9

Money Matters

In the small-business world, there are two key sides to the issue of money: How much do you need to start and operate, and how much can you expect to take in? Doing this analysis is often extremely difficult for small-business owners who would rather be in the trenches getting the work done than bound to a desk dealing with tiresome numbers. A dirty floor or dusty armoire may have more appeal than a budget that needs planning, but the budget is critical, because if your business isn’t profitable, you won’t be around to do any cleaning.

Sources of Startup Funds

Most of the cleaning service operators we spoke with used personal savings to start their businesses and then reinvested their early profits to fund growth. If you need to purchase equipment, you should be able to find financing, especially if you can show that you’ve put some of your own cash into the business. Beyond traditional financing, you have a range of options when it comes to raising money. Some suggestions:

• Your own resources. Do a thorough inventory of your assets. People generally have more assets than they immediately realize. This could include savings accounts, equity in real estate, retirement accounts, vehicles, recreation equipment, collections, and other investments. You may opt to sell assets for cash or use them as collateral for a loan. Take a look, too, at your personal line of credit. Many a successful business has been started with credit cards.

• Friends and family. The next logical step after gathering your own resources is to approach friends and relatives who believe in you and want to help you succeed. Be cautious with these arrangements; no matter how close you are, present yourself professionally, put everything in writing, and be sure the individuals you approach can afford to take the risk of investing in your business. Never ask a friend or family member to invest or lend you money they can’t afford to lose.

• Partners. Using the “strength in numbers” principle, look around for someone who may want to team up with you in your venture. You may choose someone who has financial resources and wants to work side-by-side with you in the business. Or you may find someone who has money to invest but no interest in doing the actual work. Be sure to create a written partnership agreement that clearly defines your respective responsibilities and obligations.

Bright Idea

Looking for startup cash? Consider a garage sale. You may have plenty of “stuff” you’re not using and won’t miss that can be sold for the cash you need to get your cleaning business off the ground. Another option for turning your things into cash is to sell them on sites such as eBay or Craigslist.

• Government programs: Take advantage of the abundance of local, state, and federal programs designed to support small businesses. Make your first stop the SBA, and then investigate other programs. Women, minorities, and veterans should check out niche financing possibilities designed to help these groups get into business. The business section of your local library is a good place to begin your research.

Setting Prices

Pricing can be tedious and time-consuming, especially if you don’t have a knack for crunching numbers. Particularly in the beginning, don’t rush through this process. If your quote is too low, you’ll either rob yourself of some profit or be forced to lower the quality of your work to meet the price. If you estimate too high, you may lose the contract altogether, especially if you’re in a competitive bidding situation. Remember, in many cleaning situations, you may be competing against the customer him- or herself; if your quote is high, he or she may think, “For that much money, I can do this myself.”

Of course, you’ll make mistakes in the beginning. For example, one residential cleaning service operator we spoke with started out quoting an hourly rate, but as she became more efficient and was able to clean faster, she realized it would be more profitable to charge by the job than by the hour. Charge for the value of your service, not the time you spend. It’s also a good idea to charge what you would charge if you had employees, even at the very beginning when you’re doing the work yourself. Some people make the mistake of undercharging when they start out just to get customers and then later on, when they grow and need to hire help, they aren’t making enough money to pay that help. Also, if you are too cheap, customers will think you aren’t experienced or don’t do quality work. So don’t underprice your services.

During the initial days of your operation, you should go back and look at the actual costs of every job when it’s completed to see how close your estimate was to reality. Learning how to accurately estimate labor and properly calculate overhead will let you set a competitive pricing schedule and still make the profit you require.

Smart Tip

Don’t set prices low just to get business when you’re starting out. Customers who use you based solely on price will leave you for the same reason. Be sure your prices are competitive, fair, and high enough for you to make a reasonable profit.

To arrive at a strong pricing structure for your particular operation, consider these three factors:

1. Labor and materials (or supplies)

2. Overhead

3. Profit

Bill Me

You’ll set your prices for specific upholstery cleaning jobs based on the condition of the items you’re cleaning, the labor and materials required, and the profit you want to make. The ranges below will give you an idea what to charge.

