In a merchandising business, inventory is merchandise that is held for resale. As such, it will ordinarily be converted into cash in less than a year and is thus a current asset. In a manufacturing business, there will usually be inventories of raw materials and goods in process in addition to an inventory of finished goods. Since we have discussed the Merchandise Inventory account as it relates to the worksheet (Chapter 10), let us now examine how the merchandise inventory amount is calculated.

Under the periodic method, inventory is physically counted at regular intervals (annually, quarterly, or monthly). When this system is used, credits are made to the Inventory account or to Purchases, not as each sale is made, but rather in total at the end of the inventory period.

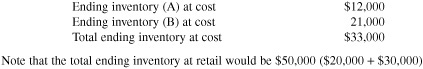

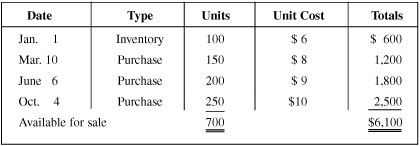

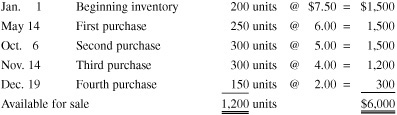

To approach the problem of inventory measurement, in order to assign the business cost to each item, three methods of valuation (FIFO, LIFO, and weighted average) have been developed and approved by GAAP (General Accepted Accounting Practices). To compare these three methods, the same data (Chart 1) will be used in all of the following inventory examples.

Chart 1

It will be assumed that a physical count of inventory on the last day of the accounting period (December 31) showed 320 units on hand. Therefore, 380 units (700 – 320) were sold during the year.

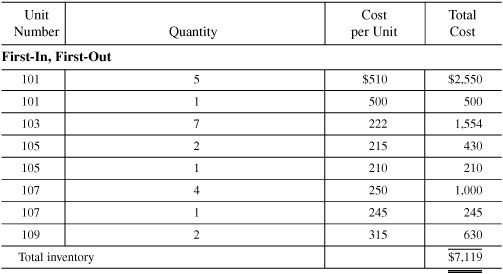

Costing Inventory: First-In, First-Out (FIFO)

The first-in, first-out (FIFO) method of costing inventory assumes that goods are sold in the order in which they were purchased. Therefore, the goods that were bought first (first-in) are the first goods to be sold (first-out), and the goods that remain on hand (ending inventory) are assumed to be made up of the latest costs. Therefore, for income determination, earlier costs are matched with revenue and the most recent costs are used for balance sheet valuation.

This method is consistent with the actual flow of costs, since merchandisers attempt to sell their old stock first. (Perishable items and high-fashion items are examples.) FIFO is the most widely used inventory method of those that will be discussed.

EXAMPLE 1

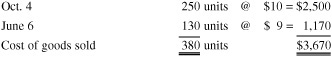

Under FIFO, those goods left at the end of the period are considered to be those received last. Therefore, the 320 units on hand on December 31 would be costed as follows:

The latest cost of the inventory consists of 250 units at $10. However, since the ending inventory consists of 320 units, we must refer to the next most recent purchase of 70 units at $9. Therefore, you could say that the process for determining the cost of the units on hand involves working backward through the purchases until there is a sufficient quantity to cover the ending inventory count. Thus the ending inventory under the FIFO method would be valued and recorded at $3,130.

EXAMPLE 2

The cost of goods sold can be determined by subtracting the value of the ending inventory from the total value of the inventory available for sale ($6,100 − $3,130 = $2,970). Since 320 units remain as ending inventory, the number of units sold is 380 (700 − 320).

