Client Meeting Preparation Checklist

Name ___________________________________ Date _________

Use the checklist below to help prepare prior to our meeting:

Key Life Events

Financials

Business

Customers love certainty, make sure you give it to them. —Amit Kalantri

This chapter discusses how to structure and execute meetings with prospects and convert them to clients. We recommend a three meeting approach to prospect meetings.1

Meeting one consists of building rapport and trust; showing you care; uncovering needs, wants, unfulfilled desires, and concerns; emotionally and economically qualifying the prospect; creating interest; and getting the prospect ready to change by selecting you as their financial advisor. This phase of the process involves a detailed creative discovery so that you know as much about the prospect as possible.

The second meeting will be a complete diagnostic of the prospect’s current financial situation. The goal is to uncover technical needs, review their goals, and continue to increase their level of congruence so that when the time comes to take the action of committing to you, they will say yes.

The third meeting will be about your game plan. You will demonstrate how you are going to help prospects achieve their goals. You will shape your presentation around the prospect’s communication and buying style and their personality. You will use emotional tie-ins and be prepared to handle objections so the prospect takes action with you.

It is critical to never meet with a prospect without that person’s significant other. Until recent years, especially with baby boomers, more men than women have taken the lead in financial issues when couples are involved. However, while women are already a significant force in the financial world, they are projected to be more so as time moves on—by 2020, women will control half of the wealth in the United States.2 There will also be a dramatic increase in their earning power, with 4 in 10 women outearning their husbands. This is an increase of more than 50 percent from 20 years ago.

The National Center for Women and Retirement estimates that 9 of 10 women will be solely responsible for their finances at some point in their lives.3 While this is an opportunity for FAs, we know that 70 percent of women fire their FA within a year of the loss of their spouse. Attempting to start developing a relationship with a surviving spouse after the death of the other spouse is too late. Relationships with both spouses need to be built from day one. The same report that gives these statistics states that Fidelity research says that women aren’t afraid to ask for the help of an advisor: Among women decision-makers without an advisor, 49 percent of those surveyed said they would like to find an FA to manage their assets compared to just 17 percent of their male counterparts. But they are also not afraid to take their business elsewhere if their advisor neglects to build a relationship with them.4

“Unfortunately, the advice industry has not received high marks on working with female investors,” the report says, citing a study by The Boston Consulting Group (BCG) that found that “women were more dissatisfied with the financial services industry than any other industry” and that “women reported being treated with disrespect and condescension, and given poor advice specifically because of their gender,” and despite this dissatisfaction, female investors present an opportunity for advisors.5

Fidelity’s research suggests that women are:

• More interested in holistic financial planning

• Typically more risk averse than men

• Often better candidates for financial advice

While there will be special cases, all meetings with clients and prospects who are part of a couple should be conducted with both parties. Beyond meetings, establishing a relationship with both parties and with their adult children should be considered mandatory for long-term success.

The first meeting with your prospects is about “discovery.” The processes we discuss are for true wealth management/financial planning practices using the consultative approach. In that case, your objective for this meeting is to understand the prospects as people as well as their needs and wants. These are two separate perspectives of discovery. From the standpoint of understanding the prospects you want to know their thoughts about their lives; their values, beliefs, hopes, and how they got to where they are; what they care about and why; who they care about; and what’s most important to them. In this meeting your questions will go beyond money and finances. You want to know about the prospect’s family, their health, their leisure interests, what they are interested in learning, their inner growth goals, and their home, community, and work lives. You can certainly note that most if not all of these “other” parts of life also have financial implications, though the focus here is on wants and needs, not on funding.

Some prospects won’t necessarily or easily want to get into the depths of their psyches on their first time meeting you. However, now and as time goes on, this is where you need to go with your “to be” best clients. This discovery process is done through your manner, your questions, and your reactions. Remember that prospects make up their mind about you in the first seven seconds of meeting you and spend the rest of their time justifying their initial belief. In those first seven seconds your prospects observe your grooming and your welcome, your demeanor, and your opening comments, as well as the physical environment. Ideally you are meeting in a nice meeting room (not your office) and appropriate beverages and perhaps light snacks are served, if appropriate. Your assistant should have previously discussed with the prospects their choice of beverages. Each of the seating places has a pen and paper awaiting the visitors and you. You and your assistant are present to greet your guests. You will not be using a PC or presentation. A round or square table is better than a rectangle because there is no head of the table. Have your guests sit where they prefer and after they are seated, you join them. Your assistant asks if you need anything else and assuming not, she leaves, telling both prospects, “It was nice meeting you.”

