10 |

Crossing the Line |

IT’S JUST A LINE ON A PIECE OF PAPER, THAT’S ALL. THE HARD LINE that separates Level 2 from Level 3.

Ask yourself, if you were the CEO of some new start-up supplier today in your industry and you wanted to disrupt the large incumbents, which operating model would you choose to build? After all, you would have a clean sheet of paper. You could build whatever kind of company you wanted!

From what our friends in the venture capital community are telling us, there are many Level 3 and Level 4 suppliers baking in the oven right now. Yet the truth is that Level 2 suppliers still dominate the landscape. This is especially true in larger, more established tech sectors. For them, the sheet of paper is not clean, and the choice to cross that line is not so simple. They are expected to deliver both short-term profits and long-term growth while they stare at the “fish problem,” discussed in Chapter 6, that is sitting between these expectations.

Among customers, the hard line also represents challenges. Having suppliers with Level 3 and Level 4 operating models means that they must choose the grand bargain. They must begin to actively dismantle or reassign some of their internal operating capabilities in order to pay for suppliers’ new services and simultaneously increase their ROI to the CFO. Usually this means reducing headcount.

So, on both sides of the great divide, hard decisions must be made about whether to cross that line. As the English rock band The Clash famously asked, “Should I stay, or should I go?”

Will There Be a New Normal?

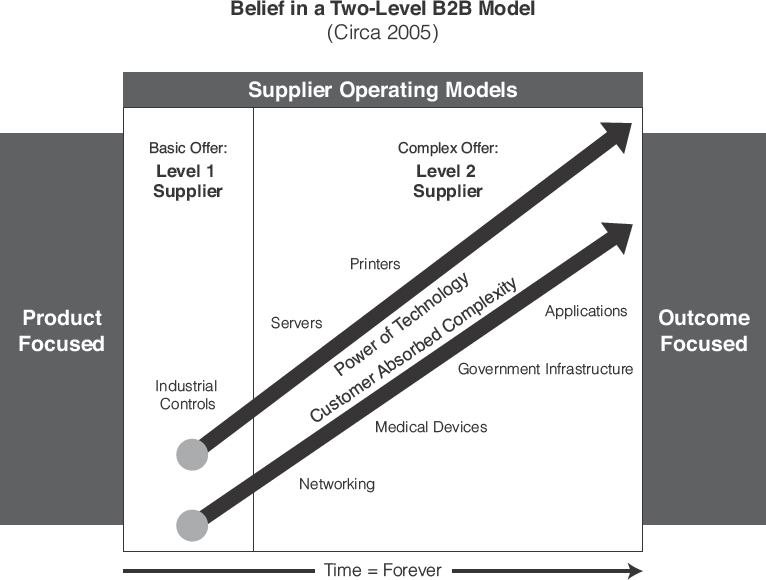

When we first started talking about the decision with supplier execs several years ago, the need for operating and business model transformation was less clear. There were many reasons to believe that Level 1 suppliers could keep on with their frictionless model of make, sell, and ship. Most Level 2 suppliers also felt that their current operating model (shown in Figure 10.1) was their permanent one.

FIGURE 10.1 Belief in a Two-Level B2B Model (circa 2005)

For suppliers at that time, investing in R&D to build ever-increasing product power by adding more features while offering a growing portfolio of product services seemed like the proven path to both short-term profits and long-term growth. On the opposite side, customers had long accepted that they were the ones who needed to absorb the complexity that went along with tech and translate it into business outcomes. Although there was talk about improving the internal efficiency of organizations such as IT or operations, there was little talk about eliminating whole parts of them. That relatively stable, decades-long period was one in which management on both sides of the great divide was comfortable. All descendants of Patterson’s B2B vision knew what everyone’s role was and how each side of the Level 1 and Level 2 partnership was going to operate. While there was a small number of interesting new-model tech companies on the periphery, they seemed confined to SMB markets. In general, Level 1 and Level 2 partnership models were dominant.

Today, the level of discussion is much more serious and the actions being taken are more urgent. We don’t think many executives on either side today would disagree that Level 3 and 4 operating models are viable, not just for SMBs, but for large enterprises as well.

