Medieval Venice

Four episodes

Venice originally used one coin, the penny of Verona. Then starting around 1182, it minted its own penny or denaro, a silver coin about 25% fine.1 In 1201, so the story goes, Venice had exacted ten tons of silver from the leaders of the Fourth Crusade to ferry them to the Holy Land. Turning that mass of metal into pennies at the current standard would have produced 100 million coins. So Venice decided to mint a new silver coin, both heavier and of higher fineness, called the (denaro) grosso or “large penny.” The penny became known as the piccolo or small penny. 2 In 1284, Venice began minting a gold coin known as the ducat, identical in size to the Florentine florin.

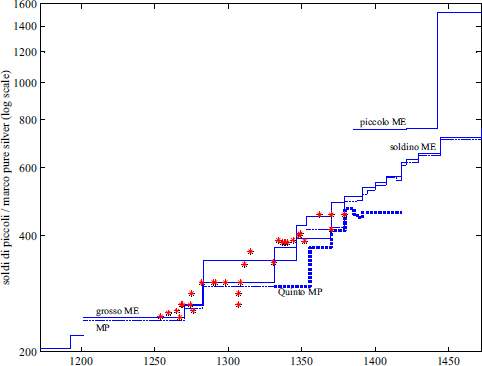

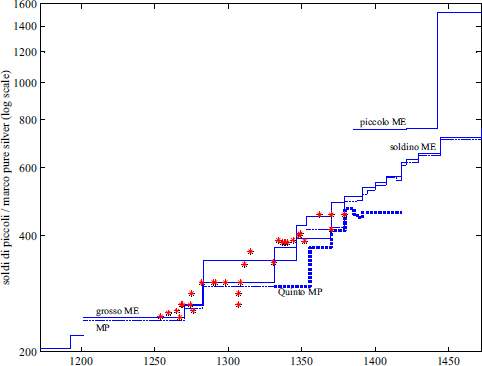

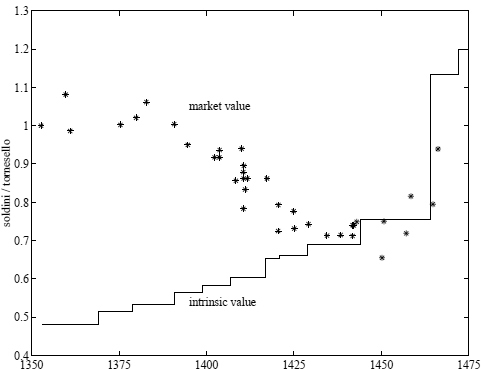

Figures 10.1 and 10.2 summarize the history of the Venetian monies up to the mid-1450s. For silver coins, figure 10.1 charts the evolution of mint prices ei (1−σi)/bi and mint equivalents ei/bi for the piccolo and the grosso and its successor, the soldino. The graph shows the usual pattern of secular upward movement, reflecting recurrent debasements of the silver coins.

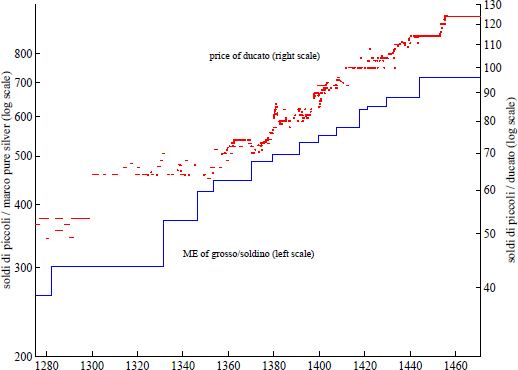

Figure 10.2 shows the market price of the gold ducat in terms of piccoli or equivalents. It displays the same general upward trend we saw in Florence, composed here of sharp accelerations punctuated by periods of stability. The gold content of the ducat, b2 in our model, remained constant throughout the period. The silver content of silver coins declined, as shown by the mint equivalent of the silver grosso/soldino.

When the standard formula is not or cannot be implemented, our model identifies either a debasement of small coins or a reinforcement of large coins as a workable policy for keeping both large and small coins in existence. Shortages of small coins occurred in Venice over this period. We shall document how they inspired the frequent exchange rate depreciations and debasements of small coins reflected in figure 10.2.

Figure 10.1 Evolution of the mint equivalent (ei/bi) and mint price (ei (1−σi)/bi) on small coins (piccolo) and large silver coins (grosso until 1331, soldino and mezzanino after 1331), Venice, 1172–1471 (see the appendix of this chapter). Mint equivalents (ME) are solid, mint prices (MP) are dashed (see page 167 for the quinto).The thick solid line corresponds to the piccolo. The thick dashed line plots the price paid for requisitioned silver from 1331 to 1417. The asterisks represent the market price of the grosso in terms of piccoli (Spufford 1986, 85; Lane and Mueller 1985, 1:556, 1:565).

We shall refer to these figures to discuss four episodes. (1) From 1250 to 1320, the grosso appreciated with respect to the piccolo and there were recurrent shortages of piccoli. (2) From 1285 to 1353, there were fluctuations in the price of gold relative to silver. (3) From 1360 to 1440, the (gold) ducat appreciated with respect to the soldino, a new coin issued around 1331 of size between the grosso and piccolo. (4) From 1442 to 1457, the government of Venice issued small light coins on its own account that eventually caused inflation. In each episode, Venetian authorities realigned the minting and melting intervals for different coins and also experimented with modifications of the medieval minting institutions. In addition, we discuss an intriguing prelude to episode (4), namely, the Venetian government’s issues of overvalued coins intended to circulate in its Greek possessions. Then, as in episode (4), the government of Venice temporarily put in place some but not all elements of the standard formula. Ultimately, in each case those missing elements led the government’s emissions of token small coins to cause inflation.

