Chapter 4

Math, Probability, and Statistical Modeling

IN THIS CHAPTER

Introducing the core basics of statistical probability

Introducing the core basics of statistical probability

Quantifying correlation

Quantifying correlation

Reducing dataset dimensionality

Reducing dataset dimensionality

Building decision models with multiple criteria decision-making

Building decision models with multiple criteria decision-making

Diving into regression methods

Diving into regression methods

Detecting outliers

Detecting outliers

Talking about time series analysis

Talking about time series analysis

Math and statistics are not the scary monsters that many people make them out to be. In data science, the need for these quantitative methods is simply a fact of life — and nothing to get alarmed over. Although you must have a handle on the math and statistics that are necessary to solve a problem, you don’t need to go study for degrees in those fields.

Contrary to what many pure statisticians would have you believe, the data science field isn’t the same as the statistics field. Data scientists have substantive knowledge in one field or several fields, and they use statistics, math, coding, and strong communication skills to help them discover, understand, and communicate data insights that lie within raw datasets related to their field of expertise. Statistics is a vital component of this formula, but not more vital than the others. In this chapter, I introduce you to the basic ideas behind probability, correlation analysis, dimensionality reduction, decision modeling, regression analysis, outlier detection, and time series analysis.

Exploring Probability and Inferential Statistics

Probability is one of the most fundamental concepts in statistics. To even get started making sense of your data by using statistics, you need to be able to identify something as basic as whether you’re looking at descriptive or inferential statistics. You also need a firm grasp of the basics of probability distribution. The following sections cover these concepts and more.

A statistic is a result that’s derived from performing a mathematical operation on numerical data. In general, you use statistics in decision-making. Statistics come in two flavors:

-

Descriptive: Descriptive statistics provide a description that illuminates some characteristic of a numerical dataset, including dataset distribution, central tendency (such as mean, min, or max), and dispersion (as in standard deviation and variance). For clarification, the mean of a data set is the average value of its data points, its min is the minimum value of its data points and the max is the maximum value. Descriptive statistics are not meant to illustrate any causal claims.

Descriptive statistics can highlight relationships between X and Y, but they do not posit that X causes Y.

Descriptive statistics can highlight relationships between X and Y, but they do not posit that X causes Y. - Inferential: Rather than focus on pertinent descriptions of a dataset, inferential statistics carve out a smaller section of the dataset and attempt to deduce significant information about the larger dataset. Unlike descriptive statistics, inferential methods, such as regression analysis, DO try to predict by studying causation. Use this type of statistics to derive information about a real-world measure in which you’re interested.

It’s true that descriptive statistics describe the characteristics of a numerical dataset, but that doesn’t tell you why you should care. In fact, most data scientists are interested in descriptive statistics only because of what they reveal about the real-world measures they describe. For example, a descriptive statistic is often associated with a degree of accuracy, indicating the statistic’s value as an estimate of the real-world measure.

To better understand this concept, imagine that a business owner wants to estimate the upcoming quarter’s profits. The owner might take an average of the past few quarters’ profits to use as an estimate of how much profit they’ll make during the next quarter. But if the previous quarters’ profits varied widely, a descriptive statistic that estimated the variation of this predicted profit value (the amount by which this dollar estimate could differ from the actual profits earned) would indicate just how far the predicted value could be from the actual one. (Not bad information to have, right?)

Like descriptive statistics, inferential statistics are used to reveal something about a real-world measure. Inferential statistics do this by providing information about a small data selection, so you can use this information to infer something about the larger dataset from which it was taken. In statistics, this smaller data selection is known as a sample, and the larger, complete dataset from which the sample is taken is called the population.

If your dataset is too big to analyze in its entirety, pull a smaller sample of this dataset, analyze it, and then make inferences about the entire dataset based on what you learn from analyzing the sample. You can also use inferential statistics in situations where you simply can’t afford to collect data for the entire population. In this case, you’d use the data you do have to make inferences about the population at large. At other times, you may find yourself in situations where complete information for the population isn’t available. In these cases, you can use inferential statistics to estimate values for the missing data based on what you learn from analyzing the data that’s available.

Probability distributions

Imagine that you’ve just rolled into Las Vegas and settled into your favorite roulette table over at the Bellagio. When the roulette wheel spins off, you intuitively understand that there is an equal chance that the ball will fall into any of the slots of the cylinder on the wheel. The slot where the ball lands is totally random, and the probability, or likelihood, of the ball landing in any one slot over another is the same. Because the ball can land in any slot, with equal probability, there is an equal probability distribution, or a uniform probability distribution — the ball has an equal probability of landing in any of the slots in the wheel.

But the slots of the roulette wheel aren’t all the same — the wheel has 18 black slots and 20 slots that are either red or green.

Because of this arrangement, the probability that your ball will land on a black slot is 47.4%.

Your net winnings here can be considered a random variable, which is a measure of a trait or value associated with an object, a person, or a place (something in the real world) that is unpredictable. Because this trait or value is unpredictable, however, doesn’t mean that you know nothing about it. What’s more, you can use what you do know about this thing to help you in your decision-making. Keep reading to find out how.