There should be no further need to introduce yourself, your credentials, or your background. If that hasn’t been previously done through collateral material, it can very briefly be mentioned at the end of the meeting or preferably, if necessary, in your follow-up email, letter, or a handwritten note, which is my preference.

The goal of this first meeting is to have the prospects become comfortable with you and commit to a second meeting. That implies the prospects and you will come to the conclusion that you should both continue to discuss working together based on the prospects’ belief that you can be of service to them and your belief that you can provide the services and solutions that will meet the prospects’ objectives. In the end, there must be a sense that the prospects and you have begun a good working relationship.

After you have a context, and it appears there is a general meeting of the minds, you can get more into the details of the prospects’ financial picture and begin to put together a plan to meet the prospects’ wants and needs, which takes place in the second and third meetings.

To recap, the first meeting consists of building rapport and trust with the prospect and showing you care, uncovering needs and wants and issues they deal with in their lives, while qualifying the prospect both emotionally and financially and, most critically, creating interest from the prospect and getting an understanding they are prepared to change—either moving from their current advisor or from managing their portfolio themselves.

In their book Storyselling for Financial Advisors, Scott West and Mitch Anthony state: “In selling, there is no denying that analysis, number crunching, logic, and organization play a necessary role. However, these left-brain functions constitute at best, about 10 to 20 percent of the critical mass necessary for sales success. The other 80 to 90 percent comes from right-brain functions, which play primary roles in the sales realm.”6 The point for the advisor is to understand the prospect’s right-brain and the person’s emotional drivers. When and where appropriate, without taking too much time, share some of your own relevant emotional drivers, especially if you can identify with the prospect.

West and Anthony also state, “The greatest mistake we make in selling is neglecting to learn more about our customers before making our presentation. We are so excited or passionate about telling our story that we fail to hear our clients’ stories.”7 Do not do this! This meeting is all about them, not about you!

West and Anthony also discuss how the more time you spend learning about the experiences and views of your clients and prospects, the more weight they will give to your experience and views. If you don’t ask before you tell, you have no assurance that what you are saying is what the client or prospect is asking for. How can you be sure you are on target with your thoughts if you have not taken the time to let the client define the target? Ask the right questions and people will talk. Critical emotions, experiences, values, and hopes are revealed when you ask the right questions. This is payoff. Once you ask you’ll understand what makes your clients tick, what they can and can’t tolerate, the highly charged emotional issues to avoid, and the principles you can use to forge a bond. Prospects and clients will appreciate your questioning, as it shows you are interested in them as individuals, not just as accounts.

This meeting is an 80/20 experience, with the advisor speaking 20 percent of the time, mostly asking questions and answering a few, but the prospects should be speaking 80 percent of the time, telling you about themselves. Be certain to concentrate equally on both spouses.

Before listing some questions for your consideration, we want to mention the “permission technique.” Using the permission technique softens situations. Asking for permission to ask a question before asking the question is a wonderful way of getting someone to really think about their answer when your question comes their way. It’s a heads-up that a response is desired and it allows your prospect to mentally get in position to answer whatever you are about to ask. It gets attention, and holds it. If you choose to ask for permission, make sure that you wait to receive it before proceeding. Because this is a question, it requires a response, thus involving your prospects. Once someone gives you permission, his or her consent becomes the green light for you to ask your question or present your proposition. Asking permission works, because anything you say with permission is bound to find a more receptive audience than anything you say without it. Permission gives your prospect something to say yes to, and a “yes” is almost always a good beginning to persuasion. In fact, asking permission is so powerful that you can continue to ask permission throughout the meeting.

The following are some of the questions to consider asking your prospects in your first “discovery” meeting. You can of course start by saying, “I’d like to ask you a number of questions. Do you mind if I work from my notes so we are sure to cover everything?” P . . . A . . . U . . . S . . . E . . . for answer. “Are you ready to get started?” P . . . A . . . U . . . S . . . E . . . for answer.

• What do you hope comes out of our meeting today? (Look for values, beliefs, priorities, and hopes.)

• I would like to get to know you both a little bit better because it will allow me to make sure I give you both the proper advice for your situation.

