12

Prediction Markets for Crowdsourcing

Christian Horn, Marcel Bogers, and Alexander Brem

Abstract

Crowdsourcing is an increasingly important phenomenon that is fundamentally changing how companies create and capture value. There are still important questions with respect to how crowdsourcing works and can be applied in practice, especially in business practice. In this chapter, we focus on prediction markets as a mechanism and tool to tap into a crowd in the early stages of an innovation process. In line with the growing interest in open innovation, we also investigate the difference between using internal or external sources in the context of prediction markets. We apply one example of a prediction market, a virtual stock market, to open innovation through an online platform, and show that using mechanisms of internal crowdsourcing with prediction markets can outperform the use of external crowds under certain conditions.

Introduction

Crowdsourcing is becoming an increasingly important mechanism for creating and capturing value by tapping into external sources of knowledge (Afuah & Tucci, 2012, 2013; Afuah, 2018b). Originally coined by Howe (2006), the term “crowdsourcing” describes the act of outsourcing a function once performed by employees to an undefined and generally large network of people in the form of an open call—mostly published on the Internet. The act of opening up to external knowledge sources is also in line with the growing interest in open innovation (Bogers et al., 2017; Chesbrough et al., 2006; Dahlander & Gann, 2010). Open innovation can be defined as “a distributed innovation process based on purposively managed knowledge flows across organizational boundaries, using pecuniary and non-pecuniary mechanisms in line with the organization’s business model” (Chesbrough & Bogers, 2014, p. 17). Indeed, the growing base of evidence on how to leverage external sources of innovation has identified a variety of mechanisms, that allow organizations to obtain knowledge from the outside (West & Bogers, 2014). As one such mechanism, crowdsourcing specifically describes how to leverage the knowledge of large groups of external people (“crowds”) to thereby accelerate the internal value creation and capture processes. Recent evidence has accordingly shown that crowdsourcing can indeed be beneficial under certain circumstances (Jeppesen & Lakhani, 2010; Poetz & Schreier, 2012).

Along with the growing interest in crowdsourcing, the complexity of the phenomenon is also becoming more apparent. For example, Afuah & Tucci (2012), who defined crowdsourcing as “the act of outsourcing a task to a ‘crowd’ rather than to a designated ‘agent’ […] in the form of an open call” (p. 355), distinguish two types of crowdsourcing. First, “tournament-based crowdsourcing” describes how the crowd self-selects how to work on a problem, with the best solution winning some type of reward. Second, “collaboration-based crowdsourcing” describes how certain members of the crowd work together to offer a solution to a certain problem. Besides, Poetz & Schreier (2012) show that outsourcing idea generation to a crowd of users generates ideas that score significantly higher (compared to professionals generating similar ideas) in terms of novelty and customer benefit, but that they score lower in terms of feasibility. Jeppesen & Lakhani (2010), moreover, showed that the marginality of the problem solver (being further away from the problem domain) increased problem-solving effectiveness in broadcast search.

In this chapter, we address a particular mechanism to implement crowdsourcing in an organization, namely the use of prediction markets. Prediction markets can be seen as an information technology (IT) resource that can act as a platform to conduct crowdsourcing with the particular aim of forecasting the outcome of certain organization processes. We build on evidence that prediction markets are useful in predicting the outcome of, for example, political events (Berg et al., 2008, Forsythe et al., 1992) or sports results (Servan-Schreiber et al., 2004). At the same time, prediction markets are also gaining some interest in the context of strategic management and new product development (Matzler et al., 2013; Stieger et al., 2012).

In the remainder of this chapter, we will specifically describe how prediction markets can be used to tap into the crowd in the early stages of the innovation process, especially in the idea evaluation phase and for market forecasting. We will develop a framework that considers different attributes of prediction markets to show under what conditions prediction markets with the crowd will outperform those with internal professionals. Given that prediction markets, like any crowdsourcing tool, require the organization to invest resources and attention to facilitate the process, these findings have important implications not only for how to create value from crowdsourcing but also how to efficiently capture that value through prediction markets.