A weighted average is an average value of a measure over a very large number of data points. If you take a weighted average of your winnings (your random variable) across the probability distribution, this would yield an expectation value — an expected value for your net winnings over a successive number of bets. (An expectation can also be thought of as the best guess, if you had to guess.) To describe it more formally, an expectation is a weighted average of some measure associated with a random variable. If your goal is to model an unpredictable variable so that you can make data-informed decisions based on what you know about its probability in a population, you can use random variables and probability distributions to do this.

- The probability of any single event never goes below 0.0 or exceeds 1.0.

- The probability of all events always sums to exactly 1.0.

Probability distribution is classified per these two types:

- Discrete: A random variable where values can be counted by groupings

- Continuous: A random variable that assigns probabilities to a range of value

- Normal distributions (numeric continuous): Represented graphically by a symmetric bell-shaped curve, these distributions model phenomena that tend toward some most-likely observation (at the top of the bell in the bell curve); observations at the two extremes are less likely.

- Binomial distributions (numeric discrete): These distributions model the number of successes that can occur in a certain number of attempts when only two outcomes are possible (the old heads-or-tails coin flip scenario, for example). Binary variables — variables that assume only one of two values — have a binomial distribution.

- Categorical distributions (non-numeric): These represent either non-numeric categorical variables or ordinal variables (an ordered categorical variable, for example the level of service offered by most airlines is ordinal because they offer first class, business class, and economy class seats).

Conditional probability with Naïve Bayes

You can use the Naïve Bayes machine learning method, which was borrowed straight from the statistics field, to predict the likelihood that an event will occur, given evidence defined in your data features — something called conditional probability. Naïve Bayes, which is based on classification and regression, is especially useful if you need to classify text data.

To better illustrate this concept, consider the Spambase dataset that’s available from University of California, Irvine’s machine learning repository (https://archive.ics.uci.edu/ml/datasets/Spambase). That dataset contains 4,601 records of emails and, in its last field, designates whether each email is spam. From this dataset, you can identify common characteristics between spam emails. After you’ve defined common features that indicate spam email, you can build a Naïve Bayes classifier that reliably predicts whether an incoming email is spam, based on the empirical evidence supported in its content. In other words, the model predicts whether an email is spam — the event — based on features gathered from its content — the evidence.

Naïve Bayes comes in these three popular flavors:

- MultinomialNB: Use this version if your variables (categorical or continuous) describe discrete frequency counts, like word counts. This version of Naïve Bayes assumes a multinomial distribution, as is often the case with text data. It does not accept negative values.

- BernoulliNB: If your features are binary, you can use multinomial Bernoulli Naïve Bayes to make predictions. This version works for classifying text data but isn’t generally known to perform as well as MultinomialNB. If you want to use BernoulliNB to make predictions from continuous variables, that will work, but you first need to subdivide the variables into discrete interval groupings (also known as binning).

- GaussianNB: Use this version if all predictive features are normally distributed. It’s not a good option for classifying text data, but it can be a good choice if your data contains both positive and negative values (and if your features have a normal distribution, of course).

Quantifying Correlation

Many statistical and machine learning methods assume that your features are independent. To test whether they’re independent, though, you need to evaluate their correlation — the extent to which variables demonstrate interdependency. In this section, you get a brief introduction to Pearson correlation and Spearman’s rank correlation.

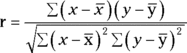

Calculating correlation with Pearson’s r

If you want to uncover dependent relationships between continuous variables in a dataset, you’d use statistics to estimate their correlation. The simplest form of correlation analysis is the Pearson correlation, which assumes that

- Your data is normally distributed.

- You have continuous, numeric variables.

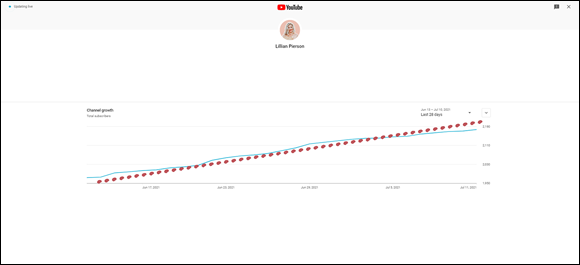

- Your variables are linearly related. You can identify a linear relationship by plotting the data points on a chart and looking to see if there is a clear increasing or decreasing trend within the values of the data points, such that a straight line can be drawn to summarize that trend. See Figure 4-1 for an illustration of what a linear relationship looks like.

FIGURE 4-1: An example of a linear relationship between months and YouTube subscribers.

To use the Pearson’s r to test for linear correlation between two variables, you’d simply plug your data into the following formula and calculate the result.

