Chapter 7

Hunting for Houses in Your Target Area

IN THIS CHAPTER

Staying focused on a certain price range

Staying focused on a certain price range

Exploring key resources for information on bargain properties

Exploring key resources for information on bargain properties

Spotting potential flips in special areas of the market

Spotting potential flips in special areas of the market

Buried in every neighborhood are hidden treasures offering real estate investors opportunities to turn a handsome profit. You just have to dig a little to discover these buried treasures. To figure out where to dig, you need a map. The real estate market offers an entire atlas full of treasure maps, ranging from property listing services, such as the Multiple Listing Service (MLS), to classified ads and real estate publications. You have to dig a little to find these valuable resources, and then you need to know how to read them to discover key words that identify the most promising properties.

In this chapter, I point the way to the plethora of publications, websites, and other resources that provide information on properties for sale, and I show you how to use the information they provide to hunt for buried real estate treasures in your target neighborhood. If you follow the suggestions in this chapter, you can create a list of at least ten promising prospects — and figure out how to select the most qualified candidate.

Focusing Your Search on Affordability

When you go hunting for a home you want to live in, you don’t look at every house in the neighborhood that has a For Sale sign out front. You narrow your list of prospects by stipulating your selection criteria. You typically begin with a price range and style of home — say a ranch-style house between $120,000 and $150,000. You may not consider a home that has fewer than three bedrooms and two baths (or even three baths if you have more than one teenager). Or you may insist on an oversized garage with a tile floor, where you can safely park your massive new SUV. You narrow your focus in order to prevent becoming overwhelmed by the wide selection of homes on the market.

When you begin looking for investment properties, take a similar approach. Settle on a price range and style of home. Depending on the predominant features in your target neighborhood, you may focus further by considering only brick homes or only two-bedroom homes that have attic space you can convert into a third bedroom. You don’t want to specialize to the extent that you limit yourself to only one or two properties, but try to limit your prospects to the number of houses you can realistically consider in your allotted timeframe and price range.

Specializing can help you master a narrow market, search more efficiently, and establish an edge over your competition. The fewer houses you have to look at, the more quickly you can inspect prospective properties, make your offer, and begin renovations.

Specializing can help you master a narrow market, search more efficiently, and establish an edge over your competition. The fewer houses you have to look at, the more quickly you can inspect prospective properties, make your offer, and begin renovations.

You don’t have to start counting your pennies yet, but before beginning a serious search for properties, you should have a ballpark figure in mind — how much you can afford to spend on a property. (Chapter 6 helps you zone in on affordable neighborhoods with promising prospects.) Several factors influence your price range, including the following:

- Amount of financing, or how much money you can get your hands on (see Chapter 5)

- Type of financing, such as cash, a bank loan, a personal loan from a relative, or hard money — a high-interest, short-term loan from a private investor (see Chapter 5 to discover more about acquiring hard money)

- Cost of renovations

- Holding costs — the monthly costs of owning the property while you’re renovating it

- Cost of purchasing and selling the property

- Additional (and often unforeseen) costs, such as unpaid back taxes or utility bills, major appliances that break down a day after closing, and residents who refuse to move out

You’re not purchasing the house yet. You’re simply determining a realistic price bracket for the houses you want to consider. If you have the financing to make a $100,000 purchase (and an additional $20,000 on hand for renovations and other costs), you may consider looking at homes in the $90,000 to $130,000 range. Because you need enough to cover purchase costs, renovations, and holding costs, you probably don’t want to pay more than $100,000 for a house in this case, but you should extend your range a little higher — you may stumble on a property that’s way overpriced or a motivated seller who’s willing to accept significantly less than the asking price or is willing to pay for some of the essential repairs.

Don’t overextend yourself, especially on your first deal. Calculate the total amount of money you need with enough padding to cover the costs of buying, holding, renovating, and selling the property. You need enough money to cover:

Don’t overextend yourself, especially on your first deal. Calculate the total amount of money you need with enough padding to cover the costs of buying, holding, renovating, and selling the property. You need enough money to cover:

- Your current living expenses

- The cost of buying, renovating, and selling the property

- Holding costs: a buffer of about six months’ worth of payments on the new property, including taxes, insurance, and utilities

- The cost of cheeseburgers for you and your crew

See Chapter 12 for guidance on estimating the total cost of flipping a particular house and how much you can afford to pay for the property in order to earn a decent profit.

