There are three types of business enterprises that make up the business society:

(1) Service. Companies and individuals that yield a service to the consumer, such as lawyers, physicians, airlines, entertainment, etc.

(2) Manufacturing. Companies that convert raw materials into finished products, such as housing construction companies and lumber mills.

(3) Merchandising. Companies that engage in buying and selling finished goods, such as department stores and retail establishments.

This chapter examines the third type, merchandising companies.

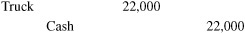

When the periodic inventory system is used to account for inventory, purchases of merchandise during the period are not debited to the Merchandise Inventory account (see Physical and Perpetual Inventory, Chapter 11), but rather are debited to a separate account known as Purchases. This account includes only merchandise bought for resale. Other types of purchases (machinery, furniture, trucks, etc.) that are to be used in the business, rather than sold, are debited to the particular asset account involved and appear in the balance sheet.

EXAMPLE 1

(a) Bought merchandise for resale, $6,000.

(b) Bought a truck costing $22,000 for delivery purposes.

Note: While Truck ($22,000) is entered on the balance sheet as an asset, the account purchases appears in the cost of goods sold section of the income statement.

Merchandising (trading) businesses are those whose income derives largely from buying and selling goods rather than from rendering services.

Inventory represents the value of goods on hand at either the beginning or the end of the accounting period. The beginning balance is the same amount as the ending balance of the previous period. Generally, not all purchases of merchandise are sold in the same period, so unsold merchandise must be counted and priced, and its total recorded in the ledger as Ending Inventory. The amount of this inventory is shown as an asset in the balance sheet. The amount of goods sold during the period is shown as cost of goods sold in the income statement. (See Section 10.6.)

EXAMPLE 2

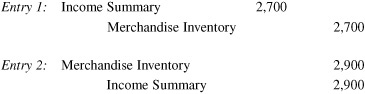

Assume that the January 1 (beginning) inventory is $2,700 and the December 31 (ending) inventory is $2,900. Two entries are required to show the replacement of the old inventory by the new inventory:

The effect on Merchandise Inventory and the Income Summary account balance is as follows:

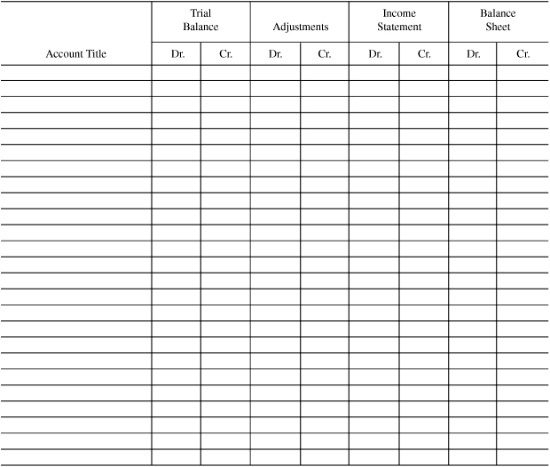

As discussed in Chapter 9, the worksheet is usually prepared in pencil on a multicolumn sheet of accounting stationery called analysis paper. On the worksheet, the ledger accounts are adjusted, balanced, and arranged in proper form for preparing the financial statements. All procedures can be reviewed quickly, and the adjusting and closing entries can be made in the formal records with less chance of error. Moreover, with the data for the income statement and balance sheet already proved out on the worksheet, these statements can be prepared more readily.

For a typical merchandise business, we may suppose the worksheet to have eight money columns; namely, a debit and a credit column for each of four groups of figures: (1) trial balance, (2) adjustments, (3) income statement, and (4) balance sheet. The steps in completing the worksheet are, then, similar to those for a service business:

1. Enter the trial balance figures. The balance of each general ledger account is entered in the appropriate trial balance column of the worksheet. The balances summarize all the transactions for the period before any adjusting entries have been applied.

2. Enter the adjustments. After the trial balance figures have been entered and the totals are in agreement, the adjusting entries should be entered in the second pair of columns. The related debits and credits are keyed by letters so that they may be rechecked quickly for any errors. The letters should be in proper sequence, beginning with the accounts at the top of the page. For the purpose of this chapter, only the adjusting entry for Merchandise Inventory will be considered, although entries for prepaid expenses, accrued salaries, depreciation, and unearned income are normally found in the adjusting columns.

3. Extend the trial balance figures and the adjustment figures to either the income statement or balance sheet columns. The process of extending the balance horizontally should begin with the account at the top of the sheet. The revenue and expense accounts should be extended to the income statement columns; the assets, liabilities, and capital to the balance sheet columns.

