There are two kinds of investors, be they large or small: those who don’t know where the market is headed, and those who don’t know that they don’t know. This pertains to any market, be it stocks, bonds, Louis XIV chairs, or pork bellies. Then again, there is actually a third type of investor—the investment professional, who indeed knows that he or she doesn’t know, but whose livelihood depends upon appearing to know.

It seems intuitively obvious that stock selection should be a skill like any other. With enough intelligence, training, experience, and effort, one should be able to beat the market.

However, the primary strength of Western culture is its reliance on the scientific method. The short version of which is that any rational belief should be falsifiable—that is to say, testable. Consider baseball hitters. You say that there is such a thing as “hitting skill”? A trivial thing to ask, of course, but still easy to test.

The batting analogy is useful because it forces us to think about the statistical nature of skill. Probably the best way to define it is in terms of persistence of performance. Let’s say that the mean batting average among baseball players is .260. Now let’s look at last year’s .300 hitters. Were there no such thing as batting skill, then their performance this year would be merely average—in other words, .260. Of course, one year’s .300 hitters as a group always do well above average the following year by such a wide margin as to remove all doubt that their performance is due to skill, and not chance. Interestingly, when exposed to the harsh light of statistical analysis, more than a few sports beliefs do fail to pass muster. One of these is the “hot hand” phenomenon in basketball. Feeding the ball to the shooter on a “hot streak” is a time-honored court strategy. And yet, a player who has recently hit a higher percentage of goals than his usual is no more likely than usual to do so going forward. That is, such performance does not persist. This highlights a human foible that has great import in finance—our tendency to see patterns where there are in fact none.

And yet, it was not until 30 years ago that researchers began to apply the same techniques to money managers. It turns out that for all practical purposes there is no such thing as stock-picking skill. The first to document this was Michael Jensen, who, in a landmark paper published in 1968 in the Journal of Finance, looked at mutual fund performance for the 20 years from 1945 to 1964 and found no evidence of persistence of fund performance. Last year’s hot manager, on the average, will be simply mediocre next year. Since then, dozens of careful analyses of money manager performance have been done, and the results are eye-opening. Many studies show a small amount of persistence, but the effect is always so tiny that after you pay fund expenses, you still come out behind the market performance, on average. Furthermore, the persistence is usually over relatively brief periods (a year or less) and not over the longer term.

Let’s take a look at some of the data. A study done by Dimensional Fund Advisors, an institutional investment firm in Santa Monica, CA, looked at fund performance for the period January 1970 to June 1998. They examined the top 30 diversified mutual funds for sequential five-year periods and then subsequent performance. The results are tabulated in Table 6-1. In each example, the top funds for the first period underperformed the S&P 500 in the subsequent period and in two of the five examples actually underperformed their peers as well.

Table 6-1. Subsequent Performance of Top Performing Funds, 1970–1998

Does this look like the performance of highly skilled money managers? No. We are looking at the proverbial bunch of chimpanzees throwing darts at the stock page. Their “success” or “failure” is a purely random affair. The most successful managers wind up being interviewed in Money, The New York Times, and by Uncle Lou. Their assets under management balloon, and their shareholders’ admiration is vindicated by the media attention.

However, time passes, and the laws of chance eventually catch up with these folks. Hundreds of thousands of investors find that the handsome prince managing their funds turned out to be just another hairy simian. In fact, with the particularly perverse logic of fund flows, very few investors actually obtain the spectacular early returns of the “top” funds. Worst of all, large asset inflows tend to depress future returns because of so-called market impact costs, which will be described later in this chapter. These early high returns inevitably attract large numbers of investors, who wind up with merely average performance, if they are lucky.

Math Details: How to Statistically Test for Skill

A detailed explanation of how to statistically demonstrate skill is well beyond the scope of this book. However, a simple illustration is useful. Let’s use the example of a .260 mean batting average, with an SD among hitters in any given year of .020. In other words, a .300 average places the hitter 2 SDs [(.300 − .260)/.020] above the mean for that single year. If a hitter averages .280 over 10 seasons, is he skilled? The “standard error” (SE) of randomly performing batters with an annual SD .020 over a 10-year period is ![]() . In other words, in a random world an annual SD of 20 points translates into an SD of 6.3 points over 10 years. The difference between the batter’s performance and the mean is .020, and dividing that by the SE of .0063 gives a “z value” of 3.17. Since we are considering 10 years, performance, there are 9 “degrees of freedom.” The z value and degrees of freedom are fed into a “t distribution function” on our spreadsheet, and out pops a p value of .011. In other words, in a “random batting” world, there is a 1.1% chance of a given batter averaging .280 over 10 seasons.

. In other words, in a random world an annual SD of 20 points translates into an SD of 6.3 points over 10 years. The difference between the batter’s performance and the mean is .020, and dividing that by the SE of .0063 gives a “z value” of 3.17. Since we are considering 10 years, performance, there are 9 “degrees of freedom.” The z value and degrees of freedom are fed into a “t distribution function” on our spreadsheet, and out pops a p value of .011. In other words, in a “random batting” world, there is a 1.1% chance of a given batter averaging .280 over 10 seasons.

