Obtain Your State Tax Exemption

Set Up a Corporate Records Book

Corporate Membership Certificates

Prepare Offer to Transfer Assets From an Existing Business or Organization to Your Nonprofit

Transfers From a For-Profit Business

Transfers From an Informal Nonprofit Group

Prepare Your Offer to Transfer Form

Prepare Minutes of Your First Board of Directors’ Meeting

Instructions for Preparing Minutes

Place Your Minutes and Attachments in a Corporate Records Book

Complying With the Bulk Sales Law

Prepare a Bill of Sale for Assets

Prepare Assignments of Leases and Deeds

File Final Papers for the Prior Organization

Notify Others of Your Incorporation

Apply for Your Property Tax Exemption

File a Domestic Corporation Statement

File an Initial Report With the Attorney General

File Your Articles With the County Recorder

Register With the Fair Political Practices Commission

Most of the hard work is over, but there are still a few important details to attend to. Don’t be overwhelmed by the number of steps that follow—many will not apply to your nonprofit corporation and others are very simple.

To chart your way through the tasks that follow, we recommend you use the Incorporation Checklist included with this book.

The California Franchise Tax Board grants a state tax exemption from corporate franchise taxes to 501(c)(3) groups that have received their federal exemption determination letter from the IRS. The state tax exemption for religious, charitable, scientific, literary, and educational nonprofits parallels the federal 501(c)(3) tax exemption. Once you obtain your state tax exemption, your nonprofit corporation is exempt from paying the annual California franchise tax, including the minimum annual franchise tax payment of $800.

To obtain your California corporate tax exemption, mail a copy of your IRS determination letter with a completed FTB 3500A, Submission of Exemption Request, to the California Franchise Tax Board. You can fill in the form online at the Franchise Tax Board website (www.ftb.ca.gov); then print and mail it to the Franchise Tax Board at the address provided on the application.

The FTB 3500A form asks for basic information about the nonprofit organization’s identity and purpose. The instructions to the form explain how to fill it out, attach your federal determination letter to it, and mail the packet to the Franchise Tax Board.

The FTB will send your nonprofit an acknowledgment letter, which indicates the effective date of your organization’s California corporate tax exemption under Section 23701(d) of the California Revenue and Taxation Code—the section of state law that parallels the federal 501(c)(3) tax exemption. The effective date of your state exemption should be the same as the effective date of your federal 501(c)(3) corporate income tax exemption. If you have any questions about the California exemption acknowledgment process, see the Franchise Tax Board website.

This new California acknowledgment procedure for obtaining state tax exemption can only be used by nonprofits that the IRS has determined are exempt under Section 501(c)(3) of the Internal Revenue Code. All other entities seeking a California state tax exemption should file form FTB 3500, Exemption Application, with the California Franchise Tax Board. Much of the information you prepared for your federal tax exemption form (discussed in Chapter 8) can be used to fill in the FTB 3500 form.

Now take a few minutes to set up or order a corporate records book—this is an important part of your incorporation process.

You will need a corporate records book to keep all your papers in an orderly fashion. These documents include articles of incorporation, bylaws, minutes of your first board meeting and ongoing director and shareholder meetings, tax exemption application and determination letter, membership certificates (for those nonprofits with formal members), and any other related documents. You should keep your corporate records book at the principal office of your corporation at all times to make sure you always know where to find it.

To set up a corporate records book, you can simply place all your incorporation documents in a three-ring binder. If you prefer, you can order a custom-designed corporate records book through a legal stationery store.

You order a nonprofit corporate kit through a legal stationery store. These nonprofit corporate kits typically include:

• a corporate records book with minute paper and index dividers for charter (articles of incorporation), bylaws, minutes, and membership certificates

• a metal corporate seal (a circular stamp with the name of your corporation, the state’s name, and year of incorporation), which you can use on important corporate documents, and

• membership certificates, printed with the name of your corporation.

Placing a corporate seal on a document is a formal way of showing that the document is the authorized act of the corporation. Nonprofits don’t normally use a seal on everyday business papers (such as invoices and purchase orders), but they do use them for more formal documents, such as leases, membership certificates, deeds of trust, and certifications of board resolutions. A corporation is not legally required to have or use a corporate seal, but many find it convenient to do so.

A metal seal is usually included in the corporate kits or you can get a customized seal from a legal stationer for about $25 to $50.

If you have decided to adopt a formal membership structure with members entitled to vote for the board of directors, you may want to use membership certificates. Ten tear-out certificates are included in Appendix B. Unlike stock certificates used in profit corporations, membership certificates in nonprofit 501(c)(3) corporations do not represent an ownership interest in the assets of the corporation. They serve only as a formal reminder of membership status.

Each certificate that you issue should be numbered sequentially. Type the certificate number at the top of the form. Type the name of the corporation in the heading and the name of the member in the blank in the first paragraph. Have the certificate signed by your president and secretary, then place an impression of the seal of the corporation at the bottom. You should also record the name and address of the member and the number of the issued membership certificate in the membership list in your corporate records.

If you are incorporating an existing organization, you may want to prepare an offer to transfer assets—this document provides a formal record of the transfer and its terms. Your offer to transfer assets is a preliminary agreement. It will be accepted by the board of directors at the first meeting of the board and then formalized by a bill of sale. There are two basic types of offers, as we describe below.

If you are incorporating a preexisting for-profit business, you may want to prepare an offer to transfer the assets and liabilities of the predecessor organization to your nonprofit (to take effect after the corporation has obtained its federal tax exemption). An offer to transfer formalizes the transfer of assets and liabilities of the prior business to your nonprofit and provides documentation of the transfer.

There can be significant federal and state income tax consequences when the assets and liabilities of a prior business or organization are transferred to a new nonprofit corporation. For an overview, see the author’s blog article, “Converting an LLC to a Corporation—It’s Not as Simple as It Seems,” at the LLC & Corporation Small Talk blog, at www.llccorporationblog.com. Although it discusses issues relating to converting a co-owned profit-making business to a corporation, the tax issues can have applicability to nonprofit corporations as well. Make sure to check with a knowledgeable tax adviser before transferring the assets and liabilities of a business or organization to your new nonprofit corporation or using the offer and bill of sale in this book.

When the people connected with the preexisting business and the newly formed nonprofit corporation are one and the same, the assets are usually transferred without payment. However, when the nonprofit acquires assets from a preexisting profit-making business run by people different from those starting up the nonprofit, the nonprofit may agree to buy the assets. In either case, the offer will record the terms of the transfer (donation or sale of assets). You can prepare this offer (as we’ve explained in Chapter 9) when completing Schedule G, which you included with your federal tax exemption application. Refer to special instruction  , in “Prepare Your Offer to Transfer Form,” below.

, in “Prepare Your Offer to Transfer Form,” below.

Lots to Consider When Transferring Assets

Many practical and legal issues arise in a transfer of assets and liabilities from a prior business to a nonprofit. We suggest you consult an accountant to make sure you have considered:

• the best transfer method to assure the best treatment

• whether the preexisting business has retained sufficient assets to pay liabilities not assumed by the nonprofit

• whether real property should be kept by the prior business owners and leased to the nonprofit

• that payment by the prior business owners of liabilities not assumed by the nonprofit allows them a current, and sometimes necessary, tax deduction for the prior business, and

• that the transfer should be made on the date (the closing date referred to below) most advantageous for the prior owners of the profit business.