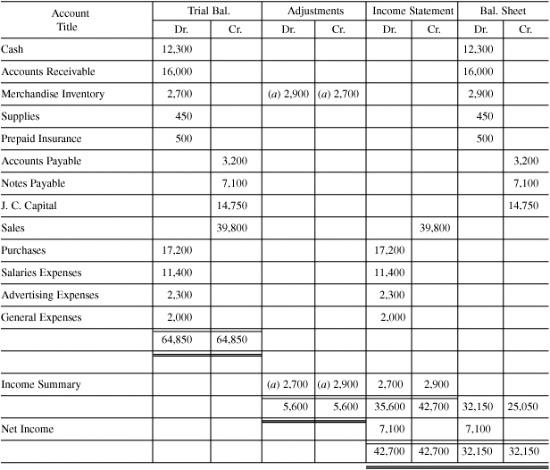

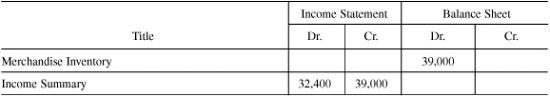

You will notice that both the debit and credit amounts for Income Summary are extended to the income statement. This occurs because both the debit amount adjustment ($2,700 of Beginning Inventory) and the credit amount adjustment ($2,900 of Ending Inventory) are needed to prepare the income statement. It would not be practical to net the two items, as the single figure would not yield sufficient information regarding the beginning and ending inventories.

The Beginning Inventory figure ($2,700) is extended as a debit in the Income Statement column because it will be combined with the Purchases account balance to determine the cost of goods available for sale. The Ending Inventory figure ($2,900) is a credit in the Income Statement column because it will be deducted from the goods available for sale in order to determine the cost of goods sold. The Ending Inventory is also recorded and entered as a debit in the balance sheet column because that will show the goods on hand at the end of the period, and thus an asset of the firm.

4. Total the income statement columns and the balance sheet columns. The difference between the debit and credit totals in both sets of columns should be the same amount, which represents net income or net loss for the period.

5. Enter the net income or net loss. In Example 3, below, the credit column total in the income statement is $42,700, the debit column total is $35,600. The credit column, or income side, is the larger, representing a net income of $7,100 for the month. Since net income increases capital, the net income figure should go on the credit side of the balance sheet. The balance sheet credit column total of $25,050 plus net income of $7,100 totals $32,150, which equals the debit column total. Since both the income statement columns and the balance sheet columns are in agreement, it is a simple matter to prepare the formal income statement and balance sheet.

EXAMPLE 3

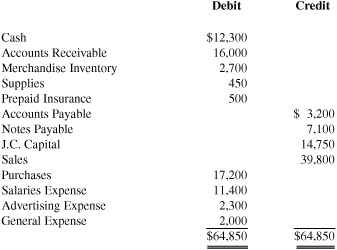

From the trial balance of the J.C. Company on the following page, you can prepare an eight-column worksheet. The Ending Merchandise Inventory (Dec. 31, 200X) was found to be $2,900, as shown in Example 2.

