The first space tourist, Dennis Tito, paid for a seat on a Russian Soyuz rocket and spent a week at the International Space Station in April 2001. A year later, Mark Shuttleworth repeated this experience. A third space tourist, Lance Bass had been training for a similar space trip scheduled for October 2002 until negotiations between Bass’s representatives and the Russian Space Agency broke down (Berger, 2002). The NASA Shuttle Columbia disaster in February 2003 resulted in the cessation of further shuttle flights for a considerable period and the suspension, at the time, of further flights by other would-be orbital space tourists.

Instead, as a result, over the following years attention shifted to sub-orbital space tourism developments. This has focused on the race among over 20 private teams to be the first to successfully launch a fully privately developed, manned spacecraft into space. And in June 2004, a team called Scaled Composites and headed by Burt Rutan with funding from Paul Allen, a Microsoft pioneer, achieved this goal flying their spacecraft known as SpaceShipOne. In October 2004 this team went on to win the US$10 million Ansari X-Prize (Dinerman, 2004; Xprize Foundation, n.d.), which was established in the 1990s to encourage commercial space tourism enterprise in the same way that aviation prizes in the early twentieth century stimulated airplane technology and commerce (Economist, 2004a; Taylor, 2004). The Ansari X-Prize required the successful team to privately develop a reusable spacecraft and to fly the craft to a minimum height of 100 kilometres, with a pilot and the equivalent weight of two passengers. To demonstrate the craft’s reusability, this had to be repeated within a period of two weeks. Richard Branson was quick to capitalize on the publicity and opportunity by agreeing, immediately after the successful flights, to purchase Scaled Composite’s technology in order to commence commercial operations, purportedly in about three years, and to be known as Virgin Galactic (Space.com, 2004).

Since then, a new prize, the America’s Space Prize, worth US$50 million, has been announced by another commercial space entrepreneur, Mr. Robert Bigelow (David, 2004; Malik, 2004), to stimulate development of a private, commercial spacecraft capable of going much faster and higher into orbit. Bigelow’s company, Bigelow Aerospace, plans inflatable orbiting space hotels.

All of this activity has created debate and discussion concerning the most appropriate means of regulating commercial space operations (Antczak, 2004; Berger, 2004; David, 2004, 2005a, 2005b; Miller, 2005; Werner, 2004a, 2004b). Views range from those who argue that safety must be guaranteed through strong regulation, to those who fear such regulation will stifle development. In the meantime, other new teams and ventures have announced their own plans to pursue commercial operation goals (e.g. CNN, 2005; Malik, 2005). The race for private, commercial, sub-orbital ventures has stimulated US lawmakers and the Federal Aviation Administration (FAA) to draft a licensing system that would permit these space flights to take place. It has been reported (Pasztor, 2004) that the FAA and the US Congressional House Science Committee are likely to introduce controls over crew training and standards for the physical condition of passengers, together with requirements for the disclosure of vehicle-safety history, initial banning of flights over international waters and foreign territory, signing of waivers by passengers and insurance. However, the legislation being drafted is aimed at limiting such controls on the basis of ‘caveat emptor’ or ‘buyer beware’, so that a space tourism industry is provided with a favourable environment in which to get started – not unlike the pioneering days of the aviation industry.

President Bush, in January 2004, announced a new NASA programme for a return of manned missions to the Moon and possibly on to Mars. His plan also saw the end of formal American government involvement in the ISS, once construction is complete, and the need for new launch technologies to replace the Space Shuttle. Although this plan for NASA made no mention of a role for space tourism, it has been argued that space tourism may in fact be pivotal to the success of future space endeavours. The private sector may eventually gain control of the ISS and the sheer number of potential tourist space flights could mean that vastly more efficient, low-cost launch vehicles eventually emerge out of the competitive and entrepreneurial developments of the private sector rather than government space programmes, driven by economies of scale and learning effects:

The challenge for future administrations will be to integrate the entrepreneurs and their companies into the space exploration program. If they do so, scientists and private citizens alike will colonize space. If they don’t, President Bush’s ambitious agenda is likely to have a hard time getting off the launching pad.

