1

Introduction

What Is Additive Manufacturing?

In the human history of making things, there have been several major steps. In oversimplified terms, there are three ways to fabricate: subtraction (hammering a flint arrowhead or whittling a stick), molding (pouring gold into a sand mold or concrete into forms), and addition (building a log cabin or a pyramid). In the nineteenth and twentieth centuries, advances in machinery—including hydraulics—increased the power for moving dirt, metal, or concrete, while new steel alloys for cutting tools and other innovations enhanced the precision of subtraction. In the realm of metalworking, however, the precision of subtraction far exceeded the precision of addition: even as recently as the 1990s, computer numerical control (CNC) machine tools as well as laser and waterjet cutters could remove material far more impressively and precisely than anything could add it.

Beginning in the 1980s, however, computers were harnessed to the task of adding minute amounts of material with heretofore impossible precision. Initially the machines were used to make plastic mock-ups of new computer-aided design (CAD) files and were known as rapid prototyping tools. By the early 1990s, the same approach was adapted to metal. In the twenty-plus years since, the advantages of additive manufacturing, as it has come to be called, continue to accumulate and move beyond prototyping into production.

Meanwhile, in classrooms and home workshops in many countries, low-cost machines for medium-precision forming of plastic have sold in large numbers. An ethos similar to the homebrew computer clubs of the 1980s motivates a “maker culture” of people who are familiar with computing, eager to create things, and share tips and designs through both physical and virtual networks. In many cases, computer files used to create small plastic items (whether a knob or a cartoon figure) are shared in line with the principles of open-source software. “Additive manufacturing” feels too heavy-duty and industrial for this branch of the technology, so we will refer to it as 3D printing. Overall, many in the industry use both terms interchangeably, and we will follow that convention when talking about commercial applications.

What Is 3D Printing?

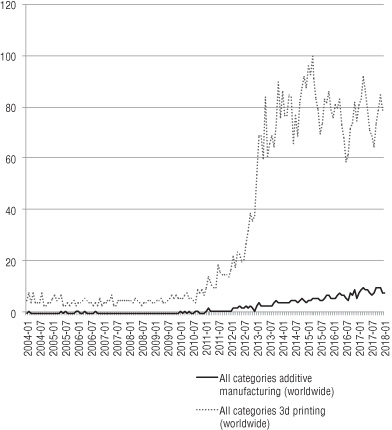

A word about usage: 3D printing is an accessible term, and can make the process sound simpler than it actually is. As one observer notes, “rapid prototype that for me” is much less intuitive or direct even though it would be more accurate for the first fifteen years of the technology’s existence. In figure 1.1, we see from Google Trends data that the term 3D printing is far more commonly used than additive manufacturing, at least in web searches since 2004.

Why is the technology so important now? There are many reasons. First, ecological concerns, combined with economic logic, favor techniques of manufacturing that do not use expensive, time-consuming processes to mill away large quantities of metal, titanium alloy in the case of aerospace components. (The colloquial term here is the “buy to fly” ratio, referring to how much of the original metal ends up in the finished part.) Second, building up a work in process (to be subsequently worked via some other technology) allows for new geometries compared to cutting or molding. Examples include honeycomb structures that are extremely strong relative to their weight, or internal cooling channels in an industrial stamping tool. Third, the prospect of printing in mixed materials promises lower cost, higher strength, and cleaner design: imagine a football helmet with a radio antenna integral to the polycarbonate plastic body rather than being fabricated by an entirely separate supply chain and then glued on after molding. Fourth, many industries ranging from aerospace to construction equipment are intent on building an end-to-end “digital thread” to maintain the integrity of a design from specification to end use, and the computer-assisted fabrication of such parts maintains extreme fidelity between computer design and final product, reducing variability.

Figure 1.1 Interest in additive manufacturing, as measured by Google searches, has been growing steadily since about 2012, whereas 3D printing exhibits a more unstable pattern of pubic attention. (Data source: Google Trends)

On the 3D-printing front, the urge not only to create but to personalize some aspects of one’s material environment is well served by this technology. As some key patents expired in the United States (particularly in regard to fused deposition modeling), home-market printer prices dropped by a factor of ten, to less than $1,000, after 2009. As we will see in chapter 4, a broadly based maker movement both was empowered by and created demand for 3D printers. Finally, the ability to personalize plastic output has merged with the use of smartphones for self-portraiture in 3D-printed figurines of real people: wedding cakes, to take just one example, can feature recognizable likenesses of the featured couple.

Why Does It Matter?