Crowdsourcing for Knowledge in Innovation Management

In his book The Wisdom of Crowds, Surowiecki (2005) gave popular examples of how users can be employed in tasks that are useful for an organization with popular applications such as “the mechanical Turk,” where tasks are fulfilled solely by agents recruited online. In their study on innovation management, Poetz & Schreier (2012) show that crowdsourcing can be a useful concept in the first few stages of new product development, specifically in the generation of good new product ideas. Especially idea contests seem to be a domain of crowdsourcing with external stakeholders (Leimeister et al., 2009). Leimeister et al. (2009) also test their concept with the help of lead users and see them as most valuable informants in the idea generation process (see Bogers et al., 2010 and von Hippel, 2005 for an overview of these arguments). Others have shown that in the early stages of the innovation process, especially in the idea creation and evaluation phase, crowdsourcing with the help of prediction markets can be a powerful tool (Chen & Plott, 2002; Soukhoroukova et al., 2012; Stieger et al., 2012; Cowgill & Zitzewitz, 2014). For marketing planning and innovation management, we go one step ahead of using merely internal resources of crowdsourcing for innovation management support.

The main idea of this chapter is to describe how to use “the crowd” to solve the problem of forecasting future market conditions and product success values efficiently in the very early stages of the innovation process. Many authors postulate that new product development is a domain for experts, such as professionals from marketing, marketing research, or product management (Ulrich, 2007; Ulrich & Eppinger, 2008). Schulze & Hoegl conclude that by “relying on the method of asking buyers to describe potential future products, big leaps to novel product ideas are generally not likely” (Schulze & Hoegl, 2008: 1744). In other contexts, it has been shown that high levels of self-explicated or ascribed profession in a certain field of research do not necessarily result in better solutions of certain problems. Jeppesen & Lakhani (2010) show, for instance, that keeping more distance from the field where experts are seen as experts positively influences the capabilities of individuals to solve complex problems in many different areas of scientific research. For example, a biologist is more likely to solve a complex problem in chemistry than a researcher with his main domain in chemistry research (Jeppesen & Lakhani, 2010). Although employees in companies are seen as experts in their fields, the crowd may help to manage forecasting in innovation management more efficiently than the persons that have been in an expert role before.

While other prediction market systems in companies only use internal “crowd” sources, it will be described how crowdsourcing allows a company to integrate “the crowd” besides experts or lead users from outside and uses their knowledge, as Poetz & Schreier (2012) postulate in their publications about crowdsourcing with users and consumers. Forecasts generated by these groups can be more efficient than forecasts with experts from within the company. Afuah & Tucci postulate that crowdsourcing is likely to be used by organizations when five requirements are fulfilled: (1) the problem is easy to delineate and broadcast to the crowd; (2) the final solution is easy to evaluate and integrate into the focal agent’s value chain; and (3) information technologies are low cost and pervasive in the environment that includes the focal agent and the crowd, (4) the knowledge required to solve the problem falls outside the focal agent’s knowledge neighborhood (requires distant search); and (5) the crowd is large, with some members of the crowd motivated and knowledgeable enough to solve the problem (Afuah & Tucci, 2012).

In applying these requirements to prediction markets, most of them fit with our prediction market framework: Requirement (1) can be met by prediction markets, as innovation process questions can usually be translated into virtual stock questions. They can be easy to understand (Christiansen, 2007) and the results of crowdsourcing with prediction markets can be easily integrated into the innovation process (requirement 2). Companies like Ford are using prediction markets exactly for this reason, to integrate the employees into their internal idea evaluation processes. Already in 2011 the company integrated 1,300 employees to real-time shift in production planning successfully. Later the usage was shifted to forecast future consumer and market trends. Several applications of prediction markets and a framework for the technical application of prediction markets (e.g. Soukhoroukova et al. (2012) show that requirement (3) can be satisfied. With the help of the crowd, complex tasks and forecasting problems can be solved. In the innovation process, experts such as managers and industry members are traditionally seen as persons from a knowledge neighborhood of innovation-related forecasting tasks. Those persons are usually seen as having all the necessary capabilities to be better in problem solving for innovation-related forecasting. Following Afuah & Tucci, using the knowledge neighborhood of the crowd, which can be anonymously required via the Internet for a prediction market, would produce more efficient results (requirement 4).