J.C. Company Trial Balance December 31, 200X

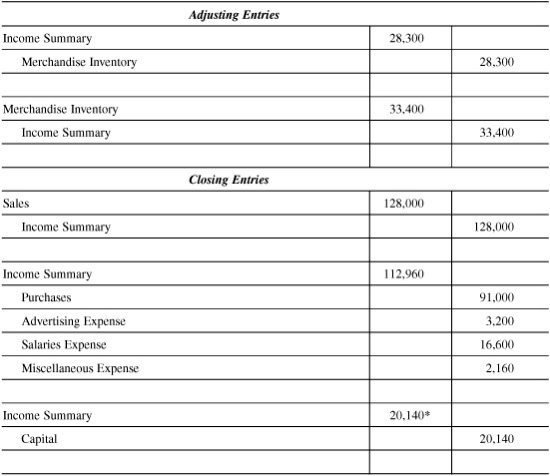

J.C. Company Worksheet Year Ended June 30, 200X

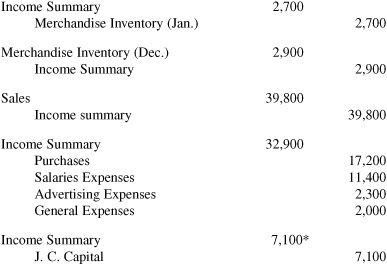

The information for the month-to-month adjusting entries and the related financial statements can be obtained from the worksheet. After the income statement and balance sheet have been prepared from the worksheet for the last month in the fiscal year, a summary account—known as Income Summary—is set up. Then, by means of closing entries, each expense account is credited so as to produce a zero balance, and the total amount of the closed-out accounts is debited to Income Summary. Similarly, the individual revenue accounts are closed out by debiting, and the total amount is credited to the summary account. Thus, the new fiscal year starts with zero balances in the revenue and expense accounts, though assets, liabilities, and capital accounts are carried forward. Note that the Income Summary balance gives the net income or net loss for the old year. Finally, Income Summary is closed to the Capital account.

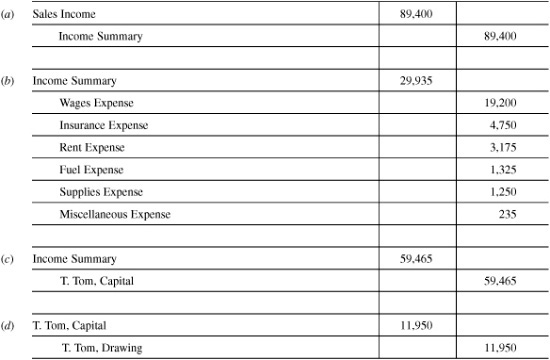

EXAMPLE 4

The adjusting entry for inventory and the closing entries based on the information obtained from the worksheet in Example 3 appear below.

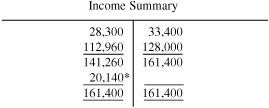

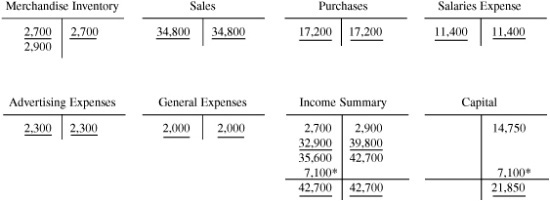

The final result of the adjusting and closing entries appears below.

*This represents the net income figure.

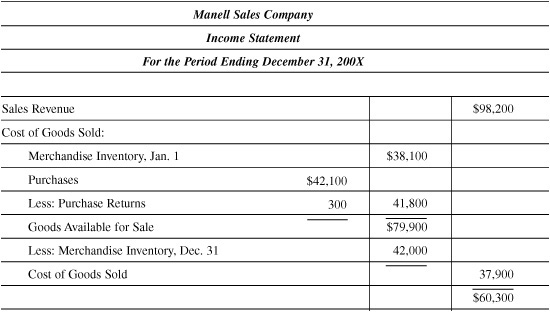

The Income Statement

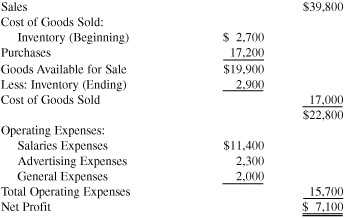

The classified income statement sets out the amount of each function and enables management, stockholders, analysts, and others to study the changes in function costs over successive accounting periods. There are three functional classifications of the income statement.

(1) Revenue. Revenue includes gross income from the sale of products or services. It may be designated as sales, income from fees, and so on, to indicate gross income. The gross amount is reduced by sales returns and by sales discounts to arrive at net sales.

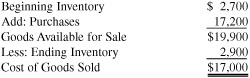

(2) Cost of goods sold. The inventory of a merchandising business consists of goods on hand at the beginning of the accounting period and those on hand at the end of the accounting period. The beginning inventory appears in the income statement (Cost of Goods Sold section, also known as COGS) and is added to purchases to arrive at the cost of goods available for sale. Ending inventory is deducted from the cost of goods available for sale to arrive at cost of goods sold.

EXAMPLE 5 (from Example 3)

(3) Operating expenses. Operating expenses includes all expenses or resources consumed in obtaining revenue. Operating expenses are further divided into two groups. Selling expenses are those related to the promotion and sale of the company’s product or service. Generally, one individual is held accountable for this function, and his or her performance is measured by the results in increasing sales and maintaining selling expenses at an established level. General and administrative expenses are those related to the overall activities of the business, such as the salaries of the president and other officers. When preparing income statements, list expenses from highest to lowest except Miscellaneous, which is always last, no matter how large the amount may be.

