In Chapter One, we explored two stories that examined the horrors of not following sound property management principles. You’re probably wondering, what are those “principles?” That’s what we’ll discuss in this chapter. There are many lessons to learn from the two stories.

These are common threads that run through both stories:

• Both owners lived in an area other than where their rental property was, yet chose to manage the property themselves instead of enlisting the help of someone who had knowledge of the market and could keep a constant watch on the investment.

• Both owners had poorly-formed systems in place in which to manage their property effectively.

Out of State, Out of Mind

It is almost never a good idea to manage a property yourself if you do not live in the area. In any given market there are a multitude of details that you couldn’t possibly know unless you specialize in that market. These issues could be legal, submarket-related, local relationships, weather patterns, and more. It is always preferable to hire someone who is local, and who knows the lay of the land intimately.

I own a property in Oklahoma. My company specializes in property management, managing over 8,000 units. Do you think that I use my company to manage these properties? Not on your life. We are based in Scottsdale, Arizona. The time and effort required to set up successful operations in Oklahoma would be a huge waste of energy and money.

Here’s what I did instead. I developed a team.

In my previous book, The ABCs of Real Estate Investing, I talk about the necessity of building a team. In real estate there is nothing more important than building a team. I used mine through the entire process of acquiring my Oklahoma City building. I enlisted a local broker to find the property and provide detailed market data. I used my attorney to draft and review legal documents like the purchase and sale agreement. I used the due diligence team from my company to explore every square inch of the property before we bought it. If you think you can do real estate by yourself, you are sorely mistaken. Experts will always see details in a minute that you or I would totally miss.

In the case of my Oklahoma property, I decided to hire a property management company to manage the property for me. Why? While I did my homework in purchasing it and have a pretty good idea of the market now, that data might be no good in a couple of months. Markets are constantly changing.

Not only is the market of Oklahoma City constantly changing, but the property’s location is a submarket within the market, and that submarket is constantly changing. In the southern part of the city there might be concessions because of low occupancy, but in the north, occupancy might be high and there would be no specials. Could you imagine if I just Googled rentals in Oklahoma City from my computer in Arizona and saw that there were specials in the market and decided to apply them to my property in the north submarket where there were no specials? I might as well just stand out on the street and hand out money.

When you live 2,000 miles away it is impossible to keep up on all the minute and shifting details in a market. That’s a headache I don’t want. Look at both the properties from Chapter One. In those cases, rents were well below the market because the owners lived too far away to have a clear picture of where the market was moving. Because of this they lost valuable income-producing opportunities.

When we took over the property mentioned in Chapter One located in Arizona it became clear right away that we needed to raise rents on the three-bedrooms. They were $45 under market, and there were 50 three-bedroom units on the property. That’s $2,250 per month in lost income, and $27,000 a year! Additionally, we found that in the property’s submarket it was common practice to charge more for ground floor units. We increased the rents by $25 on those. On 100 units that equals $2,500 per month in lost income, and $30,000 a year! After we instituted these increases, the Arizona property was collecting on additional rents at $57,000 per year.

To figure the value of a property based on its net operating income—that is the income after operating expenses—we use something called a capitalization rate. It’s really not as complicated as it sounds. Here’s the equation:

Net Operating Income / Capitalization Rate = Property Value

More often than not you can get average capitalization rates for an area from a local broker. Let’s apply this concept to the lost revenue in the case of the 200-unit property and find out how much a little mistake can add up to a major loss.

Let’s say the average capitalization rate in the Phoenix submarket is 6 percent, and let’s take that capitalization rate and apply it to the lost revenue of $57,000 from not raising rents to market.

$57,000 (lost NOI) - 6% (capitalization rate) = $950,000 (lost property value)

Just think, if the owners had decided to sell their property instead of hire us to manage it, they could have lost out on almost a million dollars based on their “little mistake” of not keeping up with the market rents. If that won’t put the fear of the property management gods in you, I don’t know what will.

The last thing I want is to miss opportunities for profit on my Oklahoma City property. That is why we hired a local expert on the apartment market to manage our valuable investment. There is no way I’d presume to think that I could manage it effectively from my office in Scottsdale.

Nuts and Bolts

In my introduction I said that property management is a down-and-dirty business. It’s true. Real estate investments are not neat and clean like stocks or bonds. They are not paper that just gets moved from one account to another. They require you or someone you hire to roll up your sleeves and get your hands dirty. What do you think property management involves?