Why do 3D printing and additive manufacturing matter? It is crucial to begin by insisting that very few fabrication technologies are used in isolation: hammers, saws, and levels are all essential to carpentry. Similarly, additive technologies must be integrated with the rest of the manufacturing tool box, and this will take time as more people unlearn (or perhaps never knew) the former limits of the possible. Here’s one example of how that can happen: several companies have introduced large industrial tools that combine metal deposition and five-axis CNC machining in one box. Thus, a raw section can be built up, then moved across the machine to be more precisely shaped and/or polished. The hybrid process can be repeated back and forth, with additive material being deposited on a partially finished milled part. Many additive processes in metal especially focus on a near-net shape as their objective, with subtractive techniques generating the final precise geometry.

Five broad usage scenarios have emerged for additive manufacturing. Two of these are currently niche markets: on-site fabrication in remote locations like offshore oil rigs, and printing materials that cannot be traditionally worked. Mass customization (the third market) is emerging as a major opportunity, as for hearing aids and orthodontic applications. Two final markets relate to production parts, where additive manufacturing is best used when complex shapes and/or short production runs of manufactured goods are required.

One major category where 3D printing is excelling is in making things that make things. Many assembly techniques involve the use of jigs and fixtures to hold work in precise locations while other operations are performed, or to protect a production piece from tools being used to fasten it. Desktop plastic printers can excel in this domain, and factories are including more and more 3D-printed workplace tools, custom-made for the job. Volkswagen used this approach to reduce jig and fixture development costs—and time—by more than 90 percent. Unlike CNC-milled metal fixtures, the plastic parts can be rapidly iterated in response to operator feedback, often improving ergonomics.1

Whether it is a steel insert used in mass production of plastic items (such as a drinking cup), a silicone mold for precision medical products, a solid pattern around which sand is molded to receive molten metal, or a sand mold printed through binder jetting, additive techniques are well suited to low-volume, high-value operations. An excellent example can be seen in a small one-hundred-year-old company in Baltimore.

Case Study: Danko Arlington

Industrial patternmaking is a behind-the-scenes activity that produces industrial patterns for the foundry industry. An industrial pattern, in turn, is a form used to create a precisely defined cavity in a sand mold used for casting molten metal into shapes.

Danko Arlington is a manufacturing company located in Baltimore, Maryland, established in 1920. The company consists of a pattern shop, an aluminum casting sand foundry, and a CNC machine shop to finish their castings to tighter tolerances and dimensions. According to the firm’s president, there are probably fewer than three hundred pattern-making businesses in the United States. Absent patternmaking and new patterns, a whole segment of the foundry industry cannot grow.

In 2010, Danko Arlington invested in additive manufacturing technology to help transform a business that was constrained by the lack of skilled patternmakers. Traditionally, patterns for low-volume castings were carved out of wood by skilled artisans, but the hand-crafted trade is no longer being taught. Enter a fused deposition modeling (FDM) 3D printer using various grades of polymers: Danko Arlington prints primarily in a polycarbonate material because it is durable, is strong enough to handle the weight of compressed sand, and resists the petroleum solvents used in the sand molds.

The 3D-printed patterns have many advantages: designers can specify corners, twisting surfaces, and reverse angles without being concerned that the pattern maker can carve them in poplar wood. The tolerances of the sand mold (+/- ![]() ′′) are far larger than the printer’s accuracy, measured in thousands of an inch. One CAD designer can do more work than several pattern makers, and can work off-site on a laptop. Time savings are significant: a pattern that an artisan would produce in weeks is now generated in hours, including exact replicas when the initial pattern wears out. That faster turnaround time is also extremely predictable, improving project scheduling. Finally, the 3D-printed pattern can be included in a proposal, impressing the client with the model’s fidelity to the original request.

′′) are far larger than the printer’s accuracy, measured in thousands of an inch. One CAD designer can do more work than several pattern makers, and can work off-site on a laptop. Time savings are significant: a pattern that an artisan would produce in weeks is now generated in hours, including exact replicas when the initial pattern wears out. That faster turnaround time is also extremely predictable, improving project scheduling. Finally, the 3D-printed pattern can be included in a proposal, impressing the client with the model’s fidelity to the original request.

Danko Arlington had many challenges in its transition to the new technology. Industrial 3D printers are expensive. The polycarbonate filament is many times more expensive than the poplar wood used in traditional patterns, so the firm experiments with multi-material patterns, using the high-cost polycarbonate only where necessary rather than as a solid volume. Patterns for thin parts, in particular, can deform as they cool, crack under the load of heavy sand, or deform in hot sand. Finally, even precise FDM parts require post-processing (see chapter 2), and given the tight tolerances, just a little too much sanding can ruin a pattern.