Thus, we try to use prediction markets, not only with experts, but we integrate “the crowd” into prediction markets instead of employees and compare the results with internal experts markets. With our configuration of prediction markets, we want to combine the principles of crowdsourcing with prediction market principles that are described in the following.

Prediction Markets and Crowdsourcing

Foundations for the use of prediction markets were laid by Hayek (1945) and Fama (1970). With the help of the market price, knowledge that lies dispersed among informants and evaluations of an uncertain future outcome can be organized and reflected by one number—the market price of a (virtual) asset. The market price can, for example, represent the price for an actual good, or prices can reflect expectations about an uncertain event, such as product success or the market entry of a competitor.

One basic concept that underpins the information aggregation mechanisms of markets in general and also prediction markets is the theory of marginal traders. Marginal traders on all kinds of markets have a high(er) knowledge about the problem and influence the market price through their transactions ino the “right” direction (McManus & Blackwell, 2011; Berg et al., 2008). In contrast, a usually larger number of “noise traders” with little knowledge are active on the same markets, too, e.g. towards the right forecasting of the later sales success of a certain product. It is necessary to have an asymmetric distribution of “good” knowledge in order to keep the markets liquid; noise traders will sell goods or virtual stocks on markets that are rational for them, but this gives them a disadvantage compared to better-informed marginal traders. For example, noise traders are willing to sell contracts on the prediction market although, with higher expertise or better information, it wouldn’t be rational to sell. As an example, trading contracts about the success of new products, those traders with less information about the target groups’ taste and needs will be willing to sell e.g. virtual stocks on products that would be successful later. Thus, marginal trades can buy these contracts for a lower price and through this be more successful in the long run. With their success, they accumulate virtual capital and can, in many market environments, have more influence on the virtual market outcome because they can leverage their opinion better with virtual capital.

Prediction markets have been extensively and successfully used for the forecasting of political events, such as presidential or gubernatorial elections (Forsythe et al., 1992; Berg et al., 2008; Hanson, 2006), macroeconomic contexts (Gürkaynak & Wolfers, 2005), or forecasting sports results (Rosenbloom & Notz, 2006; Servan-Schreiber et al., 2004).

There is a rising number of prediction markets publications in academic research, also for use in companies. Snowberg et al. (2012) gave an overview of numerous possible uses in economic forecasting, such as macroeconomic measures. Rieg and Schoder (2011) mention Google, Deutsche Lufthansa, or Eli Lily as examples of companies that make creative use of internal prediction markets for forecasting, e.g. in logistics or in financial markets.

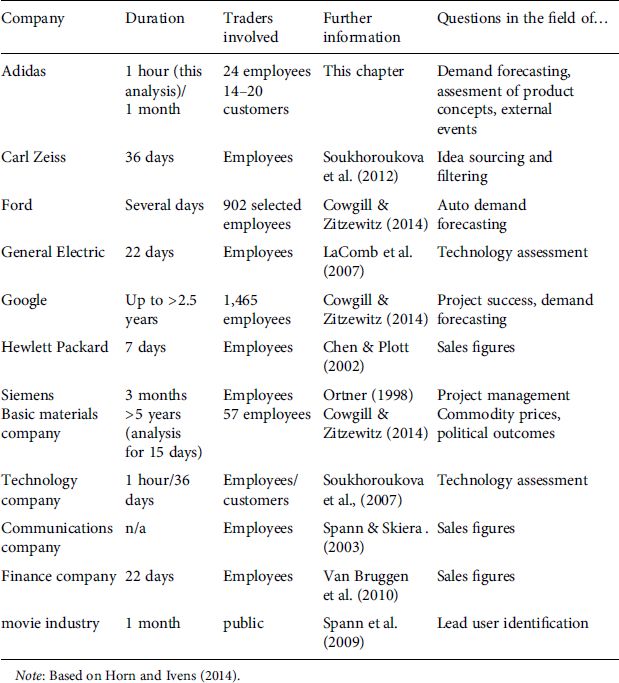

Table 12.1 shows an overview of scientific publications about prediction markets in business use. A comprehensive synopsis and classification of publications about prediction markets can be found in the Journal of Prediction Markets (Horn et al., 2014).