(Dinerman, 2004, p. D6)

The role the private sector could play in this new vision could be considerable:

Even space enthusiasts now warn that only private enterprise will truly drive human expansion into space.... What might cause market forces to take up the mission? Tourism and entertainment are both possibilities…. The true space entrepreneurs in America, the people who are building realistic, privately funded spacecraft for tourism, and moon satellites for entertainment, have had no government handouts or incentives. They push on regardless. They are the pioneers most worth applauding.

(Economist, 2004b, p. 9)

In the past year, private commercial space tourism has been demonstrated to be technologically feasible. However, what has yet to be demonstrated is the commercial feasibility of ‘space tourism’ (ST). Although, there is good reason to believe that there is a strong desire on the part of many people – such as Bono and William Shatner – to travel into space, this desire is generally expressed as an abstract latent desire independent of the cost and reality of what a touristic space experience might entail. Unlike many other adventure activities we know little about the characteristics of what will make a ‘value for money’ experience for those wishing to partake of a flight into near earth, or earth, orbit. Although numbers have been bandied about, few people know what the actual cost of a ticket will be – other than it will be expensive – or what the training might entail, or how it might exclude many people. But how would individuals react to placing their life in someone else’s yet-to-be-proven hands? What, for example, would be the reaction to the first death, or near death, experience in a private tourist vehicle?

There is no doubt that some, perhaps many, will convert their desire into action (indeed some already have), but just how many? Space tourism operators need to be concerned with more than addressing just the issues of cost, time and risk to customers. They need also to understand how other design variables will affect customer perceptions and demand. For example, how will the design of the spacecraft itself affect customers? The wide variety of possibilities from rocket planes to parachute ascents to vertical-take-off to capsule return to splash downs to horizontal landings on runways, and so on, will have a multitude of implications on factors such as cost, risk, flight duration, comfort, training needs, viewing configurations, launch and return locations. There is little doubt that few, if any consumers, know or understand these options and their implications. The public also has the choice of options ranging from high-altitude jet fighter flights to zero-g flights to sub-orbital space tourism and orbital space tourism. How will space tourists decide between engaging in any of these activities now and delaying their participation until prices drop, risks improve or better information is available? Commercial space tourism entrepreneurs therefore have very many marketing questions that remain to be answered.

The path to commercial success for any new product is long and arduous. Marketers know that for every successful product there are many others that fail along the way. Therefore, difficult and complex decision making is required. However, when the new product being developed is merely a new model of an existing product with an established market history, there is often some good information available on which these decisions can be partly based. But when the product is an entirely ‘new-to-world’ innovation, much greater risk and uncertainty is involved.

The purpose of marketing research is to enable better decision making throughout the new-product development process and subsequently through the complete life cycle of the product. When one considers the level of investment that will be required to establish a viable commercial space tourism industry, the current embryonic stage of the industry and the degree of ‘unknowns’ involved, and therefore the financial risks entailed, rigorous and reliable marketing research is imperative.

Several studies of public interest in space tourism have been conducted, either by ‘independent’ academic researchers, government or public organizations, or commercial enterprises wishing to numerically substantiate their hope that space tourism is a viable investment (Crouch, 2001). In the case of this latter group of interested parties, although some of the results are available, these should be interpreted in light of the potential vested interests involved.

The most concerted effort to examine public interest in space tourism in a variety of countries has been carried out by Collins and others who studied public interest in Japan, the US and Canada (Collins, Iwasaki et al., 1994; Collins, Kanayama et al., 1994; Collins, Maita et al., 1996; Stockmans et al., 1995). In their 1993 Japanese study, 3,030 Japanese were asked whether they would like to travel into space: 80 per cent of the respondents under the age of 60 responded positively compared to about 45 per cent of respondents older than 60. On average, females were about 5 percentage points lower than males in their response to this question. About 20 per cent of interested respondents also indicated a preparedness to spend a year’s salary or more on an opportunity to travel into space.

Stockmans et al. (1995) also surveyed 1,020 households in a telephone poll across the US and Canada, closely modelled on the earlier Japanese survey. Over all age groups, 62 per cent expressed an interest in travelling to space, with a clear decline as a function of age from 83 per cent for those in their 20s to 27 per cent for those over 60 years of age. Women were again less interested than men by about 10 percentage points on average. There was similarly a clear preference for longer (2 to 3 days or more) rather than shorter trips (a day or less). Of those interested in a trip to space, 2.7 per cent expressed a willingness to pay three years’ salary and 10.6 per cent indicated they would pay one years’ salary.

