FINANCIAL PREPAREDNESS

Challenge

Your employer suddenly closes his doors, giving you only a week's severance pay. Do you have an adequate emergency fund with which to survive until you can find employment? Or have you burdened yourself so heavily with debt that you will quickly sink under its weight?

You may question the relevance of money management in disaster preparedness. Certainly it is not a topic covered in most handbooks. Its importance, however, is easy enough to see. Consider that your finances play three distinct roles in disaster preparedness:

1. Extra money enables you to purchase emergency supplies.

2. An emergency fund helps you to handle unexpected financial pressures.

3. A financial safety net protects your assets during times of loss.

Each of these three roles is vitally important and will be discussed in detail. Realize, however, that money is not the most important element of preparation. What you know is always more valuable than what you own.

You should never feel that you are not properly preparing because of budget constraints. Do what you can when you can. Being prepared is as much a frame of mind as it is a closet of supplies. There are many steps to becoming better prepared that cost nothing more than your time, including learning first aid, forming a community preparedness group, and ensuring that your home is protected from hazards.

For now though, let's turn our attention to money.

By this point in the book, you have probably come to realize that preparing can be rather expensive. Throughout the chapters, every effort has been made to limit the recommended supplies to include only the most important items. Even with this limitation, costs can be significant. With all the various recommendations, you may wonder where to begin. Everyone has a limited budget, so becoming fully prepared will take time—perhaps months or even years. Patience and persistence win the day.

When it comes to preparing, patience and persistence win the day.

It would be satisfying to possess a simple linear checklist to run down to get prepared—buy item A, perform action B, learn skill C, and so on. Unfortunately, such a general approach is impractical. Every family's priorities will differ because each is exposed to different types of threats. If you live on the East Coast and experience powerful nor'easters, you will want to prioritize shoring up your home to better weather those events. Likewise, if you live in the Northwest where heavy snowfall is common, a fully stocked pantry and secondary heat source are likely high priorities. The point is that every family's situation is unique.

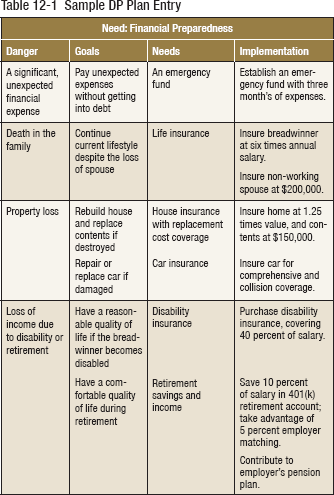

The best way to start is to identify and prioritize your family's needs. This process begins with completing a DP Plan Worksheet (see Appendix) for each of the fourteen needs (e.g., food, water, shelter, etc.). To make it easier, sample DP plan entries have been furnished at the end of every chapter. The goal of using the worksheets is to map out the specific actions you will take, as well as the supplies you will purchase, to prepare for various types of threats.

Preparation is easier when accomplished in stages. For example, you might wish to first identify everything you need to reach an arbitrary minimum level of self-sustenance, that is, able to provide all of your family's needs for a brief time (perhaps for a single week). This might require stocking the cupboards with extra food, purchasing a water filter, shoring up your home, getting a few lanterns, and other basic preparations.

Start by reaching a minimum level of self-sustenance—perhaps a single week.

After reaching this minimum level, you can then expand your capabilities based on the likelihood of the need and the cost of the preparation. Increasing your food stockpile to a thirty-day supply and your water to a fourteen-day supply are often reasonable starting points for the second phase of preparation. The order of your preparations is dependent on the particular threats you may face, their likely impact, and the extent of your ability to prepare for them. For example, a generator is very expensive, but if you frequently find yourself without electrical power, it might be a high priority purchase for your family.

Once again, the idea is to methodically work through your DP Plan worksheets while considering which threats are most likely to affect your family.

People come from all walks of life, each with his or her unique financial situation. Some people are unquestionably wealthy while others struggle to pay the rent. One commonality spanning all classes, however, is that we spend too much and save too little. Consider that Americans carry a revolving debt in excess of $900 billion (as of June of 2007). Add in loans, but still exclude mortgages, and the personal debt rises to a whop-ping $2.46 trillion.220 These figures don't consider the trillions of dollars that the country's wasteful politicians have overspent.

One of the goals of this chapter is to provide you with common sense approaches to becoming better financially prepared. But the darker truth is that every citizen should be deeply concerned with the financial condition of our country. Both as individuals and as a country, we are overspending. The solution to the nation's coming insolvency problems will surely involve government and citizens alike, but you should prepare for this coming debacle by getting your own financial house in order now.

The nation's impending insolvency problem is a disaster of epic proportions.

Perhaps you haven't given much thought to your financial health. If that's true, use this foray into disaster preparedness to get financially fit. Some may shy away from the uncomfortable topic of money because it forces them to acknowledge some poor decisions they may have made in the past. Rest assured, from billionaires to paupers, everyone has made poor financial decisions at one time or another. Learn from your mistakes and move on.

A good place to start is to informally assess your own personal level of financial preparedness. Take a moment to answer the following questions as honestly as possible:

1. Are you living paycheck to paycheck?

2. Do you have an emergency fund set aside to handle a significant, unexpected expense?

3. Can you cope with the financially difficulties caused by an extended illness in your family?

4. If you or your spouse dies suddenly, will your family be able to maintain the same standard of living as it does today?

5. If your home or car is damaged or destroyed, can you afford to repair or replace it without excessive financial hardship?

6. Do you have a reasonable plan for retirement? (Hoping to win the lottery is not a plan!)

Your answers should give you insight into your current level of financial preparedness. Maybe your financial preparations are rock solid, in which case, you should stay the course. However, if your financial readiness is less than ideal, now is the time to turn things around. Sound money management will not only help you become better prepared, but also grant you a sense of control in your life. You are encouraged to read this chapter carefully, follow it up with your own research, and then put the principles into practice.

