Pounding the Paperwork

For a mortgage lender to make a proper assessment of your current financial situation, the lender needs details. Lots of them! Thus, mortgage lenders or brokers ask you to sign a form authorizing and permitting them to make inquiries of your

employer, the financial institutions that you do business with, the Internal Revenue Service, and so on.

Mortgage lenders provide you with an incredibly lengthy list of documents that they require with mortgage applications, including the following:

- Pay stubs, typically for the most recent 30 consecutive days

- Two most recent years’ W-2 forms

- Two most recent years’ federal income tax returns

- Signed IRS Form 4506-T Request for Transcript of Tax Return

- Year-to-date profit-and-loss statement and current balance sheet if you’re self-employed

- Copies of past two months’ bank, money market, and investment account statements

- Recent statements for all outstanding mortgages

- Copy of current declarations pages for homeowners insurance policies in force

- Home purchase contract (if you’re financing to buy a home)

- Rental agreements for all rental properties

- Divorce decrees

- Federal corporate tax returns for the past two years

- Partnership federal tax returns for the past two years

- Partnership K-1s for the last two years

- Condo or homeowners association documentation — such as CC&Rs, (covenants, conditions, and restrictions) bylaws, articles of incorporation, budget, reserve study, current regular assessment amount owed, if any, special assessments due now or approved for the future, if any, contact name, address, and phone number

- Title report, abstract, and survey

- Property inspection report and pest control inspection report (if you’re buying a home)

- Gift letter — the source of any funds being used toward your down payment must sign indicating that these funds are a “gift” and are not required to be repaid

- Receipts for deposits (if you’re buying a home)

Don’t despair at the length of the list. This list covers all possible situations, so some of the items won’t apply to you.

Still, you may rightfully ask, “Why do lenders require so much information?”

Most of the items on this laundry list are required to prove and substantiate your current financial status to the mortgage lender and, subsequently, to other organizations that may buy your loan in the future in the secondary mortgage market. Pay stubs, tax returns, and bank- and investment-account statements help to document your income and assets. Lenders assess the risk of lending you money and determine how much they can lend you based on these items.

If you’re wondering why lenders can’t take your word about the personal and confidential financial facts and figures, remember that some people don’t tell the truth. Lenders have no way of knowing who is honest and who isn’t. The unfortunate reality is that lenders have to assume that all their loan applicants may lie given the opportunity.

Even though lenders require all this myriad documentation, some buyers still falsify information. And some mortgage brokers, in their quest to close more loans and earn more commissions, even coach buyers to lie to qualify for a loan. One example of the way people cheat: Some self-employed people create bogus tax returns with inflated incomes. Although a few people have gotten away with such deception, we don’t recommend this wayward path. Also, lenders have become smarter, too, and now typically rely only on tax returns that they receive directly from the IRS or the state taxing authority.

If you can’t qualify for a mortgage without resorting to trickery, getting turned down is for your own good. Lenders have criteria to ensure that you’ll be able to repay the money you borrow and that you don’t get in over your head.

Falsifying loan documents is committing perjury — and fraud is not

in your best interests, even if you won’t get impeached for it. Mortgage lenders can catch you in your lies. How? Well, some mortgage lenders have you sign IRS Form 4506-T (Request for Transcript of Tax Return) — typically at the time you submit your loan application — that allows them to request directly from the IRS

copies of the actual tax returns that you filed with the IRS.

Falsifying loan documents is committing perjury — and fraud is not

in your best interests, even if you won’t get impeached for it. Mortgage lenders can catch you in your lies. How? Well, some mortgage lenders have you sign IRS Form 4506-T (Request for Transcript of Tax Return) — typically at the time you submit your loan application — that allows them to request directly from the IRS

copies of the actual tax returns that you filed with the IRS.

Besides the obvious legal objections, lying on your mortgage application can lead to your having more mortgage debt than you can really afford. If you’re short on a down payment, for example, alternatives are available (see Chapter 2

). If the down payment isn’t a problem but you lack the income to qualify for the loan, check out loans known as “No Doc” or NIVs (no income verification) or stated

income loans that don’t require documentation of income. Also, see Chapter 2

for other ideas on overcoming low income or credit problems.

