Chapter 4. Companies Capitalize Competences

WEB 2.0 TRANSFORMS THE ECONOMICS OF KNOWLEDGE-BASED BUSINESSES EVERYWHERE. Companies of all sizes are being forced to rethink their strategies for competing in a hyper-connected, web-savvy world. These fundamental shifts in how work gets done are zooming across organizations, business and social networks, and an increasingly “flat world.” Executives, managers, and policymakers no longer have the luxury of a “wait and see” attitude, given the speed and volatility with which local and seemingly small events triggered by a few individuals and groups—users, partners, employees, and knowledge workers—can result in ripples throughout the world.

The speed and exponential nature of change in the business world is why 60% of the CEOs surveyed by PricewaterhouseCoopers consider networks and the networked world the most important factor in their strategies, much more than innovation or technology. Many of the “strategic inflection points” or “tipping points” disrupting their businesses and challenging their competitive leadership are cultural, social, and global, as well as user-generated. Some of the more unexpected items on the boardroom agenda include the knowledge economy, local and open innovation, global warming, social responsibility, and “creative capitalism.”

The terms “dynamic” and “dynamic capabilities” take on a whole different meaning and time frame in the Web 2.0 world. I was part of a team that first asked the research question, “How do companies manage successfully in turbulent environments?” in the 1990s, when the U.S. was losing its technology lead in semiconductor chips to the Japanese. We published our “Dynamic Capabilities” article in the Strategic Management Journal (SMJ) not long after the Netscape IPO but before the dot-com boom. We heralded the shift of strategic management toward the knowledge economy and external “capabilities” using intangible assets such as knowledge and know-how. We encouraged CEOs and top corporate strategists to move away from the industrial economics and structural approach of viewing strategy as primarily tied to industry-level forces and bargaining power. We put these ideas into practice at top European and Japanese multinationals, while following the guideposts of earlier thinkers.

It’s time for an update. Although this SMJ article has become one of the most cited in the strategy field, Web 2.0 changes the relevant research question to:

“How do industry leaders create value in a very fast-changing global networked knowledge environment?”

Now the mainstream industry leaders, International 100s, and Fortune 500s that are having the hardest time adjusting their hierarchical organizations, outdated business models, and strictly in-house capabilities to the new strategy challenges of the digital and knowledge economy. The goals have changed from being a steward and “managing successfully” the gains, products, services, and legacy of the past to “creating value.” The companies detailed in this chapter have found innovative ways to capitalize on that created value, either with direct revenue streams or, more often, using indirect revenue streams. For the first time, the level and pace of knowledge-based productivity are being driven by a diverse group of users like you and me, not just digital natives, credentialed scientists, or salaried employees.

The speed at which relevant knowledge is produced, accessed, distributed, and validated is constantly accelerating. This shifts the costs, revenues, and cumulative benefits from closely held research-and-development and internal function areas to a broad network of suppliers, partners, advertisers, affiliates, communities, and individual users. Eric von Hippel called this trend the “democratization of innovation” to emphasize the shift from hierarchically managed research and development (R&D) toward lead users and learning-by-doing. Web 2.0 makes it just as easy for physicians across nationwide hospital chains to “Flickrize” CAT, MRI, and NMR scans as for photo hobbyists to share their work.

“Dynamic capabilities” now means evolving your slower-moving organization into a fast-moving team focused on the innovative combination and orchestration of a multicompany ecosystem of global partners, users, and customers. To survive and compete, companies must quickly leverage and capitalize on the range of internal and external capabilities, know-how, know-who, and networks needed to solve problems faster, better, and cheaper.

Satyam Computer Services in India has thrived in this fast-changing global networked environment, growing from a $350,000 company in the 1990s to a multibillion-dollar company. At the 2008 World Economic Forum, B. Ramalinga Raju, the company’s founder and chairman, suggested that “the trouble with our times is that the future is not what it used to be.” In a world where manufacturing industry rules no longer apply, “all of our various businesses are incidental—the issue is to create value in a world that is changing...we are more akin to an ant colony—each with a mind of its own...but carrying out a group strategy....”[24]

According to Forrester, companies are adopting Web 2.0 technology for business productivity (74%), competitive pressure (64%), specific problem solution (53%), partner recommendation (53%), employee request (45%), and bundled service (25%).

But what are these companies actually doing? We’ll look at why Web 2.0 matters to the following companies’ financial results and way of doing business:

- IBM

Local to global network effects

- Salesforce.com

Software as a service

- Amazon

Competence syndication

But first, a brief background on dynamic capabilities and online syndication.