Unexpected financial hardship

To accomplish anything difficult generally requires a plan, and becoming financially prepared is no exception. Readying your finances for the challenges that hard times are almost certain to bring begins by adopting a sound money management plan (a.k.a., the “Money Plan”).

Designing an effective money management plan is painfully simple. Putting it into practice is the hard part! Getting financially healthy is analogous to getting physically fit. On paper, it all sounds great… eat more vegetables, exercise 30 minutes a day, get plenty of sleep, and so forth. But once you see that cheesecake in the fridge, the best laid plans go out the window! This chapter will do its part to lay out a reasonable plan. You must do your part to resist the cheesecake.

The “Money Plan” is broken down into six steps (see tip box). Each and every step is crucial to your success. Together, they act as the foundation to your financial house. If any part is missing, the house quickly collapses.

1. Spend less than you make.

2. Save more.

3. Limit your debt.

4. Get the most bang for your buck.

5. Be adequately insured.

6. Don't get scammed.

As you will see, achieving financial preparedness will likely require you to adopt new spending and saving habits. This may lead to some dramatic changes in your way of living. For that reason, it must be a family commitment. Involving your children is especially important because they are the next generation either doomed to repeat our mistakes or to learn from them.

The first step of the “Money Plan” is certain to be the most difficult. But without it, you simply cannot succeed. You must learn to live below your means. Not above your means. Not even at your means. You must spend less than you make.

If our world was a cash-driven society, it would be much easier to keep from overspending. With cash, you can only spend what you have in hand. With the advent of debt, however, many people have adopted lifestyles that are beyond their means. People observe friends and neighbors living to a certain standard, and assume that they should live to that level too (a.k.a., “Keeping up with the Joneses’” syndrome).

One simple way to determine if you are living beyond your means is to answer this question:

Do you have short-term debt, such as credit cards or loans, that rolls over from month to month?

If the answer is yes, then you have borrowed money from your future to pay for your past. Said another way, you bought things you couldn't afford at the time. If it makes you feel any better, you are certainly not alone in this predicament. Debt is as seductive as the song of the Sirens.

Living below your means implies that you have extra money each month, thereby eliminating the need for short-term debt. By doing so, you will achieve a level of financial freedom. The word freedom may seem a bit extreme, but taking on debt is akin to placing yourself in the servitude of a company, organization, or individual. Is that really where you want to be? Being in debt is neither a natural nor desirable state for anyone.

Learning to live below your means sounds like such a simple thing. All you have to do is spend less than you make. What could be easier? In reality, living below your means will likely be a tremendous challenge, one that will require significant changes to your current lifestyle.

Living below your means is the single most important step to becoming financially prepared.

The process is straightforward. Begin by determining your monthly gross and net incomes. Gross income is the amount you earn before taxes and withdrawals. Net income is your take-home pay—the number of dollars you actually put into your wallet after the government takes its share. If your pay is not the same each month, then use the last twelve months to establish averages.

Next determine the amount that you would like to save. Most financial experts recommend that you save 10 percent of your gross income. As you become an experienced saver, you may wish to increase this amount. For now though, 10 percent is doing fantastic! Subtract that amount from your net income to get your available income—this is the money you have available to pay your bills, buy groceries, and keep gas in the car.

Once you determine your available income, calculate your monthly expenses. Determining your expenses is a bit trickier because some bills vary from month to month, and others may only come due once or twice a year. For those, determine the yearly totals and divide by twelve to determine average monthly expenses. With a bit of effort, you can get estimates that are close enough for budgeting purposes.

Finally, see how it all adds up. Any extra cash remaining each month is your available income minus your expenses. If this number is positive, congratulations are in order. You can live below your means without any appreciable changes to your income or spending. Unfortunately, for most people, the difference is more likely a negative number. This means that your monthly expenses are in excess of your available income. Your challenge is to increase your available income, decrease your monthly expenditures, or both.

Recognize that doing either one is difficult. Raising your income may require working extra hours, taking on a second job, or perhaps even making a job change. Lowering your expenses may require sacrifices that you simply don't want to make. Remind yourself that your financial readiness depends on working this out.

Numerous suggestions for increasing your income and reducing your expenditures are given in this chapter. They represent a smorgasbord of ideas, not all of which will apply to you. But don't dismiss them out of hand without consideration. Remember, the first and most important step to becoming financially prepared is to spend less than you make. Consider all the options, decide how you will make this happen, and then do it!

Below are suggestions to increase or supplement your income. As you take steps to raise your income, never lose sight of what you are trading for the additional money, whether it is simple “down time” or something more important like quality time with those you love. Make the appropriate choices:

• Upgrade your skills. Get the training or education you need to advance to a more highly paid position. Remember, if you have skill, energy, and a decent attitude, you are an employer's dream!

• Become more valuable to your employer. Put in the extra hours; volunteer for additional responsibilities; do exceptional work. Your employer will notice.

• Take on a second job. Burn the midnight oil and work a second job, at least until you can get some of your debt knocked out.

• Maximize your investments for the best returns. Put your money in the highest yielding accounts. Money under your mattress is losing its value in an inflationary economy.

• Start up a small business. Do something that you enjoy and are good at, such as a lawn cutting service, math tutoring, scrapbooking, and so on.

• Sell some stuff. Look through your attic and closets and sell some of the things collecting dust. You can do this through consignment shops, online auctions, or garage sales.

When looking to increase your income, don't underestimate your abilities. The difference between a fast food restaurant manager and the CEO of a Fortune 500 company is not so great. Both handle daily business pressures, deal with difficult people, and are always on the lookout to raise revenue and cut costs. If you see jobs that are more rewarding than the one you currently have, take a practical approach to making the transition. Believe in yourself.