O’Neil et al. (1998) reported the results of a joint NASA/STA (Space Transportation Association) study of a sample of 1,500 US families conducted in 1996. They found that 34 per cent of respondents ‘would be interested in taking a two-week vacation in the Space Shuttle in the future’, and 42 per cent were interested in the concept of space travel aboard a space cruise vessel offering accommodation and entertainment programmes similar to an ocean-going cruise ship. In response to the question ‘What would you be willing to pay per person for such an experience?’ 7.5 per cent indicated US$100,000 or more.

Another US study, Commercial Space Transportation Study Alliance (CSTS, 1994), involving an alliance of six US Aerospace Corporations, produced three demand curves (low, medium and high probability). The low-probability (or optimistic) scenario yielded estimates of demand varying between 200 passengers and 3 million passengers worldwide annually for ticket prices of US$1 million and US$10,000 respectively. By comparison, the high-probability (or pessimistic) scenario produced a range of 20 to 6,000 passengers annually.

The German market was surveyed by Abitzsch (1996) following the Collins et al. studies to estimate national demand: 43 per cent of Germans expressed an interest in participating in space tourism, a lower proportion than the Japanese (80 per cent) and Americans/Canadians (62 per cent). Abitzsch’s estimates for global market demand, derived by consolidating his and the various Collins et al. results, produced more price elastic figures than the CSTS study, ranging from 170 passengers per year at a price level of US$500,000 to 20 million passengers at US$1,000.

Barrett (1999) replicated the Collins’ surveys (Collins, Iwasaki, et al., 1994; Collins, Kanayama, et al., 1994; Collins, Maita, et al., 1996; Stockmans et al., 1995) in the United Kingdom on a much smaller sample of only 72 people: 35 per cent of respondents stated an interest in taking a trip into space, and 12 per cent were prepared to pay one year’s salary for such a tour.

Another US survey by Roper Starch Worldwide (1999) asked 2,002 Americans to assess interest in, and demand for a six-day trip from the Earth to the Moon and back on a luxurious space cruise ship for the Bigelow Companies. To the question, ‘If you had the money, how interested would you be in taking this adventure?’ 35 per cent answered ‘interested’ or ‘very interested’.

An unpublished study, by Kelly Space and Technology (n.d.), used Harris Interactive polling services to interview 2,022 respondents in the ‘high income sector of the [US] population’ to estimate space tourism demand. This survey estimated that the demand for orbital space travel would grow to about 4,000 passengers annually from 2015–25, and 10,000 passengers from 2010–20 for suborbital travel. The methodology used employed a choice-based conjoint analysis (Space Adventures, n.d.).

Futron Corporation (2002), in a study for NASA and conducted by Zogby International, surveyed 450 affluent Americans. The principal findings were that suborbital space travel could reach 15,000 passengers annually by 2021, representing revenues in excess of US$700 million, and that, by the same time, orbital travel was forecast to reach 60 passengers per year, amounting to revenues of US$300 million. Surprisingly, perhaps, half of the respondents indicated that they would be indifferent to travelling in a privately developed suborbital vehicle with a limited flight history versus a government-developed spacecraft. As the other studies have suggested, Futron concluded that ‘Orbital travel is a fairly elastic market; there are significant jumps in demand when the price drops to US$5 million and again at US$1 million.’

Recently Crouch and Laing (2004) assessed Australian public interest in space tourism using, for comparative purposes, a survey approach similar to a number of the studies summarized above. The study demonstrated a level of interest in the prospects for public space travel in Australia which is broadly comparable with the results of similar studies conducted in Japan, the US and Canada, the UK and Germany. The findings suggest that, conceptually at least, a majority of respondents would like to travel into space if they could (58 per cent of respondents), but cost, safety and product design factors would have a significant impact on consumer response. Demographic and behavioural characteristics of consumers are also strongly associated with these attitudes and interests. Younger respondents and male respondents were found to be statistically significantly more interested in space tourism. As one might expect, a strong positive association was found between current risk-taking behaviour in recreation and leisure activities and desire to travel into space. Consistent with other survey results, to the question, ‘How long would you like to stay in space?’, the modal response was two to three days (37 per cent). Although the majority of respondents indicated they would be prepared to pay between one to three month’s salary, 12 per cent indicate they would be willing to forego a year’s salary or more.