Digging Through Property Listings, Ads, and Publications

When homeowners decide to sell their property, they do what any good capitalist does — they market and advertise. It’s all about supply and demand. They can’t do much on the supply side, so they try to increase demand by getting the word out and catching the interest of as many buyers as possible.

The most comprehensive marketing blitz begins by listing the property with a real estate agent, who advertises the property through various publications online and off and markets it through a network of motivated real estate agents. When you’re scoping out a neighborhood for properties to flip, start your search with the valuable and easily accessible resources presented in the following sections.

Searching listings with the help of your real estate agent

Real estate agents may have access to more robust property listings, such as the Multiple Listing Service (MLS) and Broker Listing Cooperative (BLC), which are like dating services for home buyers and sellers. Through a real estate agent, a home seller can post a complete description of the property, including the asking price, total square footage of the house, room specifications, and a host of other details about the home’s layout and construction. Prospective buyers can search these listings to find the ideal match for their needs and to contact the agent who listed the property. Real estate agents often have more powerful search tools that can search numerous listing services to find a greater selection of properties that meet your criteria.

Your agent should be able to set up a search with exactly what you’re looking for and configure options to automatically send you an e-mail or text message as soon as a match comes on the market. With many listing services, agents can add terms like “as is,” “bank owned,” “fixer-upper,” “short sale,” and so forth to the search criteria to search for bargains. If your agent can’t do this for you, find one who’s more tech savvy or has access to better tools.

Your agent should be able to set up a search with exactly what you’re looking for and configure options to automatically send you an e-mail or text message as soon as a match comes on the market. With many listing services, agents can add terms like “as is,” “bank owned,” “fixer-upper,” “short sale,” and so forth to the search criteria to search for bargains. If your agent can’t do this for you, find one who’s more tech savvy or has access to better tools.

Choose a real estate agent who’s a member of the local board of Realtors and who has access to all listing services for your target area, or use two or more agents. Chapter 4 has more information about selecting the right agent for your needs.

Choose a real estate agent who’s a member of the local board of Realtors and who has access to all listing services for your target area, or use two or more agents. Chapter 4 has more information about selecting the right agent for your needs.

In the following sections, I show you how to navigate the property listings to locate and assess basic information, sniff out important clues, and weed out potential time wasters.

The National Association of Realtors (

The National Association of Realtors (www.realtor.com) offers a searchable database of more than 2.5 million listings. Consider this database the CliffsNotes version of the MLS.

Brushing up on the basics

Ask your agent to supply you with the listing and listing history of all properties for sale that match your search criteria, including the following:

- Location

- School district (see Chapter 6 for the importance of school districts)

- Asking price

- Style of home

- Construction materials

- Total square footage

- Number of bedrooms

- Number of bathrooms

- Presence (or not) of a basement

The listing history indicates when, for how long, and for how much the home has been on the market. And it provides you with the following key information:

- All transactions on the property in the past few years.

- How much the seller paid for the property.

- Whether the seller listed the property with another agency in the past — and how long it was listed and for how much. (This information is helpful in determining actual time on the market. The current listing shows only the time that the seller listed the property with the current agent. Generally, the longer a home is on the market, the more eager the owner is to get rid of it.)

- The amount the property has appreciated from one sale to the next.

- Whether the seller has dropped the asking price and by how much.

- How much trouble the seller is having trying to unload the property.

Through listing services, your agent can also look up the number of homes that have been on the market in the area and have sold in the past three years. By looking at sales over the most recent six-month period, the agent can clue you in to the health of the housing market. If ten homes are on the market and six sold in the past six months, that’s a good sign. If 20 homes are on the market and only 3 have sold, that could mean trouble. Chapter 6 has more on taking the pulse of the real estate market in a particular neighborhood.

Keep an eye on sale-pending properties. Often, someone makes an offer that ties up the property but then fails to close on the sale. The property is typically placed back on the market at a reduced price. The law forbids your agent from disclosing the sale price of a pending sale, because if the transaction falls through, the seller will have a tough time negotiating the next offer, but you can compare the new asking price with the old one to determine whether the seller has become more motivated. In some areas, pending sales are flagged as “first right contingency,” meaning a prospective buyer has the first right to purchase the property; they typically have 24 hours to remove the first right or step aside.

