CHAPTER 9

The Longest Run: Sustainability

In this chapter, we explore the third leg of Gifford Pinchot’s economic stool: the longest run. It’s pretty clear from Pinchot’s background what he meant by that term. Pinchot was the first chief of the United States Forest Service. He was concerned about preserving our natural resources so they would be there for generations to come. Academics call that idea sustainability. It’s a wonkish word, but an important one without easy synonyms.

Natural Capital

Sustainability is what gets Dave going in the morning. You see, he is an ecological economist who studies the impacts of the economy on our planet. The picture he sees isn’t pretty. What is obvious from his studies is the way we humans, especially in the United States, are rapidly wasting our natural capital, all the things we get from nature to provide for our needs. Earlier in this book, we talked about different types of capital, including built capital (our factories, the roads we drive on, the machines that harvest our food, and so forth); human capital (our education and capacities); and social capital (our connections with family, friends, and community). But natural capital may be the most essential capital of all.

Understanding the value of natural capital was a by-product of Dave’s childhood. He grew up in suburban Tacoma, Washington, with a half-acre “little woods” next door, a sixty-acre “big woods” public park close by, and Mount Rainier National Park only an hour away. That’s a lot of beautiful nature. Fishing, clam digging, birding, hiking, and camping with a loving, environmentally aware family made for a wonderful childhood. It was time well spent. Later, Dave did graduate work in ecological economics at Louisiana State University, with the professor many consider to be the founder of the discipline, Herman E. Daly. Daly emphasized that natural capital is essential to every economy.

Economics is about preferences and choices. If you haven’t thought much about the value of natural capital, try Dave’s test: Would you rather have all Bill Gates’s wealth (some $50 billion) or just one of nature’s services, say, photosynthesis, and the good it produces—oxygen (which has no market value at all, no GDP value)? If you think you’d choose Bill’s money, try holding your breath for five minutes. Of thousands in audiences that Dave has spoken to, all but two people chose oxygen. Dave quickly challenged each one to come up front and hold their breath. A college student on the swim team lasted almost two minutes.

The Sustainability Paradox

Humanity faces a paradox. Never in human history have we been more successful and powerful. The human population has never been larger; we have never been wealthier, and our technological prowess has never been greater. Yet this success and the sheer size of the human enterprise now threaten to unravel the planetary systems upon which we all depend. Our successes are endangering the sustainability of our successes! You could call it the Sustainability Paradox.

Consider the following facts, all flowing from the Sustainability Paradox. They indicate that we cannot keep increasing our production, consumption, resource use, and waste disposal impacts on the planet.

• There are nearly 7 billion people in the world,1 who all need resources.

• The Earth’s atmospheric, oceanic, and land temperatures are rising, threatening to increase the size of deserts, flood seacoasts, spread tropical diseases, and more.2

• Agriculture and grazing systems already occupy 24 percent of the Earth’s land area.3

• Global fish catches peaked in the late 1980s; today one quarter of fisheries are overfished.4

• Freshwater shortages are rapidly escalating, threatening drinking water, irrigation, and industry.5

• World oil production has been flat since 2005 and is expected to decline.6

• Twenty-five countries are now completely deforested.7

• Human consumption runs rivers dry, including the Nile, Yellow, and Colorado.8

• Industrial chemicals damage the ozone layer, causing higher skin cancer rates.9

• Human-driven species extinction is occurring at a rate seldom known in geologic history and one thousand times the natural rate.10

• Hurricanes and typhoons are larger and more frequent.11

• Harmful industrial chemicals are found in every human being’s body.12

• World food prices are rising, while one billion people remain malnourished.13

Whew!

We Have Seen Bigfoot … and He Is Us

How far from sustainability are we?

More than a decade ago, two scientists at the University of British Columbia, Mathis Wackernagel and Bill Rees, developed a gross measure of sustainability called the ecological footprint. In short, it is a measure of the resources, energy, and space needed to provide your stuff and absorb your waste. Wackernagel and Rees developed this measure to provide a way for people to assess and reduce their negative impact on the planet. It is also a broad estimate of whether our economy is sustainable or in overshoot, that is, unsustainable, implying an eventual and undesirable ecological reckoning. The ecological footprint measures the share of the Earth’s productive land and water necessary to provide for the lifestyle of an individual or a country. And we Americans fill the biggest shoes on the planet. (Check out your ecological footprint size by taking a simple test at: www.myfootprint.org.)

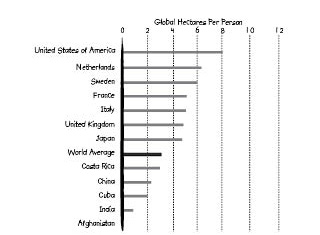

Both authors of this book took the global footprint measure and both use roughly fifteen acres of land and resources. We are like the average European, who uses about twelve acres. If we were average Americans, we would use over twenty acres.14 There is a problem with that. The Global Footprint Network (www.footprintnetwork.org), which now promotes the concept of the ecological footprint around the world, calculates that there are less than five acres of productive land and water available for every person on Earth. So if everyone were to adopt the current American lifestyle, we would need five planets to meet the demand. That leaves us about four planets short.

