Chapter 21

Complex Situations

The financial situation of the Thompsons was about as simple as it gets. Their only non-government source of retirement income was their RRSP and they had no debt.

In this chapter, we will look at a more complicated situation that will be closer to reality for many retirees. It will feature another couple who are on the verge of retirement, Steve and Cathy Wong. Steve (64) and Cathy (60) operated a successful sporting goods business, which they are now winding down. Here are the details on their financial holdings:

- They have $350,000 in RRSPs and another $90,000 in TFSAs between the two of them.

- They have $70,000 in stocks and bonds in a self-directed account outside of their RRSPs and TFSAs. The money will be subject to an average income tax rate of 10 percent when they sell the securities.11

- They own a condominium worth $450,000 that they rent out. The gross annual amount they are collecting from the tenant is $18,000 but from this amount they deduct property taxes, condo maintenance fees, repairs and insurance, which leaves them with net rental income of $8,000 a year. There is a $100,000 balance on the mortgage on the condo on which they are making monthly payments of $1,000 for another ten years. As a result, their net annual cash flow from the condo is negative $4,000.

- Their home is worth $900,000, but they took out a home equity line of credit a few years back and still owe $75,000. Their plan is to repay it over three years at $27,500 a year, including interest.

- Steve plans to work part-time for another three years and will pull in $30,000 a year. He will contribute $6,000 to his TFSA each year.

- Steve is entitled to 79 percent of the maximum CPP payable at 64, if he starts payments now, versus 78 percent if he starts CPP at 65 or later.

- If Cathy starts CPP immediately, she gets 78 percent of the maximum payable at 60. If she starts it at 65 or later, only 67 percent of the maximum CPP is payable.

- They set up a reserve for spending shocks and contribute 3 percent of income to it each year until Steve is 75.

The challenge is to turn this hodgepodge of assets, income, and debts into a steady stream of income over their lifetime. Fortunately, it is just a matter of entering all the data into PERC, which will do the work for us. We will look at several scenarios.