Filling Out the Uniform Residential Loan Application

U.S. mortgage lenders and brokers use the Uniform Residential Loan Application to collect needed data about home purchases and proposed loans. Many lenders use this standardized document, known in the mortgage trade as Form 1003,

because they sell their mortgages to investors. When mortgage loans are resold, government organizations called Fannie Mae

and Freddie Mac

agree (if the mortgage loans meet federal standards) to guarantee the repayment of principal and interest, which makes it easier for lenders to sell the loans and more desirable for investors to buy them.

Some mortgage lenders may expect you to complete this form on your own. Other lenders and brokers help you fill out the form or even go so far as to complete it for you.

If you let someone fill out the Uniform Residential Loan Application for you, be sure

the information on the form is accurate and truthful. Ultimately, you’re

responsible for the accuracy and truthfulness of your application. Also be aware that, in their sales efforts, some mortgage lenders and brokers may invite you to their offices or invite themselves to your home or office to complete this form for you or with you. Although we have no problem with good service, we do want you to keep in mind that you’re not beholden or obligated to any lenders or brokers. It’s your money and your home purchase, so — as we discuss in Chapter 7

— be sure to shop around for a good loan officer or mortgage broker.

In the following sections, we explain the major elements on the Uniform Residential Loan Application.

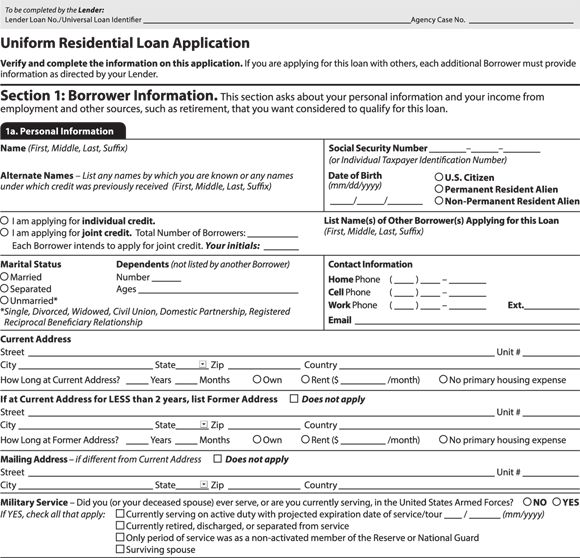

1. Borrower information

This section of the loan application (see Figure 10-1

) is where you begin to provide personal information about yourself as well as any co-borrower you’re buying with or currently own the property with. You also detail your employment and income sources in this lengthy and important section.

The lender also wants to know where you’ve been living recently. If you’ve been in your most recent housing situation for at least two years, you don’t need to list your prior residence. Lenders are primarily looking for stability here. Most lenders also request a letter from your landlord to verify that you’ve paid your rent in a timely fashion. If you’ve moved frequently in recent years, most lenders check with previous landlords. If your application is on the borderline, good references can tip the scales in your favor. If you’ve paid the amount you owed on time, you should be fine. If you haven’t, you should explain yourself, either by separate letter to the lender or in the blank space on Page 4 of the application.

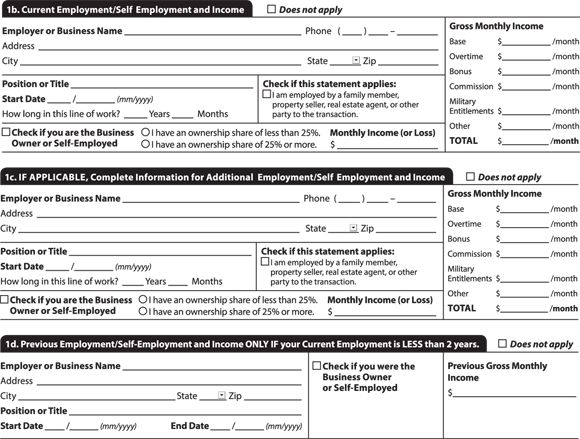

Your recent work history is important to a mortgage lender (Figure 10-2

). Unless you’re financially independent (wealthy) already, your lender knows that your employment income determines your ability to meet your monthly housing costs. As with your prior housing situation, lenders seek borrowers with stability, which

can help push a marginal application through the loan-approval channels. To lenders, recent stability of the borrower in where he lives, where he works, and the source and amount of his income translates into predictability or future stability, which results in lower risk.