The figure below tracks the hectares per person consumed by the United States and other countries. Our big feet take eight hectares per person. The Global Footprint Network estimates that we are already using 1.5 Earth’s worth of biocapacity each year to meet humanity’s demands.15 In other words, we are already in overshoot, depleting and degrading critical natural systems. And we are still growing by leaps and bounds.

Now for some good news: Fortunately, we know how to reduce our footprint. Taking individual action is important. How you invest your time, energy, expenditures, and space really does count.

Importantly, we understand these problems better than people understood past problems. Consider, for example, the Black Plague in the fourteenth century. Back then, nearly one third of humanity died without anyone knowing that bacteria were the cause. Explanations for the plague included bad smells, maggots, the wrath of God, Jews, heretics, excessive merriment, excessive sadness, and the “evil eye.” “Cures” applied included smelling sweet fragrances, avoiding maggots, flailing yourself to appease a wrathful God, killing Jews and heretics, cultivating sadness or euphoria, hiding, or heading for the hills (which also spread the plague). Desperate guesses, self-interested ideology, and ignorance left humanity without effective solutions, leading people down a horrific trail of tears, sickness, suffering, and death.

Bacteria are not to blame for the Sustainability Paradox; rather, as the comic strip character Pogo put it, “We have met the enemy … and he is us.”

We need to unhitch the rail cars of ecological catastrophe from the economic engine, not just in the United States but worldwide. The National Academy of Sciences summed up the situation in 2009: “The world is entering a new geologic epoch, sometimes called the Anthropocene, in which human activities will largely control the evolution of the Earth’s environment.”16

The Right Picture

On January 10, 1610, Galileo saw the moons of Jupiter with the recently invented telescope. He assumed they were stars. But on the next few nights, he saw them move with Jupiter across the night sky. Incredibly, they changed position in relation to each other, unlike any star. Then it dawned on him. He was watching moons orbit Jupiter.

He published his findings in March 1610, making the case that the Earth and planets orbit the sun. That was earthshaking news. Religious teaching had it that all heavenly bodies orbit the Earth. Galileo’s view was strongly resisted. Though forced to recant, he eventually won the argument. The older worldview was proven false. Today, it is considered absurd.

There is no substitute for getting the big picture right. In the economic cosmology of twentieth-century economics, the economy is the big thing, a container with no physical limit to expansion and one that contains everything else. The environment is seen as but a subsector within the economy, providing resources (as shown on the following page).

The actual physical relationship between the environment and the economy is quite the opposite of that implied by our current economic paradigm. The economy is actually a physical subset of the environment, the source of all that comprises the economy (as shown above).

Solving the Sustainability Paradox requires understanding the true relationship between the economy and the environment. For too long, we have considered the environment to be part of the economy—the source of our resources. We need to begin to think instead of the economy as a wholly owned subsidiary of the environment. As the famous environmentalist David Brower once put it, “There will be no corporations on a dead planet.”17

Economies Need Nature

Natural systems provide foundational economic goods (things you can drop on your toe) and services (benefits that you can’t drop on your toe). Nature’s goods, including oxygen, water, land, food, timber and fiber, minerals, and energy, are required by all economies. In fact, every atom of the economy came originally from nature. Nature’s goods can be measured by weight, volume, and space.

Nature’s (or “ecosystem”) services are far more difficult to measure. Ecosystem services include storm protection, a stable climate, flood protection, waste assimilation, nutrient cycling, and natural processes that cleanse the air, water, and land. If these services are lost, we suffer damage and pay for lots of costly built capital replacements, like dikes or levees. Nature’s services also include educational, spiritual, cultural, recreational, and aesthetic benefits that contribute to the economy and our quality of life. All economies and the habitability of the planet require nature’s goods and services.

We can categorize the goods and services that we know of. Each of these categories holds many subcategories. For example, recreation includes hiking and biking. These goods and services are shown in the table on page 160.18

A Junk Tree Saves Lives

Nature holds far more value than meets the economic eye. Consider just one item in one category of the accompanying table. Northwest loggers using two-man crosscut saws left some “valueless” trees standing in the 1920s. Thus a scruffy 250-year-old Pacific yew (Taxus brevifolia) tree still flourishes in Dave’s yard. More recently armed with chain saws, loggers slashed and burned yew trees without replanting them across millions of acres of Northwest timberlands. Then, unexpectedly, extract from the bark of a Pacific yew tree found twenty-five miles from Dave’s house was tested and discovered to have cancer-fighting properties. That extract, called Taxol, is now the world’s most widely used and most successful treatment for breast cancer. Yew trees suddenly rose from junk tree status to medicinal wonder, becoming the most valuable trees in the forest!

