Understanding value versus cost

There is a simple principle that underpins many of the ideas used in pricing. In order for a sale to take place, the buyer and the seller have to agree on the right price for the product or service. This may sound obvious, but there are a surprising number of situations where they don’t agree yet a sale still takes place.

What you will see in this chapter is that the only important element in pricing is the value to each customer.

This chapter includes:

- The value Scales.

- What happens when the scales don’t balance?

- How to balance the scales.

- The dissipation of value over time.

- The importance of discussing value with customers.

The previous chapter looked at the most common methods of setting price and concluded that value in the eye of the customer is the only real issue. This chapter considers the issue of value in more depth.

The seller will set their price taking into account a range of issues that they consider important, such as the raw cost of whatever product or service they are selling, the delivery costs, the business running costs and the profit they want to make. It is rarely that well thought through, but clearly there is an objective of selling at a price that does at least generate an apparent profit.

The buyer does a similar assessment of alternative suppliers and alternative products, and essentially determines whether the value to them of acquiring the product or service is equal to or greater than the price they are being asked to pay. Now this may happen at a very basic or even subconscious level, but an assessment of some kind is made.

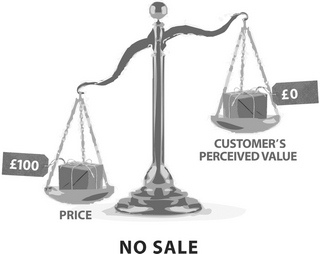

Let’s translate this idea to a set of scales. On one side is the price that the supplier is seeking to charge in order to get what they want from the deal. Let’s say this is £100, so initially the scales would be tipped completely towards No Sale.

FIGURE 5.1

On the other side of the scales is the perceived value to the customer; ie the amount that the customer is happy to pay based on what the product or service is worth to them. If that figure was also £100, then that would be seen as a fair deal and the sale may well happen.

If the customer’s perception of value was as high as £120, then they would see it as a bargain, and a sale is even more likely to take place.

FIGURE 5.3

In both these situations it is still possible that the buyer may question the price as an automatic reaction. Your salespeople therefore need to be wary of thinking that such a challenge is a genuine concern about value.

However, let’s assume that the customer’s perception of value is actually only £80.

If this were the case the value Scales don’t tip far enough towards a sale taking place. The buyer simply thinks that the product isn’t worth the price, so no sale would take place.

What happens when the scales don’t balance?

The most common outcome is for the supplier to simply discount the price by £20 to the £80 that the customer is happy to pay. This is done far too often, and far too quickly. The problem is that this discount falls straight to the bottom line profit, and can crucify the profitability of many businesses that fail to understand this key point. (Chapter 10 covers the whole area of discounting in great depth and considers why this happens and a number of options that can be discussed as an alternative.)

The second point is that the customer may temporarily accept paying the extra £20 and over-pay for the goods or services. This may sound ridiculous; why would someone pay more than they perceive something is worth? It may be that they just don’t have time to shop around or argue the price in this instance, or that they are very happy indeed with other products and services from the same supplier and that this individual item is simply not important enough to worry about. In many cases this dissatisfaction only materializes after the event when they reflect on the deal or when alternative suppliers offer their deals. On many purchases there is a post-transaction period of doubt where customers worry they have bought the wrong thing or paid too much.

The problem with this solution is that the customer has not changed their perception of the value to them. It is just that in this instance or on these products, they are prepared to tolerate what they see as over-pricing. However, the reality is that this will linger as dissatisfaction.

Acceptance of the price does not mean that they are actually happy with it.

Customers may passively shop around for the next purchase or the issue will fester between supplier and customer. What is clear is that eventually a customer regularly paying more than they perceive something is worth will become unhappy and leave.

The best option by far is an open exploration of each side’s respective perception of value to see where the differences lie. If, for example, the supplier perceives that giving the customer extended credit is highly valuable, but the customer does not, then they may agree a reduced price for cash payment with order. If the supplier feels that same-day delivery is a key feature but the client does not, then they may agree a lower price if the buyer collects. Quite often it is simply that a customer does not appreciate the features and benefits that are included within the deal, such as free delivery, guarantees and extended warranties, immediate availability, etc.

I didn’t appreciate all of the features and benefits of buying from the company because the salesman never mentioned any of them.

Charlie Oliver

It is only by discussing all of these issues that the differences between each side’s perceptions of value can be understood. Sometimes the scales can be made to balance by simply raising the customer’s appreciation of features and benefits to the level the supplier wants to charge. It may be that the supplier is able to identify some features that the customer doesn’t value and remove these from the deal before reducing the price.

So what are the two critical issues on the Value Scales?

The biggest issue is that these differences are rarely explored in any depth. The most common reaction to any difference of opinion on values is for the supplier to simply reduce the price. This is done as a result of the poor selling skills of the person at the frontline and poor training and systems to deal with this very common problem. In later chapters you will learn some techniques that allow you to work with customers to review the price issues properly.

