Chapter 8

Growing with Global Production Sharing: The Tale of Penang Export Hub, Malaysia

Prema-Chandra Athukorala

**Paper for the International Conference on Trade, Investment and Production Networks in Asia organised by Leverhulme Centre for Research on Globalisation and Economic Policy, University of Nottingham, 16-16 February 2012, Kuala Lumpur

Introduction

Global production sharing—the division of production processes into geographically separated stages—has been an increasingly important facet of economic globalization over the past few decades.292 With a modest start in the electronics and clothing industries, multinational production networks have evolved and spread into many industries such as sports footwear, automobiles, televisions and radio receivers, sewing machines, office equipment, power and machine tools, cameras and watches, and printing and publishing. At the formative stage, production sharing involved assembly of small fragments of the production process in a low-cost country and re-importing the assembled parts and components to be incorporated in the final product. Subsequently, production networks began to encompass many countries engaged in the assembly process at different stages, resulting in multiple border crossings by product fragments before they were incorporated in the final product. As international networks of parts and component supply have become firmly established, producers in advanced countries have begun to move the final assembly of an increasing range of consumer durables, including, computers, cameras, televisions, and automobiles, to overseas locations to be closer to their final users and/or take advantage of cheap labour. There has been a steady rise in trade in parts and components and assembled final products – network trade – within global production networks. In 2007, network trade accounted over half of total world manufacturing exports, with over two-fifths of these exports originating in developing countries (Athukorala 2011a).

Global production sharing in consumer goods such as garments and footwear normally takes place through arm’s length relationships, with international buyers playing a key role in linking producers and sellers in developed countries. However, the bulk of global production sharing in electronics and other high-tech industries still takes place under the aegis of MNEs. This is because the production of final goods requires highly customized and specialized parts and components whose quality cannot be verified or assured by a third party, and it is not possible to write a contract between the final producer and input supplier that would adequately specify product quality. This is particularly the case when establishing production units in countries that are newcomers to export-oriented industrialization. As the production unit becomes well established in the country and it forges business links with private- and public-sector agents, arm’s length subcontracting arrangements with local firms can develop, leading to firm-level upgrading of technology and management capabilities.

This paper seeks to broaden our understanding of global production sharing and explore policy options for developing countries to engage effectively in production networks as part of national development policy. The export production hub in the State of Penang, Malaysia, with over four decades as a major hub in global production networks, provides a valuable laboratory for a study of the interplay of government policies and global sourcing strategies of multinational enterprises (MNEs) in determining developmental gains from global production sharing (UNIDO 2009, UNCTAD 2010, Narayanan 1999). A key theme of the paper is the role of public-private partnerships in Penang in the context of rapid changes in global production networks and increased competition faced by existing production locations as production networks expand to new locations with greater relative cost advantages. The main objective of the study is to draw policy lessons from the Penang experience for other developing countries. However, the study is also of interest in its own right in informing the contemporary policy debate in Malaysia on appropriate policies and strategies for transforming the economy from middle-income to high-income status (NEAC 2009, 184).

This study uses information from three main sources: (1) Documents from Penang Development Corporation (PDC), the Penang state government organization responsible for investment promotion and public-private partnership implementation, Invest Penang, the investment promotion arm of PDC, and the Penang state government; (2) Interviews conducted during 29 November – 23 December 2010 with senior officials of government and private sector economic facilitator organizations, senior managers of major MNE affiliates, and representatives of chambers of commerce and industry293; (3) Firm-level information extracted from the unpublished returns to the Penang Industry Survey 2007 conducted by the Socio-Economic and Environmental Research Institute (SERI), Penang, and the Census of Manufacturing Industries 2005, conducted by the Malaysian Department of Statistics.

The paper is organised as follows. Section 2 provides an overview of the initial economic conditions in Penang to set the stage for the ensuing analysis. Section 3 discusses the policy context, key elements of policy reforms and the institutional setting in which export-oriented development strategy was implemented. Section 4 examines the evolution of the export hub against the backdrop of on-going changes in global production sharing over the past four decades. Section 5 looks at investment patterns. Export performance and its economy-wide implications are examined in Section 6. Key findings and policy lessons are presented in the final section.

Penang: geography and history

Penang is a state located on the northwest coast of Malaysian Peninsula (see Figure 8.1: Map). It is divided into two parts: Penang Island (Pulau Pinang, in Malay), an island of 293 square kilometres located in the Strait of Malacca; and Seberang Perai (formerly Province Wellesley), a narrow hinterland of 753 square kilometers on the peninsula across a narrow channel bordered by Kedah in the east and north and by Perak in the south. Penang is the second smallest among the 13 states in area, but the eighth most populous at 1.52 million (NEAC 2010). In terms of natural resources relative to its population, Penang is the least favorably endowed of all states of Malaysia. Until recently Penang was the only Malaysian state with an ethnic Chinese majority. According to the 2010 Population Census the native Malay community (Bumiputera) accounted for 43.5% of Penang’s population with Chinese and Indians accounting for 41.0% and 10.0%, respectively. However, the share of Chinese population is still well over the national average or the comparable figure in any other Malysian state.

Penang’s modern history began with the arrival in August 1786 of Captain Francis Light to set up an East Indian Company trading post. In the nineteenth century Penang became the first port of discharge of ships sailing from Europe and India to the Strait of Malacca. Penang’s status as an entrêpot significantly diminished after Stamford Raffles in 1819 created a port and military base in Singapore. Nevertheless, Penang’s economic base as a free port city was strengthened in the second half of the nineteenth century by growth of tin mining and rubber industries and massive influx of Indian and Chinese immigrants to work the plantations and tin mines.

From the early twentieth century, Penang was a centre of Islamic, Chinese and English education in Southeast (Andaya and Andaya 2001). The British established English- speaking schools to prepare the local population for government service. Compared to other Malaysian states, people in Penang were relatively well educated; most of them had at least 9 years of schooling, with a substantial number proficient in English (Tan 2009).

At independence in 1957, Penang’s economic status was healthier than the other Malay states and comparable to Singapore and Hong Kong. Trade-related infrastructure, including the Byan Lepas airport and the Gelugor container port and sea-cargo terminal, was better than other parts of the Federation. There were well-developed banking, insurance and freight forwarding services, water supply, electric power, telecommunication services and transport facilities. Penang had a relatively well-developed network of small enterprises evolved around entrêpot activities.

The early years of independence shifted the focus of economic and administrative development to Klang Valley, in particular to the new capital, Kuala Lumpur. Port Swettenham (renamed Port Klang) became the main port of the country. Penang’s entrepot trade originating from Thailand, Burma and Indonesia also dwindled as each country developed its own ports. Indonesia’s policy of ‘confrontation’ with Malaysia from 1963 to 1965 cut off lucrative trade with the Indonesian archipelago. The final blow to the entrepot trade came with the revocation its free port status (inclusion of Penang into the principal customs area of Malaysia) in 1967. Consequently, throughout the 1950s and 1960s, Penang’s trade-dependent economy therefore slid rapidly while the population was growing rapidly as a result of the postwar baby boom.

In the early 1960s, the Alliance Party state government attempted to avert the Penang economy’s collapse through a programme of import substitution industrialization. An industrial state was set up in Perai in 1964 to produce goods for the domestic market. However, most of these industries failed within few years. By the end of 1960s, Penang’s per capital income was 12% lower than the national average. The unemployment rate reached 9% (16% when underemployment is considered) and the population’s general mood was rebellious. Penang was plagued by frequent strikes, social unrest and racial tension (Singh 2011, Lim 2005).

In this volatile climate revitalizing the economy was the dominant issue of the May 1969 general elections. The newly formed Gerakan Rakyat Malaysia (Malaysian People’s Movement Party), led by Dr Lim Chong Eu, won with an overwhelming majority by promising to revitalize the economy and create employment opportunities through export-oriented industrialization. This new political leadership ushered in an era of policy reforms, which set the stage for the emergence of Penang export hub.

Policy reforms

In 1969, following the end of Penang’s free-port status, the central government engaged Robert R. Nathan Associates, a US-based consultancy firm, to analyze opportunities and challenges facing Penang’s economy and prepare a master plan for revitalizing the economy. Analysing Penang’s development potential in light of the experiences of Japan, Taiwan, Hong Kong and South Korea, the Nathan Report (Penang Master Plan Study) called for a shift in economic structure through export-led growth strategy. After taking into account Penang’s limited agricultural potential and lack of mineral resources, the report emphasized “plugging in” the economy into the global economy based on human resources as the only viable strategy for Penang for avoid economic stagnation, chronic unemployment and outmigration of capable young people. The Nathan report foresaw the onset of an international division of labour: at the time the electronics industries in developed countries had begun to look for cheap labour doing repetitive work. It proposed a shift of the focus of Penang’s development strategy from Seberang Perai (capital of Province Wellesley) to Bayan Lepas because of better transport facilities and other logistics, and access to a large labour pool (Nathan Associates 1970).

Lim Chong Eu embraced the Nathan Report as the blueprint for policy reforms (Lim 2005, p. 9). He selected the electronics industry – broadly defined to include both electronics and electrical goods – as the priority sector, and the establishment of free trade zones (FTZs) as the vehicle for attracting electronics multinational enterprises (MNEs) to set up production facilities in the state. The choice of electronics as the target industry was based on two considerations: first, its labour-intensive nature and second, unlike heavier polluting industries, it was compatible with Penang’s role as a centre of tourism.

Penang state government’s decision to embark on export-led industrialization was followed by a major policy shift at the Federal level. In May 1969, Malaysia experienced its first major ethnic conflict. Following this traumatic event the Malaysian government formulated a sweeping affirmative-action based national development programme, the New Economic Policy (NEP) (Leigh 1992). The overriding objective of NEP launched in 1971 was to maintain national unity through (1) poverty eradication of among the entire population, and (2) restructuring Malaysian society so that the identification of race with economic function and geographical location is reduced and eventually eliminated (Government of Malaysia 1976, p. 7). For the first objective, development strategy was reformulated with emphasis on export-oriented industrialization. For the second objective, long-term targets were established for the Malay equity ownership in limited companies, and the proportion of Malays employed in manufacturing and occupying managerial positions.

The choice of export-oriented growth as a key element of the new development strategy at the national level greatly facilitated the Penang government’s export-led industrialization move by avoiding possible policy conflict. However, the NEP’s ethnicity- centered development policy posed a major challenge for the Chinese dominated Penang government.

Malaysia has a centralized form of federal administration (Crouch 2007). While Malaysia is technically a federation, state governments have only limited revenue-raising capabilities. The federal government monopolized taxation; state governments can only raise revenues through land acquisition and management and setting utility rates. The states have little influence on offering tax incentives and other concessions to foreign investors. The states, apart from allocating land, providing infrastructure, and some freedom in respect of collecting local taxes, have to work within the general national guidelines while devising their own projects and programmes. Moreover, there are no clear-cut procedures for budgetary allocation among the states. Conflicts surface especially when an opposition party controls a state government (Jomo and Wee 2002).

Lim Chong Eu obtained autonomy and freedom of action required for the implementation of his Penang development strategy through a collaborative approach. He maintained close links with Tun Abdul Razak, then deputy Prime Minister and Director of the National Operations Council (NOC),294 who later became the Prime Minister. Lim committed full support to Razak in restoring peace and order in Penang during the turbulent period following the ethnic riots in Kuala Lumpur. This cooperation led to the joining of the Gerakan party with the federal ruling party, Alliance, to form a coalition called Barison Nasional. This well-calculated move helped to avert conflict with the federal government in implementation of policy reforms in Penang.