Figure 10.2 Mint equivalent of the silver grosso/soldino (from fig. 10.1, left scale), and price of the gold florin (1275–84) and the gold ducat (1285–1471) in silver money (right scale), Venice (Lane and Mueller 1985, app. D).

Piccolo and grosso, 1250 to 1320

In this section, we let e denote the exchange rate of the grosso for the piccolo. From 1250 to 1360, e drifted upward in response to recurrent shortages of coins. Sometimes the government tried to remedy the shortage while maintaining the basic coin supply mechanism by debasing the small coin. At other times it tried to change the mechanism, by requisitioning silver for coinage at below market prices. The rises in e were typically “spontaneous,” i.e., market determined. However, occasionally the government announced an official e. We regard most of those announcements as belated official confirmations of exchange rates that the market had set.

Soon after the grosso was first issued, authorities set its value at 26d., although it may have been intended initially at 24d. Minting of the piccolo ceased at the same time. The asterisks in figure 10.1 represent the few available observations of the market price of the grosso in that period (or more precisely, the implied mint equivalent of a marc of silver in grossi when computed at a given market price). 3 The exchange rate between grosso and piccolo appears to have been stable for at least two generations at 26 . However, in the 1250s, an appreciation of the grosso occurred and by 1268 the grosso traded at 28d. An indication that the appreciation of the grosso originated in the short supply of piccoli is a law of May 1268 that made it illegal to export more than £25 in piccoli at a time.

. However, in the 1250s, an appreciation of the grosso occurred and by 1268 the grosso traded at 28d. An indication that the appreciation of the grosso originated in the short supply of piccoli is a law of May 1268 that made it illegal to export more than £25 in piccoli at a time.

Starting in 1269, important reforms affected the piccolo. 4 In December 1269, the market valuation of 28d. for a grosso was officially confirmed; simultaneously, the piccolo’s weight was reduced so that its content of silver was  that of a grosso. Minting resumed. A law was passed requiring transactions below £50 to be made in piccoli. In the mid-1270s, the minting of piccoli declined again. The export of metal was prohibited in 1274. The grosso’s rise resumed, and the city itself used a rate of 32d. in its calculations as early as 1275. Foreign coins minted in Austria were allowed to circulate in 1277, albeit subject to a 5% import tax.5 In 1282, the grosso’s official exchange rate was lowered again to 32d. Simultaneously, the piccolo was debased. This time, however, on the recommendation of mint officials, the piccolo was made lighter than the grosso to cover the piccolo’s higher manufacturing costs.

that of a grosso. Minting resumed. A law was passed requiring transactions below £50 to be made in piccoli. In the mid-1270s, the minting of piccoli declined again. The export of metal was prohibited in 1274. The grosso’s rise resumed, and the city itself used a rate of 32d. in its calculations as early as 1275. Foreign coins minted in Austria were allowed to circulate in 1277, albeit subject to a 5% import tax.5 In 1282, the grosso’s official exchange rate was lowered again to 32d. Simultaneously, the piccolo was debased. This time, however, on the recommendation of mint officials, the piccolo was made lighter than the grosso to cover the piccolo’s higher manufacturing costs.

In the following years, further measures were adopted to increase minting of piccoli. The government ordered coins from the mint on its own account. 6 For example, the mint was ordered in 1287 to have a reserve fund of £3,000, of which 60% was to be in piccoli, and to pay out piccoli for grossi on request up to £50 per day. Further instructions in 1289 and 1291 ordered the mint to produce piccoli at specific rates (£250, then £500 permonth), and a bonus was given to mintmasters for quantities produced in excess of those rates. In 1292, the city raised the mint price for piccoli to the point that seigniorage net of production costs was zero.

Such policies appear to have been successful in arresting the depreciation of piccoli for a long time. The rate of the grosso was maintained at 32d. for about 30 years after 1280. It resumed its rise in the 1310s, and reached 38½d. by 1315. In 1317, the authorities took more measures to increase the production of piccoli, with an order to the mint to produce £1,000 in piccoli every month, with funds appropriated for that purpose. The legal rate of 32d. per grosso was reaffirmed in 1321.

As in Florence, a consequence of these exchange rate movements was to create multiple units of account. During the period of the grosso’s stable value in terms of piccoli, large payments, although denominated in pence (lira di denari), were made indifferently in small coins, with lira di denari a piccoli, or in large coins, with lira di denari a grossi. These expressions indicated only the type of coin used to make payment for a given sum of piccoli. After the grosso began its sustained appreciation, the form of payment mattered. If the coin composition of the original loan was known, the standard repayment doctrine readily applied: debts should be repaid in coins of the denomination and weight specified in the contract (see chapter 5). But if the original coin was not known, or if wage contracts had not specified a coin of payment, another way to interpret the obligation was required. Two units of account emerged to solve the problem: the lira di denari a piccoli continued to contain 240 piccoli (now debased). The lira di denari a grossi, which had consisted of 240/26 grossi for so long, continued to contain 240/26

grossi for so long, continued to contain 240/26 grossi (not debased). Debts or contracts denominated in “lire” were then reinterpreted to mean a constant number of piccoli or a constant number of grossi, according to the context, and, presumably, the bargaining power of the parties. Workmen’s wages, for example, were indexed to the piccolo. But the wages of city officials, as well as debt payments, were indexed to the grosso. More generally, “the same development probably occurred also in most other accounts of a kind in which payments had been made in grossi” (Lane and Mueller 1985, 130).

grossi (not debased). Debts or contracts denominated in “lire” were then reinterpreted to mean a constant number of piccoli or a constant number of grossi, according to the context, and, presumably, the bargaining power of the parties. Workmen’s wages, for example, were indexed to the piccolo. But the wages of city officials, as well as debt payments, were indexed to the grosso. More generally, “the same development probably occurred also in most other accounts of a kind in which payments had been made in grossi” (Lane and Mueller 1985, 130).