Cushions only |

$10–$15 each |

Dining room chairs |

$9–$20 |

Draperies |

$2.50–$8.00 per pleat |

Foot stools and ottomans |

$10–$25 |

Love seats |

$40–$140 |

Occasional chairs |

$20–$30 |

Recliners |

$35–$50 |

Sofas (depending on size) |

$60–$196 |

Stools and benches |

$12–$20 |

Toss pillows |

$5–$10 each |

If odor control is necessary, add 25 percent

Labor and Materials

Until you establish records to use as a guide, you’ll have to estimate the costs of labor and materials. Labor costs include wages and benefits you pay your employees. If you’re even partly involved in executing a job, the cost of your labor, proportionate to your input, must be included in the total labor charge. Labor cost is usually expressed as an hourly rate.

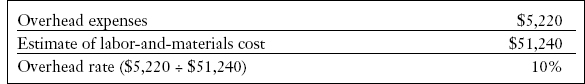

Overhead

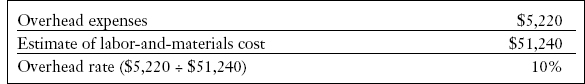

Overhead consists of all the non-labor, indirect expenses required to operate your business. Your overhead rate is usually calculated as a percentage of your labor and materials. If you have past operating expenses to guide you, figuring an overhead rate isn’t difficult. Total your expenses for one year, excluding labor and materials. Divide this number by your total cost of labor and materials to determine your overhead rate. When you’re starting out, you won’t have past expenses to guide you, so use figures that are accepted industry averages. You can raise or lower the numbers later to suit the realities of your operation.

Let’s Make a Deal

You may have some prospective customers who honestly believe your quote is too high, others who make it a habit to never accept the first price as the final one, and still others who simply enjoy haggling. Whether you choose to negotiate is entirely up to you. Orlando residential cleaning service owner Fenna Owens starts and sticks with what she believes is a fair price. “If they don’t like it, that’s their prerogative,” she says. “I don’t usually go lower than what I think it should be.”

If you charge less than what you think the job is worth or less than it will take for you to make a reasonable profit, the quality of your work and, eventually, the overall success of your company will suffer. It’s difficult to turn down work, especially when you’re first getting started, but sometimes it’s better to decline an account than to take it on at a loss.

One effective negotiating technique is to reduce your price only when you take something out of the service package. When a prospective customer says her price is too high, Wanda Guzman in Orlando goes through what her quote covers and suggests removing some of the services to bring the price down. Or you can ask what the customers are willing to pay and tell them how much you’ll do for that price.