Ecosystem Goods, Services and Benefits

Taxol is a wildly complicated molecule. Without nature having created it, humanity would never have synthesized it. It is not a perfect cure. Eliminating industrial carcinogens would do more to reduce cancer fatalities. But Taxol has made a great difference for many women. Without the yew tree’s cure, many more would have died. Many more children would have been without mothers. How much value would have been lost? And how many Taxols still await discovery? Ecosystems are valuable. Biodiversity is valuable even if we don’t know its full value yet.19

Vital Concepts of Ecological Economics

Nature is the original economic engine. Ecosystems can be self-maintaining, solar-fueled, self-governed (a libertarian’s dream!), and provide benefits in perpetuity (if we don’t destroy them). For example:

1. Natural systems produce whole suites of goods and services. Forests prevent flooding; provide timber, water, water filtration, habitat, shade, oxygen, recreation, beauty, and more.

2. Natural systems require less maintenance than built capital. Though restoration and other investments are often required, healthy ecosystems can be largely self-maintaining. Built capital requires maintenance and still falls apart. Restoring the Mississippi Delta wetlands provides self-maintaining hurricane protection indefinitely. Levees fall apart every fifty years or less.

3. All “built capital” is built out of natural capital. The metal, glass, rubber, and plastic comprising cars and the rest of our “stuff ” comes right out of the planet. In addition, water delivered to your house requires nature’s good, water, and built capital, the pipes. Natural and built capital are complements. Pipes don’t substitute for water.

4. Matter and energy are conserved, and useful energy is disbursed. This is basic science. Matter does not magically appear or disappear, and energy is dissipated (the first and second laws of thermodynamics). Economies do abide by the laws of science, yet much of economic theory was developed without attention to physical balances. Thus toxic waste and greenhouse gases and their costs didn’t exist in economic models.

5. There are limits to the physical size of the economy. As the physical dimensions of the economy expand, natural systems and the essential values they provide are damaged or lost. Eventually, the lost benefits and increased costs of degraded natural and social systems outweigh the marginal benefits of a physically bigger economy. Herman E. Daly calls this uneconomic growth. Attempting unlimited physical growth of the economy is neither possible nor desirable.20

In the 1930s, when the discipline of macroeconomics was born, natural capital was abundant and thus less valuable. Indoor plumbing and built capital were scarce and more valuable. No wonder our economic measures focused on the stuff we made. Today, clothes, plastic toys, asphalt, and other material goods are wildly abundant and relatively less valuable. Water, flood protection, climate stability, oil, fish, and all the other goods and services of natural capital are increasingly scarce and more valuable. Solving the Sustainability Paradox requires that our economic actions reflect these scarcity and value changes.

The situation facing North America’s largest river delta highlights the confluence of the economy and nature, the concepts of ecological economics, and the Sustainability Paradox.

Lessons from Louisiana

Louisiana and the Mississippi River Delta are laboratories for sustainability lessons. The delta is the sportsman’s paradise and houses more than 2 million people, 40 percent of the nation’s coastal wetlands, abundant fisheries, wildlife, shellfish, agriculture, timber, trade, beaches, endangered species, water, shipping, oil, gas, chemicals, Cajun culture, jazz, and Tabasco Sauce. It is also home to the aptly named cancer alley, but we won’t go there, at least not yet.

As a graduate student, Dave worked a summer for the Louisiana Geological Survey examining the ecosystem services provided by the wetlands of the Mississippi Delta, including the hurricane reduction value of the wetlands, and the trade-offs between oil production and renewable natural resources.

There are facts that no one disputes. Since 1930, the Mississippi Delta has lost 1.2 million acres of wetlands, converted to open water. Levees channel billions of tons of sediment and trillions of gallons of freshwater from the Mississippi Rive off the continental shelf into the Gulf of Mexico. That lost water and sediment could rebuild and sustain the delta. Mississippi Basin dams catch sand, once destined to build barrier islands. Canals for oil drilling cut up the wetlands, wiping out huge tracts. The waters of the Gulf of Mexico are heating up. That warmer water powers hurricanes, which have become larger and more frequent since 1970. The sea level is rising. Atmospheric temperatures are rising. The delta is sinking. If the landscape falls apart, so do the economies it contains.

Hurricanes gain power over open water and lose power over wetlands. But the Louisiana coastline has retreated more than thirty linear miles in some areas. Dave returned to Louisiana after Hurricanes Katrina and Rita had done their damage. Standing on the shoulder of a remnant levee overlooking the gaping breach where Hurricane Katrina’s storm surge swept away houses and the lives of men, women, and children, he experienced a cold sweat of horror. Katrina alone caused $200 billion in damage. It disrupted the nation’s oil supply, drove 2 million people from their homes, and killed another fourteen hundred.