If you’ve held your recent job for at least the past two years, that’s the only position you need to list (unless you currently work more than one job, in which case you should list all current jobs separately). Otherwise, you must list your prior employment to cover the past two-year period.

We know that, in this ever-changing economy, some people change jobs fairly frequently and not always out of personal choice. Perhaps you’ve held a position for only a few months (or less) and feel it would make your loan application look more attractive to simply leave the position off your forms. Others, who have had gaps in their employment, either because they took advantage of changing jobs to engage in other activities or because it took some time to find a suitable new position, may be tempted to discreetly gloss over gaps in employment.

What do we advise? Well, our overall perspective is that a mortgage application is somewhat like a résumé. You should absolutely present your information in a positive and truthful way. It’s better to show the employment gap than to have the lenders uncover it, which they can do because they often ask for the dates of your employment when verifying information with your employers.

What do we advise? Well, our overall perspective is that a mortgage application is somewhat like a résumé. You should absolutely present your information in a positive and truthful way. It’s better to show the employment gap than to have the lenders uncover it, which they can do because they often ask for the dates of your employment when verifying information with your employers.

As for leaving off a short-term or part-time job, the choice is up to you. This section of the application doesn’t state that you must list every position.

Remember that lenders don’t mind some job hopping. If they see frequent job changes, then the prospects for continued employment

section of the verification-of-employment request

that your current employer receives from the lender will be more important.

This section of the application also asks that you list the monthly income from prior jobs. You don’t provide your monthly income from your current job here because it’s provided in the next section of the application.

You may also wonder (and be concerned about) why the lender wants your current and previous employers’ phone numbers. Shortly before your loan is ready to close, the lender may call your current employer to verify that you’re still employed, but verification of employment is usually done through current pay stubs and W-2s.

It’s highly unlikely that lenders will call your previous employers unless they need to verify an outstanding question about employment dates or similar information.

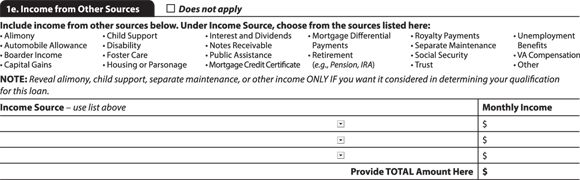

If you have other income sources, such as child support or alimony, list and describe them in the last portion of this section (see Figure 10-3

). The more income you can list, the more likely you are to qualify for a mortgage with the most favorable terms for you. (To ensure that you “get credit” for child support or alimony payments received, you must be able to prove receipt of the funds. This requirement can get sticky because the ex-spouse may be asked to provide a canceled check. See, there’s a good reason to remain on good terms with your ex.)

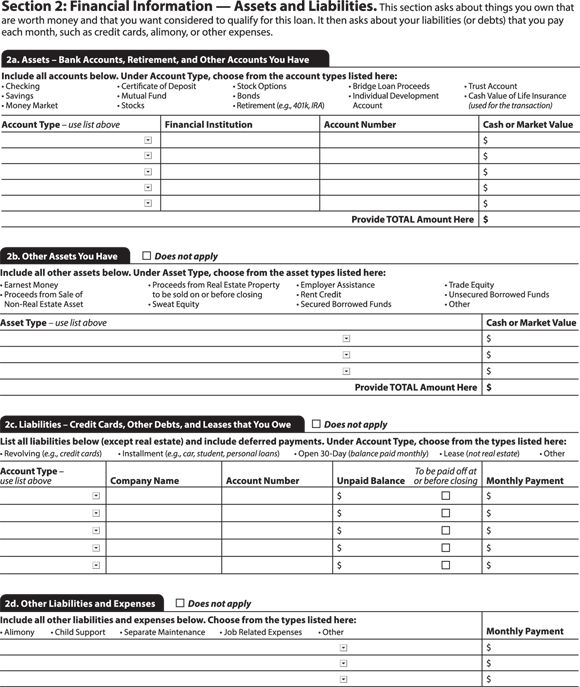

2. Financial information — assets and liabilities

In Section 2 (see Figure 10-4

), you present your personal balance sheet, which summarizes your assets and liabilities. Your assets

include bank checking and savings accounts, money market funds, retirement accounts, and other accounts you have.