Below are suggestions to reduce your monthly expenses. Everyone has different priorities. You may feel that some of the suggestions are too great a sacrifice, but once again, give each item some honest consideration. The goal is to assess where your money is going each month, and then figure out ways to reduce or eliminate those expenses:221

• Make a budget. Manage your money using a formal budget. Start by planning how you will spend every dollar of your paycheck. Bills, savings, grocery money, and other necessities are budgeted first. Any additional money is then mapped out for leisure activities—movies, dinner out, amusement parks, and the like. Numerous budget worksheets are available for free online.

• Downsize. It may be particularly painful to think about moving to a smaller house, or replacing that fancy new car with a used one, but these steps can free up a significant amount of money.

• Get rid of high-interest debt. Shop around for favorable rates on credit cards, car loans, home mortgages, and home equity lines of credit.

• Stop smoking. Quitting will not only reduce your monthly expenses but also help you to obtain more affordable life insurance—not to mention live longer.

• Go out for bids on insurance. Shop around for the best rates on your home, car, and life insurance.

• Cut back on services. Try living without cable, Internet, cell phone, caller ID, and other techno-luxuries.

• Brew your own coffee. Make coffee at home instead of hitting the coffee shop.

• Learn to love water. Drink tap water when eating out, rather than sodas, wine, or beer. Also, use a home water purifier instead of bottled water.

• Avoid impulse buying. Limit your purchases to real needs, rather than impulse buys. Always ask, “Do I really need this?”

• Carpool. Establish or join a carpool to work.

• Sell that second car. Get by with only one car. It will reduce your debt as well as cut insurance and tax expenses.

• Save energy. Run the heater/AC less, weatherproof your house, turn down the water heater, cutoff unused lights, and run appliances less frequently to conserve energy.

• Drop memberships. Discontinue memberships if you are not getting your money's worth (e.g., gym, golf club, hunting club).

• Avoid using atms. Eliminate fees by keeping a little money in your sock drawer.

• Limit trips to town. Plan your trips to town to accomplish as much as possible.

• Stay healthy. Getting sick can cost you bundles. Take care of yourself, and it will fatten your wallet.

• Buy store brands. Try out those generic store brands. For many products, you will never notice the difference.

• Thrift stores. Check out the local thrift or consignment stores for great deals on secondhand products, particularly in well-to-do areas.

• Generic or online drugs. Generics can save 30 percent or more over brand-name drugs. Likewise, drugs can sometimes be ordered online for additional savings (e.g., www.drugstore.com).

• Online shopping. Compare local prices to those of online stores. Many online stores offer lower prices and have the advantage of not charging taxes.

• Avoid eating out. Cook at home. Not only is it cheaper, but it is often healthier.

• Buy clothes off season. Never pay the full retail price for clothing. Even designer clothes can be purchased at huge savings when out of season.

• Use coupons. Use coupons for groceries, restaurants, services, and so forth. Check out newspaper inserts as well as online coupon websites, such as www.couponchief.com, www.fatwallet.com, www.retailmenot.com, and www.ultimatecoupons.com.

• Loyalty cards. Use grocery store loyalty cards to receive special savings on promotional items.

• Watch the register. Monitor the checkout register for pricing errors.

• Join a warehouse club. Join Costco, Sam's Club, or other large warehouse stores to receive significant savings on bulk purchases.

• Keep your car as long as possible. Resist the urge to replace your car when the new wears off. Try to get at least ten years (or 150,000 miles) out of a car.

• Buy used cars. When you must replace your vehicle, buy one that is a couple of years old to save on depreciation.

• Learn to love the library. Quit buying what you can get for free. Discover the treasure trove of books, CDs, and movies that libraries offer.

• Rent instead of going to the movies. Stay at home and watch movies using low-cost services like Netflix, Blockbuster, or Redbox.

The single most important thing you can do to cut your expenses is to learn to curb your consumerism. Quit accumulating stuff! When is enough really enough? The answer is different for each person, but even recognizing that there is a logical limit to just how much you want to accumulate in life is eye opening.

The second step to becoming financially healthy, and thus better prepared for unexpected financial burdens, is to save more. If you are like most Americans, you don't save enough. How much is enough? A respectable goal is to save 10 percent of your gross income. That means if your gross family income is $80,000, you should be saving $8,000 a year.

There are several important benefits to saving:

• Savings allow you to deal with unexpected hardships using an emergency fund.

• As your money grows, it serves as a new income stream.

• Savings help you to have a better life after you retire.

• With savings can come generosity, whether it is in the form of donations to your local animal shelter, paying for your grandchildren's college costs, or helping the church to build the new gymnasium. Prosperity can also be passed down to your children and other loved ones.

There are many people who don't save a dime. Either they argue that they are living life to the fullest—mistakenly correlating spending to happiness, or more likely, they convince themselves that they simply can't afford to save.

Your goal is to save 10 percent of your family's gross income.

Those in the first category will almost certainly come to regret their choices as they grow older and are forced to work to their dying day—assuming they are healthy enough to do so. As for the people who feel that they don't have enough income to save, it is generally more a matter of willingness to sacrifice. If your income was suddenly cut by 10 percent, would you still survive? Almost certainly you would. You might have to make some adjustments to how you live, but you would adapt and survive.

Also, recognize that savings is a sliding scale. If you make a lot, then you need to save a lot—enabling you to handle larger financial burdens and ultimately retire at the same standard that you have today. Likewise, if your income is small, then it is possible to save fewer dollars and still achieve your goals. Remember, 10 percent is your goal.

The goal of saving is to become financially prepared—out of debt, socking away money each month, and prepared to deal with unexpected challenges. The obvious first step to achieving this goal is to establish an emergency fund.

However, there is another equally important goal of saving. Getting ready for the huge financial challenge nearly everyone faces. It's called retirement! There will very likely be a point in your life when you will be unable (or perhaps just unwilling) to work. If you have properly prepared, then retirement can be a wonderful and comfortable phase of life. But if retirement is forced upon you or arrives before you have fully prepared, it can become a disaster like any other.