The new nonprofit corporation is not usually liable for the debts or liabilities of the prior business unless it assumes the debt or the transaction was fraudulent (with intent to frustrate and deceive the prior business creditors). In rare cases, the transfer must also comply with the Bulk Sales Law (the Bulk Sales Law is explained below, in “Complying With the Bulk Sales Law”).

The former business owners remain personally liable for debts or liabilities of the prior business incurred prior to the transfer of assets to the corporation (even if they are assumed by the corporation). They may also be held personally liable for debts incurred after the transfer, if credit is extended to the corporation by a creditor who believes and relies on the fact that she is still dealing with the prior profit business and hasn’t been notified of the incorporation (see “Notify Others of Your Incorporation,” below, for notification procedures).

If you are incorporating a preexisting nonprofit association or another less formal type of nonprofit group, you might want to prepare a transfer form to document the details of the transfer of any assets and liabilities. Documentation of this type (who is transferring or contributing what to the new nonprofit) can avoid disputes or misunderstandings later on. In this case, you will need to modify the form to show that it is prepared by the trustees, officers, members, or organizers of the preexisting nonprofit organization or group.

To transfer assets from a prior profit-making business or a nonprofit association to your nonprofit corporation, you can use the Offer to Transfer Assets form. Refer to the sample form as you follow the instructions below. The sample form below is written to apply to the transfer of a profit-making business to a nonprofit. We have included options in brackets for you to select either the word “business” or “organization” when preparing the form. Simply delete the inapplicable word as you prepare the offer with your word processor.

• The parenthetical blanks, “(________),” in the sample form indicate information that you must supply.

• Optional information is enclosed in brackets, like this: “[optional information].”

• Replace the blanks in the online form (each series of underlined characters) with the information indicated in the blanks in the sample form below.

Each circled number in the sample form (they look like this:  ) refers to an instruction that helps you complete an item.

) refers to an instruction that helps you complete an item.

Attach a copy of an assets and liabilities statement (Balance Sheet) that is current as of the date that is one business day before the date of sale. Insert this Balance Sheet date in the blank—it represents the “closing date of the offer,” a date that is referred to throughout the remainder of the offer. As explained earlier, this date should be as advantageous as possible, tax-wise, to the prior business owners or organization (consult with your accountant). If you prepare this offer at the same time that you prepare your federal exemption application, keep in mind the three- to six-month time lag that usually occurs before the IRS approves your exemption. This means that you may want to hold off making the offer until you hear from the IRS that your federal tax exemption has been approved. This offer states that it is contingent upon your nonprofit corporation obtaining its federal and state tax exemption (see instruction

Attach a copy of an assets and liabilities statement (Balance Sheet) that is current as of the date that is one business day before the date of sale. Insert this Balance Sheet date in the blank—it represents the “closing date of the offer,” a date that is referred to throughout the remainder of the offer. As explained earlier, this date should be as advantageous as possible, tax-wise, to the prior business owners or organization (consult with your accountant). If you prepare this offer at the same time that you prepare your federal exemption application, keep in mind the three- to six-month time lag that usually occurs before the IRS approves your exemption. This means that you may want to hold off making the offer until you hear from the IRS that your federal tax exemption has been approved. This offer states that it is contingent upon your nonprofit corporation obtaining its federal and state tax exemption (see instruction  , below). Also, in the unlikely event that the Bulk Sales Law applies to you, make sure this date allows you enough time to comply with the appropriate presale notice requirements.

, below). Also, in the unlikely event that the Bulk Sales Law applies to you, make sure this date allows you enough time to comply with the appropriate presale notice requirements.

For an example, see the general format of the Balance Sheet provided in Part IX(b) of your federal exemption application. The bookkeeper or accountant of the prior business or organization can help you prepare this statement.

If the nonprofit corporation will not assume any debts or liabilities of the preexisting business or organization, include these bracketed provisions in paragraph 3(b) and omit the bracketed provisions of paragraph 4(a).

If the nonprofit corporation will not assume any debts or liabilities of the preexisting business or organization, include these bracketed provisions in paragraph 3(b) and omit the bracketed provisions of paragraph 4(a).

If the corporation is going to assume the debts and liabilities of the business or organization, include the bracketed provisions of paragraph 4(a) and omit the bracketed provisions in paragraph 3(b), as explained above. If the corporation is to assume some, but not all, debts and liabilities, indicate any exceptions in paragraph 4(a). If you are preparing the offer at the time of applying for your federal tax exemption, you should return to this section of your offer in your response to Schedule 6, question 7.

If the corporation is going to assume the debts and liabilities of the business or organization, include the bracketed provisions of paragraph 4(a) and omit the bracketed provisions in paragraph 3(b), as explained above. If the corporation is to assume some, but not all, debts and liabilities, indicate any exceptions in paragraph 4(a). If you are preparing the offer at the time of applying for your federal tax exemption, you should return to this section of your offer in your response to Schedule 6, question 7.

TO: (name of corporation) , a California nonprofit (public benefit [or] religious) corporation.

1. The undersigned is [are] the sole proprietor [partners] known as “(name of prior business)” , located at (street address) , (city) , (county) , California.

2. A true and correct statement of the assets and liabilities of this business as of the close of business on (date of statement) , , is attached to this offer.

3. On the terms and conditions herein set forth, I [we] offer to sell and transfer to you at the close of business on (closing date) , , subject to such changes as may occur therein in the ordinary course of business between the date of this offer and the close of business on (closing date) , :

subject to such changes as may occur therein in the ordinary course of business between the date of this offer and the close of business on (closing date) , :

(a) All stock in trade, merchandise, fixtures, equipment, and other tangible assets of the business as shown on the financial statement attached to this offer [except . . . (indicate here any exceptions, e.g., real property to be leased to the corporation, retained cash, etc.) ;]

(b) The trade, business, name, goodwill, and other intangible assets of the business [free and clear of all debts and liabilities of the business as shown on the financial statement attached to this offer, and all such additional liabilities as may be incurred by me (us) between the date of the financial statement and the close of business on the (closing date) , ].

4. As consideration for the sale and transfer, you agree:

[(a) To assume and pay all debts and liabilities of the business as shown on the financial statement attached to this offer, and all such additional liabilities as may be reasonably incurred by me (us) between the date of the financial statement and the close of business on (closing date), , except . . . (indicate any unassumed debts or liabilities).]

(b) To pay an amount of $____ [which represents the fair market value of the business as transferred to the above Corporation per the terms prescribed above], to be paid as follows: (state terms of payment) .

[or]

(b) To execute a note in the amount of $______, [which amount represents the fair market value of the business as transferred to the above Corporation], incorporating the following provisions regarding payment under the note: (state terms of loan) .

5. If this offer is accepted by you and upon payment of $______, per the terms of paragraph 4(b), above [or “upon execution of a note per the terms of paragraph 4(b), above”], I [we] shall:

I [we] shall:

(a) Deliver possession of the business and assets described in paragraph 3 of this offer to you at the close of business on (closing date) , .

(b) Execute and deliver to you such instruments of transfer and other documents as may be required to fully perform my [our] obligations hereunder or as may be required for the convenient operation of said business thereafter by you.

[NOTE: It is clearly understood that this offer is contingent upon the above nonprofit corporation obtaining tax-exempt status with the IRS under Section 501(c)(3) of the Internal Revenue Code and with the State of California under Section 23701(d) of the California Revenue and Taxation Code, and that failure to obtain either or both of these exemptions within (number) months shall allow me (us) to rescind this offer at any time thereafter, notwithstanding any of the other provisions of this offer contained above.]