This can also be computed as

It should be noted that as a method of assigning costs, FIFO may be used regardless of the actual physical flow of merchandise. Indeed, we might say that FIFO really stands for first-price-in, first-price-out. In a period of rising prices—inflation—the FIFO method will yield the largest inventory value, thus resulting in a larger net income. This situation occurs because this method assigns an inventory cost based on the most recent, higher costs. Conversely, the FIFO method would produce a smaller cost of goods sold, because the earlier, lower costs are assigned to the cost of goods sold. Because FIFO results in the most recent charges to inventory, the value of the ending inventory is closer to its replacement cost than under any other method.

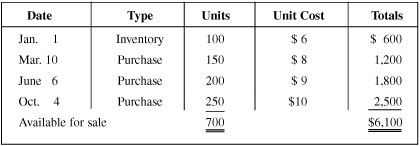

EXAMPLE 3

Two years of determining the value of the same number of units in the inventory are shown below.

(a) First year, 200X (rising costs):

If 10 units are on hand, the value under FIFO would be computed as

Thus, the ending inventory of 10 units is $80.

The cost of goods sold would be calculated as $260 − $80 = $180.

(b) Second year, 200X (falling costs):

If 10 units are on hand, the value under FIFO would be computed as

Thus, the ending inventory of 10 units is $50.

The cost of goods sold would be calculated as $280 − $50 = $210.

Note that even though there are 10 units left in both years, under FIFO, the year 200X produces a higher ending inventory in a rising market, thus producing a higher net income. This is because the cost of goods sold is lower in a rising market ($260 − 80 = $180) than in a declining market ($260 − $50 = $210). Thus the lower the cost, the higher the profit.

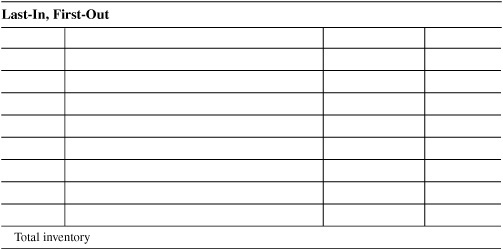

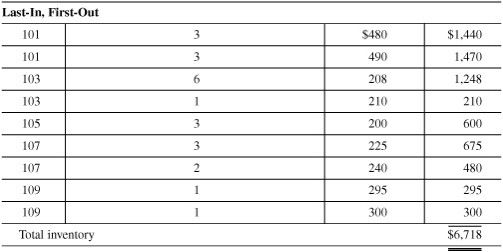

Costing Inventory: Last-In, First-Out (LIFO)

The last-in, first-out (LIFO) method of costing inventory assumes that the most recently purchased items are the first ones sold and the remaining inventory consists of the earliest items purchased. In other words, the goods are sold in the reverse order in which they are bought. Unlike FIFO, the LIFO method specifies that the cost of inventory on hand (ending inventory) is determined by working forward from the beginning inventory through purchases until sufficient units are obtained to cover the ending inventory. This is the opposite of the FIFO system.

Remember that FIFO assumes costs flow in the order in which they are incurred, while LIFO assumes that costs flow in the reverse order from that in which they are incurred.

EXAMPLE 4

Under LIFO, the inventory at the end of the period is considered to be merchandise purchased in the first part of the period. What is the cost of the 320 units on hand? (See Chart 1.)

Thus, ending inventory under the LIFO method would be valued at $2,430.

EXAMPLE 5

The cost of goods sold is determined (from Example 4) by subtracting the value of the ending inventory from the total value of the inventory available for sale ($6,100 − $2,430 = $3,670). This cost may also be computed as

A disadvantage of the LIFO method is that it does not represent the actual physical movement of goods in the business, as most businesses do not move out their most recent purchases. Yet firms favor this method because it does match the most recent costs against current revenue, thereby keeping earnings from being greatly distorted by any fluctuating increases or decreases in prices. Yet it sometimes allows too much maneuvering by managers to change net income. For example, if prices are rising rapidly and a company wishes to pay less taxes (lower net income) for that year, management can buy large amounts of inventory near the end of that period. These higher inventory costs, because of rising prices, under LIFO immediately become an expense (cost of goods sold), and thus result in the financial statement showing a lower net income. Conversely, if the firm is having a bad year, management may want to increase net income to garner favor with stockholders. This can be done by delaying any large purchase of high-cost inventory until the following period by keeping the purchase out of the Cost of Goods Sold section for the current year, and thus avoiding any decrease in net income.