Silver and gold, 1285 to 1353

The introduction of a gold coin in 1284 exposed Venice’s system of coinage to pressures from swings in the relative price of gold and silver. By shifting the positions of the intervals between the minting and melting points for gold and silver coins, changes in the relative price of gold and silver generated pressures for one coin or the other to be melted or minted. Chapter 11 describes these pressures at work again in France during the sixteenth century.7

In 1285, Venice belatedly followed the example of Florence and issued a gold coin, the ducat. Its weight and fineness matched the florin, although its design was distinct. For the initial run, the mint was authorized to borrow to buy gold; but the mint soon adopted the practice of coining any amount of gold offered at the mint price. A law of 1285 made the ducat legal tender for any debt in grossi, at a rate of 40 soldi a grossi (equivalent to 49 soldi di piccoli in fig. 10.2). The market price of the ducat soon exceeded that official rate.

The relative price of gold to silver changed in the following decades (Spufford 1986, lxii), rising from 11 or 11.5 in 1285 to 15 in the 1320s, at its peak. As a result, the ducat appreciated in terms of both the piccolo and the grosso, reaching 64 soldi di piccoli, or 24 grossi, by 1305. It remained at that level for about 25 years. In 1328, the ducat’s legal tender value was officially raised to 24 grossi (or 64 soldi di piccoli), recognizing a now long-standing market value.

Soon after, however, the relative price of gold reversed course, and in the mid-1330s fell from 14 to 11. This sharp depreciation of the ducat’s content is not reflected in figure 10.2 because of actions taken by the Venetian authorities. They replaced the grosso with a new coin having a higher mint equivalent, and at the same time requisitioned silver at below-market prices.

Specifically, around 1331, new silver coins called the mezzanino and the soldino were introduced. Only the soldino became a fixture of the monetary system. Valued at 12d., the soldino stood between the piccolo and the grosso (then around 35 or 36d.). Minting of the grosso slowed considerably, and ended in the 1350s. Ample minting of the soldino and the mezzanino occurred. An indication that shortages of small coins had ended is that the import tax on Austrian coins, which had been repealed in 1332 due to “a need for money,” was reinstated in 1338 because “our territory presently has an abundance of coins” (Cessi 1937, 80, 120).8

In another departure from the traditional supply mechanisms for coins, the metal supplies for the soldino were secured by imposing a tax on all silver imported into Venice. The tax, called the quinto, forced importers to sell 20% of their silver to the mint at a below-market mint price. In figure 10.1, the thick dotted line plots the mint price imposed for silver requisitioned under the quinto. Rather than raising the mint price concurrently with the debasement, authorities maintained it at its previous level by compulsion.

The combined effect of the debasement and the quinto was to raise the mint equivalent of silver money, as shown in figure 10.1, and also to widen the interval between the mint equivalent and the effective (cum quinto) mint price. It was soon found, however, that the tax did not provide satisfactory quantities of silver. In 1353, the mint was instructed to coin into soldini all silver offered at a set mint price. That mint price, markedly higher than the price paid on requisitioned silver, is plotted as a normal dotted line in figure 10.1 after 1353. After 1369, the mint price paid on requisitioned silver was brought closer to the market price, and, after the 1390s, it does not appear to have been updated. By then, it was recognized that the quinto was too easily evaded, and the tax was formally abolished in 1417.

The soldino was briefly replaced by a debased mezzanino in 1346, and returned after another devaluation in 1353, minted at the same fineness as the now obsolete grosso. With these operations, the price of the ducat remained stable between 64s. and 70s. The fall of the relative price of gold by a third was matched by a devaluation of the silver coinage of the same size (a cumulative 32% from 1331 to 1353).

Adaptation of units of account

An adaptation of the unit of account accompanied the replacement of the grosso as principal silver coin. The lira a grossi, indexed on the grosso, progressively fell out of use and was officially abolished in 1404. Another unit of account tied to the grosso, the lira di grossi, contained 240 grossi (in the same way that a lira di piccoli contained 240d.). That unit underwent the following transformation. Since the price of the grosso in piccoli had been stable at 32d. from 1282 to the 1310s, a lira di grossi was equivalent to 240 × 32 = 7680 piccoli. When the grosso resumed its rise in the 1320s, a unit called the lira di grossi a monete (lira di grossi in small coins) made its appearance, containing 7680 piccoli. When the soldino came into circulation at 12d., the lira di grossi a monete became  soldini. Similarly, in the 1340s, the lira di piccoli became

soldini. Similarly, in the 1340s, the lira di piccoli became  soldini. The lira di grossi was thus converted from an index of the grosso to an index of the soldino.

soldini. The lira di grossi was thus converted from an index of the grosso to an index of the soldino.

Soldino and ducat, 1360 to 1440

As figure 10.1 shows, the soldino was debased often, in 1369, 1379, 1391, 1399, 1407, 1417, 1421, 1429, and 1444. The cumulative debasement from 1354 to 1444 was 38%. The loss in value of the soldino relative to the gold ducat over the same period was somewhere between 38% and 43%. 9 Our model directs us to look for clues of denomination shortages. These are apparent for the soldino, which largely replaced the now secondary piccolo.

We glean these clues from the laconic preambles to the debasement resolutions taken by the legislative bodies. 10 In 1359 and 1360, complaints about the prevalence of clipped soldini and mezzanini were linked with the observation that gold coins were being exported in large quantities. In 1369, the lack of gold and silver coins was deplored, the good and full-weight coins being exported as soon as they were minted, and only the “vile and bad” coins remaining. In 1368, the melting of soldini was reported: “our soldini are taken out of Venice by some who destroy them for profit, because they can be sold whenever the price of silver reaches £15 7s. per marc, and for this reason these same soldini are lacking, which results in great inconvenience for the whole land and community” (Cessi 1937, 140). The soldino was debased in 1369 to deter melting and “so that there be an abundance of coins, which our territory greatly wants” (Cessi 1937, 144). The order of 1379 made clear the desire to have more coinage, as well as the reluctance to subsidize the mint: “It is useful and good to insure, insofar as can be done without loss for the Commune, that more coins be made” (Cessi 1937, 157).