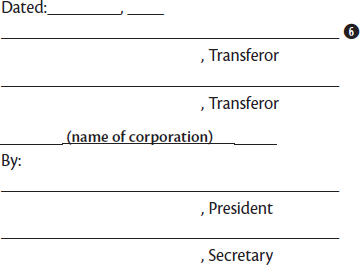

Dated: __________, _____

(signature of prior business owner[s])

[The blanks below are to be filled in later, after the first board meeting:].

The above Offer was accepted by the board of directors on (date of board meeting) , , on behalf of (name of corporation) , a California nonprofit (public benefit [or] religious) corporation.

[When you have completed the form, you will wish to make several attachments as indicated in special instruction  .]

.]

Use paragraph 4(b) if you are transferring the business for a lump sum of cash to be paid by the corporation. If the assets will be donated, state $1 as the amount. This silly amount satisfies an age-old legal rule, namely, that there must be some consideration (money) for a contract to be valid, although the actual amount usually doesn’t matter.

Use paragraph 4(b) if you are transferring the business for a lump sum of cash to be paid by the corporation. If the assets will be donated, state $1 as the amount. This silly amount satisfies an age-old legal rule, namely, that there must be some consideration (money) for a contract to be valid, although the actual amount usually doesn’t matter.

If you are transferring the business for its fair market value, write the dollar amount and include the language in brackets. If you are transferring the assets of a profit-making business, and you had an appraisal done (see Schedule G, question 6(a), of the federal exemption application), you can use the appraisal figure determined by the qualified expert in response to question 4(b) of Schedule I of your federal tax exemption application, unless this figure has changed. State the terms of the cash payment at the end of this paragraph (such as the date of payment).

Use this paragraph 4(b) instead of the preceding paragraph 4(b) if the corporation will not immediately pay cash for the assets, but will instead sign a loan note and pay the amount in specified installments. The discussion above concerning fair market value applies here as well. Specify the terms of the loan—the amount and date of installment payments, the rate of interest, and maturity date, whether it’s an interest-only loan with the principal amount paid at some future date, a noninterest note for the principal amount only, or payable on demand.

Use this paragraph 4(b) instead of the preceding paragraph 4(b) if the corporation will not immediately pay cash for the assets, but will instead sign a loan note and pay the amount in specified installments. The discussion above concerning fair market value applies here as well. Specify the terms of the loan—the amount and date of installment payments, the rate of interest, and maturity date, whether it’s an interest-only loan with the principal amount paid at some future date, a noninterest note for the principal amount only, or payable on demand.

The terms of the loan should be commercially reasonable—a definite payback period and schedule, and a commercially reasonable rate of interest. This will help avoid a determination by the IRS that the prior business owners (who perhaps now are directors or officers of the nonprofit corporation) or organization are receiving some monetary advantage from the corporation, such as an above-market value payment or an excessive rate of interest paid by the nonprofit. Conversely, the more generous the terms to the nonprofit corporation, the less likely are your chances of having your exemption application denied or having problems with the IRS later upon an audit of your organization.

Use the unbracketed sentence of paragraph 5 if the corporation will pay the full sum of money when the business is transferred to the corporation. Use the bracketed phrase if the amount will be paid off over time per the terms of a loan note.

Use the unbracketed sentence of paragraph 5 if the corporation will pay the full sum of money when the business is transferred to the corporation. Use the bracketed phrase if the amount will be paid off over time per the terms of a loan note.

Include this bracketed NOTE paragraph if you are drafting the offer while preparing your federal exemption application. State how much time the corporation has to obtain its exemption before the prior business owner(s) can cancel the offer.

Include this bracketed NOTE paragraph if you are drafting the offer while preparing your federal exemption application. State how much time the corporation has to obtain its exemption before the prior business owner(s) can cancel the offer.

Print the form and have the prior business owner(s) or one or more authorized managers or officers of the unincorporated organization sign and date the offer. If the offer is prepared for the transfer of assets of a prior nonprofit organization, we assume the transfer was properly approved by the prior nonprofit organization according to its charter or bylaws. Don’t fill in the blanks at the bottom of the offer yet—do so after the first meeting of your board of directors. If you are preparing the offer for submission with your federal exemption application in response to Schedule G, question 6(b), your response to this item on an attachment page can state: “The offer is contingent upon the nonprofit corporation obtaining its federal tax exemption, at which time the offer will be submitted to the board of directors and, upon approval by the board, will be signed by the appropriate officers of the corporation.”

Print the form and have the prior business owner(s) or one or more authorized managers or officers of the unincorporated organization sign and date the offer. If the offer is prepared for the transfer of assets of a prior nonprofit organization, we assume the transfer was properly approved by the prior nonprofit organization according to its charter or bylaws. Don’t fill in the blanks at the bottom of the offer yet—do so after the first meeting of your board of directors. If you are preparing the offer for submission with your federal exemption application in response to Schedule G, question 6(b), your response to this item on an attachment page can state: “The offer is contingent upon the nonprofit corporation obtaining its federal tax exemption, at which time the offer will be submitted to the board of directors and, upon approval by the board, will be signed by the appropriate officers of the corporation.”

Attach a copy of the prepared financial statement to the offer and a copy of an appraisal, if applicable.

Attach a copy of the prepared financial statement to the offer and a copy of an appraisal, if applicable.

If you are submitting this offer with your federal exemption application, make a copy of the form and all attachments, and submit these copies with your federal application (see Schedule G, question 6(c)). Place the originals of these papers in your corporate records book.

Now that you’ve prepared your articles and bylaws, filed your articles with the secretary of state, and obtained your federal and state tax exemption (and possibly prepared an offer to transfer assets of a prior business or organization to your nonprofit corporation), your next step is to prepare minutes of your first board of directors’ meeting. The purpose of this meeting is to transact the initial business of the corporation (elect officers, fix the legal address of the corporation, and so on) and to authorize the newly elected officers to take actions necessary to get your nonprofit corporation going (such as setting up bank accounts and admitting members, if appropriate). Although this meeting sometimes is a “paper meeting” (where the directors informally agree to the decisions reflected in the minutes without actually sitting down together and talking business), we suggest that you take this opportunity to meet in person and discuss any other steps you’ll need to take to get your nonprofit corporation off the ground. Our minutes form assumes that your directors really did meet and approved the decisions reflected in the minutes.

Preparing minutes for your first meeting is not hard. Use the form included with this book (Minutes of First Meeting of Board of Directors) and consult the sample form below as you follow our instructions. We have flagged optional resolutions on the sample form and in the instructions. If an optional resolution does not apply to you, do not include it in your final minutes.

• The parenthetical blanks, “(________),” in the sample form indicate information that you must complete on the form.

• Replace the blanks in the online form with the information shown in the blanks in the sample form.

• Each circled number in the online form ( ) refers to an instruction to help you complete an item.

) refers to an instruction to help you complete an item.

Normally, you must follow formal notice rules when holding special meetings (the first meeting of the board is a special meeting). This Waiver of Notice form allows you to dispense with that notice. Fill in this form as indicated, giving the time, date, and place of the meeting. Have all the directors sign the form and type the directors’ names under their signature lines. It may be signed and dated before the actual meeting of the board.

Normally, you must follow formal notice rules when holding special meetings (the first meeting of the board is a special meeting). This Waiver of Notice form allows you to dispense with that notice. Fill in this form as indicated, giving the time, date, and place of the meeting. Have all the directors sign the form and type the directors’ names under their signature lines. It may be signed and dated before the actual meeting of the board.