= mean of x variable

= mean of x variable = mean of y variable

= mean of y variable- r = Pearson r coefficient of correlation

Once you get a value for your Pearson r, you’d interpret it value according to the following standards:

- if r close to +1: Strong positive correlation between variables

- if r = 0: Variables are not linearly correlated

- if r close to -1: Strong negative correlation between variables

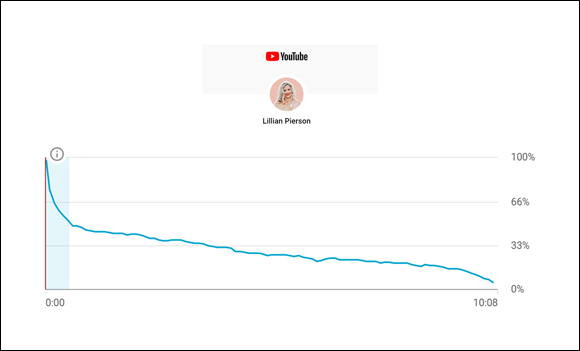

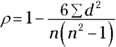

Ranking variable-pairs using Spearman’s rank correlation

The Spearman’s rank correlation is a popular test for determining correlation between ordinal variables. By applying Spearman’s rank correlation, you’re converting numeric variable-pairs into ranks by calculating the strength of the relationship between variables and then ranking them per their correlation.

The Spearman’s rank correlation assumes that

- Your variables are ordinal.

- Your variables are related nonlinearly. You can identify nonlinearity between variables by looking at a graph. If the graph between two variables produces a curve (for example, like the one shown in Figure 4-2) then the variables have a nonlinear relationship. This curvature occurs because, with variables related in a non-linear manner, a change in the value of x does not necessarily correspond to the same change in dataset’s y-value.

- Your data is nonnormally distributed.

To use Spearman Rank to test for correlation between ordinal variables, you’d simply plug the values for your variables into the following formula and calculate the result.

- ρ = Spearman's rank correlation coefficient

- d = difference between the two ranks of each data point

- n = total number of data points in the data set

FIGURE 4-2: An example of a non-linear relationship between watch time and % viewership.

Reducing Data Dimensionality with Linear Algebra

Any intermediate-level data scientist should have a good understanding of linear algebra and how to do math using matrices. Array and matrix objects are the primary data structure in analytical computing. You need them in order to perform mathematical and statistical operations on large and multidimensional datasets — datasets with many different features to be tracked simultaneously. In this section, you see exactly what is involved in using linear algebra and machine learning methods to reduce a dataset’s dimensionality — in other words, to reduce a dataset’s feature count, without losing the important information the dataset contains, by compressing its features’ information into synthetic variables that you can subsequently utilize to make predictions or as input into another machine learning model.

Decomposing data to reduce dimensionality

Okay, what can you do with all this theory? Well, for starters, using a linear algebra method called singular value decomposition (SVD), you can reduce the dimensionality of your dataset — reduce the number of features that you track when carrying out an analysis, in other words. Dimension reduction algorithms are ideal options if you need to compress your dataset while also removing redundant information and noise. In data science, SVD is applied to analyze principal components from with large, noisy, sparse data sets — an approach machine learning folks call Principal Component Analysis (PCA). Since the linear algebra involved in PCA is rooted in SVD, let’s look at how SVD works.

The SVD linear algebra method decomposes the data matrix into the three resultant matrices shown in Figure 4-4. The product of these matrices, when multiplied together, gives you back your original matrix. SVD is handy when you want to compress or clean your dataset. Using SVD enables you to uncover latent variables — inferred variables hidden within your dataset that affect how that dataset behaves. Two main ways to use the SVD algorithm include

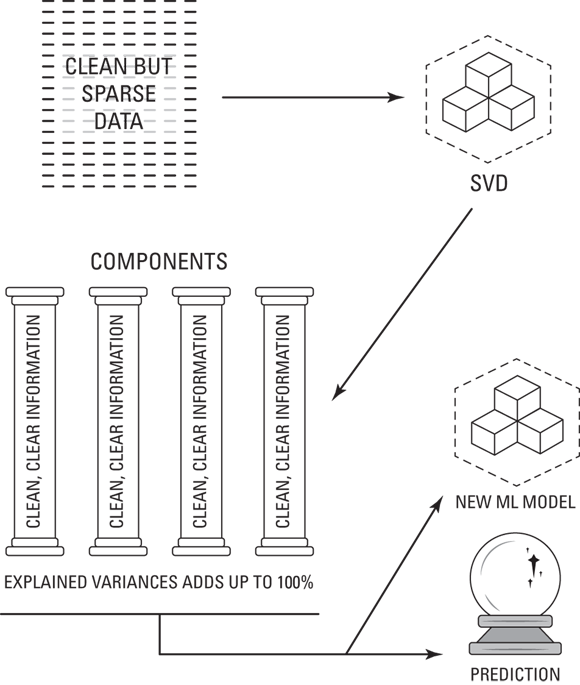

- Compressing sparse matrices: If you have a clean yet sparse dataset then, you don’t want to remove any of the information that the dataset holds, but you do need to compress that information down into a manageable number of variables, so that you can use them to make predictions. A handy thing about SVD is that it allows you to set the number of variables, or components, it creates from your original dataset. And if you don’t remove any of those components, then you will reduce the size of your dataset without losing any of its important information. This process is illustrated in Figure 4-3.