The reforms began with restructuring government machinery. A new statutory body, Penang Development Corporation (PDC), was formed as the principal development agency (Singh 2011). The legal status of PDC as a statutory body allowed it flexibility in fulfilling national objectives in areas where government departments faced constraints. It provided an institutional mechanism for coordinating activities of the municipal administration and the state government. Dr Lim filled the key positions of PDC with senior personnel of the federal administration who had been involved in the Penang master plan study. Of particular importance was the appointment of Chet Singh, an ethnic Indian economist from the Malaysian Civil Service and the State Financial Officer, as the first general manager of PDC. Singh played a pivotal role as Lim’s right-hand man during the ensuing two decades in transforming Penang into an export-production hub with MNE participation.

Dr Lim chaired the State Planning and Development Committee (SPDC), the apex policy-making body of PDC, during his more than 20-year tenure as the Chief Minister (May 1968 – October 1990). The SPDC made all decisions relating to permission for land acquisition and development. All proposals were reviewed within three months of receipt, correspondence was replied to within seven working days, and responses to complaints were given within 21 working days. The PDC operated with the work ethic and management style of a private-sector company, with reward for employees based on productivity (Singh 2011).

In 1974, the two local authorities on Penang Island were abolished and the island was placed under a single municipal administration, the Board of Management of Penang Island. On the mainland, the three district councils were merged to form a single local authority, the Board of Management of Seberang Perai. PDC assumed the role of coordinating activities of state government and the city council, addressing the various flows and gaps within the two levels of governance. Municipal administration reforms facilitate PDC’s task of coordinating the work of the various agencies involved in approving new businesses.

PDC started operations with an initial grant of Malaysian ringgit (MYR) 5 million (US$ 1.6 million) from the state government. Given Malaysia’s high degree of fiscal management centralization, PDC programmes had to be implemented under severe resource constraints. In the formative years, PDC was granted autonomy to evolve a budgetary system to finance its programmes and activities from internally generated funds supplemented by loans from private institutions. An innovative feature of the PDC budgetary system was a land bank – formed through acquisitions and strategic purchases – that acted as a main source of revenue and facilitated infrastructure development. Financial autonomy gained through this strategic move was vital for PDC‘s success because other Malaysian states soon followed Penang‘s example of creating their own development corporations and thus creating intense competition for federal funding (Hutchinson 2008).

The PDC tactfully handled the NEP employment quotas by permitting firms to recruit workers of their own choice based on response to job advertisements – that is, by requiring firms to recruit solely on the basis of advertisements rather than trying to fill the quotas. The PDC enjoyed considerable autonomy because Lim Chong Eu effectively used his political connections to cushion PDC management against influences from the federal level.

Free trade zones, industrial states and infrastructure development

Based on the Nathan Report recommendations, the Penang state government pioneered the establishment of free trade zones (FTZs) in Malaysia. Through close consultation with relevant federal agencies, in particular, the Economic Planning Unit (EPU) operating under the National Consultative Council, Penang persuaded the federal government to promulgate the Free Trade Zone Act in 1971. The Royal Customs and Excise Department opposed FTZs on the ground that they would provide Penang with a back door to regaining its free port status. However, the state government was able to jump this hurdle thanks to the intervention by Tun Razak (Singh 2011).

The first FTZ in Bayan Baru (Bayan Lepas FTZ) opened in August 1972. It aimed to attract clean industries that required the movement of materials and products by air-transport such as electronics, medical and other precision and machining industries (Lim 2005). A second FTZ opened eight years later in Seberang Perai near the shipping port to serve firms producing bulk items – high weight-to-value products such as household electrical appliances that depend on the shipping port and railways for the movement of material and products. Subsequently the original Bayan Lepas FTZ was extended in three further phases. Near the FTZs, five industrial estates were set up for supportive and ancillary industries related to FTZ firms, resource-based industries and import-substitution manufacturing activity.

PDC used FTZs and industrial estates for focused infrastructure development for successful global integration of the Penang economy. Two new townships, Bandar Bayan Baru and Bandar Seberang Jaya, adjacent to the two FTZs, were established to redress the social and economic imbalances between the rural and urban populations. In the new townships, surpluses obtained from the sale of medium-cost housing units were used to subsidize low-cost units. To link the two new townships, the Penang Bridge was opened in 1985 with the support of the Federal government. PDC subsequently embarked on a major urban development programme to meet the growing demand for civic, administrative and community amenities in the George Town city centre.

Land is a scarce resource in Penang. In its development planning, PDC created a land bank through market acquisition of paddy fields and reclamation. The land bank used the rule that for every acre of industrial land, there should be four acres for development of housing, recreation, civic and social amenities and other related economic activities. Given land scarcity in Penang, the importance of land reclamation from the sea was recognized as far back as early 1970s as the most economical way of obtaining land for development, as private land is expensive. The possible total area of reclamation from the sea was estimated to be about 3,800 hectares (Singh 2011).

Investment promotion

From its inception, PDC undertook promotion missions to various countries. The investment promotion campaign was designed with a help of Andy Ross, a consultant who had worked closely with Singapore electronics firms for many years. Most of these missions, in particular those to California’s Silicon Valley, Germany and Japan were led by the Chief Minister. In its investment promotion campaigns, PDC successfully delivered the message that Penang people’s skills and adaptability could effectively complement the needs of high- tech industries (Todd 1987).

When investors arrived in Penang, PDC provided an efficient and speedy one-stop service of investment approval and facilitation. In addition, PDC understood the importance of addressing the needs of investors already located in Penang: “the after sales service was just as, if not more, important than the initial promotional work” (Singh 2011, p. 614). Delegations led by the PDC Chairman often called upon CEOs of companies that had invested in Penang to maintain close relationships and obtain inputs to developing the investment promotion camping in an evolving fashion.

PDC avoided organizing large investment seminars or conferences. Rather it conducted meetings with individual companies so that full attention could be paid to their specific needs in an effective manner. Over the years, PDC’s approach to investment promotion was shaped by interactions and close relations with the MNE affiliates in Penang.

Fostering MNE-SME links

Fostering links between branch plants of multinational enterprises in Penang and local investors has been a key PDC priority (Grunsven 2007, Hutchinson 2008). Based on his close ties to the local business community, the Chief Minister encouraged MNE affiliates to procure components locally and forge subcontracting relationships with local firms. Promoting links between small- and medium-scale enterprises (SMEs) and MNE affiliates operating in Penang has been a priority of the Penang Skill Development Centre (PSDC), an innovative business-university-government training centre (see Box 2). PDC also encourages and provides institutional support to MNE affiliates to initiate vendor development programmes to strengthen backward input linkages with local suppliers.

At the formative stage, local firms faced two constrains in venturing into subcontracting with MNEs. First, they had to pay duties on imported inputs where as foreign firms located in FTZs were exempted from those duties. Second, being new to the industry, they were at a disadvantage compared to foreign investors. In 1986, the incentive package offered to foreign firms, including licensed manufacturing warehouse status, was also offered to local firms. In addition, at the request of the state government, the Malaysian Industrial Development Authority (MIDA, the federal investment approval body) imposed a minimum capital requirement of RM 2.5 for foreign machine tool firms seeking approval to set up operations in Malaysia in order to protect smaller local machine tool firms (Rasiah, R. 1994).

Vocational training programs

In 1970, PDC established an Industrial Training Institute with West German assistance to offer occupational training in areas such as auto mechanics and welding. PDC, in collaboration with the City Council of Georgetown, launched a “job-cum-training scheme” under which unemployed school leavers were employed as temporary workers, permitting half-a-day work and the rest of the work day receiving technical training in basic electronics and electrical component assembly. These trainees were the first recruits of the new electronics factories in the early 1970s. Under this training programme, MNEs could install their equipment at the centre and train their workers there. This helped reducing start-up time for new factories. PDC also liaised with the Industrial Research and Consultancy Service Centre of the Universiti Sains Malaysia (Malaysian University of Science) to provide technical courses for SMEs.

By the late 1980s when skill shortages began to hamper expansion of the electronics industry, PDC joined with MNEs to establish the Penang Skill Development Centre (PSDC). PSDC started in 1989 with 32 courses for 559 participants; by 2010 it offered over 400 courses to 7500 participants and had trained over 90,000 workers. At the formative stage, foreign firms featured prominently in its training activities. Local firms’ engagement has expanded over the years. At the beginning, the main focus was on creating a large pool of technicians to meet the immediate needs of rapidly expanding electronics firms, particularly just-in-time measurement and precision engineering skills. Over the years, the scope and breath of the organization have expanded in line with the changing operational environment. PSDC has attracted worldwide attention as an example of successful public-private partnership in human capital development (Athukorala 2011, Box 2).

Lessons from failed projects

In the early 1970s, PDC directly invested in several fields: electronics and electrical goods, agro-based industries, construction, mushroom cultivation, precision engineering and shipbuilding. These projects failed commercially within few years. As the Nathan Report correctly predicted, given its remote location within the Malaysian Federation and the small domestic market, Penang was not a viable location for import substitution activities. Once the new projects proved to be commercial failures the state government swiftly abandoned them, without trying to make them survive through direct subsidies (Lim 2005).

This was in sharp contrast to the import substitution attempts in many other developing countries and in the rest of Malaysia, which saw perpetuation of inefficient industries become a drain on government budgets and domestic resources. Other than the short-lived, state-led industrialization attempt, the prime focus of economic policy in Penang remained committed to creating an enabling environment for private sector led growth. As already noted, in its investment promotion campaign the government did focus on electronics and electrical goods industries for legitimate considerations of employment potential and environmental impact, but there was no attempt to target specific product lines or potential investors within these industries. At the initial stage of investment promotion Penang state government focused on electronics and electrical goods industries for legitimate considerations of employment potential and environmental impact, but there was no attempt to target particular investors (firms) within these industries. The policy emphasis was on supporting “all potential winners”,295 through the creation of an enabling environment for the operation of private enterprises, both foreign and local.

Evolution of the export hub

The first MNE to set up an assembly plant in Penang was National Semiconductor (NS) from the United States. Chet Singh, PDC’s founding General Manager296, recalls his first encounter with NS as follows:

The NS people arrived at PDC on a Friday evening in 1971. They had a lot of questions to ask which, in honesty, we were not able to answer immediately. I took a bold chance and asked them to let us have a copy of the questionnaire and promised that the information sought would be made available on Monday. I suggested that they enjoy a break at the beach as they have been travelling for over two weeks. We worked hard during the weekend and managed to hand over the very technical questionnaire back to them on Monday, all filled up. They were impressed. We then showed them land and other facilities we had. And they made a swift decision to come in. Filling the NS questionnaire was an invaluable experience for us. We realized that other potential investors too would also require relevant information. So we prepared an investment guide based on the NS questionnaire and our answers.

The arrival of National Semiconductor was an auspicious start for the Bayan Lepaz FTZ. Charlie Sporck, the CEO of National Semiconductor, had started his career at Fairchild Semiconductor, which is considered the United States electronics industry’s equivalent of “a sycamore tree with its wing seeds” (Jackson 1997, p. 21). Two other semiconductor companies, Advanced Micro Devices (AMD) and Intel, founded by other ‘Fairchild children’, soon followed NS to Penang. Coming to Penang was the first step of the global spread of both these companies. The Intel plant later became the largest single employer in Malaysia.297 National Semiconductor set up its first overseas operations in Singapore in 1968 and came to Penang in search of an additional low cost location because of rising labour and rental cost in Singapore.

Between 1972 and 1975, five other MNEs set up assembly plants in Bayan Lepas FTZ: Osrum (a German automotive lighting manufacturer), Hewlett Packard (a United States electronics producer), Bosch (a German auto part producer), Hitachi (a Japanese semiconductor producer), and Clarion (a Japanese auto part producer). These eight MNEs, which drove the industrial transition in Penang, are known locally as the “Eight Samurai”.