In a rising price market, certain tax advantages are gained through LIFO because it yields a lower profit because of its higher cost of goods sold.

EXAMPLE 6

Use Chart 1.

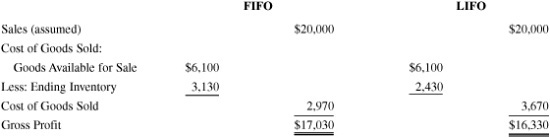

As Example 6 shows, LIFO produces (in a rising price market) (1) a lower ending inventory, (2) a higher cost of goods sold, and (3) a lower gross profit. FIFO will produce the opposite.

The IRS will permit companies to use LIFO for tax purposes only if they use LIFO for financial reporting purposes. Thus, if a business uses LIFO for tax purposes, it must also report inventory and income on the same valuation basis in its financial statements, but it is allowed to report an alternative inventory amount in the notes to the financial statements. This is permitted because it affords true financial analysis in comparing, on a similar basis, one business with another. It should be noted that a business cannot change its inventory valuation method any time it chooses. Once a method has been adopted, the business should use the same procedure from one period to the next. If management feels a need to change, permission must be granted by the IRS. The business must then follow specific authoritative guides that detail how the changes should be treated on financial statements.

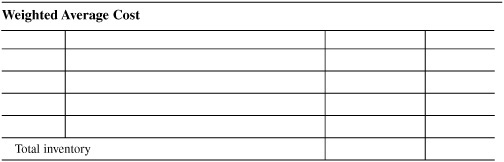

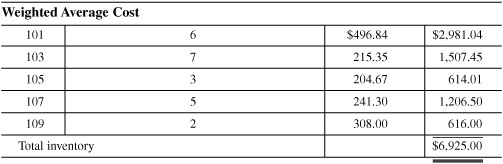

Costing Inventory: Average Cost Valuation

The average cost valuation system, also known as weighted average, is based on the average cost of inventory during the period and takes into consideration the quantity and the price of the inventory items by assigning the same amount of cost to identical items. In other words, it spreads the total dollar cost of the goods available for sale equally among all the units.

The ending inventory is determined by the following procedure:

1. The cost of the total number of units available for sale (beginning inventory plus purchases) is divided by the total units available for sale.

2. The number of units in the ending inventory is multiplied by this weighted average figure.

EXAMPLE 7

Referring to the data in Chart 1, the cost of the 320 units on hand would be calculated as follows:

1. $6,100 + 700 units = $8.71 unit cost.

2. $8.71 × 320 units on hand = $2,787* ending inventory.

EXAMPLE 8

The cost of goods sold is then calculated by subtracting the value of the ending inventory from the total value of the inventory available for sale ($6,100 − $2,787 = $3,313).

Because there were 700 units available for sale and 320 units on hand at the end of the period, the number of units sold was determined as 700 − 320 = 380 units. Therefore, another method of computation to determine the cost of goods sold would be $8.71 × 380 units (cost of goods sold) = $3,310.*

The average cost method is best used by firms that buy large amounts of goods that are similar in nature and stored in a common place. Grain, gasoline, and coal are good examples of products that could logically be costed under weighted average.

There are some limitations that should be noted in this valuation procedure. Unit cost cannot be related to any physical purchase and does not represent any price changes. In those industries that are greatly affected by price and style change, this method will not yield specific cost determination. Also, the time needed to assemble the data is greater under this method than for FIFO or LIFO, if there are many purchases of a variety of different items bought.

