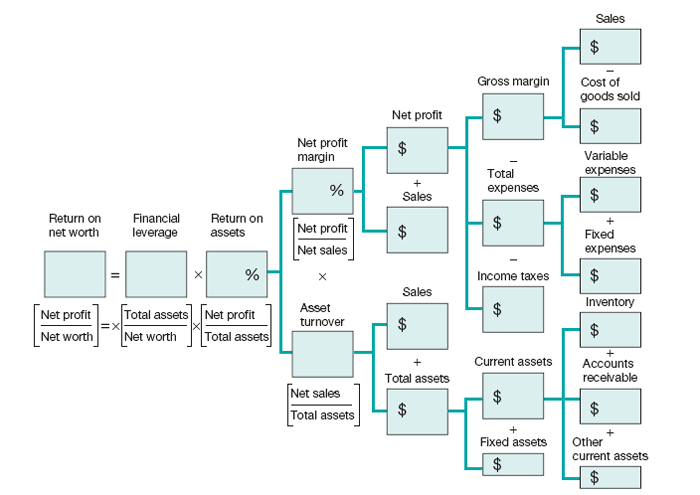

DuPont scheme

The DuPont scheme can be used to illustrate the impact that different factors have on important financial performance indicators, such as the return on capital employed (ROCE), the return on assets (ROA) or the return on equity (ROE). While these ratios can be calculated using a simple formula, the model provides more insight into the underlying elements that make up the ratios. It is similar to sensitivity analysis, in the sense that the model makes it possible to predict the effect of variability in one or more input variables. The tool is well known in purchasing management, as it shows the tremendous impact that effective purchasing can have on profitability (Figure 28.1).

The model can be used in several ways. First, it can be used as the basis for benchmarking, i.e. comparing different companies in an industry to answer the question why certain companies realise superior returns than their peers. Secondly, it can be used to predict the effect of possible management actions.

The DuPont scheme will show big differences between industries. If one looks at the ROE, a high score can be caused either by ‘operational efficiency’ or by ‘capital efficiency’. High turnover industries (e.g. retailers) tend to face low profit margins, high asset turnover and a moderate equity multiplier. Other industries, such as fashion, depend on high profit margins. In the financial sector, the ROE is determined mainly by high leverage, gaining large profits with relatively low assets. It is essential to choose peers carefully when analysing how to improve the profitability of a specific company (Figure 28.2).

Figure 28.2 Return on equity = operational and capital efficiency

The following steps have to be performed in a DuPont scheme:

The DuPont scheme originates from the work of F. Donaldson Brown, who developed the scheme at DuPont in 1919. The scheme has thus proved its value, as it is still useful. It helps to determine the factors that influence profitability most. However, it lacks the possibility to validate that the correct numbers are used. As opposed to other models, such as the balanced scorecard (including key performance indicators; see Chapter 17), the DuPont scheme lacks parameters other than financial parameters, excluding other important factors such as employee motivation.

Besides these shortcomings, the main disadvantage is that identifying the factors that influence profitability most is only part of the story. The next step is to find appropriate actions that will improve profitability, but the DuPont scheme is not equipped for identifying and deciding on those actions. Other models, such as root cause analysis (Pareto analysis; see Chapter 48) are better suited to determining which actions are appropriate.

Bodie, Z., Kane A. and Marcus, A.J. (2004) Essentials of Investments, 5th edn, pp. 458–459. New York: Irwin/McGraw-Hill.

Groppelli, A.A. and Nikbakht, E. (2000) Finance, 4th edn, p. 444. New York: Barron’s Educational Series.

Ross, S.A., Westerfield R. and Jaffe, J. (1999) Corporate Finance, 5th edn. Maidenhead: McGraw Hill.