The most important need is to be able to obtain a reasonable prediction of the actual demand for space tourism rather than mere interest or desire (as market research studies to date have done). However, this is quite difficult to achieve when an entirely new industry with no market demand, track record or history is available upon which demand estimates can be based or extrapolated. Furthermore, market demand is not some hidden quantity waiting to be discovered or revealed. That is, there are many possible market demands – if you like, there is a probability distribution of demand and this distribution is a function of a wide range of factors, some of which include:

The challenge of estimating and forecasting the size of the market for space tourism is considerable and faces a number of challenges. With the exception of the two individuals who have travelled into space as tourists to date, there is no history of commercial space tourism that might reliably point to future consumer attitudes and behaviour in this market. Future market research must address the many important variables involved. Situational factors such as economic trends and events, global political developments and conflicts, and changing public attitudes will also shape the context of consumer choice towards space tourism.

Most importantly, however, public attitudes and interest towards space travel and tourism are not measures of actual future demand or choice behaviour. Indeed, past marketing research experience suggests the likelihood that such surveys substantially overestimate market demand, particularly in the short term. Potential space tourism consumers currently know very little about space tourism and the characteristics of space tourism products and experiences that may emerge in the years ahead. This lack of knowledge and information on the part of consumers raises a further caution concerning the conduct and interpretation of market research studies.

There are, however, behavioural theories and research methodologies which can potentially address these challenges. Discrete choice modelling (DCM) (Louviere et al., 2000) using random utility theory (RUT) (McFadden, 1986), in conjunction with Information Acceleration (IA) (Coltman et al., 2004; Urban et al., 1997) provides a rigorous and reliable means currently available for making progress in answering problems of this nature.

Discrete choice models decompose the total utility of each choice alternative into its component parts. They enable a researcher to estimate how much each attribute – the key differentiator between alternatives – contributes to the decision to choose an alternative. RUT postulates that choices can be decomposed into a systematic and observable/explainable component, and a random and unobservable/unexplainable component. The systematic component represents the decision strategy used by the individual(s) (known as a utility function) and the random component represents all possible unobserved influences on decisions. The approach leads to different probabilistic discrete choice models that represent the underlying process generating the choices. DCM is therefore based on a sound, well-tested behavioural theory that recognizes that preferences (and the choices that reveal them) have both deterministic and random components.

Gathering the data required to enable the DCM of consumer choice in space tourism would entail the design and execution of consumer choice experiments. This approach is ideal in situations where:

Where the modelling of future changes, trends or circumstances is required or where new or different choice attributes need to be evaluated for their likely impact, experimental choice modelling is particularly useful. In combination with IA methods, it is possible to model consumer adjustments to very new products or choice features. IA was developed in the early 1990s, using multimedia and information technology to accelerate consumer learning, in recognition of the fact that traditional methods failed to forecast the uptake of new technologies accurately due to a failure to: provide accurate information to potential users about relevant aspects of new technologies/products; simulate learning processes associated with new innovations and their evolutionary paths; and recognize that individuals and organizations make decisions and choices about technologies/products, and that market outcomes depend on these elemental behaviours. The IA approach is also applicable where very new choice environments or product features are of interest. So with these methods one can combine information about possible futures with ways in which consumers choose possible future products conditional on that information. IA is thus a powerful and flexible way to forecast the likely adjustment in response to futures and technologies. Coltman et al. (2004) recently developed significant advances in IA methods and applications that allow for cheaper and more robust estimation of demand where the context in which that demand is arising is unknown.

Employing the approach of Coltman et al. (2004) a pilot test was undertaken in April 2005. The pilot examined how the public might react when faced with four potential space tourism alternatives spanning high-altitude jet fighter flights, zero-gravity flights, sub-orbital space tourism, and orbital space tourism. That is, for the purpose of this particular application, the pilot focused on how the attributes of these four alternatives influenced how individuals might choose between the alternatives, with a focus on zero-gravity flights and sub-orbital space tourism. The pilot provides an assessment of the role that the attributes play in influencing choice between, but not within, each of the four types. It would, however, be straight forward to design a similar but different choice experiment that examined choice among alternatives within one of these types of space tourism alternatives, such as sub-orbital space tourism. This would enable an assessment to be made of the relative role that each attribute plays in influencing choice between one sub-orbital space tourism venture and another.

The Process

The pilot choice experiment proceeded as follows:

Hypothetical Choice Scenarios

The core element of the survey concerned the evaluation of a series of choice scenarios. There were two sets of these scenarios. The first set focused on zero-gravity flights and respondents were presented with several scenarios, each showing a detailed zero-gravity flight alternative, plus a high-altitude flight and a sub-orbital flight alternative. The second set instead focused on sub-orbital flights; competing alternatives included a zero-gravity flight and an orbital flight. Appendix 2 illustrates an example of a screen display of one scenario from the first set.

Each scenario shows three space tourism options and each option is explained in terms of the key attributes as explained above. The value or level of each attribute in each option is indicated in the scenario as manipulated by the fractional factorial experimental design. The scenarios included hotlinks for each attribute which opened a window with a detailed explanation of the attribute to avoid the need to return to the full glossary.

Each respondent then responded to each scenario by answering three questions (Appendix 2) that indicated which of the three options they preferred most, which they preferred least, and on which, realistically, they would actually spend time and money if they were available in the next 12–24 months.

Overview of Preliminary Results from the Pilot

We briefly describe the preliminary results from the choice experiment that focused on sub-orbital choices. More than 35 variables (called ‘attributes’) that describe possible future choice options were experimentally manipulated, each varying over 2 to 16 levels as needed to describe future variations. This recognizes that there is not one possible space tourism option, but in reality many millions of possibilities. The objective of the choice experiment is to quantify the effects of the attributes on choices among Zero-G (ZG), Sub-Orbital (SO) and Orbital (OR) choice options. Of course all three options might be unacceptable for whatever reason, and so we also include the option to choose no options.

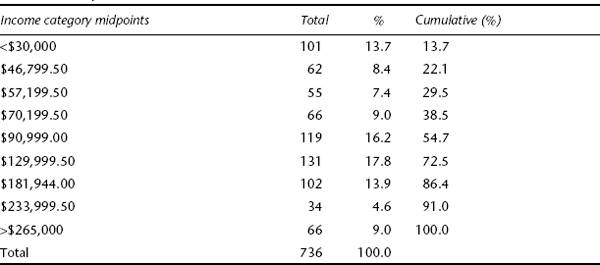

Our sample consists of predominantly high income and/or high net-worth individuals. By comparison, the 90th percentile for individual weekly disposable income in Australia in 2003 was around A$850, which would be approximately A$1,130 before taxes, or A$59,000 annually. Table 22.1 indicates that about 70 per cent of our sample is above the 90th percentile in annual household income. Thus, our sample is biased towards individuals who have the income or net worth to potentially afford the prices of the services studied.

Table 22.1 Sample income distribution

Table 22.2 shows the average number of choices in the experiment across all scenarios. These averages hide large variations in response to attribute level combinations. For example, SO choices range from nearly 23 per cent at the lowest prices tested to around 9 per cent for the highest prices tested. The table indicates that there were no differences in the choices of the services studied on average by level of household income. We further analysed differences by combining income and assets to create individuals who were above or below the median in income and net worth. An analysis of the response of these two groups to the prices of SO services indicates no differences in the response curves to price. Thus, our sample should be regarded as representative of 10 per cent or less of the Australian population, who should be able to afford to purchase at least some of the services offered if they so choose.

Table 22.2 Choice frequencies and income effects

| Choice | Total sample (%) | Sample> $90,000 HH Income (%) |

|---|---|---|

| Zero-G | 35.7 | 37.8 |

| Sub-Orbital | 14.6 | 14.0 |

| Orbital | 12.1 | 12.8 |

| None of the options | 37.6 | 35.3 |

| Total | 100.0 | 100.0 |

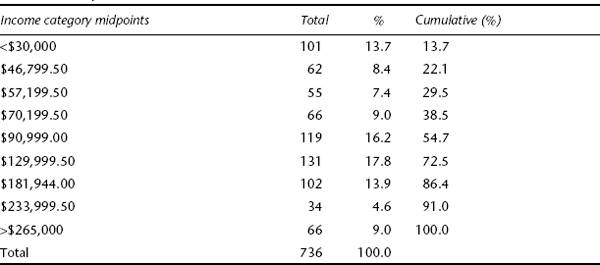

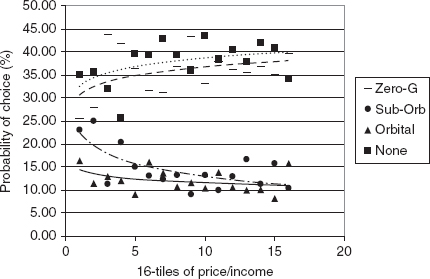

Turning to the results of the choice experiment, not surprisingly price was a significant driver of choices for all options. For Sub-Orbital (SO) options, choices decrease approximately logarithmically, and the rate of decrease is virtually identical for low or high wealth individuals. We also find a logarithmic decrease in choices as a function of the ratio of SO trip price to an individual’s total income or assets (see Figures 22.1 and 22.2). The choice models allow us to capture differential substitution effects due to price, such that as the price of SO increases, individuals substitute ZG or OR or None much more than would be expected if they were not substitutes.

Other attributes that are significant drivers of SO choices include the following:

Figure 22.1 Effects of price/income on choice

Figure 22.2 Effects of price/assets

There were other minor attribute effects, and some of these may reach statistical significance when we pool the datasets to allow for more extensive and detailed analysis. Of course, potential operations of SO services also need to know who the likely target customers are, and so we also included a number of individual difference variables in our model analyses (also called ‘covariates’). A number of these effects are very large, as we note below:

For good reason, the emerging space tourism industry has, to date, focused primarily on technological considerations. And, no doubt, technological concerns will remain critical for many years to come. But, as more attention turns toward issues of commercialization, it is imperative that sound, state-of-the-art marketing research is carried out to understand better the panoply of consumer behaviour questions the industry must confront. Without the sort of information that good quality marketing research can supply, commercial ventures and investors must be prepared to ‘fly blind’.

The major marketing research hurdle facing space tourism concerns the fact that this is a ‘new-to-world’ product. For all intents and purposes, we have no past consumer behaviour data that might be used to forecast demand or understand consumer perceptions of, and reactions to, product design, development, pricing and promotion decisions. Traditionally, what occurs in markets like this is that bold predictions are made about the first movers, though few if any of them manage to survive as they invariably serve as the experimental test bed on which consumers assess the appropriateness of the new offering (Golder and Tellis, 1993).

What our study shows, however, is that there are tools and techniques available that can be used to help address this hurdle and provide a more direct assessment of possible future scenarios of the demand for space tourism. Random-utility theory-based methods of discrete choice modelling, in conjunction with information acceleration techniques, provide the most applicable approach to this problem. These methods are theoretically sound and very flexible from a practical implementation perspective. In addition, the results are immediately operational in the sense that they can inform not just marketing but design. Hence, it is possible to apply the approach to any marketing research question in space tourism which can be defined in terms of:

The pilot test summarized in this paper provides one example of the type of application toward which this technique can be applied.

We wish gratefully to acknowledge the assistance of the following members of the Industry Advisory Group:

| Dr. Buzz Aldrin | Sharespace |

| Derek Webber | Spaceport Associates |

| Paul Young | Starchaser Industries |

| Peter Diamandis | Zero-G Corporation and X-Prize Foundation |

| Eric Anderson | Space Adventures |

| Patricia Grace-Smith | US Federal Aviation Administration |

We also thank Michael McGee and Steve Cook from Future and Simple, Sandra Peter at the Australian Graduate School of Management, and Jennifer Laing at La Trobe University for their valuable assistance.

Table 22.3 An example of sub-orbital space tourism attributes

| Zero-G flights | ||

|---|---|---|

| Attributes | Levels | |

| Price | 1. Price of Zero-G flight experience | 8 levels: From US$1,000 to US$8,000 |

| Operators | 2. National identity of operator | 8 levels: US/Russia/China/UK/France/Germany/Japan/Australia |

| 3a. Zero-G flight experience of operator (in years) | 8 levels: From ‘no experience & no harmful incidents’ to ‘10 years experience & some harmful incidents’ | |

| Safety | 3b. Safety history of this venture | |

| 4. Safety history of other Zero-G ventures | 4 levels: From ‘no incidents of harm’ to passengers to ‘1 loss-of-life accident’ | |