Here’s an interesting exercise. Take a moment before you continue reading this book and get a paper and a pen. I want you to write out a list of everything you think is involved in managing a property. We’ll call this the nuts and bolts—the things that are required to make a property run smoothly and efficiently. Make it as detailed as possible. Then, add the time you think it will take to do all the things on the list and how frequently you think you will have to do them.

Now, I’ll show you my list. When you are done reading this section pull out your list and compare it to mine. Most likely there will be some significant differences between your list and mine. But then again, maybe there won’t be. In which case, you probably can put this book down. Thanks for buying it, but sorry, no refunds. For a majority of investors, however, there is a gross misconception of the time, effort, and work that is involved in managing a property.

Residents

It has been my experience that the number one fear of any investor is dealing with residents. This fear is understandable. Numbers are easy, people aren’t. Chances are you are a nice person. You don’t like to be confrontational. Most people aren’t. Your first impulse will be to give that person an extra week to pay the rent or not charge them for painting after they have moved out. This stems from fear. It is easier to just let it fly, rather than confront the situation. Well, I’ve news for you. In order to be an effective property manager you have to confront issues head-on and with confidence. Some residents are like sharks—they can smell blood in the water. If you are not sure of your position, they will eat you alive.

You are an unwelcome presence in the life of most residents if you are a property manager. Think about it. All of us probably rented at one time or another. What were your thoughts when the manager knocked on the door? “Oh, they must be coming by for a friendly chat. Maybe I should put a pot of coffee on!” Hardly.

Let’s not kid ourselves. Residents know the less they see their property manager, the better, because the truth is we are generally the harbingers of bad news. When we come by it is to address a complaint, or collect late rent. It is not for a chat—though a cup of coffee would be nice every once in a while.

If you are not willing or able to really assert yourself, and most people aren’t, your property is really in for it. Remember the story of my in-laws’ house? All of their problems stemmed from the fact that they were afraid of confrontation. In retrospect, here is what my father-in-law had to say about the situation:

“One thing, in hindsight, and it’s real apparent, if you sense that there is a problem, and you start getting bounced checks and things, you need to move on it. Pronto. And nip it in the bud, and if that includes evicting them, then so be it.”

That’s good advice from someone who learned it at the school of hard knocks. But here’s what his wife had to say to her husband about that: “I think that takes a different kind of person than you are.”

Ouch. In considering whether to manage your own property, you have to be honest with yourself. If you are not the kind of person that can evict a family from your property, then you are not the kind of person that should be managing it. Even more, through the course of time some residents may actually become your friends. Can you evict someone that you had beers with two weeks ago? Thankfully my father-in-law eventually wised up and hired a property manager.

The biggest part of property management is interacting with residents. Everything else stems from that. Just some of the many things that you’ll have to do involving residents are:

• Find them

• Collect rent/fees

• Be a sounding board for them

• Address their maintenance issues

• Enforce policies and contracts

If you own a building that has more than one rental unit, you will have to deal with resident-to-resident issues as well. Inevitably residents will have disputes with each other. Will they handle these issues themselves? Sometimes they will, but often they bring these issues to you. Very rarely will you be able to make both sides happy, so know that you will always have someone that thinks you’re a jerk. That’s the way it is.

When I was younger and still managing properties on-site, I had a memorable experience with resident-to-resident issues. The incident involved neighbors. A single guy was sleeping with the neighbor’s wife while the husband was out working. It turned out that the single neighbor had a venereal disease and had passed it on to the wife. Even worse, the wife had then passed it on to the husband.

“That’s their problem,” you’re probably thinking. Well, they didn’t think so. The husband demanded that I evict the single neighbor. What would you have done? Can you imagine the range of emotions that each party brought to the table? As I’m sure you know, I couldn’t do anything. No one had broken any contractual obligation or rule. You can’t evict people for being stupid. Needless to say, the husband was not satisfied with this answer.

Maintenance

I have seen situations where the lack of maintenance is unbelievably appalling. A client of mine purchased a building in a foreclosure, and we were doing an initial walk of the property, inspecting each unit, before taking over management. During this inspection, I walked into a unit where a fifty-year-old woman was living. She had lived there for many years. There were stacks of newspapers from floor to ceiling, and food and trash were lying out in the open covering every square inch of the floor. As if that wasn’t enough, there were roaches. And not just a couple. There were so many roaches that it appeared as if the walls were moving. I’m not exaggerating. Thousands of roaches had infested the entire unit and this little old lady was living in the midst of this filth and decay.