A thorough savings plan should therefore meet both emergency and retirement needs. A four-step savings strategy is outlined below:

1. First, establish your emergency fund.

2. Once the emergency fund is fully funded, begin contributing to retirement accounts that offer employer matching. Invest enough to take full advantage of any employer matching. With any remaining money, pay off short term debt, such as credit cards.

3. When short-term debts are paid off, put the full 10 percent into retirement accounts, even if it is more than what your employer matches.

4. If you have more than 10 percent available to save, either supplement your retirement accounts, or put the extra aside for other savings goals, such as the kids’ college accounts, travel, a new car, or leisure items.

Before anything else, you need to prepare for unexpected financial challenges. Establishing a strong emergency fund therefore comes first. If you don't have a suitable emergency fund, you will be forced to resort to using credit cards with the first unexpected financial setback.

After establishing your emergency fund, take advantage of any employer matching of retirement funds. The return on investment is simply too good to pass up. Apply what's left of your monthly savings to paying off short-term debt, starting with the accounts that have the highest rates and fees.

Finally, once all your short-term debt is knocked out, put the full 10 percent savings into your retirement accounts. If you have more than 10 percent available, apply the additional money toward other savings goals. Don't make the common mistake of saving for your kid's college needs at the expense of your retirement. There are many types of assistance available to pay for college (e.g., grants, loans, scholarships), but there is no one to help you with retirement. Let's apply the plan to an example situation.

Example: Assume that you have an income of $60,000 gross per year, $9,000 of credit card debt, and work for a company who offers 5 percent retirement matching. Through sacrifice and hard work, you have found that you can save 10 percent of your gross income, or $6,000 annually ($500 per month). You determine that your emergency fund should be $7,000. The savings plan would be applied as follows:

1. Save the full $500/month for fourteen months to fully fund your emergency fund.

2. After your emergency fund is established, begin contributing enough into your retirement account to take advantage of your employer's matching. In this case, your employer will match up to 5 percent of $60,000, which is $3,000 annually ($250/month). Therefore, invest $250 per month in your retirement account to receive the full matching. The other $250/month of the 10% percent savings goes toward paying off short-term debt.

3. Once the $9,000 in short-term debt is eliminated (taking about thirty-six months at $250/month), put the entire $500/month into your retirement accounts.

4. If you find that you have additional money beyond the 10 percent to save, put it toward specific goals. These could include college savings accounts, annual family travel, new car planning, or simply things that you would really enjoy having.

This example shows that in a little over four years, you will have established a $7,000 emergency fund, paid off $9,000 of short-term debt, and begun establishing a retirement nest egg. Not a bad start to improving your financial preparedness!

Establishing an emergency fund should be your first priority in savings. This fund will serve many important purposes, including handling the costs of unexpected car/house repairs, health care expenses, and weathering a job loss. It should be drawn upon only for emergencies, and only when no other options exist.

An emergency fund is your front-line defense against unexpected financial hardships.

Financial experts have differing recom mendations about how big an emergency fund should be. A reasonable goal is to establish an emergency fund large enough to pay all your bills for at least three months. If your bills come to $3,000/month, then you should have a minimum of $9,000 in an emergency fund. Keep the bulk of your emergency fund liquid, not locked up in a CD or other account that isn't easily accessible. It is usually best to put the money in an FDIC-insured savings account or money market fund. The yields will be low from these accounts, but safety comes first when dealing with your emergency fund.

Check into using an online bank, since they frequently offer higher interest savings rates than your local bank or credit union. When you establish an online savings account, it links directly to your local bank account, making it very easy to transfer money between the accounts. Saving in an account like this also helps to keep the money out of sight, making it less likely to be used for things other than true emergencies.

The importance of an emergency fund cannot be overemphasized. It is the safety net that catches you when times get tough. If you draw money out of your emergency fund, immediately begin replenishing it with the money you set aside each month for savings. Maintaining the emergency fund is always your first priority, even if it means temporarily not putting savings into other accounts.

Planning for retirement is an exercise in wisdom. Unfortunately, people don't tend to gain this wisdom until later in life. Many people don't get serious about building their retirement savings until they see retirement on the horizon, perhaps when they are in their forties or fifties. This is unfortunate because the most benefit can be had if you begin saving for retirement when in your twenties (or even earlier).

The greatest benefits from saving are achieved by starting early!

Albert Einstein is attributed with saying that the most powerful force in the universe is compound interest. Regardless of whether that is true or simply urban legend, it does highlight a very important savings phenomenon. In layman's terms, compound interest simply means that interest can earn more interest.

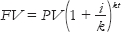

The equation for calculating compounded interest is given below:

Where FV = future value, PV = present value, i = interest rate (e.g., 10% = 0.1), k = number of times the interest is compounded per year, and t = number of years. If you are not particularly math savvy, the equation may appear confusing. Don't worry over it. The coming conclusion is what's important.

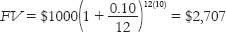

Let's look two examples. First, assume that you have $1,000 in an investment account that earns 10 percent annually and is compounded monthly. Even if you never added another penny to the account, how much money would you have at the end of ten years?

At the end of ten years, your $1,000 has grown to over $2,700. Almost a tripling of your money—not bad!

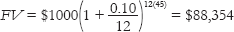

Now, what if you put the same $1,000 into an account when you were age twenty and let it sit until you were ready to retire forty-five years later?

When you were ready to retire, that single $1,000 investment would have grown to over $88,000!

These examples demonstrate that there are two significant impacts you can have on how much your money will grow: invest in an account with the largest rate of return, and invest as early as possible.

There is a very useful rule that can be used to estimate how long it takes money to double through interest accumulation. It is called the “Rule of 72.” The rule states that if you divide the number 72 by the interest rate, it will indicate the number of years required to double an investment. For example, if you invest in an account with an interest rate of 6 percent, it takes about 72/6 = twelve years for that money to double. Likewise, if the interest rate is 10 percent, the money will double about every 72/10 ≈ seven years.