| 5. Safety standard of this venture as judged by independent experts | 2 levels: meets required standard/significantly exceeds required standard | |

| Duration of experience | 6a. Total time in Zero-G | 8 levels: From ‘10 loops – 4 mins.’ to ‘25 loops – 16 mins.’ |

| 6b. Number of Zero-G parabolic loops | ||

| Type of aircraft | 7. Aircraft type | 2 levels: modified American Boeing 727/ modified Russian Ilyushin 76 |

| Location | 8. Airport type | 2 levels: normal civilian airport/private airport |

| 9. Proximity of airport for Zero-G departure | 4 levels: From ‘within a 1 hour drive’ to ‘requires an international flight’ | |

| Amenities | 10. Zero-G space per passenger | 4 levels: Images showing different levels of crowding/space |

| 11. Passengers per assisting crew member | 4 levels: 6/4/3/2 | |

| Activities | 12. Opportunity to conduct Zero-G activities/games | 2 levels: limited to floating only/several activities available |

| Training and testing | 13. Duration of pre-flight training | 4 levels: 2 hours/4 hours/6 hours/1 day |

| 14. Stringency of physical requirements | 4 levels: very low/low/moderate/high | |

| 15. Further educational enhancements | 4 levels: none/presentation by space scientist/ presentation by little-known NASA astronaut/ presentation by well-known NASA astronaut | |

| Legal factors | 16. Licensed status of operator | 2 levels: has an operating license from the one local authority/has an operating license form the US Federal Aviation Administration (FAA) and several other licensing authorities |

| 1 7. Insurance coverage | 2 levels: passenger travels at own risk or takes out own insurance coverage/fully covered by operator’s insurance policy | |

Figure 22.3 Example of a hypothetical choice scenario

Abitzsch, S. (1996) ‘Prospects of space tourism’. Paper presented at the 9th European Aerospace Congress: Visions and limits of long-term aerospace developments, Berlin, May

Antczak, J. (2004) ‘Space tourism faces safety regulations’. Space.com, 7 October. Retrieved 6 May 2005, from http://www.space.com

Barrett, O. (1999) ‘An evaluation of the potential demand for space tourism within the United Kingdom’. Spacefuture.com, March. Retrieved 5 November 2011, from http://www.spacefuture.com/archive/an_evaluation_of_the_potential_demand_for_space_tourism_within_the_united_kingdom.shtml

Berger, B. (2002) ‘Russia withdraws lance bass’ name from October Soyuz mission’. Space.com, 9 September. Retrieved 10 September 2002 from http://www.space.com

Berger, B. (2004) ‘House passes private spaceflight bill’. Space.com, 20 November. Retrieved 5 November 2011, from http://www.space.com/news/spaceflight_bill_041120.html

CNN (2005) ‘Sweden mines space for tourist dollars’. CNN, 23 March. Retrieved 24 March 2005, from http://edition.cnn.com

Collins, P., Iwasaki, Y., Kanayama, H. and Okazaki, M. (1994) ‘Potential demand for passenger travel to orbit: Engineering construction and operations in Space IV’. In Proceedings of Space ‘94 (Vol. 1) Albuquerque, NM: American Society of Civil Engineers, pp. 578–86

Collins, P., Kanayama, H., Iwasaki, Y. and Ohnuki, M. (1994) ‘Commercial implications of market research on space tourism’. Journal of Space Technology and Science, 10(2), 3–11

Collins, P., Maita, M., Stockmans, R. and Kobayahi, S. (1996) ‘Recent efforts towards the new space era’ (AIAA Paper No. 96–4581) Paper presented at the 7th American Institute of Aeronautics and Astronautics International Spaceplanes and Hypersonics Systems and Technology Conference, Norfolk, VA, November

Coltman, T. R., Devinney, T. M. and Louviere, J. J. (2004) ‘Utilizing rich multimedia methods for the elicitation of preferences for radical future technologies’. In Where science meets practice. Amsterdam: ESOMAR, pp. 271–88

Crouch, G. I. (2001) ‘The market for space tourism’. Journal of Travel Research, 40(2), 213–19

Crouch, G. I. and Laing, J. H. (2004) ‘Australian public interest in space tourism and a cross-cultural comparison’. The Journal of Tourism Studies, 15(2), 26–36