But how far will it go? Are Level 3 and Level 4 supplier models just niche opportunities, or are they going to become the “new normal.” Although it will certainly be the case that most suppliers will be in the “and, not or” situation of operating different models for different product markets for many years, the question of how big a bet to place on Levels 3 and 4—and when—is crucial.

If you are a senior executive of a high-tech or near-tech supplier, you are probably already facing these decisions. If you are a top IT, operations, or manufacturing executive on the customer side, you must decide how much and how soon you can depend on those suppliers to play new roles in your partnerships. Collectively, executives on both sides must decide for themselves: What is going to happen here? So we would like to end the book by assessing where many tech markets are going to go, not just based on our conclusions, but also on yours.

To pursue this topic together, we ask you to consider whether you agree or disagree with some of the core assertions of B4B:

1.New Level 1 offers are usually innovative, but often are in basic forms. They may be perfect for simple applications or individual end users. However, many of them are not yet sophisticated enough to be adopted by large enterprise customers.

2.Level 2 is where offers become industrial enough and flexible enough for large enterprises to be able to adopt and standardize them. Moving from Level 1 to Level 2 is usually the biggest single period of power growth for the product.

3.At Level 3, there can be some additional power added to the offer through active supplier involvement in daily product operating and adoption roles. Although the Level 3 offer is more powerful, the steepness of the power growth curve is less than when moving from Level 1 to 2.

4.At Level 4, customers may have to make some compromises to their normal expectations of a highly customized product in order to let the supplier de-risk the offer and ease complexity.

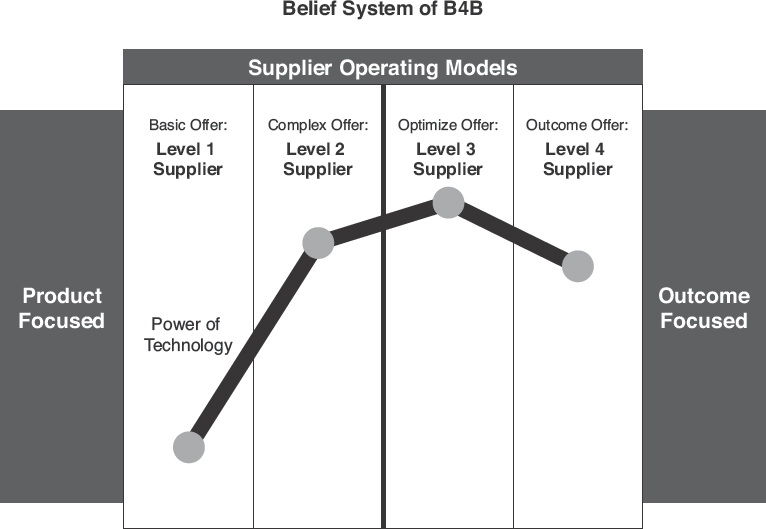

If you generally agree with these assertions, then you are probably OK with drawing an Offer Power Line (the product plus the services) on the B4B construct that looks something like that shown in Figure 10.2.

A couple of examples might help to illustrate the pattern. Think about the history of CRM software. In the early 1990s, Act! was the leading contact management software application for a salesperson’s PC. But it took Siebel in the mid-1990s to make industrial-strength Level 2 CRM software. By 2008, salesforce.com had moved CRM to an industrial-strength Level 3 offer. Then think about how it has worked in a completely different near-tech market. Take an industrial product such as commercial HVAC. At Level 1, heating/air-conditioning units could control the temperature of a room, but it took Level 2 building management systems to give owners the power to control their utility costs. Now “smart building” managed services providers are taking this industry to Level 3 by offering to actively manage these systems, improving their energy efficiency while also reducing on-site labor costs.

FIGURE 10.2 B4B Belief System

As we said, there are precious few Level 4 examples today. AWS and Rackspace are getting really close. Some tech sectors may never get to that point. But as some do, we believe the customer will need to adopt the supplier’s way of doing things. The solutions they offer might not be quite as customized or sophisticated as their old Level 2 or 3 solutions were. The customer may not have quite as much control over how detailed processes work. They may even have to give up a few features. But in exchange, Level 4 customers may have far fewer headaches, far less risk, and far lower costs. This is exactly the trade-off going on today as a growing number of large enterprise CIOs are piloting AWS as a cloud storage supplier for non-mission-critical data.