One issue frequently discussed when considering financial preparedness is the buying of gold or other precious metals. The concern is that the value of assets tied to paper currency will drop if inflation occurs. Gold is seen as a “hard asset” offering protection from inflation and wild stock market swings. If you listen to the radio and television commercials, you might think that gold is a prepper's financial salvation.

Investing in gold has many drawbacks and is not the only way to hedge against inflation.

Gold coins (Wikimedia Commons/Olegvolk)

In reality, there are many drawbacks to buying physical gold. The worst of which is that you have to pay a premium both when you buy and sell the gold—typically losing 5 percent of the market price each way.222 This means that gold has to rise 10 percent in value just for you to break even. To make matters worse, the IRS considers gold a collectible and taxes gains at much higher tax rates than stock gains. Finally, you have to store gold in special segregated vaults to guarantee its purity. If you keep it at home in a safe or in a bank's safety deposit box, you must have the gold re-assayed before selling it—yet another expense.

If you want to invest in gold while avoiding the many drawbacks, buy it through exchange-traded funds like SPDR Gold Trust (GLD) or iShares COMEX Gold Trust (IAU). The shares are backed by gold bars stored in certified vaults in New York and London. Admittedly, it is not quite the same as holding a gold Krugerrand in your hands, but it is a better investment. Either way, if you decide to own gold (or any other precious metal), most experts advise that you limit the investment to no more than 10 percent of your portfolio.

A better option all around might simply be to put your money in inflation-protected index funds (available through all major investment brokers). Gold is far less predictable. It has been a good investment over the past few years, but if you look at it over the past few decades, the yield has not been very impressive. Even with the recent spike in prices, gold has risen only about 400 percent over the last fifty years. That corresponds to an average compounded yearly rate of less than 3 percent.

The third step to becoming financially prepared is to limit your debt. Consider the definition for debt as provided by Merriam-Webster Online:223

Debt—sin, trespass; something owed, an obligation; a state of owing

Wow. Does that cause you to pause for a second? Are these the words you want used to describe your financial condition?

Debt is so prevalent that it is taken for granted as a necessity in modern society. It enables you to purchase expensive items and amortize that cost over time. The problem arises when people use debt to fund everyday expenses. Worse yet is when debt is used to fund living expenses, essentially borrowing from the future to pay for the present. As the world's governments are now learning, this method of borrowed living is not sustainable.

Credit cards—friend or foe?

The personal debt problem is largely the result of the ease of credit. Each year, the credit card industry mails out approximately six billion credit card offers across the United States.224 Why do these companies go to the expense of such widespread solicitation? The answer is obvious—there is a lot of money to be made!

There are countless complaints about the unethical practices of credit card companies, including tacking on exorbitant penalty fees, delaying payments to incur late fees, charging rates higher than originally promised, targeting college kids with the expectation that their parents will pick up the expenses, and raising interest rates to outrageous levels when a borrower falls behind. Credit card companies are the modern day equivalent of the loan shark business, but on an unprecedented scale. Fortunately, the recently adopted Credit CARD Act legislation is taking steps toward protecting the consumer, but many questionable practices remain.

From the tone of the condemnation, you may think that credit cards should always be avoided. This is far from the truth. When used correctly, credit cards provide very real benefits, including:

• They provide buyer protection by limiting your liability to purchasing fraud.

• Many offer extended warranties on card-purchased items.

• Many offer rewards, such as cash back or frequent flyer miles.

• They are easily replaced if lost or stolen.

• They are necessary for certain purchases or rentals.

• They help you build a higher credit score, which is needed for mortgages or other large purchases.

• They can help you categorize your purchases for purposes of budgeting.

Despite the harsh words for credit card practices, you may wish to enjoy their many benefits. The key to credit of any type is using it correctly. So how do you do that with credit cards? Follow three simple rules and you can't go wrong:

1. Find a credit card with the best benefits. Cards can be compared online at www.creditcards.com and www.cardweb.com.

2. Use the credit card to make your purchases.

3. Pay off the credit card balance each month.

Debit and business cards may leave you liable for significant expenses should they ever be lost or stolen.

If you are unable to balance your checkbook well enough to guarantee your ability to pay off your credit card balance each month, then don't use credit cards. The bottom line is that credit cards can be a convenient tool or an irresistible temptation to overindulge.

Many people use debit cards—cards that charge directly against funds in your bank account. The advantage of a debit card is that you can't use it to put yourself into debt. The drawback is that debit cards don't provide the user the same protection that credit cards do. For example, when using VISA or MasterCard, you are limited to a $50 liability should the card be stolen and used fraudulently. The same is not generally true for debit cards. Likewise, business credit cards are often pushed on people (even those without a business). Why do credit card companies offer better deals on business credit cards? The answer once again comes back to consumer liability. If a business card is lost or stolen, the credit card company can claim that you were negligent with the handling of the card and hold you fully responsible for all fraudulent charges.

There are of course many other types of debt besides credit cards. Car loans are one good example of this. The ideal way to purchase anything that depreciates in value is using cash. To borrow money to invest in something that depreciates is financially unwise. With that said, there is an argument for purchasing automobiles on credit. Cars are used to gain and keep employment, which in turn brings in income. Therefore, the case can be made for borrowing money to purchase a car if it is used to support employment. However, this does not suggest you borrow money to purchase a new Lexus to get back and forth to your job. If the cost of the debt prevents you from meeting your savings goals, then you can't afford it. Also, you will save significantly on depreciation by buying a car that is at least two years old.