• Could you take a few minutes and tell me about yourselves? (Note that each spouse should give a separate answer.)

• Where are you from? (You can ask what it was like there growing up if appropriate.)

• How did you two meet?

• Please tell me about your family.

• Is there anyone besides yourself whose future hinges on your financial decisions? (Give examples such as parents, children, special needs, etc.)

• Tell me about your family when you were growing up. Were there any messages about money you received when growing up? What financial values of your folks continue to affect you today? What does money mean to you?

• What are your most important financial concerns? How do you hope we can address them?

• What are your most important nonfinancial concerns and objectives?

• What are some of the things in your life that you are most passionate about? People? Causes?

• What and who are more important in your life than money?

• What are your aspirations for the future?

• What would you do differently if you had no financial concerns?

• Tell me about your work (or the work you did).

• How did you gather the wealth you have?

• What are things that you want your money to do for you? What is your “wish list”? Everyone I meet always has dreams, goals, or some deep want that they don’t believe they can attain. I can’t promise you we can make it happen, but let’s take a moment and put together our wish list. (Give examples such as travel, family, giving, and experiences.)

• What have you done to date about these wishes? (An example is asking where have they traveled and what did they like there.)

• What is the best financial decision you have made in your life?

• What is the worst financial decision you have made in your life?

• Are there any current or anticipated factors or circumstances in your life that could affect your financial plans?

• May I ask about your experiences with other financial advisors?

• How did you meet your current financial advisor?

• What is most important to you about your relationship with a financial advisor?

• What did the advisor do that you liked?

• Was there anything the financial advisor did that wasn’t valuable or helpful for you?

• What are some things you want to avoid in any relationship with a financial advisor?

• What didn’t the advisor do that you’d like to see added?

• Do you understand your portfolio and why it’s invested the way it is?

• On a scale of 1 to 10, with a 10 being exceptional, what would cause a 10 rating for your advisor?

• There are emotional issues and life-altering traumas in every person’s life. Is there anything that affected your life that you’d like to bring up? (Examples might be a layoff, medical issue, loss, etc.)

• How are you feeling about the world these days?

• What have been your sources for learning about investing, and what principles do you follow with your money?

• What would you want of this relationship? What do you expect from a financial advisor?

As time allows, it’s of value to understand where the prospect is today with respect to a host of issues and where they see themselves in perhaps five years or longer, depending on the issue.

• We discussed your family. Do you anticipate any major changes over the next five or so years? (Examples are parental dependency, college costs for children, wedding or other event costs.)

• How is your health and that of your family, and do you anticipate any major changes over the next five or so years?

• How is business doing, and do you anticipate any major changes over the next five or so years? (If they have a business of their own you might also ask for details about employment, growth plans, and succession plans.)

• What do you do outside of work, and will you be doing more or less of that over the next five years or so? (As an example, to meet their future desired lifestyle wants or needs, people may need to downsize and/or move geographically. To put your plan together you need to gather that knowledge so you can prepare alternative options.)

• Do you see any threats to your financial security?

• Would you be willing to give me a high-level overview of your financial status?

• To get a financial picture you want an overview, no details! If they want to show you statements, you can say, “If you think we have a meeting of the minds, and it appears we can be of help, in our next meeting we will get into the details of your accounts and finances.”

• If they want to leave their financial materials, great—it’s a sign of trust.

• Do you have a recent estate plan in place, including business succession planning (if appropriate)?

• How satisfied are you with the level and quality of insurance protection you currently have?

• How satisfied are you with your current investment choices?

• How satisfied are you with being on track to build a sufficient retirement nest egg?

• How satisfied are you with the feelings you have about your money life?

• I need to ask you about situations that you definitely want to avoid with your investments and finances. Tell me about all the situations we need to avoid.

• How satisfied are you with the working relationships you have with your other service providers (i.e., insurance agent, banker, broker, financial planner, accountant)?

• Are there any questions I haven’t asked you that you would like to add to give me more background?

• What questions do you have for me?

There are too many questions here to ask in a single session. At most, these discovery sessions should be kept to 90 minutes and 60 minutes, if possible. After that attention wanes, on the part of both the prospects and the advisor. It’s always courteous to ask your prospects (as well as clients) how much time they have allocated to the meeting.

