Financial ratio analysis: liquidity, solvency and profitability ratios

Financial ratios help to analyse the financial performance of all the activities of an organisation and all its products and services in all markets. Financial ratios are based on the balance sheet and profit and loss account of the organisation. Using financial ratios gives two types of insight: where the organisation performs best; and the financial constraints and possibilities the company has when considering new activities, project or strategies.

It is wise periodically to analyse the financial position and financial performance of every organisation. In practice, these analyses occur very regularly as they are not only carried out with each investment opportunity or new strategic initiative, but they are also often integrated into the periodic reporting of the organisation.

Financial ratios standardise financial data, so that they are transparent and can be compared with those of competitors and/or with the organisation’s historical performance (measuring progress). Most of the ratios can also be calculated per product, per market, per business unit or any other company cross-section.

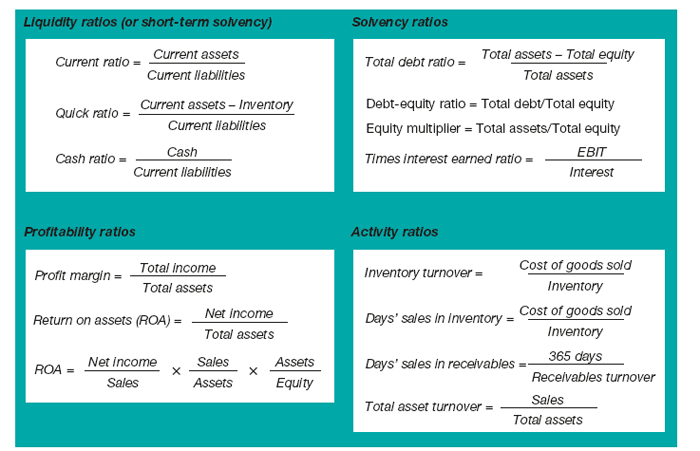

Figure 30.1 Financial ratio analysis

The financial ratio analysis provides a view of:

There are four different types of financial ratios (see Figure 30.1), reflecting the performance of the organisation:

To perform a financial ratio analysis, you simply collect the data from the financial administrative systems that are mentioned in each of the formulas and then calculate the ratios. The required data are generally rapidly available, as most ratios are part of regular management reports.

A financial ratio analysis provides insights into the current financial state of affairs of an organisation. It can also give an impression of the future financial situation if policies were to remain unchanged. The financial ratio analysis should not, however, be used in absolute terms. There is great risk involved in giving too much attention to the financial component of setting a new strategy: the results of the ratio analysis are never directional for a new strategy, but will only show the financial possibilities and limitations of the organisation.

Keown, A.J., Scott, D.F., Martin, J.D. and Petty, J.W. (1994). Foundations of Finance: The Logic and Practice of Financial Management. Upper Saddle River, NJ: Prentice-Hall.

Walsh, C. (2008) Key Management Ratios: the 100+ Ratios every Manager Needs to Know. Harlow: Pearson.