Not only that, but when we examined the kitchen we found out that her fridge wasn’t working. She clearly had no sanitary place to store food and that explained some of the smell. On examination of the cupboards we found a bird living in them. The bird had actually pecked away at the side of the building and had burrowed its way into the cupboards from the outside. Who knows how long it had been there.

Clearly, this is on the extreme side of deferred maintenance. But it’s important to note the problem with a resident like this is that they affect the rest of your residents too. Roaches don’t stay in one apartment. If you want to get rid of roaches, you have to spray that unit, and all the units adjacent to it. From an owner’s perspective that is a lot of extra cost.

It is imperative that you have sound systems in place for maintaining your property. Maintenance is the single most time-consuming and expensive aspect of owning an investment property. It is often the reason that residents move out of your property as well. If they are not happy with the level of service provided by you, then they will move on down the street.

Think about it. What if you were living in a community and you wanted to throw a dinner party? Only one problem: the toilet is out in your unit. You submit a work order a week in advance. You then get to living your life. You plan the menu, clean the house, do the grocery shopping, and so on. On top of this you are, of course, still working, and trying to get some leisure time in.

About a half a week rolls around and the toilet isn’t fixed. So you call the manager or owner. “Oh, sorry,” they tell you. “We’ve been really busy. But we’ll send someone over today.” But nobody comes over.

You call again the next day. Now you’re starting to get irritated. They promise to have it fixed, and you tell them it’s important because you are having guests over that weekend. They promise that they will have it fixed by then. Meanwhile, the toilet is sitting stagnant, and it’s starting to smell pretty bad.

Finally, you have your party and nobody has come to fix your toilet. You’d be understandably upset, right? Given a common scenario like this, how inclined would you be to renew your lease when the time comes around? One bad experience is usually enough for most residents to at the very least start shopping your competitors, and more than likely to move.

In the case of the stinky toilet, the property management’s inability to implement efficient maintenance systems would cost them dearly when you moved. They would have to turn the unit, experience lost rent income, and pay to advertise for a new resident. All of which is much more expensive than to call in the plumber or send the maintenance technician.

Deferred maintenance can also severely affect the value of your property. Think about my in-laws’ house. That too was an example of deferred maintenance. They should never have been in the position that they were in when the problem renter moved out. They should never have relied on a resident to “take care” of their investment.

Do you remember how much they had to spend just to get their property back into a livable condition? $55,000 in repair costs. That doesn’t even include the value of their lost time. The deferred maintenance on their house had severely devalued the property to the point where they couldn’t even sell it if they wanted to. And they tried. Once they had assessed the amount of damage and the work it would take to fix it, my in-laws attempted to sell the house “as-is” at a significant discount. Two different potential buyers ended up walking from the deal because the amount of work that would have been involved far outweighed any potential savings to be gained. My in-laws were stuck and had no choice but to complete the work themselves.

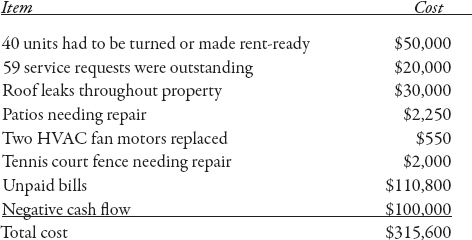

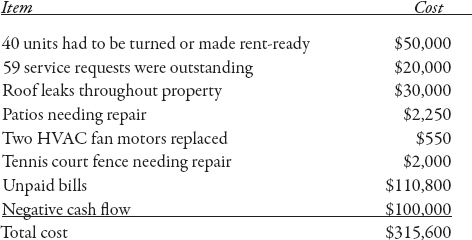

Deferred maintenance was also a huge issue when we took over the 200-unit property. So much so that we fired the entire maintenance staff. Let’s review the letter I drafted to the owners. The issues were:

These costs would not be directly translated into a reduction of the same amount in the purchase price of the property if the owners had chosen to sell. The cost would have been much more. The buyer would have been looking at not just hard costs, but lost revenue from units being down for a month or more already estimated nearly $1 million in value just on the three-bedrooms and ground-floor units! All of this would have been taken into consideration, and a buyer would have a lot of bargaining power with the owner to drive down the purchase price.