Prepare a questionnaire in advance. It’s quite okay to have it in front of you and use it to record answers, noting from whom the answers came (i.e., spouse 1 or spouse 2). Feel free to ask the prospects if they mind if you use the questionnaire so you make sure to cover everything. It is extremely rare that people would ever say they would mind. In fact, using the questionnaire is a way of showing your preparation and professionalism.

There are some questions you can ask that give you time to respond if you need a minute to think about a reply. You can essentially ask for further clarification with these questions:

• What’s important about that to you? Why is it important? (Ask the other partner if they feel the same way.)

• Tell me why you say that. (For example, if a prospect suggests the cost of a full-service financial advisor is too high, you ask, “Why do you say that?” Understand what the prospect’s experience may be before responding. You do have to answer this question in many cases, whether it’s overtly asked or not.)

• Tell me more. (You can slow a conversation with these three words.)

By the end of this first meeting you should have qualified the prospect and gained an understanding of whether you are on the road to a good relationship and they are willing to consider you as their advisor.

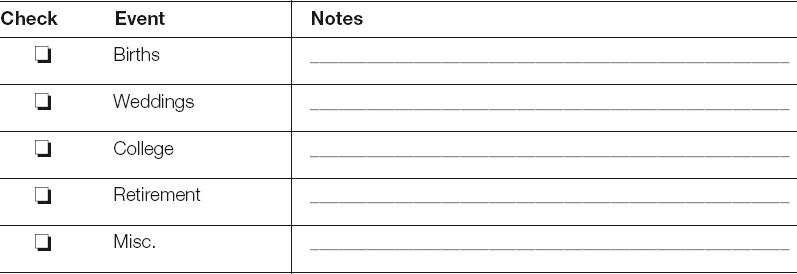

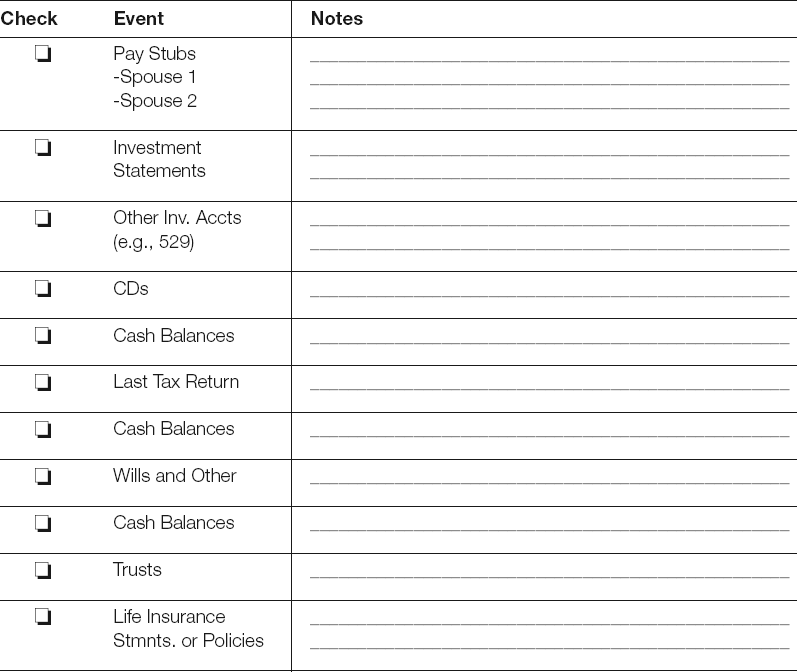

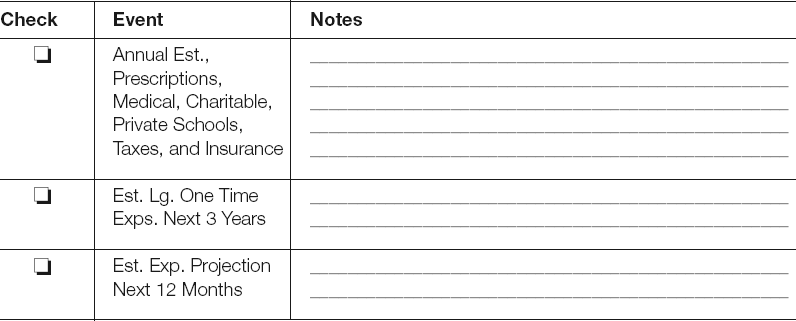