Whether or not we consider such a batter skilled also depends on whether we are observing him “in sample” or “out of sample.” In sample means that we picked him out of a large number of batters—say, all of his teammates—after the fact. In which case he is probably not skilled, since it would not be unusual for 1 of 30 individuals to experience a 1.1% random event. On the other hand, if his performance measured is out of sample—that is, we had picked him alone among his teammates—then he probably is skilled, since we would have only one chance at a 1.1% occurrence in a random batting world. An only slightly more complex formulation is used to evaluate money managers. One has to be extremely careful to distinguish out-of-sample from in-sample performance. One should not be surprised if one picks out the best-performing manager out of 500 and finds that his p value is .001. However, if one identifies him ahead of time, and then his performance p value is .001 after the fact, then he probably is skilled.

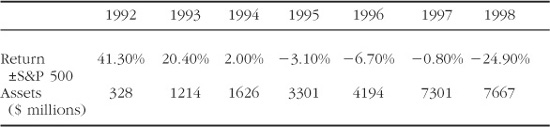

One of the best illustrations of how this reversal can occur is provided by Robert Sanborn, who ran Oakmark Fund. Mr. Sanborn is an undisputed superstar manager. From inception in 1991 to year-end 1998 Oakmark’s annualized return was 24.91% versus 19.56% for the S&P 500. In 1992 it beat the benchmark by an astonishing 41.28%. By any statistical criteria Mr. Sanborn’s performance could not have been due to chance.

However, a different story emerges when we examine the fund’s performance and assets by individual year. The first row tracks the performance of Oakmark Fund relative to the S&P 500, the second row tracks the fund’s assets:

What we see is the all-too-familiar pattern of fund investors chasing performance, with more and more investors getting lower and lower returns. In fact, if we “dollar-weight” the fund’s returns, we find that because most investors hopped on the bandwagon after the best returns had occurred, the average investor in this fund underper-formed the S&P 500 by 7.55% annually.

In defense of Mr. Sanborn, it is fair to point out that S&P 500 tracking error is not a reasonable measure over the past few years for a value manager’s performance. One can get around this by calculating the fund’s alpha, which refers to the excess return added by a manager after taking into account such factors as market exposure, median company size, and value orientation. This is done with a technique (available in most spreadsheet packages) known as regression analysis, in which the monthly or quarterly returns for the manager in question are laid alongside the returns of benchmarks for various market factors or sectors. The manager’s returns are “fitted” to the returns of the other factors, resulting in a custom-made benchmark for that manager. The alpha is the difference between the fund’s performance and that of the regression-determined benchmark and a measure of how well the manager has performed. It is expressed the same way as return, in percent per year, and can be positive or negative. For example, if a manager has an alpha of –4% per year this means that the manager has underperformed the regression-determined benchmark by 4% annually. Oakmark’s alpha for the first 29 months is truly spectacular, and quite statistically significant, with a p value of .0004. This means that there was less than a 1-in-2000 possibility that the fund’s superb performance in the first 29 months could have been due to chance. Unfortunately, its performance in the last 29-month period was equally impressive, but in the wrong direction.

My interpretation of the above data is that Mr. Sanborn is modestly skilled. “Modestly skilled” is not at all derogatory in this context, since 99% of fund managers demonstrate no evidence of skill whatsoever. However, unfortunately even these skills were overwhelmed by the “impact-cost drag” (to be discussed in the next section) of managing billions of dollars of new assets, chasing up stock prices and lowering ultimate returns.

The take-home message here is clear. It’s human nature to find patterns where there are none and to find skill where luck is a more likely explanation (particularly if you’re the lucky manager). But successful or lucky actively managed funds sow the seeds of their own destruction. Avoid them.

Mutual fund manager performance does not persist and the return of stock picking is zero. This is as it should be, of course. These folks are the market, and there is no way that they can all perform above the mean. Wall Street, unfortunately, is not Lake Wobegon, where all the children are above average.

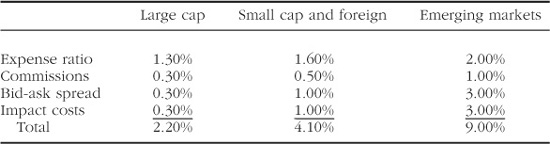

So the bad news is that the process of mutual fund selection gives essentially random results. However, the really bad news is that actively managed funds are so expensive. Funds, of course, incur costs. Sadly, even the best-informed fund investors are usually unaware of just how high these costs really are.

Most investors think that the fund’s expense ratio (ER), listed in the prospectus and annual reports, is their true cost of fund ownership. Wrong. There are actually three more layers of expenses beyond the ER, which merely comprises the fund’s advisory fees (what the managers get paid) and administrative expenses. The next layer of fees are the commissions paid on transactions. These are not included in the ER, but since 1996 the SEC has required that they be reported to shareholders. However, they are presented in such an obscure manner that, unless you have an accounting degree, it is almost impossible to calculate how much return is lost as a proportion of fund assets.

The second extra layer is the bid-ask spread of stocks bought and sold. A stock is always bought at a slightly higher price than it is sold, to provide the market maker with a profit. This “spread” is about 0.4% for the largest, most liquid, companies and increases with decreasing company size. For the smallest stocks it may be as large as 10%. It is in the range of 1% to 4% for foreign stocks. For example, at the market close of business on April 12, 2000, Microsoft was quoted at a bid (the price at which an investor could sell the stock) of $80.125 and an ask (the price at which an investor could buy the stock) of $80.25. The difference—one-eighth of a dollar—is the spread. Because Microsoft is one of the most actively traded stocks in the world, this represents just 0.15% of the price. At the other end of the spectrum, on the same day Officeland, a tiny company dealing in used copying machines, traded at $0.65/$0.70 of bid to ask, a spread of 7.7%.