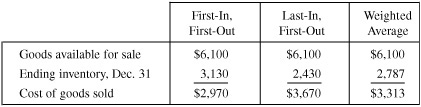

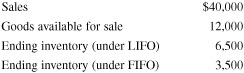

Comparison of Inventory Methods

The three methods of inventory valuation discussed are based on an assumption as to the flow of costs. The FIFO method is based on the assumption that costs flow in the order in which they were incurred; the LIFO method assumes that costs flow in the reverse order from that in which they were incurred; and weighted average assumes that costs should be assigned to the merchandise inventory based on an average cost per unit. Note that if the cost of all purchases remains the same, all three methods of inventory valuation will yield identical results. As you will realize, prices never stay constant, so each of these three methods will result in a different cost for ending inventory. Remember that the ending figure is subtracted from the cost of goods available for sale to arrive at the cost of goods sold (COGS). Therefore, the net income or loss will vary according to the inventory method chosen. Also, the ending inventory on the balance sheet will vary with each method.

In Example 9 below, we compare the results of the FIFO, LIFO, and weighted average methods, with regard to both ending inventory and cost of goods sold. Since the two amounts are related through the equation

Goods available for sale – Ending inventory – Cost of goods sold

it is seen that if ending inventory is overstated, cost of goods sold will be understated and net profit overstated. On the other hand, if inventory is understated, then cost of goods sold will be overstated and net profit understated. Clearly, the method chosen for inventory computation can have a marked effect on the profit of the firm. There is no one method that is best for all firms, but careful consideration of the following factors will be helpful in making the decision: (1) the effect on the income statement and balance sheet, (2) the effect on taxable income, (3) the effect on the selling price.

EXAMPLE 9

Based on Example 9, the following evaluation is considered:

FIFO

1. Yields the lowest cost of goods sold

2. Yields the highest gross profit

3. Yields the highest ending inventory

Note: During a period of inflation or rising prices, the use of FIFO will result in the yields shown above, but in a declining price economy the results will be reversed. The major criticism of this method is the tendency to maximize the effect of inflationary and deflationary trends on amounts reported as gross profit.

LIFO

1. Yields the highest cost of goods sold

2. Yields the lowest gross profit

3. Yields the lowest ending inventory

Because the costs of the most recently acquired units approximate the costs of their replacement, this method can be defended on the basis that its use more nearly matches current costs with current revenues. The major justification for LIFO is that it minimizes the effect of price trends on gross profit.

Weighted Average

1. Yields results between FIFO and LIFO for cost of goods sold

2. Yields results between FIFO and LIFO for gross profit

3. Yields results between FIFO and LIFO for ending inventory

This compromise method of inventory costing makes the effect of price trends (up or down) more stable, as all factors are averaged, both in the determination of gross profit and in determining inventory cost. For any given series of prices, the average cost will be the same, regardless of the direction or price trends.

Although a physical inventory is taken once a year, there are occasions when the value of the inventory must be known during the year. When interim financial statements are requested (monthly, quarterly, or semiannually), an inventory amount must be estimated. If no physical count is taken, the amount of inventory must be estimated. Also, in the event of fire or any other casualty, an amount must be reported as a loss. Two of the most popular methods of estimating inventory (when no physical count is used) are the gross profit method and the retail method.

Gross Profit Method

The gross profit method rearranges the Cost of Goods Sold section of the income statement. As stated previously, the cost of goods sold formula is

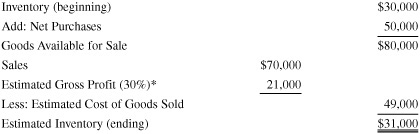

Note that when you subtract inventory (ending) from the goods available for sale, the cost of goods sold is determined. Conversely, if you subtract the estimated cost of goods sold from the goods available for sale, the value of the inventory (ending) will result. The estimated cost of goods sold figure is arrived at by using the past year’s gross profit percentage and subtracting the resulting amount from sales.