Monetary difficulties persisted in the following years. Some complaints relate to the shortage or poor quality of the circulating coins. Thus, in 1385, “it is necessary to give attention to the shortage (strictura) of coins that is at present in the land, shortage that is extreme as is well known, and particularly for gold coins.” In 1387, “it is to the advantage of our land, that as many grossi be made in our mint as possible, also for the good and subsistence of those poor people who work in making coins.” Other documents refer to foreign and clipped coins. Measures were taken in 1385 against “extremely poor denari and bad foreign coins.” In 1389, it was said that “our silver money and particularly our soldini, as is well known, are clipped and shaved” (Cessi 1937, 160, 181).

England was one destination for exports of soldini. Starting in 1399, English documents mention silver halfpennies brought from Venice by ship (hence their name of “galley halfpennies”). The Venetian soldino’s silver content was about 41% of the English penny’s, and soldini circulated in England at ½d. Complaints that 3 or 4 galley pennies “were scarcely equal to one sterling in value” led to prohibitions on their circulation in 1399, 1400, 1409, 1414, 1415, 1423, and as late as 1519 (Ruding 1840, 249, 254, 256, 270, 302).

Other complaints in Venetian documents relate to the drying up of the silver trade. In 1362, it is said that there is only one silver trader left on the Rialto where there used to be eighteen. The 1407 debasement order cites the loss of the silver trade to other venues and the inactivity of the mint. That silver ceased to come to Venice was no doubt linked to the implicit tax that the quinto imposed on silver imports, but the flow of silver was still unsatisfactory after the repeal of the quinto in 1417. The debasement of 1421 was based on the need to “provide for our Mint to coin as much money as possible, for the honor of the city as much as for the support of the poor people, and also to give merchants every possible motive to bring silver to Venice.”

The debasement of 1417 was explicitly a response to the fact that silver could not be minted at prevailing prices. The preamble to the debasement decision states that “the orders given to coin money at the rate of £27 4s. per marc, set when the ducat was worth 93s., have not been obeyed for a long time and cannot be obeyed, because making the coins accordingly, no one could bring silver to the mint when the ducat is worth 100s., since they would incur a great loss, and thus silver is never brought to Venice” (Bonfiglio Dosio 1984, 95). This statement explicitly links the unprofitability of coining metal to the high exchange rate between the ducat and the silver coinage, and presents debasement as a response to misaligned intervals.

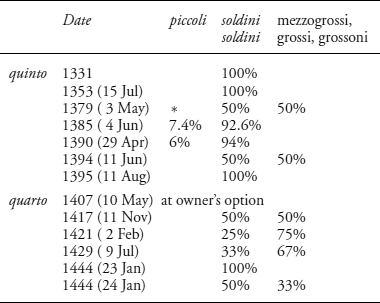

Difficulties extended beyond the soldino to include the piccolo. The policy concerning that coin is not well documented before 1369. At that date, we learn that the mint was then coining piccoli at a loss, and the Venetian Senate thought it “not good that money be coined by the Commune at its expense” (Cessi 1937, 147). The piccolo was debased, and its mint equivalent aligned with that of the soldino. Few, if any, coins appear to have been coined at the time, however. 11 In 1379, the piccolo’s weight and content were reduced again, to make them light relative to the soldino. An order was to be issued by the Signoria calling for the demonetization of all existing small coins, including old Venetian piccoli. A period of one month was allowed during which old piccoli could be exchanged for new light ones, one for one, at the mint. The order was not issued in 1379, however, but a version of it was issued in 1385. Once the delay for exchanging the coins expired, officials were under orders to search and confiscate the demonetized coins, with the right to keep the demonetized coins they found and to receive a new coin for each old coin they found, as a reward (Cessi 1937, 163, 176). To insure that minting of piccoli took place, the mint was required to pay for requisitioned silver partly in new piccoli. Table 10.2 lists the proportions in which the mint was required to make those payments. The mix was more heavily weighted toward smaller coins in periods of debasements.

The rise of the ducat’s price led to a new generation of units of account, one indexed to the ducat, the other to silver money. So long as the ducat’s price remained relatively stable at 64s. or above in the 1340s, its daily fluctuations had been recorded in account books with the use of a variable premium. When the ducat’s price began to rise permanently in the 1350s, another unit of account emerged to represent a constant quantity of gold. The lira di grossi, which, as we saw earlier, contained 240 grossi, begat the lira di grossi a monete, based on the stable exchange rate of the grosso to the monete of the early fourteenth century. Similarly, the ducat’s value in grossi had long been stable at 24 grossi; thus, the lira di grossi had also come to mean 10 ducats. When the ducat’s valuation rose, the lira di grossi a oro continued to represent 10 ducats, independently of the silver coins.

Figure 10.3 Exogenous increase in Venice’s stock of m, prosaically known as Juno bestowing her gifts on Venice, by Valentin Lefebvre after Paolo Veronese. (Author’s collection).

The following two sections describe two episodes in which the monetary authorities tampered with the supply mechanism to let them issue coins whose exchange value substantially exceeded their intrinsic value. In these episodes, “fiat money” and the “quantity theory of money” appeared.