Given all this, doesn’t it seem absolutely essential to have tight maintenance systems? You have to be diligent to forge relationships with plumbers, electricians, HVAC technicians, and others. Would you be confident that if you needed a plumber to go out to your property at nine in the evening, you would know exactly who to call?

Similarly you need to have a way to log all the work orders that your residents call in. Are your files a mess, or are they immaculate? Can you verify and keep track of the time you’ve spent on each unit? The cost?

Something else to consider is that established property management companies have relationships with maintenance vendors and can contract work at a much lower rate than the general public. Even more, they have the ability to be bumped to the top of the list when it comes to responding to emergencies. We call this economy of scale. If you owned a plumbing company, who would you be more motivated to service, and service at a discount, an account that represents over 1,000 apartments, or someone who owns one rental house?

Maintenance is also what people bring up as the most distasteful part of property management when I talk to them. I haven’t met too many people who proclaim the joys of toilet cleaning. Do you? Taking care of your residents’ maintenance issues will draw you out of your home at all hours, and take up a significant portion of your time. Whether you like it or not, your residents look to you to be timely and accommodating to their schedules, not your schedule, when it comes to fixing their homes. They are in fact paying for this service. Your properties’ success will depend heavily upon how well you understand this concept.

![]()

Rich Dad Tip

![]()

In property management, your resident’s schedule will be your schedule.

Vacancy, Turnover, and Leasing

Vacancy, turnover, and leasing, much like maintenance, are continual time-and money-eaters. In fact, I would venture to say that money and time lost from vacancy will be the biggest stress point of managing your property. If it takes you two weeks to get a place rent-ready you have lost two weeks of potential income. As a property manager it is essential to have systems in place for turning a rental quickly and efficiently.

First off, you have to be able to assess the condition of the unit upon the move-out of the resident. It would be wise to have a form to fill out. I do this in my company. We use an NCR inspection form so that we have multiple copies of the condition report. You can go onto my Web site, KenMcElroy.com, and see an example. We fill out this form when the resident moves into their unit and have them sign it, and we do the same when they move out. I cannot stress enough the importance of documentation.

If you just wing inspections the chances that you will miss something (possibly something very costly) are great. Beyond that, if you have a dispute with a previous resident over damage to your property and haven’t documented the history of the unit, you’re not going to have a leg to stand on legally. One thing that we do is take pictures at move-in and at move-out. Photo documentation is a very powerful tool in protecting yourself—it’s very hard for a resident to argue they aren’t responsible for damages when you can produce photographic evidence. But they still will!

Once you have assessed the condition of the unit at move-out, you have to do two things:

1. You have to determine how much, if any, of the resident’s security deposit you are going to refund.

2. You have to line up the work that is needed on the unit.

Maybe the unit needs to be painted and the carpets need to be cleaned. Are you going to do this by yourself or hire outside help? Either one will take time and money. How much exactly we will examine in a future chapter. Just know that it’s not a little, it’s a lot. Also, keep in mind that during this entire time, you are losing money due to lost rent because the unit is vacant.

This is especially true if you had a family occupying your property. I know firsthand how true this can be. I remember the two years when my family and I were living in a townhouse while we were building our dream house. Our plan was to rent the unit after we moved into our new home.

We have two sons. At the time, one was nine and the other was six, and both were full of life. That is a nice way of saying they were pretty much out of control the majority of the time! If it wasn’t baseballs flying into Sheetrock, it was boys slamming into walls while wrestling. Kids will cause all kinds of damage. They will create beautiful artistic masterpieces with crayons on your walls. Posters will be pinned into walls, and staples will hold up arts-and-crafts projects.

If you have kids, especially boys, you know exactly what I’m talking about. After a while, all the roughhousing, coming in from the outside muddied up, accidents, and general mayhem add up to quite a bit of damage. When we moved out, the entire townhouse required patchwork. The walls needed to be repainted. (There’s nothing like greasy handprints to add to the ambience.) The carpets in my sons’ rooms needed to be replaced, and the whole house needed a thorough cleaning. All this “little stuff” added up to a lot of money. All said and done I was $4,000 out of pocket.

The cost to turn a property is tangible. You can see how much you are spending. You can feel the pain in your pocketbook as you write more checks. Often overlooked, however, is the cost that comes from lost income while the unit is vacant. Take my townhouse for example. All the work that needed to be done took a month. Then finding a resident took another month. The market rent for that type of townhouse is roughly $1,500 per month. That’s $50 a day in lost revenue!