Emergence of ancillary industries

Following the entry of Eight Samurai a network of ancillary industries began to emerge to meet their requirements: stamped metal components, automation equipment, gigs and fixtures, machine tools, and molded rubber products. The MNE-SME partnerships became more prominent over time, resulting in the growth of a large pool of local tooling and equipment manufacturing firms. At the beginning these supporting industries were dominated by SMEs from Japan, Singapore and Taiwan. Subsequently, local firms began to emerge. Former MNE employees created most of the local firms. For instance, former Intel employees established LKT Engineering, Globetronics, Shinca, Shintel and Unico, and former Motorola employees set up Loshita and BCM Electronics. Other local firms such as Eng Teknologi and LKT Engineering expanded their operations benefitting from vender development programme launched by Intel and other MNEs (Lim 1991; Lai 1995; Athukorala 2001b, Box 3).

By the mid-1980s an export cluster with a sizable number of branch plants of major electronics and electrical MNEs and a network of supporting industries was well established in Penang. Penang had become the world’s largest exporter and the third largest assembler semiconductors after the United State and Japan. The international media dubbed Penang Asia’s “Silicon Island” (Todd 1986). However, during the first decade of industrial transition, electronics firms in Penang were almost exclusively engaged in simple downstream assembly processes in the semiconductor manufacturing chain. Only a few companies such as Intel and AMD had started testing facilities. Four-fifths of the workforce in the 1970s and 1980s was engaged in jobs requiring little or no skills (Narayanan and Cheah 1993).

In the mid-1980s, intense competition from Japanese firms resulted in increasing automation in electronics assembly. A number of MNEs and local firms sought to attain critical aspects of the Toyota process flow dynamics of multi-product single line production with its emphasis on zero defects and low inventory levels. Intel and other MNEs recognized the need for increased automation to improve productivity and quality. In-house automation groups were formed and potential local tooling and other component suppliers were identified as strategic partners. By the late 1990s most electronics factories had fully automated and integrated assembly and testing faculties (Lai 1995).

Ancillary industries that evolved around the major electronics and auto firms expanded rapidly adding to network cohesion during this period. Plastics, machine tools and chemicals were added to the product mix in the early 1990s. Some Penang firms became suppliers to other high-tech firms, operating both locally and overseas, in addition to supplying their MNE partners. Linkages of MNEs affiliates with local ancillary factories strengthened over time due to the improved quality and reliability of local suppliers and services, rising transportation costs, and exchange rate volatility. Starting as small backyard workshops, some of these firms achieved the status of original equipment manufacturers (OEM), with substantial R&D and design capabilities (Athukora 2011b, Boxes 4 and 5). Over the years, as the input-procurement practices become well established MNE affiliates have transferred expertise in fabrication, hardware and equipment controlling software to local tooling SME partners. Some local firms such as KLT and Globatronics, after expanding their product lines, became contract manufacturers (CMs).298

From semiconductors to consumer electronics and computer peripherals

The next phase of expansion of the Penang export hub began in the late 1980s with the arrival of consumer electronics and computer peripherals. Until the late 1980s there were no firms involved in consumer electronics assembly, except Motorola, which was producing two-way radios, mobile car phones and cordless telephones. From the beginning, Motorola’s Penang plant was its design centre for these products. From the late 1990s a number of MNEs, including Sony, Sanyo, NEC and Dell established assembly plants for consumer products, such as car stereos, hi fi equipment, calculators and telephones. Most consumer electronics companies are Japanese owned, while some have Taiwanese, Singaporean and Malaysian equity.

In the area of computer peripherals assembly, most significant was the arrival of disk drive firms staring in 1988. Between 1988 and 1991, most major players in this industry, including Segate, Maxtor, Hitachi Metals, Control Data, Applied Magnetic and Conner Peripherals, set up assembly plants in Penang (McKendrick, Doner and Haggard 2000, Chapter 9). With the emergence of disk drives, local industry begun to produce disk drive components, which require a high level of precision engineering technology. The industry also engaged in improving and rebuilding machines based on imported prototype machinery for both local and regional markets.

Major foreign-owned contract manufacturing companies in the hard disk drive industry came to Penang in the late 1980s and early 1990s. Several Singapore-based entities came between 1989 and 1990 to provide manufacturing services in printed circuit board assembly (PCBA). Several United States-based companies came in the early 1990s to provide contract-manufacturing services in PCBA and flex circuit board assembly (FCBA). The development of locally owned contract manufacturing companies took place in the early 1990s. As they progressed, these firms expanded their services to include box-build and provided total solution systems for their customers. In the early days, most contract manufacturers performed on a consignment basis. By the mid 1990s, most of these companies in Penang were implementing turnkey operations, carrying out broad assembly and test, system assembly and test, and supply-based management.

Recent Structural changes

Over the past two decades, the Penang export hub has undergone notable structural transformation driven by domestic cost pressure – mainly increasing wages and rents due to land scarcity – and on-going changes in patterns of global production sharing. There has been a significant contraction in final assembly of consumer electronics and electrical goods as an outcome of competitive pressure from China for final assembly (Athukorala 2009).299 Companies like Sony, Dell and NEC have significantly scaled down their operations in Penang. At the same time, firm in disk drive industry have shifted relatively more labour intensive segments in the production process to other low-cost locations in the region, in particular Thailand and the Philippines. However, for two reasons this structural shift has not resulted in a “hollowing out” of the Penang export hub, as some observers have inferred simply by looking at those companies that are leaving or scaling down their operations.

First, electronics firms involved in component design, assembly and testing restructured their operations by moving into high-value tasks in the value chain, while shifting simple low-end assembly activities to other low-cost locations. This process has been greatly aided by the deep-rooted nature of their production bases backed by a pool of skilled workers developed over the past three decades. A number of large electronics MNEs have shifted regional and also global headquarter functions to Penang. Manufacturing is only part of their operations. Their activities in Penang now encompass corporate and financial planning, R&D, product design and tooling, sales and marketing. Most MNEs that have shifted final assembly of consumer electronics and electrical goods to China perform the related trading and services activities from Penang. Some of them now use their Penang affiliates as an integral part of their global training and skill enhancement programmes.

Osrum, Motorola and Altera have regional R&D hubs in Penang. Intel, AMD, Agilent started as assembly operators but now engage in supplying global shared services within their global networks. Intel Malaysia is now responsible for the group’s global shared services. AMD now has its global shared services and design centre in Penang. Intel has one of its three global R&D design centres in Penang. It designed and developed the Atom Chip, which is the core of the Netbook revolution.

Motorola’s largest R&D facility, responsible for development and manufacture of all Motorola 2-way communication devices – accounting for more than 50% of market share, is in Penang (NEAC 2010 (Part 1), Appendix 4). Penang plays a pivotal role in Fairchild’s global production networks by manufacturing new products and packages, acting as a technical service centre for global customers, and providing leadership and management support for back-end manufacturing, and administrative and engineering service. Agilent Penang accounts for more than 60% of the group’s turnover.

Altera’s largest design centre is in Penang. It is currently designing the next generation FGPA chip. Engineers represent 94% of it current Penang workforce and they account for 60% of its worldwide engineering talent. Western Digital recently announced that it would build a US$ 1.2 billion R&D and manufacturing facility in Penang. STEC, a leading global provider of solid-state technologies and solutions for OEMs, built facility with complete design, manufacturing and logistics capabilities in the Bayan Lepas FTZ in 2007. It designs, develops and manufactures custom and open-standard memory solutions based on flash memory and DRAM technologies and external storage solutions.

Second, while the electronics industry is still the main engine of growth in Penang, in recent years the production base has begun to diversify into a number of electronics-related dynamic product lines. These include medical services and equipment, light emitting diodes (LED), and photovoltaic design and development.

International players in the LED industry have made significant inroads into the Penang export hub. With its head start in electronics, Penang could become a major global LED hub. The MNEs with production plants in Penang include Osrum Opto Semiconductors, Philips Lumileds, Rubicon Technology, Globetronics, and Dsem and IntraMas. Osrum, which came to Penang in the early 1970s to assemble general lighting, now ranks second in the world in the LED industry. It has wafer fabrication, assembly and testing operations in Penang. Osrum’s largest production plant outside Germany and its global R&D centre is in Penang. Phillips Lumileds, which has assembly and testing operation in Penang, ranks fifth in the world LED industry. SILQ, a joint venture of Semileds Corporation (a LED manufacturer in the league of Lumileds and Osrum) and IQ Group Berhad, is involved in LED packaging, modules and final LED lightings in Penang. Two local contract manufacturers, Globetronics and CS Opto, have made significant inroads in to LED industry in recent years benefitting from the emergence of local LED final product design houses.

The LED industry is poised to grow, driven by increased LED penetration rates in mobile handsets, notebooks, LCD (liquid crystal display) televisions, automotive and general lighting. LED television back lighting (signs and display segment) is considered to be the most important LED growth driver over the coming years. Another important segment for rapid growth of LED lighting is general lighting: some countries have imposed environmental regulations to phase out or ban the use of incandescent lighting. Electricity consumption of LED lighting is lower than that of incandescent lighting by about six to seven times. LED has gained a new lease of life in recent years with increasing demand for lighting services from the fast growing economies, in particular China and India as an alternative to providing grid electricity to the rural areas (Dupuis and Krames 2008, Bhusal et al. 2007).

In the medical services and equipment industry, B. Braun GMBH, a German medical and pharmaceutical company, has been in Penang since 1980. It has a plan to invest MYR1.75 billion in its Penang plant by 2013. This will involve expanding its production capacity 131% and increase production by 50% by 2013. In recent years a number of newcomers have entered the industry: Cardinal Health, St Judes, Accellent, Small Bone Innovation, and Symmetry Medical.

Cardinal Health (a “Fortune 18” company) is one of the largest healthcare services providers in the world, supplying pharmaceuticals and products. Symmetry Medical is the largest contract manufacturer of orthopedic devices for big companies such as Strykey, Johnson & Johnson, Zimmer, Bioner and Smith & Nephews. Cardinal Health also designs, develops and produces products for other segments of the medical device market, including arthroscopy, dental, laparoscopy, osteobiologics and endoscopy, and provides specialized products and services to non-healthcare markets, such as aerospace. It chose Penang because of accessibility to the major markets of China and Japan, ease of communication, a strong legal system with intellectual property protection, and the ease of integration for expatriates.

Symmetry Corporation, a provider of products to the global orthopedic device industry and other medical markets, announced in 2008 that it plans to invest US$ 20 million over the next three years to expand its Malaysian manufacturing and design and development capabilities. The company is planning to move its existing facility to a larger, new 50,000 square foot facility in Penang. This facility will house the regional design and development centre together with a regional logistics operation, and enable the parent company to bring its Total Solutions(R) business model to the Asian market.

In sum, after 40 years of development, Penang export hub has a range of industries, including electronics, electrical goods, machine tools, general lighting equipment and light- emitting diodes, and medical devices. Due to domestic cost pressure and the emergence of competitive production locations Penang is no longer an attractive location for assembly of consumer electronics and electrical goods and low-end component assembly within the electronics value chain. These activities in Penang have shrunk in recent years. However, MNEs involved in the electronics design, assembly and testing activities have restructured and expanded their operations in Penang. At the same time, some new dynamic product lines, including light-emitting device, photovoltaic design and development, and medical devices, have emerged with considerable prospects for further expansion.

Investment trends and company profiles

Systematic analysis of trends in foreign direct investment in Penang is hampered by dearth of data. At the formative stage until about the early 1980s, PDC maintained continuous records of investments based on administrative records and annual surveys of firms. In recent years publically available data on realized projects are limited to surveys periodically commissioned by PDC. As the response rate varies significantly among the survey years, data from these surveys do not permit year-to-year comparisons. Moreover, the response rate to questions relating sales turnover and investment has been very poor. This section aims to provide some insights into investment trends and the profile of firms operating in Penang by piecing together information from scattered sources.

In 1975, there were seven branch plants of MNEs (henceforth referred to as foreign affiliates or foreign firms) employing around 2,000 workers in the Byan Lepaz FTZ (Warr 1987). By the mid-1980s the number of firms had increased to 59 and they employed 39.600 workers (PDC 1987). Two decades later, the 2005 Malaysian Manufacturing Census counted 203 foreign firms employing 215,517 workers (Table 8.1).