Home mortgages are a unique class of debt. Most people are unable to purchase a home outright, so either they must rent for the majority of their lives, or surrender to this form of debt and take out a mortgage. Of all the types of debt, home mortgages are the best. There are several reasons for this. First, homes have historically appreciated in value, making them a reasonable investment. Second, they replace the expense of renting. The interest on home mortgages is also tax deductible, effectively lowering the borrowing costs. Finally, a mortgage gives an immediate return on the investment since you are able to enjoy living in the house. However, the same rules of affordability still apply. You can only afford a house if the mortgage, utilities, taxes, maintenance, association fees, and insurance costs don't prevent you from meeting your savings goals.

If you give two people one hundred dollars and ask them to go out and purchase a set of clothes, they will come back with very different results. A business man might come home with a pair of trousers and a tie. A frugal grandmother on the other hand might come home with two dresses, a pairs of shoes, some pantyhose, a new purse, and a pocket full of change. The difference being that one knows how to bargain shop. This is a classic example of getting the most bang for your buck. Learn to buy things off season or when they are falling out of fashion. Even high-end clothing can be found at huge discounts if you are willing to do end-of-season shopping. Online stores are also an excellent place to do comparison shopping and find bargains (especially on electronics).

One word of caution… if something sounds too good to be true, then it is too good to be true. There are rarely any exceptions to this rule. Be very careful when parting with your money! Remember what Thomas Tusser said, “A fool and his money are soon parted.” Scams target everyone, rich and poor alike. The most common elements of scams are discussed a little later in this chapter.

A very important step to financial preparedness is being adequately insured. There are countless disasters that can cause property damage, injury, and loss of life. Having appropriate safety nets in place is vital to your family's financial security.

Your home is likely to be your largest financial investment, both the structure and the contents. If you are a renter, then the property contained in your apartment, townhouse, or rental home is probably a large part of your assets. Having adequate homeowner's or renter's insurance is therefore imperative.

There are many companies that offer homeowner's or renter's insurance (e.g., State Farm, Allstate, Prudential). All of these companies have good and bad reputations depending on who you ask. It probably doesn't really make much difference which of the major insurers you choose. What does matter is that you select adequate coverage and sufficiently document your belongings.

The definition of “adequate coverage” is enough insurance to fully rebuild your home and replace all of your belongings with new items should they be lost to a major disaster, such as a fire, flood, tornado, or earthquake. Be sure to clarify that you want replacement cost insurance, not coverage that is pro-rated based on the age of the item. You may also need special endorsements known as riders to cover specialty items such as jewelry, guns, electronics, collectibles, or antiques.

Homeowner's insurance generally comprises two parts: property protection and liability protection. Property protection covers the dwelling, detached structures, personal contents, and costs associated with loss of use. Liability protection covers personal liability, such as damage to other people's property and medical expenses associated with an accident on your property. Do you know the details of your current policy? If not, take a few minutes to read through it. If your policy doesn't cover the worst case scenarios, make the appropriate changes.

Document your belongings using a video camera.

Importance of home insurance (photo by FEMA/Dave Gatley)

One major problem that often arises when a catastrophic event completely destroys a home is convincing the insurer of what was actually lost. Insurers are all too familiar with customers claiming that every room was filled floor to ceiling with Gucci handbags and Rolex watches. It is your responsibility to document what you actually possess and want insured. For this reason, you should create a home inventory video. Simply walk through your house with a camcorder (or camera), documenting every room and closet, as well as noting any high-value or irreplaceable items. Give a copy of the recording (or photos) to your insurer, and keep a copy for yourself somewhere other than inside your house. Repeat the process annually or when you have significant changes to your contents. Video documentation will help to protect you as well as make claims much easier to process.

Auto insurance coverage is another financial necessity. Whether you drive a new BMW or a true junkyard classic, you need car insurance. At a minimum you will need liability insurance to pay for damages or injury to others, as well as comply with the law. If your vehicle is of any significant value, you will also want collision insurance, which pays for your car to be repaired in case of an accident. The only recommendation here is to find the best price on the best policy. It may make sense to use the same provider as do for your home since companies typically offer multi-policy discounts. Also, find an insurer with a local office and get to know the representative and staff.

One in three workers will become disabled before age sixty-seven.

Disability insurance is likely to be the most difficult insurance decision you will have to make. This type of insurance provides a monthly stipend in case of disability. Depending on the type and coverage, it has a specific payout (paying a fixed amount each month) and duration (lasting a given number of years). If you opt for this coverage, be sure to ask many questions, such as how disability is determined, how insurance payments are affected by government disability payments, how long the payments will keep coming, and how long must you have to be out of work before the first payment is made.

It is estimated that one in three workers will become disabled for an extended period before age sixty-seven.225 In a perfect world, every worker should therefore have disability insurance. In reality, few do. Disability insurance is relatively expensive, and often does not provide a comparable replacement income. It can, however, soften the financial impact of a disability.

Medical insurance is another of life's necessities. Whether you are age six or sixty, health problems can arise forcing you to seek medical services. It is truly unfortunate that nearly 50 million Americans have no medical insurance.226 The problem is that medical insurance is very costly, to the point of being impossible to afford for people with serious pre-existing conditions. Without insurance, medical costs can quickly drain away emergency funds and even entire life savings.

If you are fortunate enough to work for an employer who provides (or at least supplements) health-care insurance, take full advantage of the benefit. If your employer offers several plans, compare the trades between cost, co-pays, deductibles, and available network of doctors. If you are self-employed or unemployed, try teaming with groups of other individuals to get more attractive rates and coverage. Alternatively, look for plans through memberships or discount clubs. You can also comparison shop at websites like www.ehealthinsurance.com. Finally, if you are unemployed and can simply not afford health care, seek treatment through lower cost clinics or county-run health offices.

It is often possible to negotiate pricing with providers and hospitals. Specifically, if you have a large outstanding balance with a health-care provider, you can often get that balance significantly reduced if you are willing to pay a negotiated amount in full.