I hired out all the work on my property, and it still took that long. Those two months of vacancy cost me $3,000 that could have easily snuck up and bitten me like a snake if I hadn’t been prepared. Can you imagine if I had been trying to get it rent-ready by myself, on top of work and all my other responsibilities? It might have taken me three or four months, and all the while I would be losing $50 a day.

Obviously you can see how important it is to make the process of turning a vacant unit as expedited as possible. There is an old saying that goes: “Sales solve all problems.” The same holds true for leases. The quicker you can get into your vacant unit, document what needs to be done, take care of any legal issues, complete the turn work, and re-rent the unit, the better.

This is where professional property managers have a huge advantage over owners who manage their own properties. When it comes to leasing, professional property managers have established client bases, deep advertising connections, and a network of other professionals who frequently refer potential residents to them. You will never have better buying power than a large property management company.

That is not to say you cannot be successful at leasing your property if you manage it yourself. It will just inevitably be harder and more expensive. If you are managing your own property, there are definitely some practices that you should adopt from the pros.

Always do a thorough background check. I can’t stress this enough. If you don’t use a standard rental application, you can review one on my Web site, KenMcElroy.com. You need to have one that requires Social Security numbers, work history, and rental history. It’s worth the time to subscribe to credit check companies that run credit and criminal checks on your applicants so that you know exactly what you are getting into. Don’t just meet with someone and go with your gut feeling as my in-laws did. If you do, the only feeling you’ll have in your gut is hunger because of all the money you’ll have to shell out. The best part of credit check services is that you charge the potential resident to run their own credit report! Something we call a pass-through. In the end, there is absolutely no expense to you. You have everything to gain and nothing to lose.

This was the first mistake that my in-laws made when renting to Ross. When I asked them what background checks they did, their response was, “We didn’t check everything. But we ran a few checks to satisfy ourselves that they were fairly stable.” When I pressed for details, it became clear that they had only talked to some of the references that Ross had listed on his application.

Often, sex offenders and potential residents with criminal backgrounds will be the nicest people you have ever met. This is because they have a past and want to gain your trust. Most avoid professional management companies because they will run background checks. Once these residents are moved into a community, they are the hardest to get out because they know how hard it will be to get another apartment. Their behavior can often drive out other residents, and they will ignore your legal notices. Often, you will have to forcibly remove them.

In the case of my in-laws, their neighbors actually brought a lawsuit against them because the property was in such disrepair that they were concerned it was devaluing their property. Letting bad-profile residents into your building will affect the value of your property in a negative way and will be an expensive problem to fix, not to mention the lost time and emotional distress you’ll experience.

Unfortunately, people lie. That is the brutal truth. Thus it is always in your best interest to have every detail of an application investigated by a professional organization. It’s been my belief that most potential residents with shady backgrounds will be so put off by background checks that they will take an application, leave the office, and you will never hear from them again. Just implying that you will be running a background check will deter 90 percent of the applicants who have a less than stellar background.

Laws—Federal, State, and Local

The most important, and often most overlooked, aspects of managing a property are the legalities involved in dealing with both your potential residents and those that already reside in your property. Like a snake in the grass, legal issues can come up and bite you before you even see them coming.

I’ve been managing properties for over 25 years, yet I never presume to know every law and rule. I work with professional attorneys who have been essential to my success. I defer to their expertise. My company and other larger companies have accounts with real estate attorneys so that if any legal issue should arise, they are ready and waiting to handle our problems efficiently and effectively.

Two attorneys I use frequently in my business are Denny Dobbins and Scott Clark. I’ve had a relationship with both their firms for many years. So it was only natural that when I was getting ready to write this section, I once again deferred to their expertise. I owe both men a debt of gratitude for their help and support in writing this section. If you own property in Arizona, I highly recommend either one for your legal needs.

A lot of investors don’t think that they will ever really have need of an attorney or that they will face any legal issues regarding their property. Don’t be fooled into believing this. If you own rental property the chance that you will run into legal challenges is very high. It may be something as simple as eviction of a resident or it might be something more serious like a lawsuit brought against you by a resident. Denny and Scott handle a combined 1,500 to 2,000 legal issues regarding property management every month! That is over 24,000 a year, and that is only two law offices. Though only a handful of these ever make it to trial, the majority of the cases that do go to trial involve small properties and owner-managers. Once a case goes to court you’re going to have to start writing a lot of checks.