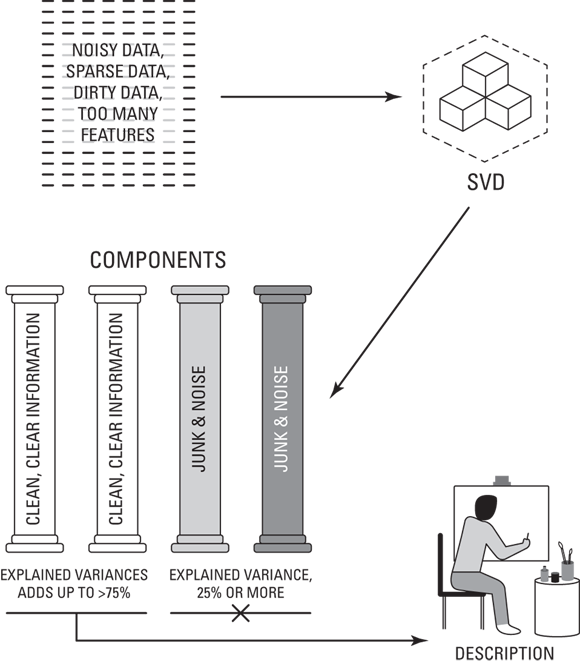

- Cleaning and compressing dirty data: In other cases, you can use SVD to do an algorithmic cleanse of a dirty, noisy dataset. In this case you’d apply SVD to uncover your components, and then decide which of them to keep by looking at their variance. The industry standard is that explained variance of the components you keep should add up to at least 75 percent or more. This ensures that at least 75 percent of the dataset’s original information has been retained within the components you’ve kept. This process is illustrated in Figure 4-4.

FIGURE 4-3: Applying SVD to compress a sparse, clean dataset.

FIGURE 4-4: Applying SVD to clean and compress a sparse, dirty dataset.

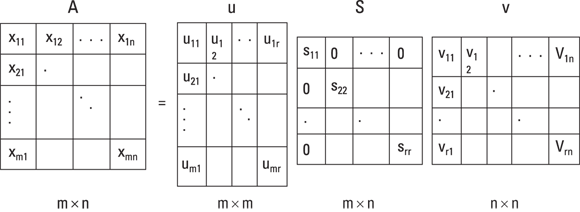

Getting a little nitty-gritty about SVD, let’s look at the formula for SVD, but keep in mind — this is linear algebra not regular algebra, so we are looking at matrix math not regular math. To take it from the beginning, you need to understand the concept of eigenvector. To do that, think of a matrix called A. Now consider a nonzero vector called x and that Ax = λx for a scalar λ. In this scenario, scalar λ is what’s called an eigenvalue of matrix A. It’s permitted to take on a value of 0. Furthermore, x is the eigenvector that corresponds to λ, and again, it’s not permitted to be a zero value. λ is simply the scale factor of the eigenvector. SVD decomposes the matrix down into three resultant matrices shown in Figure 4-5. The product of these matrices, when multiplied together, gives you back your original matrix.

Take a closer look at Figure 4-5:

A = u * S * v

- A: This is the matrix that holds all your original data.

- u: This is a left-singular vector (an eigenvector) of A, and it holds all the important, nonredundant information about your data’s observations.

- v: This is a right-singular eigenvector of A. It holds all the important, nonredundant information about columns in your dataset’s features.

- S: This is the square root of the eigenvalue of A. It contains all the information about the procedures performed during the compression.

FIGURE 4-5: You can use SVD to decompose data down to u, S, and V matrices.

Reducing dimensionality with factor analysis

Factor analysis is along the same lines as SVD in that it’s a method you can use for filtering out redundant information and noise from your data. An offspring of the psychometrics field, this method was developed to help you derive a root cause in cases where a shared root cause results in shared variance — when a variable’s variance correlates with the variance of other variables in the dataset.

When you find shared variance in your dataset, that means information redundancy is at play. You can use factor analysis or principal component analysis to clear your data of this information redundancy. You see more on principal component analysis in the following section, but for now, focus on factor analysis and the fact that you can use it to compress your dataset’s information into a reduced set of meaningful, non-information-redundant latent variables — meaningful inferred variables that underlie a dataset but are not directly observable.

Factor analysis makes the following assumptions:

- Your features are metric — numeric variables on which meaningful calculations can be made.

- Your features should be continuous or ordinal (if you’re not sure what ordinal is, refer back to the first class, business class, and economy class analogy in the probability distributions section of this chapter).

- You have more than 100 observations in your dataset and at least 5 observations per feature.

- Your sample is homogenous.

- There is r > 0.3 correlation between the features in your dataset.

In factor analysis, you do a regression — a topic covered later in this chapter — on features to uncover underlying latent variables, or factors. You can then use those factors as variables in future analyses, to represent the original dataset from which they’re derived. At its core, factor analysis is the process of fitting a model to prepare a dataset for analysis by reducing its dimensionality and information redundancy.

