17.3 Creating the Financial Statement and Profit and Loss Statement

SAP General Ledger Accounting is the central instance of FI because it forms the basis for statutory reporting (financial statement and P&L statement). The FI-GL component is responsible for SAP General Ledger Accounting in the SAP system, which is based on G/L accounts. The G/L accounts, in turn, must be specified in the chart of accounts and must also be created together with the relevant master data so that postings can be made to these accounts. The primary cost element in CO derives from the G/L account (see Chapter 18).

[»] Transfer from Subledgers

In FI, data are available in real time. If a posting is made in a subledger (e.g., in the vendor account), a corresponding posting is also automatically made in the G/L. This is known as automatic entry.

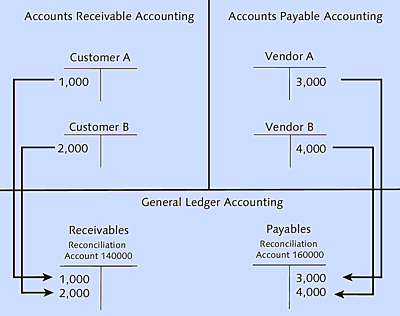

The G/L and the subledgers are linked by a reconciliation account (Figure 17.4). This is a special header account of SAP General Ledger Accounting that guarantees the automatic entry of all items of the subledgers in SAP General Ledger Accounting. You need at least one reconciliation account for customers and one reconciliation account for vendors.

You enter the number of the reconciliation account in the master record or the customer/vendor to link the subledgers (AR and AP) with SAP General Ledger Accounting.

SAP General Ledger Accounting has the following essential tasks:

- Forms the basis for the financial statement

- Used for account management and guarantees a full proof of all business transactions

- Forms the basis for the P&L statement

Figure 17.4 Reconciliation Account Function

The financial statement is a compact list and evaluation of all assets of a business. An opening financial statement is created when an enterprise is founded, and a closing financial statement is made at the end of each fiscal year. Throughout the fiscal year, all business transactions are posted in G/L accounts that are merged for the closing financial statement at the end of the fiscal year.

A P&L statement is created based on information from the G/L and published at the end of the fiscal year. It compares expenses and gains to indicate the operating income.

Why Financial Statement and Profit and Loss Statement?

When you post every transaction in the P&L statement and the financial statement at the same time, you can determine at any time which resources are available (financial statement) and which path you’ve already completed (P&L statement). You could compare this with a car: If you travel from Munich to Hamburg, you’ll only feel comfortable when you know how much gas is left (financial statement) and what distance you’ve already covered (P&L statement). Of course, you would also reach your destination if you only had a mileage indicator, and you stopped every 100 miles to check with a probe how much gas is left in the tank. This corresponds to an accounting where the expenses and gains are permanently posted, and a review is made once at the end of the year. Modern cars, however, have a mileage indicator and a gas gauge that provide the correct values simultaneously and in real time. This also applies to modern accounting; both the financial statement and P&L statement are updated at the same time.

In the SAP system, you can automatically call the structure of either statement for each or several company codes if you’ve assigned G/L accounts to the individual, bottom-line financial statement, and P&L statement items in Customizing. The standard version of SAP provides the classic financial statement and P&L statement structures, which you must populate with the G/L accounts from your chart of accounts.

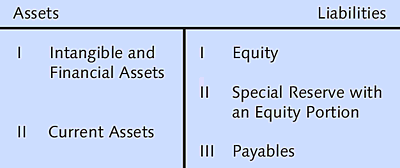

Let’s assume your financial statement items are structured as in Figure 17.5.

Figure 17.5 Items in the Financial Statement Structure

In this case, you must assign the corresponding accounts to the individual items (e.g., current assets) in Customizing. Follow these steps to call the financial statement:

- Enter Transaction S_ALR_87012284 in the command field or select the following path in the SAP Easy Access menu: Accounting • Financial Accounting • General Ledger • Information System • Reports for General Ledger • Financial Statement/Profit and Loss Statement/Cash Flow • General • Actual/Actual Comparisons • S_ALR_87012284 Financial Statement/Profit and Loss Statement.

-

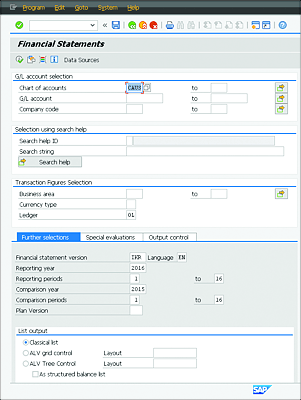

The system displays the initial screen of the financial statement and the P&L statement (Figure 17.6). Enter the following values:

- Chart of accounts: “CAUS”

- Company code: “1000”

- Financial statement version: “IKR”

- Reporting year: “2016”

- Reporting periods: “1” to “16”

- Comparison year: “2015”

- Comparison periods: “1” to “16”

- List output: Classical list

Figure 17.6 Maintaining Financial Statements

-

After you’ve made your entries, press (F8) or click the Execute

button to continue.

button to continue.

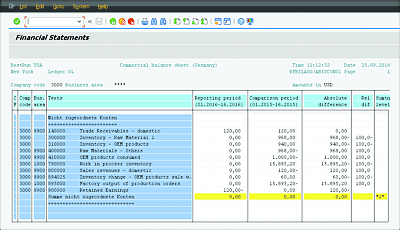

- As you can see in Figure 17.7, the system now displays the financial statement/P&L statement for the selected period and chart of accounts as requested.

The Financial Statements report is the most critical report that you can call in SAP General Ledger Accounting. If you made the corresponding settings in Customizing, you can also implement other reports, for example, advance return for tax on sales/purchases within the scope of closing operations.

Figure 17.7 Financial Statements Report

Now that you know the most important functions of SAP General Ledger Accounting, let’s turn our attention to the first subledger.