CSTS (1994) ‘Commercial space transportation study’. Unpublished manuscript, Commercial Space Transportation Study Alliance, May

David, L. (2004) ‘Rules set for $50 million “America’s Space Prize”’. Space.com, 8 November. Retrieved 9 November 2004, from http://www.space.com

David, L. (2005a) ‘Doctor’s orders: The right stuff for space tourists’. Space.com, 25 March. Retrieved 5 November 2011, from http://space.com/missionlaunches/050325_space_tourism.html

David, L. (2005b, April 20) ‘Rutan: Space tourism will thrive, but regulations already interfering’. Space.com, 20 April. Retrieved 5 November 2011, from http://www.space.com/news/050420_faa_hearing.html

Dinerman, T. (2004) ‘Space: The tourist frontier’. Wall Street Journal, 22 January, p. D6

Economist (2004a) ‘One small step for space tourism’. The Economist, 18 December, pp. 127–8

Economist (2004b) ‘A grand but costly vision’. The Economist, 17 January, p. 9

Futron Corporation (2002) ‘Space tourism market study: Orbital space travel and destinations with suborbital space travel’. Retrieved 5 March 2003, from http://www.futron.com

Golder, P. N. and Tellis, G.J. (1993) ‘Pioneer advantage: Marketing logic or marketing legend?’. Journal of Marketing Research, 30(2), 158–62

Kelly Space and Technology (n.d.) ‘Space transportation market demand, 2010–2030’ (NRA8–27 Final Report). Retrieved 15 June 2005, from http://www.kellyspace.com

Louviere, J. J., Hensher, D. A. and Swait, J. D. (2000) Stated choice methods: Analysis and application. Cambridge: Cambridge University Press

McFadden, D. (1986) ‘The choice theory approach to marketing research’. Marketing Science, 5(4), 275–97

Malik, T. (2004) ‘America’s Space Prize: Reaching higher than sub-orbit’. Space.com, 6 October. Retrieved 10 October 2004, from http://www.space.com

Malik, T. (2005) ‘Space tourism group picks Florida launch’. Space.com, 9 March. Retrieved 5 November 2011, from http://www.space.com/missionlaunches/aera_spacetourism_050309.html

Miller, L. (2005) ‘Space entrepreneurs worry about fed regulations’. Space.com, 10 February. Retrieved 14 February 2005, from http://www.space.com

O’Neil, D., Bekey, I., Mankins, J., Rogers, T. F. and Stallmer, E. W. (1998) General public space travel and tourism, Vol. 1: Executive Summary. Washington, DC: National Aeronautics and Space Administration and the Space Transportation Association

Pasztor, A. (2004) ‘Travel’s final frontier’. The Wall Street Journal, 29 January, pp. D1, D8

Roper Starch Worldwide (1999) ‘Spacecruiseship study’. Unpublished manuscript. Roper Starch Worldwide

Space Adventures (n.d.) ‘Space tourism market analysis’. Unpublished manuscript. Space Adventures

Space.com (2004) ‘Virgin Galactic to offer public space flights’. Space.com, 27 September. Retrieved 28 September 2004, from http://www.space.com

Stockmans, R., Collins, P. and Maita, M. (1995) ‘Demand for space tourism in America and Japan, and its implications for future space activities’ (Paper No. AAS 95–605). In Advances in the Astronautical Sciences: Sixth International Space Conference of Pacific-Basin Societies (Vol. 91). Marina del Rey, CA: American Astronautical Society, pp. 601–10

Taylor, C. (2004) ‘The sky’s the limit’. Time, 29 November, pp. 48–52

Urban, G. L., Hauser, J. R., Qualls, W. J., Weinberg, B. D., Bohlmann, J. D. and Chicos, R. A. (1997) ‘Information acceleration: Validation and lessons from the field’. Journal of Marketing Research, 34(1), 143–53

Werner, E. (2004a) ‘Senate dispute may scuttle space tourism bill’. Space.com, 14 October. Retrieved 10 November 2004, from http://www.space.com

Werner, E. (2004b) ‘Congress passes space tourism bill’. Space.com, 9 December. Retrieved 10 December 2004, from http://www.space.com

Xprize Foundation (n.d.) ‘X Prize Foundation: Revolution through competition’. Retrieved 20 January 2004, from http://www.xprize.com