Decreasing dimensionality and removing outliers with PCA

Principal component analysis (PCA) is another dimensionality reduction technique that’s closely related to SVD: This unsupervised statistical method finds relationships between features in your dataset and then transforms and reduces them to a set of non-information-redundant principal components — uncorrelated features that embody and explain the information that’s contained within the dataset (that is, its variance). These components act as a synthetic, refined representation of the dataset, with the information redundancy, noise, and outliers stripped out. You can then use those reduced components as input for your machine learning algorithms to make predictions based on a compressed representation of your data. (For more on outliers, see the “Detecting Outliers” section, later in this chapter.)

The PCA model makes these two assumptions:

- Multivariate normality (MVN) — or a set of real-valued, correlated, random variables that are each clustered around a mean — is desirable, but not required.

- Variables in the dataset should be continuous.

Although PCA is like factor analysis, they have two major differences: One difference is that PCA does not regress to find some underlying cause of shared variance, but instead decomposes a dataset to succinctly represent its most important information in a reduced number of features. The other key difference is that, with PCA, the first time you run the model, you don’t specify the number of components to be discovered in the dataset. You let the initial model results tell you how many components to keep, and then you rerun the analysis to extract those features.

- Used for descriptive analytics: If PCA is being used for descriptive purposes only (for example, when working to build a descriptive avatar of your company’s ideal customer) the CVE can be lower than 95 percent. In this case you can get away with a CVE as low as 75-80 percent.

- Used for diagnostic, predictive or prescriptive analytics: If principal components are meant for downstream models that generate diagnostic, predictive or prescriptive analytics, then CVE should be 95 percent or higher. Just realize that the lower the CVE, the less reliable your model results will be downstream. Each percentage of CVE that’s lost represents a small amount of information from your original dataset that won’t be captured by the principal components.

Modeling Decisions with Multiple Criteria Decision-Making

Life is complicated. We’re often forced to make decisions where several different criteria come into play, and it often seems unclear which criterion should have priority. Mathematicians, being mathematicians, have come up with quantitative approaches that you can use for decision support whenever you have several criteria or alternatives on which to base your decision. You see those approaches in Chapter 3, where I talk about neural networks and deep learning — another method that fulfills this same decision-support purpose is multiple criteria decision-making (or MCDM, for short).

Turning to traditional MCDM

You can use MCDM methods in anything from stock portfolio management to fashion-trend evaluation, from disease outbreak control to land development decision-making. Anywhere you have two or more criteria on which you need to base your decision, you can use MCDM methods to help you evaluate alternatives.

To use multiple criteria decision-making, the following two assumptions must be satisfied:

- Multiple criteria evaluation: You must have more than one criterion to optimize.

- Zero-sum system: Optimizing with respect to one criterion must come at the sacrifice of at least one other criterion. This means that there must be trade-offs between criteria — to gain with respect to one means losing with respect to at least one other.

Another important thing to note about MCDM is that it’s characterized by binary membership. In mathematics, a set is a group of numbers that share a similar characteristic. In traditional set theory, membership is binary — in other words, an individual is either a member of a set or it’s not. If the individual is a member, it’s represented by the number 1, representing a “yes.” If it is not a member, it’s represented by the number 0, for “no.”

The best way to gain a solid grasp on MCDM is to see how it’s used to solve a real-world problem. MCDM is commonly used in investment portfolio theory. Pricing of individual financial instruments typically reflects the level of risk you incur, but an entire portfolio can be a mixture of virtually riskless investments (US government bonds, for example) and minimum-, moderate-, and high-risk investments. Your level of risk aversion dictates the general character of your investment portfolio. Highly risk-averse investors seek safer and less lucrative investments, and less risk-averse investors choose riskier, more lucrative investments. In the process of evaluating the risk of a potential investment, you’d likely consider the following criteria:

- Earnings growth potential: Using a binary variable to score the earnings growth potential, then you could say that an investment that falls under a specific earnings growth potential threshold gets scored as 0 (as in “no — the potential is not enough”); anything higher than that threshold gets a 1 (for “yes — the potential is adequate”).

-

Earnings quality rating: Using a binary variable to score earnings quality ratings, then you could say that an investment falling within a particular ratings class for earnings quality gets scored as 1 (for “yes — the rating is adequate”); otherwise, it gets scored as a 0 (as in “no — it’s earning quality rating is not good enough”).

For you non-Wall Street types out there, earnings quality refers to various measures used to determine how kosher a company’s reported earnings are; such measures attempt to answer the question, “Do these reported figures pass the smell test?”

- Dividend performance: Using a binary variable to score dividend performance, then you could say that when an investment fails to reach a set dividend performance threshold, it gets a 0 (as in “no — it’s dividend performance is not good enough”); if it reaches or surpasses that threshold, it gets a 1 (for “yes — the performance is adequate”).

Imagine that you’re evaluating 20 different potential investments. In this evaluation, you’d score each criterion for each of the investments. To eliminate poor investment choices, simply sum the criteria scores for each of the alternatives and then dismiss any investments that don’t earn a total score of 3 — leaving you with the investments that fall within a certain threshold of earning growth potential, that have good earnings quality, and whose dividends perform at a level that’s acceptable to you.