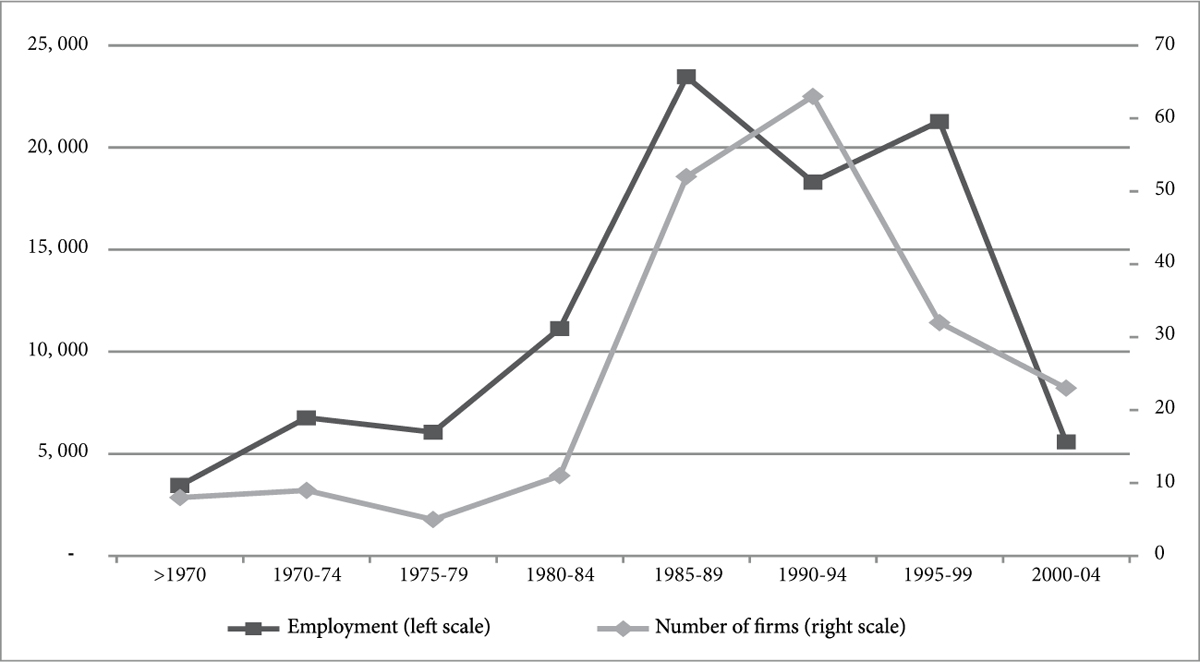

The data on the age distribution of these firms (Table 8.1; Figure 8.2) are basically consistent with the growth trajectory discussed in the previous section. With a modest start in the 1970 there was a rapid expansion of MNE entry until about the mid-1990s. There has been a notably decline in the number of firms commencing commercial production in over the past 10 years. This reflect gradual erosion of Malaysia’s attractiveness for low-end activities in the electronics value chain and final assembly of consumer electrical and electronics products due to increasing domestic wages and the emergence of alternative low cost investment locations within the region.

According to the foreign investment approval records of the Malaysian Industrial Development Authority (MIDA) (reported in Table 8.3 in Athukorala 2011b), the number of approved projects increased, albeit with some year-to-year fluctuations, in the 1980s and 1990s. As discussed, during this period Penang was very attractive to MNEs producing consumer electrical goods and electronics and computer peripherals. Following a notable decline during the Asian financial crisis in the second half of 1990s, approvals have picked up since 2000. Allowing for some erratic fluctuations, capital per worker in approved projects has increased significantly over the past two decades, from annual average level of US$2800 during 1990-95 to over US$ 10300 during 2004-2008. This pattern points to a gradual, but persistent, shift in the production structure towards product lines characterized by greater capital intensity as the labour market tightens.

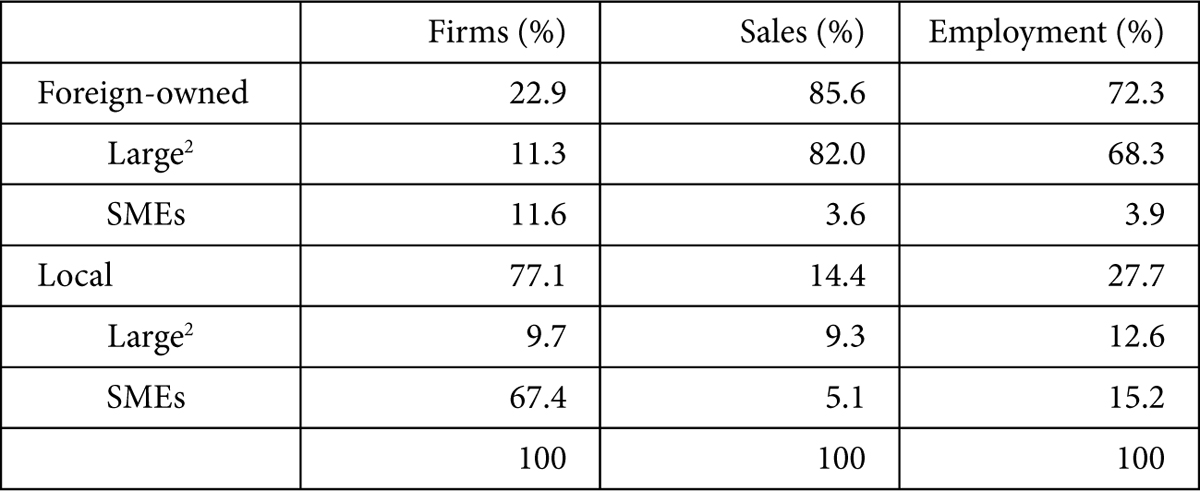

Foreign firms (MNE affiliates) dominate manufacturing in Penang (Table 8.2). In 2007, they accounted for over 85% of total sales turnover and over 72% of total employment in the manufacturing sector in Penang, even though they accounted for only about one fifth of the total number of firms in operation. The top 11% of foreign firms in size accounted for 82% of total sales and 68% of total employment.