External and Internal Forces

The industry analysis, or “five forces,” approach to strategy developed by Michael Porter looks at the external conditions facing the firm—the forces that are determining the profitability of the industry, such as new entrants or overly powerful suppliers. In contrast, the resource-based approach to strategy (exemplified by the work of Edith Penrose) looks primarily at the company-level internal and organizational factors, such as combining tangible and intangible assets—people, systems, skills, processes, and capabilities—as key determinants of strategic performance.

The original dynamic capabilities framework,[25] written before the advent of the Web, was quite prescient. It suggested that both firm-level and industry-level factors are critical. Companies must dynamically adjust to turbulent outside forces by combining inside and outside capabilities, assets, and resources.

Developing Dynamic Capabilities: Before the Web

If these dynamic capabilities are so important to a company’s strategic performance and profitability, how do you acquire them? We know from economists that it’s hard enough to create, value, transfer, and replicate individual knowledge, especially if it is in a “tacit” form of know-how and personal experience in someone’s brain or muscle memory, rather than in an “explicit” or “codified” form, such as a mathematical formula or blueprint. That is why it is difficult to explain how to ride a bike to someone without that person actually doing it. Unfortunately, accumulated individual learning-by-doing limits the rate of diffusion and the scope of proliferation of capabilities or skills.

Michael Polanyi called this personal knowledge; see his book Personal Knowledge: Towards a Post-Critical Philosophy (University of Chicago Press). He developed much of the terminology we still use today for explaining the difficulties of international technology transfer and the stickiness or lumpiness of knowledge. “Knowledge goods” behave differently in markets and transactions than other digital and physical goods of economic value. Communities accelerate knowledge and competence transfer and replicability by sharing experiences and increasing peer-to-peer social interaction and communication. They also provide the feedback that is necessary for cumulative and aggregated learning.

Because individual competences and experience are embedded in the brains and memories of individual people, companies can “buy” brains and talent and “acquire” experience and competences in that way. But how can they keep this intellectual capital from walking out the door and across the street to a competitor?

Companies have developed ways of turning individual competences into group or organization-level capabilities, for example, Sony’s core competence in miniaturization, or Apple’s capabilities in cool design. These capabilities combine and orchestrate talented people inside and outside the company with resources and tangible assets, such as network infrastructure, IT systems, equipment, inventory, laboratory, and manufacturing facilities. This leads to the development and leverage of valuable intangible assets, including market capitalization, network effects, brand, reputation, buzz, business models, relationships, ecosystems, goodwill, and momentum.

However, the pace of organizational learning is still tied to the company’s prior experience in its domain of interest, often referred to as absorptive capacity, as well as its level of organizational inertia due to “not-invented-here” (NIH) syndrome, which slows information and knowledge transfer because of structural rigidities, bureaucracies, and functional silos.

Web 2.0 technologies provide an unexpected and new answer to the age-old challenge of how big companies in slow-moving but highly competitive industries get dynamic capabilities without turning the clock back.

From Online Syndication to Competence Syndication

Anyone who subscribes to a local newspaper because they like Dilbert or Doonesbury has seen syndication in action. Scott Adams and Gary Trudeau, the creators of those strips, are originators, or original content creators. A syndicator collects and packages original content, specializing in comic strips, and sells them to print publications. Thousands of local newspapers deliver the cartoon to avid readers, along with late-breaking news articles, photographs, and classified ads. They choose which cartoons go into their paper from the selection offered by the syndicator.

Syndication is common in the entertainment world for TV programs, cartoons, and articles, but it’s unusual elsewhere. That is because syndication is actually the sale of the same good, sometimes remixed and repackaged, to many different customers, who then integrate it with other offerings and redistribute it. This is hard to do with physical goods such as cars or watches that can be sold to only one customer at a time.

In contrast, digital goods—being electronic bits, not physical atoms—can be copied at no cost; furthermore, the information or content contained within these digital bits can be reused by an infinite number of people. Thanks to the instant access and easy distribution mechanisms of the Web, syndication has become a more radical disrupting force than the redistribution of repackaged digital content.

Online syndication accelerates the rapid transfer of digitized know-how and competences. RSS is a technology standard that allows any online publisher to broadcast information onto the Internet in feeds. Users can link to the information in these feeds in a number of ways, clicking buttons or links (often orange) in the page or the web browser, or through other tools.

If users have a personalized home page, such as MyYahoo! or Google Gmail, they are probably already RSS users. MyYahoo! and Google Gmail provide a web-based news aggregator that alerts users to new content from their favorite sites as soon as it hits the Web, and aggregates all their favorite sources of information so they can peruse them on one page.

