Sustainability has had a hard time breaking into economic theory because the economics of the past fifty years has been overwhelmingly devoted to economic growth. The term “economic growth” has in practice meant growth in gross national product. All problems are to be solved, or at least ameliorated, by an ever growing GNP. It is the only magnitude in all of economics that is expected to grow forever—never to reach an economic limit at which the marginal costs of further growth become greater than the marginal benefits. In microeconomics every enterprise has an optimal scale beyond which it should not grow. But when we aggregate all microeconomic units into the macroeconomy, the notion of an optimal scale, beyond which further growth becomes antieconomic, disappears completely!

There are several reasons for this. First, all microeconomic activities are seen as parts of a larger whole, and it is the relationship to the larger whole that limits the scale of the part to some proper or optimal size. The macroeconomy is not seen as a part of anything larger—rather it is the whole. It can grow forever, and by so doing it removes the temporary constraints on each of its sectors that result from bottlenecks imposed by shortages in other complementary sectors of the economy. As long as the proportions are right, the total, and its parts, can grow forever. Each firm may still reach an optimal scale due to managerial limits, but the industry or sector can grow forever by adding new firms. Prices measure relative scarcity and guide us in keeping everything in the right proportion relative to everything else—but there is no recognition of any absolute scarcity limiting the scale of the macroeconomy.

The chapters of Part 1 are based on the preanalytic vision that the macroeconomy is not the whole, but is itself a subsystem of a larger finite and non-growing ecosystem, and consequently that the macroeconomy too has an optimal scale. A necessary requirement for this optimal scale is that the economy’s throughput—the flow beginning with raw material inputs, followed by their conversion into commodities, and finally into waste outputs—be within the regenerative and absorptive capacities of the ecosystem. The whole idea of sustainable development is that the economic subsystem must not grow beyond the scale at which it can be permanently sustained or supported by the containing ecosystem.

There is much confusion about what, precisely, is supposed to grow as GNP grows. Many people speak of the “dematerialization of the economy” and the possibility that GNP can grow forever without encountering physical limits, because it is measured in value units rather than in physical units. Perhaps the best example of this is the development of computers—newer generations use less matter and energy to perform more complicated operations. The value of services increases, but the matter and energy required for those services diminishes. In this book such qualitative improvement in the state of the arts is referred to as “development”; increasing the number of computers, of whatever vintage, is referred to as “growth.” GNP accounting does not distinguish growth from development—both lead to an increase in the GNP, an increase in the value of annual goods and services, and are counted as “economic growth.” But conflating qualitative improvement and quantitative increase in the same value index leads to much confusion.

GNP will be looked at more closely in Part 3, on national accounts. For now it must at least be said that although GNP is not a simple physical magnitude, it is nevertheless, a value-based index of an aggregate of goods and services which are physical. Aggregation by prices into a value index does not annihilate physical dimensions. In fact, in calculating real GNP, economic statisticians go to great lengths to eliminate changes that are not due to increase in physical units of output. Value is P x Q and the price index, P, is held constant so that changes in value will reflect only changes in the quantity index, Q, which are physical. Even services represent the service of somebody or something for some time period, and consequently have a physical dimension.

To the extent that “dematerialization” is just an extravagant term for increasing resource productivity (reducing the throughput intensity of service) then by all means we should push it as far as we can. Much excellent work is done by people who use the term in this restricted sense (at the Wuppertal Institute in Germany, for instance). But the notion that we can save the “growth forever” paradigm by dematerializing the economy, or “decoupling” it from resources, or substituting information for resources, is fantasy. We can surely eat lower on the food chain, but we cannot eat recipes!

But one really does not have to argue that point. We can simply distinguish growth (quantitative expansion) from development (qualitative improvement), and urge ourselves to develop as much as possible, while ceasing to grow, once the regenerative and absorptive capacities of the ecosystem are reached (sustainable development). Those who believe in dematerialization should have even less reason to oppose this policy than those who are worried about physical limits.

A word is in order about what I have omitted from Part 1, but might have included. The relation of economics and entropy is mentioned, but not discussed in detail. For this the reader is referred to the magisterial work of the late Nicholas Georgescu-Roegen, The Entropy Law and the Economic Process.1 A summary of his contribution is provided in Chapter 13, but it will be helpful to briefly outline here Georgescu-Roegen’s insights regarding entropy and economics.