Liabilities

are any loans or debts you have outstanding. The more of these financial obligations you have, the more unwilling a mortgage lender is to lend you a large amount of money.

If you have the cash available to pay off high-cost consumer loans, such as credit card and charge card balances and auto or other consumer loans, consider doing so now (note the box you can check off indicating you intend to pay off certain loans before closing). These debts generally carry high interest rates that aren’t tax deductible, and they hurt your chances of qualifying for a mortgage (see Chapters 2

and 3

for an explanation of this matter). When paying off credit cards (revolving accounts), we suggest not closing them without first discussing it with your loan officer. Closing accounts can hurt your credit score in the short term.

Note (in the last part of this section) that you are to list child support and alimony payments that you make as well as out-of-pocket expenses related to your job if you aren’t self-employed. These monthly expenses are like debts in the sense that they require monthly feeding.

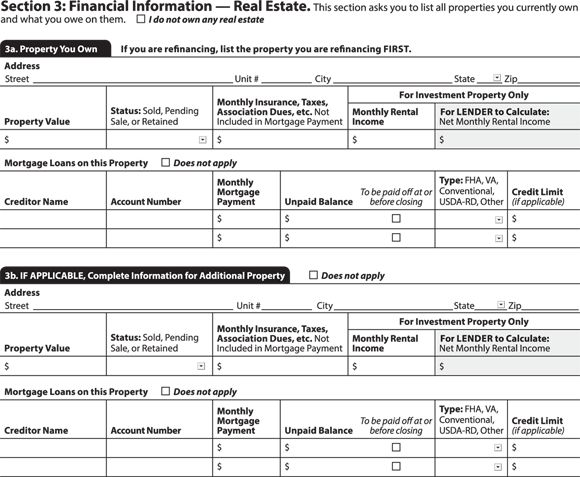

3. Financial information — real estate

Section 3 (see Figure 10-5

) continues over onto Page 4 and includes space for the details of real estate you already own. If you still own a home and are trying to sell it or have an offer on it but that transaction is pending, you should list that property in this section. This is where you also include any second home or rental income properties.

If you make a profit from such holdings, that profit can help your chances of qualifying for other mortgages. Conversely, negative cash flow

(property expenses exceeding income) from rentals reduces the amount that a mortgage lender will lend you. Most mortgage lenders want a copy of your tax return (and possibly copies of your rental agreements with tenants) to substantiate the information you enter in this space. Investment real estate is often owned in separate legal entities for tax and reduced liability purposes, so be prepared to provide your personal tax return, including the IRS form 1065 (Schedule K-1) for each of your real estate holdings.

Net monthly rental income

(which lenders now calculate) refers to the difference between your rental real estate’s monthly rents and expenses (excluding depreciation). Rental property

is any property that you’ve bought for the purpose of renting it out. Therefore, net monthly rental income

is the profit or loss that you make each month on rental property (excluding depreciation). If you’ve recently purchased the rental property, the lender counts only 75 percent of the current rent that you’re collecting. If you’ve held your rental property long enough to complete a tax return, most lenders use the profit or loss (excluding depreciation) reported on your tax return.

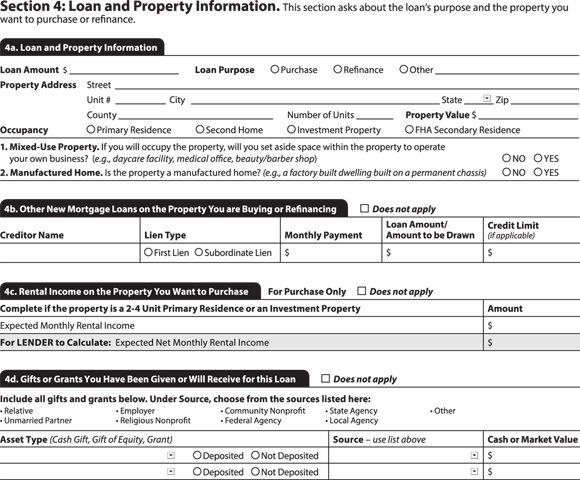

4. Loan and property information

The information you include in the Loan purpose

section (see Figure 10-6

) indicates to the lender whether you plan to use the mortgage to buy a home, refinance an existing loan, or something else like construct a new home. Mortgage lenders and the investors who ultimately buy these types of mortgages want to know why you want to borrow money. So, in this section, you provide the address and the property value (usually the purchase price if you’re buying the home).