Tragedies require good detectives, but hurricanes leave sizable fingerprints, clues to the source of the damages. Louisiana State University professors Paul Kemp and Hassan Mashriqui marshaled their students and recorded the debris lines along the coast. They revealed a stunning pattern. Where there was open water, the debris line was high, showing a big storm surge. Levees were demolished. Where there were barrier islands, wetlands, scrub oak, cypress swamps, and other natural barriers, the debris line was low, and levees were intact. For generations, many had said that wetland features dramatically reduce hurricane storm surge. Now there was hard proof.

Wetlands reduce the storm surge by more than one foot for about every 2.5 miles of wetlands. With twenty-five miles of wetlands, a hurricane’s storm surge could be reduced by ten feet. That saves levees, property, and lives. As little as one mile of wetland in front of a levee reduces the pounding wave action to a bathtub-style rise, substantially protecting levee integrity. The hurricanes of 2005 demolished or severely damaged over fifty levee sections, while wetlands protected most other levees.

Wetlands provided another advantage: Fifteen Gulf cities treated waste using wetlands. These systems were up and running again within months, while traditional sewage treatment plants were destroyed. New Orleans and other cities have switched to wetlands waste treatment because it also builds cypress swamps, providing added hurricane protection.

The choice for people in the area is clear: relocate or restore. Abandon the coast or invest in restoring the phenomenally productive Mississippi River Delta. Fortunately, there’s an able ally: The Mississippi River itself has the energy, sediment, and water to restore the delta. Dave is now on a scientific panel to identify projects to restore this delta, which will provide greater hurricane protection, increased fisheries production, recreation, “dead zone” reduction in the Gulf of Mexico, carbon sequestration, and reduced upstream and downstream flooding.

The wetlands expert John Day, professor emeritus at Louisiana State University, suggests that “as the great Mississippi River Delta disappears, so do the ecosystems, economies and people that it holds. The Mississippi River is the solution. It has the water, sediment and energy to rebuild land, defend against hurricanes and again provide habitat, safety, livelihood, and prosperity. We must look to the natural functioning of the delta to guide us in restoration.”21

It will cost about $15 billion to restore the Mississippi River Delta. Is the investment worth it? Is sustainability worth the cost? The 2010 study Gaining Ground, conducted by Dave and six others, partially valued eleven of twenty-three categories of economic services that the Mississippi Delta provides, showing $12–47 billion in benefits every year. Products and services, such as drinking water, fisheries production, hurricane protection, recreation, carbon sequestration, and flood protection were included in the calculation.22

Treated like a capital asset, the delta’s minimum asset value would be between $330 billion and $1.3 trillion.23 Aggressive restoration would provide at least $62 billion in avoided costs and additional benefits. Large-scale restoration is a good investment. In addition, reconnected wetlands do not degrade in fifty years like a levee. If the wetlands are maintained, these economic benefits could flow indefinitely. Levees, cities, economies, and people require healthy natural systems.

If Hurricanes Katrina and Rita weren’t enough, the Gulf of Mexico got hit again on April 20, 2010, when an explosion and billowing fire broke out on BP’s Deepwater Horizon off-shore oil rig in five thousand feet of water, drilling thirteen thousand feet below the seabed. The U.S. government guessed that 4.9 million barrels (254 million gallons) of crude oil belched into the biologically rich Gulf waters. At $100/barrel, that oil would have sold for $490 million on the global market. Disturbingly, the GDP recorded the spill as a vast economic gain, far greater than if the oil had actually been refined and sold. Cleanup costs, legal costs, ships rented, and compensation paid out all added to the GDP, between $5 billion and $8 billion by June 2010 and still rising.24 BP is selling assets and setting aside $15 billion over three years for the compensation fund.25 Losses related to the spill, such as lost fisheries production, are not counted as losses in the GDP; they just don’t appear at all. Louisiana typifies the confluence of challenges forcing economic transformation: peak oil and climate change.

Trouble Peaking on the Horizon

Through the eyes of an economist and geologist, the oil spill marked even deeper trouble. The United States is drilling in deep water because it is running out of oil. In 2005, Chevron bought a two-page New York Times advertisement stating, “It took us 125 years to use the first trillion barrels of oil. We’ll use the next trillion in 30.” It continues, “One thing is clear: the age of easy oil is over.” The ad was both a warning about peak oil and a pitch to “drill, baby, drill.”

It takes tremendous amounts of energy to obtain oil from deep water. Why is the United States investing the last of its cheap and easily recovered oil to pursue expensive, hazardous, hard-to-get oil? It pays off for oil companies, which receive between $6 billion and $36 billion in federal subsidies annually to go get it. However, it would be far more sensible to burn less gas commuting (an unhappy activity anyway) and invest to get off oil. U.S. and world oil reserves are shrinking. Climate and water are also economic game changers. The Sustainability Paradox really means that our current economy is less viable every year that water and oil scarcity rise and the climate heats up. Fortunately, we can burn less oil. We can use water more efficiently. We can build a climate-friendly economy that is better than what we have now. Economic achievement and ecological disaster need not be coupled. We’ve got solutions.