In talking with both Denny and Scott it quickly became clear that there were distinct differences between the types of interactions they have with professional property management companies and with owner-managed properties. For both firms, dealing with professional companies is a much more streamlined process because they do not see the, for lack of a better term, amateurish mistakes that owner-managers make. As Denny Dobbins put it, “For large companies, legal issues are ready, aim, fire. For mom-and-pops, it’s ready, fire, aim.”

Right away let me make clear that the fact that owner-managers represent a majority of the complicated and avoidable legal cases in no way means that owner-managers are stupid or somehow deficient. Rather, it brings home the fact that the laws and ordinances in any given area are complicated and nuanced. The average person simply doesn’t have the capability to keep up with changing laws or to effectively interpret them. And when it comes to the legalities of property management, ignorance can be costly.

By way of example, ask yourself this: Do you know your state’s Landlord Resident Act? Would you even know where to find it?

Even seemingly simple procedures can become major issues if you handle them wrong. For instance, if you need to evict a resident, how many days’ notice do you legally have to give in your state? How does that notice have to be delivered? What are valid reasons for evicting someone? If you don’t know the answers to these questions you could be in serious trouble. An eviction that is handled incorrectly can cost you a lot of time and money—and in the end you might not even be able to evict the resident, even if the reasons were valid. For both Scott and Denny, a majority of cases that go to trial arise because of someone’s ignorance or misinterpretation of the landlord laws.

A story that Scott Clark shared with me is an excellent example of how easy it is to misinterpret landlord laws. One of his clients had a resident that lived on the second floor of a building and played his drums loudly at all hours of the night. Naturally, the other residents were frustrated by the noise and they logged innumerable complaints with the owner. The owner sent written notice to the man asking him to keep his drumming to a minimum and within certain hours.

Time went by, and the resident ignored the notice and continued to play his drums at all hours. Under pressure from other residents, the owner did what any of us would have probably done and sent the resident a notice of intent to evict. Seems fair and logical doesn’t it?

Any one of us would want to get this guy out of our building, right? Well, it turns out the resident used to be a physician and had been brutally beaten outside a bar one night on his way home from the hospital. The assault had almost killed him. His face was horribly disfigured and he had lost nearly all his hearing. One of the only things he could hear anymore was his drums, and they had been configured and given to him as therapy.

The resident fought the eviction and the case went to trial. The jury ruled in his favor, saying that the owner had not properly tried to accommodate his disability. Under the law, the owner was under an obligation to do everything in his power to help the resident, and it was the judgment of the jury that he hadn’t done that. In the end, the resident was able to stay in the apartment and the owner not only had to accommodate the disability, but was also stuck with hefty legal fees.

This is just one example of how not knowing information can create a legal nightmare for you and your property. If you are planning on managing your own property, it is imperative that you find a good lawyer for your team and actively take part in educating you and your staff, should you have one, on the laws of your state and locality. That being said there are some simple and practical things you can immediately do as an owner to protect yourself and your investment.

A SOLID LEASE

A well-drafted lease is essential for your protection. A majority of people have leases that are simply too short. I’ve even heard of someone that used to have new residents sign a lease on the hood of his car. It was basically a piece of paper with the rent and expiration date.

Remember, if it’s not in the lease, it doesn’t exist. For instance, if you don’t have a clause in the lease that says your resident isn’t allowed to have pets, you can’t go back and tell them to get rid of their dog. The lease has to specify that before they move in.

Denny Dobbins has a lease for his properties that is twenty-two pages long. He has been perfecting it for over twenty years. My company has a lease that is similar. A lot of people are nervous to have a lease that is so long because they are afraid the resident will be intimidated by the length. Here is a secret: they won’t read it whether it’s two pages or twenty. The purpose of the lease is to clearly explain the expectations and the consequences of action for the resident and you.

Both Scott and Denny agree that a majority of cases that are lost in court are due to the fact that the lease didn’t specify whether the issue in question was allowable or not. Now, you can’t possibly cover every possible scenario in a lease—but you can try. Nothing is more empowering than asking a resident to read their lease (which both you and the resident should have signed and dated) when it comes to a dispute. You’ll thank yourself for your foresight.