Table 12.1. Prediction markets for business use.

Yet we still see a lack of empirical evidence of usage in the innovation process, especially with the involvement of customers as “the crowd.” Although the number of publications has increased in the last few years, Graefe’s statement (2011) about prediction markets used in companies, that there are very few publications that were written with actual company data, is still true. Data that are used for empirical studies are often generated by experimental setups instead of real-world conditions. Horn et al. (2014) show a comprehensive synopsis about prediction markets research streams which underlines this statement.

So far, there have mainly been four steps where prediction markets have been seen as possibilities for helping companies to innovate (Dahan & Hauser, 2002): idea generation and screening, building product concepts and testing them, product testing, and product launch. The steps can be specified as pre-launch phases and post-launch phases. The first two phases face problems associated with the development and evaluation of ideas, the product testing phase deals with product alternatives. Ortner (1998) shows prediction markets inside the Siemens company to forecast project deadlines. LaComb et al. (2007) use prediction markets at General Electric, Soukhoroukova et al. (2012) establish prediction markets in the early stages of the innovation process. The last phase where prediction markets can support the innovation process is the forecasting of sales figures before (Skiera & Spann, 2011) and continuous sales forecasting after the launch as part of the marketing planning information system. In our case, we focus on product and concept evaluation and forecasting tasks in the early stages of the innovation process. Matzler et al. (2013) showed that forecasting can be successfully done with prediction markets in that stage. Chen and Plott (2002) had shown previously how HP used prediction markets to forecast printer sales successfully.

Empirical Analysis: Case and Methodology

Prediction markets have mainly been used by companies to integrate informants from inside the company. But how prediction markets can be used successfully for real “crowd”-sourcing to support the innovation process is a field to be discussed too. For empirical investigation we concentrated on Adidas, the international sporting goods and fashion company.

With their main brand, “Adidas Sports Performance” and other popular brands such as “Reebok” or “Taylormade,” their worldwide turnover in more than 60 countries was 19.3 billion Euro in 2016. In our study, we found that 100 percent of the crowd members were aware of the brand “Adidas” by a questionnaire after participation in the prediction market. Adidas has more than 60,000 employees, 10 percent of the employees worked in marketing or research and development functions. The studies took place at their Germany-based company headquarters.

Adidas has implemented forecasting systems and as in most consumer markets, the reduction of flop rates of new products is still a major goal. The task was to establish an innovation supporting system that helps to improve the existing and well-established innovation management, strategic marketing planning, and product management tools. Information about other operand resources is not the subject of this article; we focus on the use of prediction markets.

First, the test environments will be outlined. After that, the results will be presented and discussed.

Empirical Studies

In the following, the four studies that were conducted to test the performance of prediction markets are described. Data collection procedure 1 (Market setup 1) produced the initial data and was performed with internal experts from the company. Market setup 2 integrated groups of customers instead of internal experts; two of the approaches that are described in Šundić & Leitners’ (2018) chapter in this book (see Table 12.2).

Table 12.2. Prediction market designs.

| Market type | Internal experts (market setup 1) | The crowd (market setup 2) | |

|---|---|---|---|

| Trading time | 1 hour | ||

| Recruitment | Invitation via email with login data, encouraged by management. | Invitation via email with login data to students from graduate/undergraduate courses. | |

| Number of stocks | 12 virtual stocks | ||

| Demand outcome scenarios | Value of stock for certain product feature, market share totals, sales volumes, sales prices. | ||

| Design market parameters | Double auction mechanisms and simple betting mechanisms (for €/$ rate). The initial capital for each player was 500 virtual $ and the initial shares of each product were put into participants’ depots. | ||

| Market outcomes | Stock prices at market closing. | ||

| Participants’ earnings | Lottery with higher winning probabilities for participants with the highest virtual portfolio values. | ||

| Encouragement of active trading | Encouraged by management. Employees got free time hours to take part. A ranking showed the traders with the highest portfolio value. | A ranking showed the traders with the highest portfolio value. | |

| A lottery system with small incentives was established. | |||

Market setup 1: Internal corporate prediction markets. In the first study, stock markets were set up to be run with Adidas employees as traders. As described above, internal markets in companies have been tested and used for different purposes. In our design, we followed the design criteria for the application of virtual markets by Soukhoroukova et al. (2012).

