maintenance of current postings demands the most space and time.

Double-Entry Accounting

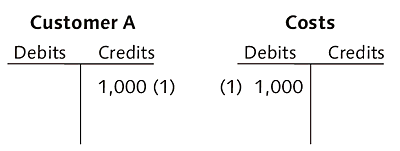

The system of double-entry accounting is usually deployed in the private sector. Double-entry accounting has a long history, as it was invented by Luca Pacioli, an Italian Franciscan monk, at the end of the 15th century. The concept of “double” refers to the fact that every business transaction (posting record) is entered twice—once as a debit and once as a credit—to ensure accuracy (Figure 17.1).

Figure 17.1 Sample Posting in Double-Entry Accounting

In accounting, accounts in T form (in which debits are entered on the left side and credits on the right side) are used to keep presentations clear and uncluttered. In addition to that, all postings are shown in the financial statements and the P&L statement.

Accounts are the central unit in accounting. Every account has an account number and comprises the two columns for debits and credits.

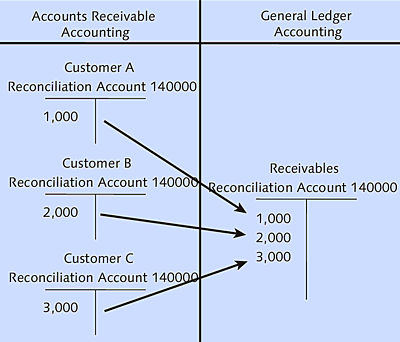

The general ledger and various subledgers (which represent the business transactions in a more differentiated approach) are kept in double-entry accounting. The general ledger consists of all accounts to which business transactions are posted and that are listed in a chart of accounts. Postings in the subledgers (e.g., AR accounting for customers and AP accounting for vendors) automatically generate a corresponding posting in the SAP General Ledger (G/L), as shown in Figure 17.2.

Figure 17.2 Connection between Subledger and General Ledger Accounting

The customer in subledger accounting is linked with the receivables account in SAP General Ledger Accounting through the reconciliation account, which you enter in the master record of the customer.

For every complex posting in the SAP system, you must enter the following information at the minimum: document date, posting date, document type, posting key, the account number, and amounts.

FI’s most important functions, which are used to map financial accounting in the SAP system, refer to the following areas:

-

SAP General Ledger Accounting (FI-G/L)

This records all business transactions relevant for accounting on G/L accounts (accounts in the chart of accounts). -

Accounts Payable (FI-AP)

This area posts all business transactions that refer to vendors and gets its most of its data from purchasing (see Chapter 15). -

Accounts Receivable (FI-AR)

This records all business transactions that refer to customers and receives most of its information from Sales and Distribution (SD) (see Chapter 15). -

Bank Accounting (FI-BL)

This records and manages business transactions that involve banks or the business’s payment transactions. -

Asset Accounting (FI-AA)

This records all business transactions that refer to the business’s assets. In this context, its assets include all complex fixed assets that are permanently available for value creation (e.g., buildings, machines, or securities). In terms of accounting, the evaluation of assets (asset values, depreciations) is particularly interesting.

Moreover, FI also includes the following two components, which aren’t deployed in all enterprises:

-

Funds Management (FI-FM)

FM is responsible for creating and controlling budgets and for transferring budgets to user departments. -

Travel Management (FI-TV)

TV supports processes related to business trips, for example, application, planning, posting, and settlement.

In the rest of this chapter, we’ll describe AR and AP in detail and explain how to work with these two subledgers. Before you can work with FI, we first describe the foundations that you must lay in financial accounting for this purpose. AA and BL aren’t further discussed in this book because these subledgers aren’t directly relevant for most users.