Between 1453 and 1455, the price of the ducat in terms of silver coins rose sharply. This rise was associated with the government’s recently having issued large numbers of overvalued small denomination coins for Venice’s newly acquired mainland territories. 12 Those coins eventually came to circulate inside Venice. Having been coined on government account to circumvent the normal supply mechanism and the costly discipline imposed by the minting and melting points, excessive issues of those coins caused inflation via a pure quantity theory effect. Soon thereafter, the monetary authorities of Venice, disliking inflation, terminated coining these light coins for the territories on government account. They reinstated the normal supply mechanism, and resisted further proposals to issue light coins on government account.

We compare and contrast that episode with an earlier one in Venice’s possessions in Greece. There the Venetian government also issued light small coins on government account. In those isolated Greek possessions, the Venetian monetary authorities held a virtual monopoly on supplying small change, so that market values of light coins above their intrinsic value could be sustained if the government limited their supply. The government managed to do this for some time, but eventually additional issues caused the coins to depreciate toward their intrinsic value. The inflationary effects of this depreciation were reflected in the price of the Venetian ducat in terms of the small currency in Greece. But the effects were confined to Greece because those small coins did not circulate outside Greece. However, during the later experiment with light coins in territories adjacent to Venice, quantity-of-coins-induced inflation in the adjacent territories was transmitted quickly to Venice because coins from the territories came to Venice.

The torneselli in Greece

After the fall of Constantinople in 1204, the Byzantine empire was divided among the victors, leading to the creation of a number of Latin states in Greece. Venice also acquired territories in Greece, mainly islands including Crete. In the following decades, the currency in Greece consisted of coins imported from western Europe or minted by the Latin states in imitation of the “tournois” penny of their native France. By the mid-fourteenth century, local mints in Greece had become inactive. In 1353, Venice started minting a new billon coin, the tornesello (“tournois” in Italian), intended only for the Venetian territories in Greece. Too light to be minted through the usual mechanism, 13 it was minted on government account and soon became the only small coin in the region.14 Worth 3d., its mint equivalent was about 900s. to the marc, twice overvalued compared to the soldino.

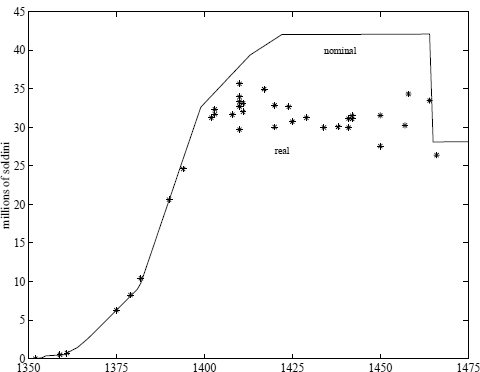

At first, the government restrained the supply of torneselli enough to keep their value high. From 1383 to 1400, under the reign of Doge Antonio Venier (who, incidentally, had served as governor of Crete just before his election as doge), the annual output of torneselli increased significantly. Production fell back to negligible amounts by the 1420s. The solid line in figure 10.4 plots the cumulative output of torneselli, and the increase in production under Doge Venier is visible as a steep increase in the nominal stock of torneselli.15

Figure 10.4 Real and nominal stock of torneselli, 1353–1475. Source: see text.

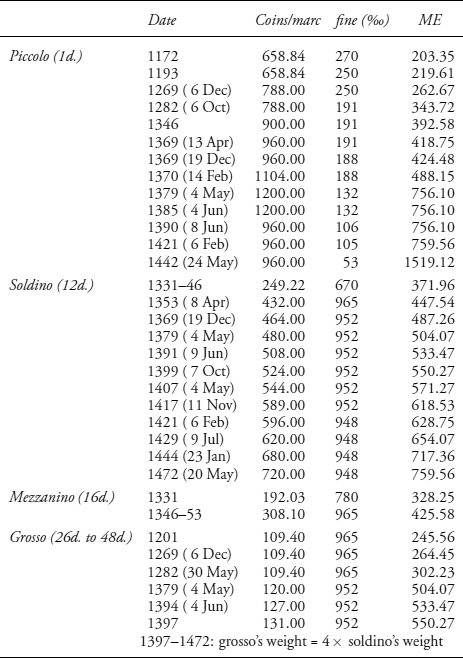

Officially, the tornesello’s value in Venetian money was constant at 3d., or 4 torneselli to the soldino. But starting at the end of the fourteenth century, the quotation of the ducat in Greece, expressed in torneselli, deviated from that of the ducat quoted in soldini in Venice, signaling a fall in the market value of the tornesello relative to the soldino. We used these quotations to infer a “market value” of the tornesello relative to the soldino, shown in figure 10.5, and to compute the real value of the stock of torneselli in figure 10.4.16 Figure 10.5 also presents the “intrinsic value” of the tornesello, that is, the soldino value of its silver content. The upward movement in the intrinsic value reflects the progressive debasements of the soldino; the tornesello, to our knowledge, was not altered, until the Venetian authorities changed its official valuation to 6 per soldino in 1464.

Figure 10.5 Market value and intrinsic value of the tornesello in soldini, 1353–1475. The market value is represented by the ratio of the ducat’s price in Venice (in soldini) to the ducat’s price in Greece (in torneselli). The intrinsic value is represented by the ratio of the soldino’s mint equivalent to the tornesello’s mint equivalent. Source: Stahl (1985, 87–90).

Figures 10.4 and 10.5 show that for a long time the tornesello circulated above its intrinsic value. Figure 10.4 shows that for a long time increases in the cumulative (nominal) stock of torneselli issued were matched by increases in their real value. But after 1410, further issues of torneselli became inflationary, with the real stock of torneselli remaining roughly constant or drifting down. The evaporation of the fiat component of its value was accompanied by an appreciation of the ducat in terms of torneselli. That pattern would be repeated years later in Spain and France, as we shall see when later we discuss figures 14.4 on page 241 and 14.7 on page 247. Figure 10.5 shows that, by 1425, the profit on minting torneselli had disappeared; not surprisingly, the government then stopped producing torneselli.