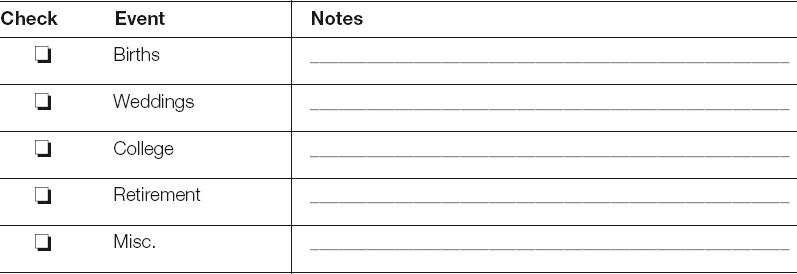

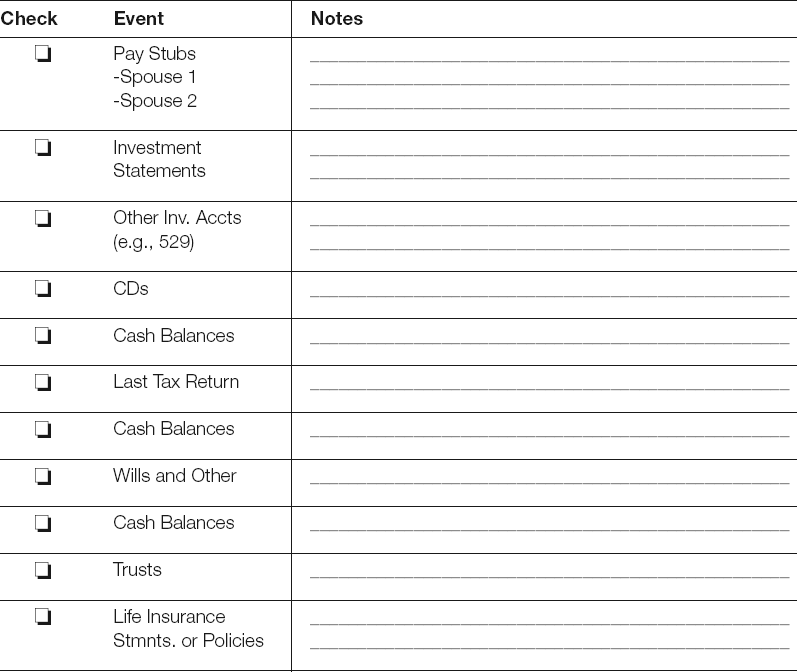

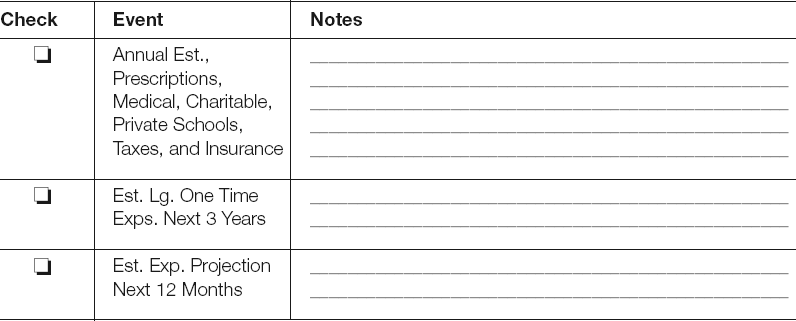

The most telling moment here is whether they commit to a second meeting. At the appropriate point, you can say, “Thank you very much for sharing about yourself and your situation with me today. Is there anything else you want to address that I may not have asked you about? Your answers and comments have given us excellent background that we can integrate into your plan. Our next step will be a complete diagnostic of your current financial situation. I can’t promise that we can fulfill all of the wants, needs, and goals we discussed, but if you are comfortable with me so far, we need to see your financial data in detail.” Then provide a checklist, such as the one in Figure 5-1.

The second meeting should be within a week of the first meeting. You can say, “In our next meeting we’ll discuss your financial situation in depth and your technical needs, go over your goals, and continue to gather the information we need to develop a financial plan. Let me suggest that we get together next Tuesday at 3 p.m., if that fits your schedule.”

At this point you also want to review and validate your understanding of the current meeting. So you can say:

I’d like to summarize today’s discussion. This is my understanding:

• Of the needs you have described

• Of the concerns you have described

Figure 5-1 | Client meeting preparation checklist.