The last layer of extra expense—so-called market-impact costs—is the most difficult to estimate. Impact costs arise when large blocks of stock are bought and sold. Imagine that you own half the shares of a small publicly traded company worth $20 million. Let’s further imagine that you have gotten yourself into a jam, need cash, and must quickly sell all of those shares. The selling pressure caused by your actions will drastically reduce the stock’s price, and the last shares sold will fetch considerably less than the first shares sold. The reverse would occur if an investor decided that he or she wanted to quickly acquire a large block of your company.

Impact costs are not a problem for small investors buying shares of individual companies, but they are a real headache for large mutual funds. Obviously, the magnitude of impact costs depends on the size of the fund, the size of the company, and the total amount transacted. As a first approximation, assume that it is equal to the spread.

![]() Expense ratio

Expense ratio

![]() Commissions

Commissions

![]() Bid-ask spread

Bid-ask spread

![]() Market-impact costs

Market-impact costs

Taken together, these four layers of expenses are smallest for large-cap funds, intermediate for small-cap and foreign funds, and greatest for emerging-markets funds. They are tabulated in Table 6-2.

Table 6-2. Active Fund Expenses

Recall that the return of large stocks for 1926–1998 was 11.22% per year. It should be painfully obvious that this is not the return that you, the mutual fund investor, would actually receive. You must subtract out of that return the fund’s total investment expense.

Now the full magnitude of the problem becomes clear. The bottom row of Table 6-2 shows the real costs of owning an actively managed fund. In fairness, this does overstate things a bit. Money spent on research and analysis is not a total loss. Such research does seem to increase returns, but almost always by an amount less than that spent. How much of the first “expense ratio” line is spent on research? Figure about a half, if you’re lucky. So if the long-term return of equity in general is about 11%, then active management will lose you about 1.5% in a large-cap fund, 3.3% in a foreign or small-cap fund, and 8% in an emerging-markets fund, leaving you with 9.5%, 7.7%, and 3%, respectively. Not an appetizing prospect. The mutual fund business has benefited greatly by the high returns of recent years, which have served to mask the staggering costs in most areas. One exception to this has been in the emerging markets, where the combination of low asset-class returns and high expenses has resulted in a mass exodus of investors.

One of the great ironies of investing is that the universal availability of financial information is in fact the reason behind the failure of security analysis. Before the Securities Act of 1933 mandated periodic public disclosure of corporate performance, even the most basic financial information about a company was usually a closely guarded secret. When Benjamin Graham wrote the first edition of Security Analysis, the simple act of ascertaining a company’s earnings or revenues was often a matter of spending a day or two on a train, then sweet-talking the information out of a secretary while being careful to avoid her boss’s watchful eye. Such efforts were often well-rewarded.

In the information age, every aspect of a company’s finances is immediately available to anyone with a computer and modem. And since everyone has access to this data, it is immediately discounted into the security’s price, so there is no further profit from acting on it.

An excellent example of how the process works is provided by the “January effect” (JE). The JE is explained as follows:

![]() Small-company stocks, because of their higher risks, have a higher return than large-company stocks.

Small-company stocks, because of their higher risks, have a higher return than large-company stocks.

![]() For many decades almost all of this excess return occurred in January.

For many decades almost all of this excess return occurred in January.

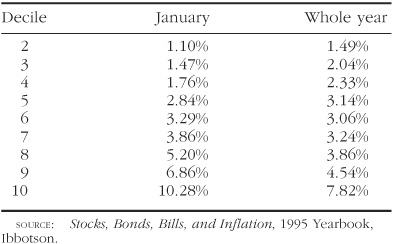

Table 6-3 shows that the January excess return is actually larger than the excess return for the entire year for the smallest stocks, as measured by Ibbotson Associates. Ibbotson divides domestic stocks into deciles by New York Stock Exchange sizes and then measures the 1926–1994 excess return over the largest (first) decile.

Table 6-3. Return in Excess of First Decile

The precise reason for the concentration of small-stock excess return in January is unknown, but there is no shortage of candidates.

End-of-year tax-loss selling is my favorite, but there are no easy answers. Entire how-to books have been devoted to the “incredible January effect,” and it’s also a perennial late-year topic for material-starved financial writers.

Unfortunately, there are two fundamental problems with the JE. First, its magnitude is roughly equivalent to the bid-ask spread for each decile. For example, look at the January excess return of 10.28% for the smallest (decile 10) stocks. In order to realize that excess return, you would have had to buy each stock on December 31 and have sold it on January 31. But since the ask (buying) price for these smallest stocks is also about 10% above the bid (selling) price, you would not have made an actual profit. In other words, the simple act of buying and selling small stocks eliminates the benefit. So if you want to realize the January effect, you have to hold small stocks for many years.

The second problem is that the JE no longer exists. Figure 6-1 shows the 10-year rolling average of the small-cap premium, calculated as the difference between the January return of the CRSP 9-10 Index and the S&P 500. As can be seen, the effect has faded into insignificance. This is one of the reasons why profitable strategies, if they exist at all, do not last for very long. As soon as they are discovered, they are acted upon by the investment community, bidding up the price of the relevant assets, thus eliminating their excess return.