The Solutions Are Here

Solving the Sustainability Paradox is not about finding more solutions. As the Mississippi Delta demonstrates, we actually have potential solutions identified and largely worked out. This goes for virtually all of our ecological problems. More investment is needed, but know-how and technology are not significant barriers to adopting successful solutions. Consider solutions we’ve got in hand, solutions that work today. The details would take books to describe, and in fact, books with the details abound. The table above shows a cursory overview of problems, identified solutions/new fields (dealing with these problems), and actions that we can take as individuals and collectively to help solve these problems. Is it more complicated than this? Yes. Can existing solutions be implemented? Yes.

These are just a few of thousands of solutions available. What we need to secure prosperity over the longest run is to implement the solutions we have in hand. That would resolve the Sustainability Paradox. So why aren’t our solutions being applied at the scale required to solve our problems? What is the problem with solving our problems? Besides politics, the answer is simple: We are not investing in solutions.

Investment: The Key to Securing the Longest Run

All these solutions require investment sufficient to the scale of the problems. Solving the Sustainability Paradox requires enough investment to transform the economy and our behavior so we live well and within our ecological and planetary means.

Let us be clear about our assumptions regarding positive change.

• The economy’s future requires securing environmental sustainability.

• Fixing the environment requires fixing the economy.

• Fixing the economy requires shifting investments from problem promotion to solution implementation.

It’s actually easier to change the economy than to reengineer human biology to safely absorb carcinogens. It is easier to reduce carbon dioxide emissions than defend ourselves against ever-larger hurricanes, floods, and droughts. It is less costly to manage better what we best understand and control: the economy.

In the largest sense, economies are easy to change. Transformation is what economies do. Every thirty years we rip up the roads, gut the buildings, replace stocks of clothing, appliances, lights, cars, trains, planes, and electronics, save for a few antiques. At a slightly slower pace, all private ownership, all leadership, all management turns over, as one generation passes onto another. We redo practically the whole economy every few decades (without the present urgencies). This habit is wasteful and needs to change. We need to ditch the “throwaway” in our throwaway society. In a generation, we have used more resources than all the people who ever lived before the mid-twentieth century.

Durability is valuable and sustainable. But the point is that economies are constantly remade, even within ten years. And changing the way we design our economy is imperative and not just possible; it is well within our reach.

Between 1934 and 1944, the U.S. economy was transformed (see chapter 10). Ten years after World War II devastated European countries and Japan, their economies were rebuilt, not into prewar economies, but into new systems. China galvanized investment from the United States, Europe, and Japan since the early 1990s on a scale never known in human history. Much of global manufacturing moved to China in a single decade. In 2010, China became the world’s second-largest economy.

The universal excuse for not investing in solutions to shift our economy to prosperous sustainability is: “It costs too much.” Truly effective investments are frowned upon as unsupportable costs, while real costs are externalized (dumped on someone else). Every day, this kind of thinking slows the adoption of less expensive, better, fairer, more efficient and productive sustainability investments.

As built capital is more abundant and relatively less valuable, while nature’s goods and services are scarce and more valuable, investing in more built capital may actually increase the scarcity of what is most valuable to us, undermining both ecological and economic sustainability.

Investing in Sustainability

If saving the environment and saving the economy both require shifting investment, what does it take to do that? Six improvements in economic analysis (accurate accounting, cost/benefit analysis, pricing and green taxes, private investment tools, banning bads, and moving big money) could move trillions of investment dollars from the unsustainable side of the balance sheet to the sustainable side.

Accurate Accounting. Seattle’s population quadrupled between 1880 and 1889. The city had no sewer system. Four unregulated private water companies drew water from local lakes, into which sewage was often dumped. After epidemics of cholera and typhoid, Seattle became known as one of the unhealthiest cities in the United States.26 Finally, in 1889, citizens had had enough.

That year, Seattleites voted (93 percent “yes”) to establish Seattle Public Utilities (SPU) to provide water to the city. SPU purchased much of the upper Cedar River Watershed in 1899 to secure a safe water supply on a scale dwarfing the city’s needs. Had the Seattle City Council required a quick return on the investment, the purchase would likely have been rejected. However, the goal was not to maximize “net present value,” but to provide a safe, reliable, and sufficient drinking water supply for the people of Seattle in perpetuity. By 1901, clean water was flowing, banishing cholera and typhoid.27 By 1909, Seattle was considered one of the healthiest cities in the United States.

It was a sound investment by any measure. Today, SPU would have to pay $200 million to build a filtration plant to do what the Cedar River Watershed does for free. Filtration plants, like all built capital, depreciate and fall apart. The forest in the watershed did not depreciate or fall apart. It appreciated and grew. Relative to the size of the asset, a forest also requires light maintenance. The watershed now provides far more water and far more dollar value than ever imagined by most citizens in 1899. Today, Seattle’s tap water is also among the cleanest in the world. Better than bottled water, it has no endocrine disruptors or pharmaceuticals, because no one is flushing anything into the watershed above the supply source.