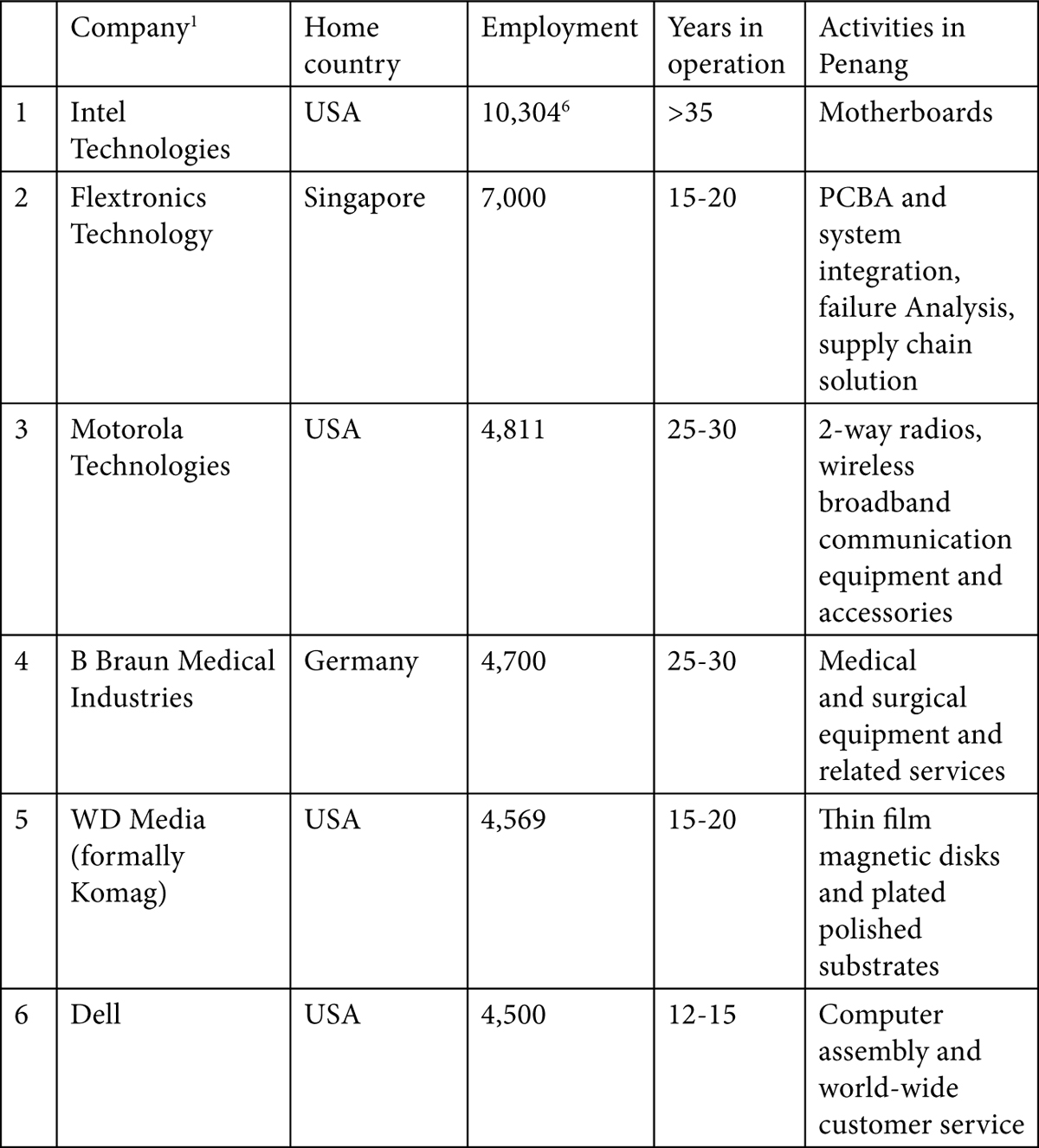

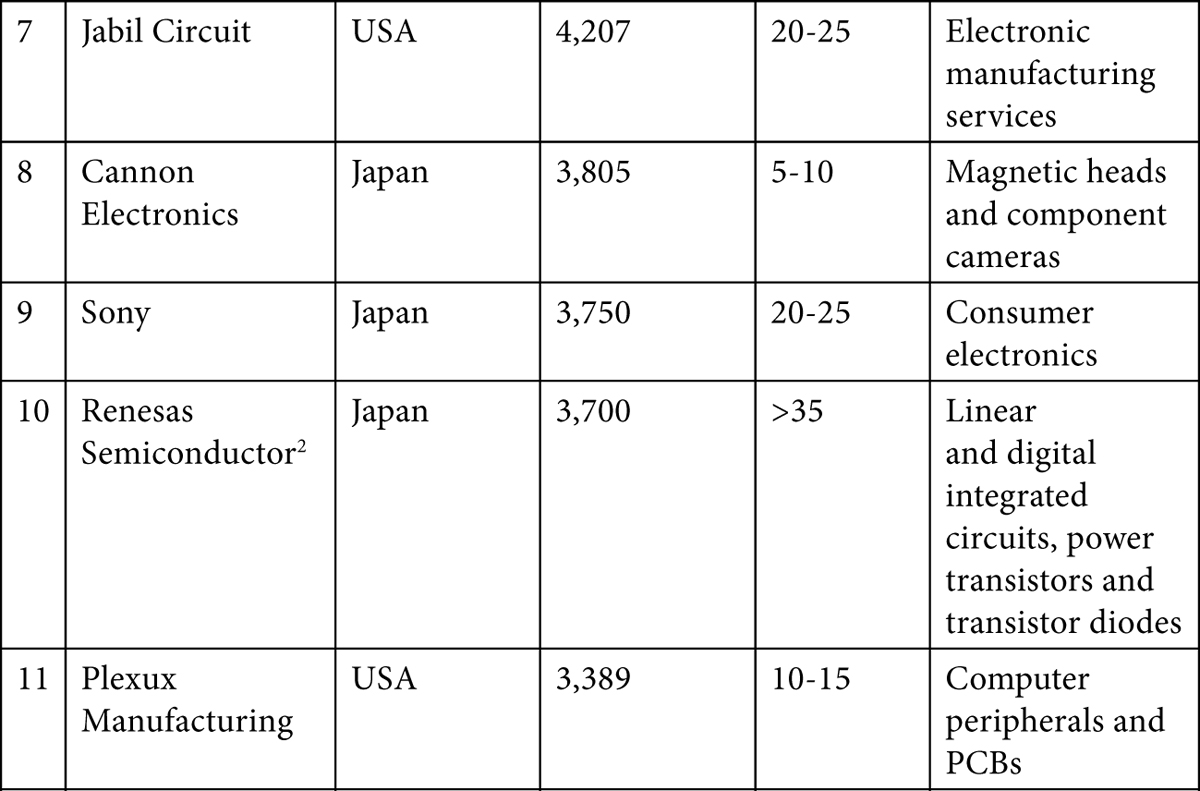

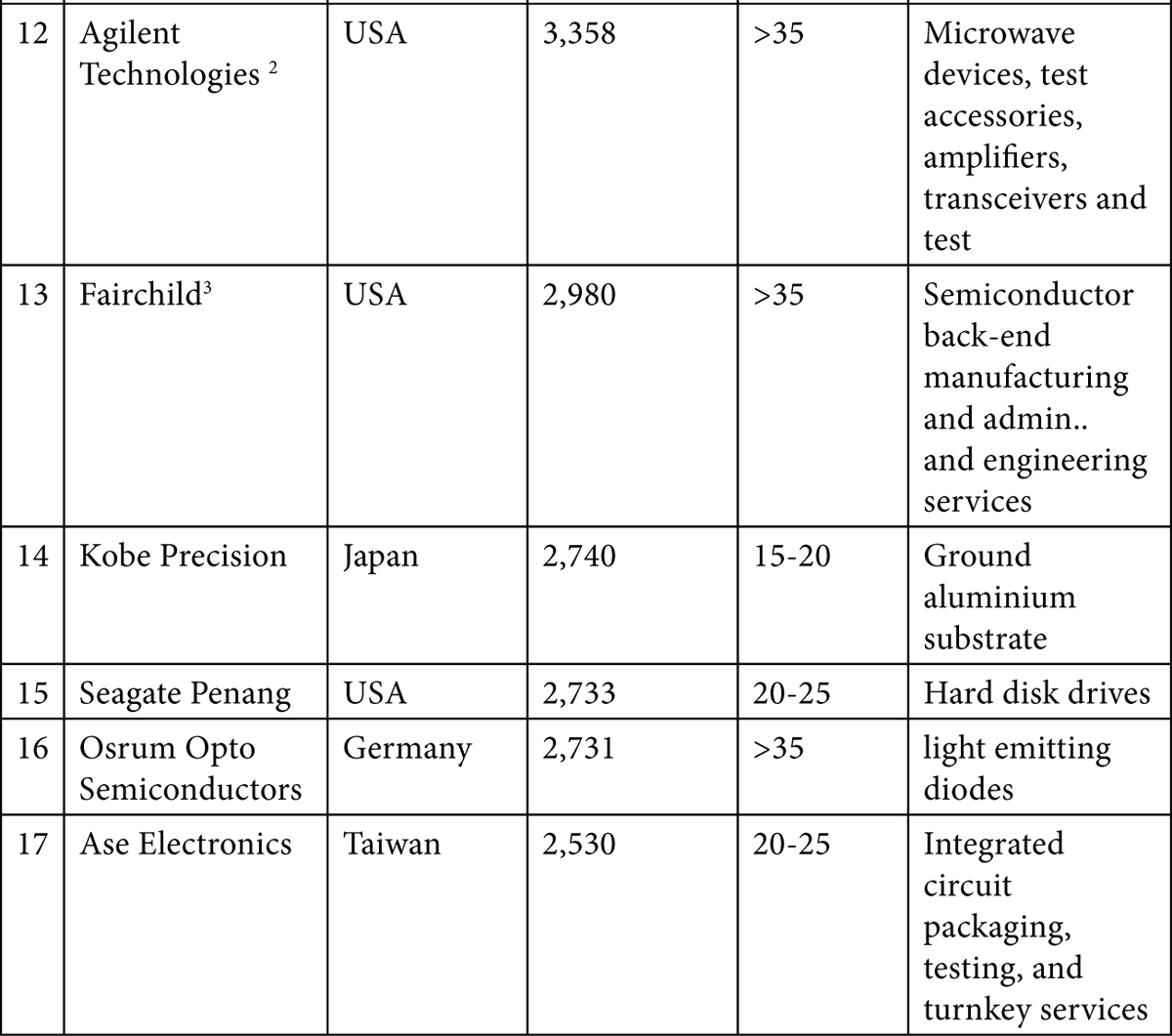

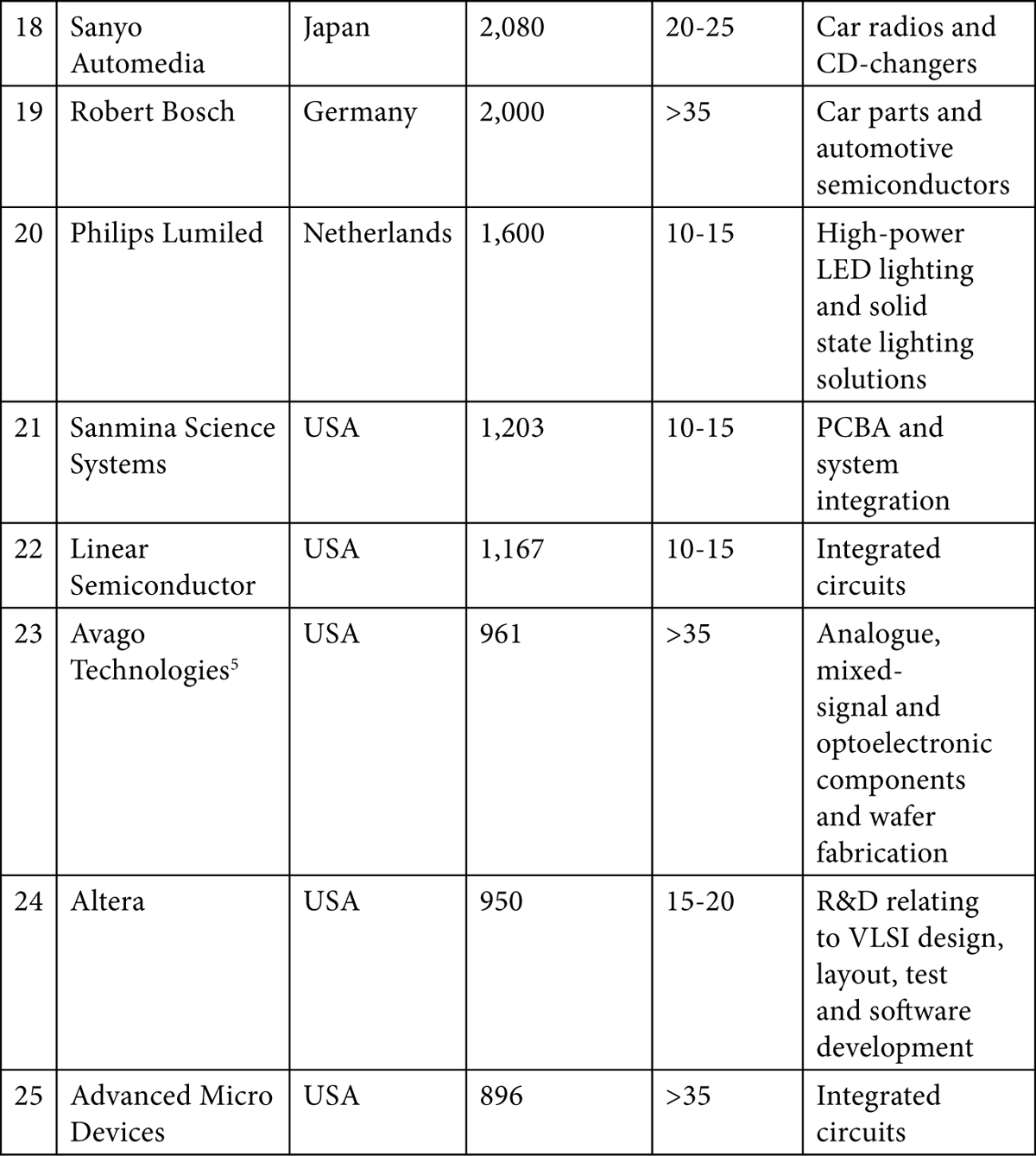

The size distribution (measured by employment headcount) of the top 25 foreign firms is depicted in Tables 8.3. The employment headcount of the 25 foreign firms varies from 896 to 10304, with the majority clustering at a median of around 3000 workers. These 25 firms account for over 75% of the total manufacturing employment in Penang. By contrast, employment in the top 25 local firms varies in the range of 200 to 1400 with the majority clustering at the lower end (Athukorala 20111, Table 8.5). They account for about 8% of total manufacturing employment.

In the 1970s, when the first wave of MNEs came to Penang, there was a general perception that these firms would soon prove to be “fly-by-night” operators. However, the data on firms in operation clearly indicates that most of these firms have become deep rooted in Penang. Seven of the Eight Samurai are among the 25 largest foreign firms (Table 8.3). United States-based MNEs are the dominant players in the Penang export hub, followed by Japanese and German MNEs (Table 8.4).

Export performance and economy-wide impact

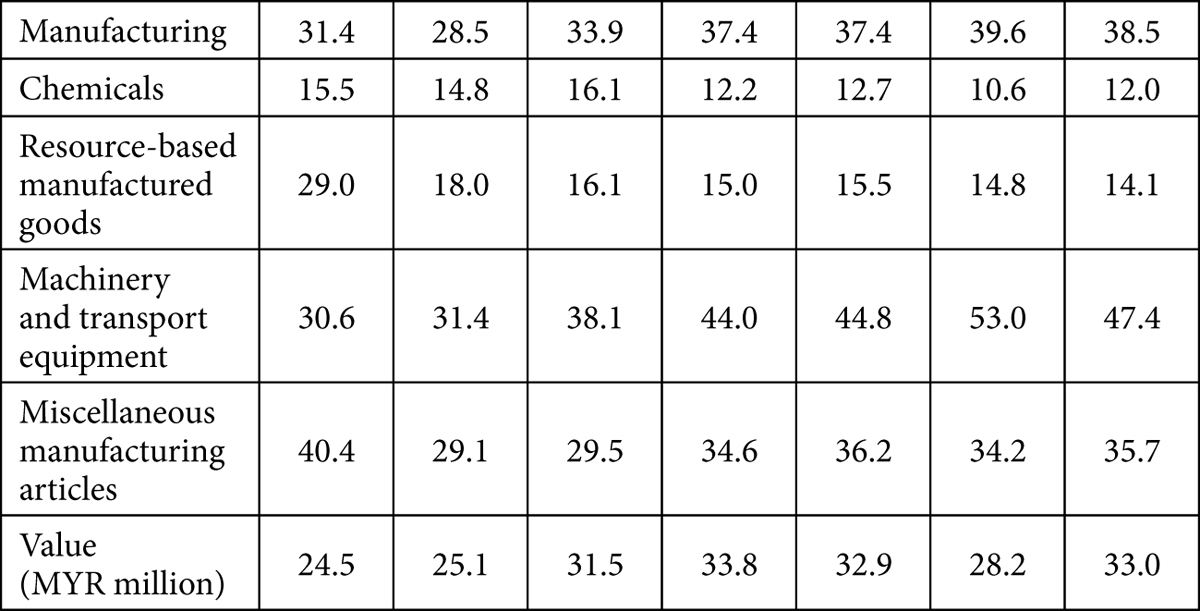

In 2009, manufactured goods accounted for 97% of total merchandise exports from Penang, up from 89% in the early 1990s. The commodity category of machinery, Section 7 of the Standard International Trade Classification (SITC), has continued to account for the lion’s share of electronics components (SITC 30 accounted for almost 90% of machinery exports in 2010 (Table 8.5). However, over the past two decades there has been some modest diversification of the commodity mix. According to the data for 2005 office and accounting machinery (SITC 30) and radio/TV, and medical appliances and components (SITC 32) accounted for 45% and 38.9% of total manufactured goods exports.300

In 2005, foreign firms accounted for 70% of total manufactured exports (Table 8.8). The export-output ratio for foreign firms was 78% compared to 33% for local firms. The lower figure for the local firms mostly reflects that most of the local firms in the electronics industry are parts and components suppliers to the foreign firms. The bulk of direct exports by local firms are concentrated in consumer electronics and electrical goods (SITC 322 and 323), which are relatively more labour intensive and technologically less sophisticated. Foreign firms’ export composition is relatively more diversified, but still electronics accounts for nearly two-thirds of their total exports.