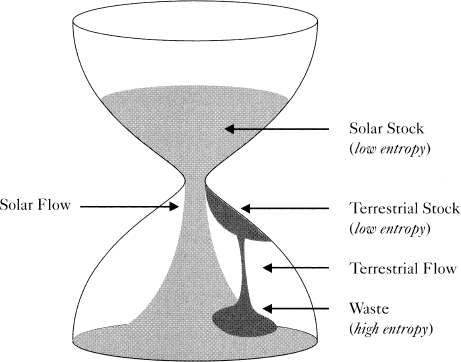

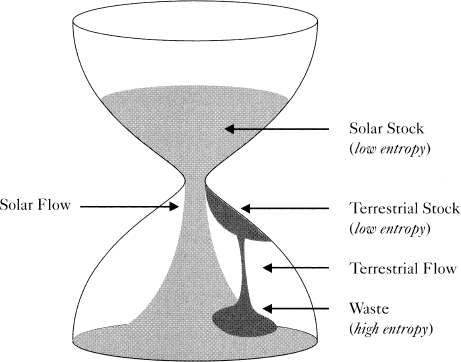

The main thrust of Georgescu-Roegen’s ideas can be summarized in his “entropy hourglass” analogy (see figure 1).

Figure 1. Entropy hourglass (Georgescu-Roegen)

First, the hourglass is an isolated system: no sand enters, no sand exits.

Second, within the glass there is neither creation nor destruction of sand, the amount of sand in the glass is constant. This, of course, is the analog of the first law of thermodynamics—conservation of matter / energy.

Third, there is a continuing running-down of sand in the top chamber, and an accumulation of sand in the bottom chamber. Sand in the bottom chamber has used up its potential to fall and thereby do work, it is high-entropy or unavailable (used up) matter / energy. Sand in the top chamber still has potential to fall—it is low-entropy or available (still useful) matter / energy. This is the second law of thermodynamics: entropy (or “used-up-ness”) increases in an isolated system. The hourglass analogy is particularly apt since entropy is time’s arrow in the physical world.

The analogy can be extended by considering the sand in the upper chamber to be the stock of low-entropy energy in the sun. Solar energy arrives to earth as a flow whose amount is governed by the constricted middle of the hourglass, which limits the rate at which sand falls, the rate at which solar energy flows to earth. Suppose that over ancient geologic ages some of the falling sand had gotten stuck against the inner surface of the bottom chamber, but at the top of the bottom chamber, before it had fallen all the way. This becomes a terrestrial dowry of low-entropy matter / energy, a stock that we can use up at a rate of our own choosing. We use it by drilling holes into its surface through which the trapped sand can fall to the bottom of the lower chamber. This terrestrial source of low-entropy matter / energy can be used at a rate of our own choosing, unlike the energy of the sun, which arrives at a fixed flow rate. We cannot “mine” the sun to use tomorrow’s sunlight today, but we can mine terrestrial deposits and, in a sense, use up tomorrow’s petroleum today.

There is thus an important asymmetry between our two sources of low entropy. The solar source is stock-abundant, but flow-limited. The terrestrial source is stock-limited, but flow-abundant (temporarily). Peasant societies lived off the abundant solar flow; industrial societies have come to depend on enormous supplements from the limited terrestrial stocks.

Reversing this dependence will be an enormous evolutionary shift. Georgescu-Roegen argued that evolution has in the past consisted of slow adaptations of our “endosomatic organs” (heart, lungs, etc.), which run on solar energy. But the present path of evolution has shifted to rapid adaptations of our “exosomatic organs” (cars, airplanes, etc.), which depend on terrestrial low entropy. The uneven ownership of exosomatic organs and of the terrestrial stocks of low entropy from which they are made, compared to the egalitarian distribution of ownership of endosomatic capital, is for Georgescu-Roegen the root of social conflict in industrial societies.

One more thing. Unlike a real hourglass, this one cannot be turned upside down! Its central feature is what Georgescu-Roegen called the “metabolic flow,” the entropic throughput of matter / energy by which the economy depends on its environment. This dependence is completely abstracted from in the neoclassical economist’s starting point, the circular flow of exchange value.