The inflationary effects of the torneselli were confined to Greece. The ducat did not rise in terms of the soldino because the torneselli did not circulate in Venice. Thus, these disturbances to small change in its Greek territories did not transmit themselves back to Venice. We turn next to an episode in which policy-induced disturbances in the small change designed for possessions adjoining Venice did raise the price of the ducat in Venice.

Expansion near Venice

Eventually Venice’s “monetary imperialism” extended to new land-ward possessions “da terra” much as it had earlier on the seaward possessions “da mar” in Greece (Mueller 1980). This section describes fluctuations in the price of the ducat emanating from disturbances to the small change of nearby territories that Venice had acquired. At first Venice supplied these territories with new coins whose mint prices and mint equivalents did not threaten to displace the small coins in Venice; that is, the intervals for these new coins were set not to trigger an “invasion” of small change from the adjacent territories. 17 However, later the government of Venice made light coins for the territories on government account.18 Those coins invaded Venice, eventually leading to an appreciation of the ducat in Venice itself.

In 1405, Venice acquired Vicenza and Verona. Those cities had a different monetary system, the local lira being worth a third more than the Venetian lira. Venice initially extended its own monetary system to the territories. The existing Venetian coins were given legal tender values in local units to conform with the 4:3 exchange rate between Venetian and Veronese lira. New coins were also created, intended for circulation outside of Venice: a full-weight soldo, minted to circulate at 12d. of the Veronese lira, and a lightweight penny or bagatino, with slightly less than the intrinsic content of  of a Venetian piccolo of the time. The result was merely to adapt Venetian coinage to the local units, along with a one-time modest profit of a recoinage.

of a Venetian piccolo of the time. The result was merely to adapt Venetian coinage to the local units, along with a one-time modest profit of a recoinage.

In 1442, at the onset of a long armed conflict with Milan that was to last until the peace of Lodi in 1454, the bagatino was debased by cutting its fineness in half. The Venetian piccolo, which circulated in nearby mainland towns like Treviso and Padua, was also debased, as shown on figure 10.1. The motivation for the debasement is noteworthy: “Whereas it is in our Signoria’s interest, in this time of penury of money, to regain money by all honest ways and means; and bagatini were formerly coined in our mint for use in Brescia, Bergamo, Verona and Vicenza, with silver, stamped with various designs according to the destination; and because these coins are now wanting, some coins from the duchy of Milan called sesini, which are silvered but otherwise pure copper, have become current in our territory beyond the Mincio. And if said bagatini were made with

silver, stamped with various designs according to the destination; and because these coins are now wanting, some coins from the duchy of Milan called sesini, which are silvered but otherwise pure copper, have become current in our territory beyond the Mincio. And if said bagatini were made with  silver, it would bring great advantage and profit to our Commune” (Papadopoli 1893–1909, 1:259).19 The Venetian officials in the said cities were ordered to use the new coins to replace old bagatini and ship them back to Venice. They were also instructed to make about 5% of their payments in the new coins.

silver, it would bring great advantage and profit to our Commune” (Papadopoli 1893–1909, 1:259).19 The Venetian officials in the said cities were ordered to use the new coins to replace old bagatini and ship them back to Venice. They were also instructed to make about 5% of their payments in the new coins.

Issues of these coins were thus clearly tied to fiscal needs: they came and went with wars. After peace was made in 1443, further issues of bagatini were forbidden. In 1447, 3,000 marcs (about 1,800 ducats) of bagatini were ordered for Brescia. In 1451, minting was suspended, but resumed two months later, “contrary orders notwithstanding,” when the mint was asked to come up with £42,000 (7,000 ducats) in piccoli of Brescia. In August 1453, the Senate ordered 3,000 ducats of Venetian piccoli.

Unlike issues of the tornesello, these issues seemed to raise the price of the ducat in Venice itself. 20 The ducat, which had been stable at 114s. for ten years, rose to 120s. by the end of 1453, and reached 124s. in 1455.

In September 1453, the same Senate noted that “due to the great number of piccoli coined in our mint up to now, they have multiplied in our territories and they have already started to be used in payments in rolls, 21 as is done in Padua, which is against all good customs of our city and an affront to our reputation.” Mint officials were forbidden to mint Venetian piccoli. By December, however, an order was given to mint 20,000 ducats in quattrini. A final peace was reached in 1454, but in 1456 the Great Council noted that minting of the piccoli had continued and edicted severe penalties for mint personnel. Still, in 1457, another £1,500 worth were ordered minted.

This episode had lasting consequences. In the immediate aftermath, measures were taken to correct these emissions. In 1458, it was decided that all piccoli in Brescia were to be brought to a central office, and only 4,000 ducats’ worth to be kept: all those in excess were to be converted into newly made quattrini. In 1463, it was made illegal to circulate small coins in sealed bags, and their legal tender was limited to 5s.

The large issues of the 1440s and 1450s had made piccoli and bagatini common in transactions. Their silver content (5% of weight) was worth about 0.4d. and easily omitted; counterfeiting predictably developed into a serious problem. The Venetian authorities resorted to various measures to deal with it. In 1463, it was ordered that all existing small coins be brought in for examination by officials, and that counterfeits be melted and the metal returned to the owners. Soon after, it was decided to issue a new type of piccolo to replace the old one. All old piccoli were demonetized and made exchangeable for new ones after examination: one for one if genuine, or at the value of their copper content for counterfeits. The exchange program was relatively successful, because the limit on the new issue had to be raised in order to meet the quantities of old piccoli brought in (about 4,000 ducats).