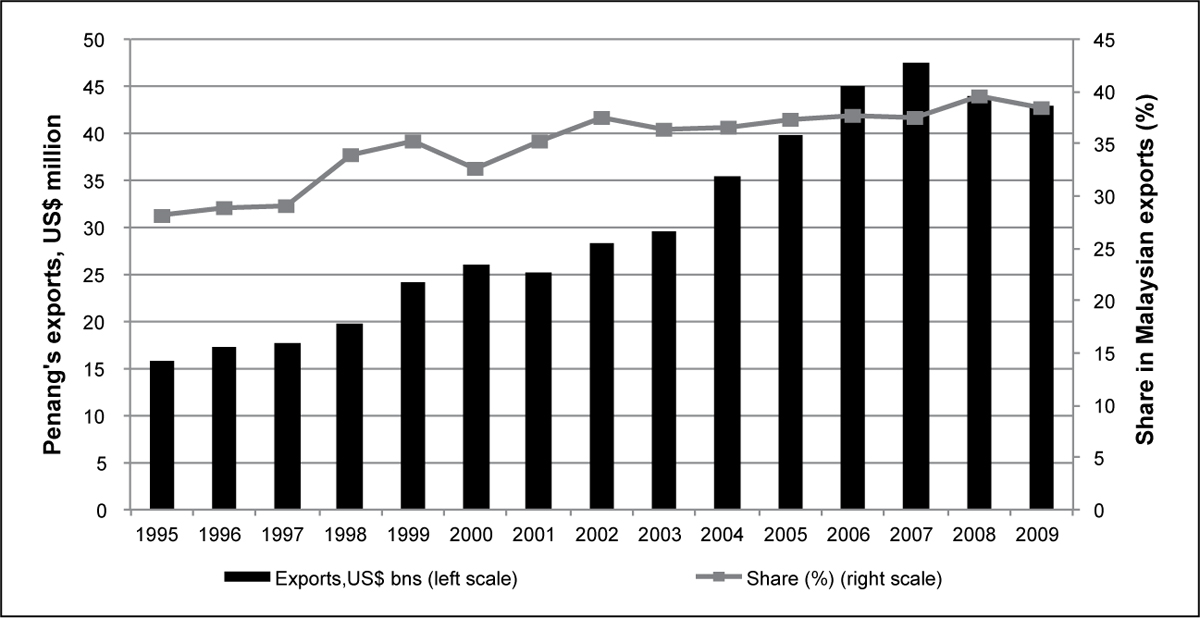

Manufactured goods exports from Penang increased from US$ 90 million in 1973 to about US$ 4.5 billion – amounting to 34% of total manufactured exports from Malaysia – in the late 1980s. Export growth has continued at an impressive rate during the ensuing two decades, notwithstanding a mild slow down following the collapse of the dot-com bubble in 2000 and the onset of the global financial crisis in 2008 (Figure 8.3). The growth rate of exports from Penang has continuously been faster than that of total manufactured goods exports from Malaysia. Penang’s share in total manufactured goods exports from Malaysia was 39% in 2009 up from about 30% a decade earlier (Table 8.5). In recent years Penang has accounted for almost half of the total machinery (electronics and electrical goods) exports from Malaysia.

Overall, the patterns revealed by the data run counter to the pessimistic view that the emergence of China as an export powerhouse has crowded out export performance of Penang. This inference is also consistent with the patterns of structural shifts in the activities of MNEs in Penang which we have observed earlier. Shifts in their operations in Penang towards high-value component design, assembly and testing in the global value chain as well as towards headquarter functions and provision of global services have been aided by the rapid expansion of final assembly in China.

To probe the role of this shift in the product mix in export expansion we compiled export value, volume and price (unit value) indices for electronics exports from Malaysia over the period 1997-2009. Separate export data are not available for Penang, but the national data are representative enough for our purpose because Malaysia’s exports in this product category have predominantly originated in Penang. The indices are depicted in Figure 8.3. Export growth in this product category since about 2001 has been largely driven by price increases (measured by unit value) rather than volume expansion. The value of total exports has moved in tandem with export price, while export volume has remained virtually flat during this period.

Economy-wide impact

Export-led industrialization transformed Penang from the site of sluggish primary production into an international manufacturing hub within a decade. The surplus labour pool of 80,000 workers, estimated by the Nathan Report in 1969, had already been absorbed in the manufacturing sector and related services. The state transformed into a vibrant industrial centre with electronics factories taking the lead. Growth continued unabated following a short slow down during the global recession in the mid-1980s. At a 2003 conference organized by PDC to celebrate the 30 years of industrialization in Penang, Prime Minister Mahathir summed up Penang’s remarkable economic transformation as follows:

I remember the time when Tun Razak [then Prime Minister of Malaysia] told me that Dr Lim Chong Eu had managed to attract some investors to Penang in the electronics industry. I was rather skeptical; what are we going to do with this new-fangled industry? We did not understand much about electronics then and soon after that … Tun Razak … told me that Penang was short of labour; the electronics industry had created so many jobs that Penang had to get workers from the mainland (Mahathir 2003, p. 15).

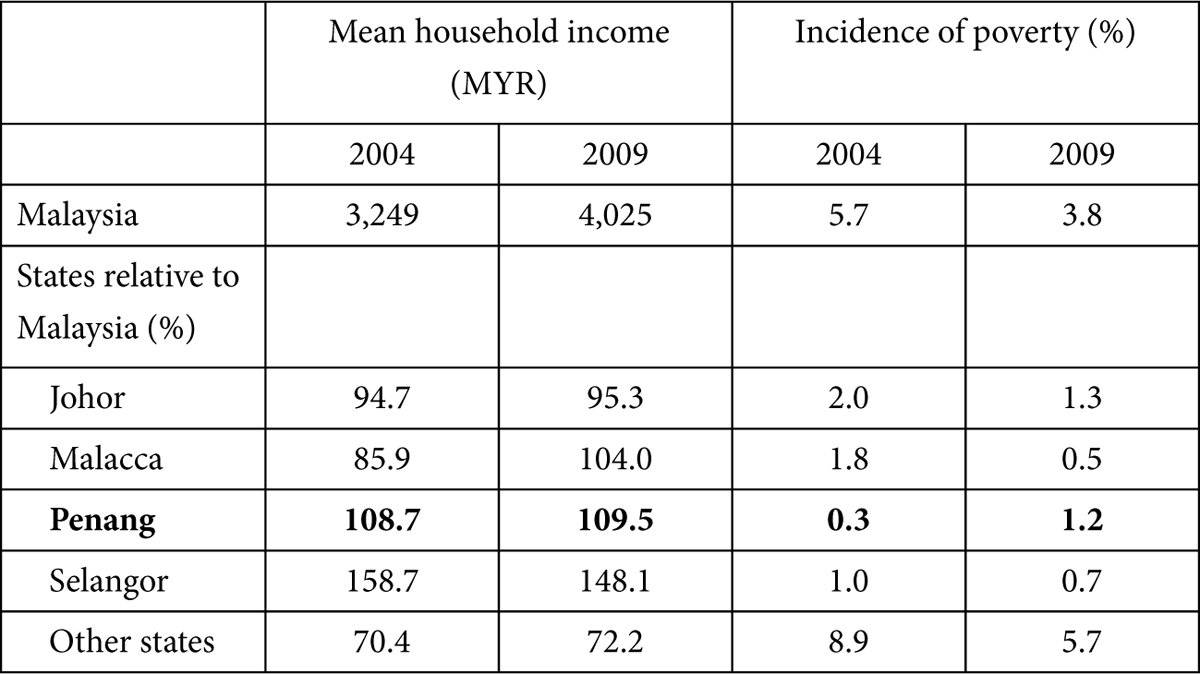

In the early 1970s, Penang’s per capita GDP was about 10% lower than the national average. At the state level it was 70% lower than the state of Selangor, which was the prime focus of national development strategy in the post-independence period (Table 6). Rapid export-led growth elevated Penang to the status of richest state within two decades. In 2010, Penang’s estimated per capita GDP was US$ 8,700, 57% higher than the national average and 30% higher than Selangor.

A comparison based on per capita GDP exaggerates Penang’s level of economic activity among the Malaysian states because, as discussed below, a larger share of income generated in Penang accrues to foreign companies as their share of profits. However, even when household monthly income is used as an indicator of economic performance, Penang ranks well above the national average. Average household income in Penang is lower only to that in Selangor (Table 8.7).

The poverty rate – the percentage of people living below the national poverty line - has also been remarkably lower in Penang compared to the other Malaysian states (Table 8.7). Since the early 1990s, the unemployment rate in Penang, which has varied annually between 0.5% and 2.5%, has been much lower than the national average of 1.5% to 4.5% (SERI 2010).