Client Meeting Preparation Checklist

Name ___________________________________ Date _________

Use the checklist below to help prepare prior to our meeting:

• Of the wants you have described

• If our plan can address your needs, wants, and concerns you are prepared to work with us. You are ready for the next step—a meeting to get back together and review investments and start creating your plan.

• Are my understandings correct?

After your discovery meeting, also debrief yourself about the meeting to ensure that you understand the prospects’ wants and needs, their personalities, and how they communicate, so that in your next meeting you can work even better with them. Medical professionals also record their notes; advisors can record the debrief using a transcription service and app like Copytalk (www.copytalk.com) or other technology. Send the prospect a summary of your meeting notes and post your notes to your CRM system.

Most important, send a thank-you note to your prospect and make it personal. We prefer handwritten thank-you cards without corporate logos. Hand-address the card and use a regular stamp. Do it the day of the meeting.

It’s always important in a set of meetings to review the previous meeting you had with the prospects. Assuming you have made headway in understanding the prospects and their status and concerns, you want to play back your conversation to validate the information and show the prospects you understand their situation. If you have elevated their concerns, you want to get the prospects back to the state they were in during your first meeting. You want the prospects to remain ready to work with you. Any negative or painful emotions prospects may have had over their current situation could have dissipated since the last meeting so they need to be restored. If any changes have taken place since your last meeting you will want to identify them.

This second meeting will be a complete diagnostic on the prospects’ current financial and related situation. Your objective is to review their goals, continue to ensure they are on the path to work with you, and identify technical needs. You want to continue to build rapport and trust and show you care and have their interests first in mind as a fiduciary. Wherever possible, begin to link potential actions or tentative recommendations to getting the results they want. Continue to get the prospects ready to work with you.

You do this through the questions you ask, similar to the first meeting:

• What are your desired outcomes for our meeting today?

• How do you both feel about first meeting?

• Are you both ready to get started on our meeting today?

• Before beginning, let’s recap our first meeting for a moment. Is that okay?

While you are gathering the financial data you need to put together your wealth management action plan, continue to validate that you are on course with the prospect. You will gather a full picture of their assets, liquid and illiquid, and whether you will manage them. If they have any concerns and fears relative to these assets, it will be of value to know them. You have already asked about the prospect’s best and worst financial decisions, but as appropriate you can validate that they believe the assets identified were good or bad decisions and why. This is another opportunity to ask if there is anything you have discussed as part of their full picture that is disturbing about their current financial situation. You are searching for the prospect’s motivations for taking actions and reaffirming they want and need your help.

Focus on the prospects’ biggest concerns and fears so they feel the need to change. Ensure that you are accurately describing the expressed concerns. Understand their perspectives about their portfolios so that you understand their role in investment decision-making and how they feel about that role now and going forward and their rationale for their various holdings.

Where appropriate, be on the lookout for opportunities to test-close and identify objections so that you can figure out how to best present your plan and recommendations. For example, you can say, “If you like our plans, how soon would you want to get started on putting them in place?” As it fits the discussion bring up alternative strategies to get reactions and ideas. This can tell you something about the prospects’ willingness to make changes. For example, you can use questions like, “How would you feel about investing part of the portfolio in well-known dividend-paying equities instead of bonds to get a better yield?” Or, “We might want to invest in ABC. It’s a solid company with a fairly stable stock price and pays a dividend of X percent and has done so for N years. How would you feel about that?” Or, “I’m curious. Have you ever considered XYZ?” You are also testing the prospects’ willingness to consider various alternatives. This can help when developing and presenting your plan.

By the end of this second meeting, you have qualified your prospects as being ready and willing to commit to an implementation plan if your plan meets their wants, needs, and goals. Explain that your next step is to prepare their personalized wealth management plan, including asset allocation and general portfolio recommendations. This plan will show the prospects how you are going to help reach their goals. Whether direct or indirect, it’s important to let the prospects know that developing this customized game plan will take a significant amount of analysis and preparation and you want to make sure that if the plan is on target, there will be every reason to accept it and move forward with its implementation if the plan meets with their approval.

At the end of this second meeting, you again want to thank the prospects for sharing themselves and their financial details. Ask if there is anything else they want you to address you may not have answered. State that it will take a week for the team to put together their plan and then suggest you get together on such and such a date—for example, “next Tuesday at 3 p.m.,” if that fits their schedule. Your primary goal is to have gotten positive receptions on all points until now and to get your prospect to the third meeting.