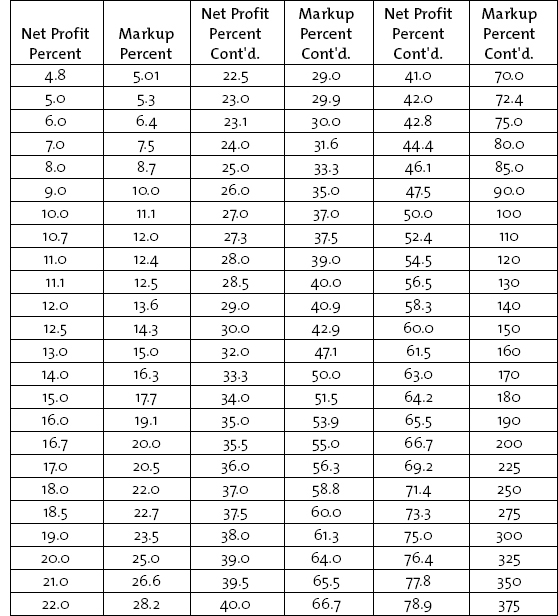

Profit

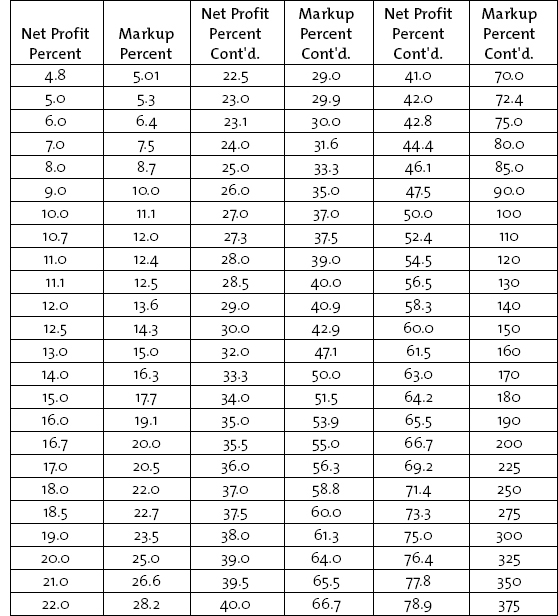

Profit is, of course, the difference between what it costs you to provide a service and what you actually charge the customer. Figure your net profit into your estimate by applying a markup percent to the combined costs of labor, materials, and overhead. The markup percent will be larger than the actual percentage of gross revenue you’ll end up with for your net profit. For example, if you plan to net 38 percent before taxes out of your gross revenue, you’ll need to apply a markup of about 61.3 percent to your labor and materials plus overhead to achieve that target. (To determine your markup percentage, refer to the “Calculating Markup” chart on page 115.)

Setting Residential Cleaning Service Prices

Most residential cleaning services don’t have particularly high overhead costs. Figure that overhead runs from 10 percent to 40 percent of your labor and materials, depending on the size of your operation, whether you’re homebased or commercial-based, and the number of employees you maintain on your payroll.

Here’s an example:

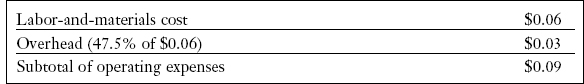

To calculate the cost of a single cleaning, the example looks like this:

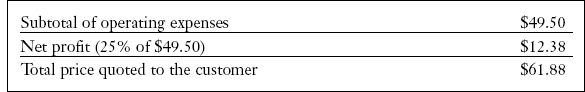

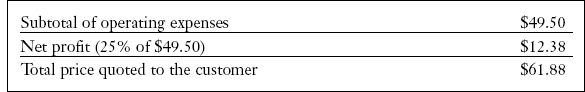

Most residential cleaning service operators expect to net 10 to 30 percent of their gross revenue. To continue our example with a target of netting 20 percent before taxes:

Note that the $12.38 net profit ends up as 20 percent of $61.88 (which is the “selling price”).

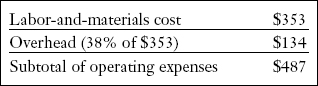

Setting Janitorial Service Prices

Overhead for a janitorial service is somewhat higher than for a residential service, typically ranging from 20 to 50 percent of labor costs.

Supplies typically run about 5 percent of labor, although Salt Lake City’s Michael Ray says his goal is to keep them between 3 and 4 percent. Use industry averages to help you calculate your estimates until you have a history and can use actual expenses.

Smart Tip

When your customers want you to provide consumable supplies, bill them for the actual amount they use. Some customers may try to get you to include those items in your basic fee, but the consumption rate can vary so significantly that you may find it impossible to make a fair estimate.

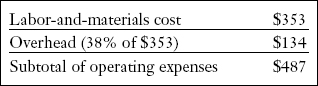

Here’s an example of a bid on a job that will take two hours of labor per day, five days a week, at $8 per hour, and using an overhead rate of 38 percent:

Most janitorial service operators expect to earn a net profit of 10 to 28 percent of gross sales. In our example, we want to yield a 22 percent net profit before taxes.

Bright Idea

Providing consumable items such as bathroom tissue, paper towels, hand soap, feminine hygiene products, and trash can liners can be profitable for you and save your clients money. If you take the volume pricing you receive from your suppliers and mark it up slightly, you’ll still make money, and your customers will likely get lower prices than they could negotiate on their own.

Note that the $136 net profit ends up as 22 percent of $623 (which is the “selling price”).

Setting Carpet Cleaning Prices

Most carpet cleaning services charge by the square foot. Mike Blair says prices can range from 15 to 45 cents per square foot, depending on the particular market, the total services provided, and the ability of the cleaning company to communicate its value. It may take experimenting with pricing in your market to determine the optimum price level that your customers will perceive as fair and yet will still allow you to make an adequate profit.

In the carpet cleaning industry, overhead typically costs from 47 to 54 percent of your labor-and-materials cost.