EXAMPLE 6

J.C. Company Income Statement Year Ended June 30, 200X

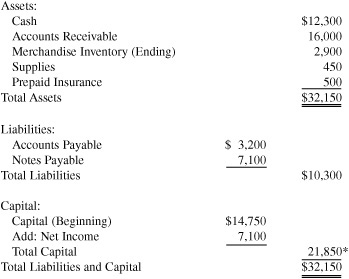

J.C. Company Balance Sheet Year Ended June 30, 200X

*A separate capital statement could be used instead of the data presented in the Capital section.

Under the periodic inventory method of inventory calculation (see Chapter 11), all purchases are recorded in the Purchases account. At the end of the accounting period, the firm takes a physical count of all inventory that is on hand. The cost of the inventory includes the net purchase price (Purchases less both Purchases Returns and Allowances and Purchase Discounts) plus any cost of transportation (Freight-In). The total cost of purchases is then added to Beginning Inventory to get cost of goods available for sale. The cost of the Ending Inventory (that which has not been sold as of the end of the period) is then subtracted from the goods available for sale to get goods available for sale sold (the cost of the inventory that was sold during the period). The cost of goods sold is then subtracted from Sales to get gross profit, which is then reduced by operating expenses to determine net income.

1. Merchandise Inventory (ending) appears as an ______________________ in the ______________________ (financial statement).

2. Merchandise Inventory is adjusted through the ______________________ account.

3. The worksheet is prepared on a multicolumn sheet of accounting stationery known as _______________________________.

4. The number of columns normally used for worksheet presentation is _____________________________.

5. The only account figure that appears on both the income statement and the balance sheet is _______________________________.

6. The beginning balance of Merchandise Inventory would be the same amount as the ending balance of the _______________________________period.

7. Worksheets are not considered formal statements, and therefore can be prepared in _______________________________.

8. The net income that comes from the data in the worksheet would carry a ______________________ balance.

9. Each of the revenue and each of the expense account balances is closed into the _______________________________. account by means of _______________________________.

10. The accounts with zero balance at the beginning of the year would be those involving ______________________ and ______________________.

Answers:

1. asset, balance sheet;

2. Income Summary;

3. analysis paper;

4. eight;

5. Merchandise Inventory;

6. preceding;

7. pencil;

8. credit;

9. Income Summary, closing entries;

10. income, expenses

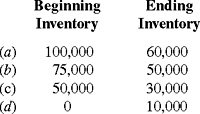

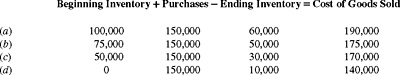

10.1 The Mills Company purchased merchandise costing $150,000. What is the cost of goods sold under each assumption below?

SOLUTION

10.2 For each situation below, determine the missing figures.

SOLUTION

(a) $23,000;

(b) $16,000;

(c) $38,000;

(d) $36,000

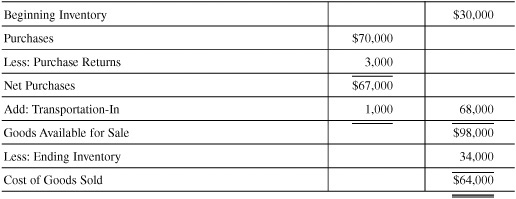

10.3 Compute the cost of goods sold from the following information: Beginning Inventory, $30,000; Purchases, $70,000; Purchase Returns, $3,000; Transportation-In, $1,000; Ending Inventory, $34,000. (Transportation-In is to be added to the cost.)

