Activity 9

Category profile

Overview

Creating a category profile requires in-depth research of the organisational expenditure that is incorporated within in each category. This information is normally developed as a precursor to the supply-market profile, as it helps the category team define all of the key internal information relating to the category, such as scope, business requirements, spend patterns, and contracts and so forth. The collation of relevant data is systematically gathered through a template approach, which sets out the internal detail needed to assist with the development of a category strategy.

External data are assembled later on using the supply-market profile and supplier profile guides.

Elements

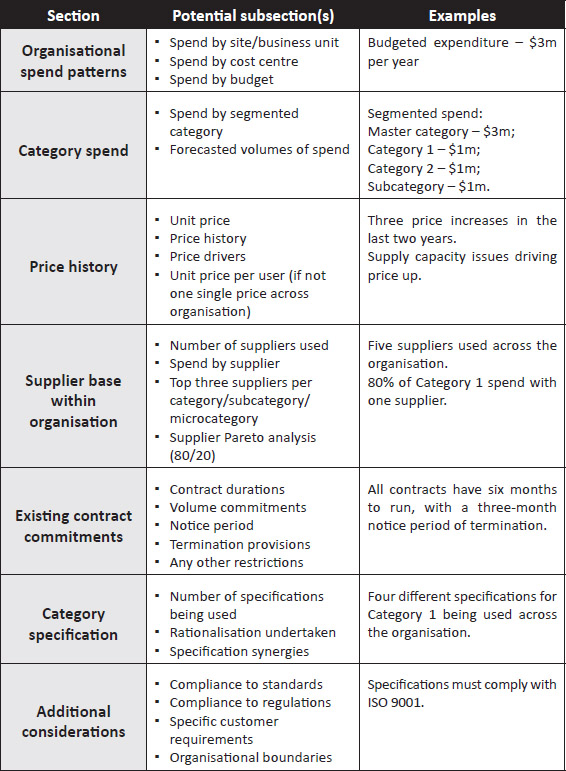

There are several areas of intelligence that need to be gathered in relation to the category. Figure 2.7 lists each main informational section and potential subsections together with accompanying examples.

So what?

A deeper understanding of how a category is bought, managed and consumed across a business will help drive a more effective category strategy. An internal focus means that key stakeholders, users and functions can be identified in order to gauge business-wide coverage.

A few category management processes compare the category profiling analysis with current business requirements using RAQSCI, which supports the assessment of potential specification gaps; however, this is not a common practice.

A comprehensive category profile that captures all organisational expenditure may enable rationalisation of specifications, suppliers and contracts, thus enhancing the ability to negotiate volume-related pricing or any other value-for-money opportunities that become apparent.

Category management application

- Supports the development of the category strategy

- Complements supply-market profiling

- Provides a foundation for an initial evaluation of potential category strategies

- Assists in identifying opportunities for supply-market leverage and added value

Limitations

There is general agreement across authors and practitioners alike that completion of the category profile is a worthwhile and useful activity to undertake during the category management process, even if collating the input data can be time-consuming.

However, there is often confusion between this activity and the supply-market profile template (which focuses on the collation of external category-related data). Some organisations combine the two in order to decrease the amount of ‘template filling’ and argue that it is difficult not to include the external supply market when completing a review of a product.

Template

The following template can be used to gather internal data relating to the category:

- Template 9: Category profile