Appendix

Appendix

Real-World Examples

Now that you’ve learned the theory, studied the frameworks, and mastered the skills you need to deliver your expansion message, you’re probably wondering how these elements all come together in a real-world scenario. “Hmph!” we hear you grumble. “Might be nice to see what all this stuff looks like in the light of day.”

Happy to oblige!

In the pages that follow, you’ll see examples of two complete stories—messages developed within the applicable frameworks, together with supporting visuals, designed to be delivered in live meetings with existing customers.*

The first comes from our own archive (yes, we subscribe wholeheartedly to the “put your money where your mouth is” theory of business). The second is a message developed in partnership with a client for its sellers to deliver to their own customers.

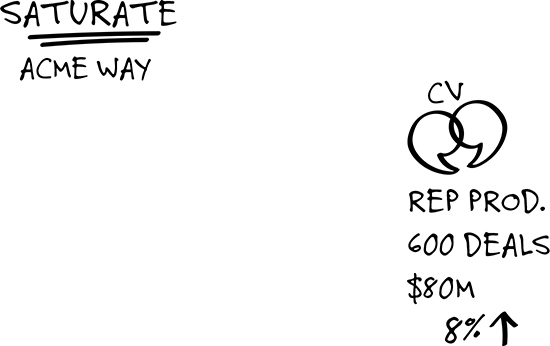

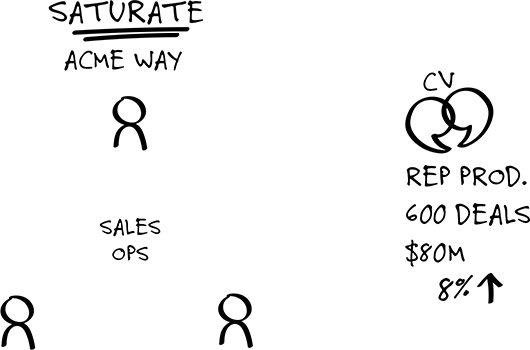

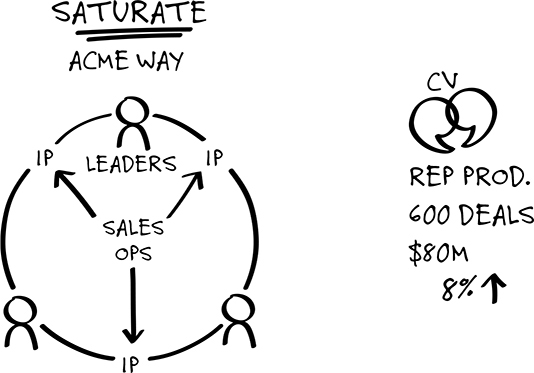

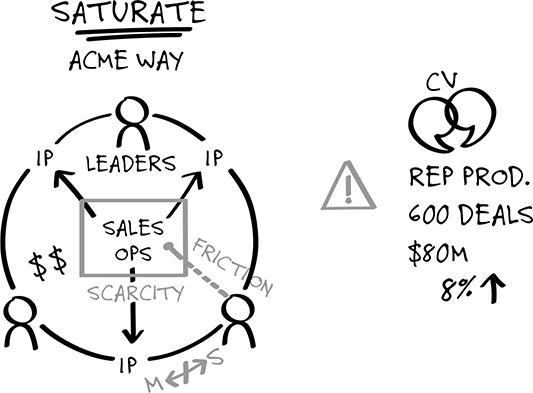

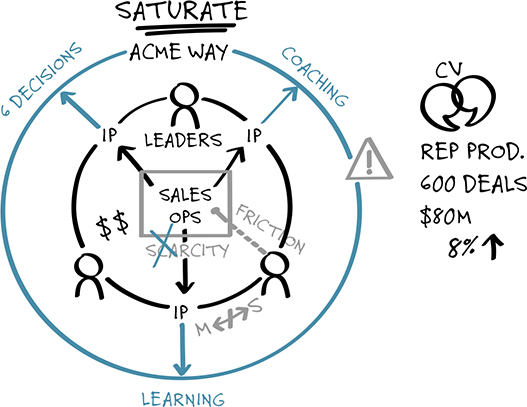

CORPORATE VISIONS WHY STAY (RENEWAL) MESSAGE FOR ACME CORPORATION

When Acme Corp., one of our longtime clients, was nearing the end of its contract term, we decided the best way to convince the company that our new (at the time) Why Stay message framework was valid was to use it to develop and deliver the renewal message.

And in case you’re wondering, the client did, in fact, renew the contract.

Here’s the story that won the renewal, and the corresponding simple, concrete visual to support that story. Review the story and the visual—then use the Why Stay planner to practice your own renewal message.

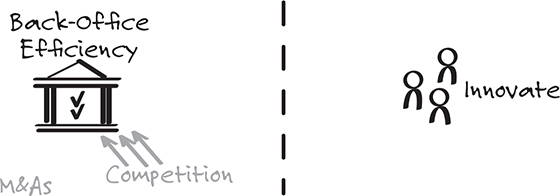

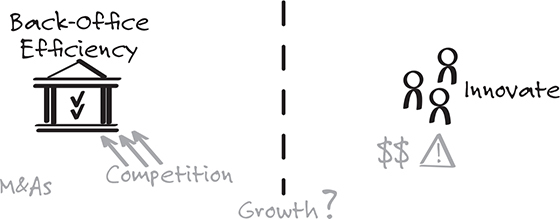

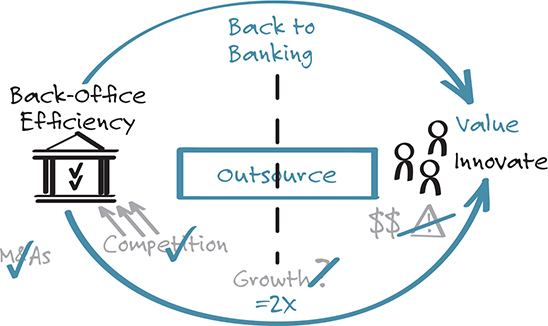

FINANCIAL SERVICES WHY EVOLVE MESSAGE

Another client, a firm that provides technology solutions and processing services to large banks, turned to us for help transitioning existing customers away from its on-premise software products to a full outsourcing arrangement. This message was tricky, because the client was also the provider of the on-premise software! And even though the new arrangement would be much more profitable for our client, its sellers were nervous about starting that conversation. This story supported the sellers’ situational fluency by giving them the framework of the message but also the space and coaching to insert client-specific detail and “reaction” questions to truly personalize the interaction.

Here’s the story they developed, and the corresponding visual.

* To protect our clients’ privacy, we’ve removed identifying details and renamed each company “Acme Corporation.”