SOLUTION

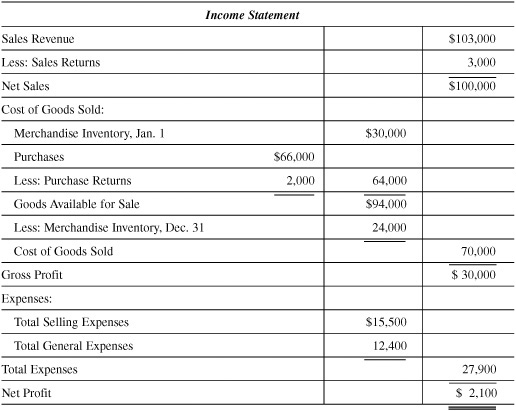

10.4 Prepare an income statement based on the following data.

(a) Merchandise inventory, Jan. 1, 200X, $30,000

(b) Merchandise inventory, Dec. 31, 200X, $24,000

(c) Purchases, $66,000

(d) Sales revenue, $103,000

(e) Purchase returns, $2,000

(f) Total selling expenses, $15,500

(g) Total general expenses, $12,400

(h) Sales returns, $3,000

SOLUTION

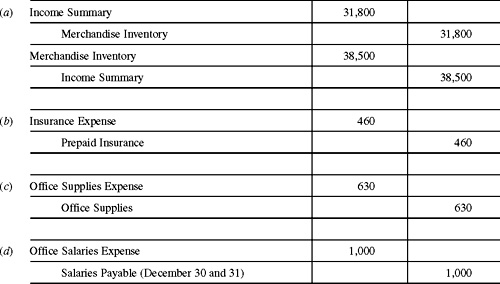

10.5 Journalize the following data:

(a) Merchandise inventory, January 1, $31,800; December 31, $38,500.

(b) Prepaid insurance before adjustment, $1,540. It was found that $460 had expired during the year.

(c) Office supplies physically counted on December 31 were worth $120. The original balance of Supplies was $750.

(d) Office salaries for a 5-day week ending on Friday average $2,500. The last payday was on Friday, December 27.

SOLUTION

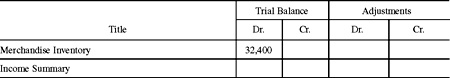

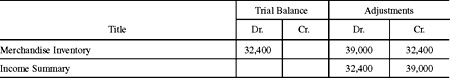

10.6 A section of a worksheet is presented below. Enter the adjustment required for Inventory, if it is assumed that Ending Inventory was $39,000.

SOLUTION

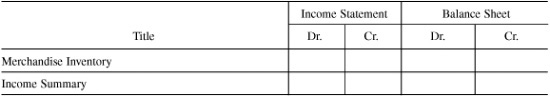

10.7 Using the information in Problem 10.6, extend the accounts in the worksheet. What classification does the Inventory of $39,000 represent?

SOLUTION

Merchandise inventory of $39,000 represents the value of the goods on hand and is classified as a current asset.

