The two principal questions that the owner of a business asks periodically are:

(1) What is my net income (profit)?

(2) What is my capital?

The simple balance of assets against liabilities and capital provided by the accounting equation is insufficient to give complete answers. For (1) we must know the type and amount of revenue and the type and amount of each expense for the period in question. For (2) it is necessary to obtain the type and amount of each asset, liability, and capital account at the end of the period. The information to answer (1) is provided by the income statement and to answer (2) by the balance sheet. Also, you will note that each heading of a financial statement answers the questions “who,” “what,” and “when.”

The income statement may be defined as a summary of the revenue, expenses, and net income of a business entity for a specific period of time. This may also be called a profit and loss statement, an operating statement, or a statement of operations. Let us review the meanings of the elements entering into the income statement.

Revenue. The increase in capital resulting from the delivery of goods or rendering of services by the business. In amount, the revenue is equal to the cash and receivables gained in compensation for the goods delivered or services rendered.

Expenses. The decrease in capital caused by the business’s revenue-producing operations. In amount, the expense is equal to the value of goods and services used up or consumed in obtaining revenue.

Net income. The increase in capital resulting from profitable operation of a business; it is the excess of revenue over expenses for the accounting period.

It is important to note that a cash receipt qualifies as revenue only if it serves to increase capital. Similarly, a cash payment is an expense only if it decreases capital. Thus, for instance, borrowing cash from a bank does not contribute to revenue.

EXAMPLE 1

Mr. T. Drew’s total January income and the totals for his various expenses can be obtained by analyzing the transactions. The income from fees amounted to $2,500, and the expenses incurred to produce this income were: rent, $500; salaries, $200; and supplies, $200. The formal income statement can now be prepared.

T. Drew

Income Statement

Month of January 200X

In many companies, there are hundreds and perhaps thousands of income and expense transactions in a month. To lump all these transactions under one account would be very cumbersome and would, in addition, make it impossible to show relationships among the various items. For example, we might wish to know the relationship of selling expenses to sales and whether the ratio is higher or lower than in previous periods. To solve this problem, we set up a temporary set of income and expense accounts. The net difference of these accounts, the net profit or net loss, is then transferred as one figure to the capital account.

Because an income statement pertains to a definite period of time, it becomes necessary to determine just when an item of revenue or expense is to be accounted for. Under the accrual basis of accounting, revenue is recognized only when it is earned, that is when services are performed or goods delivered, and expense is recognized only when it is incurred. This differs significantly from the cash basis of accounting, which recognizes revenue and expense generally with the receipt and payment of cash. Essential to the accrual basis is the matching of expenses with the revenue that they helped produce. Under the accrual system, the accounts are adjusted at the end of the accounting period to properly reflect the revenue earned and the cost and expenses applicable to the period.

Most business firms use the accrual basis, whereas individuals and professional people generally use the cash basis. Ordinarily, the cash basis is not suitable when there are significant amounts of inventories, receivables, and payables.

The information needed for the balance sheet items are the net balances at the end of the period, rather than the total for the period as in the income statement. Thus, management wants to know the balance of cash in the bank, the balance of inventory, equipment, and so on, on hand at the end of the period.

The balance sheet may thus be defined as a statement showing the assets, liabilities, and capital of a business entity at a specific date. This statement is also called a statement of financial position or a statement of financial condition.

In preparing a balance sheet, it is not necessary to make any further analysis of the data. The needed data—that is, the balances of the asset, liability, and capital accounts—are already available.

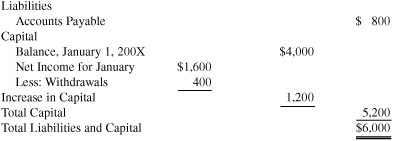

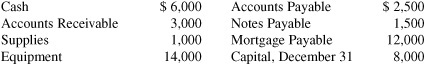

EXAMPLE 2 Report Form

T. Drew

Balance Sheet

January 31, 200X

LIABILITIES AND CAPITAL

The close relationship of the income statement and the balance sheet is apparent. The net income of $1,600 for January, shown as the final figure on the income statement of Example 1, is also shown as a separate figure on the balance sheet of Example 2. The income statement is thus the connecting link between two balance sheets. As discussed earlier, the income and expense items are actually a further analysis of the capital account.