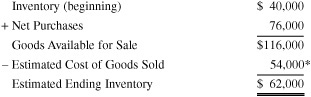

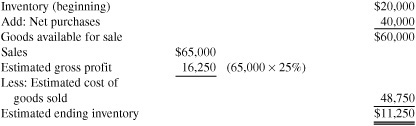

EXAMPLE 10

During the past 5 years, a company’s gross profit averaged 30 percent of sales. If the sales for this interim period are $70,000, the inventory at the beginning of the period is $30,000, and the net purchases are $50,000, you would estimate the inventory (ending) under the gross profit method as follows:

*($70,000 × 30%)

This method of estimating ending inventory is also useful for determining casualty losses such as fires, flood, or theft, when such a calamity destroys a company’s inventory. It is obvious that a dollar amount must be assigned to the inventory lost before any insurance claim can be made. Although this may appear to be an impossible task, it is possible to build up to the inventory figure. For example, the dollar amounts of all the sales, purchases, and beginning inventory can be obtained from the previous year’s financial statements. Also, information can be further provided by customers, suppliers, sellers, etc.

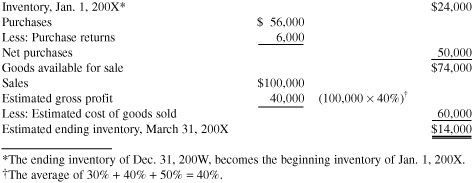

EXAMPLE 11

A fire occurred in a retail store, and most records were destroyed. If the average gross profit rate, based on the last 3 years of operations, is 40 percent, and the net sales (according to various sales records) were $90,000, determine the ending inventory by the gross profit method of estimation. Assume that outside verification has determined that the beginning inventory was $40,000, and all purchases (net) were $76,000.

Bear in mind that the gross profit method is not intended to replace the physical inventory count but is used to estimate the inventory cost when a physical counting is not deemed possible. This method is based on the assumption that over the years the rate of gross profit has been fairly stable in the past periods under examination and will remain so in the future. Without this stability, the calculations of inventory using the gross profit method will be inaccurate and not useful in any accounting procedure. Since this method is based solely on estimation, it is not acceptable for tax purposes unless no other physical inventory method is available.

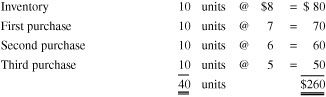

Retail Inventory Method

The retail inventory method of inventory costing is used by retail businesses, particularly department stores. Department stores usually determine gross profit monthly but take a physical inventory only on an annual basis. The retail inventory method permits a determination of inventory any time of the year and also produces a comparison of the estimated ending inventory with the physical inventory ending inventory, both at retail prices. This will help to identify any inventory shortages resulting from theft or other causes.

This method, similar to the gross profit method, is used to estimate the dollar cost of inventory (ending) when a physical count cannot be done. The procedure for determination under the retail inventory method is as follows:

1. Beginning inventory and purchases must be recorded both at cost and at selling price.

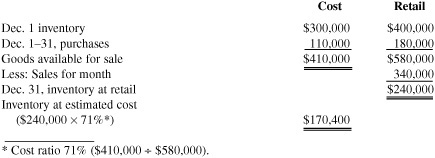

2. Total goods available for sale is then computed on both bases, cost and selling price.

3. Sales for the period are deducted from the goods available for sale at the selling price.

4. Ending inventory at the selling price is the result of step 3. This amount is then converted to ending inventory at cost by multiplying by the appropriate markup ratio.

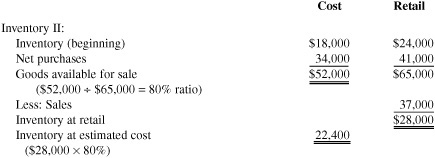

EXAMPLE 12

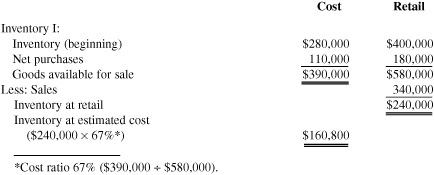

In Example 12, the cost percentage is 67 percent, which means that the inventory and purchases are marked up on an average of 33 percent (100 percent – 67 percent).