The virtual stocks in the prediction markets represented questions that were important for the innovation process of the partnering company. Numerical values of the stock prices represented values such as sales prices, sales volumes, or other numerical values that could clearly be assigned to the values in question. For example, a stock value of “5” represented an estimated sales number of 5,000 units in a specific sales period. In other cases the optimum sales price for a polo shirt was represented by a virtual stock market price of 75,89 €. This design also follows Matzler et al. (2013). Stock prices at the end of the trading time were taken as final forecasting values.

Prediction market topics. Each trading group was confronted with the following forecasting questions: (1) How much additional earnings can be made with additional product feature Z? (Z = one other sports shirt); (2) What would be the ideal sales price for product X? (X = four different sports shirts); (3) What will be the sales volumes for products Y? (Y = five other different sports shirts); (4) What will be the sales volumes for product X? We also asked (5) What will be the euro-dollar exchange rate on day T? (T = date in future, after closing the trading phase). Additionally, we asked other questions which are not relevant for this analysis, such as the prediction of popular sports results in order to motivate the participants in all groups. For reasons of confidentiality, product names and absolute figures had to be changed, but numbers do reflect the correct relations. In total, the participants could trade on 12 different topics.

Starting the markets and trading phase. The markets were initiated by the provision of a certain amount of resources to each market player. Both groups traded the virtual stocks with virtual play money. The play money was issued by placing 500 virtual dollars and an initial amount of virtual stocks in each player’s depot. Thus, each player could begin buying or selling stocks to maximize their own personal portfolio value. Also, using play money avoids regulatory risks that can arise from a gambling character in the markets in the case where real money with a chance to win or lose for the participants has been used. Also, the perceived risk of the market participants stays lower.

The transactions were matched by continuous double auctions or betting market mechanisms. Participants can place buy and sell orders that are executed immediately, with corresponding orders on the other side of the order book (Madhavan, 1992). Orders with no matching bids are cued in an order book and executed as soon as a matching order is sent. The 12 markets were set up simultaneously for two groups of ten and seven active traders. Each group had their own market environment and was not able to interact with persons from the other group on the markets. Research has shown that this number of persons can result in efficient markets (Borison & Hamm, 2010). Forty-nine persons were invited for each market (average age 31.3 years), 27 signed in and placed orders, but only those persons with at least three transactions were considered as active traders. Orders which were not executed on the virtual markets because they didn’t match other orders were not taken into consideration. During the firm-internal markets, 254 transactions were performed in total, 15 per person on average. With this market, we generated benchmark data from 24 prediction markets to compare this data to the forecasting accuracy set up by the crowd.

Each participant was invited via a personal email address and the login data was provided before the trading phase. The motivation of the trading persons is an important topic in prediction markets. As the equilibrium price changes with each transaction, a minimum number of transactions are needed and more transactions can improve the quality of outcome (Berg et al., 2008). Intrinsic motives can result in higher trading volumes for company internal agents, as well as for the crowd. Fun on the “game” as well as the need to help in completing the task and in solving the question can be motives for intrinsic motivation (Kapp, 2012; Borison & Hamm, 2010). To motivate the participants in all of the markets and stimulate them to actively participate in the markets, incentives in the form of Amazon.com gift cards, ranging from 10 to 100 Euro, were distributed among trades with the best results and in a lottery. This form of motivation represents a competitive component and the setup is a form of competitive crowdsourcing or tournament-based crowdsourcing. In tournament-based crowdsourcing, a task is set up and only the best solution(s) can win the prize(s) for completing the task (Afuah 2018a, b). In our setup, each trader had the chance to win one of the 40 gift cards in each trading environment, but the better the portfolio values were, the higher was the probability of winning one of the incentives. In each scenario, the participants could win the same amount of prizes. The trading activity resulted in 254 transactions on the markets during the one-hour trading time and produced results for 23 of the 24 forecasting scenarios among the 12 topics. For one market, the number of transactions was too small, thus it was not analyzed. The trading platform included a profile section, a portfolio overview section, and a high score ranking list to inform traders about their success in the markets. The traders were asked not to interact with each other aside from the market platform.