Focusing on fuzzy MCDM

If you prefer to evaluate suitability within a range, rather than use binary membership terms of 0 or 1, you can use fuzzy multiple criteria decision-making (FMCDM) to do that. With FMCDM you can evaluate all the same types of problems as you would with MCDM. The term fuzzy refers to the fact that the criteria being used to evaluate alternatives offer a range of acceptability — instead of the binary, crisp set criteria associated with traditional MCDM. Evaluations based on fuzzy criteria lead to a range of potential outcomes, each with its own level of suitability as a solution.

Introducing Regression Methods

Machine learning algorithms of the regression variety were adopted from the statistics field in order to provide data scientists with a set of methods for describing and quantifying the relationships between variables in a dataset. Use regression techniques if you want to determine the strength of correlation between variables in your data. As for using regression to predict future values from historical values, feel free to do it, but be careful: Regression methods assume a cause-and-effect relationship between variables, but present circumstances are always subject to flux. Predicting future values from historical ones will generate incorrect results when present circumstances change. In this section, I tell you all about linear regression, logistic regression, and the ordinary least squares method.

Linear regression

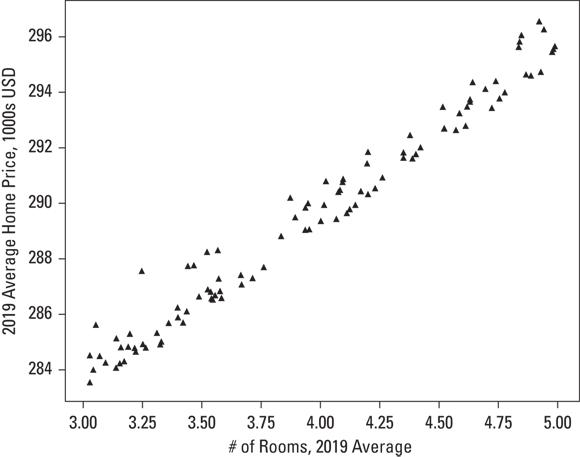

Linear regression is a machine learning method you can use to describe and quantify the relationship between your target variable, y — the predictant, in statistics lingo — and the dataset features you’ve chosen to use as predictor variables (commonly designated as dataset X in machine learning). When you use just one variable as your predictor, linear regression is as simple as the middle school algebra formula y=mx+b. A classic example of linear regression is its usage in predicting home prices, as shown in Figure 4-6. You can also use linear regression to quantify correlations between several variables in a dataset — called multiple linear regression. Before getting too excited about using linear regression, though, make sure you’ve considered its limitations:

- Linear regression works with only numerical variables, not categorical ones.

- If your dataset has missing values, it will cause problems. Be sure to address your missing values before attempting to build a linear regression model.

- If your data has outliers present, your model will produce inaccurate results. Check for outliers before proceeding.

- The linear regression model assumes that a linear relationship exists between dataset features and the target variable.

- The linear regression model assumes that all features are independent of each other.

- Prediction errors, or residuals, should be normally distributed.

Credit: Python for Data Science Essential Training Part 2, LinkedIn.com

FIGURE 4-6: Linear regression used to predict home prices based on the number of rooms in a house.

Logistic regression

Logistic regression is a machine learning method you can use to estimate values for a categorical target variable based on your selected features. Your target variable should be numeric and should contain values that describe the target’s class — or category. One cool aspect of logistic regression is that, in addition to predicting the class of observations in your target variable, it indicates the probability for each of its estimates. Though logistic regression is like linear regression, its requirements are simpler, in that:

- There doesn't need to be a linear relationship between the features and target variable.

- Residuals don’t have to be normally distributed.

- Predictive features aren’t required to have a normal distribution.

When deciding whether logistic regression is a good choice for you, consider the following limitations:

- Missing values should be treated or removed.

-

Your target variable must be binary or ordinal.

Binary classification assigns a 1 for “yes” and a 0 for “no.”

Binary classification assigns a 1 for “yes” and a 0 for “no.” - Predictive features should be independent of each other.

Logistic regression requires a greater number of observations than linear regression to produce a reliable result. The rule of thumb is that you should have at least 50 observations per predictive feature if you expect to generate reliable results.

Ordinary least squares (OLS) regression methods

Ordinary least squares (OLS) is a statistical method that fits a linear regression line to a dataset. With OLS, you do this by squaring the vertical distance values that describe the distances between the data points and the best-fit line, adding up those squared distances, and then adjusting the placement of the best-fit line so that the summed squared distance value is minimized. Use OLS if you want to construct a function that’s a close approximation to your data.

OLS is particularly useful for fitting a regression line to models containing more than one independent variable. In this way, you can use OLS to estimate the target from dataset features.

Detecting Outliers

Many statistical and machine learning approaches assume that your data has no outliers. Outlier removal is an important part of preparing your data for analysis. In this section, you see a variety of methods you can use to discover outliers in your data.

Analyzing extreme values

Outliers are data points with values that are significantly different from the majority of data points comprising a variable. It’s important to find and remove outliers because, left untreated, they skew variable distribution, make variance appear falsely high, and cause a misrepresentation of intervariable correlations.