Personal aside: Several years back, my mother had a large hospital bill (over $6,000). I called and explained that she was elderly, had little income, and would only be able to pay about $50 per month. As her son, I offered to pay a lump sum if they could lower the bill. Within twenty-four hours, they cut the bill to $1,200, which I promptly paid. The hospital was content with the partial payment because it was far more than they would have received otherwise. Likewise, I was happy with having paid off the debt at a fraction of the original cost.

Life insurance is often misunderstood. The point to keep in mind is that life insurance is not designed for the person who has died; rather, it acts as a safety net for those left behind. Because of this, it is not a question of whether someone needs life insurance, but only how much they need.

When a person is young or without dependents, life insurance needs are very modest, perhaps only providing for burial expenses. Once a person gets married and has children, life insurance must provide for the family's continued well-being in case of the loss of the breadwinner. This can be quite substantial. As the family matures and children move away from home, life insurance needs will decrease, ultimately settling at the modest levels required to settle an estate.

Example: Jack, age thirty-five, is a corporate salesman. His wife, Jill, is a homemaker who homeschools their three kids, ages five, seven, and ten. Jack earns $100,000 a year. They live in a home with a mortgage of $300,000. Family debt (e.g., cars, credit cards) totals $40,000. The family's monthly expenses are $4,000 (half of which is a mortgage payment). Jack has a 401(k) retirement fund with a $100,000 balance. How much life insurance does he need and of what type? What about when he turns seventy? Will he still have the same needs?

If Jack died today, his family would be without his significant income. His wife is a homemaker who has chosen to homeschool their children, meaning that her ability to replace his income is very limited. The amount of life insurance needed to act as a proper safety net could be calculated by summing up the following needs:

1. Pay off home mortgage.

2. Pay off other debt.

3. Establish savings large enough to provide an income stream to meet the family's long-term needs.

The mortgage payoff is easy to determine, $300,000 in this case. The additional debt adds another $40,000. The third part of the calculation is the hard part. How much money is needed to take care of future needs? Once the house is paid off, the monthly expenses will come down to $2,000. Let's assume that the remaining insurance money is put into a diversified investment account (stocks, bonds, money markets), with an average yield of 10 percent. Backing out the amount needed to earn $2,000 of interest each month, gives a net deposit of $240,000. The insurance breakdown would be:

Mortgage: |

$300,000 |

Debt: |

$40,000 |

Savings: |

$240,000 |

The grand total comes to $600,000 in life insurance needs. This example neglects many things (e.g., Social Security survivor benefits, future education needs, inflation, investment variations, etc.), but it serves as a basis for the recommendation of many financial advisors. Many experts recommend that your life insurance be equal to five to ten times your annual gross salary. In this simple example, it was shown that Jack needed about six times his annual income.

A person's life insurance needs change significantly during the course of a lifetime. The five to ten times rule does not generally hold early or very late in life. For example, if Jack lives to be seventy, his children will all be grown, his house will already be paid off, and he will likely have additional retirement assets for his surviving wife. Therefore, a large insurance policy is neither necessary nor cost effective at that age.

What about Jill's insurance needs? Since she is a homemaker, her insurance needs are significantly different than his. Even with Jill's death, Jack would continue to work, so his family's income would remain unchanged. Normally this would indicate that very little life insurance is needed for Jill. In this case, however, the family may decide that private schooling should replace homeschooling, and the costs of that schooling would need to be included in her insurance policy. This demonstrates how life insurance needs are unique to every individual. Once again the thing to keep in mind is that life insurance is about meeting the needs of those left behind.

Regardless of your net worth, you should have a Last Will and Testament. A will should name an executor who you trust to handle your affairs when you die. It should clearly spell out how your assets are to be distributed. If you have children, it should name who you would like take custody of them should both parents die together. A will serves all these vital purposes, but it does one thing more. It gives you a sense of peace. Death may come suddenly, or it may come slowly. Either way, knowing that you have prepared your estate and named caregivers for your children will give you peace of mind.

For most people, writing a will is inexpensive and easy to do. You can use online services, such as www.legalzoom.com, or software packages, such as Quicken's Willmaker. Another option is to hire a local attorney to draft up a will for a modest fee.

The final step in becoming financially prepared is learning to hang onto your money. Scamming is big business. Billions of dollars are stolen from unsuspecting people each year. Being scammed and being robbed are tantamount to the same thing since both leave you with less cash in your pocket and the same violated and angry feelings. Below are a few basic observations about scamming:

1. At the root of nearly every scam is an exchange of money (or other valuable asset)—something leaving your hands and entering theirs.

2. In this electronic age, the most trusted form of payment is cash. Cashier's checks, money orders, bank checks, wire transfers, and personal checks are all readily forged.

3. Everyone is a target for scamming, from the single mother working two jobs to pay her rent, to the millionaire living in the Manhattan townhouse. Some scams amass money by targeting lots of “little people”; others shoot for the big payoffs.

Don't think you are too smart to be scammed.

What can you do about it? First and foremost, don't fool yourself into thinking that you are too smart to be scammed. Everyone is vulnerable. With that said, there are many things you can do to minimize your vulnerability by making yourself a tougher target than the next person.

Start by familiarizing yourself with the most common scams (some of which are discussed on the next page). Talk about them openly with your entire family, including your kids. A great resource for learning about scams is Clark Howard, heard on AM radio, seen on CNN, and found at www.clarkhoward.com.

Look at every financial transaction with skepticism. Ask yourself a few questions. What could go wrong? How will you handle problems? How can you protect yourself? Are you feeling rushed? Does something seem not quite right? Use a protected form of payment whenever possible (such as a credit card, PayPal, etc.). Most credit cards are protected against fraud if reported within sixty days. The maximum loss you will typically suffer is $50. For this reason, if you buy something and it hasn't arrived within sixty days, consider reporting it as a fraudulent transaction to your credit card company. You can always cancel that report should the item arrive later.