The new piccoli, however, contained the same amount of silver. At the same time, authorities studied the feasibility of issuing pure copper coins. The mint was asked to provide proofs. A proposal to make pure copper piccoli at 64 coins per marc was rejected twice in 1463 and 1464. Given that copper was worth about 40d. to 50d. per marc (Lane and Mueller 1985, 559), the coins would have been fairly heavy (3.7g) but roughly full-bodied. Eventually, a similar proposal was adopted in 1472, and the mint ordered to make piccoli for Verona and Vicenza, “of such manner and size that twelve be worth one mezzanino [12d. in local units], including the costs of production; and let 2,000 ducats be made and sent to said cities, to be exchanged with whomever wants them.”

These coins, along with copper coins issued in Naples the same year, were the first pure copper coins issued in Europe since imperial Rome (Grierson 1971). The Venetians had been made cautious by their experiences of the 1440s and 1450s. As the mint’s orders make clear, the coins were full-bodied. Not content with this precaution against counterfeiting, the Venetian government tightly controlled the quantities issued. In July 1473, the Council of Ten instructed the mint not to coin copper without its express permission, usually given in response to a petition by local officials about lack of small coins. Often, the amount authorized was not to be issued immediately, but only as ordered from time to time by the Signoria. The Venetian government authorized the issue of 11,500 ducats over the following 35 years, only half of the issues of the year 1453 alone.22

Concluding remarks

After experiencing shortages of small coins and the depreciations and debasements that they caused under the medieval mechanism, the government of Venice tentatively experimented with pieces of the standard formula by issuing overvalued coins, first the tornesello for its Greek possessions and then some coins for its mainland possessions. In these experiments, the government tried the “token” part of the standard formula without putting in place the “convertibility” part.23 But inflation led the government to abandon its attempts to initiate token small denomination coins. We shall see parts but not all of the standard formula being tried again and again before ultimately all parts would be simultaneously implemented.

Appendix: mint equivalents and mint prices

For figure 10.1 we mostly follow Lane and Mueller (1985, appendix A), but with some differences that are explained here. The numbers we use for the mint prices and mint equivalents are in tables 10.1 and 10.3.

Concerning the piccolo’s content from 1269 to 1282, we follow the interpretation of Cessi (1937, xxix, xxxix) rather than Lane and Mueller. Cessi only sees two debasements of the piccolo, each contemporaneous with the change in legal tender value of the grosso. The debasement order for 1282 is in Papadopoli (1893–1909, 1:121) and, contrary to what Lane and Mueller state (1985, 499 n18), in Cessi as well (1937, xxxix). The debasement order for 1269 does not survive. Cessi interprets his document 30, also in Papadopoli (1893–1909, 1:326), as describing the weight of the piccolo at all times between 1269 and 1282, and assumes that the fineness was unchanged, as numismatic evidence suggests. He also cites a deliberation of 1268 to resume minting of the piccolo on a 1:28 ratio to the grosso, which is consistent with the mint equivalent implied by Cessi’s assumptions. This is a simpler hypothesis than Lane and Mueller’s, who appear to postulate debasements in 1278 and 1282.

Table 10.1 Mint price for free and requisitioned (quinto) silver, in soldi di piccoli per marc of pure silver, Venice, 1209–1472.

| Date | free | quinto |

| 1201 | 240.35 | n.a. |

| 1269 | 258.84 | n.a. |

| 1282 | 295.82 | n.a. |

| 1331 | n.a. | 295.82 |

| 1353 (8Apr) | 414.39 | 295.82 |

| 1355 | 414.39 | 372.95 |

| 1369 (19 Dec) | 420.05 | 411.65 |

| 1379 (4May) | 491.46 | 470.46 |

| 1385 (4Jun) | 491.46 | 453.66 |

| 1387 (1Aug) | 494.61 | 445.26 |

| 1391 (9Jun) | 512.47 | 459.26 |

| 1394 (4Jun) | 524.02 | 459.26 |

| 1399 (7Oct) | 540.82 | 459.26 |

| 1401 (8Aug) | 540.47 | 459.26 |

| 1407 (4May) | 567.07 | 459.26 |

| 1414 (22 Apr) | 556.57 | 459.26 |

| 1417 (11 Nov) | 610.13 | n.a. |

| 1421 (6Feb) | 620.31 | n.a. |

| 1429 (9Jul) | 645.63 | n.a. |

| 1444 (23 Jan) | 620.00 | n.a. |

Sources: Lane and Mueller (1985), Papadopoli (1893–1909), Cessi (1937); see text.

Table 10.2 Mix of denominations in payments on requisitioned silver (quinto) and on mandatory refining (quarto), 1331–1444.

*: minting of piccoli at mint officials’ discretion, “in the quantity they shall think is necessary for the use and the convenience of the land.”

Sources: Cessi (1937, 104, 157, 175, 181, 186, 188), Bonfiglio Dosio (1984, 81, 96, 104, 110, 125, 126).

The piccolo’s content between 1343 and 1379 is also a source of difficulty. Lane and Mueller follow Papadopoli’s estimate of the piccolo’s weight during the reign of Andrea Dandolo (1343–54), but this results in an implausibly heavy standard for the piccolo. In particular, after 1353, it would have made the piccolo minted at a mint equivalent below the contemporaneous mint price, which makes no sense. Papadopoli does not say the size of the sample of coins on which he based his weight estimates. It seems simpler to assume that the piccolo continued to be minted as before under Andrea Dandolo, and that the weight described in Cessi (1937, doc. 158) had been used since Giovanni Gradenigo’s reign (1355).

Lane and Mueller (1985, 510) state that the mint price paid on requisitioned silver did not change until 1369. But Cessi (1937, 157) documents that the mint price was 11s. 3d. di grossi a monete before the change of 1369. We assume that this price had been in use since the reforms of 1355 and the cessation of coinage of the grosso.

Table 10.3 Weight, fine, and mint equivalent (ME) of Venetian coins, 1172–1472. The mint equivalent is in soldi di piccoli per marc (238.5g) of pure silver.

