As the primary investment candidate in the retail tea sector, DavidsTea is worthy of investigation, even though on most of our criteria it turns out to be negative.

Unfortunately, in searching for the next buy-and-pretty-much-forget investment, we’re going to reject far more companies than we will accept. Including companies such as DavidsTea that on first impression appear promising, but on further investigation fail on too many of our criteria.

Still in the Start-up Phase

Financially, DavidsTea is still in the start-up phase, even though founded in 2008 and despite having 193 stores.

On the positive side, gross sales have been increasing.

On the negative side, while same store sales are rising at around 6 percent annually, the rate of same store sales has been declining from a peak of 17.8 percent in 2013.

The primary cause of this decline is Davids’ expansion into the US market. Its American stores’ gross sales are, at best, half the gross of its Canadian stores.1 Which strongly suggests that Davids chose the wrong market for expansion beyond Canada.

Continuity of management. But the major question mark over DavidsTea’s future is continuity of management.

A primary factor in the long-term success of Starbucks, Whole Foods, Walmart, McDonald’s, and other high-growth companies is that the founder and his management team stay in place essentially till “death (or senility) do us part.”

But in the year following DavidsTea’s 2015 IPO, an almost complete turnover occurred at the top, including the resignation of the company’s founder and visionary, David Segal.

Whether this new team is an improvement remains to be seen. As we have no way of judging the new management without a sufficient period of data, DavidsTea cannot, currently, be a candidate for a long-term investment.

DavidsTea’s financials. Though the company was founded in 2008, financial data is only available from 2013. So we have insufficient data to infer long-term judgments of the management’s financial behaviors.

Nevertheless, on certain measures the company’s financial behavior looks highly promising:

Conservative debt management? Following its 2015 IPO, Davids paid off its long-term debt of C$4.29 million, ending the year with zero long-term debt.

In addition, at the IPO preferred shares were converted to common stock, so eliminating the dividend on these shares.

Thus, the only interest payments are on short-term liabilities. For example, the company has a revolving credit facility of C$20 million.

However, since prior to the IPO the company did make extensive use of debt financing, we cannot assume that the management has a long-term commitment to a debt-free or low-debt company.

A manageable ratio of profits to interest payments? The company’s ratio of profits to interest payments is not meaningful. Nevertheless, with no long-term debt, in the worst-case scenario of a deep recession, DavidsTea will not be burdened with interest payments.

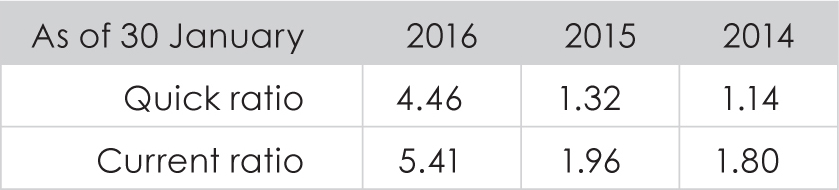

The quick and current ratios are also positive:

A pile of cash? As of 31 January 2016, DavidsTea had C$72.5 million in its cash kitty. The increasing cash from the previous years is, however, the result of the IPO rather than accumulated profits.

Dividends? Unsurprisingly, DavidsTea does not currently pay any dividends and doesn’t expect to do so for the foreseeable future. We don’t know whether that is company policy or just a reflection of the reality that until 2016, there were no profits to distribute.

Despite these positive signs, the rest of the financial news, while potentially promising, is not too good.

Marginally profitable. In the years leading up to 2014, the company made an operating loss.

While it achieved profitability in 2015, that record is not a good sign for an eight-year-old chain with so many outlets!

A major reason for that change from loss to profitability is that the IPO, by enabling the company to pay off all its long-term debts, has eliminated over a million dollars in annual interest charges.

Return on equity and return on capital are both negative.

Growth in gross sales and same store sales are both positive at 27.35 percent and 6.9 percent respectively.

But, as noted above, same store sales growth has been declining. The high growth in same store sales appears to be coming from its home market, while Davids’ expansion into the United States is sending the growth rate down.

Unfortunately, the company provides no breakdown of results in the two different markets. And this is not the only omission in the company’s financials.

In summary, with insufficient data to project owner earnings and intrinsic value, and serious question marks over the potential of its US expansion, not to mention the management changes, it’s impossible to make a realistic forecast of DavidsTea’s future earnings.

The best case we can make for DavidsTea is that it may continue to expand profitably. But not at a sufficiently high rate of growth to warrant considering it as a candidate for a long-term investment.