Market setup 2: The crowd. In this data collection period, the setup of study three was taken over with small, but relevant modification. Five groups from 14 to 20 persons (mainly students from graduate and undergraduate courses) were tested in our markets in contrast with the internal experts. The group of students was not seen as experts in sporting goods and apparel, as they were drawn randomly from several classes and distributed amongst the trading groups. Following West & Sims’ (2018) chapter, the participants formed a crowd, not a community, as they were self-selected and randomly drawn to one of the groups and there were no traces that they shared a common goal or collaborated to perform the tasks. The distribution of age and gender of the participants also form the Adidas professionals (average age 24.5 years, σ= 2.47). In this study, all tests took place at the computer science lab at the university campus. The groups did not trade on all markets in order not to have too many open questions within the one hour trading time. Other conditions were kept ceteris paribus. The results that are shown are parts of a larger series of prediction market research activities in real business environments as well as under controlled conditions. Other aspects such as more detailed market designs and empirical results can be found in Horn (2015) and Horn and Ivens (2014).

Evaluating the prediction markets. All of the stock questions addressed innovation-related topics that could not be known at the time of running of the markets, and would only be assessed empirically after market closing to create benchmarks for later evaluations of the accuracy of the answers and to calculate prediction errors. The mean absolute prediction error (MAPE) is calculated for every scenario to calculate errors, because MAPE is commonly used to assess prediction markets (Skiera & Spann, 2011), or as a general performance measure in business and economics forecasts (Russel & Adam Jr, 1987; Armstrong & Collopy, 1992). It is unit-free and measures the deviation between the benchmark values and the values of the markets’ closing prices. Specifically, it is calculated using the following equation:

(12.1)

(12.1)

where

S = the number of different observations in trading group n;

B = the value of the benchmark of the sth stock;

P = the price of the sth stock in the market at time point t;

t = the closing time of the market.

To interpret the value of the MAPE, it can be considered that the smaller it is, the smaller the deviation of the market outcomes compared to the benchmark value, and thus the better the accuracy of the market. We compare the performance of the different types of market designs to the real-life market outcomes as benchmarks. The company provided the realized, actual market data after the experiments and the forecast events. Those were, for example, after several months, the sales figures or the market share of the products that were traded in the virtual markets. According to interviews with managers by the partner company, 10 percent errors are excellent forecasts, and 20 percent are still very good results in this industry, as seasonal changes and fast fashion trends challenge all forecasting methods. Matzler et al. (2013) find an average Mean Absolute Error of 2.74 percent to 9.09 percent in their study on forecasting and use a similar method to present their results. The differences in the absolute values and means are commonly used to present forecasting errors, as do Matzler et al. (2013) in their study.

Table 12.3 reports the MAPEs of the different market design setups (columns) and for each of the innovation-related questions (rows) that were investigated. The first virtual stock type in the table is “Specific product features.” This question represents the valuation of the market for certain product features to be helpful for later market success. The second virtual stock shows the MAPE for the market outcomes of the evaluation of the later market share for a certain range of products. The other virtual stocks follow the same scheme.

Table 12.3. Mean absolute prediction error (MAPE) results from the markets.

|

Conclusions and Future Research

The results suggest that a crowd can produce valuable results in forecasting innovation-related questions effectively. The groups, the non-experts crowd as well as the internal markets with Adidas experts, demonstrate that forecasting market success in innovation management can be done by internal experts as well as with the help of external sources of knowledge. This demonstrates that the crowd is capable of producing valuable results in the tested innovation tasks with this market setup. As postulated by Afuah (2018b) and discussed by Šundić & Leitner (2018), the knowledge from non-expert persons can also be a valuable resource of knowledge in the innovation process and in crowdsourcing especially. Thus, it not only makes sense to involve non-experts, but in specific circumstances their evaluations even outperform expert opinions.