Certainly not all items in the goods available for sale are marked up exactly 33 percent. (There are those marked higher and those lower than 33 percent.) In other words, the retail method uses a percentage that represents an average of markup cost. Suppose that a retailer had different categories of inventory, each with different cost ratios. How would the firm use the retail method to estimate the total cost of all the inventory on hand at any time of the year? The retailer would simply apply the retail inventory method to each category separately, using its own specific cost ratio, then add the costs of the three categories to determine an estimate of the overall cost of inventory.

Summary

The major difference between the gross profit method and the retail inventory method is that the former uses the historical gross profit rates, and the latter uses the percentage markup (cost-to-selling-price ratio from the current period). In other words, the gross profit method uses past experience as a basis, while the retail inventory method uses current experience.

The gross profit method is usually less reliable, because past situations may be different than current ones. Remember that both methods are useful, because they allow the accountant to prepare financial statements more frequently without the cost of time spent on a physical count (perpetual method) each time or by the requirement to maintain perpetual inventory records. When goods are very expensive, the perpetual method of counting each time a sale is made or goods are bought is used. However, the physical method does require an annual physical count, as it will disclose any loss due to theft or other shrinkage conditions and will serve as the basis for an adjustment to all inventory records and the Inventory account.

1. When inventory is physically counted at the end of an accounting period, we have the __________ method.

2. The inventory method used when units are generally of high value is the __________ method.

3. The __________ inventory method is most commonly used in retail establishments.

4. A method of inventory valuation based on the concept that the goods are sold in the order in which received is known as __________.

5. The valuation of inventory based on the concept that the most recent costs incurred should be charged against revenue is known as __________.

6. In a rising market, net income under __________ would be smaller, thus producing a smaller tax.

7. The inventory method based on the concept that the unit cost of merchandise sold is the average of all expenditures for inventory is known as __________.

8. The gross profit method is not intended to replace the __________ inventory.

9. The gross profit method is based solely on __________.

10. When determining ending inventory under the retail method, the ratio of cost to __________ must be used.

11. Of the two methods of estimation, the __________ is less reliable as an indicator of the inventory.

12. It can be said that the gross profit method uses __________ experience as a basis, while the retail method uses __________ experience.

Answers:

1. periodic;

2. perpetual;

3. periodic;

4. first-in, first-out (FIFO);

5. last-in, first-out (LIFO);

6. LIFO;

7. weighted average;

8. physical;

9. estimation;

10. selling price;

11. gross profit method;

12. past, current

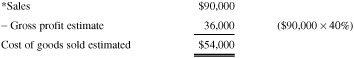

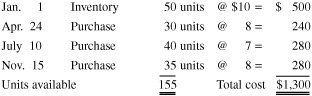

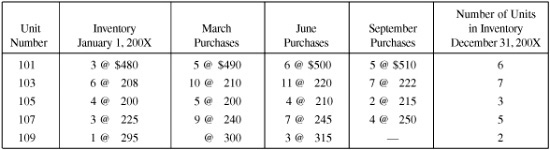

11. 1 The inventory information of a product is given below:

After taking a physical count, we find that we have 14 units on hand. Determine the ending inventory cost by the FIFO method.

SOLUTION

Remember that values are assigned to the inventory based on the latest cost (the most recent purchases).

11. 2 Assign a value to the ending inventory under FIFO using the following cost data:

An inventory count at the end of the period reveals that 450 units are still on hand.

SOLUTION

11. 3 Based on the information in Problem 11. 2, determine the cost of goods sold for the period.

SOLUTION

There are two methods to determine the cost of those goods sold.