Let’s say you cleaned 2,144,800 square feet of carpet in one year. Our example looks like this:

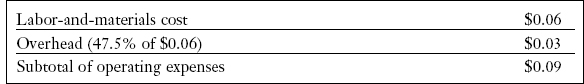

Using an overhead rate of 47.5 percent as just computed, we can take our example to the next step and calculate the cost to clean one square foot of carpet:

The typical net profit for carpet cleaning businesses ranges from 30 to 45 percent of gross revenue. To calculate a net profit of 38 percent for our example, the numbers look like this:

If you compare the price of $0.15 above with the cost of labor and materials ($0.06) already estimated, you’ll see that the quote is just a little more than double the labor charge. Some carpet cleaners use this ratio as a basis for determining price—they estimate their labor costs and then double that figure to arrive at their quotes.

Keeping Records

One of the key indicators of the overall health of your business is its financial status, and it’s important that you monitor your financial progress closely. The only way you can do that is to keep good records. You may want to crunch your numbers manually. If not, there are a number of excellent computer accounting programs on the market. Ask your accountant for assistance getting your system set up. The key is to monitor your finances from the very beginning and keep your records current and accurate throughout the life of your company.

Keeping good records helps generate the financial statements that tell you exactly where you stand and what you need to do next. The key financial statements you need to understand and use regularly are:

• Profit and loss statement (also called the P&L or the income statement), which illustrates how much your company is making or losing over a designated period—monthly, quarterly, or annually—by subtracting expenses from revenue to arrive at a net result, which is either a profit or a loss

• Balance sheet, which is a table showing your assets, liabilities, and capital at a specific point. A balance sheet is typically generated monthly, quarterly, or annually when the books are closed.

Something’s Afoot

The factor that has the biggest impact on the square foot rate for carpet cleaning is whether the property is empty or furnished. The next most important factor is the degree of soil and general condition of the carpet.

“How we distinguish the price has to do with the number of square feet and the number of furnishings we have to negotiate or don’t have to negotiate,” explains Mike Blair, owner of AAA Prestige Carpet Care in St. George, Utah. “If the property is empty, it’s less in almost every application.” The condition of the carpet, type of soil, and traffic patterns can also affect the time it takes—and therefore the cost—to clean.

You’ll also want to consider the type of fiber in the carpet. “There are some unique fabrics that have to be considered,” Blair says. For example, cleaning a valuable Oriental rug will cost more than the typical low-end carpet used in apartment complexes because of the expertise required.

• Cash flow statement, which summarizes the operating, investing, and financing activities of your business as they relate to the inflow and outflow of cash. As with the profit and loss statement, a cash flow statement is prepared to reflect a specific accounting period, such as monthly, quarterly, or annually.

Successful cleaning service operators review these reports regularly, at least monthly, so they always know where they stand and can quickly move to correct minor difficulties before they become major financial problems.

Billing

If you’re extending credit to your customers—and it’s likely you will if you have corporate accounts or if you are in the janitorial business—you need to establish and follow sound billing procedures.

Beware!

Mail thieves operate even in the nicest of neighborhoods. If you receive checks in the mail, rent a post office box so you know they’ll be secure.

Coordinate your billing system with your customers’ payable procedures. Candidly ask what you can do to ensure prompt payment; that may include confirming the correct billing address and finding out what documentation may be required to help the customer determine the validity of the invoice. Keep in mind that many large companies pay certain types of invoices on certain days of the month; find out if your customers do that, and schedule your invoices to arrive in time for the next payment cycle.

Beware!

If you offer an early-payment discount, be prepared for some customers to deduct the discount but still take 30 days or longer to pay. Some business owners say this is a good reason not to offer such discounts because if you try to collect them when they’ve been incorrectly taken, you risk damaging your relationship with your customer. It’s a judgment call only you can make.

Most computer bookkeeping software programs include basic invoices. If you design your own invoices and statements, be sure they’re clear and easy to understand. Detail each item and indicate the amount due in bold with the words “Please pay” in front of the total. A confusing invoice may be set aside for clarification, and your payment will be delayed.

Your invoice should also clearly indicate the terms under which you’ve extended credit. Terms include the date the invoice is due, any discount for early payment and additional charges for late payment. For example, terms of “net 30” means the entire amount is due in 30 days; terms of “2-10, net 30” means that the customer can take a 2 percent discount if the invoice is paid in 10 days, but the full amount is due if the invoice is paid in 30 days.

It’s also a good idea to specifically state the date the invoice becomes past due to avoid any possible misunderstanding. If you’re going to charge a penalty for late payment, be sure your invoice states that it’s a late payment or rebilling fee, not a finance charge.