Online syndication or RSS (along with link lists) is the highly viral distribution engine for the blogosphere. With one initiating click of the RSS button, users get notified by headlines when their favorite blog authors write something new on their topics of interest. If users comment or hyperlink in their next blog entry, the positive feedback loop starts—leading to the observation, and sometimes the criticism, that the blogosphere is an amplifier, an echo chamber for a few loud voices.

Syndication has grown rapidly from a means for a few technically literate bloggers to share their postings into something that people do without even thinking. Most blogging software generates feeds by default and makes them available to potential readers. Thousands of sites now collect those feeds and filter or aggregate them to present them to readers who have particular interests. Readers explore them through many different viewers in many different formats, and some of the readers are computers (from search engine crawlers to complex aggregators), not just human customers.

Blogging has emerged as a powerful force, but its use of syndication isn’t all that different from the syndication of news articles, photos, comic strips, and TV shows. Syndicating organizational competence takes syndication to a whole new level.

Because organizational competences, know-how, and processes can be embodied and packaged in digital form, these valuable services can also be syndicated and sold to many different buyers and companies. One company can syndicate a shopping-cart ordering and payment system to many online retailers. Another company can syndicate a logistics platform. Another might syndicate fraud-detection and credit-scoring algorithms, and yet another could syndicate human resource processes, recruiting, and training. In the first generation of the Web, the distribution of these digital services and applications was more complicated and expensive, with high upfront costs. As businesses have learned to take better advantage of the Web, those costs have declined.

Software as a Service (SaaS)

Software as a service (SaaS), a web-enabled software application distribution model, has created explosive growth in the syndication of business services and processes. In SaaS, a creator is often a business software application developer, an independent software vendor (ISV), or a software value added reseller (VAR), rather than a consumer or media-oriented blogger, YouTuber, or citizen journalist/cartoonist. The creator develops a web-native software application and hosts and operates (either independently or through a third party) the application for use by its customers over the Internet. The syndicator or distributor is often an SaaS platform provider like Salesforce.com or IBM’s On Demand and Utility computing services.

Customers pay for using the software application only when they need it (service-on-demand) rather than actually buying the software as a product or license. This reduces upfront costs and is especially attractive to small- and medium-size businesses. It has the same benefits as commercially licensed, internally operated software with its accompanying IT support staff, but avoids the complexity and high initial cost of buying or building a custom application.

SaaS revenue streams are attractive to the creator or developer as well. Because these applications are priced on a per-user basis, they encourage positive direct network effects and increasing returns rather than an an upfront perpetual license supplemented by ongoing maintenance and support fees over time.

By applying economies of scale to the operation of applications, and distributing applications directly to web browsers online, a service provider can offer better, cheaper, and more reliable applications to a wider population, as well as being able to reach a more targeted global market. A company that makes software for human resource management at boutique hotels might once have had a hard time finding enough of a market to sell its applications, but a hosted application can instantly reach the entire market, making specialization within a vertical market not only possible but preferable to a “shrink-wrapped” product.

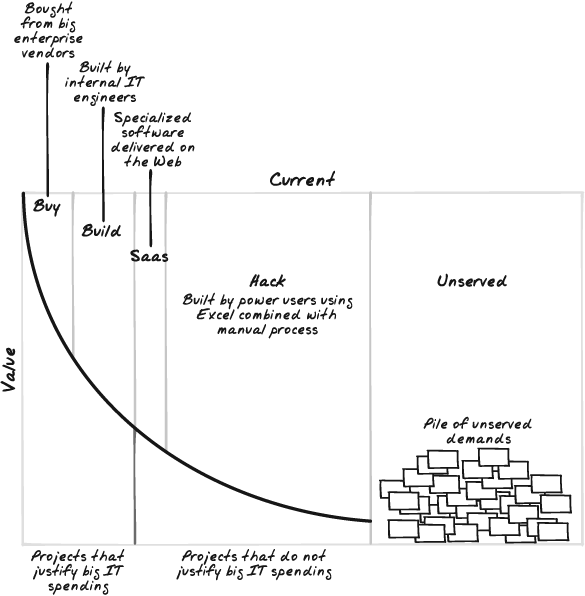

Part of the consumer-driven Web 2.0 and “Google effect” is a level of comfort and trust with new external applications that are web-based and ubiquitous, from searching, calendaring, keeping spreadsheets, and sending emails to expense reporting and applicant screening. As shown in Figure 4-1, SaaS fills a gap in the existing software market, giving customers a more formal opportunity than hacking but a lower barrier than is needed to build software or sustain a market for shrink-wrapped applications.