Taking a closer look at the results, they show that the internal experts perform much better in the innovation management tasks than the external, non-expert participants. It turns out that non-experts can be useful sources, but are outperformed by internal experts under ceteris paribus conditions with the use of prediction markets. As such, our findings contribute to the larger domain of open innovation in which it has become clear that companies increasingly need to rely on external sources of innovation to accelerate their innovation processes (Chesbrough, 2006; Chesbrough & Bogers, 2014; West & Bogers, 2014). We thus show that crowdsourcing in general and the use of prediction markets in particular can be a powerful resource in implementing open innovation.

In the area of crowdsourcing, there are still important aspects to be investigated in future research. The empirical analysis was performed on consumer products, as seen in Matzler et al. (2013) or Spann and Skiera (2003). Replication studies in other industries could suggest limitations in the ability of firms to employ virtual markets for solving difficult business decisions with the help of the crowd. Although we did not externally test the participants on their knowledge about the topics that were addressed in the prediction markets, it should be noted that only the information that exists within the marginal traders’ minds can be gathered by the markets. Thus, for lesser known products, such as industrial goods or other business-to-business markets, results may look different. It is true that all of the participant traders in our studies were knowledgeable about the products traded. As a consequence, similar study designs may produce different results for samples of crowds who are asked to trade stock for products they are less familiar with. However, the fact that participants do not need to be high-level experts in the field produces opportunities for the use of prediction markets in many contexts. Prediction markets in panel-like setups for business forecasting, especially with employees, are still under-researched and could potentially offer a large field of contributions for scholars and a high practical use. However, it is necessary to spend some time finding the right target group for the internal market, as recent research on differences has shown, e.g. in the individual degree of risk aversion of the persons trading (Boulu-Reshef et al., 2016).

Over decades, scholars as well as practitioners have made tremendous efforts to develop instruments that allow the prediction of future developments in markets to improve the innovation process. This is also true for the field of new product development at the intersection between marketing and innovation management (Brem et al., 2011). Crossing different domains may also help in developing new tools and frameworks to enable cross-fertilization of knowledge within and between organizations (Bogers & Horst, 2014), which may also become applicable outside of the traditional corporate setting (e.g. Eftekhari & Bogers, 2015).

The results show that design variables for prediction markets that have been discussed in other contributions are relevant for our use, too (Christiansen, 2007; Borison & Hamm, 2010). The level of expertise and knowledge is one of the relevant design variables. For managers, it may be concluded that prediction markets—if designed carefully with regard to the latest scholarly knowledge—can be effective tools for providing important insights with respect to key questions in the innovation process. The selection of the right kinds of “experts” is still a key design element for successfully applying crowdsourcing with prediction markets.

When designing prediction markets, firms need to decide whether to use customers as informants, or their own employees, or other stakeholder groups. As discussed, the alternatives differ with respect to costs of setup and incentives that are required to motivate participation. Additionally, in many cases, confidentiality may be required in order to prevent competitors from learning about development projects too early. Confidentiality and ease of implementation would be two main arguments in favor of employees participating. On the other hand, the participation of employees does not necessarily yield better insights into future market developments when compared with the use of other stakeholder groups, as the outcomes depend on the level of expertise. This means that prediction markets can help to gather information and support the innovation process without employees spending time on related tasks. They can be implemented as an alternative tool for conducting market research with current and potential customers. On the other hand, prediction markets do not yield less valuable insights into market phenomena as compared with answers gleaned from customers. Given the traditional argument in marketing that firms should conduct market research among customers in order to understand customer value expectations and needs, this is an interesting result and worthy of further work in the area. It allows questioning whether customers are truly required as reference points for new product development in all situations. Rather, it seems that firm employees’ “myopia” may not be as strong as sometimes suggested. It is likely that firms should mix different sources of information when attempting to understand market developments via crowdsourcing.

Acknowledgments

The authors would like to thank Björn Sven Ivens from the Department of Marketing at Otto-Friedrich-University of Bamberg for his valuable support and comments. We are also grateful for the support we received from the editors of this volume and for the comments that we received from the participants of the “Crowd” volume workshop in Lausanne, Switzerland on November 27, 2015.