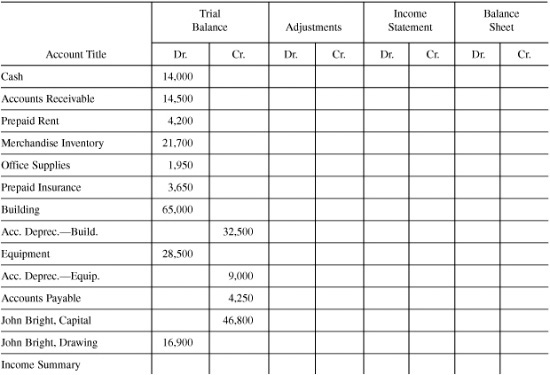

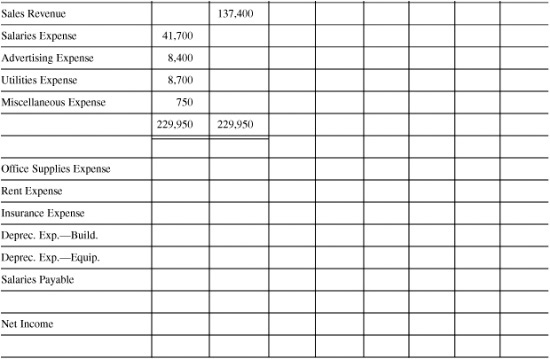

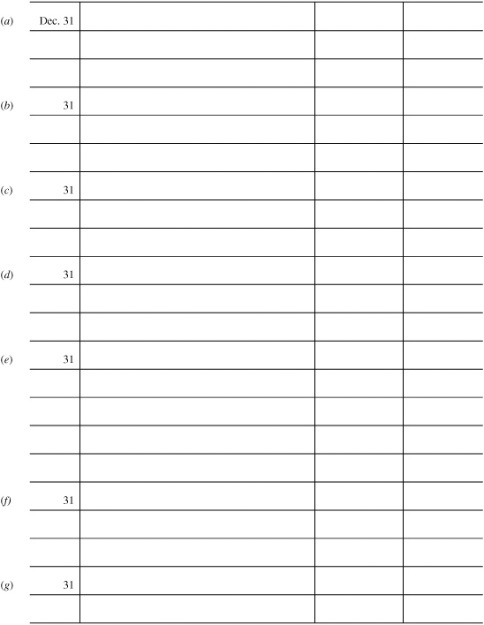

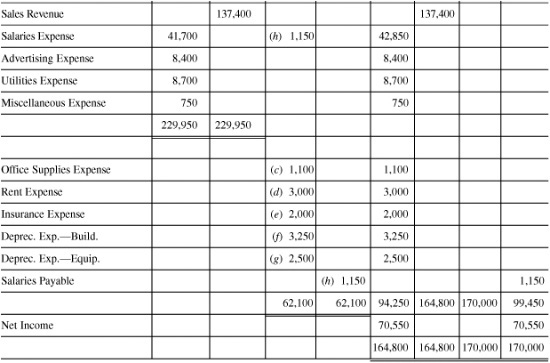

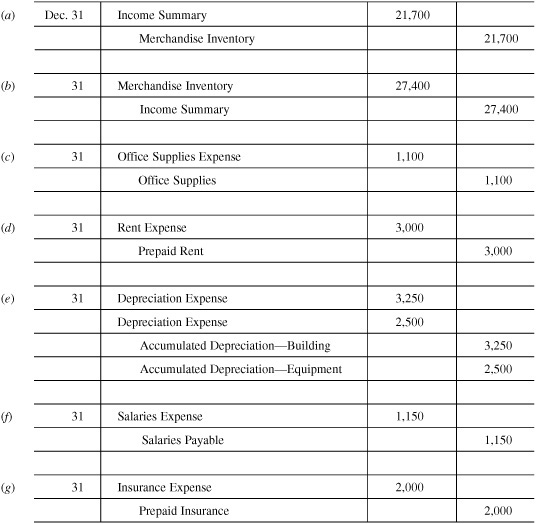

10.8 John Bright runs Bright Light, a light fixture store. John has completed his trial balance for the fiscal year just ended and has asked you, his accountant, to complete the worksheet and make any adjustments necessary. Below are the necessary adjustments that you have discovered.

(a) Merchandise inventory on December 31, $27,400

(b) Office supplies on hand on December 31, $850

(c) Rent expired during the year, $3,000

(d) Depreciation expense (building), $3,250

(e) Depreciation expense (equipment), $2,500

(f) Salaries accrued, $1,150

(g) Insurance expired, $2,000

Complete the worksheet and show the necessary adjusting entries as of the end of the fiscal year, December 31, 200X.

Adjusting Entries

SOLUTION

Adjusting Entries

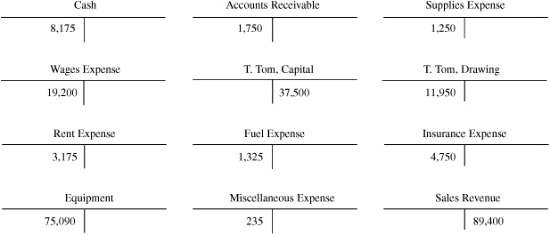

10.9 From the information in the following T accounts, prepare the necessary closing entries for December 31.

Closing Entries

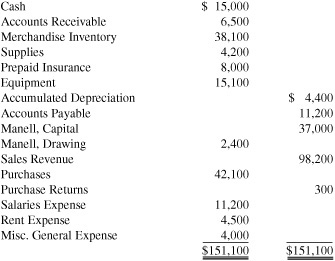

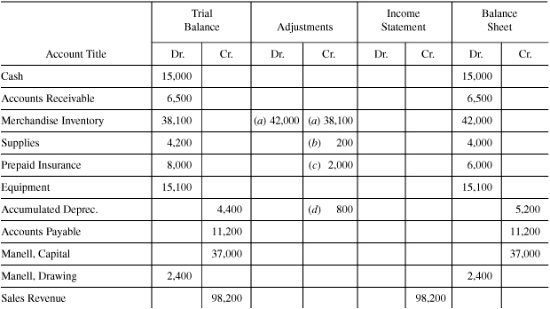

SOLUTION

10.10 From the trial balance of the Manell Sales Company, as of December 31, which follows, prepare an eightcolumn worksheet, using the following additional information for year-end adjustments: (a) merchandise inventory on December 31, $42,000; (b) supplies on hand, December 31, $4,000; (c) insurance expired during this year, $2,000; (d) depreciation for the current year, $800; (e) salaries accrued on December 31, $400.