The lender also wants to know whether the property is your primary or secondary residence or is an investment property (in this section, you also estimate expected rental income). Your answers to these questions determine which loans your property is eligible for and the terms of the loans. From a lender’s perspective, construction loans (which are usually short-term loans) and investment-property loans are riskier and therefore cost you more than other loans.

You may be tempted (and some mortgage brokers and lender representatives have also been tempted) to lie on this part of the mortgage application to obtain more favorable loan terms. Be aware that lenders can — and sometimes do — challenge you to prove that you’re going to live in the property if they suspect otherwise. Even after closing on a purchase and their loan, lenders have been known to ask for proof — such as a copy of a utility bill in your name — that you’re living in the property. Some lenders have even been known to send a representative around to knock on the borrower’s door to see who’s living in the property. (Lender’s only really require proof of owner-occupancy at the time of the loan closing and possibly a short time thereafter, but they don’t care if months later the borrower relocates and uses the property as an income property.)

You may be tempted (and some mortgage brokers and lender representatives have also been tempted) to lie on this part of the mortgage application to obtain more favorable loan terms. Be aware that lenders can — and sometimes do — challenge you to prove that you’re going to live in the property if they suspect otherwise. Even after closing on a purchase and their loan, lenders have been known to ask for proof — such as a copy of a utility bill in your name — that you’re living in the property. Some lenders have even been known to send a representative around to knock on the borrower’s door to see who’s living in the property. (Lender’s only really require proof of owner-occupancy at the time of the loan closing and possibly a short time thereafter, but they don’t care if months later the borrower relocates and uses the property as an income property.)

To ensure that the money for your down payment and closing costs isn’t coming from another loan that may ultimately overburden your ability to repay the money they’re lending you, mortgage lenders want to know the source of funds for your down payment and closing costs. Ideally, lenders want to see the down payment

and closing costs coming from your personal savings. Tell the truth — lenders have many ways to trip you up in your lies here. For example, they ask to see the last several months of your bank or investment account statements to verify, for example, that someone else, such as a benevolent relative, didn’t give you the money last week.

If you’re receiving money from a relative as a gift to be used toward the down payment, have the gift giver write a short note (your broker/lender can provide a standardized gift letter) confirming that the money is indeed a present that you do not

have to repay. Lenders are often suspicious that such payments are loans that must be repaid and that will add to your debt burden and risk of default. But in recent years, it has become so much more difficult for younger people to buy homes that it’s quite common for parents and relatives to offer “no repayment required” funds to family members seeking to purchase their first condo or starter home.

If you’re receiving money from a relative as a gift to be used toward the down payment, have the gift giver write a short note (your broker/lender can provide a standardized gift letter) confirming that the money is indeed a present that you do not

have to repay. Lenders are often suspicious that such payments are loans that must be repaid and that will add to your debt burden and risk of default. But in recent years, it has become so much more difficult for younger people to buy homes that it’s quite common for parents and relatives to offer “no repayment required” funds to family members seeking to purchase their first condo or starter home.

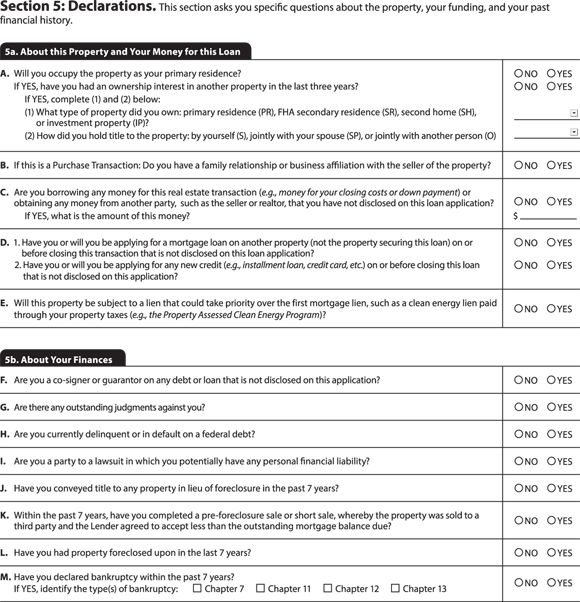

5. Declarations

Figure 10-7

shows what this section looks like. Many of these questions are potential red flags to lenders or designed to see whether you’re giving answers consistent with the rest of your application.