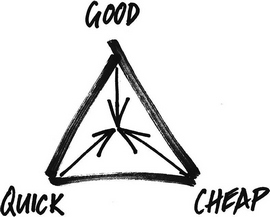

Just one simple model that works really well is the price triangle, illustrated below.

FIGURE 5.5

When the customer challenges the price of, say, fitting a new kitchen, the salesperson will respond by saying something like:

Yes of course we can negotiate on the price. Let’s just look at the options.

They will then draw the triangle and say:

Which two of these issues is most important to you?

Our prices are set to enable us to do the quality of job that our customers want, within a reasonable timescale. I can only reduce the price by taking longer, say by using fewer people, or fitting your job in around others. Or I can reduce the price by reducing the quality of the materials or workmanship.

In other words, I can do it cheap and I can do it quick, but it will not be as good. Or I can do a good job and I can do it cheap, but it won’t be quick, or alternatively I can do a good job, I can do it quick, but I cannot also do it cheap. So what aspects are most important to you?

The logic of this is pretty obvious to most customers; ie if you want great quality and great service, then this must come at a price. What most customers want to aim for is a place somewhere in the middle of the triangle where the product or service is delivered to a reasonable standard, within a reasonable timeframe and at a fair price.

The message is simple. If price is the only issue that you discuss, then it will only be price on which they make their decision. If you want customers to agree with your view of the value you place on what you do, then you must explore it with them and ensure they understand all of the features and benefits you deliver.

The next point is that it is the customer’s perception of value that determines the price that they are prepared to pay. That perception can only be based on the features and benefits that they know about, hence the point above that these must be explored as part of the sales process. Many businesses offer a fantastic range of features and benefits, but neglect to mention these. They may be unique features of the product or service, or just aspects of the way the business operates. But if the customer doesn’t know them, they cannot place a value on them. Consider the box below and whether you offer these features and whether you explicitly discuss these with the customers at the point of the sale.

Examples of typical hidden features of a sale:

- Offering credit terms (pay over 12 months or after 30 days).

- Specific product guarantees (14-day return policy).

- Specific service guarantees (providing a loan item during repair period).

- Warranties (replace broken parts with 12 months).

- Training (showing the customer how to get the best from the product or service).

- Installation (trained engineers will set up the product).

- Delivery (held in stock for next-day delivery, or cheaper if collecting).

- Instant availability (reducing waiting time to zero for crucial products).

- Technical knowledge and experience (can offer advice on the right purchases).

- Exceptional customer service (friendly people and free tea and coffee, etc).

- 24-hour call out (no problems from a delay in repairs).

There are many more features that different businesses can offer depending on the products or services they sell. There are thousands of obvious and common features and some quite unique and exceptional features. The key is that if the business simply assumes that the customers know these things, even where they may be existing long-term customers, they will be wrong. It is essential to believe that customers know none of these features and benefits and to ensure they are automatically included in any sales dialogue. If not, how can the business expect its customer to place a value on them?

We have always had a 24-hour call-out service, with phone diverts and rotas to handle it, but we then realized that the salespeople never mentioned this to any of our customers. When we challenged them their response was that they didn’t want to get calls in the middle of the night!

David Victor, Mechanical Support Services Limited

The value Scales need all of these issues to be covered if the supplier is to avoid the damaging option of simply reducing the price.

But the critical point is that it is the customer’s perception that determines the value, not the actual cost of that component.

CASE STUDY

One project uncovered an example where a customer went into a business to see if they could supply a particular product. The salesperson checked, confirmed that they had the item in stock and that it was £500. The customer argued that this was more expensive than other potential suppliers, and the salesperson agreed to discount the price by 20 per cent to £400.

A director of the business was watching this exchange, and asked if he could have a few moments with the customer to ask a few questions. Did he know, for example, that the business offered a trade account and therefore 30-days’ credit? The customer said this was of no value to him because he always paid cash on the day.

Did the customer appreciate that the business had technical experts that could talk with him about whether that product was the best answer, or whether a newer product may be a better solution? The customer explained that the item was specified on a customer’s job and they had no ability to use alternative products.

Did the customer know that the business offered same-day delivery of items if ordered by lunchtime, to reduce the time he spent visiting his suppliers? He did like this, but said in this case he needed the item that afternoon and would not have placed the order by the requisite time.

The final question was the most critical:

Did the customer appreciate that the company held £2m of stock so that customers could be confident that whatever they wanted, it was almost certainly in stock. Yes, he explained, this was very valuable to him, as he had already visited five other suppliers and been unable to source the product he needed anywhere else!

Now, do you think the salesperson would have been so ready to give the £100 discount had he known he was number six on the list of people to try, and that the only reason the customer had used them was that they were the only ones that had the item in stock. Probably not!