When selling something, don't release the item until you have a cleared payment from the purchaser. If payment is made through a personal check, have your banker contact the buyer's bank to verify funds. You should then wait until the check clears before releasing the item. Likewise, if payment is made with a bank-issued check, have your banker call the issuing bank to verify authenticity. For small transactions, you might consider using postal money orders with serial numbers that allow online verification. Don't accept wire transfers since they are often fraudulent.

A discussion of several common scams appear below:

• Need Your Info: Never give out personal or financial information to unknown callers or emailers. If someone calls or emails asking for your Social Security number or bank account information, it is a scam. There are many variations of this scam, including a court clerk claiming to be calling about jury duty, a bank representative claiming there is a problem with your account, or a prize company suggesting they want to deposit money into your bank account.

• The Sure Thing: Beware of any investment that claims to “beat the market.” This is often a huckster trying to convince you to part with your life savings through a Ponzi scheme or by investing in very high risk activities. If anyone can reliably beat the stock market without added risk, they surely would not have to go looking for customers!

• Money Up Front: Don't pay for a service until the work is completed. If supplies are needed to perform the service, you may be required to pay enough to cover those costs. If the service is not done to your satisfaction, refuse final payment, and take up the issue with the parent company.

• Online Hucksters: Don't buy goods from questionable sellers. In the past, the shady salesperson might have been a street corner peddler with a coat full of cheap knockoff watches. That danger is largely replaced with online auction hucksters. If you decide to purchase something through an online auction, understand that it is inherently riskier than making retail purchases. Once again, use only protected forms of payment.

• Return to Sender: Never refund money back for accidental overpayment. If someone overpays you for an item and then asks for a partial refund of the overpayment, it is always a scam. Their original payment will ultimately prove to be worthless—often taking weeks to bounce.

• Lottery: You will never receive a legitimate limited-time-only “act fast” lottery offer. Neither will you ever win the lottery through email. If you win any form of lottery, you will receive a certified letter as well as personal contact from the issuing company. You will never be required to pay any form of upfront payment, such as issuance, processing, registration, tax, or transfer fees. If it is truly your lucky day, there will be no doubt in your mind.

• Nigerian Royalty: If you receive a chain letter or email offering you a handsome commission for depositing a Nigerian prince's inheritance (or other such nonsense), it is a scam. If you reply, you will be led through a carefully crafted scheme that has you send money for one reason or another.

• Hit Man: If you receive a letter from a professional assassin claiming that he has a contract to kill you but will let you live if you pay him a fee, it is a scam. Report it to your local law enforcement agency or the FBI. But relax. No one is out to get you, only your money.

• Gypsies and Curses: If a gypsy, palm reader, tarot card reader, or anyone else tells you that your money is the source of a curse, it is a scam. They will ultimately try to convince you to give it to them to throw over a bridge, burn, or dispose of in some other way. Get away from them and seek better counseling.

In February of 2008, Consumer Reports published an article detailing twelve financial mistakes that could cost you $1,000,000. Let's wrap up this financial preparedness chapter with a quick listing of those common money-related blunders:

1. Investing too conservatively for retirement—limits your savings growth

2. Retiring before you can afford to—leaves you with inadequate savings for your leisure years

3. Having an expensive divorce war

4. Underinsuring your home—results in hefty losses when the structure or contents are damaged

5. Overpaying your mortgage by having a high interest rate

6. Carrying credit card balances—requires payment of significant interest (and perhaps fees)

7. Living an unhealthy lifestyle—leads to higher insurance costs and greater medical expenses

8. Not using Roth accounts

9. Cashing out retirement accounts early—results in loss of retirement accumulation as well as hefty withdrawal penalties

10. Underfunding retirement accounts

11. Paying excessive brokerage and fund fees

12. Falling for a scam

Avoiding these costly mistakes while following a reasonable money management strategy, such as the “Money Plan,” will help to ensure that you have adequate funds to meet the challenges that unforeseen events can bring.

Quick Summary—Financial Preparedness

Prioritizing can be done using the personalized DP Plan worksheets. Begin by identifying everything you need to reach a minimum level of self-sustenance. Once that level is reached, expand your capabilities to support your family through a prolonged or more severe disaster.

Prioritizing can be done using the personalized DP Plan worksheets. Begin by identifying everything you need to reach a minimum level of self-sustenance. Once that level is reached, expand your capabilities to support your family through a prolonged or more severe disaster.

Financial preparedness plays an important role in disaster preparedness, enabling you to stockpile supplies, cope with unexpected financial pressures, and minimize losses.

Financial preparedness plays an important role in disaster preparedness, enabling you to stockpile supplies, cope with unexpected financial pressures, and minimize losses.

Six key steps to achieving financial preparedness are: living below your means, limiting your debt, saving 10 percent of your gross income, getting the most from your money, being adequately insured, and not getting scammed.

Six key steps to achieving financial preparedness are: living below your means, limiting your debt, saving 10 percent of your gross income, getting the most from your money, being adequately insured, and not getting scammed.

The ultimate goal of saving is to become financially prepared—out of debt, socking away money each month—and thus prepared to deal with life's unexpected challenges.

The ultimate goal of saving is to become financially prepared—out of debt, socking away money each month—and thus prepared to deal with life's unexpected challenges.

A savings plan begins by establishing an emergency fund of at least three months of expenses. The emergency fund is only used to cope with hardships from unexpected events.

A savings plan begins by establishing an emergency fund of at least three months of expenses. The emergency fund is only used to cope with hardships from unexpected events.

Adequately insure your property, life, health, and ability to work. Remember, life insurance should be determined by the needs of those left behind.

Adequately insure your property, life, health, and ability to work. Remember, life insurance should be determined by the needs of those left behind.

Leave behind a properly executed will to dictate how your possessions will be distributed, and who will care for your surviving children.

Leave behind a properly executed will to dictate how your possessions will be distributed, and who will care for your surviving children.

Protect your money by guarding against scams.

Protect your money by guarding against scams.