Sources: Lane and Mueller (1985), Papadopoli (1893–1909), Cessi (1937); see text.

A final difference with Lane and Mueller is that we have computed fineness as percentage pure silver, rather than percentage of argento da bolla. The reason is that this standard varied over time; furthermore, the fineness of early coins, based on numismatic examination, is stated by Papadopoli in terms of pure silver as well. The difference is very small.

1 This section is mostly based on the account of Lane and Mueller (1985), with some complements from Papadopoli (1893–1909) and Cessi (1937).

2 Unfortunately, this account of the grosso’s origin is doubtful.

3 Lane and Mueller (1985, 556, 565). The “market prices” on page 556 cannot be in soldi a grossi as stated. Instead we interpret them as the value in soldi di piccoli of the mint price of 233 soldi a grossi; we infer a market valuation of the grosso.

4 The content of the grosso remained unchanged. For the debasements of the piccolo, we follow Cessi (1937, xxix, xxxix) who relies on surviving texts, rather than Lane and Mueller (1985,497–99) who follow Papadopoli and rely on weights of surviving coins.

5 In chapter 2 we described these “invasions” of foreign coins as endogenous debasements.

6 See chapter 2 for a comparison of the consequences of coining on government account versus a regime of unlimited or free minting.

7 See chapter 11 for a graphical presentation of intervals for three coins in a bimetallic monetary system.

8 Whether the introduction of the soldino was motivated by the impending appreciation of silver, as Lane and Mueller (1985, 392) suggest, or by other difficulties, is not clear. By some accounts, the ducat was rising, not falling, in the years 1329 to 1331 (Cessi 1937, lx). Furthermore, in the account books of the Peruzzi bankers the gold/silver ratio still stood at 14.2 in March 1332, which is the par value for the ducat rated at 24 grossi. By November 1335, in the same source, the ratio had fallen by 20% (Sapori 1934, 108–9).

9 Lane and Mueller (1985) give two possible explanations for the depreciation of the soldino. One is the desire to generate seigniorage revenues, but the low net seigniorage rates make this unlikely to be a prime factor. The other is a response to “the rising price of silver” (p. 380), which they attribute to wear and tear of the silver coinage in circulation, although they concede that wear and tear is not sufficient to account for the full extent of the soldino’s debasement.

10 Documents up to 1399 are printed in Cessi (1937); later documents are in Bonfiglio Dosio (1984).

11 Papadopoli does not know of any piccolo minted under Andrea Contarini (1368–82) but Majer (1933) describes one, probably minted after 1379.

12 This episode is studied in Mueller (1980). See also Papadopoli (1893–1909, 1:235–36,259–68,276, 283–86; 2:573).

13 Since it was overvalued, its mint price was too low.

14 The tornesello was extensively studied by Stahl (1985), whom we follow here, with the following exception. The minting order of 1353 appears to specify a fineness of and weight of 320 coins per marc. However, the surviving torneselli studied by Stahl match the fineness but fall far short of the weight, something that cannot be explained by error or deceit persisting over decades. The mean weights in hoards documented by Stahl (1985, 31, 72–76) might suggest a decline in the weight from 380 per marc to 460 per marc, but there are no documented weight reductions and the standard deviations are large enough to be consistent with a constant weight of 400 to the marc. Furthermore, the tornesello was intended to replace a local Greek coin, the tornesello of Morea, which is known to have been coined at 400 to the marc and

and weight of 320 coins per marc. However, the surviving torneselli studied by Stahl match the fineness but fall far short of the weight, something that cannot be explained by error or deceit persisting over decades. The mean weights in hoards documented by Stahl (1985, 31, 72–76) might suggest a decline in the weight from 380 per marc to 460 per marc, but there are no documented weight reductions and the standard deviations are large enough to be consistent with a constant weight of 400 to the marc. Furthermore, the tornesello was intended to replace a local Greek coin, the tornesello of Morea, which is known to have been coined at 400 to the marc and  fine (Pegolotti 1936, 116). It is plausible that the Venetians would have issued a coin of same weight, but half as fine. We thus assume throughout that the weight of the tornesello was 400 to the marc.

fine (Pegolotti 1936, 116). It is plausible that the Venetians would have issued a coin of same weight, but half as fine. We thus assume throughout that the weight of the tornesello was 400 to the marc.

15 Stahl (1985, 46, 51) provides an index of annual tornesello output for each doge’s reign from 1353 to 1471, and an estimate of the annual output around 1400, allowing us to scale the former by the latter. We then cumulate annual production into an annual series of the outstanding stock, in torneselli, which are converted to “nominal” soldini at the official rate of 4 torneselli per soldino until1464, and 6 thereafter

16 The stock in torneselli is converted into “real” soldini by dividing by Stahl’s (1985, 87–90) prices for the ducat in Greece, in torneselli per ducat, and multiplying by Lane and Mueller’s (1985, app. D) prices for the ducat in Venice, in soldini per ducat.

17 Again, see our interpretation of “invasions” of foreign small change in terms of “spontaneous debasements” in chapter 2.

18 As we explained in chapter 2, coining light coins on government account so widens the intervals that protection against inflation must be provided not by the price guarantee afforded by the intervals but by a limitation on the quantity of the coins supplied.

19 Note Cipolla’s sardonic comment on the “honest means,” cited by Mueller 1980

20 The existing quotations of the ducat in mainland cities show no deviation from those in Venice (Lane and Mueller 1985, 606–17).

21 This refers to the practice of wrapping small coins in rolls and tendering the unopened rolls in payment (see page 254 for a similar practice). Small coins were thus used as substitutes for large coins.

22 The minting authorizations from 1472 to 1506 can be found in Bonfiglio Dosio (1984, 187–277).

23 See the discussion of the inflation in seventeenth-century Castile in chapter 14.