Figure 6-1. Ten-year January CRSP 9–10 decile minus S&P.

Money manager, writer, and financial elder statesman Charles Ellis observed three decades ago with growing alarm the first data demonstrating a lack of money manager skill. He thought to himself, “I’ve seen this somewhere else.” An avid tennis player, he realized that for most amateur participants winning or losing was less a matter of skill than simply playing conservatively and avoiding mistakes. He wrote a famous article, appearing in the 1972 Financial Analysts Journal called “The Loser’s Game,” in which he compared professional investing to amateur tennis. Just as the amateur tennis player who simply tries to return the ball with a minimum of fancy moves is the one who usually wins, so too does the investor who simply buys and holds a widely diversified stock portfolio. This investor is the one who usually comes out on top. The title of the piece refers to the concept that in both amateur tennis and professional investing, success is less a matter of winning than avoiding losing. And the easiest way to lose in investing is to incur high costs by trading excessively.

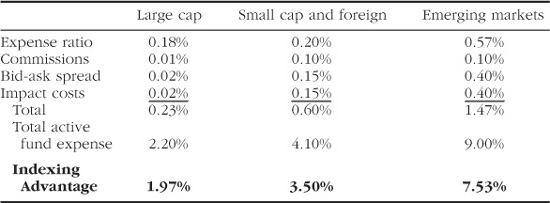

The ultimate loss-avoidance strategy, then, is to simply buy and hold the entire market, i.e., to index. The reason should be apparent from the preceding discussion of fund costs. Since constantly analyzing and adjusting your portfolio results in high expenses and almost no excess return, why not just work at minimizing all four layers of expenses by buying and holding the market? Table 6-4 lists the four expense layers for an indexed approach to investing. The last row shows the theoretical difference in returns between the active and indexed approach.

Table 6-4. Index Fund Expenses

Again, it has to be pointed out that this is a theoretical advantage, since at least some of the active-fund expenses are spent on research, which has been shown to be of benefit. But remember that research expenses almost never completely pay for themselves, and only a small portion of an active fund’s total four-layer expense structure is spent on analysis. The basic thing to remember about research expense is that it results in turnover, which in turn increases total expense through commissions, spreads, and impact costs.

The average random scatter of active manager returns in any given year has about 8% of SD, but over an n year period (where n is the number of years) that scatter will be reduced by the square root of n. In other words, over a four-year period the returns scatter of active managers is reduced by half, and over 25 years by 80%. So, over a 25-year period, the random scatter (SD) of fund performance will be 8%/5 = 1.6%.

So, we see that the average active manager is flying into an annual headwind of anywhere between 1% and 8%. Since the SD, or “scatter” of annual returns for active funds is about 8% in any given year, a difference of a few percent may not be noticed. But over many years, it takes a toll, as the SD of 25-year returns is only 1.6% (see Math Details).

For large-cap funds, this means that the index-fund advantage, which has about the same 1.6% value, will result in a +1 SD performance. Meaning that the index fund should beat 84% of actively managed funds. A small or foreign index fund with a 3.2% advantage should perform 2 SDs above the norm, meaning that it should beat 97% of active funds over a 25-year period. And an emerging-markets index fund with a several-percentage-point advantage should best all of its actively managed peers.

Unfortunately, the real world is not nearly this neat, and it is worth looking at the actual data. We shall compare index-fund and active-fund performance with the Morningstar Principia database. This nifty tool is worth some discussion. Morningstar is the premier purveyor of mutual fund data for both small and institutional investors. It is best known for its print publications, available in most large public libraries, but I highly recommend the Principia software package. The guts of the program are monthly returns for 11,000 or so mutual funds, and more importantly, benchmark indexes. This allows you to calculate, display, and graph fund rankings and performance in an almost infinite variety of ways, and even to calculate correlations among funds and asset classes via their indexes. A wide variety of other information regarding valuation and fund operational data is also included. Much of my research depends on this package.

For starters, it is important to realize that we have to be careful just how we benchmark and compare our actively managed funds. The earliest persistency studies simply looked at all equity funds. This is suboptimal. It is important to compare like with like. For example, over the past several years large-cap growth stocks (think McDonald’s, Microsoft, Wal-Mart) have been the strongest performers. It would be unfair to compare a small-cap or foreign fund to general-equity funds, which as a group tend to have a heavy concentration of these stocks, or to the S&P 500 for the same reason. Principia employs a particularly effective approach to this problem. They divide domestic stock funds into a 3-by-3 grid of size versus value orientation. They categorize funds by company size into small, medium, and large. They also pigeonhole funds as value, growth, or “blend” (halfway between growth and value). This produces nine categories and is a good way to compare performance between funds fairly.

Let’s start with the granddaddy of all index mutual funds, the Vanguard 500 Index Fund. It is no accident that sometime within the next year this should become the biggest mutual fund in the world. Over the 15-year period ending December 1998 it ranked in the 8th percentile of the Morningstar “large-cap blend” category, meaning that it beat over 92% of its peers. This is actually better than we’d expect from a fund with a 1.5% expense advantage in a category with 8% SD of annual active-manager scatter ![]() SD above the mean, which is about 23rd percentile). We’ll come to the reason why in a minute.