Many businesses view Salesforce.com as emblematic of SaaS. Founded in 1999 by former Oracle executive Marc Benioff, the company helped drive the rapid shift from on-premise Siebel, PeopleSoft, and Oracle enterprise-level software for sales force automation (SFA) and customer relationship management (CRM) to on-demand, web-browser-based, hosted software services. Salesforce.com’s AppExchange product allows external or third-party developers to create add-on applications for email marketing tools, sales analysis, and finance; and to sell and distribute their applications through the AppExchange web site. Close to 600 applications are now available in the AppExchange ecosystem.

This changes the nature of competition among software developers. Instead of hoarding valuable, proprietary, and internal competences and processes, established and successful companies can compete over how quickly they can package these services into applications to distribute them to clients, provide platforms for related applications, and support ecosystem development to multiply the number of direct or indirect revenue streams. The balance is shifting toward agility in recreating, dynamically integrating, and acting as a platform and host to rapidly distributing the best available syndicated components, systems, and services.

This kind of web syndication faces unique rewards as well as competitive risks. On the bright side, browser-based competence syndication:

Opens up many opportunities for customer and traffic acquisition

Offers growth and flexibility

Enables businesses to choose where they wish to concentrate their efforts

Piggybacks on a myriad of other businesses and application creators for the software, web services, and related components and specialized systems it needs

The syndicated world of the Web has different rules from those of the offline business world, where assets tend to be fixed and roles and relationships stable. To thrive in this environment of competence syndication networks, companies have to change many of their old assumptions and strategic approaches. They need to connect and interact with other companies and customers, open their ecosystems, and maximize their connections to other companies and users. Companies also have to be agile in managing these positions and connections because they are evolving and dynamically changing.

Finding Competence Across the World: IBM

Opening up and orchestrating inside and outside competences was the major transformation that Lou Gerstner, former CEO of IBM, set into motion at the major Fortune 500 company. IBM shifted from controlling a dominant share in one major pie of IBM-centric computing to becoming a sliver in thousands of little pies—fields in which IBM participated but did not necessarily dominate, many of which provided no direct revenue stream to the company. That may sound like a dangerous and risky strategy, but there was more downside in being only in major pies.

Integrating Linux and Apache

When Linus Torvalds posted his first version of Linux on an obscure software bulletin board in 1991, he could not have foreseen a multibillion dollar ecosystem that allows large corporate champions of open source, like IBM, to challenge Microsoft’s operating system in major emerging software marketplaces, such as China, India, Russia, and Brazil. The old model of companies competing on the basis of their own homegrown proprietary solutions faced a free alternative built by a loose network of programmers who seemed more motivated by community, robust software, and bug-fixes than by profit-making or industry leadership.

IBM showed that “the elephant could dance,” transforming itself into a champion for open systems and embracing a new kind of collaborative innovation and learning culture, becoming a trusted member of a very decentralized developer community of thousands. IBM, with the zeal of the recently converted, estimates that by including open source programming, contributing to the community, and adapting the open source philosophy, they have saved nearly $1 billion per year compared with what it would have cost to develop a Linux-like operating system on their own.[26]

Collaborations can produce more robust, user-defined, fault-tolerant products in less time and for less money than the conventional closed approach. (And anyone can contribute to open source: large companies, governments, individuals, and pretty much any group that is willing to accept the basic philosophy.)

IBM is showing off its dynamic capabilities, demonstrating how an industry leader can strategically transform the uses, combinations, and interactions of assets and resources from inside and outside the company. IBM used to be recognized for its success using its capabilities—resources, systems, people, and organization—to dominate large corporate markets with proprietary and highly integrated hardware and software enterprise systems. In this case, however, IBM showed a remarkable capability to deeply transform its strategy, people, organization, and systems through its involvement in the open source communities of Apache and Linux.

Mentoring

IBM is invested in supporting the emerging vast and vibrant ecosystem of startup companies and developers that are driving the next wave of development in open source business applications and services, especially in emerging markets, such as China and India. Explicit partnering agreements are part of the approach, but a broader set of initiatives is designed to build the number of developers in these countries. Developers don’t have to work for IBM directly to contribute to the projects IBM would like to see succeed.

In 2004, IBM announced a new initiative called virtual mentoring not only to help the new generation of application developers but to raise its new products, services, and innovations to certification standards (to ensure compatibility), and to actively comarket these new products and services globally. About 400 emerging-market developers join IBM’s developer networks daily.