This third meeting in the process is about the personalized game plan your team prepared for the prospect. Your objective is to gain commitment to implement your plan.

You want to make sure your prospects are looking forward to the meeting, so 48 hours before the meeting the advisor should directly call the prospects to confirm the meeting and minimize any concerns or fears that could hold them back from taking action.

Sid and Nancy, I’m very much looking forward to seeing you on __________ because I know you are going to be really excited about your plan. I’m sure we are going to be able to get your wants and needs met (be specific) and avoid what we discussed about (concerns). I’ll see you on _________.

In presenting your plan you will focus on how you are going to help the prospects achieve their goals. Use the words, thoughts, and concerns and any other elements you learned about the prospects, their communication style, their buying style, and their personalities. Since the majority of buying decisions are based on emotion, get the prospects back to any emotional concerns raised in your meetings. Continue to seek positive feedback and answer any objections or concerns as they arise. While being compelling about the plans you have developed, avoid anything pushy or aggressive.

After your initial remarks, ask your prospects if they are ready to review their plan. Use language like “Our plan” and “When the three of us . . .” as you discuss various points, whether a recap of their situation or your recommended asset allocation and the reasons for your recommendation. Get agreement on all key points and/or decisions one at a time.

Use the word “because” to share your reasoning. For example: “I recommend X because ____________.” Where appropriate, ask, “Do you see how this will address ____________?” Note the prospect’s response. The word “because” is powerful. “Research shows that when the word ‘because’ is inserted in a repetitive script in an attempt to influence a lot of different people, compliance goes up consistently by 32 percent. . . .”8

• Say to your prospect, “After careful analysis we have decided on a 30/60/10 mix of equities, fixed income, and cash because you stated a major concern about preserving your assets, getting income of $24,000 a year, while participating to some degree in the growth of the equity markets.”

• Assuming agreement, you might say, “And to contain risk, we’re going to invest your fixed income in only highly rated securities because we want to limit risk. How does that sound?” (Or, “What will this mean to you?”)

• Assuming agreement, you might say, “And we are going to invest your equities in five highly rated funds or exchange traded funds (ETFs) representing all major equity styles because we want to limit overlap and also contain risk. How does that sound?”

Don’t use the word “proposal”—use the word “plan.” Proposals are for consideration; plans are for actions to be taken. Plan your approach in advance and understand that if you get bogged down you can use a technique called “pattern interrupt.” The intent is to change the mood, the situation, a thought or behavior, or any tension or negative or unresponsive pattern. The plan should be by sections, with each recommendation addressing a specific need or want or concern.

As you complete the review of your game plan, seek feedback and concerns. For example: “What would you say are the three most important benefits?” Up to this point you should have been getting positive responses along the way. It’s now appropriate to ask, “Are there any questions you want to address that I may not have covered?” Pause for a response and answer any questions. If there are none, it is appropriate to say something like, “If our plan is on target, I suggest we get started. It’s simply a matter of signing this account agreement and transfer form. Once the assets are transferred but before we make any investment commitments, we’ll have another discussion. I very much appreciate you for selecting me as your advisor. I look forward to a long and fruitful relationship and helping you meet your financial goals and in any other area in which I can be of service to you.”

Some FAs would of course like to get to a close in two meetings by combining meetings one and two. This is not recommended. If you are in a hurry, don’t rush. You want to take your time and show your professionalism and the care you take in putting a wealth management plan together. Of course, many prospects don’t make a decision even in three meetings. It often takes more time and meetings to get prospects ready to make changes in their financial matters.

Most financial advisors we have worked with believe that if they can get a prospect to come to their office for a first meeting, they can convert the prospect into a client. This is your chance. You only have one chance to make a first impression. Make sure it’s a great one. If you would like ideas for doing that, we recommend the article, “9 Ways to Make a Great First Impression.”9

The three meeting process is an approach using the steps we have outlined. It is efficient and effective if done correctly:

• Meeting one focuses on building rapport and trust and uncovering needs, wants, and concerns, qualifying the prospect, and creating and assessing the prospect’s interest.

• The second meeting will be a complete diagnostic of the prospect’s current financial situation and uncover the prospect’s technical needs.

• The third meeting is about presenting your game plan, addressing concerns and objections, and gaining the prospect’s commitment to work with you.