SD above the mean, which is about 23rd percentile). We’ll come to the reason why in a minute.

Math Details: The Ultimate Benchmark

If you’re really serious about benchmarking a fund, as well as looking for skill, you perform a three-factor regression on fund returns. Here’s how it works. Developed by Ken French of MIT and Eugene Fama of University of Chicago, the regression starts with monthly returns for the broad stock market, as well as monthly return contributions for small-stock and value-stock exposure. You then lay the monthly returns for the fund or manager in question side by side with these three benchmark series and perform a multiple regression. This statistical technique, available on most spreadsheet packages, produces the “best fit” of the three factors to the manager returns series and spits out a blizzard of output numbers. The most- important of these is the residual return (the intercept of the regression), or alpha. The alpha is the excess return left after exposure to the market, size, and value have been taken into account. For most managers, it is a negative number. The output also includes the statistical significance of the alpha, telling us how likely it is the results are due to chance (a low p value suggesting skill or lack thereof, depending on whether it is positive or negative). It also calculates the actual behavior of the portfolio along the small-large and value-growth axes. This methodology is now the preferred technique for measuring performance of pension fund managers and is also heavily favored in the academic community.

Vanguard also runs two other large-cap index funds, one for growth and one for value. Over the five-year period ending December 1998, the Growth Index Fund ranked in the 2nd percentile of the Morningstar large-cap growth category. The Value Index Fund ranked in the 21st percentile of its large-cap value category. Again, both of these are better than we’d calculate from the above formulation, which would predict only about 34th percentile five-year performance.

Finally, to complete the picture, let’s look at small-cap indexing. The oldest small-cap index fund is the Dimensional Fund Advisors (DFA) 9-10 Small Company Fund. Over the past 15 years, it has ranked in the 57th percentile, actually worse than average.

A superficial analysis of the above data suggests that indexing works for large-cap stocks, but not for small-cap stocks. But if we dig a little deeper, we find that this is not the case. There is a direct relationship between how well indexing works in a particular asset category and how well that asset category is doing compared to other asset classes.

Let’s consider the extraordinary performance of the Vanguard Growth Index Fund, with it’s 2nd percentile five-year record. It is no accident that the Barra Large Cap Growth Index, which it tracks, had the highest five-year return of any asset class—27.94% annualized—for the five-year period from 1994 to 1998. The Value Index Fund did reasonably well also, at 21st percentile for the period. Again, its tracking index, the Barra Large Cap Value Index, did reasonably well, returning 19.88% for the period.

Now, compare the 15-year 8th percentile ranking of the Vanguard 500 to the DFA 9-10 Small Company Index Fund’s 57th percentile ranking. It is no coincidence that the 15-year returns of their tracking indexes were 17.91% and 9.17%, respectively. If one looks a little closer at the performance of these two index funds, one finds that there is a direct relationship between how well small stocks did vig-à-vis large stocks and their relative rankings. For example, for the three-year period from 1992 to 1994, small stocks outperformed large stocks by 7.59% annually, and the Vanguard 500 Index Fund ranked in only the 46th percentile of its category, while the DFA 9-10 Small Company ranked in the 13th percentile of its category.

There is in fact a relationship between asset-class performance and index-fund performance, known as Dunn’s law (after Steve Dunn, a friend with an astute eye for asset classes):

“When an asset class does relatively well, an index fund in that class does even better.”

The mechanism behind this is relatively straightforward. Let’s again take the performance of the DFA 9–10 Small Company Index Fund and the Vanguard 500 Index Fund as examples. An index fund takes the full brunt of an asset class’s excellent or poor performance relative to other asset classes. During the past 15 years, most actively managed small-cap funds have owned some midsize and large stocks, and this has helped their performance relative to the small-cap index. The reverse is also true of almost all actively managed large-cap funds, which frequently own stocks smaller than those in the S&P 500. This has hurt their performance relative to the S&P 500.

So, to summarize, because of the dominance of large-company stock returns over the past 15 years, large-cap indexing looks better than it actually is, and small-cap indexing looks worse than it actually is.

The same phenomenon is observed in other areas. DFA’s index funds for REITs and international small companies have poor percentile rankings. This is not due to any lack of efficacy of indexing in these areas but rather to an artifact of the poor performance of the asset classes themselves.

The situation with international indexing is extremely interesting. Charles Schwab has the oldest diversified international index fund, and its five-year ranking for 1994–1998 is a respectable 21st percentile. If one uses the EAFE index as a proxy index fund, one comes up with an awful 10-year 90th percentile ranking, but an amazing 1st percentile 15-year ranking. The problem here is called “Japan.” The EAFE until recently was overweighted in Japan, which comprised 65% of the index at the height of the Nikkei bubble in the late 1980s. During periods when Japanese equity did particularly poorly, so did foreign indexing, and vice versa. However, it is heartening to note that in spite of the fact that Japan underperformed the EAFE as a whole by more than 5% annually over the past 15 years, there is not one diversified international fund with a higher return over the same period, because of the expense advantage.

As we discussed earlier, the biggest theoretical advantage of indexing should be in the emerging-markets area. And in fact, over the past five years the DFA and Vanguard Emerging Markets Funds have ranked in the 10th and 15th percentile of their peers, respectively, in spite of the terrible returns of this asset class for the period.