Contemporaries of Gifford Pinchot in Seattle, San Francisco, Tacoma, Portland, Vancouver (British Columbia), New York, and other cities put his goal of the longest run into durable practice, accessing forested watersheds to provide clean water in perpetuity. Impressively, the management and staff of these utilities have held true to that mission.

In November 2010, these six watershed public utilities, which provide water for over 16 million Americans, met in Seattle to discuss a problem with their bottom lines.28 These utilities’ current balance sheets list their watersheds as assets only for their bare land and timber values. There’s not a penny of value on their books for providing and filtering water. Yet these watersheds require investment: fencing cows back and improving septic systems in New York; funding restoration on private lands in San Francisco; reducing siltation by removing roads in Seattle and Portland; acquiring additional watershed lands for Tacoma and Vancouver. That takes financial investments.

Watershed operations and maintenance are chronically underfinanced. If SPU needs a new fleet of vehicles, it can borrow money, buy the vehicles (counted as assets), and pay back the loans with income from water sales. But there is no dedicated capital budget to restore the watershed. It’s hard to invest in a valueless asset. If the value of the watershed for providing water counted as an asset on SPU’s books, the utility could sell bonds and invest to restore the watershed, improve water quality and production, and bill ratepayers for the capital improvement. That is far less costly to ratepayers than building a filtration plant. A watershed with an asset value for producing water also justifies a sufficient budget for maintaining the watershed.

In addition, the utilities realized their watersheds are providing a lot of other valuable goods and services, including flood protection, biodiversity, carbon sequestration, habitat, and more, all of which don’t show up on the books.

Facilities, pipes, vehicles, buildings, roads, computers, and copy machines count. This is not utilities’ choice, nor is it their fault. The accounting rules for governmental entities are set by the Governmental Accounting Standards Board (GASB). Six major U.S. utilities are moving to request an accounting change from GASB so they can actually count watersheds as assets that provide and purify drinking water. That would enable increased financing for productive investments to conserve and restore these watersheds.

Water is the tip of the iceberg. The deeper issue is that legal accounting rules require governments and private industry to account for built capital assets, but not natural capital assets, though both may produce the same product. But the economy has changed. Natural capital is now scarce and more valuable. Enabling adequate investment in natural capital requires improved accounting rules. We need accounting that appropriately values the benefits of aquifers, deltas, climate, forests, farms, snow pack, rivers, lakes, wetlands, and other natural systems that affect every American community.

Cost/Benefit Analysis. What counts as cost and benefits in the economic analysis that guides investment is important as well. All federal and state agencies, cities, counties, and many private firms utilize cost/benefit analysis to make infrastructure investment decisions.

For about a decade, the United Kingdom has required that ecosystem services be valued and factored into all flood protection cost/benefit analysis. This has resulted in the more long-term and cost-effective approach of buying out some properties, setting levees back, and providing more robust flood protection, adding habitat, improving water quality, increasing recreation, lowering flood insurance rates, and reducing property damage.

Nature’s goods and services are a bargain and a good investment opportunity. Washington’s Puget Sound Basin houses more than 4 million people. Its natural systems provide “work” and benefits worth at least $9 billion, and up to $83 billion in value every year.29 Treated like an economic asset, the natural capital of the Puget Sound basin would be valued between $300 billion and $12.6 trillion.30 That’s big value. And it can now be included in economic analysis. How can we better include ecosystem services in economic analysis?

The next generation of tools is being developed to do just that and help guide public and private investment. Ecosystems and economies are dynamic, living systems that interact across the landscape and in people’s daily lives. From every drop of water you drink, bite you eat, toilet you flush, or breath you take, something is provisioned. Watersheds and aquifers provision water. On the other hand, airborne mercury from burning coal contaminates lakes, then fish, then people. These stocks, flows, and processes can be mapped and modeled. Dave and his colleagues, led by Ferdinando Villa, received a National Science Foundation grant to develop cutting-edge ecosystem service modeling. Their software program utilizes geographic information systems (GIS) combined with modeling software, enabling the mapping and modeling of natural systems and economies as never before.

Here’s the simplified description. Picture each ecosystem service in a watershed, like flood protection, drinking water, or recreation, mapped for an area with three overlays.

1. A map of the provisioning area for that service.

2. A map of the people and industries that benefit from that service.

3. A map of the impairments to that service.

Flood protection, for example, is provided by both natural and built capital assets, and these can be mapped. These assets include forests and rivers, snow pack, permeable soils, dams, and levees. Rainfall levels and how water moves through the landscape can also be modeled. That’s the first mapping/modeling process. The beneficiaries of flood protection usually live in the lower reaches where flooding most often occurs. They can also be mapped. Impairments to flood protection, such as a bridge or natural constriction narrowing the floodway, denuded hills, floodplain fill, impermeable surfaces, or other features, can also be mapped and modeled. Drinking water is provisioned differently by natural assets that overlap with flood control and a built capital distribution system. The beneficiaries include well-sourced households and people served by public utilities. Impairments might include a plume of polluted water threatening the aquifer. Recreation has another map. The water supply for San Francisco, for example, is sourced from public lands, in this case, Yosemite National Park, a critical conservation and recreation area.