If you don’t have a solid lease for your properties, you are heading for trouble. I encourage you to contact a local attorney and work with him or her to draft an acceptable document. It’s important to realize that laws are different in various states and localities. You need a lawyer that specializes and works in real estate law in your area. They will be an expert on the local laws and can make sure you meet the needs of your property in the area that it is in.

When it comes to interacting with your residents, clear and precise communication is the key. On my properties we keep resident communication logs. No matter the nature, we write down the details of a conversation with a resident and have them sign the log, agreeing that the details accurately reflect the conversation. This will save you a lot of grief down the road.

Here’s a great example of how effective communication logs can be. One of my properties has garages that can be rented for $100 per month. Our policy is that you can add a garage to your lease even after you have moved in, but you cannot remove it until your lease expires. Recently a resident who had added a garage to his lease wanted to have it removed because he wasn’t using it anymore. At first, he made a big stink and was yelling at the manager. But the manager was able to calmly pull the resident’s file and show him the communication log with his signature that clearly stated he was informed when he rented the garage that he couldn’t take it off the lease. Time and time again, documentation saves the day and defuses a potentially explosive situation.

In addition to a resident communication log, you will need to have any number of state-specific legal notices on hand. These would include things like eviction notices and notices of breach of lease and policies. The laws regarding legal notices vary from state to state so you need to be sure that you get the property forms from your attorney. Handing a resident the wrong form for an eviction notice can negate the entire process and cost you more money and time.

Don’t try to write your own notices. A colleague of mine relayed a funny story involving a manager who did just that. The manager had set up a monthly pest spray service, commonly referred to in the industry as a “bug bomb.” You know what’s coming next, right? Knowing that they had to give residents notice of entry, the manager wrote a notice and posted it on the resident’s doors that read, “NOTICE TO BOMB.” Needless to say the phones were busy that day.

One of the hardest lessons to learn as a property manager is when to swallow your pride and let a resident win a battle. If a resident is willing to go to court to dispute $200, it will cost you $1,500 in legal fees just to get it. Sometimes settling differences outside of court will save you a lot of money, even if you know you are right and can win.

If you rent to low-income and government-assisted residents, you should be especially aware of this. Low-income residents generally qualify for state-sponsored legal assistance, so there is no incentive for them not to fight you in court. They have no money at stake, but you do. Even if you win in these types of cases, many times you lose. A majority of the time, a resident simply won’t have the money to pay you despite a verdict, and you will have racked up hefty legal fees.

LLCs—LIMITED LIABILITY COMPANIES

This is a no-brainer. Robert Kiyosaki, the Rich Dad team, and I always hit on this topic because it is so important. Keep all your properties in separate limited liability companies (LLC). An LLC is a legal entity that protects your personal assets should a legal issue arise with your property.

The advantage of an LLC over other legal entities is that it is relatively inexpensive to set up and there is little cost and effort to maintain one. Yet, when it comes to real estate, it provides the same kind of protection a corporation would. The procedures for setting up an LLC vary from state to state, and while you could certainly set one up yourself, I encourage you to contact your local attorney and work with them to make sure your LLC is set up properly and that you have every protection provided to you by the law. Another option is to pick up Loopholes of Real Estate by Garrett Sutton (www.sutlaw.com), a fellow Rich Dad advisor and an excellent attorney, who offers expert advice on the legal aspects of real estate investing.

As I discussed above, you should always document every aspect of your resident interactions. When it comes to your word versus your resident’s word, you never want to have to say, “But I told you ...” Residents have an incredible ability to hear and remember only what is convenient for them. How could you really possibly remember every detail of every conversation you’ve had with your residents? There is nothing worse than the feeling of knowing you’ve been “had” by a resident because you didn’t document a conversation or provide written notification.

![]()

Rich Dad Tip

![]()

As a property manager, one of the most empowering things you can say is “Read your lease.”

There are many forms that you should have on hand at all times:

• Leases

• Addendums to the lease (e.g., pets, parking)

• Move-in/move-out forms

• Community policies and procedures

• Resident conversation logs

• All manner of legal notices (as discussed above, get these from your attorney)

• Traffic logs to keep track of potential residents

Samples of many of these forms can be viewed on my Web site, KenMcElroy.com. Also, if you are a member, you can get standard forms from your local multi-housing associations or from the National Apartment Association. These forms are guidelines. Each community will have its own individual needs. Make sure to adapt forms to fit those needs.

![]()

Rich Dad Tip

![]()

Always document everything when it comes to resident communication.