On many occasions, I have been asked whether it makes sense to invest in a 99-year leasehold condominium. The short answer I usually give is this: “If you are in it for the rental yields, by all means invest in one.” In general, 99-year leasehold residential units fetch 3 to 5 per cent per annum yields as opposed to 2 to 4 per cent yields for freehold residential units — this is a one percentage point difference.

So what does this mean, specifically? Yield, in its most simple and loose form, is defined as the annual rental income divided by the price of purchase. Based on this broad definition, why would a 99-year leasehold condominium provide a better yield? Is the rental income higher? Or is the price (or capital value) lower?

In my experience, prospective tenants almost never ask this question when looking around for apartments to lease for, say, two to three years: “Is this property a freehold property?”

Rightly so. They are interested in the product factors, such as the facilities available, transportation infrastructure for ease of getting to work and schools, amenities in the neighbourhood, the prestige and reputation of the development, the size and rental price of the apartment, the quality of maintenance and upkeep. The lease tenure of the land is not of concern to them. This implies that if the product factors are equal for a 99-year leasehold apartment and a freehold apartment, the rental values should be exactly the same for both properties. Therefore the higher yield that one can obtain from a 99-year leasehold apartment would be due to a lower capital value.

As a general rule of thumb, I have long been applying a 20- to 25-per cent discount to 99-year leasehold residential properties in comparison to similar freehold ones. The one percentage point difference in rental yields translates to about around this level of discount.

We have grouped all the various land titles, such as Freehold, Estate in Fee Simple, Estate in Perpetuity and Statutory Land Grant, under the catch-all term ‘freehold’ because the differences between these titles are very fine and their values are exactly the same. As for 999-year properties, their values are not far different from that of freehold, and if the remaining lease runs into several hundred years, banks will not impose limits on the loan period (in such cases, loan periods are more likely limited by the age of the borrowers). Therefore, for purposes of this article and general discussions about real estate values, 999-year leasehold values are taken to be the same as freehold land values.

When a developer purchases a piece of residential land through the government land sales programme, the countdown begins for the 99-year lease. By simple logic, if the whole world remained constant and land values across Singapore remained flat for the next 100 years, then the land value of a 99-year leasehold condominium must depreciate by about 1 per cent a year. This is because at the end of the 99-year period, the land has to be returned to the landlord (the government).

Therefore, all else being equal — location, product quality, specifications, facilities, etc — a 25-year-old condominium on a 99-year leasehold land will trade at 25 per cent lower price than a 25-year-old condominium that sits on a freehold land. This is due to the depreciating value of the 99-year leasehold land even if the value of the buildings and facilities on both pieces of land depreciated at the same rate.

Near to the time when the 99-year lease expires, the owners of the condominium might have to demolish the buildings and reinstate the land to original condition “if so required by the lessor”. The ‘lessor’ or landlord is the government body (for example, the Urban Redevelopment Authority or Housing Development Board) that sold the land 99 years earlier. Therefore, if the government so requests, condominium owners will have to bear demolition and ‘make good’ costs — tearing down the buildings, excavating the underground carpark, filling the land, planting grass and restoring environmental conditions to the field.

As the government will only take a decision at the end of the 99-year period, current investors of condominiums will not know whether such costs will be incurred in the future. In any case, the costs will be collectively borne by all the subsidiary proprietors of the condominium block and the remaining sinking funds may or may not need to be supplemented by contributions. And while demolitions of buildings and removing debris are costly, they are not as costly as excavations of underground carparks and surface level swimming pools, re-filling the deep hole and restoring the land to environmentally acceptable standards (for example, there should not be traces of chemicals used in the swimming pool in the reinstated land). Condominiums and houses with a few years of lease remaining could start to plan for some reserves to cover possible reinstatement costs.

But we have many more years to go before we need worry about that issue because the oldest 99-year leasehold condominiums and houses have at least 30 more years of lease to run. For example, the semi-detached cluster at Jalan Bangket in Mayfair Park, near Rifle Range Road, have 40 years of lease left, having started their 99-year lease from March 1952.

In recent years, there have been some properties where the underlying title of the land is freehold and the landowner had sold the land to developers on a 99-year or a 103-year leasehold to build condominiums or cluster houses. Investors looking at such properties should check the fine print in the terms and conditions carefully. There should be clauses relating to how the landowner might expect the land to be returned at the end of the lease period.

To drive home the point about the difference in value between 99-year leasehold and freehold properties, I usually quote the examples of Southaven 1 and Southaven 2 located on the same street at 41 and 31 Hindhede Walk respectively. Both projects were developed by Ho Bee Group in the late 1990s and share many similar characteristics in terms of facilities, build quality, materials used, size of apartments, etc. They also share a perimeter fence (see Table 19). They were launched for sale a few months apart in the first half of 1995.

Data from URA Realis reveals 38 transactions of Southaven 1 in 1995, the first year of its launch. The average dollar per sq ft transacted was $635. In comparison, there were 80 transactions of Southaven 2 in 1995 and the average dollar per sq ft of these transactions was $689. This represented an 8.5 per cent price discount that the market deemed acceptable in 1995 for a 999-year leasehold condominium (whose value is almost exactly the same as a freehold condominium).

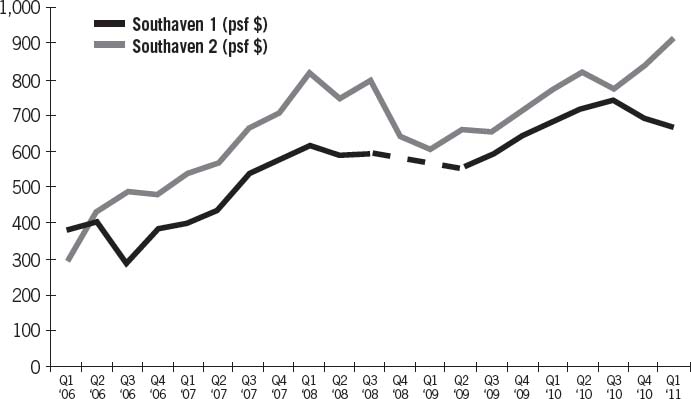

Today, the lease remaining on Southaven 1 is about 82 years while that for Southaven 2 is 865 years. Within the last five years, from January 2006 up to March 2011 (1Q 2006 to 1Q 2011), we can see from Figure 14 that the dollar per sq ft value of Southaven 1 has been consistently below that of Southaven 2. The average per sq ft price difference in the last five years was a 16 per cent discount for the 99-year leasehold Southaven 1.

Table 19 Comparing Southaven 1 and Southaven 2

|

Southaven 1 (41 Hindhede Walk) |

Southaven 2 (31 Hindhede Walk) |

Land tenure |

99 years from 1 August 1994 |

999 years from 21 June 1877 |

Facilities |

One tennis court, swimming pools, playground, BBQ pits, sauna, clubhouse, reading room |

Two tennis courts, swimming pools, playground, BBQ pits, sauna, clubhouse, reading room, table tennis room, mini-mart |

Number of apartments |

157 |

293 |

Number of floors |

10 |

10 |

Year completed |

September 1997 |

January 1999 |

(Sources: IPA, URA Realis)

Entrance to Southaven 1 and Southaven 2

Figure 14 Per sq ft prices of Southaven 1 and Southaven 2

(Sources: IPA, URA Realis)

Well the comparisons are not exactly between apples and apples because the number of transactions in each quarter in the last five years was not consistent throughout. For example, in the first quarter of 2006, there were only two transactions for Southaven 1, and the single transaction for Southaven 2 was for an exceptionally attractively priced 5,500 sq ft penthouse unit with roof terrace (at $1.6 million!) And then in the fourth quarter of 2008 and the first quarter of 2009, there were no transactions for Southaven 1 (see Table 20).

The data set is thin, complicated by the very low number of transactions in some periods. Furthermore, not all investors file a caveat for their purchases, so the total number of transactions on record are not as many as we would have liked. There are 450 units in both developments combined but only 498 transactions reflected in URA Realis data since 1995 to 22 March 2011. Looking at this, there is no way we can perform more complex analysis and test for the quality and soundness of the result.

However, I believe that what we have here is good clear evidence that there is a discount for 99-year leasehold properties: Southaven 1, which has 17 years expired lease, has been trading at a five-year average discount of 16 per cent to the close-to-freehold Southaven 2.

The highest residential property price on record (based on data from URA Realis) on a dollar per sq ft basis is a 3,003 sq ft unit on the 16th floor of The Marq on Paterson Hill. It was transacted at $5,262 psf ($15.8 million) in September 2007. The Marq is a freehold condominium.

Table 20 Transactions and price discounts per quarter

|

Southaven 1 |

Southaven 2 |

Price discount |

Q1 2006 |

2 |

1 |

-29% |

Q2 2006 |

1 |

6 |

6% |

Q3 2006 |

1 |

4 |

42% |

Q4 2006 |

2 |

6 |

20% |

Q1 2007 |

5 |

4 |

25% |

Q2 2007 |

6 |

9 |

24% |

Q3 2007 |

3 |

4 |

19% |

Q4 2007 |

3 |

3 |

19% |

Q1 2008 |

2 |

6 |

25% |

Q2 2008 |

4 |

2 |

21% |

Q3 2008 |

2 |

2 |

26% |

Q4 2008 |

0 |

2 |

n.a. |

Q1 2009 |

0 |

2 |

n.a. |

Q2 2009 |

2 |

6 |

16% |

Q3 2009 |

1 |

8 |

9% |

Q4 2009 |

6 |

5 |

10% |

Q1 2010 |

2 |

8 |

13% |

Q2 2010 |

3 |

5 |

12% |

Q3 2010 |

2 |

4 |

4% |

Q4 2010 |

2 |

9 |

17% |

Q1 2011 |

1 |

2 |

27% |

|

Five-year average price difference |

16% |

|

(Sources: IPA, URA Realis)

Almost 30 storeys higher at the nearby The Orchard Residences above the ION shopping mall, another luxury residential unit of 4,273 sq ft traded at $5,000 psf in July 2007. Its 99-year lease began on 13 March 2006 and it was sold for $21.4 million in 2007.

Both transactions were two months apart and took place during a period when Singapore’s residential index was rising at probably its fastest pace in a decade. The discount of the most expensive 99-year leasehold condominium at $5,000 psf to the most expensive freehold condominium at $5,262 psf was 5 per cent in 1997.

An additional point of note regarding prices in the Southaven examples: when the market is bullish and property prices trend up, whether a property is 99-year leasehold or freehold, it will trend up.

We can draw several conclusions and consequences from the above discourse:

1. Due to the gradual depreciation of land value towards zero value (or negative value if demolition costs are to be incurred) at the end of a 99-year lease term, high net worth families do not invest in 99-year leasehold condominiums for the purpose of multi-generation wealth preservation.

2. Investors interested in yields and capital appreciation could do well with 99-year leasehold condominiums because of the higher yields (3 to 5 per cent per annum) from rental returns. When the property market rises, 99-year leasehold condominiums rise in value in tandem with freehold condominiums, even though depreciation is gradually forcing values down.

3. It is therefore important to select good investment quality 99-year leasehold properties by narrowing down to those in the best locations and those that are very well maintained after completion. Properties before completion present higher risks to investors because we cannot see the quality of the finishing and how well the common areas will be maintained.

4. Based on the above, if an investor comes across two investment opportunities next to each other — one a freehold residential condominium and the other a 99-year leasehold condominium, and the freehold one is going for a lower dollar per sq ft price than the leasehold one — my advice would be to select the freehold condominium.

This article has merely attempted to deal with the value differences between 99-year leasehold properties and freehold properties. We have not covered the various investment approaches associated with each of them. While this discussion might not be adequate enough to help you make a quick investment decision, I believe it highlights the key issues that will help you make a better-informed decision.