Since there were a total of 800 units available and 450 were on hand at the end of the period, 350 units were sold (800 − 450 = 350).

11. 4 Product information for item #204 is as follows:

By a physical count, it is estimated that 95 units are left in the ending inventory. (a) What is the value of the ending inventory under FIFO valuation? (b) Determine the cost of goods sold.

SOLUTION

*A total of 95 units are on hand. Since we have 75 units (35 + 40) from the two most recent purchases, only 20 of 30 units of the April 24 purchase are needed.

(b)

Alternative method:

Note that since there were 155 units available and 95 units were on hand, 60 units (155 – 95) were used to determine the cost of goods sold.

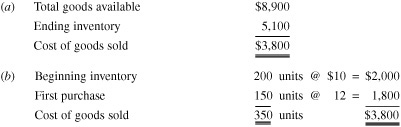

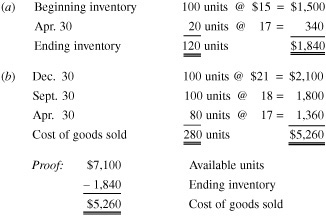

11. 5 Based on the following information, determine under LIFO valuation (a) ending inventory of 120 units and (b) its cost of goods sold.

SOLUTION

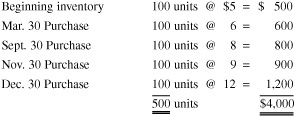

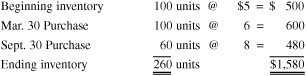

11. 6 Based on the following information in a rising price market, determine (a) ending inventory of 260 units under LIFO and (b) the cost of goods sold.

SOLUTION

(a)

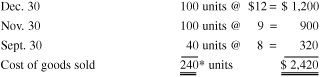

(b) The ending inventory is $1,580 and the cost of goods sold is ($4,000 – $1,580 = $2,420), computed as

*Since there were 500 units in the total inventory, and 260 remained, 240 units had been sold.

11. 7 If, in Problem 11. 6, management had decided to delay the December 30 purchase until the following year (in order to show a higher profit based on a lower cost), what would be the cost of goods sold without the last December purchase?

SOLUTION

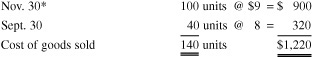

Four hundred units (the December purchase of 100 units is eliminated) were available to be sold and 260 units remained on hand. Thus the 140 units sold will be costed as follows:

*No December purchase is considered.

Therefore, management now has a cost of $1,220 rather than $2,420 (Problem 11. 6), thus meeting its objective of higher profits. This lower cost will then yield a higher profit, yet it keeps the ending inventory at the same figure.

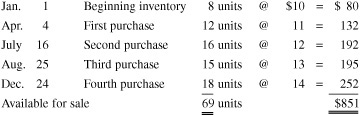

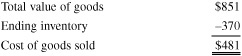

11. 8 The beginning inventory and various purchases of product Y were as follows:

An inventory count disclosed that 30 units of product Y were on hand. (a) Determine the ending inventory under the weighted average method. (b) Determine the cost of goods sold.

SOLUTION

*Rounded to the nearest dollar.

(b) Since 69 units were available for sale and 30 of those units were on hand, 69 − 30 = 39 units were sold. To determine the total cost of goods sold, multiply the units sold by the average cost of each unit. Therefore:

39 units × 12.33 per unit = $481

Alternative method:

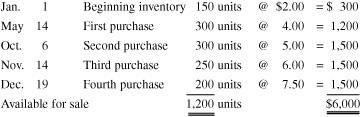

11.9 In an inflationary market, Essex Corp. bought the following items:

If 225 units are left on hand, determine (a) the ending inventory in this inflationary period under the average cost method and (b) the cost of goods sold.

