Every couple experiences some degree of conflict or frustration in the area of finances. Finances rank among the big three of marital problems. (The other two are communication and sex.) The vast majority of couples who go into divorce courts are head over heals in debt.

How do you handle finances? Are you a spender or a saver? Do you like to use charge cards? Do you have a budget? Robert J. Hastings said that “money management is not so much a technique as it is attitude. And when we talk about attitudes, we are dealing with emotions. Thus, money management is basically self-management or control of one’s emotions. Unless one learns to control himself, he is no more likely to control his money than he is to discipline his habits, his time or his temper. Undisciplined money usually spells undisciplined persons.”1 Do you agree with Mr. Hastings?

Fill out the following questions and share with your fiancé your thoughts concerning finances.

1. My attitude about the wife working outside the home is:

2. State your attitude about the wife working outside the home after the birth of children:

3. Are you going to pool financial resources (gifts, savings, and earnings)? How?

4. If you have been married before, do you have any reservations or do you feel that there will be any problems in pooling finances from the former marriage (gifts, properties, savings, investments, insurance, trust funds or wills, etc.)? Explain:

5. I foresee the following problems with the “my money, your money” feelings:

6. My attitude toward debt, credit cards, borrowing money, and buying on time is:

7. If we experience financial reverses (unemployment, debt, sickness, etc.), I plan to:

8. Who will handle the checkbook?

9. Who will pay the bills?

10. What is your plan for budgeting?

11. How generous are you?

12. What are your thoughts about giving (church, charities, etc.)?

13. What are your thoughts about saving money (savings accounts, investments, property, retirement)?

14. What are your thoughts about life insurance?

15. What are your thoughts about health insurance?

16. How do you feel about writing a will?

17. What are your thoughts about the possibility of someday being financially responsible for your in-laws?

18. How do you feel about your spouse holding extra or part-time jobs?

19. What financial aspects do you think are involved in entertaining guests in your home?

20. If we get into financial difficulties, I will:

21. I have the following questions about finances:

Super Simple Budget

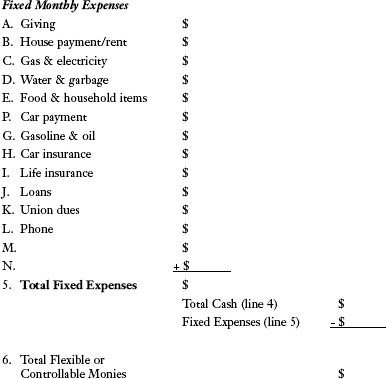

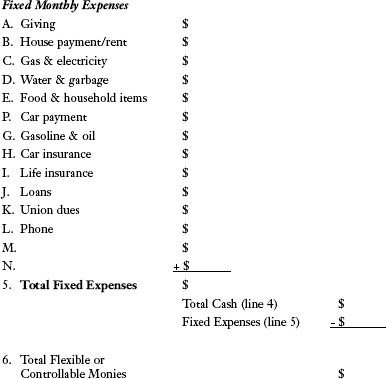

A “Super Simple Budget” has been included for those couples who do not have a system of budgeting finances. There are usually three problem areas in family finances.

First, most couples do not know what the total of their fixed monthly expenses are (line 5). Because of this they buy items and have no idea of where they are financially until they are out of funds. (Very few arguments occur over fixed monthly expenses. You pay the rent or you are out on your ear. You pay your gas and electricity or they are turned off—without any argument with your mate.)

The second problem area occurs when the couple has bills totaling more than their monthly controllable income (line 6). When this happens, the couple usually puts all of their controllable monies towards their bills. This eliminates any extra cash flow. With no cash flow the couple can become frustrated and hostile. They have no money for emergencies, entertainment, or medicine. The couple might be wise to set aside some money for emergencies that may arise.

The third problem area revolves around who pays the bills. If one mate is not aware of how their money is being spent there can be trouble. For those who pay the bills I suggest the following:

1. Pay the fixed monthly expenses (usually no argument).

2. Come to your mate with the total of the fixed monthly expenses and the total of miscellaneous expenses. Show him or her what needs to be paid and how much you have to pay with.

3. Ask your spouse which bills need to be paid first and how much should be put on each bill. Then pay the bills as you both agreed. Then, when your mate asks you why a certain bill has not been paid you can relate to them your discussion and that you paid the bills according to your agreement.

The Super Simple Budget

Income (monthly)

| 1. Salary or wages—husband (“take-home” after deductions) | $ |

| 2. Salary or wages—wife (“take-home” after deductions) | $ |

| 3. Other income (only list regular monthly income) | $ |

| 4. Total Cash—(“take-home” income per month) | $ |

Giving

Tithing—usually 10 percent of all income.

Love Giving—giving out of love and in response to the benefits received from the Lord.

Faith Giving—a promise to give an amount beyond ordinary income.

Sacrifice Giving—giving to the Lord something that I really needed and wanted.

Everyone must make up his own mind as to how much he should give (2 Corinthians 9:7 TLB).

Miscellaneous Expenses

A. Doctor, dentist, drugs |

$ | ||

B. Clothing |

$ | ||

C. Gifts |

$ | ||

D. Entertainment, recreation |

$ | ||

E. Allowances |

$ | ||

F. Education, lessons |

$ | ||

G. Savings (some, place their savings in “Fixed Monthly Expenses”) |

$ | ||

H. Car maintenance |

$ | ||

I. Charge accounts |

$ | ||

J. Babysitting/daycare |

$ | ||

K. Home improvements |

$ | ||

L. Subscriptions |

$ | ||

M. Appliances |

$ | ||

N. Incidentals |

+ | $ | |

| Total | $ |

| Controllable Monies from Line 6 (p. 53) | $ | ||

| Less Buffer or Emergency Monies | - $ | ||

| Total $ | |||

| Less Miscellaneous Expense | - $ | ||

| Total | |||

1. Robert J. Hastings, The “10-70-20” Formula for Wealth: From the Marriage Affair (Wheaton, IL: Tyndale House Publishers, 1971), p. 363.