Chapter 23

Other Assets

I got a lot of stuff from people I loved. When I used to pass the blue glass bowl, on some level I was reconnected with my grandmother’s living room, and to the way her hair smelled. At my tag sale, it wasn’t easy watching people look at my things so coldly. I even found myself wondering what kind of homes things like the bowl were going to live in. But you know, I got through it—and the people I care about are still with me, inside. I mean, it’s only things, you know?

—Clara T.

Short of a sale, personal assets such as term bank accounts, stocks and bonds, and personal property such as antiques, art, and jewelry are not generally considered a source of cash. However, there are other alternatives to accessing cash based on these assets. Even if you decide to sell a personal item, preparing ahead can maximize the amount you receive.

Section 1. Certificates of Deposit and Other Term Bank Accounts as Collateral for a Loan

Any certificates of deposit and other bank accounts that include a penalty for withdrawing funds before a certain date may be used prior to maturity as collateral for a low-interest loan. These loans are available, generally without fees, from commercial lenders—particularly from the bank that issued the certificate of deposit or holds the bank account.

Section 2. Stocks and Bonds as Collateral for a Loan

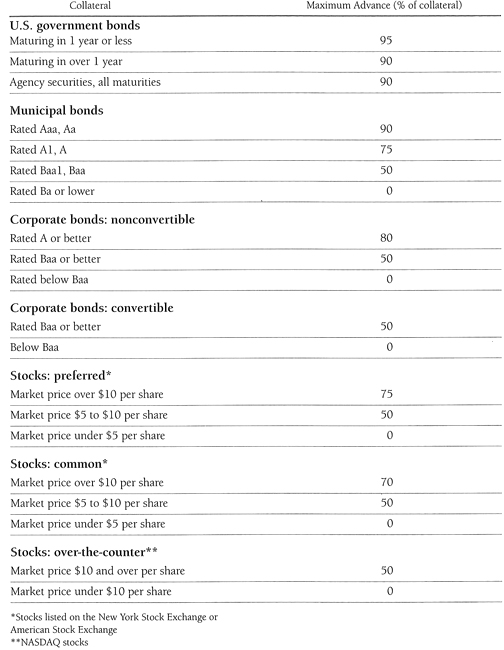

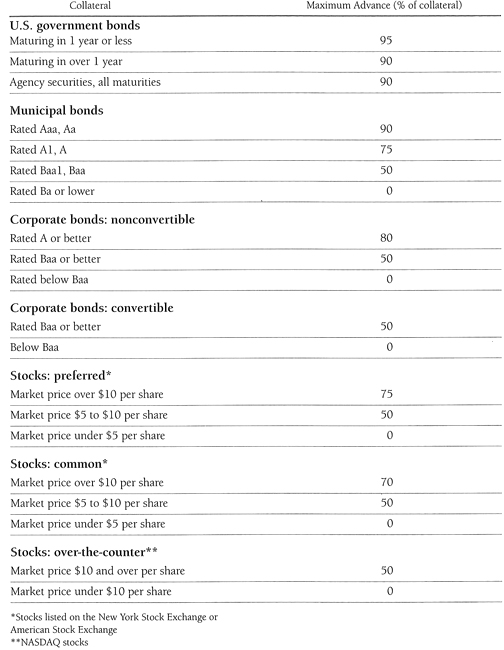

The use of stocks and bonds as security for loans from commercial lenders such as banks or securities brokerage firms is regulated by the federal government. The regulations concern the amount that can be loaned, as well as the permitted type of security.

The stocks and bonds must be freely salable and unrestricted. If the stocks are listed on the New York or American Stock Exchanges, they must have a market value of $5 or more per share. If they are over-the-counter stocks, the market value must be $10 or more per share. The terms for the loan, such as interest rates, fees, and other matters, are determined by the lender.

The guidelines for the maximum that can be advanced are listed here.

For any other stocks and bonds, or to secure a loan in a greater amount than permitted by commercial lenders, you will need to locate a friend or relative willing to make the loan.

Section 3. Personal Property as Collateral for a Loan

Banks and other commercial lenders. If you have personal property with substantial value, such as important artwork, jewelry, or silver, a commercial lender may allow their use as collateral for a loan. Do not be surprised if the lender insists on taking possession of the property until the loan is paid off.

Tip. If you own a house, it is sometimes possible to add personal property to the value of the house when obtaining a loan against real estate. This permits an increase in the size of the loan, and the deductible interest.

Auction houses. Some auction companies have programs that will lend money against the collateral of personal assets. In these instances, the borrower is usually permitted to retain possession of the art, antiques, furniture, or jewelry. There is a catch: the auction houses usually insist that you agree to sell the assets through the auction house after your demise.