SOLUTION

(a) $6,000 + 1,200 units = $5 per unit 225 units on hand × $5 per unit = $1,125 ending inventory

(b) 1,200 units – 225 units on hand = 975 units sold 975 × $5 per unit = $4,875 cost of goods sold

To prove that both items (a) and (b) are correct:

11.10 In a deflationary market, the Elizabeth Corp. bought the following items:

If 225 units are left on hand, determine (a) the ending inventory in this deflationary period under the average cost method and (b) the cost of goods sold.

SOLUTION

(a) $6,000 ÷ 1,200 units = $5 per unit 225 units on hand × $5 per unit = $1,125 ending inventory

(b) 1,200 units – 225 units on hand = 975 units sold 975 units × $5 per unit = $4,875 cost of goods sold

Proof: $1,125 + $4,875 = $6,000 Goods available for sale

Note that in both this problem and Problem 11.9, the ending inventory value is the same regardless of inflation (rising prices) or deflation (falling prices). This happens because we are averaging the entire accounting period. In the next problem, different values do occur, because the inventory is valued under FIFO and LIFO as well as average cost.

11.11 From the following information, determine the cost of inventory by first-in, first-out (FIFO), by last-in, first-out (LIFO), and by the weighted average cost method.

SOLUTION

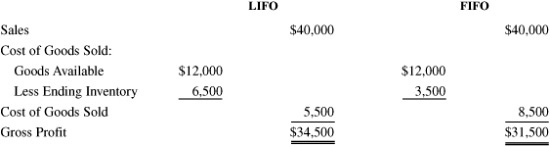

11.12 Determine the gross profit under the (a) LIFO and (b) FIFO assumptions, given the following information:

SOLUTION

Since FIFO had a lower ending inventory, its corresponding profit was lower. Also, as a proof, FIFO had a higher cost of goods sold, therefore yielding a lower gross profit.

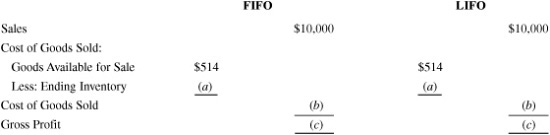

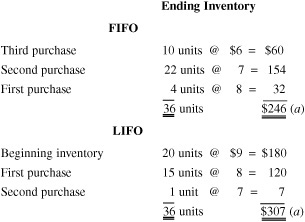

11.13 Based on the following inventory information and other pertinent data, determine

(a) Ending inventory—36 units

(b) Cost of goods sold

(c) Gross profit

SOLUTION

In order to determine the gross profit, we must first determine the ending inventory and cost of goods sold under both the FIFO and LIFO methods.

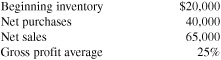

11.14 Based on data below, determine the inventory that was destroyed by fire under the gross profit method.

SOLUTION

11.15 A flood destroyed most records and inventory of the Noah Company in March 200X. After investigating outside records of various sources, the following information was obtained:

Determine the amount of the inventory loss to be claimed during 200X under the gross profit method.

SOLUTION

11.16 Determine by the retail method the estimated cost of the December 31 inventory.

SOLUTION

11.17 Determine by the retail method the estimated cost of the ending inventory on December 31.

SOLUTION

11.18 A fire destroyed the inventory of a boating store. Based on past records, it was determined that the gross profit rate averaged 45 percent, the net sales $160,000, ending inventory of the previous year $50,000, and net purchases during the year $70,000. What is the amount the boating company can claim on its damaged inventory on hand?

SOLUTION

11.19 Determine the total estimated inventory destroyed by fire under the retail inventory method for two different inventories of the Happy Department Store.

SOLUTION

11.20 Determine the ending inventory under the retail inventory method using the following merchandising data for two specific inventories:

SOLUTION

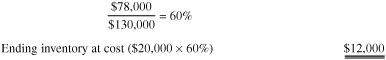

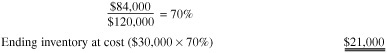

Ratio of cost to retail price

Ratio of cost to retail price

Then add: