Worksheet for Assignment 22: Break-even analysis

Using the format on the break-even analysis sheet (Table 22.1):

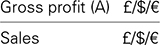

Table 22.1

|

1 |

Calculate your gross profit |

||

|

Projected sales |

£/$/€ |

||

|

– Direct costs: |

|||

|

Purchases (material costs) |

£/$/€ |

||

|

Labour costs |

£/$/€ |

||

|

= Gross profits |

£/$/€ |

(A) |

|

|

2 |

Calculate your gross profit margin |

||

|

|

× 100 |

||

|

= Gross profit margin |

% (B) |

||

|

Notes: |

|||

|

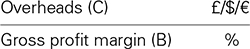

3 |

Calculate your overheads |

||

|

Indirect costs: |

|||

|

Business salaries |

|||

|

(including your own drawings) |

£/$/€ |

||

|

+ Rent |

£/$/€ |

||

|

+ Rates |

£/$/€ |

||

|

+ Light/heating |

£/$/€ |

||

|

+ Telephone/postage |

£/$/€ |

||

|

+ Insurance |

£/$/€ |

||

|

+ Repairs |

£/$/€ |

||

|

+ Advertising |

£/$/€ |

||

|

+ Bank interest/HP |

£/$/€ |

||

|

+ Other expenses |

|||

|

(eg depreciation of fixed assets) |

£/$/€ |

||

|

£/$/€ |

|||

|

£/$/€ |

|||

|

£/$/€ |

|||

|

£/$/€ |

|||

|

= Overheads |

£/$/€ |

(C) |

|

|

4 |

Calculate your actual turnover required to break even |

||

|

|

× 100 |

||

|

= Break-even sales £/$/€(D) |

|||

|

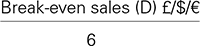

5 |

Calculate the monthly target to break even |

||

|

|

|||

|

= Monthly break-even sales £/$/€ ——————— |

|||

|

6 |

Calculate your estimated profit |

||

|

Projected sales |

£/$/€ |

||

|

– Break-even sales (D) |

£/$/€ |

||

|

+ Gross profit margin (B) |

% |

||

|

= Profit (for 12 months) |

£/$/€ |

||

- Construct a break-even analysis for year 1 of your business from the figures calculated in the last three chapters. You can use the Wavendon example below as a guide, or use a spreadsheet as given above.

- Estimate the effect of the following events on your break-even point for each year:

- a 10 per cent rise/fall in sales volume;

- a 10 per cent rise/fall in unit selling price;

- a 10 per cent rise/fall in variable costs per unit of sale, eg a meal;

- a 10 per cent rise/fall in fixed costs;

- a requirement for achieving your profit objective by year 1 – now what ‘volume’ of product must you sell to break even?

- Look back to Assignment 8 on Pricing, and review your proposed selling price in the light of work/research carried out during this assignment.