Now consider combining the three maps for each of the ecosystem services in a single watershed. Suddenly, a new view of value emerges. Overlap on the landscape between the provisioning of drinking water, flood protection, recreation, salmon restoration, storm water conveyance, biodiversity, carbon sequestration, and other services can be revealed. That mapping, when used to influence public policy, design restoration, or build infrastructure, can provide better services and save a lot of money. This analysis is stronger than traditional cost/benefit analysis because it is spatially specific. It shows the beneficiaries and how investment value is distributed in time and space.

Prices and Green Taxes. In the U.S. market economy, the citizen consumer is king. Personal consumption is the largest portion of our GDP, accounting for 70 percent of the total. But central to the concept of consumer sovereignty is the idea that consumers understand the full costs of their purchases—to themselves and to others.

Markets can only function efficiently if all costs are included in the price of the product. Otherwise, market values are distorted. The costs of such negative externalities as the pollution caused by burning gasoline are often not included in the price of the product and are borne by someone outside the transaction—taxpayers or asthma victims, for example. Negative externalities are unjust, uneconomic, and undesirable. Most economists agree on that. Thus, if prices don’t reflect true costs, markets may be doing more damage than good.

Citizens can’t be good sovereigns if prices don’t reflect true costs. If you don’t adjust the price, the costs will be there anyway. It’s just that they come later in the form of cancer, a financial crisis, extinction of species, flood damage, or other problems. Cigarettes are a good example. Once barely taxed, they produced incalculable damage and billions of dollars of losses in lawsuits and medical expenses. Today, the price of cigarettes is closer to the real cost, people smoke much less, and the tax money is in part used to pay for treatment of people who get lung cancer. It is better for everyone to get these true costs right initially, and that can shift investment on a grand scale.

Private Investment Tools. Getting the prices right and improving private investment tools are closely related. Green building provides an example: Were the full benefits of conserving water or using nontoxic materials included in the price of homes and buildings, investment would quickly shift to green building, industry-wide. If a sufficient portion of the savings generated by a green building could be returned to the builder, owner, and renter, that would adjust the cost, asset, and income variables in the real estate investment models that large and small developers utilize. It would quickly shift billions in real estate investment.

Markets do not naturally include the cost of pollution in the price of the product. As the example of cigarettes has taught us, government taxes and charges can be used to correct for externalized costs. These green taxes make markets and economies more efficient. In the twenty-first century, paying attention to what guides investment is really the key to saving the environment and the economy.

Every firm and industry has financial tools to direct internal investment. Industrial indicators are planning tools that integrate environmental, social, and financial goals to assist companies in performing better. Better indicators can help answer the most common request from industry middle management: “Help me make the financial case to justify green investment.”

These tools help businesses measure negative and positive environmental impacts, to the firm and society. Some businesses don’t care (that’s the topic of the next section). This section is about innovators, not greenwashers.

Five paper mills in Washington State (Simpson Tacoma Kraft, Port Angeles Nippon Paper Industries, Port Townsend Paper Corporation, Boise Wallula, and Grays Harbor Paper) were willing to surpass environmental compliance standards by developing and applying new indicators. Saving energy and improving processes also helped the bottom line. The paper mills contributed staff time and data.

The indicators were developed not to compare paper mills (which have fundamentally different products and processes), but to assist mill managers in combining improved performance, energy efficiency, better environmental outcomes, wood chip sourcing, and improved bottom lines. They include forty-two environmental indicators, fourteen economic indicators, and sixteen social indicators, ranging from emissions and energy consumption to jobs, customer satisfaction, worker conditions, and value added.

Potential investments identified were extensive, including fixing compressor leaks, surveying wildlife, and sourcing wood chips from state-certified timberlands. These changes enable paper mills to better implement green investment improvements within their regular maintenance and capital improvement schedules, reducing costs and improving environmental performance. Adopting indicators specific to every industry would shift trillions of investment dollars toward sustainability.

This requires a lot of “nitty-gritty” in every industry, in every single plant. That’s a lot of good that do-gooders can achieve, but what about bad actors?