If one of your answers in this section is likely to raise a red flag, then be sure to attach an explanation that honestly provides lenders with the background and details so they understand whether any negative situations were likely unusual or one-time events. Often showing how you dealt with unexpected challenges in life head-on, without making excuses, can be a positive aspect in the overall evaluation of your loan application.

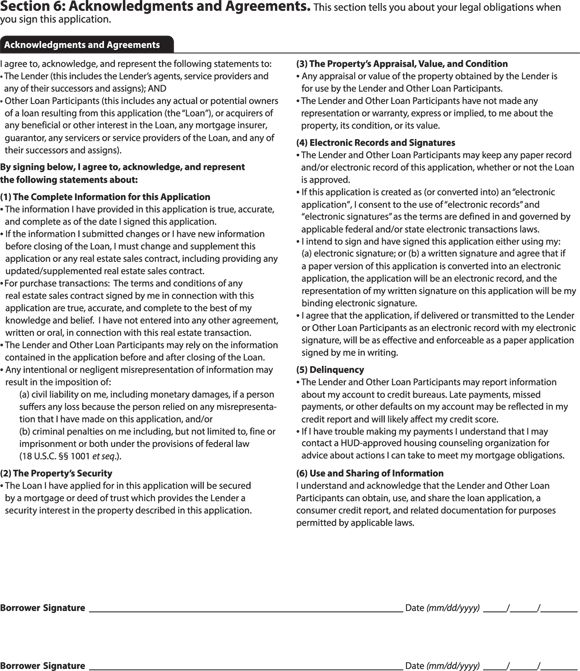

6. Acknowledgments and agreements

If you haven’t been honest on this form, here’s your last chance to rethink what you’re doing (see Figure 10-8

). Remember, these days with the advent of “big data” and electronic records for everything we do financially, there is no such thing as getting away with misleading or lying in your loan application. The best policy is full and complete disclosure and transparency. Lenders know that almost everyone has one or more issues with his credit or employment or living situations, so be upfront and offer any details that may give lenders a comfort level with what happened and why you’re a good risk for the pending loan.

If you’ve had a mortgage broker (or anyone else) help you with this application, be sure to review the answers he provided for accuracy before you sign the agreement. Now is the time to ask yourself questions (and to review your responses) to ensure that you’ve presented your information in a positive but truthful light.

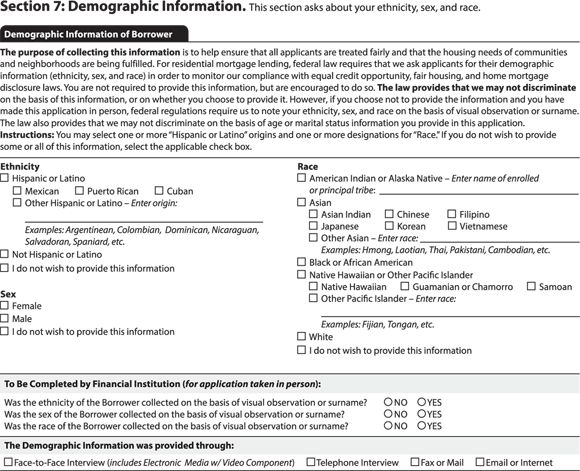

7. Demographic information

You may refuse to answer the questions in this section (see Figure 10-9

) if you want to — this information isn’t required.

The federal government tracks the ethnicity and gender of borrowers to see (among other things) whether lenders discriminate against certain people.

Introducing Other Typical Documents

All mortgage lenders and brokers have their own, individualized package of documents for you to complete. The following sections introduce some of the other common forms that you’re likely to encounter.