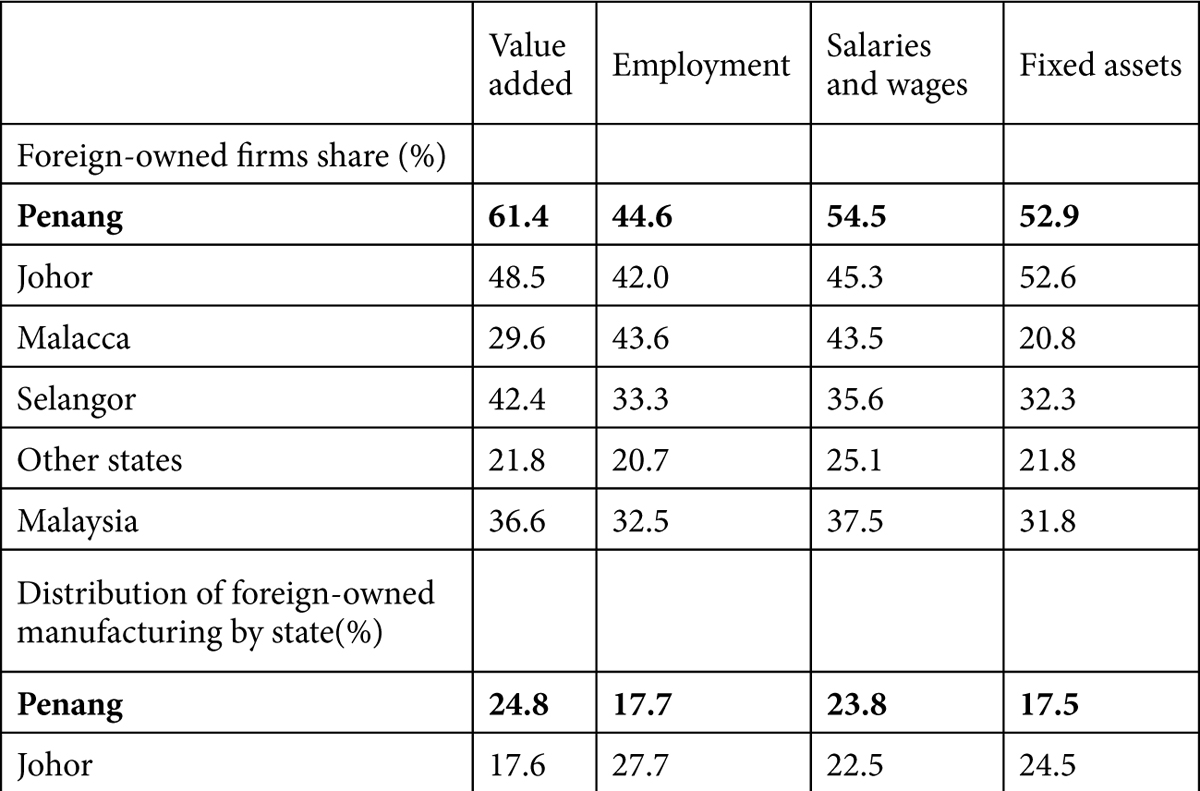

Manufacturing has been the engine of growth in Penang, accounting for over 40% of GDP over the past three decades with a mild upturn in recent years. By contrast, manufacturing accounted on average for only 27% of GDP in Malaysia. Manufacturing accounted for 41% of total labour deployment in 2001. This figure declined to 36% in 2008 because of faster growth in services (SERI 2010). Foreign firms play a much more important role in the Penang’s economy compared to other states in Malaysia (Table 4). For instance, in 2005 foreign firms accounted for over 61% of manufacturing value added in Penang compared to about 37% in the entire country.

Often-voiced criticism of export-oriented growth through global production sharing is the weak linkage effects of the export sector on the rest of the economy. In Penang, the share of local raw material to total raw material used increased from 3% in 1976 to 11% in the early 1980s (Warr 1993). After two-and-a-half decades of manufacturing expansion, this had increased only to about 18% by 2005.301

Domestic input linkages of foreign firms operating within global production networks generally tend to be less than those of domestic market-oriented manufacturing firms. This is because, unlike meeting consumer requirements in domestic markets, producing for highly competitive global markets calls for imported inputs meeting exact quality requirements and specifications. More importantly, input structures within global production networks are determined largely by corporate decisions of MNEs at the global level rather than by relative- cost differential and other factors specific to a particular production location.

Despite the weak input linkages, foreign firms have significantly impacted the domestic economy through human capital development. The talent pool developed over the past four decades is now a primary attraction of Penang for MNEs for locating there upper- end activities and headquarter functions within global production networks. Most MNEs have indigenized their workforce; only 8% of CEOs in foreign companies in Penang are foreigners. Many MNEs draw on managerial and technological expertise of their Penang affiliates when expanding operations to other countries.

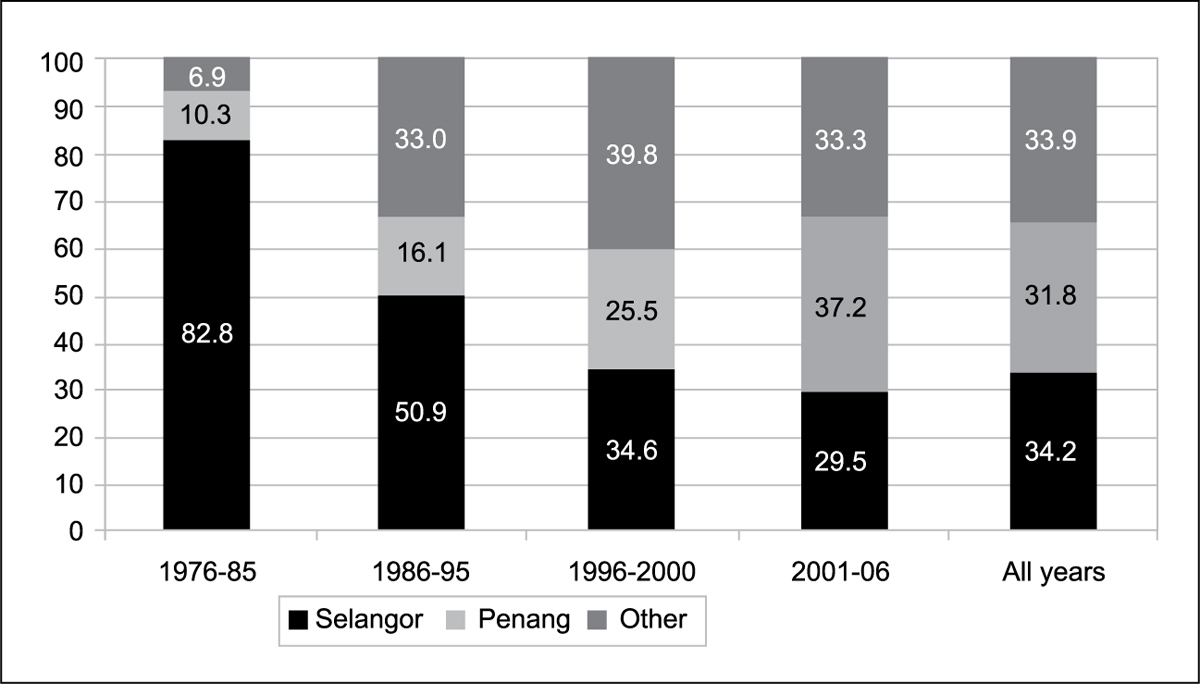

A major concern in the contemporary Malaysian policy debate is the slow process of technological upgrading and productivity growth in export-oriented industries (Rasiah, R. 2010, NEAC 2010, Yusuf and Nabeshima 2009). There are no robust estimates available to check the validity of this concern for Penang. However, it seems to perform better than the rest of Malaysia in R&D activities, as revealed by patent registration data (Figure 5). During 2001- 06 Penang accounted for 37.2% of Malaysia’s registered patients, up from 10.3% during 1976-85. In a comparative study of corporate innovative activities in Singapore, Penang and Bangkok, Diez and and Kiese (2006) conclude that “Penang as a high-tech enclave is most certainly not representative of Malaysia as a whole” (p. 1014). They find that, despite Singapore’ clear lead over Malaysia at the national level, Penang and Singapore are at a similar stage of technological development, and Bangkok clearly trails behind both (emphasis added).

Conclusion and policy lessons

The Penang export hub has gained maturity and consolidated its position within global production networks over the past four decades. Concerns that the Malaysian industry has

“reached a point of saturation and its survival depends on the capacity to climb up the technology ladder” (UNCTAD 2010), and that “Malaysia’s manufacturing performance has stalled over time and the sector remains at odds with the objective of – “moving up the value chain” (NEAC 2010 Part 1, p. 181) are certainly not consistent with Penang’s recent growth experience.

As a result of increasing domestic wages and emergence of competing low-cost production locations, Penang’s attractiveness for low-end activities and final assembly within global production chains has been rapidly eroding over the past two years. But this has not resulted in a hollowing out of the Penang export hub. Firms involved in design, assembly and testing activities in the electronics and electrical goods value chain have begun to expand and consolidate their operations in Penang. More importantly, based on the early-mover advantage in electronics and the skilled labour pool developed over the years, the production base has begun to diversify into a number of electronics-related dynamic product lines with brighter growth prospects. These include medical devices, light emitting diodes (LED), and photovoltaic design and development. China’s rise as the premier assembly centre does not seem to have crowed out export performance of Penang. On the contrary, there appears to be a complementary relationship between China’s rise as the premier assembly centre within global production networks and export performance in Penang. Rapid expansion of final assembly in China has been accompanied by a notable shift in MNE operations in Penang towards high-value component design, assembly and testing in the global value chain. Reflecting this structural shift, expansion of exports from Penang in recent years has been driven predominantly by increase in prices rather than volume expansion.

What explains Penang success? Penang started the process of export-oriented industrializations with some unique advantages. It had a long tradition of both English and Chinese education, with a literacy rate well above the national average. From the colonial era it inherited fairly well developed trade-related infrastructure and institutions. However, these initial advantages would not have been translated into a notable economic success if it were not for a proactive state government led by Chief Minister Lim Chong Eu who embarked on a visionary strategy to unleash the island’s growth potential. The strategy carefully mitigated the adverse impact of the affirmative action elements of the 1971 New Economic Policy on private-sector initiatives, while benefiting from Malaysia’s long-standing commitment to an open trade and investment policy stance, and emphasis on export-oriented growth.

Penang is a unique example of government marrying its job creation policy objectives with emerging opportunities for international specialization by linking its economy to global production networks. The state government not only attracted foreign investors but also helped them become deeply rooted in the economy through a well-design investment promotion strategy including FTZ status, infrastructure development, skills development and vocational training, and forging links between local and foreign firms.

It is hazardous to make sweeping generalization from a single case study. The experience of Penang does, however, offer a number of policy insights that may be useful to policy makers in other countries in designing FDI policy, especially in the context of the ongoing process of global production sharing.

•Institutional reforms

The policy reforms began by forming a new statutory body, Penang Development Corporation (PDC) as the principal development agency independent of the formal government structure. The carefully designed autonomous organizational structure enabled PDC to perform effectively its role as the centre point of formulation, implementation and coordination of the export-oriented industrialization strategy. PDC was successful in creating in the business community an impression of a unified and cooperative team with a firm commitment to FDI promotion.

•Focused investment promotion

After the failure of initial attempts at import-substitution industrialization, the state government of Penang made a clear and decisive policy shift to export-oriented industrialization, with the electronics industry – broadly defined to include both electronics and electrical goods – as the key focus of investment promotion. Once the import substation projects proved to be commercial failures, they were swiftly abandoned, without trying to make them survive trough direct subsidies. The choice of electronics as the priority sector at the outset nicely matched Penang’s source endowment and unfolding opportunities for international specialization. Thus choice also helped designing an investment promotion strategy with an industrial cluster focus. The cluster focus in turn provided a viable setting for promoting MNE-SME linkages within the export hub, and creating a “skill pool” which turned out to be the major attraction of Penang as an attractive location for MNEs in a wide range of industries with an electronics base.

•Effective personal involvement from the top level of government

The Chief Minister Lim Cong Eu played an active personal role in the process, sending a clear, consistent message to investors about development priorities. He chaired the State Planning and development Committee, the apex policy making body of PDC, and led investment missions to the major home countries of prospective investors. The long tenure of the Chief Minister and his top management team (for over two decades) helped assuring policy certainly and building investor confidence.

•Post-investment care

PDC created an institutional mechanism to maintain close links with both MNE affiliates and local firms operating in Penang. This helped policy makers staying abreast of investor requirements and thus continuously adapting to the changing investment climate. More importantly, this receptivity approach helped to engage the foreign firms already operating in Penang in the investment promotion campaign. PDC often used references from these firms to complement the government’s commitment to investment promotion.

•Infrastructure development

PDC effectively used Free Trade Zones and Industrial estates as the vehicles for focused infrastructure development for successful global integration of the Penang economy. It successfully addresses the problem of land scarcity faced in accommodating foreign investors by creating an innovative land back through market acquisition of private land and reclamation.

•Vocational training and skill development

At the formative stage of the export hub, PDC played an important facilitating role in labour absorption by the newly established MNE by conducting vocational training program. When skill shortages began to hamper the expansion of electronics industry by the later 1980s, PDC joined with MNEs to establish the Penang Skill Development Centre. The federal government also helped skill development at the firm level by offering general tax deductions on MNEs contributions to PSDC schemes and their own skill development efforts.