Manell Sales Company Trial Balance

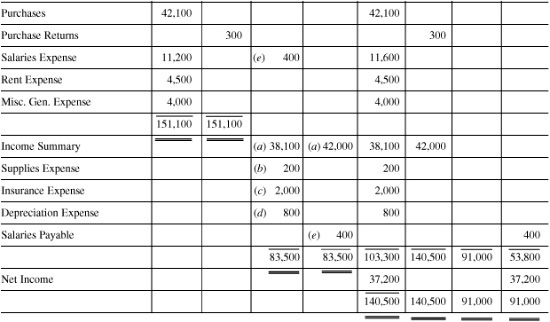

Manell Sales Company Worksheet

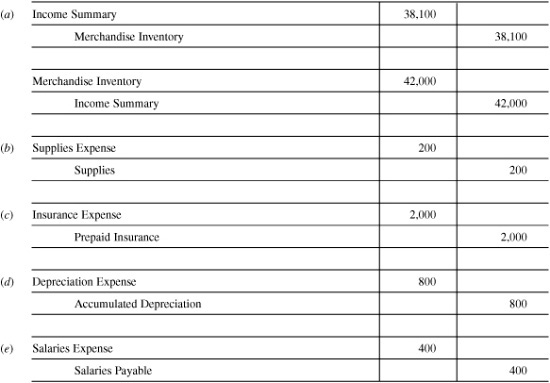

SOLUTION

Manell Sales Company Worksheet

10.11 From the information in Problem 10.10, prepare all necessary adjusting and closing entries.

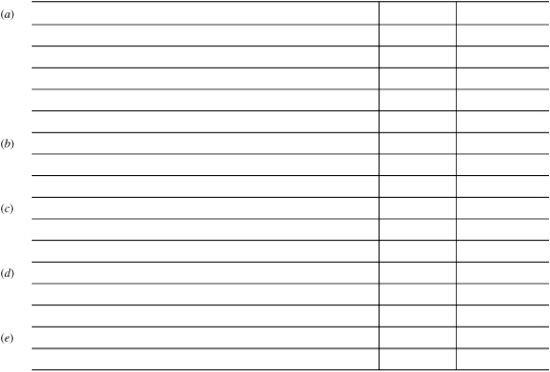

Adjusting Entries

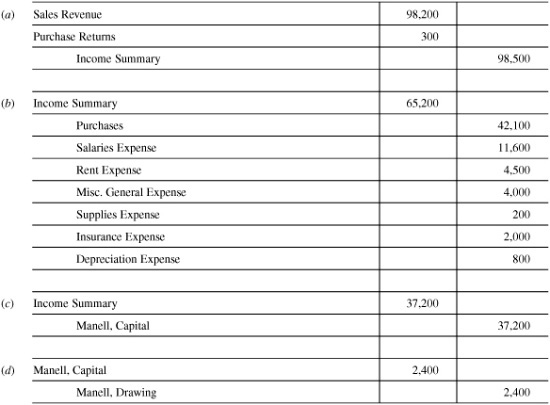

Closing Entries

SOLUTION

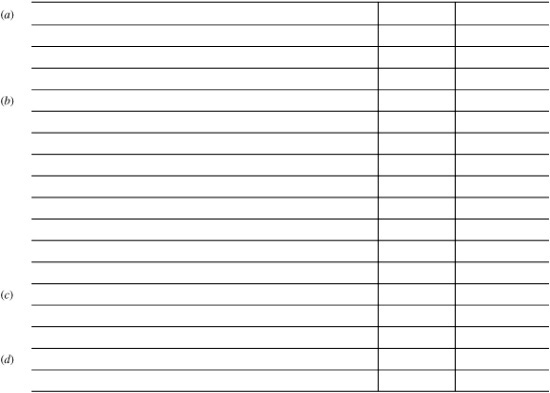

Adjusting Entries

Closing Entries

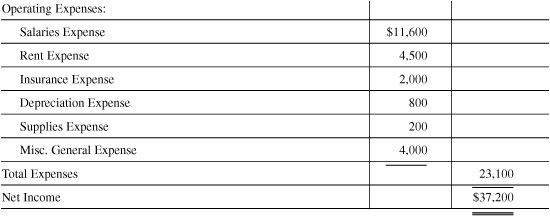

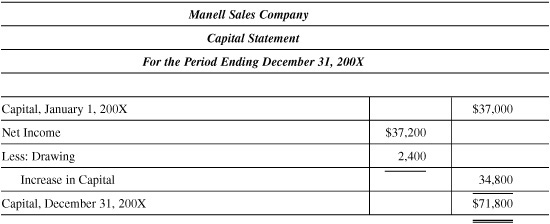

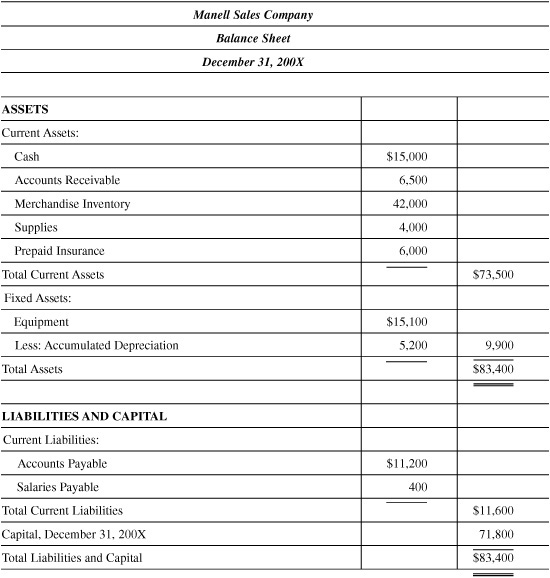