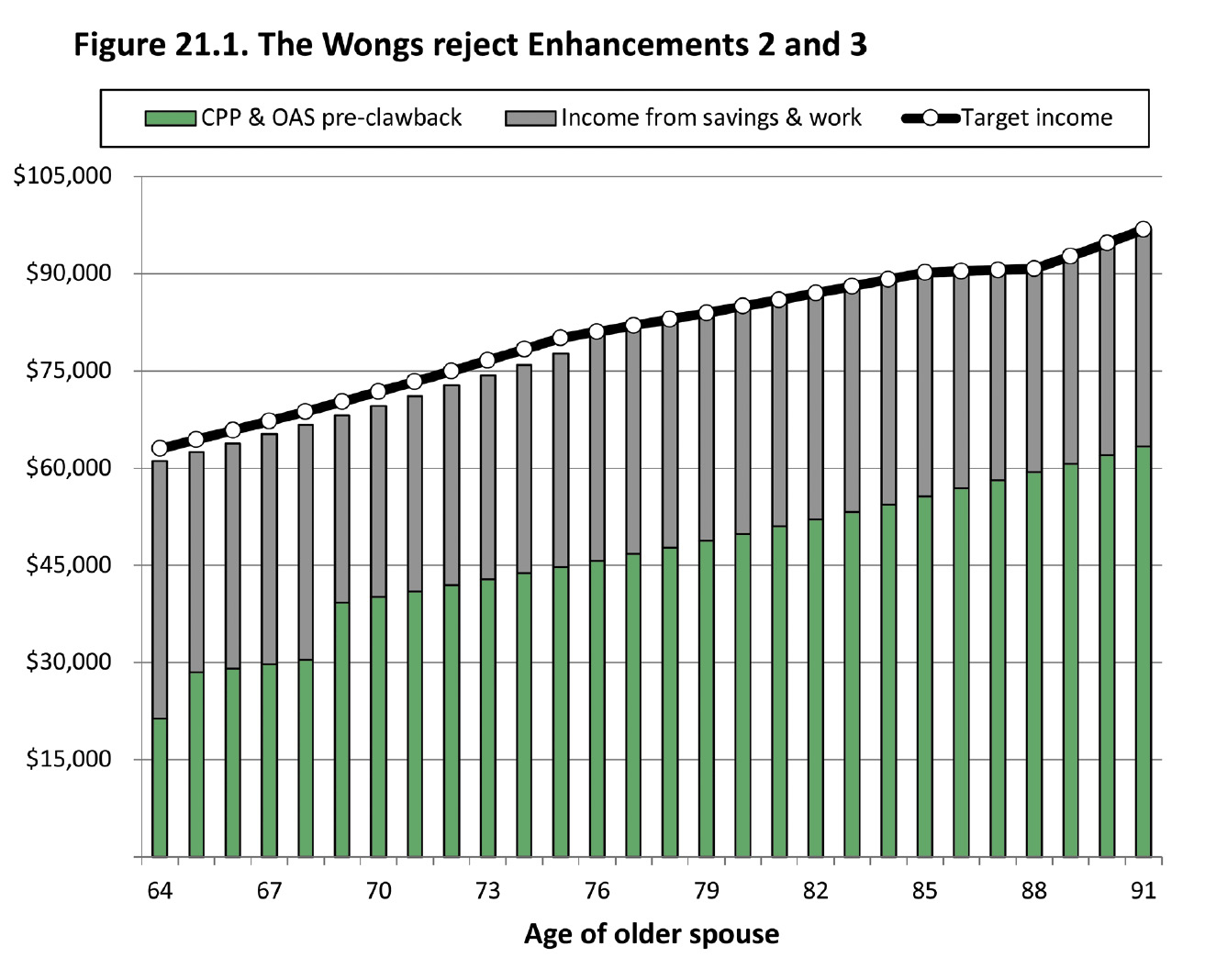

In Scenario 1, Steve and Cathy hold onto their rental property for another ten years and then sell it for $470,000, which represents a $20,000 appreciation in value from the current price. After we net out transaction costs and a small amount of capital gains tax, they clear about $440,000. In addition, they reduce their investment fees on their RRSPs and TFSAs (Enhancement 1) but take a pass on Enhancements 2 and 3. This is all depicted in Figure 21.1.

Figure 21.1. The Wongs reject Enhancements 2 and 3

Steve and Cathy adopt Enhancement 1 but not 2 and 3. They incur 5th-percentile returns. Income from savings and work includes the condo and is net of debt repayment.

In the above scenario, the Wongs successfully manage to turn some very lumpy assets into a smooth income stream. The only problem is that they are taking on a fair amount of risk to do so. What if they can’t sell their condo in ten years’ time for anywhere close to $470,000? What if they lose their tenant and take awhile finding another (and possibly incur major renovation expenses on the condo to attract a new tenant)?