This next generation of location-specific Linux developers and software innovators may well redefine the IT market. Already everything from enterprise applications to enterprise resource planning (ERP) to content management and business intelligence to retail and e-commerce payment services and inventory management—basically anything you need to run a small or enterprise-level business—is available as a low-cost, open source, online distributed, pay-as-you-go web service.

The full array of new ventures and applications is astonishing (around 10,000 and growing). Although these new applications help IBM around the world, they also address the needs of billions of users in the emerging markets of Brazil, Russia, India, and China (often referred to as the BRIC countries).

The open source community supports the heavy lifting by helping produce and debug the software, while IBM provides the certification and cross-national marketing, access, and support. The money that these developers and small companies spend can go directly into developing regionally localized features and services. This is a big change from the proprietary enterprise model, where more than 70% of the costs go into development, sales, and marketing. Competence syndication occurs when regional developers create Linux-based, value-added, local applications for their home countries that are ideal for proliferating and distributing with equal or higher value in many other locations.

Ecosystems and competence syndication

IBM’s strategy reflects more interest in developing ecosystems than in syndicating its own competence as such. Ecosystems are about technology platforms and competence syndication is about distribution. It’s like comparing hub-and-spoke airplane companies like United and American with regional upstarts like Southwest.

IBM, like many other enterprise software vendors, talks about the number of partners in its ecosystem as though many vendors signing up for a partner program were a sure indicator of success. To its credit, IBM is one of the few companies that has realized that the application developer landscape has shifted dramatically. First, 14 million new Linux developers will emerge in China and India in the next 5 years.[27] Second, the most significant cost and barrier to success that these developers will face is sales and marketing, not the cost of hardware, servers, or storage.

Giving Away the Store: Amazon

Amazon’s strategy can be best understood within the framework of competence syndication. Although Amazon started as an online book retailer, founder and CEO Jeff Bezos soon realized that Amazon’s early advantages could not be guaranteed to sustain its scale, as thousands of competitors were always just a click away.

First steps: letting other sellers into the store

In 2001, Amazon opened zShops, providing virtual shelf space to online competitors. They could sell their goods through the same system Amazon used, paying a listing fee plus commissions on sales. At little cost, Amazon became a distributor of easily found online storefronts and products, and it was able, like Google’s AdWords, to reach a long tail with small- and medium-size businesses—some of which had never even advertised online before.

Both Wall Street and some of Bezos’ own management thought it was risky to push into these uncertain markets while the core online book business still had yet to make a profit. As Bezos said:[28]

It was the kind of thing that became controversial internally. It made people nervous. But the reality is that if you give customers what they want—price, selection, and fast delivery—you’re going to get more sales.

Giving competitors a piece of the action primed the pump for Amazon’s own business success. Sales grew by 34% in 2003, climbing to more than $5 billion. And at the end of 2003, after nearly a decade of operating at a loss, Amazon posted its first profit.

It helped that Bezos never considered Amazon to be merely a distributor and that he creatively repositioned it to play many different syndication roles. Early on, Amazon launched an aggressive affiliate program to take its site where customers were clicking. Amazon Associates provides a way of syndicating its online store to affiliates’ web sites. Affiliates provide specialized content and organize product listings for a specific audience or community. Thousands of nonemployees act as a virtual sales force that gets paid only on a success-fee basis when a sale is realized.

These techniques follow a key Web 2.0 practice: give something away for free, but always do it in such a way that it ends up expanding your business. Positive network effects can make this strategy work. Bezos was one of the first people to stop thinking of the world of retailing as bricks and mortar, and to see it as a way of turning competitors into customers. In the Web’s syndicated world, core capabilities are no longer secrets to protect, but instead are just the thing to sell to your competitors as web services, which could potentially become your most popular product.

Amazon is using syndication to turn distinctive capabilities, such as ordering systems and online shelf space, into an easy-to-use shopping cart system that can be sold to stores and content sites throughout the Web. Potential competitors become customers and users, actively participating in Amazon’s ecosystem.

Next steps: sharing back-office competences

After leasing its cash-register services, Amazon moved from the storefront to the back office, spending millions on web services that take advantage of its experience running an enormous site with millions of users.

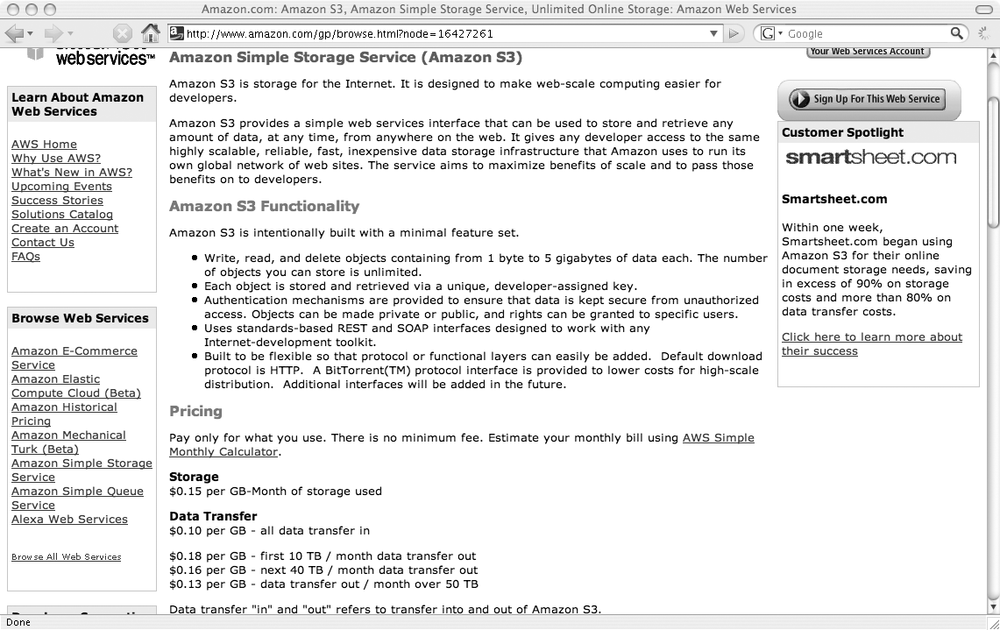

The first component of this strategy is storage capacity. As shown in Figure 4-2, Amazon’s Simple Storage Service (S3) charges 15 cents per gigabyte per month to store data on the company’s servers, plus costs for data transfer. S3 is designed to do very little, but to do it on a vast scale at low cost.

S3 may seem extremely distant from Amazon’s core retail business; however, it extends talents that Amazon has already demonstrated to a whole new audience. Web 2.0 startups, for example, are using S3 to save money while they develop an audience for their projects.

More recently, Amazon has been renting out computing power for 10 cents per hour through the Elastic Compute Cloud, EC2. (For more information on EC2, see http://www.amazon.com/gp/browse.html?node=201590011; there’s much more involved than in S3!) Bezos asked a simple question when deciding to pursue these kinds of projects:

If we needed this kind of technology internally, then chances are a bunch of companies could also benefit.

Amazon’s vision isn’t limited to its web expertise but extends to its tightly integrated warehouse and logistics services. Having given away online shelf space to competitors, Amazon is now providing them with physical room in its warehouses. Fulfillment by Amazon lets smaller companies leave their inventory management to Amazon. When a customer places an order, Amazon ships it out.

Helping others share competences

Some sections of this book were transcribed from lectures and presentations. Amazon’s support for a service called CastingWords is another example of a low-tech, high-labor-cost, fragmented industry—transcription services—that has benefited from networked and global dynamic capabilities. I uploaded an audio WAV file of my iPod-recorded lecture to http://www.CastingWords.com. One or two days later, I received a high-quality transcription in Word format at the unbeatable rate of less than a dollar per minute of recording. Inspired by the story of the Mechanical Turk, the chess-playing “computer” that had a real person inside the box, Amazon’s service routed my WAV file online to a pool of transcribers—somewhere worldwide—who were immediately ready to provide services and who were paid online through some agreed-upon revenue share by PayPal.

Encouraging Competence Mashups: Google

Musically, mashups combine two or more songs to create a new song or dance track.[29] Over the last few years, the mashup concept has spread to the Web, encompassing much more than just popular songs. Developers can now mix, match, reuse, and morph web content, data, and services. These “high-tech versions of Tinkertoys” are changing the way companies and users look at information. Mashups are starting to fulfill some of the promises of web services, software, and data services that can be tapped on demand. “They’re taking little bits and pieces from a number of companies and sticking them together in a clever way.... You’ll start to see the real power of web services,” noted Amazon’s Bezos.[30]

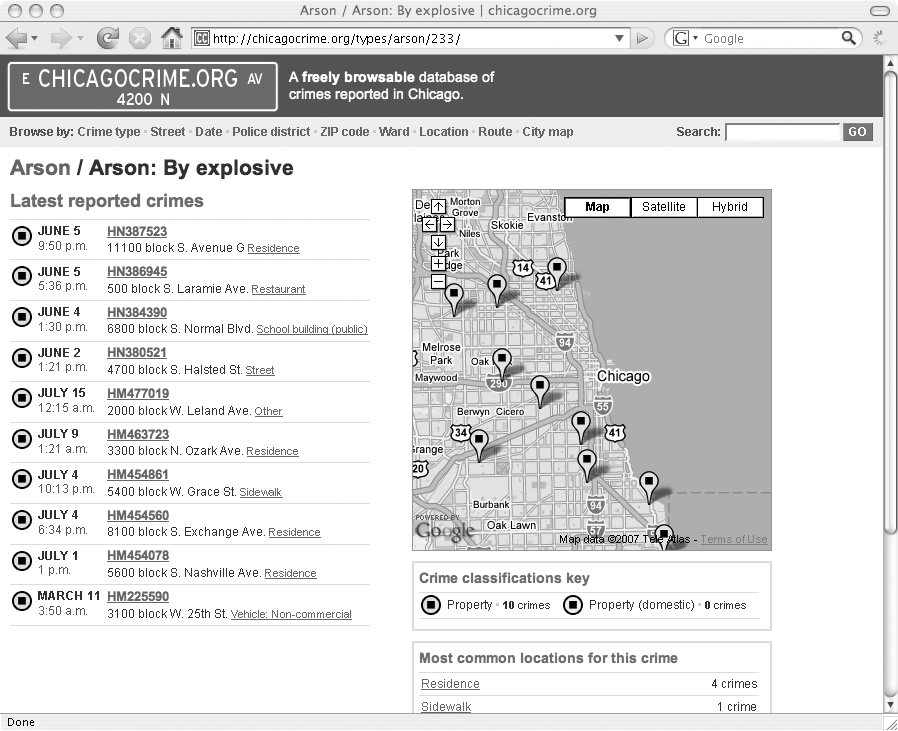

HousingMaps.com (http://www.housingmaps.com), shown in Figure 4-3, was a mashup created by Paul Rademacher. While looking for a place to live, he was frustrated with having to pore through Silicon Valley rentals on Craigslist and then separately look for the locations on Google’s map service. So he decided to combine the two sites and create a truly useful web service. The listings on his mashup creation are transformed into interactive pushpins on maps of different regions that provide rental details when the pushpins are clicked. Similarly, on Chicagocrime.org (http://www.chicagocrime.org/), shown in Figure 4-4, Adrian Holovaty combined a Chicago Police Department crime web site and Google Maps to show recent crimes close to any address.

Mashups evolved because commercial applications, services, and data (see the earlier "Software as a Service (SaaS)" section) were distributed via the web browser, and application programming interfaces (APIs) were opened to offer developers easier access to data and services. Vint Cerf of Google commented:[31]

We know we don’t have a corner on creativity. There are creative people all around the world, hundreds of millions of them, and they are going to think of things to do with our basic platform that we didn’t think of. So the mashup stuff is a wonderful way of allowing people to find new ways of applying the basic infrastructures we’re propagating. This will turn out to be a major source of ideas for applying Google-based technology to a variety of applications.

John Musser’s ProgrammableWeb site (http://programmableweb.com/) forecasts 1,000 mashups a year, based on a daily creation rate count. Why is the Web 2.0 mashup ecosystem growing? One factor is the combinatorial effect: there is simply an amazing amount of readily available, democratized content, and collective interaction. The other factor is the appearance of positive network effects. Smart aggregation, recombination, and hyperdistribution make the online world and its user services exponentially better than the simple sum of its parts.

Mashups are inherently cool, but they present challenges as well as opportunities. A laboratory of mashups will find all kinds of new opportunities in existing data, but the results of those mashups don’t always look like what the data providers had planned. Advertising may vanish, for example. Providing data to mashups may also incur costs, from simple processing and bandwidth to data licensing costs. Because of these issues, many companies require registration for their APIs, and terms of service agreements often let experiments and nonprofit projects use data at lower (or no) costs than businesses that want to incorporate data into their own work.

Lessons Learned

The Web has created new opportunities for businesses to sell software and services, including features and content that used to be kept tightly proprietary. Businesses can look around at what they do well, and find ways to sell it over the Web, or newcomers can create possibilities that didn’t exist before—often from parts they’ve gleaned from other companies. The old content syndication models have led to new service syndication models.

Often, making this work demands a shift in perspective on the business itself. Jeff Bezos looked at Amazon as a set of capabilities with a regular audience of customers rather than as a bookseller, and thus found new ways to sell those capabilities. Lou Gerstner and his successors at IBM focused on making IBM a key provider of computing talent and have made huge investments in creating ecosystems that allow talent to flourish, producing harvestable goods.

Even in new projects, creating value often means letting some of that value flow elsewhere. The creative energy of mashups appears in large part because the companies providing the services being mashed up no longer insist on total control over their products. That flexibility allows a different dynamic than the usual system of “create, patent, and license” that has dominated intellectual property for the last few decades.

That flexibility may apply both inside and outside of companies. Facebook’s API, explored in the previous chapter, is an open invitation for developers to come work inside of Facebook. Salesforce.com thrives because a wide variety of companies are willing to replace their own systems with Salesforce.com, bringing these new tools inside their businesses.

Finally, these kinds of collaborative approaches create new questions about privacy and user data. It may be easy to move data from one place to another, shifting it to the place that has the most competence to handle it, but users may not always be happy about where their data lands.

Questions to Ask

Expanding dynamic capabilities by sharing competences means examining how many different aspects of your company operate, from traditionally outward-facing aspects to tasks that are traditionally handled in-house.

Strategic Questions

- Consider how your business and industry currently works...

To what degree have you opened up to dynamic capabilities—multiplying the ways that users inside and outside of your project, team, or organizational unit can easily leverage, aggregate, and spark collective work, knowledge, and systems?

- If you took the perspective of a CEO and strategic leader...

How and when do you see Web 2.0-enabled dynamic capabilities disrupting the current practices, business model, competitive advantages, and economics of your business and industry? What’s the risk of being a leader or laggard? When should this become a boardroom agenda item?

- If you took the perspective of a CIO and program manager...

How could you better benchmark, analyze, compare, and quantify the impact of shifts in dynamic capabilities in key functional areas such as marketing and sales, product and services development, customer support, inventory management, logistics and operations, recruitment and training, partner and supplier relations, and procurement? How can this provide a new basis for enterprise and financial valuation?

- If you are a project team member...

Are you ready to brainstorm with your group members on how the dynamic capabilities practices described for multinationals, such as Cisco, IBM, and Amazon, could be applied effectively in your business—whether consumer-focused or industrial, product- or service-oriented, offline or online, local or global, small or large?

Tactical Questions

What kinds of online data, besides the basic web site, does your business provide?

Do you (or your management team) feel comfortable letting outsiders work with your data? Put their data into your processes?

Does your business currently syndicate content it generates? Press releases? Articles? Reporting?

Are third-party services aggregating your data?

How do you monitor the use of content you syndicate?

Are you aware of specific markets that might want to work with the data you syndicate?

Are your software products available as APIs and web services?

Do you have clear and accessible policies and systems for letting outside developers connect to your services or data?

How do you charge for the use of your APIs?

How do you encourage developers to use your APIs?

What kinds of benefits do you derive from your APIs?

Are there aspects of your business that are so far ahead of the competition that you could sell them as services?

On which communities does your business and technical infrastructure depend?

Can you risk investing in communities without a clear direct payback?

Are there areas of your business where you could benefit by letting someone else provide the services instead?

Do your internal cost structures fit better with upfront software purchases or with software as a service?

How much data sharing are your users willing to accept?

[24] From the summary of the “Developing Strategy in a Networked World” session at http://www.weforum.org/en/knowledge/KN_SESS_SUMM_22310?url=/en/knowledge/KN_SESS_SUMM_22310.

[25] David Teece, Gary Pisano, and Amy Shuen. “Dynamic Capabilities and Strategic Management.” Strategic Management Journal 18, no. 7 (1997): 509–533.

[26] From Don Tapscott and Anthony D. Williams. Wikinomics. Portfolio Hardcover, 2006.

[27] Amy Shuen, corporate venture research on IBM presented to the Fall Meeting of NVCA Corporate Venture Group, Sept. 2005.

[28] Susanna Hamner and Tom McNichol, “Ripping up the rules of management,” Business 2.0, May 21, 2007, http://money.cnn.com/galleries/2007/biz2/0705/gallery.contrarians.biz2/2.html.

[29] See http://www.mashuptown.com.

[30] Robert Hof, “Mix, Match, and Mutate,” BusinessWeek, July 25, 2005, http://www.businessweek.com/magazine/content/05_30/b3944108_mz063.htm.

[31] Juan Carlos Perez, “Q&A: Vint Cerf on Google’s Challenges Aspirations,” Computerworld, Nov. 25, 2005, http://www.computerworld.com/developmenttopics/development/story/0,10801,106535,00.html.