Banning Bads. Full-cost pricing would go a long way toward shifting investment and improving products. But in many cases, economic efficiency is best served by banning toxic chemicals and other dangerous products entirely. Had asbestos been banned earlier, lives and bankrupt corporations could have been saved. Some trade should also be banned, for example, the trades in ozone depleting substances, toxic waste, or endangered species. These trades are not trades in “goods,” nor are they fair and just commerce. No price adjustment can make them so. There is no replacement for just law, well enforced. When a United Nations agreement, the Basel Convention, banned the export of hazardous waste from rich to poor countries, such exports became rare. As Jim Puckett, the executive director of the Basel Action Network (BAN), puts it: “If you don’t allow toxic waste to be cheaply dumped or exported, it’s like plugging the exhaust pipe. Costs rise, industry suddenly decides that investing in cleaner technology and not producing toxic waste is affordable. That’s the real solution. As enforcement has risen the trade in raw hazardous waste has withered. We see few cases these days. Now it has shifted to hidden wastes in ‘recyclable’ products.” Puckett is now working to reduce the toxics in recycling electronic waste, car batteries, and ships. If these products were designed to be nontoxic and to be easily recycled, we would have a more efficient and sustainable economy.31 (See www.ban.org for more information.)

Moving Big Money. Changing accounting rules, improving economic analysis to reveal costs and benefits, strengthening financial regulation, and changing taxes and pricing are critical to changing incentives and investment at the scales of the household, firm, nation, and world. Here are three additional ideas that would move large amounts of money to shift our economy to sustainability.

An Atmospheric Trust is the suggestion of Working Assets founder Peter Barnes and Robert Costanza.32 The trust would be a new institution, administered by trustees with the mission to “protect the assets of the climate system and atmosphere) for the benefit of current and future generations.” Since greenhouse gases are a current threat to the climate, it would regulate greenhouse gas emissions. The trust would create a global cap on carbon based on precautionary science. The price of carbon would be set to meet this cap either through a carbon tax or through a cap and trade system. Caps set quantity and allow price to vary; taxes set price and allow quantity to vary. For that reason, Barnes and Costanza prefer a cap and trade system.

The Atmospheric Trust would auction carbon permits under the cap and trade system. If the auction price were ten to eighty dollars per ton, a global trust would bring in between about $1 trillion to $3.6 trillion. Because all of humanity and future generations are the “shareholders” in the atmosphere, the revenues would be spent in three ways.

First, every person would get a portion refunded (this would redistribute wealth from carbon emitters to carbon conservers and raise incomes in poor countries). Second, a portion of the funding would go for replacing coal and other carbon-intensive technologies with renewable energy and compensate for ecosystem services and carbon sequestration. Third, a portion would be spent to run the Atmospheric Trust. Interestingly, the fund would not give money to governments. Trustees would be appointed for their commitment to the mission of protecting climate and the atmosphere, not based on any political, geographic, or other criteria. All expenditures would be posted on the Internet.

No system is perfect, but the Atmospheric Trust is a refreshing proposal because it is an institution set at the scale of the problem with a mission to solve it and a funding mechanism to do so.33

Another suggestion is a small currency and financial transactions tax of less than about .25 percent further described in (chapter 12). This tax would shift a significant part of $4 trillion in daily speculative currency and stock trading out into more constructive investment. This would likely crowd about $3 trillion into actual investments rather than speculation. Real investors would pay little and gain from greater market stability. The tax would also raise substantial funds from remaining speculators, on the order of tens of billions. This could be dedicated to investments in our energy/climate transition.

Shifting off a declining fossil fuel economy and onto a sustainable path requires investment on a large scale, both private and public. That implies changing the incentives that guide trillions of dollars in private investment, ensuring that sustainability investments outperform ecological crash-and-burn investments. That takes active government policy. In addition, American corporations and citizens will have to pay higher taxes to accomplish this infrastructure shift and keep the deficit under control. Raising the marginal income tax rates more in line with those of Europe would generate the funds to create jobs and build an economy that will be more sustainable and prosperous than the unsustainable and currently declining American economy.

Regarding peak oil, as Republican representative Rosco Bartlett stated before Congress, “What we need is a program that has a total commitment of World War II, the technology focus of putting a man on the moon, and the urgency of the Manhattan Project.”34

Solving the Sustainability Paradox

Humanity faces a paradox. The economy that produced affluence is now degrading the very ecological systems that support it. Shifting our economy off oil and fossil fuels to renewable sources, conserving water, and biodiversity will entail tremendous investments.

How can we afford it? Finance has never been cheaper. First, move trillions from speculation to investment with the right accounting and incentives. Second, create institutions at the scale of the problem with funding mechanisms to solve the problem. Third, shift taxes to move public finance, generate green jobs, and implement transition.

Solving the Sustainability Paradox is not a case of figuring out what is causing our problems. It is a problem of committing ourselves to implement well-known cures, a sacrifice at first, but one that will pay off soon, and handsomely, in better lives for all. Largely the only argument against pursuing a sustainable economic path is “it costs too much,” and that rebuttal is based on faulty accounting and erroneous calculations of overall costs.

Threats at the personal and planetary scale make the transition to a new and better economy even more imperative. More of the same “economic growth” is not the solution. We Americans can build a new and better economy quickly. As the next two chapters make clear, we’ve done it before. Understanding how we got here, the economic ideas that built our economy, and how to make the needed transition to sustainability and happiness requires a bit of a trip through American economic history.