One place where indexing seems to fail, even after all of the above factors are taken into consideration, is the area of small-cap growth stocks. These companies are highly entrepreneurial, rapidly growing affairs, and there are data to support the notion that resources spent on researching these companies may more than pay for itself. Another reason may be that these stocks often exhibit considerable price “momentum.” A small-cap indexing strategy would of necessity sell the most rapidly appreciating stocks as they grew beyond the index’s size borders, when in fact these are the companies with the highest returns going forward.

As we’ll discuss further along in this chapter, small-cap growth stocks have poor long-term returns, and it is probably wise to avoid investing in this area, active or indexed.

The deeper one delves, the worse things look for actively managed funds. Consider for a moment what happens when you open up the quarterly New York Times supplement and start sampling fund performance over the past 10 years. You might think that you’re getting a fairly accurate picture of historical fund performance. And you’d be wrong. That is because what you’re looking at is not the performance of all of the funds in existence over the past decade, but only the ones that survived. In other words, the very worst funds in the group got killed off (or more likely, merged with other funds), so you are looking at an overly optimistic picture of overall fund performance.

Burton Malkiel, author of A Random Walk Down Wall Street, has looked at this problem in some detail, and he estimates that the effect is on the order of 1.5%. In other words, the reported performance of the average fund category is about 1.5% higher than that of the true category performance. And it’s almost certainly higher for some fund categories, particularly small stocks, where it may be as much as 3%. This is not a small point. I screened the Morningstar Principia database (November 1999) for domestic small-cap funds. I found 213 with a five-year track record, with an average annualized five-year return of 12.19%. The index funds in the category had only slightly higher returns (Vanguard Small Cap Fund, 13.64%; DFA 9-10 Small Company Fund 13.10%). So you might or might not be impressed with their performance. But Morningstar’s database contains only surviving funds, so it’s likely that the true average annualized return for the group is actually in the 9%–10% range. In which case the index funds have done very well indeed.

If the case I’ve presented for indexing is not powerful enough, then consider the effect of taxes. While many of us hold funds in our retirement accounts, where taxability of distributions is not an issue, most investors also own funds in taxable accounts.

While it is probably not a good idea to own actively managed funds in general, it is a truly terrible idea in taxable accounts, for two reasons. First, because of their higher turnover, actively managed funds have higher distributions of capital gains, which are taxed at your capital gains rate at both the federal and state level. An index fund allows your capital gains to grow largely undisturbed until you sell.

There is another factor to consider as well. Most actively managed funds are bought because of their superior performance. But as we’ve demonstrated above, this outperformance does not persist, and most small investors using active fund managers tend to turn over their mutual funds for this reason once every several years, generating more unnecessary capital gains and resultant taxes. For the taxable investor, indexing means never having to say you’re sorry.

A caveat about small-cap indexing and taxes. Small-cap index funds (both foreign and domestic) tend to have higher turnovers than large foreign and domestic index funds. Even worse, they generate high capital gains distributions proportionate to their turnover, since the primary reason for selling a stock is a large price increase, resulting in that stock’s “graduating” out of the index. For this reason, they may not be suitable for taxable investors. Fortunately, “tax managed” small-cap and large-cap index funds are now available. These strive to minimize distributions, and more will be said about them in Chapter 8.

As mutual funds have become the primary investment vehicle of small investors, they have come to manage ever more massive amounts of capital—about $5 trillion at the time of this writing. But the real money is managed by pension funds—about twice as much. The Investment Company Institute estimates that in 1998 only 7% of mutual fund assets were indexed, versus 34% of the pension assets of the 200 largest U.S. corporations.

It should come as no surprise that the world’s biggest money managers have embraced indexing. The world of pension management is complex. There are four basic players here, and it’s useful to survey the scene. The first two are the pension fund sponsors (the corporations themselves) and their employees and beneficiaries. Next are the pension fund managers. The competition for pension fund investment management slots is unbelievable. Although these managers are paid only a few basis points of money managed, 0.02% of $10 billion annually ain’t chump change. Underperform the benchmark for more than a few quarters and “you’re toast.” Last are the pension consultants. Their primary function is to go out and find the “best” of these money managers for the pension sponsors.

By now, you know how this movie ends. Almost none of these managers in reality has even a drop of skill. Like our mutual fund managers, they are just one more tribe of hairy apes throwing projectiles at a stock list. Some will get lucky and attract the attention of the pension consultants, who will sell them to the sponsors. Following which the laws of probability take over and they underperform, get sacked (perhaps along with the pension consultant that found them), and the cycle starts again. This is one expensive merry-go-round—approximately 1% of $10 trillion of total pension expenses annually, or $100 billion.

On the average, these pension funds hold about a 60/40 stock/bond mix. Consulting firm Piscataqua Research found that for the period 1987–1996 only 8% of the nation’s largest pension plans actually beat an indexed 60/40 mix.

So, one by one the light bulbs go on over at the pension fund sponsors, out go the stock pickers, and in many cases even the pension consultants themselves. It seems highly likely that in the next decade most pension money will be indexed. And so should yours.