The Taxman Cometh

Businesses are required to pay a wide range of taxes, and there are no exceptions for cleaning service business owners. Keep good records so you can offset your local, state, and federal income taxes with the expenses of operating your company. If you have employees, you’ll be responsible for payroll taxes. If you operate as a corporation, you’ll have to pay payroll taxes for yourself; as a sole proprietor, you’ll pay a self-employment tax. Then there are property taxes; taxes on your equipment and inventory; fees and taxes to maintain your corporate status; your business license fee (which is really a tax); and other lesser-known taxes. Take the time to review all your tax liabilities with your accountant.

Finally, use your invoices as a marketing tool. Mention any upcoming specials, new services, or other information that may encourage your customers to use more of your services. Add a flier or brochure to the envelope—even though the invoice is going to an existing customer, you never know where your brochures will end up.

Establishing Credit Policies

When you extend credit to someone, you’re essentially providing them with an interest-free loan. You wouldn’t expect someone to lend you money without getting information from you about where you live and work, and your potential ability to repay. It makes sense that you would want to get this information from someone you’re lending money to. Reputable companies won’t object to providing you with credit information.

Extending credit involves some risk, but it’s an essential part of operating successfully, especially if your customer base is primarily other businesses.

Typically, you’ll only extend credit to commercial accounts, although some residential cleaning services will extend credit to individuals. But most residential customers will likely pay with cash, check, or a credit card at the time you provide the service. You need to decide how much risk you’re willing to take by setting limits on how much credit you’ll allow each account.

Your credit policy should include a clear collection strategy. Don’t ignore overdue bills; the older a bill gets, the less likely it will ever be paid. Be prepared to take action on past due accounts as soon as they become past due.

Red Flags

Just because a customer passed your first credit check with flying colors, don’t neglect to re-evaluate their credit status—in fact, you should do it on a regular basis.

Tell customers when you initially grant their credit applications that you have a policy of periodically reviewing accounts so that when you do it, it’s not a surprise. Things can change quickly in the business world, and a company that’s on sound financial footing this year may be wobbly next year.

An annual reevaluation of all customers on open accounts is a good idea—but if you start to see trouble in the interim, don’t wait to take action. Another time to reevaluate customers’ credit is when they request an increase in their credit lines.

Some key trouble signs are a slowdown in payment and difficulty getting answers to your payment inquiries. A sharp increase in complaints could be a red flag; they may be preparing to decline payment based on unsatisfactory service. Also, pay attention to what your customers are doing. A major change in their customer base or product line is something you may want to monitor.

Take the same approach to a credit review that you do to a new credit application. Most of the time, you can use what you have on file to conduct the check, but if you’re concerned for any reason, you may want to ask the customer for updated information.

Smart Tip

Once you’ve established your policies on extending credit, be sure to apply them consistently. Failure to do so will confuse your customers, make them wonder about your professionalism, and leave you open to charges of discrimination.

Most customers will understand routine credit reviews and accept them as a sound business practice. A customer who objects may well have something to hide—and that’s something you need to know.

Accepting Credit and Debit Cards

Whether your target market is business accounts or individual consumers, it will help if you’re able to accept credit and debit cards. Though most businesses prefer to be billed directly for cleaning services, some smaller businesses may want to charge the amount to their company credit card—if for no other reason than to rack up frequent flier miles. And while many consumers will write a check or even pay in cash, a significant number would prefer to use their credit cards—and may even buy more of your services than if they had to pay cash.

Today, it’s much easier to get merchant status than it has been in the past because merchant status providers are competing aggressively for your business.

To get a credit card merchant account, start with your own bank. Also check with professional associations that offer merchant status as a member benefit. Shop around; this is a competitive industry, and it’s worth taking the time to get the best deal.

The easiest and least expensive way to accept credit cards is by using an online payment service such as PayPal or WePay that allows your clients to pay with their credit cards. The primary drawback is that your clients have to be willing to go online to make their payments (unless you use a mobile app and are face-to-face when you get paid). A benefit is that the money is transferred to your account immediately.

Unless you're a mathematics whiz, you may find calculating markup confusing. The following table shows you the percentage you need to mark up your operating costs to reach the desired net profit. Here's how it works: Choose the desired net profit from the left-hand column, then use the markup percent from the corresponding column on the right. For example, if you want a net profit of 4.8 percent, you need to use a markup of 5.01 percent.