10.12 From the information in Problem 10.10, prepare all financial statements.

SOLUTION

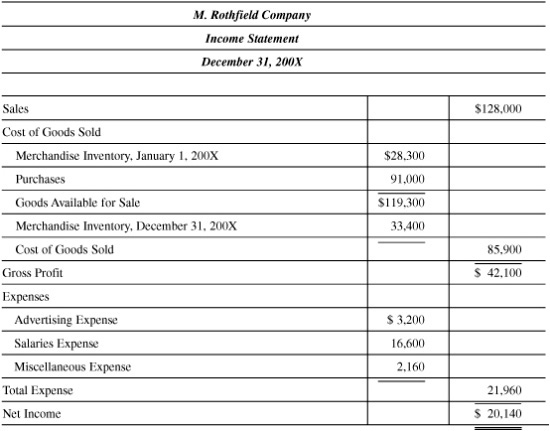

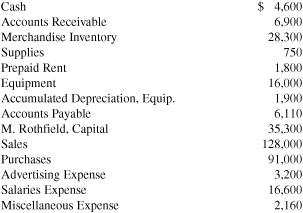

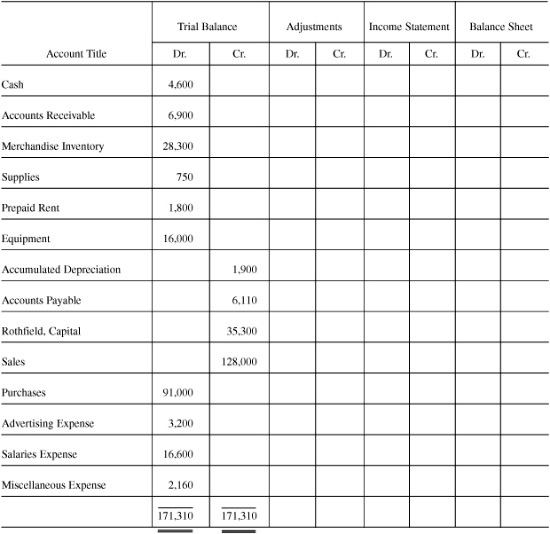

1. The accounts and their balances in the M. Rothfield Company ledger on December 31, 200X, the end of the fiscal year, are as follows:

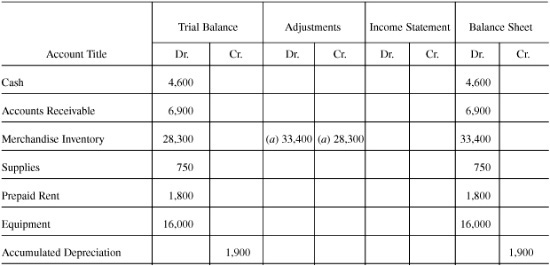

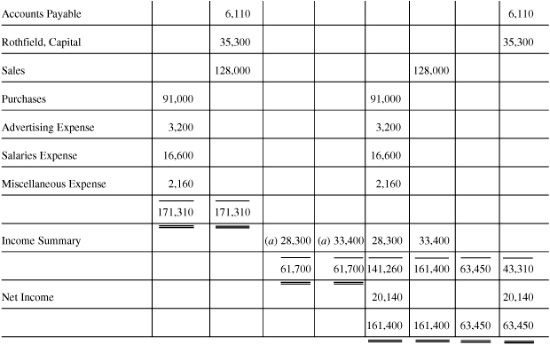

Prepare an eight-column worksheet with the following adjustment: Merchandise Inventory as of December 31, $33,400.

SOLUTION

2. Based on the information in part 1, prepare the adjusting entries, the closing entries, and the income statement.

SOLUTION