Pawnbrokers, also known as collateral loan brokers. While they seem to be rapidly disappearing from our landscape, pawnbrokers can be useful if your need for cash is short-term. Pawnbrokers generally loan money collateralized by personal property for a short time, such as three to six months, subject to high interest rates.

Generally under strict state licensing requirements, the pawnbroker takes possession of your items and gives you the money and a memorandum, note, or ticket that contains the substance of the arrangement. Unlike other collateralized loans, the holder of the memorandum or note is presumed to be the person entitled to redeem the articles pledged as collateral, so the ticket has to be carefully guarded.

If after the time specified the articles have not been reclaimed by repayment of the loan plus interest, the pawnbroker has the right to sell the pawned items. If the sale results in a profit to the pawnbroker over and above the principal plus interest and fees, the borrower generally has a period of time in which to claim this profit. The ticketholder may generally redeem the pledged articles at any time prior to the sale.

Tip. Don’t be surprised if a pawnbroker asks to fingerprint you. To prevent pawnbrokers from being used as an outlet for stolen goods, many states require fingerprinting.

Personal loans. There are generally no restrictions or rules concerning use of personal property for loans by friends or relatives, except that the interest rate agreed upon may not exceed the state’s usury laws.

Section 4. Selling Personal Property

4.1 Prepare Well in Advance

If you decide to sell, do not wait until matters reach the emergency stage when immediate need reduces bargaining power.

If selling your own items is too difficult, ask a friend or relative to handle it for you, for a fee if necessary.

Be sure to know the value of any items you decide to sell. You can take photos of the items or take the items themselves to expert dealers for their opinion. Auction houses will also give you an idea of value.

If you want a valuation, but don’t know an appraiser, you can locate one through the American Society of Appraisers (703-620-3838), the Antique Appraisal Association of America (714-530-7090), or the International Society of Appraisers (708-882-0706). Of course, because of the conflict of interest, do not rely on a dealer’s opinion of value when you are considering selling the item to the dealer.

Tip. Do not feel that you have to sell your items locally. If you live in a rural area, it may be worth taking or shipping your items to an urban area where the demand and the prices are likely to be greater.

4.2 Alternative Places to Consider for Selling Personal Property

Auction houses. An auction house conducts a public sale at which items are sold to the highest bidder. Sellers are allowed to set a minimum (a reserve). If there are no bids above the minimum, the goods are returned to the seller. The auctioneer’s fee is usually a percentage of the sale price—ranging from 5 to 25 percent.

Consider

• the reputation of the auction house.

• if the items are appropriate for the auctioneer’s expertise as well as the type of buyers who generally attend the auctions. For example, you would not want to auction world-class art at a small-town auction house. The auction house should specialize in the type of items you want to sell.

• what other items will be included in the auction. You do not want to be part of a sale in which your items are likely to be the most expensive or incompatible with the rest. Be in a sale that attracts bidders interested in the type of items you are selling.

• whether and how the auction house will advertise the sale and whether a catalog will be printed.

• whether the auction house picks up the items or you must deliver them.

Tip. Check to be sure the auctioneer carries appropriate insurance on the property while in its possession—or that you do.

Consignment. Consignment is when you give your property to a professional (usually a shopkeeper) to sell for you for a fee. The two of you together set the offering price and the minimum you will accept. The shop owner retains a percentage of the sale price, generally 20 percent, but it can range as high as 60 percent. If a sale doesn’t occur within the time you and the dealer set, the items are returned to you.

Tip. Generally when goods are in a shop on consignment, the owner is obligated to keep them insured. Verify that the dealer has this coverage.

Selling items yourself. There are many alternatives for selling personal items yourself including a garage or yard sale, a tag sale in your house, setting up a table at a flea market, renting a booth in a coop collectibles store, setting up a table at a collectibles show, or through the Internet.

If you’re going to conduct a yard or garage sale, find out if any local regulations govern such sales, and check that your liability insurance covers potential purchasers coming onto your premises.

If you so desire, professionals will conduct a tag sale for you.

An excellent resource for tips in maximizing the effectiveness of a sale is Flea by Sheila Zubrod and David Stern (HarperCollins Publishers, 1997).

Sell to dealers. The fastest way to sell personal items is to dealers—whether you take the items to their stores or ask them to visit your premises. You can expect a low price for the items since the dealers will be looking to purchase at the equivalent of wholesale so they can make a profit when they sell at retail.

Tip. Before selling any item, take into consideration the taxable gain or deductible loss.

Section 5. Charitable Donations

Another alternative to consider is giving personal property as a gift to charity and thereby freeing up money by reducing income or estate taxes.

Gifts can be made outright or through the use of different types of trusts, such as a “charitable remainder trust,” in which the person who sets up the trust has the right to keep and use the assets for life, and the assets automatically pass to the charity on the person’s demise. If this is of interest, speak with your tax adviser. Perhaps the charity of your choice has the ability to advise you. If so, check its advice with your tax adviser.