If you can generally agree to the shape of that Offer Power Line (or something that approximates it in your market) in Figure 10.2, then we can move on to considering a second set of assertions. These relate to the complexity typically facing customers at the four levels. See how much you agree with these statements:

1.Customer-managed complexity at Level 2 is the highest of all levels.

2.A Level 3 offer begins to provide some relief to customer-managed complexity from supplier offers such as managed services or remote hosting.

3.A Level 4 offer, at least in theory, could drop customer-managed complexity dramatically.

If you generally agree with these assertions, then you are probably OK with adding a second line to the belief system diagram so that it might look something like what is shown in Figure 10.3.

FIGURE 10.3 B4B Belief System

Together, these simple lines begin to bring the true potential of new B4B operating models into clear view. Although they may not provide the same gain in raw power that occurs when tech products move to Level 2, they represent the potential for something at least as important: better ROI (see Figure 10.4).

FIGURE 10.4 The ROI of B4B

We believe that many tech customers are shifting their focus from owning the most technology to extracting the most ROI from it. B4B offers a way to frame that journey for both the customers who want to experience it and the suppliers who want to deliver it. Suppliers’ individual drawings of their product and/or markets will be unique. Likewise, customers may have different shapes to their lines in different categories of their tech spending. But, importantly, we don’t think the basic message of these lines will change.

The basic message is this: Level 2 suppliers may have offered the most rapid growth in the power of technology at Level 2, but it is Level 3 and Level 4 suppliers who may now offer the most rapid growth in customer ROI. That is how they will compete and, when ROI is the customer’s priority in the decision, how they will win. Widening that gap between the power of technology and the total cost of ownership (TCO) is what every supplier at Levels 3 and 4 is banking on today to disrupt their incumbent Level 2 competitors. This is true whether they are a start-up or an established market leader making the transition.

The hard line that separates Level 2 from Level 3 is not only a line that changes the operating model of a supplier; it is also a line that changes how customers think. It will affect who they choose and why. It may lead them to sacrifice certain features for the confidence of a solid, dependable return on their investment. If they are willing to engage in the grand bargain of reducing in-house expenses, they may go from being alleged cost centers to proven profit centers. It is a simply irresistible proposition for customers. We recently heard one CIO say, “Eighty percent of the functionality at 50% of the total cost is exactly what I want.” Customers are making explicit decisions on a category-by-category basis of where they still prioritize product innovation and where good-enough tech at a lower TCO is the perfect option. To many suppliers’ dismay, more and more customers are switching more and more categories of spending from the former to the latter.

When this moment happens—when the hard line is crossed and the possible becomes reality—does anyone have a choice? When Level 3 and Level 4 supplier models begin offering much higher ROI to customers, do the customers have any choice but to choose them? They have a responsibility to their stakeholders. Can they really say no to an offer that is clearly a better, more certain investment? Once this shift happens, do Level 2 suppliers still have a choice about crossing over to Level 3 or 4 operating models? Sure, there is risk to both sides by crossing over this line too soon by agreeing to an operating model that neither side can really deliver. But a Level 2 supplier that waits too long takes the risk of getting left behind by a market that has switched how they think about buying technology.

Business Model Implications

Another big thing Level 2 suppliers must do is prepare their cost structure for Levels 3 and 4. If we are right and Level 2 is no longer a permanent state but a transitory one as tech markets mature (see Figure 10.5), then suppliers are going to have some very hard decisions to make. That’s because how they make money changes at Levels 3 and 4.

FIGURE 10.5 The Supplier Transformation Challenge of B4B

We just used the CRM market to exemplify how tech offers move from Level 1 to Level 2 to Level 3. It is a fact that the price per unit also changed at each level. Act! cost several hundred bucks. Siebel was a couple million bucks. Level 3 suppliers such as salesforce.com already represent a lower cost-per-license alternative to today’s Level 2 offers from SAP and Oracle. If Microsoft had its way, it would probably love to become the first true, fully automated Level 4 CRM supplier. You can bet that would bring everyone’s prices down. You can also bet that the unit volumes would go up. Salesforce.com is proving that it can steal market share each and every quarter just by offering a Level 3 solution. So are AWS and Rackspace in their markets. If traditional Level 2 computing and storage companies can’t match the prices and value of companies such as these, they risk losing their customers. The best they could hope for is to have two very large customers: AWS and Rackspace. But operating at high unit volumes and lower prices is not what most large Level 2 tech suppliers were built to do. Remember the tail of our fish? The expense (cost) line was heading down. It has to. That can only be achieved by a technology-fueled, data-driven operating model—one that drives labor costs down significantly. For suppliers in particular, moving right on the B4B framework has huge implications on how they conduct business. R&D must significantly redirect their focus far beyond just multi-tenancy. How suppliers sell will change. So will their service portfolios. Even which companies they acquire will change. When complexity was racing to the stars, buying an out-sourcer made sense. In hindsight, maybe someone should have bought AWS! We have extended the TSIA B4B framework to show how moving to the right affects financial models, go-to-market models, required capabilities, and organizational structures—more than 20 transformations. These transformations are not insignificant. But we believe they can and must be undertaken in order for suppliers to succeed in maturing technology markets where ROI is the key competing factor.

To be perfectly clear, not every supplier needs to move to the right. Maybe a tech component product manufacturer can remain peacefully in its current Level 1 mode. Maybe an enterprise software company that has found an interesting new niche has another decade of feature-led growth. That is absolutely great. Remaining at Level 2 makes sense. In cases such as these, focusing on improving the operational excellence of their existing operating model is exactly the right thing.

But maybe a supplier senses that its product markets are facing deteriorating core-offer profitability. Or that demand for XaaS is increasing. Or maybe a few of its most important customers are quietly asking the supplier to move its operating model to the right. When any of those are the case, we offer one final tale.

Gulliver and the Lilliputians

These are serious challenges requiring increasingly urgent action, especially for Level 2 suppliers. But the fish problem may be causing them to hesitate. They may feel trapped between what shareholders want in the short term and what customers will want in the long term. But they must avoid the Gulliver Scenario (see Figure 10.6).

FIGURE 10.6 Giants Who Sleep Too Long

You probably know the story. Gulliver could have easily combated any of the tiny Lilliputians. After all, he was the only giant on the island. But he was asleep. And he slept too long. It was no single Lilliputian who conquered him: It was because one tiny Lilliputian tied down his left foot and another tied down his right one. At the same time, a different group attacked his left arm while yet another was busy on his right. By the time Gulliver finally woke up, it was too late. He had lost his power. And none of it was due to the action of another giant.

Dominant Level 2 suppliers must be vigilant to avoid Gulliver’s fate. They can’t wait too long to create new operating model capabilities inside their core. They can’t dismiss all the little new model companies for too long. They can’t pretend that just switching to subscription pricing, and then demanding huge minimum commitments, is their new model. We think shareholders can be made to understand that logic. Successful suppliers must be awake and active about their transformation. They cannot remain still while others take action. Do you agree?

If you do and you are a supplier, you must develop a deadline for adding a new operating model to your repertoire. If you do and you are a business customer, you must develop a deadline for redefining your supplier selection criteria and preparing your internal cost reduction plans. For both sides, the key question is, When? When will the industry’s standard operating model in a particular tech sector switch from one level to another? Try this simple exercise: Figure out what supplier level in Figure 10.4 is the standard today for a given tech sector. By what year will the standard be one level further to the right? How many years will it be before you are ready to play at that different level? If your answer to what year the market will move one level right is sooner than the year you will be ready, you may have a problem.

The Next Generation of B2B

In 1884, John H. Patterson sat down with a clean sheet of paper and devised the modern B2B operating model. The complexity of his products necessitated a new approach. It was a triumph of ingenuity and practicality that lasted for 125 years.

Today, we are staring at the hard line that separates his legacy from two new partnership models for suppliers and their customers. Never before was it possible to cross, to conquer complexity in new ways. But today, thanks to the way that software and the Internet have eaten the world, we have the technology and the data and the analytics to double our options for bridging the great divide. New thinking is arriving. New models are developing. New leaders are emerging. They believe that the ROI of technology can be even better than it is today. And customers are responding.

That one line? It could trigger the reinvention of many B2B high-tech and near-tech markets. But it only matters if you agree. Is it time for your company to get ready for B4B?