You can use outlier detection to spot anomalies that represent fraud, equipment failure, or cybersecurity attacks. In other words, outlier detection is a data preparation method and an analytical method in its own right.

Outliers fall into the following three categories:

- Point: Point outliers are data points with anomalous values compared to the normal range of values in a feature.

- Contextual: Contextual outliers are data points that are anomalous only within a specific context. To illustrate, if you’re inspecting weather station data from January in Orlando, Florida, and you see a temperature reading of 23 degrees F, this would be quite anomalous because the average temperature there is 70 degrees F in January. But consider if you were looking at data from January at a weather station in Anchorage, Alaska — a temperature reading of 23 degrees F in this context isn’t anomalous at all.

- Collective: These outliers appear nearby one another, all having similar values that are anomalous to the majority of values in the feature.

You can detect outliers using either a univariate or multivariate approach, as spelled out in the next two sections.

Detecting outliers with univariate analysis

Univariate outlier detection is where you look at features in your dataset and inspect them individually for anomalous values. You can choose from two simple methods for doing this:

- Tukey outlier labeling

- Tukey boxplotting

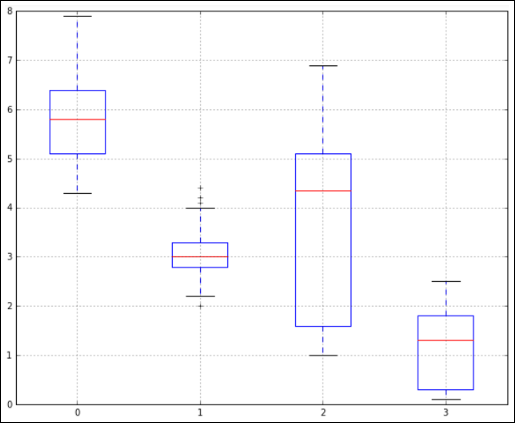

Tukey boxplotting is an exploratory data analysis technique that’s useful for visualizing the distribution of data within a numeric variable by visualizing that distribution with quartiles. As you might guess, the Tukey boxplot was named after its inventor, John Tukey, an American mathematician who did most of his work back in the 1960s and 70s. Tukey outlier labeling refers to labeling data points (that lie beyond the minimum and maximum extremes of a box plot) as outliers.

It is cumbersome to use the Tukey method to manually calculate, identify, and label outliers, but if you want to do it, the trick is to look at how far the minimum and maximum values are from the 25 and 75 percentiles. The distance between the 1st quartile (at 25 percent) and the 3rd quartile (at 75 percent) is called the inter-quartile range (IQR), and it describes the data’s spread. When you look at a variable, consider its spread, its Q1 / Q3 values, and its minimum and maximum values to decide whether the variable is suspect for outliers.

a = Q1 – 1.5*IQR

and

b = Q3 + 1.5*IQR.

If your minimum value is less than a, or your maximum value is greater than b, the variable probably has outliers.

On the other hand, it is quite easy to generate a Tukey boxplot and spot outliers using Python or R. Each boxplot has whiskers that are set at 1.5*IQR. Any values that lie beyond these whiskers are outliers. Figure 4-7 shows outliers as they appear within a Tukey boxplot that was generated in Python.

Credit: Python for Data Science Essential Training Part 1, LinkedIn.com

FIGURE 4-7: Spotting outliers with a Tukey boxplot.

Detecting outliers with multivariate analysis

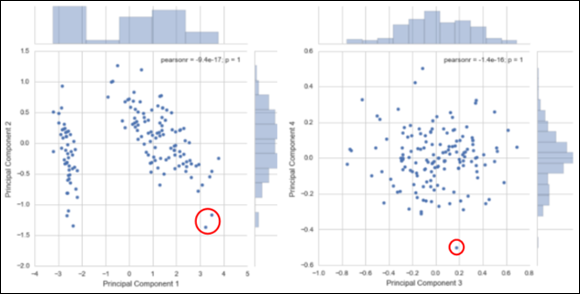

Sometimes outliers show up only within combinations of data points from disparate variables. These outliers wreak havoc on machine learning algorithms, so it’s important to detect and remove them. You can use multivariate analysis of outliers to do this. A multivariate approach to outlier detection involves considering two or more variables at a time and inspecting them together for outliers. You can use one of several methods, including:

- A scatter-plot matrix

- Boxplotting

- Density-based spatial clustering of applications with noise (DBScan) — as discussed in Chapter 5

- Principal component analysis (PCA, as shown in Figure 4-8)

Credit: Python for Data Science Essential Training Part 2, LinkedIn.com

FIGURE 4-8: Using PCA to spot outliers.

Introducing Time Series Analysis

A time series is just a collection of data on attribute values over time. Time series analysis is performed to predict future instances of the measure based on the past observational data. To forecast or predict future values from data in your dataset, use time series techniques.