This is the first page of your minutes form. Fill in the blanks as indicated, entering the names of directors present and listing those, if any, who are absent (a quorum of the board, as specified in the bylaws, must be shown in attendance). Name one of the directors chairperson, and another as secretary of the meeting.

This is the first page of your minutes form. Fill in the blanks as indicated, entering the names of directors present and listing those, if any, who are absent (a quorum of the board, as specified in the bylaws, must be shown in attendance). Name one of the directors chairperson, and another as secretary of the meeting.

Minutes of First Meeting of Board of Directors of

(name of corporation)

WAIVER OF NOTICE AND CONSENT TO HOLDING

OF FIRST MEETING OF BOARD OF DIRECTORS OF

(NAME OF CORPORATION)

A CALIFORNIA NONPROFIT (PUBLIC BENEFIT [OR] RELIGIOUS) CORPORATION

We, the undersigned, being all the directors of (name of corporation) , a California nonprofit (public benefit [or] religious) corporation, hereby waive notice of the first meeting of the board of directors of the corporation and consent to the holding of said meeting at (principal place of business) , California, on (date) , , at (time) M., and consent to the transaction of any and all business by the directors at the meeting, including, without limitation, the adoption of bylaws, the election of officers, and the selection of the place where the corporation’s bank account will be maintained.

Date: ____________

MINUTES OF FIRST MEETING OF BOARD OF DIRECTORS  OF

OF

(NAME OF CORPORATION)

A CALIFORNIA NONPROFIT (PUBLIC BENEFIT [OR] RELIGIOUS) CORPORATION

The board of directors of (name of corporation) held its first meeting on (date) , at (principal office address) , California. Written waiver of notice was signed by all of the directors.

The following directors, constituting a quorum of the full board, were present at the meeting:

(names of directors present at meeting)

There were absent:

(names of absent directors, if any)

On motion and by unanimous vote, (name of director) was elected temporary chairperson and then presided over the meeting. (name of director) was elected temporary secretary of the meeting.

The chairperson announced that the meeting was held pursuant to written waiver of notice signed by each of the directors. Upon a motion duly made, seconded, and unanimously carried, the waiver was made a part of the records of the meeting; it now precedes the minutes of this meeting in the corporate records book.

BYLAWS

There was then presented to the meeting for adoption a proposed set of bylaws of the corporation. The bylaws were considered and discussed and, on motion duly made and seconded, it was unanimously:

RESOLVED, that the bylaws presented to this meeting be and hereby are adopted as the bylaws of the corporation;

RESOLVED FURTHER, that the secretary insert a copy of the bylaws in the corporate records book, and see that a copy of the bylaws is kept at the corporation’s principal office, as required by law.

FEDERAL AND CALIFORNIA TAX EXEMPTIONS

The chairperson announced that, upon application previously submitted to the Internal Revenue Service, the corporation was determined to be exempt from payment of federal corporate income taxes as a/n (501(c)(3) tax-exempt classification, e.g., “educational,” “charitable,” “religious,” etc.) organization under Section 501(c)(3) of the Internal Revenue Code per Internal Revenue Service determination letter dated (date of federal determination letter) and, further, that the corporation has been classified as a public charity under Section (IRC section or sections under which the corporation qualifies as a public charity) of the Internal Revenue Code. The effective date of the organization’s 501(c)(3) tax exemption is (effective date of federal tax exemption).

The chairperson also announced that the California Franchise Tax Board acknowledged the corporation’s federal tax exemption and its classification as exempt from payment of state corporate franchise taxes under Section 23701(d) of the California Revenue and Taxation Code per Franchise Tax Board acknowledgment letter dated (date of state acknowledgment letter). The effective date of the corporation’s 23701(d) tax exemption is (effective date of state tax exemption).

The chairperson then presented copies of the IRS tax-exemption determination letter and the California Franchise Tax Board acknowledgment letter, and the secretary was instructed to insert these letters in the corporate records book.

ELECTION OF OFFICERS

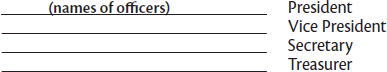

The chairperson then announced that the next item of business was the election of officers. Upon motion, the following persons were unanimously elected to the offices shown after their names:

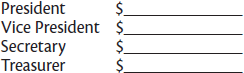

COMPENSATION OF OFFICERS

There followed a discussion concerning the compensation to be paid by the corporation to its officers. Upon motion duly made and seconded, it was unanimously:

RESOLVED, that the following annual salaries be paid to the officers of this corporation:

The secretary presented to the meeting for adoption a proposed form of seal of the corporation. Upon motion duly made and seconded, it was:

RESOLVED, that the form of corporate seal presented to this meeting be and hereby is adopted as the seal of this corporation, and the secretary of the corporation is directed to place an impression thereof in the space next to this resolution.

(Impress seal here)

PRINCIPAL OFFICE

After discussion as to the exact location of the corporation’s principal office for the transaction of business in the county named in the bylaws, upon motion duly made and seconded, it was:

RESOLVED, that the principal office for the transaction of business of the corporation shall be at (street address) , in (city) , California.

BANK ACCOUNT

Upon motion duly made and seconded, it was:

RESOLVED, that the funds of this corporation shall be deposited with (name of bank) .

RESOLVED FURTHER, that the treasurer of this corporation be and hereby is authorized and directed to establish an account with said bank and to deposit the funds of this corporation therein.

RESOLVED FURTHER, that any officer, employee, or agent of this corporation be and is authorized to endorse checks, drafts, or other evidences of indebtedness made payable to this corporation, but only for the purpose of deposit.

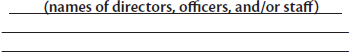

RESOLVED FURTHER, that all checks, drafts, and other instruments obligating this corporation to pay money shall be signed on behalf of this corporation by any (number) of the following:

RESOLVED FURTHER, that said bank be and hereby is authorized to honor and pay all checks and drafts of this corporation signed as provided herein.

RESOLVED FURTHER, that the authority hereby conferred shall remain in force until revoked by the board of directors of this corporation and until written notice of such revocation shall have been received by said bank.

RESOLVED FURTHER, that the secretary of this corporation be and hereby is authorized to certify as to the continuing authority of these resolutions, the persons authorized to sign on behalf of this corporation, and the adoption of said bank’s standard form of resolution, provided that said form does not vary materially from the terms of the foregoing resolutions.

CORPORATE CERTIFICATES (Optional)

The secretary then presented to the meeting proposed director, sponsor, membership, or other forms of corporate certificates for approval by the board. Upon motion duly made and seconded, it was:

RESOLVED, that the form of certificates presented to this meeting are hereby adopted for use by this corporation and the secretary is directed to attach a copy of each form of certificate to the minutes of this meeting.

ISSUANCE OF MEMBERSHIPS (Optional)

The board next took up the matter of issuance of memberships in the corporation.

Upon motion duly made and seconded, it was unanimously:

RESOLVED, that upon [“making application therefor in writing” (or state other procedure as specified in the membership provisions in your bylaws)] [“and upon payment of an application fee” (and/or) “first annual dues in the amount(s) of $ ,”] members shall be admitted to the corporation and shall be entitled to all rights and privileges and subject to all the obligations, restrictions, and limitations applicable to such membership in the corporation as set forth in the articles of incorporation and by-laws of the corporation and subsequent amendments and changes thereto, and subject to any further limitations as resolved from time to time by the board of directors.

RESOLVED FURTHER, that the secretary of the corporation shall record the name and address of each member in the membership book of the corporation and, upon the termination of any membership in accordance with the termination procedures specified in the bylaws of the corporation, the secretary shall record the date of termination of such membership in the membership book.