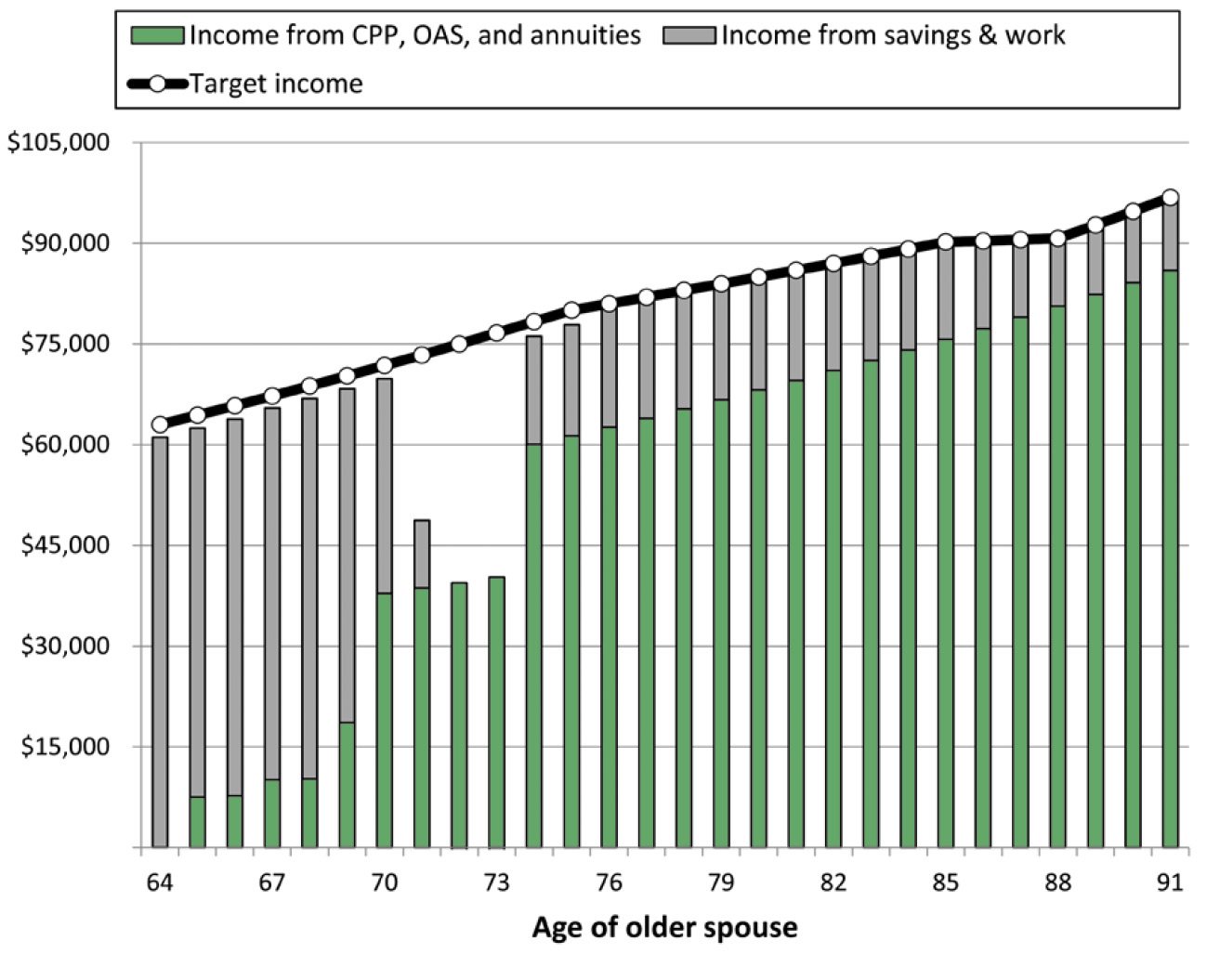

Let’s park the condo problem for a moment and assume that the only change the Wongs make is to adopt Enhancements 2 and 3. (They wait until Steve is 67 to buy the annuity since Steve will still be working part-time up until then.) The result is shown in Figure 21.2.

While Enhancements 2 and 3 usually work like a charm, they fail here. The Wongs face a severe cash flow shortage eight years into retirement. The cause is not insufficient wealth but rather not enough liquidity. Holding onto the condo for ten years is not compatible with adopting Enhancements 2 and 3, at least not in this case. In general, holding onto real estate or other illiquid investments that produce minimal net income can make it difficult or impossible to achieve a smooth income stream.

Figure 21.2. The Wongs adopt Enhancements 2 and 3

This is the same as Figure 21.1 except they now adopt Enhancements 2 and 3. This creates a cash flow problem in their early 70s because they haven't sold the condo yet.

In this case, the Wongs can reduce the risk of being a landlord and take advantage of Enhancements 2 and 3 by doing one thing: they sell their condo just six years into retirement instead of ten. This solves both their cash flow problems and reduces risk, since they are no longer landlords after the sale. They meet their income target each year (not illustrated) and have a significant amount of savings remaining as they enter their 90s.

This is true even though the net proceeds on selling the condo (I am assuming $352,000) are less after six years than after ten because there is still a small mortgage remaining and the property hasn’t appreciated as much in value.

Takeaways

- PERC is useful in taking an assortment of “lumpy” assets from many sources and turning them into a smooth income stream.

- If you want to create a smooth income stream, you may have to sell off illiquid assets, such as an investment property, sooner than you otherwise would.