•Fostering MNE-local firm links

From the inception, PDC placed emphasis on developing a domestic supplier network around the branch plants of MNEs. This helped increase economic impact of MNE presence on the domestic economy through a multiplier effect and was instrumental in anchoring foreign investor in the export hub through tighter and more appropriate supplier relationships. The domestic vendor networks that initially evolved around semiconductor assembly facilitated the subsequent diversification of the production base of the export hub into other product lines such as consumer electronics and computer peripherals, and more recently to light- emitting diodes and medical devices.

REFERENCES

Andaya, Barbara Watson and Leonard Y. Andaya (2001), A History of Malaysia, 2nd Edition, Houndmils (UK): Palgrave Macmillan

Athukorala, Prema-chandra (2009), The Rise of China and East Asian Export Performance: Is the Crowding-out Fear Warranted?, World Economy, 32(2), 234-66.

Athukorala, Prema-chandra (2011a), Production Networks and Trade Patterns in East Asia: Regionalization or Globalization?, Asian Economic Papers, 10(1), 65-95.

Athukorala, Prema-chandra (2011a), Growing with Global Production Sharing: The Tale of Penang Export Hub, Working Papers in Trade and Development 2011/13, Arndt-Corden department of Economics, Crawford School of Economics and Government, Australian National University, Canberra (https://acde.crawford.anu.edu.au/acde-research#working-papers)

Bhusal, Pramod, Alex Zahnd and Liisa L. Halonen (2007), Energy-efficiency, Innovative Lighting and Energy Supply Solutions in Developing Countries, International Review of Electrical Engineering, 2(5), 665-670.

Brown, Clair and Greg Linden (2005) Offshoring in the Semiconductor Industry: A Historical Perspective in Lael Brainard and Susan M. Collins (eds.) The Brookings Trade Forum 2005: Offshoring White-Collar Work: The Issues and Implications. Washington DC: Brooking Institution Press. pp.270-333.

Crouch, Harold (1996), Government & Society in Malaysia, Sydney: Allen & Unwin.

Dies, Javier Revilla and Mathew Kiese (2006), Scaling Innovation in South East Asia: Empirical Evidence from Singapore, Penang (Malaysia) and Bangkok, Regional Studies, 40(9), 1005-1023.

Dupuis, Russell D. and Michael R. Krames (2008), Development an Application of High- brightness Visible Light-emitting Diodes’, Journal of Lightware Technology, 26(9), 1154-1171.

Government of Malaysia (2001), Eighth Malaysia Plan, 2001-2005, Kuala Lumpur: Economic Planning Unit, Prime Minister’s Department.

Government of Malaysia (2006), Ninth Malaysia Plan, 2001-2005, Kuala Lumpur: Economic Planning Unit, Prime Minister’s Department.

Government of Malaysia (2011), Tenth Malaysia Plan, 2001-2005, Kuala Lumpur: Economic Planning Unit, Prime Minister’s Department.

Grunsven, L. van (2006), Evolution versus Creation: The Automation Industry in Penang, Malaysia. In P. van Lindert, A. de Jong, G. Nijenhuis and G. van Westen (eds), Development Matters: Geographical Studies on Development Processes and Policies,

Utrecht: Department of Human Geography and Planning, Faculty of Geosciences, Utrecht University, 215-229.

Hutchinson, Francis E. (2008), Developmental State and Economic Growth at the Subregional Level: The Case of Penang, in Institute of Southeast Asian Studies (ISEAS), Southeast Asian Studies 2008, Singapore: ISEAS, 223-244.

Jackson, Tim (1997), Inside Intel: Andy Grove and the Rise of the World’s Most Powerful Chip Company, New York: Plume.

Jacobson, Michael (2009), Frozen Identities: Inter-Ethnic Relations and Economic Development in Penang, Malaysia, Copenhagen Discussion Papers No 30, Copenhagen: Asia Research Centre, Copenhagen Business School.

Jomo S.K. and C.H. Wee (2002), The Political Economy of Malaysian Federalism: Economic Development, Public Policy and Conflict Containment, World Institute for Development Economic Research Discussion Paper No. 2002/13, Helsinki.

Lai, P.Y. (2005), Value-added Manufacturing: A New Paradigm, in Asian Strategic and leadership Institute, Penang into the 21st Century, Kuala Lumpur: Pelanduk Publications, 51-63.

Leigh, Michael (1992), Politics, Bureaucracy, and Business in Malaysia: Realigning the Eternal Triangle, in Andrew J. MacIntyre and Kanishka Jayasuriya (eds.), The Dynamics of Economic Policy Reforms in Southeast Asia and the South-west Pacific, Singapore: Oxford University Press, 115-137.

Lim, Chong Eu (2005), Building on Penang‘s Strengths: Going Forward‘, Penang Lecture 2005, http://www.seri.com.my

Lim, Peggy (1991), Steel: From Ashes Rebuilt to Manufacturing Excellence, Penang, Malaysia: Intel Technology Sdn, Bhdr.

Mahathir B. Mohamad (2003), The Prime Minister Recollects, in Penang Development Corporation (PDC), Penang, Malaysia: Strategy & Success, Bayan Lepas (Penang): PDC, 15-18.

McKendrick, David G., Richard F. Doner and Stephen Haggard (2000), From Silicon Valley to Singapore: Location and Competitive Advantage in the Hard Disk Drive Industry, Stanford, California: Stanford University.

Narayanan, Suresh (1999), Factors Favouring Technology Transfers to Supporting Firms in Electronics: Empirical Data from Malaysia, Asia-Pacific Development Journal, 6(1), 55-72.

Nathan Associates, Inc. (1970), Penang Master Plan Volume 1: Summary and Recommendations, Penang Master Plan Committee (Photocopy available in the library of SERI)

NEAC (National Economic Advisory Council) (2010), New Economic Model for Malaysia, Parts 1 & 2, Kuala Lumpur: NEAC).

PDC (Penang Development Corporation) (2003), Penang, Malaysia: Strategy & Success, Bayan Lepas (Penang): PDC.

Rasiah, Rajah (1994), Flexible Production Systems and Local Machine Tool Subcontracting, Cambridge Journal of Economics, 18(3), 279-298.

Rasiah, Raja (2010), Are Electronics Firms in Malaysia Catching Up in the Technology Ladder?, Journal of the Asia Pacific Economy, 15(3), 301-319.

SERI (Socio-Economic & Environmental Research Institute) (2001), The Second Penang Strategic Development Plan, 2001-2010, Technical Papers, George Town: SERI.

SERI (2010), Penang Blueprint 2011-2015, Progress Report, George Town: SERI.

Singh, Chet (2011), Institutions for Regional Development: The PDC as I know It (1970-90), in Institute for Strategic and International Studies (ISIS), Malaysia: Policies and Issues in Economic Development, Kuala: Lumpur: ISIS, 597-622 (forthcoming).

Spinanger, Dean (1986), Industrialization Policy and Regional Economic Development in Malaysia, Singapore: Oxford University Press.

Sturgeon, Timothy J. (2003), What Really Goes on in Silicon Valley? Spatial clustering and dispersal in modular production networks, Journal of Economic Geography. vol. 3. pp. 199-225.

Tan Liok Ee (2009), Conjunctures, Confluences, Contestations: A Perspective on Penang History, in Yeoh Seng Guan, Loh Wei Leng, Khoo Salma Nasutian and Neil Khor (eds.), Penang and Its Region: The Story of an Asian Entrepot, Singapore: NUS Press, 30-54.

Todd, Halinah (1986), Penang: Asia‘s Silicon Island, Reader’s Digest, March, pp. 17-21. UNCTAD (United Nation’s Conference on Trade and Development) (2010), Creating Business Linkages: A Policy Perspective, Geneva: UNCTAD.

UNIDO (United Nation Industrial Development Organization) (2009), Industrial, Industrial Development Report 2009, Vienna: UNIDO.

Warr, Peter G. (1987), Malaysia‘s Industrial Enclaves: benefits and Cost‘, The Developing Economies, 25(1), 30-55.

Yusuf, Shahid and Kaoru Nabeshima (2009), Can Malaysia Escape the Middle-Income Trap? A Strategy for Penang, Policy Research Working Paper No 4971, Washington DC: World Bank.

Tables 8.1: Branch plants of multinational enterprises operating in Penang, 2005

Source: Compiled from unpublished returns to the Census of Manufacturing Industries 2005, Department of Statistics, Malaysia.

Table 8.2: Ownership structure of manufacturing firms in Penang, as of August 20081

Notes:

1.Based on information provides by 629 of 1193 enumerated firms.

2.Companies with annual revenues of more than MYR 25 million (US$ 9 million) or more than 150 full-time employees.

Source: SERI 2008

Table 8.3: Top 25 foreign enterprises in Penang: employment and product lines (as at August 2008)

Note:

1.Ranked by employee head count.

2.Formerly Hewlett-Packard.

3.Formerly National Semiconductor.

4.Formerly Hitachi Malaysia. Renesas was established as Japan‘s largest semiconductor supplier in 2003 through a merger of Hitachi and Mitsubishi Electric group.

5.The semiconductor division of Agilent, which became an independent company in 2005.

6.Total employment in Penang and Kulim (in the State of Kedah) plants.

Source: SERI (2008) supplemented by information from Invest Penang (Penang Development Corporation), company websites and interviews with company managers.

Table 8.4: Home-country profile of foreign firms in Penang (as at August 2008)

Note: Compiled from unpublished returns to Penang Industry Survey 2007 conducted by SERI in 2008 for Invest Penang

Table 8.5: Merchandise exports from Penang: value, composition and share of total Malaysian exports

Note: * Two-year average.

Source: Compiled from customs returns of Penang (SERI database) and UN Comtrade database (for total Malaysian exports)

Table 8.6: Per capital GDP in Malaysia and Malaysian States and Federal Territories (in MYR)

Note: * At 1987 prices

Source: for 1970 and 1975 from Spinanger (1986), Table 1.3; Government of Malaysia (2001, 2006, 2010)

Table 8.7: Mean monthly gross household Income and incidence of poverty

Source: Government of Malaysia (2006 and 2010)

Table 8.8: Foreign-ownership in Malaysian manufacturing: Penang in the national context, 2005 (percentage shares)

Source: Compiled from unpublished returns to the Manufacturing Census 2005, Department of Statistics, Malaysia.

Figure 8.1: Map of Malaysia and Penang

Figure 8.2: Penang: distribution of the number branch plants of MNEs in operation and their employment (headcount) by the year of entry as at 2005

Source: Based on data compiled from unpublished returns to Manufacturing Census 2005, Department of Statistics, Malaysia.

Figure 8.3: Manufactured Exports from Penang: Vale (US$ million) (left scale) and share in Malaysian exports1

Note: 1. Annual average growth rates (%):

Source: Based on data compiled from unpublished returns to Manufacturing Census 2005, Department of Statistics, Malaysia

Figure 8.4: Value, Volume and Price (unit value) indices of electronics exports from Malaysia

Source and methodology: Compiled for UN Comtrade database. Cover 20 products at the HS 6 digit level which for which volume data are available for all years during the period 1997-2009. These products accounts for about 70% of the commodity category of electronics under the Standard International Trade Classification (SITC 77)

Figure 8.5: Malaysian Patent registration: Selangor, Penang and other states, 1976-2006

Source: NEAC 2010, Part 1, p. 183

292Several terms have been used to describe this phenomenon, including international production

293The full list of interviewees is given in Appendix 1 in the discussion paper version of this paper (Athukorala 2011b).

294The decision-making body set up to tackle the ethnic conflict with overall authority over the armed forces, police and civil service.

295As stated by Mr Chet Singh in the interview. Emphasis added.

296Interview, 19 November 2010.

297Intel Corporation was founded 1968 by two former Fairchild employees, Robert Noyce and Gordon Moore. In 1970, Intel invented the microprocessor, which revolutionized the electronics industry and set the stage for Intel to become the world‘s most powerful electronics company.