[RESOLVED FURTHER, that each person admitted to membership in the corporation shall be given a membership certificate, signed by the president and secretary of the corporation, and the secretary shall record the date of issuance of said certificate in the corporate membership book.]

ACCEPTANCE OF OFFER TO TRANSFER ASSETS AND  LIABILITIES OF PREDECESSOR ORGANIZATION (Optional)

LIABILITIES OF PREDECESSOR ORGANIZATION (Optional)

Upon motion duly made and seconded, it was unanimously:

RESOLVED, that the corporation accept the written offer dated _______, ____, to transfer the assets and liabilities of the predecessor organization, (name of predecessor organization) , in accordance with the terms of said offer, a copy of which precedes the minutes of this meeting in the corporate records book.

RESOLVED FURTHER, that the appropriate officers of this corporation are authorized and directed to take such actions and execute such documents as they deem necessary or appropriate to effect the transfer of said business to this corporation.

Since there was no further business to come before the meeting, on motion duly made and seconded, the meeting was adjourned.

This resolution shows acceptance of the contents of the bylaws by your directors.

This resolution shows acceptance of the contents of the bylaws by your directors.

This resolution recites the particulars of your federal and state tax exemptions. Fill in the blanks as indicated, using information contained in your federal tax exemption determination letter and Franchise Tax Board tax exemption acknowledgment letter. Indicate your tax-exempt classification with the IRS—for example, educational, religious, charitable—and the date of your federal determination letter. Then show the code section or sections under which you have obtained federal public charity status, as shown in your IRS exemption letter (for example, “a publicly supported organization of the type described in Section 509(a)(2)”). Next, insert the effective date of your federal tax exemption.

This resolution recites the particulars of your federal and state tax exemptions. Fill in the blanks as indicated, using information contained in your federal tax exemption determination letter and Franchise Tax Board tax exemption acknowledgment letter. Indicate your tax-exempt classification with the IRS—for example, educational, religious, charitable—and the date of your federal determination letter. Then show the code section or sections under which you have obtained federal public charity status, as shown in your IRS exemption letter (for example, “a publicly supported organization of the type described in Section 509(a)(2)”). Next, insert the effective date of your federal tax exemption.

Fill in the remaining blanks to show the date of your letter from the Franchise Tax Board acknowledging your federal tax exemption and recognizing your state tax exemption under Section 23701(d) of the California Revenue and Taxation Code. Finally, show the effective date of your state tax exemption, which should be the same as the effective date of your federal tax exemption.

Type the names of the persons you elect as officers of your corporation. Remember, directors may be officers and any one person may hold more than one officer position with the exception that the person(s) who serve(s) as the secretary and/or treasurer cannot also serve as the president (or chairperson of the board).

Type the names of the persons you elect as officers of your corporation. Remember, directors may be officers and any one person may hold more than one officer position with the exception that the person(s) who serve(s) as the secretary and/or treasurer cannot also serve as the president (or chairperson of the board).

If you decide to provide for officers’ salaries, indicate each officer’s salary in the blanks in this resolution. Of course, you may decide to omit one or more officer salaries here—if so, simply type a zero in the appropriate blank.

If you decide to provide for officers’ salaries, indicate each officer’s salary in the blanks in this resolution. Of course, you may decide to omit one or more officer salaries here—if so, simply type a zero in the appropriate blank.

A majority of the directors of a California public benefit corporation cannot be paid (other than as directors of the corporation). See “Directors,” in Chapter 2, for further information on this disinterested director rule for public benefit corporations.

Article 9, Section 5, of the bylaws included with this book contains compensation approval procedures that help your nonprofit meet the excess benefit avoidance rules under federal tax law (see “Limitation on Profits and Benefits,” in Chapter 3, for more on these rules). These bylaw provisions require disinterested members of your board or a committee of the board (such as a compensation committee) to approve officer salaries, after obtaining comparable figures for compensation paid to similar officers in similar organizations. A safe harbor rule at the end of Article 9, Section 5c, allows smaller nonprofits to approve officer salaries if they have comparability data from three similar organizations showing that their officer salary levels are comparable to those organizations. Complying with this bylaw provision also should help you meet the special requirements under the California Nonprofit Integrity Act of 2004 for approving salaries paid to your chief executive officer (president) and chief financial officer (treasurer). (See “Compensation of Officers,” in Chapter 2.)

If you fill in any of the officer salaries in this resolution, we suggest you add a paragraph to the resolution stating that you approved the salaries in compliance with Article 9, Section 5, of your bylaws, and that you document each of the applicable facts or items listed in Article 9, Section 5d, of the bylaws. For example, your additional language should include the following information:

• the name of the board committee that approved the salary and the members of the committee. This listing should show that only disinterested (unpaid) members voted for officer compensation

• the names and votes of each board or committee member

• the comparability data that justified the approval of the salary. Attach any written data to the minutes. The data should show specific salary levels paid by other organizations in your geographical and program area for similar officer positions, and

• the skills, experience, education, and other qualifications of all the officers that help justify each salary as reasonable.

If you’ve ordered a corporate seal, impress your corporate seal in the space indicated on the printed form.

If you’ve ordered a corporate seal, impress your corporate seal in the space indicated on the printed form.

So far, your formal documents have indicated only the county of the principal place of business of your corporation. Here you should provide the street address and city of this office. Do not use a post office box.

So far, your formal documents have indicated only the county of the principal place of business of your corporation. Here you should provide the street address and city of this office. Do not use a post office box.

It is important to keep corporate funds separate from any personal funds by depositing corporate funds into, and writing corporate checks out of, at least one corporate checking account. List the bank and branch office where you will maintain corporate accounts. In the fifth paragraph, say how many people must cosign corporate checks, giving the names of individuals allowed to cosign checks on the lines below this paragraph. As a minimal measure of fiscal control, specify the signature of two persons here. Many nonprofits list the president and treasurer, or the names of other supervisory officers who can be trusted with check-writing authority.

It is important to keep corporate funds separate from any personal funds by depositing corporate funds into, and writing corporate checks out of, at least one corporate checking account. List the bank and branch office where you will maintain corporate accounts. In the fifth paragraph, say how many people must cosign corporate checks, giving the names of individuals allowed to cosign checks on the lines below this paragraph. As a minimal measure of fiscal control, specify the signature of two persons here. Many nonprofits list the president and treasurer, or the names of other supervisory officers who can be trusted with check-writing authority.

This is an optional resolution for membership nonprofits. If you plan to use the tear-out membership certificates included with this book (or if you will order membership, director, or sponsor certificates from a legal stationer), include this page in your minutes. Attach to your printed minutes a sample of any certificates you plan to issue.

This is an optional resolution for membership nonprofits. If you plan to use the tear-out membership certificates included with this book (or if you will order membership, director, or sponsor certificates from a legal stationer), include this page in your minutes. Attach to your printed minutes a sample of any certificates you plan to issue.

This resolution is for membership corporations, that must include it. State your procedure for admitting members in the first bracketed phrase, according to the membership provisions in your bylaws. If you have provided for application fees and/or annual dues in your bylaws, use the second bracketed phrase to describe the amount of such fees and/or dues provided for in your bylaws. If your membership corporation has no qualification requirements, annual fees, or dues, you can simply cross out the word “upon” just before the blank and leave the blank empty without filling in the blanks, or retype this paragraph to read: “RESOLVED that members shall be admitted to the corporation and shall be entitled to all rights and privileges and subject to all the obligations . . .” If you plan to issue membership certificates, add the bracketed paragraph shown on the sample form at the end of the resolution.