This is a blunt example, but the message is very important. If you do not consider all of the elements of the deal that sit on your side of the value Scales, then it is impossible for the customer to place any value on these features and benefits themselves. If you genuinely believe an item is worth £100, then you need to ensure your customers know why you believe this by getting the salesperson to discuss all the elements of the deal. If you still don’t agree and the scales still don’t balance, you can look to take items out of the deal or add new ones in, rather than just dropping the price to match the customer’s perception.

The issue of value was covered within the previous chapter with the example of Mr Smithfield. In this illustration he linked his selling price of a product to its buying price. When his buying price fell, so did his selling price. However, the customer’s appreciation of value did not change, not least because customers didn’t even know what the buying price was.

The dissipation of value over time

Consider another aspect of value to further illustrate the point.

A man is charged with a very serious crime, and seeks out the best barrister he can find: ‘Get me off this charge and I will pay whatever you ask.’

The day of trial comes and he repeats his promise to pay whatever it takes.

At the end of the trial he is acquitted and thanks the barrister, reminding him to send his bill as whatever it is he will pay it immediately because it was worth every penny. He was really worried about being convicted and couldn’t have done it without the barrister’s expertise.

The busy barrister takes a month to raise the invoice for his fees at £20,000.

When the man receives the bill he is astounded by its size remarking that it was an open and shut case, and that he was clearly innocent, and that all the barrister had to do was just to turn up.

What this demonstrates is that the value of the product or service changes over time. If the barrister had said up front that it could cost between £20,000 and £30,000 the man would in all probability have written a cheque there and then if asked. By leaving the issue of price until after the event, the appreciation of value has dissipated.

If you have ever had financial difficulties, a tax investigation, or even a positive business opportunity, you will have wanted the issue tackled as a priority because speed and quality are more important to you than the cost at that point in time. The value of the solution at the beginning of the task is much greater than after it is finished.

The importance of discussing value with customers

What is perhaps more important is that the value to the customer may be higher than the supplier thinks it is. So many times a salesperson who has been asked for a price will simply leap in with a figure.

Let’s consider a plumber who has been asked for a price to install a new heating and hot water system. He puts forward his price of £5,000.

The customer then says: ‘Brilliant, I thought it would be twice that much.’

Of course, as soon as he has put this figure on the table it is very hard to move it up. By failing to uncover the issues with the customer in advance and ask some pertinent questions he has missed a big opportunity. He could have said:

A new heating system could cost between £5,000 and £10,000 depending on some options for you to consider. For example, a standard boiler costs around £3,000, but if there are a number of people in the house using showers or running baths at the same time, you may want a more powerful option. Equally, there are some slightly more expensive boilers that are much more energy efficient in the long term and more reliable. The other consideration is how long the job will take. I can opt to have three men on the job so that it is done as quickly as possible with the least disruption for you, or I can make it slightly cheaper by having one man on the job, but it will take a lot longer. What are your preferences?

As you can see, some of this is, in effect, simply a better sales approach, and a slight variation on the Good, Quick, Cheap triangle above, but the key element is to establish a price range and to explore with the customer where they are in terms of affordability and the value of the key options to them. If a customer does want the best job, as quickly as possible, they will be drawn to the top end of the price range based completely on the value to them of the various elements. More often than not there will be a reaction of either ‘I was only expecting £3,000 to £4,000, can you work to that?’ or ‘That’s fine I was expecting it to be around £10,000’. Any reaction is OK, as the objective is to get some indication of their price expectation.

Knowing your costs and being able to configure pricing that enables you to make a profit is an essential business skill. However, this must be accompanied by a very clear understanding of what value you are offering, presented in terms that the customer can easily digest.

You must avoid an overly simplistic price structure based on the cost to you of delivering your product or service, or at the very best based on what you think the customers’ perception of value may be. You need mechanisms to explore the value to each customer in order to set a price that works for you and the customer.

Don’t be afraid to state the value you are giving, and always offer a higher value option at an increased pricing level. The way to get the price up is to ensure that customers understand all of the components of value, and they will only understand them if you tell them.

Set up a team to include key people in your staff (include people from sales, finance, production and anyone dealing directly with customers). Get this team to:

1 Compile a list of your major products/services. You will revisit this many times, so begin with a list of your top 20 most profitable items.

2 Run a workshop for a small group of senior people from sales, and production. Ask them to record all of the value features and value benefits of the top 20 items, from the perspective of the customers.

3 Ask the team to brainstorm ways of offering extra value to the top 20 items. Get them to set a Premium level of pricing to those items. Involve a finance person in this area of the work.

4 Using that information, have your sales or marketing people amend the brochures and web pages that customers see, and also train the sales force to present the values to customers. This includes conveying to existing customers exactly what the value is in the existing products/services they buy, and an introduction to the Premium offering.

5 Set up a programme to roll out to customers, explaining the existing values of each top 20 item and the new Premium offering.

6 Ask your finance people to monitor the profits coming from the top 20.