The balance sheet of Example 2 is arranged in report form, with the liabilities and capital sections shown below the asset section. It may also be arranged in account form, with the liabilities and capital sections to the right of, rather than below, the asset section, as shown in Example 3.

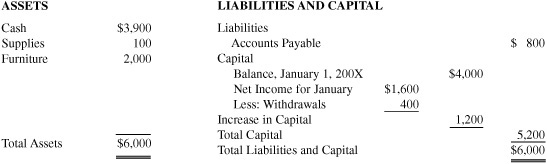

EXAMPLE 3 Account Form

T. Drew

Balance Sheet

January 31, 200X

Instead of showing the details of the capital account in the balance sheet, we may show the changes in a separate form called the statement of owner’s equity.

EXAMPLE 4

T. Drew

Statement of Owner’s Equity

For the month ending January 31, 200X

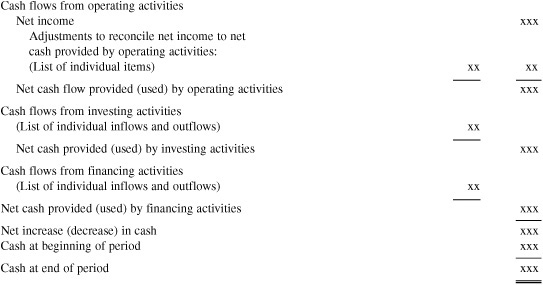

The Statement of Cash Flows, as it name implies, summarizes a company’s cash flows for a period of time. It provides answers to such questions as “where did our money come from?” and “where did our money go?” The statement of cash flows explains how a company’s cash was generated during the period and how that cash was used. This statement reports on net cash flows from operating, investing, and financing activities over a period of time.

EXAMPLE 5

Company Name

STATEMENT OF CASH FLOWS (Indirect Method)

Period Covered

Since it is quite complex to prepare this statement, the above example is only an illustration of a Statement of Cash Flows. For further details of how to prepare one, please refer to any Financial Accounting text.

The three financial statements from Examples 2, 3, and 4 are interrelated as shown in Example 6.

EXAMPLE 6

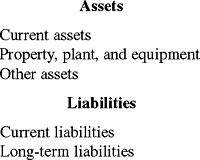

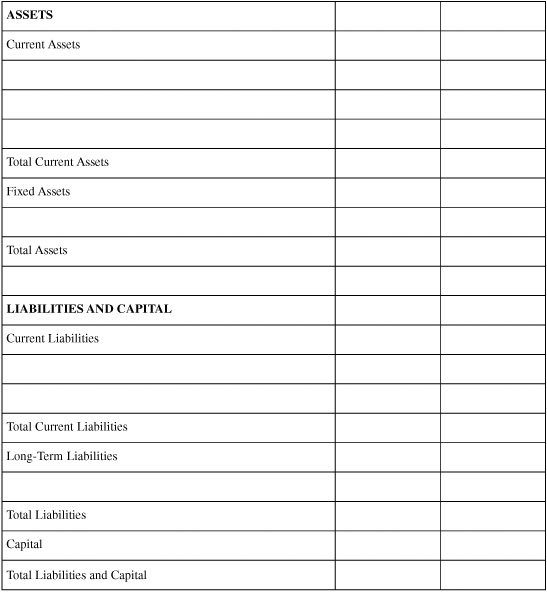

Financial statements become more useful when the individual items are classified into significant groups for comparison and financial analysis. The classifications relating to the balance sheet will be discussed in this section. The classifications relating to the income statement will be discussed in Chapter 10.

The Balance Sheet

The balance sheet becomes a more useful statement for comparison and financial analysis if the asset and liability groups are classified. For example, an important index of the financial state of a business, which can be derived from the classified balance sheet, is the ratio of current assets to current liabilities. This current ratio ought, generally, to be at least 2:1; that is, current assets should be twice current liabilities. For our purposes, we will designate the following classifications:

Note 1. The net income of the income statement, $1,600, is transferred to the statement of owner’s equity.

Note 2. The capital is summarized in the statement of owner’s equity and the final balance included in the balance sheet.