This resolution is for membership corporations, that must include it. State your procedure for admitting members in the first bracketed phrase, according to the membership provisions in your bylaws. If you have provided for application fees and/or annual dues in your bylaws, use the second bracketed phrase to describe the amount of such fees and/or dues provided for in your bylaws. If your membership corporation has no qualification requirements, annual fees, or dues, you can simply cross out the word “upon” just before the blank and leave the blank empty without filling in the blanks, or retype this paragraph to read: “RESOLVED that members shall be admitted to the corporation and shall be entitled to all rights and privileges and subject to all the obligations . . .” If you plan to issue membership certificates, add the bracketed paragraph shown on the sample form at the end of the resolution.

This is an optional resolution. If you have incorporated a preexisting profit-making business or other organization and have prepared an Offer to Transfer Assets, include this resolution in your final minutes, indicating the date of the offer and the name of the predecessor business or organization.

This is an optional resolution. If you have incorporated a preexisting profit-making business or other organization and have prepared an Offer to Transfer Assets, include this resolution in your final minutes, indicating the date of the offer and the name of the predecessor business or organization.

After printing your minutes, your secretary should date and sign the form at the bottom of the last page.

After printing your minutes, your secretary should date and sign the form at the bottom of the last page.

You are now through preparing your minutes. Place your minutes and all attachments in your corporate records book. Your attachments may include the following forms or documents:

• waiver of notice and consent to holding of the first meeting

• written offer (fill in the blanks at the end of the form and have your nonprofit corporation president and secretary sign the offer)

• certified copy of your articles

• copy of your bylaws, certified by the secretary of the corporation

• federal tax exemption determination letter and state exemption acknowledgment letter, and

• copy of any membership, director, and/or sponsor certificate that you plan to issue, certificate marked as a “Sample.”

To certify your bylaws, have the corporate secretary date and sign the certificate section at the end of all copies of your bylaws.

Remember, you should continue to place an original or copy of all formal corporate documents in your corporate records book and keep this book at your principal office. For example, if you have prepared or ordered membership certificates, place any unissued certificates in the membership certificate section of your records book.

A few nonprofits that have incorporated existing businesses may have to comply with California’s Bulk Sales Law (Division 6 of the California Commercial Code, starting with Section 6101). You might have to comply, for example, if you have taken a preexisting retail or wholesale business, such as a charitable thrift shop, and incorporated it to obtain nonprofit corporate status. But compliance is required only if all of the following are true:

• The business being incorporated is a restaurant or one whose principal business is selling inventory from stock (such as a retail or wholesale business, including a business that manufactures what it sells).

• You are transferring more than half the value of the old business’s inventory and equipment to your new corporation.

• The value of the business assets being transferred is $10,000 or more (an exemption from the provisions of the bulk sales law also applies if the value of the assets being transferred is more than $5 million).

If, as is true for most nonprofits, these three conditions do not apply to your incorporation, you can skip the rest of this section. For those of you who do, however, meet the test, take heart. Even if you are incorporating the type of business covered by this law, you may still be eligible for an exemption from most of the provisions of this law if your corporation:

• assumes the debts of the unincorporated business

• is not insolvent after the assumption of these debts, and

• publishes and files a notice to creditors within 30 days of the transfer of assets.

To comply with this exemption, call a local legal newspaper. The paper should be able to send you the proper form (see “Notify Others of Your Incorporation,” below) to prepare and will publish and file this form with the county recorder’s and tax collector’s offices for a small fee.

There are various notice forms that fit specific provisions of the bulk sales law. To rely on the exemption above, prepare and have the newspaper publish and file a Notice to Creditors under Section 6013(c)(10) of the California Commercial Code. This notice will usually include a heading indicating that it is a Bulk Sale and Assumption form. In any case, it must include a clause stating that the buyer has assumed or will assume in full the debts that were incurred in the seller’s business before the date of the bulk sale (you may see slightly different wording, but the sense should be the same).

For other exemptions from the Bulk Sales Law, see Division 6 of the California Commercial Code.

If you have incorporated a preexisting business or organization, you may want to prepare a bill of sale to formally transfer the assets for the organization to the nonprofit corporation. This should be done according to the terms of the written offer, if you prepared one in “Prepare Offer to Transfer Assets From an Existing Business or Organization to Your Nonprofit.” It should have been accepted by the board at the first meeting and signed by the officers on behalf of the corporation after the meeting.

Before using this bill of sale, see the caution relating to tax consequences in “Transfers From a For-Profit Business,” earlier in this chapter. Prepare the bill of sale by completing the form that is included with this book, following the sample form and special instructions below.

• The parenthetical blanks, “( ),” in the sample form below indicate information that you must complete on the online form.

• Optional information is enclosed in brackets, for example, “[optional information].”

• Replace the blanks in the online form with the information indicated in the blanks in the sample form below.

• Each circled number in the sample form refers to a special instruction that will help you complete an item.

Include this first bracketed phrase if your written offer specified an amount of money to be paid upon the transfer of the business. If appropriate, include the language that states that this amount represents the fair market value of the business or organization (if the assets were donated, you will just show $1 as the amount of payment without the statement concerning fair market value).

Include this first bracketed phrase if your written offer specified an amount of money to be paid upon the transfer of the business. If appropriate, include the language that states that this amount represents the fair market value of the business or organization (if the assets were donated, you will just show $1 as the amount of payment without the statement concerning fair market value).

Include this second bracketed phrase (instead of the first bracketed phrase referred to above) if the business or organization will be transferred in return for a promissory note. A sample promissory note is shown below. You may need to modify its terms to conform to the terms contained in your offer. In all cases, your note should state the date and place of its execution, the due date, amount to be paid, and rate of interest, if any.

Include this second bracketed phrase (instead of the first bracketed phrase referred to above) if the business or organization will be transferred in return for a promissory note. A sample promissory note is shown below. You may need to modify its terms to conform to the terms contained in your offer. In all cases, your note should state the date and place of its execution, the due date, amount to be paid, and rate of interest, if any.

Attach an inventory to the offer, showing all tangible assets of the business—this can be copied from the schedule of assets and liabilities you’ve attached to your written offer. Add, in the blank provided, any nontransferred assets according to the terms of your offer.

Attach an inventory to the offer, showing all tangible assets of the business—this can be copied from the schedule of assets and liabilities you’ve attached to your written offer. Add, in the blank provided, any nontransferred assets according to the terms of your offer.

Include this paragraph if the corporation will assume liabilities of the prior business or organization, noting any exceptions.

Include this paragraph if the corporation will assume liabilities of the prior business or organization, noting any exceptions.

Include this paragraph if the business’s or organization’s accounts receivable will be transferred to the corporation, indicating any exceptions.

Include this paragraph if the business’s or organization’s accounts receivable will be transferred to the corporation, indicating any exceptions.

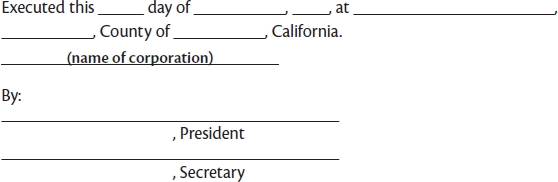

Fill in the bottom portion of the bill of sale and print the form. Have the form signed by the prior business owners or the authorized manager(s) or officer(s) of the prior organization (the “transferors”) and the president and secretary of the corporation. Place the completed form, together with the attachments (inventory and promissory note), in your corporate records book. Give copies to the prior business owners or representatives of the prior nonprofit organization. The business or organization is now officially transferred.