In the end, the transformation in Danko Arlington’s entire business process resulting from the shift to additive methods has led to a revenue uptick, and the firm continues to add staff across many functional areas, including sales, molding, and delivery drivers. Further, Danko Arlington announced in 2018 that it had purchased a third additive manufacturing machine, to join two FDM units: a binder-jetting machine will 3D print in sand, making the molds directly. A new five-thousand-square-foot facility is dedicated to additive fabrication, marking a significant evolution in a nearly one-hundred-year-old company using methods that date to the Bronze Age.2

Back to the question of why computer-guided additive technologies matter: the limits of what is possible to create are being redrawn. New software tools will generate CAD files from little more than a list of basic parameters using a process called generative design. Getting new generations of engineers and artisans into the workplace will take time, but will exploit the new design flexibility coming into both the software and fabrication phases. At the same time, economies of scale are also being challenged. Whether for prototypes, spare parts, custom-fitted pieces (prosthetics are a prime example), or for other unique applications, it is now possible to economically make one or two of something. With plastics, the process of mold-making and retooling of the production line made short runs impractical. Those limits are now being transcended dramatically. With metals, the economies of scale are more complex: while there are stamping operations that rely on long runs just as plastics do, some fabrications are intricate and done in very small batches. Here, additive manufacturing offers the potential for higher fidelity to the electronic blueprint, closer tolerances than human welders can achieve, and design features (such as internal cooling fins) that could not be built with previous technologies.

To take one example, Facebook bought a 3D-printing company that embeds electronics in additively manufactured modular housings. The acquisition is expected to help accelerate Facebook’s hardware innovation, such as virtual reality goggles, and was to be supported by a reported $6 million budget as of late 2016.3

Looking ahead a bit, 3D printing will increase people’s ability to enhance aesthetics, durability, and/or functionality by varying the material composition within a part. Consider an airplane wing: some sections might be made of a composite for weight and radar stealth considerations. Other parts might need to resist deterioration from exposure to fuel or hydraulic fluid. Still others might need to accept precision threading for bolt-on components. Other pieces might function as antennas. Just as some home printers allow for plastic items to be printed in multiple colors, in the future manufactured parts might be seamlessly built up from a collection of materials, each optimized for what it is doing in that particular application. (An MIT lab has demonstrated a technology for mixing ten different materials in the same pass of the printer head.)4

The same idea has been applied to housing by a different lab at MIT: at a large scale, a nozzle can expel insulation as well as interior and exterior wall materials.5 As the US manufacturing economy shifts from mass production of consumer items like shoes or bicycles to advanced products such as MRI machines or jet engines, several emerging technologies—sensors, big data, robotics, advanced materials, machine learning—are enabling new levels of precision, productivity, and innovation. 3D printing fits squarely in this cluster of technologies, situated as it is at the intersection of materials science, robotics, cloud computing, sensing and imaging, crowdsourcing, data analytics, and other areas.

The notion of “mass customization” was first discussed in the 1990s: how could businesses maintain economies of scale while also tailoring offers to unique customers?6 Software proved amenable to such variation, but until recently, physical items were hard to manage along competing parameters of speed and cost versus individual tailoring. Now, many custom-fit items are being produced using additive techniques. Dental implants and braces are proven to work; some dentists have 3D printers on site. In medicine, doctors will print a replica of an internal organ for orientation before surgery: if the backside of a child’s heart must be repaired without direct line of sight, having navigated the life-size model beforehand will facilitate better surgical planning and preparation. Hearing aids are a textbook example of mass customization: 3D stereolithography now generates almost all commercially available devices, improving fit and comfort while reducing returns from bad fits. Drill guides for dentists are a type of “tooling” much like that used in industry, but for much more precise, and unique, orientation.

Prosthetics are an obvious area of opportunity, ranging from robotic exoskeletons to artificial limbs; Carolina Panthers linebacker Thomas Davis wore a 3D-printed sleeve to protect a broken arm in Super Bowl 50. Wheelchairs are another area ripe for improvement. Given that exoskeletons that allow a paralyzed person to meet people face-to-face and standing upright are still years away from commercial availability, 3D-printed wheelchair components promise better comfort, fewer medical complications, better safety, lighter weight, and other tangible benefits in the interim. Less tangible but similarly important are the possibilities for paraplegics to personalize their equipment.

Speaking of sports, athletic-shoe manufacturers are providing custom-fit cleats to elite athletes: Cleveland Indians pitcher Corey Kluber was the first major league baseball player to use 3D-printed cleats on his shoes when he wore a custom-made pair in 2017.7 (His supplier, New Balance, launched a digital sports division in 2016, the same year Under Armour announced 3D printing would be a key technology in its new R&D center, and the same year Nike partnered with HP to investigate 3D printing.) Olympic sprinter Alyson Felix wore custom-made 3D-printed spikes from Nike at the 2016 Rio games. Nike has also adapted sock-knitting technology to create shoe uppers that are produced without the waste of traditional cut-and-sew processes. (According to the Wall Street Journal, the Nike Flyknit shoe was the first mass-produced additively manufactured consumer product.8)

Prosthetics are an obvious area of opportunity, ranging from robotic exoskeletons to artificial limbs.

Additive manufacturing and 3D printing (both industrial and consumer-grade technologies are included here) have the potential to reinvent supply chains: instead of goods being made only in capital-intensive factories often located far from the end user, production can be moved to where the product will be used. The most extreme case of this phenomenon was on the International Space Station, where a 3D printer made a wrench in zero gravity.9 Closer to earth, the same dynamic can allow navy ships at sea to fabricate repair parts on board rather than warehouse completed pieces in a highly constrained space, wait until they enter port, or request a complex resupply while deployed.

Maintaining obsolete spare parts is an issue for many businesses, whether the product is a bomber (the first B-52 entered service in 1954 and the plane is expected to still be flying after 2040) or a tractor (Caterpillar still supports machines made one hundred years ago). Mass production, followed by warehousing of an indefinite duration, is expensive and inefficient; in contrast, additive methods fit the business need very closely, including the capability to repair broken gear teeth, for example, that previously had to be replaced with a whole new part. Short runs of metal parts, including those without CAD drawings and/or whose manufacturer no longer exists, can be facilitated by reverse engineering using 3D-scanning techniques followed by additive manufacturing, often in a matter of days rather than weeks.

3D Printing in the Context of Digital Fabrication

Neil Gershenfeld of MIT is a pioneer in the use of 3D printers as a component in a compact fabrication lab that decentralizes industrial making from big expensive factories to small-scale but high-tech workspaces. In the early 2000s he was studying how these labs changed peoples’ relationships to their made environment, their learning patterns, and their expectations of the technology. Reflecting on his experiences in 2012, Gershenfeld published a key article10 that identified many of the central issues.

- • 3D printers, by themselves, are not nearly as interesting as additive technologies combined with CNC machine tools, drill presses, and other standard fixtures of a workshop. Analogously, for all the projections in the 1950s that microwave ovens were the future of cooking, “Microwaves are convenient, but they don’t replace the rest of the kitchen” (p. 44).

- • Just as the personal computer took enterprise technology into the home, office, or classroom, so too is additive manufacturing decentralizing the means of industrial production. People with PCs, in turn, did not drive assembly lines or calculate artillery projections; they sent messages, looked up recipes, and listened to music. What will happen to formerly industrial tools when they become commoditized, then consumerized?

- • Rather than taking mass production into the home or community space, digital fabrication brings the ability to make the items that aren’t found in mass market retailers: better-fitting, more expressive, or custom-configured things—whether shoes, crutches, or jewelry—represent whole new markets that factory-scale production could not (and usually did not want to) reach.

- • Geography no longer limits who can have what, when. At the extreme, being able to print nutrients and protein at one’s desire rather than waiting for what’s in season or being subject to the mass tastes implicit in mass marketing will change what it means to feel at home. At the same time, people working with the same tools in different places, connected digitally, can create and problem-solve in powerful ways. Changes in tools and networks will change the nature of making.

- • This decentralized model of making is hard to regulate or shape. Unlike color copiers, which announce their unique identifier with encoded dots and so cannot anonymously counterfeit currency, 3D printers can in some cases actually replicate themselves. There is no central authority that can enforce copyright, patent, or even good taste. In response, the maker community is embracing many tenets of open-source software.

- • Gershenfeld concludes with a powerful insight: “The real strength of a fab lab is not technical; it is social. The innovative people that drive a knowledge economy share a common trait: by definition, they are not good at following rules. To be able to invent, people need to question assumptions” (p. 57). In the future, the barriers between things and data, and between bits and atoms, will grow even fuzzier than they are today, meaning that 3D printing is but a step on a much longer journey to redefine computation, fabrication, innovation, disability, and many other limits that used to be taken as given.

Questions

The technical capabilities of 3D printing advance every year, aided not only by new science and engineering knowledge but also by more field experience. That craft knowledge, in turn, is sometimes instantiated in software, giving more users the benefit of hard-won experience. Social networks of makers, both consumer- and industrial-grade, are key for spreading trade knowledge. Schools, too, have a critical role to play in preparing students to work with, on, and alongside these new machines. As we will see, designing for additive manufacturing departs from many past practices and assumptions.

Despite much good news from users of the technology, the industry is still wrestling with how to make money. High margins on supplies such as metal powder or liquid polymer are the profit engine for many machine manufacturers; initial machine sales by themselves are much more competitive. High prices on materials can dissuade users from experimenting on or otherwise running the machines, so adoption is slowed. The industry at large is confronting this conundrum, with mixed success.

As of 2018, the stock prices of many additive manufacturing suppliers are flat, having retreated from high valuations in 2013–2014. MakerBot, a leading consumer brand in the field, was bought by Stratasys, which in turn saw sales slow and its share price slide; several rounds of mass layoffs at MakerBot ensued, cutting the peak workforce by 50 percent as of early 2017. GE has either purchased or invested in a number of additive companies, including acquisitions of Morris Technologies, Arcam (including its Canadian powdered metals subsidiary AP&C), and Concept Laser, as well as smaller positions in Desktop Metal, MatterFab, and others. The acquisitions are bundled into the GE Additive business unit, but GE at large is in the midst of significant restructuring, so the additive business is only one of many competing priorities. Furthermore, GE suffered a public setback as its GE Digital business failed to achieve sufficient market uptake; it’s unclear whether the firm can understand and execute a digital transformation, including in additive manufacturing.11 Elsewhere, HP jumped into the market late but with a significant presence. In each of these instances, corporate managers and startups alike are experimenting with different business models.

Powdered metals, filament, filters, gases, and other inputs to additive processes are expensive, especially compared to the same material sold into conventional molding or milling applications. In some cases, this practice reflects the razors-and-blades business model attributed (somewhat loosely) to King Gillette12 in the 1920s: sell a platform at a competitive price—even a loss—to lock in customers to your resupply, which you then sell at extremely high margins. HP does this with printer ink, but somewhat surprisingly is encouraging open markets for supplies in its new 3D-printing business. Arcam/GE and other companies, meanwhile, limit their customers’ choices to official powder and other consumables, strongly influencing the total landed cost of a 3D-printed part.

Other companies are selling printing as a service, functioning as job shops for multiple customers and freeing manufacturers from the learning curve associated with the new technology. According to Wohlers Associates, an industry analyst focused on 3D printing, services revenue growth through 2017 has outpaced product revenue growth every year except one since 2010.13 (“Services” includes printing for customers, maintenance contracts, training, and the like.) As the two biggest pure-play companies in the field—Stratasys and 3D Systems—struggle to scale in the face of the entry of giants including GE and HP, these business model questions will intensify in importance. Balancing products and services, new sales vs resupply vs maintenance, and global customer bases will all be critical for success.

Some companies are experimenting with the lines between machine sales, printing, and resupply. Online marketplaces are connecting people who design objects, owners of additive capacity (whether a desktop consumer machine or a full-scale industrial unit), and customers who want the objects. Shapeways was founded in 2007 then spun out of the Dutch Philips corporation, after which time its headquarters moved to New York. Materialise, a Belgian 3D-printing pioneer, includes an i.materialise subsidiary designed to serve as a printing service, online community, and marketplace. Sculpteo, operating out of France, serves both commercial and household markets, including interior decorators. MakerBot Industries launched Thingiverse to serve as an open-source repository of community members’ designs. Stratasys’s GrabCAD functions similarly, allowing engineers to bring designs to a wider market. 3D Hubs, yet another Dutch startup, is an ambitious play connecting more than 7,000 global 3D-printing services spanning desktop printers to metal-capable industrial machines and CNC tools. Customers can currently choose from eight polymer materials as well as stainless steel, aluminum, and titanium.

Because of the high growth rate in the services side of the market, manufacturers of 3D printers are migrating toward it, beginning with 3D Systems in 2009: the printer manufacturer had acquired seventeen service providers as of 2017. Similarly, Stratasys is a major provider of both printers and 3D-printed parts. Voxeljet, Arcam, and ExOne also play both roles. There is an inherent conflict, however, in that such a model can put the capital-equipment manufacturers in conflict with their customers.14

Conclusion

It should be clear that 3D printing represents an important step forward in the history of making things, whether commercially or personally. It is, however, another tool in a very large toolbox: Neil Gershenfeld’s insight about microwave ovens is on target. Determining how to make these tools, how to sell them, how to integrate them with the rest of the toolbox, and how to use them to their best advantage remains an ongoing work in progress, and we will turn to addressing those questions in the remainder of this book.