OK, so human beings cannot pick stocks. Perhaps a more fruitful approach would be to time the market and avoid losses by pulling out of stocks during the bear markets. Maybe investment newsletter writers, whose specialty this is, might help us do better. John Graham and Campbell Harvey, two finance academics, recently performed an exhaustive review of 237 newsletters. They measured the ability of these newsletters to time the market and found that less than one-quarter of the recommendations were correct, much worse than the monkey score of 50%. Even worse, there were no advisors whose calls were consistently correct, although there were many who were wrong with amazing regularity. They cited one very well known advisor whose predictions produced an astounding annualized 5.4% loss during a 13-year period when the S&P 500 produced a 15.9% gain. Astonishingly, there is even a newsletter which ranks the performance of other newsletters; its publisher believes that he can identify persistently excelling advisors. The work of Graham and Harvey suggests that in reality he is actually the judge at a coin-flipping contest. When it comes to newsletter writers, remember Malcolm Forbes’ famous dictum: the only money made in newsletters is through subscriptions, not from taking the advice.

Noted author, analyst, and money manager David Dreman, in Contrarian Market Strategy: The Psychology of Stock Market Success, painstakingly tracked expert opinion back to 1929 and found that it underperformed the market with 77% frequency. It is a recurring theme of almost all studies of “consensus” or “expert” opinion that it underperforms the market about three-fourths of the time. Mr. Dreman argues that this is a powerful argument against the efficient market hypothesis: how can the markets be efficient when the experts lose with such depressing regularity?

All of this evidence falls under the rubric of what is known as market efficiency. A detailed discussion of the efficient market hypothesis is beyond the scope of this book, but what it means is this: it’s futile to analyze the prospects for an individual stock (or the entire market) on the basis of publicly available information, since that information has already been accounted for in the price of the stock (or market). Cognoscenti frequently respond to news about a company with a weary, “It’s already been discounted into the stock price.” In fact, a very good argument can be made that the market more often than not overreacts to events, falling too much on bad news and rising too much on good news. The corollary of the efficient market hypothesis is that you are better off buying and holding a random selection, or as we have shown above, an index of stocks rather than attempting to analyze the market.

I am continually amazed at the amount of time the financial and mass media devote to well-regarded analysts attempting to divine the movements of the market from political and economic events. This is a fool’s errand. Almost always these analysts are the employees of large brokerage houses; one would think that these organizations would tire of looking foolish on so regular a basis. (If you are not convinced of the futility of trying to predict market direction from economic conditions, then consider that the biggest money is made by buying when things look the bleakest: 1932, 1937, 1975, and 1982 were all great times to buy stocks. Then consider that the most dangerous times to buy or own stocks is when there is plenty of economic blue sky; those who bought in 1928, 1936, or 1966 were soon sorry.)

In the end, it is easy to understand why the aggregate efforts of all of the nation’s professional money managers fail to best the market: They are the market.

There is a small town not far from where I live which has only one store. An owner of the store, who died many years ago, had a manic-depressive disorder. One week he would be in the manic phase, cheerful and expansive, and during these periods would mark up the prices of his goods. The next week he might become depressed and would mark down prices. The townspeople learned to stock up during his depressed periods and buy only what was necessary when he was manic. The financial markets are about as rational as this store owner, and the intelligent investor stocks up when prices are low and lightens up when they are high. It would be very silly indeed to mimic the moods of our store owner, and buy tomatoes simply because their price was rising. Yet this seems to be what most investors, especially professionals, do. This sort of behavior is deeply ingrained in human nature; nobody likes being left out of the party. Some readers will note the similarity of our store owner to Mr. Market from Ben Graham’s The Intelligent Investor. If you read only one book about stocks, this should be it; my book is named in its honor.

Mr. Graham, in fact, wrote a famous article in a women’s magazine many decades ago in which he made the sexist but wise recommendation that stocks should be bought in the same manner as groceries, and not perfume. Had he instead advised men to buy stocks like they buy gasoline, and not like they buy automobiles, he would have offended our tender modern sensibilities less.

The trick for the small investor, then, is to know just how much he or she is paying for those tomatoes. You know that they are a bargain at 25 cents per pound; you know you are being robbed at $3 per pound. Buying a stock or a market sector without knowing how cheap or expensive it is constitutes the pinnacle of foolishness. As we shall see in Chapter 7, determining the cheapness (or “valuation”) of a market sector is quite easy.

By now I hope that I’ve convinced you that market movements are essentially a “random walk”—unpredictable in every regard, making stock selection and market timing an impossibility. It turns out that market movements are not totally random, and although it is nearly impossible to profit from this behavior, it still behooves the investor to be aware of market patterns. In order to do this, we have to be clear about what we mean by the term random walk. This means that yesterday’s, last month’s, or last year’s market return conveys no information about future returns. Is this strictly true?

To answer this question we first have to ask how one goes about looking for nonrandom behavior. There are dozens of ways to do so, but the simplest is to look for “autocorrelations” in price changes. What we are in effect asking is, “Does the price change from the previous day, week, month, year, or decade correlate with the price change of the succeeding day, week, month, year, or decade?”