Fill in the bottom portion of the bill of sale and print the form. Have the form signed by the prior business owners or the authorized manager(s) or officer(s) of the prior organization (the “transferors”) and the president and secretary of the corporation. Place the completed form, together with the attachments (inventory and promissory note), in your corporate records book. Give copies to the prior business owners or representatives of the prior nonprofit organization. The business or organization is now officially transferred.

This is an agreement by (names of prior business owners) , herein called “transferor(s),” and (name of corporation) , herein called “the corporation.”

1. In return for [“payment of $ which represents the fair market value of the business transferred” (or state other amount to be paid per the terms of the written offer)]  (or) [“execution of a promissory note in the principal amount of $ , with the terms as contained in said note, a copy of which is attached to this agreement”]

(or) [“execution of a promissory note in the principal amount of $ , with the terms as contained in said note, a copy of which is attached to this agreement”]  by (name of corporation) , a California nonprofit corporation, I [we] hereby sell, assign, and transfer to the corporation all my [our] right, title, and interest in the following property:

by (name of corporation) , a California nonprofit corporation, I [we] hereby sell, assign, and transfer to the corporation all my [our] right, title, and interest in the following property:

All the tangible assets listed on the inventory attached to this bill of sale, and all stock in trade, trade, goodwill, leasehold interests, trade names, and other intangible assets [“except . . . (show nontransferred assets) of (name of prior business) , located at (street address) , (city) , (county) , California”].

2. [In return for the transfer of the above property to it, the corporation hereby agrees to assume, pay, and discharge all debts, duties, and obligations that appear on the date of this agreement, on the books and owed on account of said business [“except . . . (list any unassumed debts or liabilities) ”]. The corporation agrees to indemnify and hold the transferor(s) of said business and their property free from any liability for any such debt, duty, or obligation and from any suits, actions, or legal proceedings brought to enforce or collect any such debt, duty, or obligation.]

3. [The transferor(s) hereby appoint(s) the corporation as his (her, their) representative to demand, receive, and collect for itself, all debts and obligations now owing to said business [“except (list any exceptions) ”]. The transferor(s) further authorize(s) the corporation to do all things allowed by law to recover and collect such debts and obligations and to use the transferor’s(s’) name(s) in such manner as it considers necessary for the collection and recovery of such debts and obligations, provided, however, without cost, expense, or damage to the transferor(s). ]

For value received, the undersigned California nonprofit corporation promises to pay to (names of prior business owners or name of prior unincorporated nonprofit association) the principal amount of $_______, together with interest at the rate of __% per annum with a total amount due under this note of $ (principal + interest) , to be paid in full by (due date) , with payment to be made in (number) equal monthly installments of $_____ each payable on the ____ day of each month, with the first installment being due on (date) [or state other provisions per the terms of the written Offer regarding rate of interest, if any, due date, and manner of payment].

If you have transferred a prior business or organization to your corporation, the prior owners or nonprofit organization may want to prepare assignments of leases or deeds if they are transferring real property interests to the corporation. Under an assignment, you step into the shoes of the old tenant—the terms and conditions of the lease don’t change.

To avoid going through a reassignment, ask the landlord to terminate the old lease and renegotiate a new lease between the landlord and your new corporation. Use this approach if you think you can hammer out a better deal than the old lease gave the old tenants.

If you prepare an assignment, the terms of the lease itself will normally require you to get the landlord’s consent. It is particularly important to communicate with the landlord if the nonprofit corporation expects to obtain an exemption from local real property taxes on the leased premises from the county tax assessor (see “Apply for Your Property Tax Exemption,” below). Nonprofit groups that obtain the exemption will want a clause in their new lease that gives them a credit against rent payments for the amount of any decrease in the landlord’s property tax bill.

A real estate broker can help you obtain and prepare forms to transfer property in which the prior owners have an ownership interest. If a mortgage or deed of trust is involved, you may well need the permission of the lender, too.

If you have incorporated a prior business or other organization, you may need to file final sales tax and other returns for the preexisting organization. You will also want to cancel any permits or licenses issued to the prior business or its principals. If you need new licenses, get them in the name of the new nonprofit corporation.

If a preexisting group has been incorporated, notify creditors and other interested parties, in writing, of the termination and dissolution of the prior organization and its transfer to the new corporation. This is advisable as a legal precaution and as a courtesy to those who have dealt with the prior organization.

To notify past creditors, suppliers, organizations, and businesses of your incorporation, send a friendly letter that shows the date of your incorporation, your corporate name, and its principal office address. Make a copy of each letter and put it in your corporate records book.

If the prior group was organized as a partnership, have a local legal newspaper publish a Notice of Dissolution of Partnership in the county where the partnership office or property was located. Then file the form with the local county clerk’s office according to the instructions on the form, or pay the newspaper to file it for you.

Most 501(c)(3) tax-exempt nonprofit corporations will qualify for and want to obtain a third-class nonprofit mailing permit from the U.S. Post Office. This permit entitles you to lower rates on mailings, an important advantage for many groups since the nonprofit rate is considerably lower than the regular third-class rate.

To obtain your permit, bring to your local or main post office branch:

• a file-stamped or certified copy of your articles

• a copy of your bylaws

• a copy of your federal and state tax-exemption determination letters, and

• copies of program literature, newsletters, bulletins, and any other promotional materials.

The post office clerk will ask you to fill out a short application and take your papers. If your local post office branch doesn’t handle this, the clerk will send you to a classifications office at the main post office. You’ll pay a one-time fee and an annual permit fee. The clerk will forward your papers to the classification office at the regional post office for a determination. In a week or so, you will receive notice of the post office’s determination.

You can download the application, Form 3624, online from www.usps.com. Fill it in and prepare the supporting documentation before you go to the post office (district offices that handle the mailing permit applications are listed online at the USPS website).

Once you have your permit, you can mail letters and parcels at the reduced rate by affixing stamps to your mail; by taking the mail to your post office and filling out a special mailing form; or by using the simpler methods of either stamping your mail with an imprint stamp (made by a stampmaker) or leasing a mail-stamping machine that shows your imprint information. Ask the classifications clerk for further information.

As a nonprofit corporation, you can obtain an exemption from local (county) property taxes on the corporation’s personal and real property, whether it’s owned or leased. Reread “California Welfare Exemption,” in Chapter 5, which explains the welfare exemption, before deciding whether to apply for it. Most groups that meet the requirements will want it.

If you lease from an organization that, itself, is exempt under the welfare exemption, you should prepare and submit the application to be exempt from personal property taxes and to reduce your rent payments to your landlord once you qualify for a real property tax exemption on the portion of the premises that you rent (you should agree with your landlord to reduce your rent once you qualify for the welfare exemption on the leased premises). Both the nonprofit tenant and the nonprofit owner of the property must apply for and obtain the welfare exemption to qualify for a real property welfare tax exemption on the leased premises.

You need not have your federal and state tax exemption to apply for the welfare exemption. Even if you have not yet filed your articles with the secretary of state (but are sure that you will do so), go ahead and file if the February 15 property tax assessment deadline is approaching.

It’s a good idea to file for this exemption early, before you’ve even obtained your state and federal tax exemptions. When you do become a tax-exempt nonprofit corporation, you will be able to obtain a complete, partial, or prorated refund on any applicable real or personal property taxes associated with real property you buy or rent or personal property you acquire during the fiscal year after you submit the copies of your state and federal exemption letters to complete your welfare exemption application information.