Current assets. Assets reasonably expected to be converted into cash or used in the current operation of the business. (The current period is generally taken as 1 year.) Examples are cash, notes receivable, accounts receivable, inventory, and prepaid expenses (prepaid insurance, prepaid rent, and so on). List these current assets in order of liquidity.

Property, plant, and equipment. Long-lived assets used in the production of goods or services. These assets, sometimes called fixed assets or plant assets, are used in the operation of the business rather than being held for sale, as are inventory items.

Other assets. Various assets other than current assets, fixed assets, or assets to which specific captions are given. For instance, the caption “Investments” would be used if significant sums were invested. Often, companies show a caption for intangible assets such as patents or goodwill. In other cases, there may be a separate caption for deferred charges. If, however, the amounts are not large in relation to total assets, the various items may be grouped under one caption, “Other Assets.”

Current liabilities. Debts that must be satisfied from current assets within the next operating period, usually 1 year. Examples are accounts payable, notes payable, the current portion of long-term debt, and various accrued items such as salaries payable and taxes payable.

Long-term liabilities. Liabilities that are payable beyond the next year. The most common examples are bonds payable and mortgages payable. Example 7 shows a classified balance sheet of typical form.

EXAMPLE 7

F. Saltzmann

Balance Sheet

January 31, 200X

F. Saltzmann

Balance Sheet

January 31, 200X

LIABILITIES AND CAPITAL

1. Another term for an accounting report is an ____________ .

2. The statement that shows net income for the period is known as the ____________ statement.

3. The statement that shows net loss for the period is known as the ____________ statement.

4. Two groups of items that make up the income statement are ____________ and ____________.

5. The difference between revenue and expense is known as ____________ .

6. Withdrawal of money by the owner is not an expense but a reduction of ____________ .

7. To show the change in capital of a business, the ____________ statement is used.

8. The balance sheet contains ____________, ____________, and ____________.

9. Assets must equal _____________.

10. Expense and income must be matched in the same ____________ .

11. The statement of cash flows presents ____________, ____________, and ____________ activities over a period of time.

Answers:

1. accounting statement;

2. income;

3. income;

4. income, expense;

5. net income;

6. capital;

7. capital;

8. assets, liabilities, capital;

9. liabilities and capital;

10. year or period;

11. operating, investing, financing

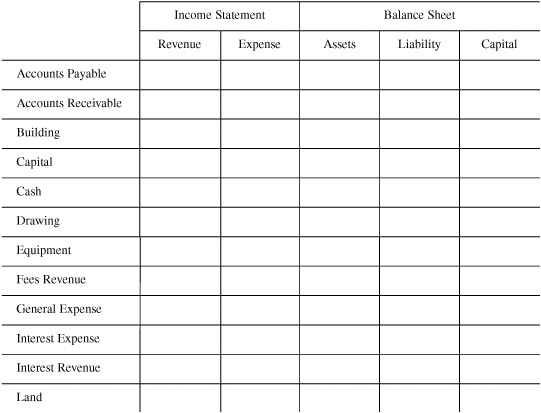

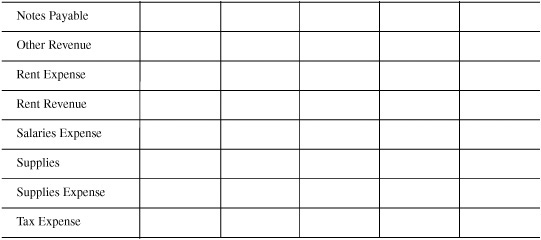

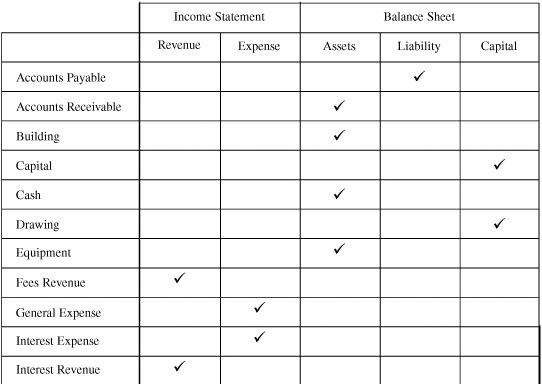

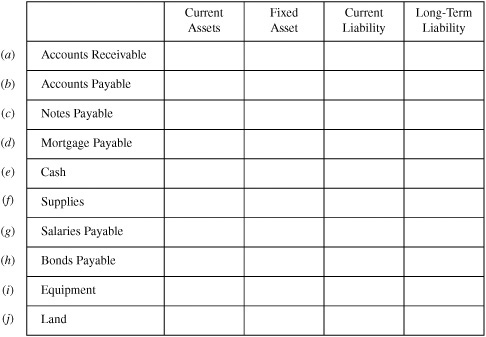

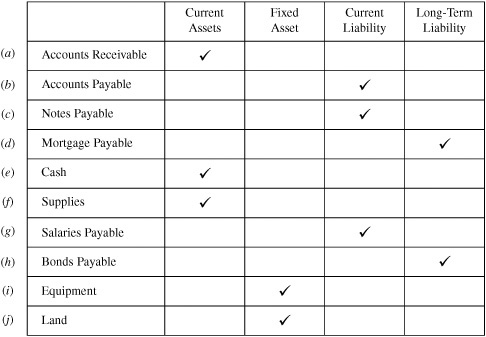

4.1 Place a check mark in the appropriate box below to indicate the name of the account group in which each account belongs.

SOLUTION

4.2 Below is an income statement with some of the information missing. Fill in the information needed to complete the income statement.

SOLUTION

(a) 12,090; (b) $73,450

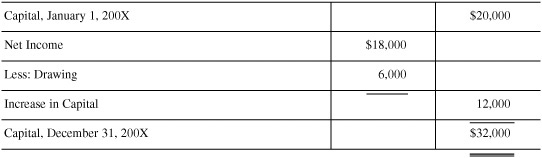

4.3 Based on the following information, determine the capital as of December 31, 200X. Net Income for period, $18,000; Drawing, $6,000; Capital (January 1, 200X), $20,000.

SOLUTION

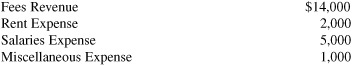

4.4 The following information was taken from an income statement:

If the owner withdrew $2,000 from the firm, what is the increase or decrease in capital?

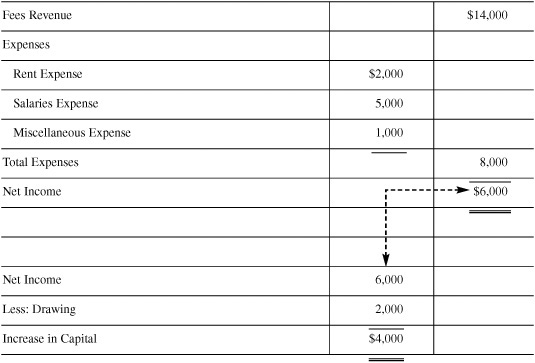

SOLUTION

There are two steps to solving this problem:

1. Prepare an income statement.

2. Determine increases or decreases in capital by subtracting the drawing (withdrawal) from the net income.

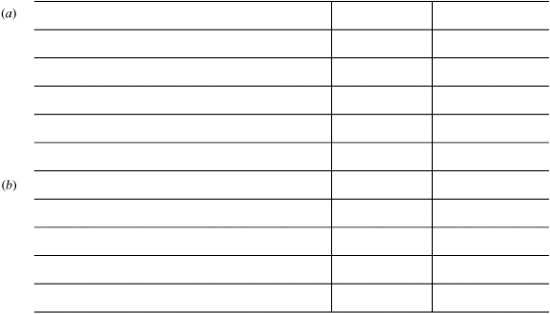

4.5 Based on the information in Problem 4.4, if the withdrawal were $9,000 instead of $2,000, what would the increase (decrease) become?

SOLUTION

If the withdrawal is larger than the net income, a decrease in capital will result.

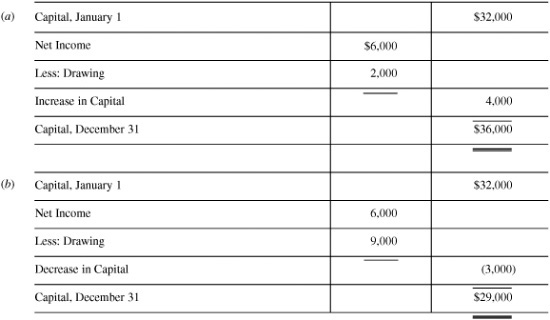

4.6 If the capital account has a balance of $32,000 on January 1, what will be the balance by December 31: (a) based on Problem 4.4? (b) based on Problem 4.5?

SOLUTION

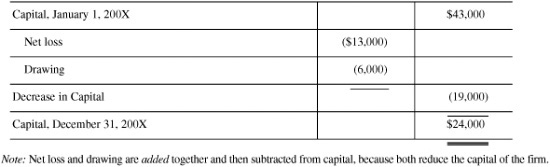

4.7 Eccleston Company had a capital balance as of January 1, 200X, of $43,000. During its first year of operation, it had produced a net loss of $13,000 and drawings of $6,000. What is the capital balance of the company as of December 31, 200X?

SOLUTION

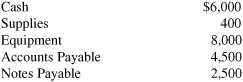

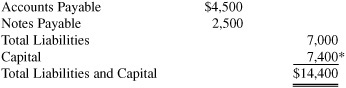

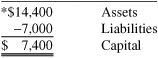

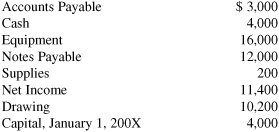

4.8 Based on the following information, determine the capital on December 31.

SOLUTION

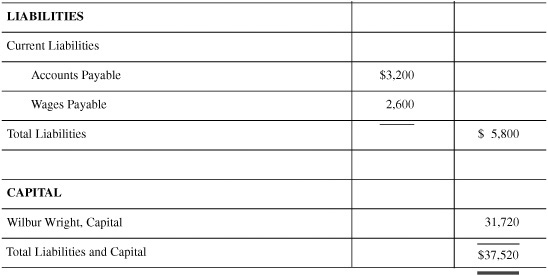

LIABILITIES AND CAPITAL

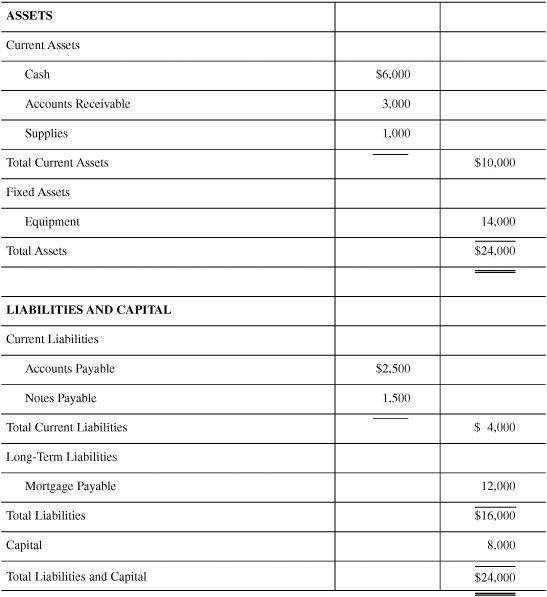

4.9 Prepare a balance sheet as of December 31, 200X, from the following data:

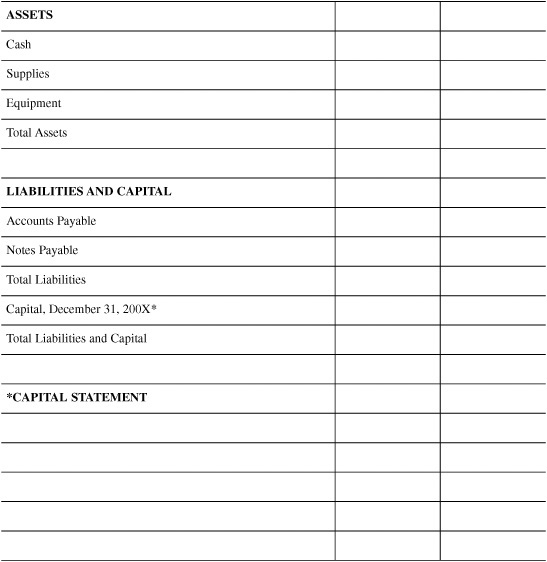

SOLUTION

4.10 Classify the following accounts by placing a check mark in the appropriate column.

SOLUTION

4.11 From the information that follows, prepare a classified balance sheet as of December 31.

SOLUTION

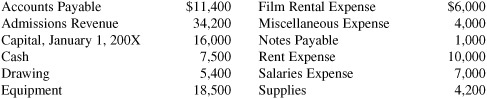

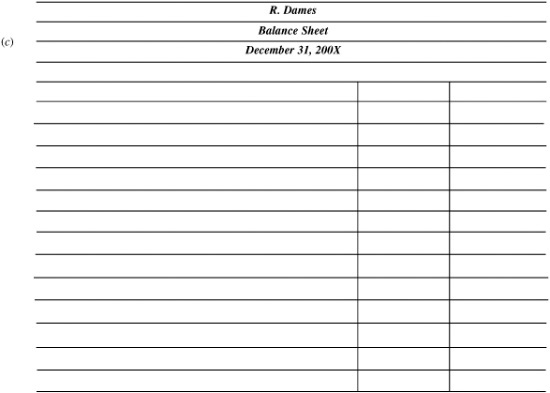

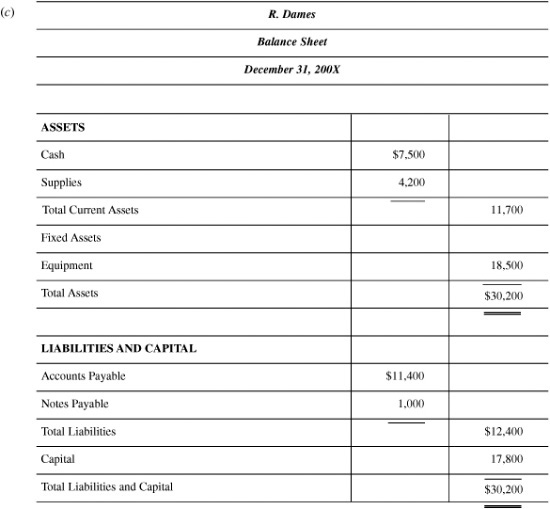

4.12 Below are account balances as of December 31, 200X, of R. Dames, owner of a movie theater.

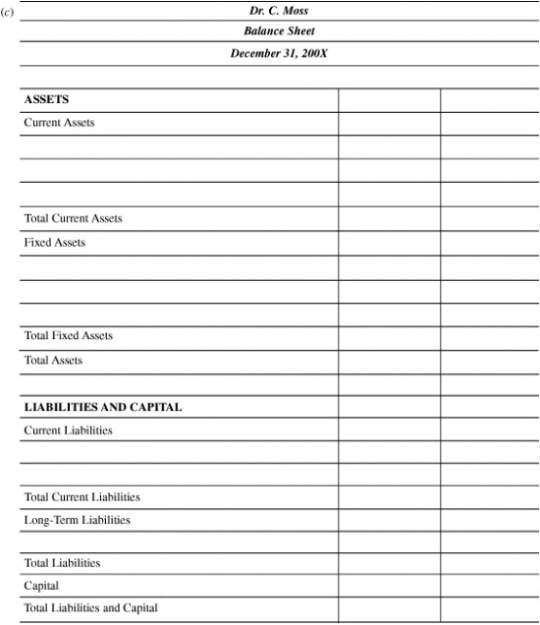

Preface (a) an income statement, (b) a capital statement, (c) a balance sheet.

SOLUTION

(b) The capital statement is needed to show the capital balance at the end of the year. Mr. Dames’ capital balance above is at the beginning. Net income increases capital, and drawing reduces capital.

R. Dames

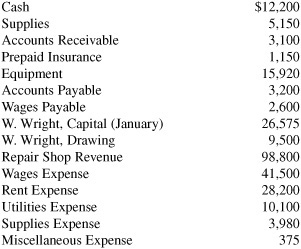

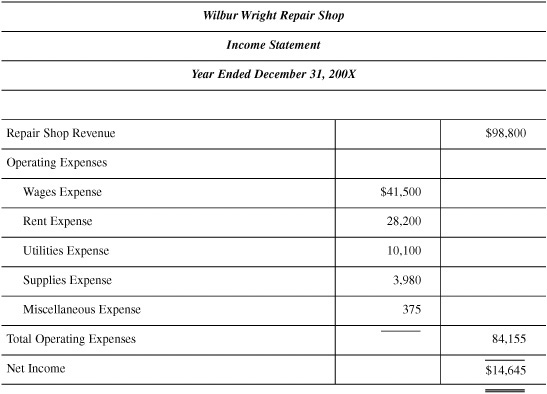

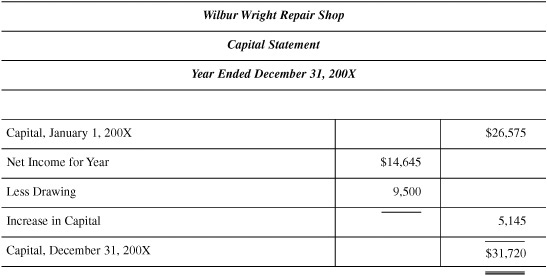

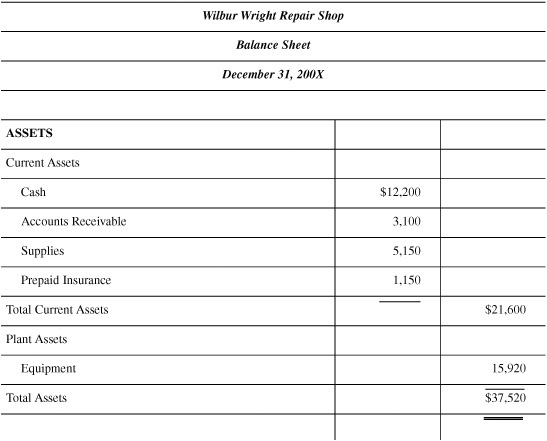

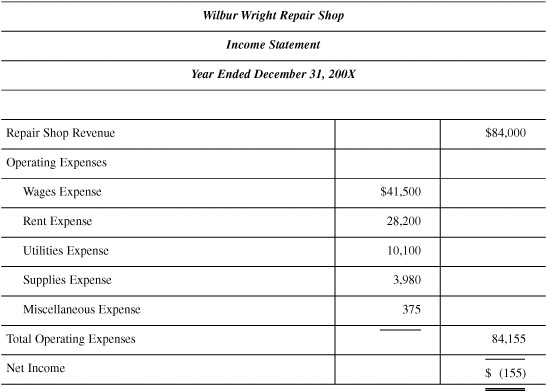

4.13 Wilbur Wright owns and operates an airplane repair shop. Listed below are the year-end balances for the shop. Prepare an income statement, capital statement, and balance sheet in good report form.

SOLUTION

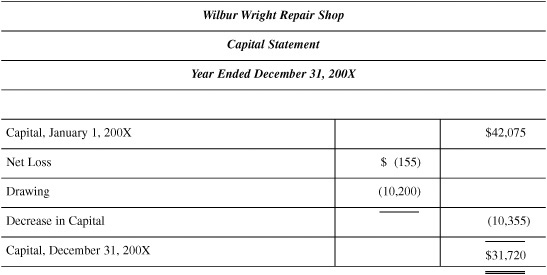

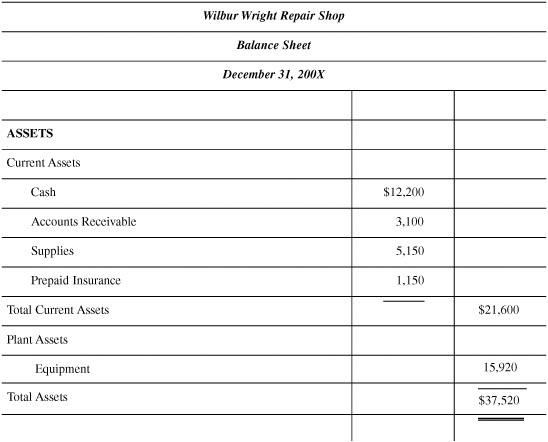

4.14 Given the information in Problem 4.13, if revenues were only $84,000, drawing was $10,200, and Wright’s beginning capital balance was $42,075, what effect would this have on the financial statements? Prepare new financial statements with these changes.

SOLUTION

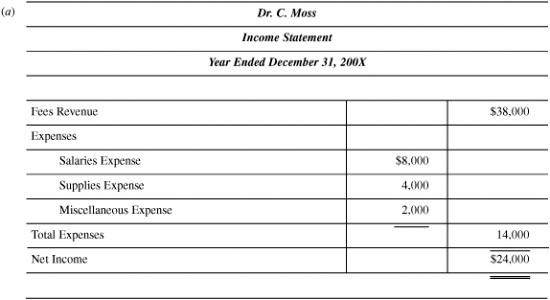

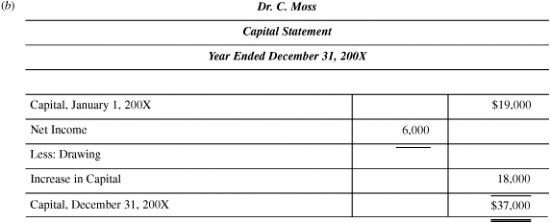

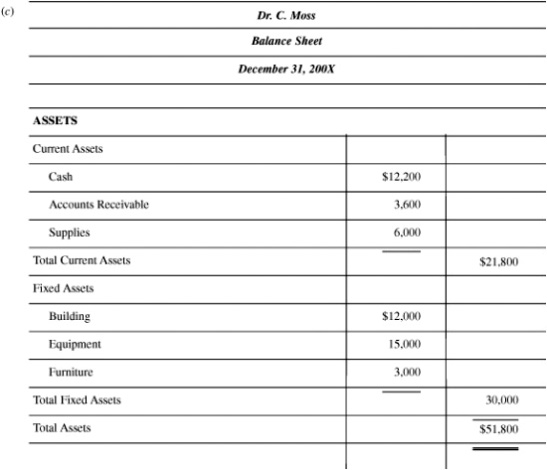

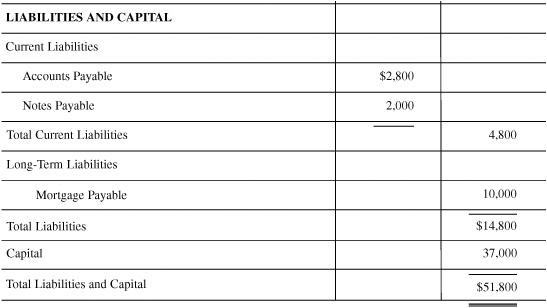

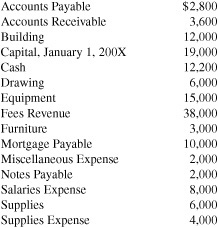

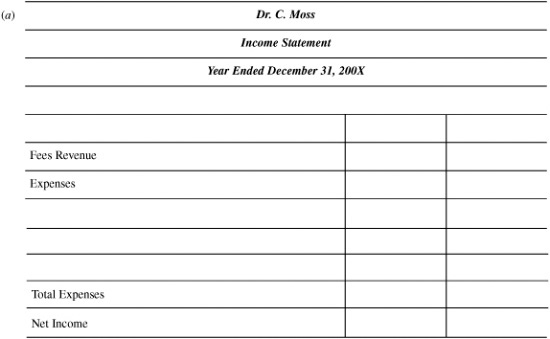

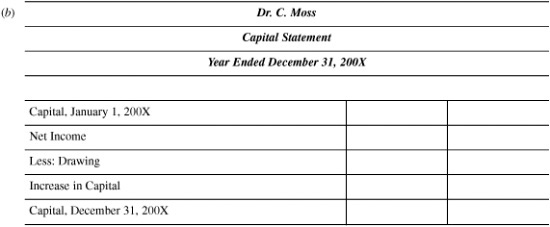

4.15 The balances of the accounts of Dr. C. Moss, Psychologist, are as follows:

Using the forms provided below, prepare (a) an income statement, (b) a capital statement, and (c) a classified balance sheet.

SOLUTION