Let’s take the monthly returns for the S&P 500 from January 1926 to September 1998. That’s 873 months. Then create two separate series, the first with the first return eliminated, the second with the last return eliminated. What we now have are two series of 872 monthly returns, offset by one month. Thanks to the magic of modern spreadsheets, it is a simple matter to calculate a correlation coefficient of these two series. The output of this correlation of a returns series with a lagged version of itself is called an autocorrelation. A positive autocorrelation means that above or below average returns tend to repeat, or trend. The “momentum” of a given asset class or security is defined by a positive autocorrelation. A negative autocorrelation defines so-called mean reversion, meaning that an above-average return tends to be followed by a below-average return and vice versa. And finally, a zero autocorrelation defines a random walk.

It turns out that the autocorrelation of large stocks’ monthly returns for 1926 through 1998 is .081. Not terribly impressive, but positive nonetheless, meaning that a good return this month means a slightly better than average chance of a good return next month. What are the odds that this could have happened by chance? In order to determine this, we have to calculate the standard deviation of autocorrelations for a data series of 873 random data points. The formula for this is ![]() , which for 873 is .034. Thus, the autocorrelation of .081 is more than twice the random-walk standard deviation of .034. This in turn means that the odds of this occurring with 873 random numbers is less than 1 in 100.

, which for 873 is .034. Thus, the autocorrelation of .081 is more than twice the random-walk standard deviation of .034. This in turn means that the odds of this occurring with 873 random numbers is less than 1 in 100.

So, yes, U.S. security prices appear to exhibit some momentum over periods of one month.

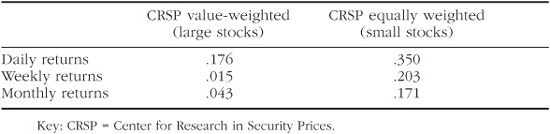

A nice summation of the autocorrelation data for U.S. stocks is found in Campbell, Lo, and MacKinlay’s (CLM) The Econometrics of Financial Markets. The following table summarizes their autocorrelation data for 1962 through 1984. The value-weighted (also known as the CRSP 1–10 Index) and equally weighted indexes can be very roughly thought of as large-stock and small-stock proxies, respectively.

This data pretty conclusively demonstrates momentum effects of high statistical significance for an index of large stocks from day to day, but not for longer periods. An index of small stocks does demonstrate momentum over days, weeks, and months. (I wouldn’t get too excited over the .350 autocorrelation for small stocks for daily periods. Remember that many of these securities do not trade every day, so that a big market move up or down one day will be followed by appropriate moves in ensuing days in the stocks that did not trade.)

It is rather amazing that when CLM looked for momentum in individual stocks, none was found. In other words, the generations of investors who have been gazing at stock price charts likely have been wasting their time, but the recent phenomenon of charting mutual fund prices may have some validity. CLM explain this apparent paradox by noting that there are highly significant “cross autocorrelations” between large and small stocks, meaning a rise or fall in large stocks is usually followed by a rise or fall in small stocks.

OK, so movements are not completely random. How does this data affect the average investor? Only at the margins. Lest we get too carried away, the most impressive autocorrelations we’ve encountered are in the .2 range. That means that no more than 4% (.2 squared, or R-squared) of tomorrow’s price change can be explained by today’s. That doesn’t buy a lot of yachts. For the taxable investor, this stuff is totally irrelevant—whatever advantage there is to this technique is obliterated by the capital gains capture from buying and selling with the high frequency necessitated by momentum techniques.

Certainly, however, these effects cannot be ignored. For the tax-sheltered asset allocator, the message is loud and clear: Do not rebalance too frequently.

If asset-class prices have a tendency to trend over relatively long periods (say months, or even one to two years) then rebalancing over relatively short periods will not be favorable. This is a somewhat tricky concept. Asset variance (which is the square of the standard deviation) is one of the main engines of rebalancing benefit. If an asset has momentum, then the annualized variances will be greater over long periods than over short periods—this is in fact a good way to test for momentum.

Think about the Japanese and U.S. markets. Both have exhibited pretty impressive momentum (in opposite directions) since 1989. Obviously, rebalancing as little as possible from the U.S. to Japan would have been more advantageous than doing it frequently.

Yet another way of thinking about this is the following paradigm—rebalance only over time periods where the average autocorrelation of your assets is zero or less. In practical terms, this means rebalancing no more than once per year.

Rather than being polar opposites, momentum investing and fixed-asset allocation with contrarian rebalancing are simply two sides of the same coin. Momentum in foreign and domestic equity asset classes exists, resulting in periodic asset overvaluation and undervaluation. Eventually long-term mean reversion occurs to correct these excesses.

Over 2 decades ago, Eugene Fama made a powerful case that security price changes could not be predicted, and Burton Malkiel introduced the words “random walk” into the popular investing lexicon. Unfortunately, in a truly random-walk world, there is no advantage to portfolio rebalancing. If you rebalance, you profit only when the frogs in your portfolio turn into princes, and vice versa.

In the real world, fortunately, there are subtle departures in random-walk behavior that the asset allocator-investor can exploit. Writer and money manager Ken Fisher calls this change in asset desirability, and the resultant short-term momentum and long-term mean reversion, the “Wall Street Waltz.”

As much as it pains me to admit it, momentum exists. Understanding what it means for rebalancing and asset behavior will make you a better asset allocator.

1. Money managers do not exhibit consistent stock-picking skill.

2. Nobody can time the market.

3. Because of 1 and 2, it is futile to select money managers on the basis of past performance.

4. Because of 1, 2, and 3, the most rational way to invest in stocks is to use low-cost passively managed vehicles, i.e., index funds.