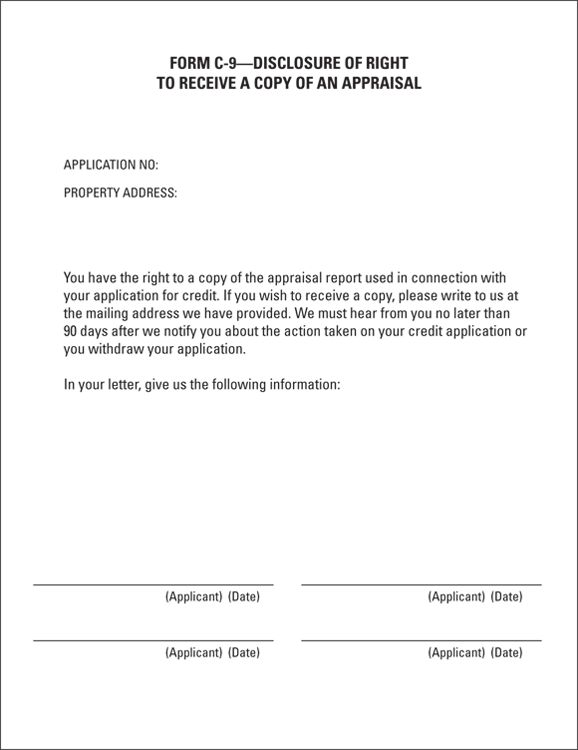

Your right to receive a copy of the appraisal

It wasn’t always the case, but you now have the right to receive a copy of the appraisal report if you paid for it. To make sure you know this, the government requires that mortgage lenders and brokers give you a written notice of your right to receive a copy of the appraisal report. (See Figure 10-10

.)

Despite the fact that the notice tells you to make your request in writing, try making the request verbally to save yourself time. Then, if your request is ignored, go to the hassle of submitting a written request for your appraisal (within 90 days of the rendering of a decision to approve or reject your loan). Appraisals are good to have in your files — you never know when an appraisal may come in handy. At the very least, you can see what properties were used as comparables to yours to discover how good or bad the appraisal is.

Having an appraisal handy could be very helpful in the future if you ever feel that your property value has declined and your property taxes are based on a formula that relies on the current value of your home. Again, looking at those comparable properties used in the original appraisal and learning that they recently resold for a lower price than the property tax assessor claims your home is currently worth can be a great basis to appeal your property taxes.

Also, having the details of your home (lot size, square footage, amenities, and so on) handy in that appraisal can help you find other properties that may have recently sold in your area for lower prices and therefore are invaluable because the tax assessor will want you to prove that the stated value of your home should be lower for property tax calculation purposes.

Equal Credit Opportunity Act

It is a matter of federal law that a mortgage lender may not reject your loan because of nonfinancial personal characteristics such as race, gender, marital status, age, and so forth. You also don’t have to disclose income (alimony) that you receive as a result of being divorced. (We think, however, that disclosing such income is in your best interests, because that income may help get your loan approved.)

If you have reason to believe that a mortgage lender is discriminating against you, contact and file a complaint with the state department of financial institutions, Department or Bureau of Real Estate, or whatever government division regulates mortgage lenders in your state. And start hunting around for a better, more ethical lender.

Complying with paperwork requests

Complying with paperwork requests

Filling out the Uniform Residential Loan Application

Filling out the Uniform Residential Loan Application

Understanding other documents in the process

Understanding other documents in the process

Falsifying loan documents is committing perjury — and fraud is not

in your best interests, even if you won’t get impeached for it. Mortgage lenders can catch you in your lies. How? Well, some mortgage lenders have you sign IRS Form 4506-T (Request for Transcript of Tax Return) — typically at the time you submit your loan application — that allows them to request directly from the IRS

copies of the actual tax returns that you filed with the IRS.

Falsifying loan documents is committing perjury — and fraud is not

in your best interests, even if you won’t get impeached for it. Mortgage lenders can catch you in your lies. How? Well, some mortgage lenders have you sign IRS Form 4506-T (Request for Transcript of Tax Return) — typically at the time you submit your loan application — that allows them to request directly from the IRS

copies of the actual tax returns that you filed with the IRS.

What do we advise? Well, our overall perspective is that a mortgage application is somewhat like a résumé. You should absolutely present your information in a positive and truthful way. It’s better to show the employment gap than to have the lenders uncover it, which they can do because they often ask for the dates of your employment when verifying information with your employers.

What do we advise? Well, our overall perspective is that a mortgage application is somewhat like a résumé. You should absolutely present your information in a positive and truthful way. It’s better to show the employment gap than to have the lenders uncover it, which they can do because they often ask for the dates of your employment when verifying information with your employers.