Identifying patterns in time series

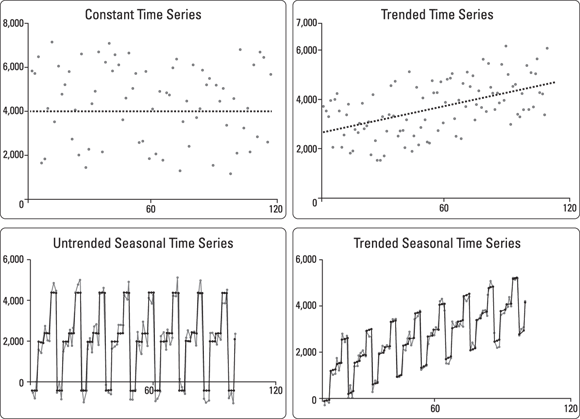

Time series exhibit specific patterns. Take a look at Figure 4-9 to gain a better understanding of what these patterns are all about. Constant time series remain at roughly the same level over time but are subject to some random error. In contrast, trended series show a stable linear movement up or down. Whether constant or trended, time series may also sometimes exhibit seasonality — predictable, cyclical fluctuations that reoccur seasonally throughout a year. As an example of seasonal time series, consider how many businesses show increased sales during the holiday season.

FIGURE 4-9: A comparison of patterns exhibited by time series.

If you’re including seasonality in your model, incorporate it in the quarterly, monthly, or even biannual period — wherever it’s appropriate. Time series may show nonstationary processes — unpredictable cyclical behavior that isn’t related to seasonality and that results from economic or industry-wide conditions instead. Because they’re not predictable, nonstationary processes can’t be forecasted. You must transform nonstationary data to stationary data before moving forward with an evaluation.

Take a look at the solid lines shown earlier, in Figure 4-9. These represent the mathematical models used to forecast points in the time series. The mathematical models shown represent good, precise forecasts because they’re a close fit to the actual data. The actual data contains some random error, thus making it impossible to forecast perfectly.

Modeling univariate time series data

Similar to how multivariate analysis is the analysis of relationships between multiple variables, univariate analysis is the quantitative analysis of only one variable at a time. When you model univariate time series, you’re modeling time series changes that represent changes in a single variable over time.

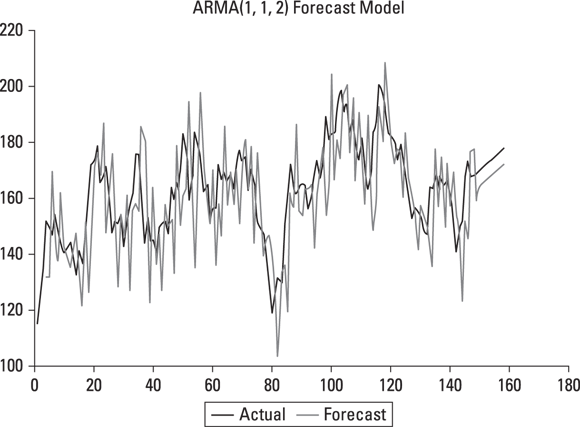

Autoregressive moving average (ARMA) is a class of forecasting methods that you can use to predict future values from current and historical data. As its name implies, the family of ARMA models combines autoregression techniques (analyses that assume that previous observations are good predictors of future values and perform an autoregression analysis to forecast for those future values) and moving average techniques — models that measure the level of the constant time series and then update the forecast model if any changes are detected. If you’re looking for a simple model or a model that will work for only a small dataset, the ARMA model isn’t a good fit for your needs. An alternative in this case might be to just stick with simple linear regression. In Figure 4-10, you can see that the model forecast data and the actual data are a close fit.

FIGURE 4-10 An example of an ARMA forecast model.

You can use descriptive statistics in many ways — to detect outliers, for example, or to plan for feature preprocessing requirements or to quickly identify which features you may want — or not want — to use in an analysis.

You can use descriptive statistics in many ways — to detect outliers, for example, or to plan for feature preprocessing requirements or to quickly identify which features you may want — or not want — to use in an analysis. For an inference to be valid, you must select your sample carefully so that you form a true representation of the population. Even if your sample is representative, the numbers in the sample dataset will always exhibit some noise — random variation, in other words — indicating that the sample statistic isn’t exactly identical to its corresponding population statistic. For example, if you’re constructing a sample of data based on the demographic makeup of Chicago’s population, you would want to ensure that proportions of racial/ethnic groups in your sample match up to proportions in the population overall.

For an inference to be valid, you must select your sample carefully so that you form a true representation of the population. Even if your sample is representative, the numbers in the sample dataset will always exhibit some noise — random variation, in other words — indicating that the sample statistic isn’t exactly identical to its corresponding population statistic. For example, if you’re constructing a sample of data based on the demographic makeup of Chicago’s population, you would want to ensure that proportions of racial/ethnic groups in your sample match up to proportions in the population overall. When it comes to experimentation, multinomial and binomial distributions behave similarly, except those multinomial distributions can produce two or more outcomes, and binomial distributions can only produce two outcomes.

When it comes to experimentation, multinomial and binomial distributions behave similarly, except those multinomial distributions can produce two or more outcomes, and binomial distributions can only produce two outcomes.