In your application, explain how far along you are in your incorporation process. For example, you might write, “nonprofit corporation, preparing to apply for federal and state corporate tax exemptions”; or “proposed nonprofit corporation to be exempt from corporate taxation under Section 23701(d) of the California Revenue and Taxation Code and Section 501(c)(3) of the Internal Revenue Code” in the appropriate blanks. Answer the questions on the application and provide attachments as best you can (for instance, you can attach filed or unfiled articles or proposed financial statements). Note on the form that you will supply additional appropriate documents (such as filed articles, exemption letters, financial data, and descriptions of real and/or personal property) during the fiscal year, when available.

If you are seeking an exemption for real property owned by the nonprofit corporation, the grant deed for the property should be filed in the county recorder’s office before March 1 (15 days before you file your claim). If you are seeking an exemption on leased property, your lease or assignment of lease should be dated before March 1.

Applying for the welfare exemption isn’t difficult. Follow these steps:

• Go online to the Board of Equalization website at www.boe.ca.gov or call the local county assessor’s office and request a welfare exemption claim form. If you go online, type “boe-267” in the site search box to locate the downloadable form. A list of county assessors with contact information is provided on the State Board of Equalization’s website at www.boe.ca.gov/proptaxes/assessors.htm. When you contact the county assessor, ask for the welfare exemption form for first-time filers, Form BOE-267, Welfare Exemption (First Filing). Complete the claim form, using the accompanying instruction sheet. Fill in all of the blanks on the form. If a particular item doesn’t apply, mark it as “Not Applicable.”

• Assemble copies of your certified articles, federal and state exemption letters (if you have obtained them), and the requested financial statements. These statements are your operating statement and balance sheet—you should be able to use the financial information submitted with your federal exemption application. Include any other appropriate attachments (such as a copy of a lease).

• Assemble all the papers together—the completed claim form and all documents. They do not need to be stapled or fastened together. Make two copies of all the papers.

• File two (duplicate) sets of your claim form and attachments with the county assessor. Keep one copy to place in your corporate records book. File your papers before February 15 of the fiscal year for which you are seeking the exemption (the property tax fiscal year goes from July 1 to June 30). If you submit it after this date and before January 1 of the following year, you will only be allowed a 90% exemption if your claim is approved. If you file even later than this during the fiscal year, you will be allowed an 85% exemption, except that the maximum amount in taxes you will have to pay is $250.

The assessor will go out and inspect your property, to determine if the uses to which it is being put meet the requirements of the welfare exemption. The inspector will prepare a field inspection report and send it, together with one copy of your claim and attachments, to the State Board of Equalization in Sacramento. The Board will review the documents and make a decision, sending a copy of the decision to you and one copy to the local assessor. If you’ve been granted the exemption, the local assessment roll will be updated and a tax “bill” showing your exemption will be sent to you. If you are renting, the updated tax bill will go to your landlord.

Religious corporations may be able to avail themselves of the streamlined application and renewal procedures of the religious exemption under Section 207 of the Revenue and Taxation Code—call your local county tax assessor’s office (Exemption Division) or go online to the Board of Equalization website for more information.

For more information on the welfare exemption and how to apply for it, consult the Assessors’ Handbook—Welfare Exemption, publication number AH-267, a pamphlet for local tax assessors written by the Board of Equalization. The handbook is included on Nolo’s website (see Appendix A for the link). If you want to check if a newer edition has come out since the publication of this book, go to the California State Board of Equalization website at www.boe.ca.gov and search for the “Assessors’ Handbook,” then select “AH-267-Welfare, Church and Religious Exemptions.”

Shortly after you file your articles of incorporation, you will receive a Statement of Information for a Domestic Nonprofit Corporation (Form SI-100) from the secretary of state’s office. This form requests basic organizational information (which will be a matter of public record and can be obtained by anyone for a small fee), including the address of your principal office, the names and addresses of your officers, and your agent for service of process. (Your initial agent is designated in your articles of incorporation and is the person authorized to receive legal documents on behalf of your corporation.) This form must be filled out and sent back to the secretary of state within 90 days of the date your articles are filed. You may want to retain some anonymity for your officers by listing the principal office of the corporation as their business address.

Every two years, the secretary of state will send you a new statement to prepare and file. Failure to file this statement when required can result in penalties and can, eventually, lead to suspension of corporate powers by the secretary of state.

The California Secretary of State’s website allows you to fill in and file the domestic corporation statement online from your browser—if you use this online form preparation and filing method, you do not need to mail in your initial or biennial statements. Go to the state site to prepare and file this form online.

Most California public benefit corporations must register by filing an initial report and thereafter file annual reports with the California Attorney General, Charitable Trusts Section. Some California nonprofit corporations, however, are exempt from registration and reporting requirements—these include California religious nonprofit corporations and California public benefit nonprofits organized as hospitals or schools. All other 501(c)(3) California nonprofit corporations must file an initial and annual reports with the Attorney General’s Charitable Trusts Section. When a public benefit corporation files its articles, the secretary of state forwards a copy of the articles to the attorney general. The attorney general will send nonexempt groups an initial report form (Form CT-1) to complete and file, and an annual reporting form (RRF-1) to complete and file for the second and subsequent years of the corporation. (For more information on filing initial and annual reports, see “Attorney General Annual Periodic Report,” in Chapter 10.)

As noted above, in addition to religious groups, the following types of 501(c)(3) nonprofits should be exempt from initial and annual reporting with the attorney general. If you think you fit in one of these categories but have received a CT-1 form, call the attorney general’s office in Sacramento to see if you can establish your attorney general exemption.

• Schools. Educational organizations set up as formal schools with the institutional attributes (such as a regular faculty and curriculum, enrolled body of students, and established place of instruction) don’t have to file form CT-1 with the attorney general. Notice that this definition is more restrictive than the one used for qualifying for your federal tax exemption, and is basically the same as that which applies to schools for purposes of obtaining public charity status.

• Hospitals. The attorney general has a restrictive definition of hospitals. In addition to being the kind of charitable hospital that made it eligible for the federal tax exemption and public charity status, the hospital must be operated on a 24-hour-a-day basis and have a round-the-clock medical staff. Day or outpatient clinics or those that don’t have licensed practitioners regularly working at the clinic will not, in most cases, qualify for the exemption.

The California Attorney General’s Guide for Charities is a helpful guide for California nonprofits, as well as a source of information on the attorney general’s reporting and filing requirements. It also contains excellent summaries of the legal responsibilities and liabilities of nonprofit directors under California law, as well as practical information on fundraising, fiscal management, and other important nonprofit issues. We recommend all California nonprofits obtain a copy of this valuable sourcebook. This guide is available for viewing and downloading from the Attorney General’s Division of Charitable Trusts website, located at https://oag.ca.gov/charities/publications. The site also contains other informative publications of the Attorney General’s Office, including the Attorney General’s Guide to Charitable Solicitations plus the initial (CT-1) and ongoing (RRF-1) registration and reporting forms required to be filed with the Attorney General’s office. The guide is also available on the Nolo website.

If you have set up a membership corporation and have membership certificates, you will want to issue them to members after they have applied for membership in the corporation and paid any fees required by the membership provisions in your bylaws. The corporate president and secretary should sign each certificate before giving it to the member.

If you have ordered membership materials as part of a corporate kit, record each member’s name and address, together with the number of the certificate, in the membership roll in your corporate records book.