Keep an eye on sale-pending properties. Often, someone makes an offer that ties up the property but then fails to close on the sale. The property is typically placed back on the market at a reduced price. The law forbids your agent from disclosing the sale price of a pending sale, because if the transaction falls through, the seller will have a tough time negotiating the next offer, but you can compare the new asking price with the old one to determine whether the seller has become more motivated. In some areas, pending sales are flagged as “first right contingency,” meaning a prospective buyer has the first right to purchase the property; they typically have 24 hours to remove the first right or step aside.

Ask your agent to print out five listings of homes that have recently sold in the same price range so you can comparison-shop. Ask for five listings of homes that have sold in the next higher price bracket so you can determine the types of modifications you need to make in order to sell the property at a higher price. With listing information in hand, you’re ready to begin your search.

Sniffing out clues on a listing

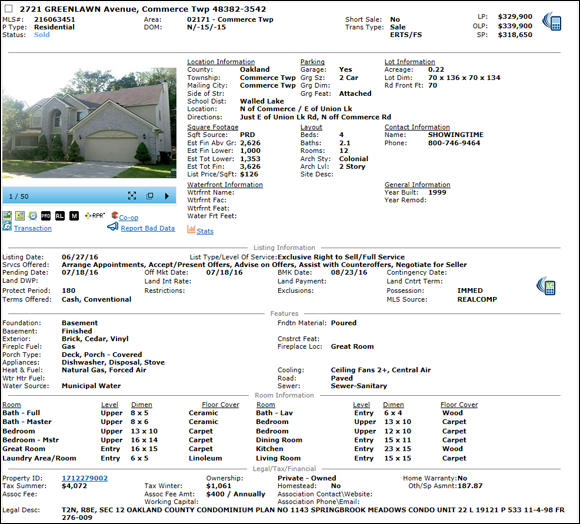

Each listing contains a deluge of details about the property, all of which can be very helpful in your search (see Figure 7-1 for a sample listing). Some of these details, however, are more useful than others. Focus your search on the following golden nuggets:

Each listing contains a deluge of details about the property, all of which can be very helpful in your search (see Figure 7-1 for a sample listing). Some of these details, however, are more useful than others. Focus your search on the following golden nuggets:

- List price: Now that you’re looking at listings of only those homes in your price range, examine the list price (found in the upper right corner of Figure 7-1) and compare it to that of other comparable houses in the same area. An inordinately low price can signal a buying opportunity, or it can raise a red flag, making you (and others) wonder, “What’s wrong with this one?”

- List date or time on the market: How long has the home been on the market? You typically find your best opportunities in homes that have recently been listed (in the past couple of days) or in homes that have been on the market for a couple of months. A home that’s not selling may be overpriced for the current market. In many cases, the longer the seller holds out, the harder it is to sell, and the more desperate the seller becomes. This cycle can signal a buying opportunity now or in the near future. Your agent can tell you the average time a home is on the market in any given neighborhood so you can properly gauge what’s considered “a long time.”

- Remarks: Near the bottom of every MLS listing is a Remarks or Property Description section that offers additional bits of information. Look for key terms, such as “sold as is,” “handyman’s special,” “in need of a little TLC,” or “needs a little work.” These phrases translate to “You’ll get the house for less because the current owner doesn’t want to clean, paint, or re-carpet.” Agents may also be able to download the seller’s residential disclosure, which contains additional details on what works and what doesn’t, whether the property has ever had biological contaminates (such as mold), how old the roof is, and so forth.

Nothing on the MLS is the gospel truth. Sellers and real estate agents alike often estimate room sizes or make mistakes when entering details. Approach all prospects with a discerning eye.

Nothing on the MLS is the gospel truth. Sellers and real estate agents alike often estimate room sizes or make mistakes when entering details. Approach all prospects with a discerning eye.

Weeding out potential time wasters

Just as a listing is likely to contain words and phrases that highlight potential buying opportunities, listings commonly contain details that function as red flags, such as the following:

Just as a listing is likely to contain words and phrases that highlight potential buying opportunities, listings commonly contain details that function as red flags, such as the following:

- Inordinately high list price: If the price is way out of line with prices of comparable properties in the same area, the seller may be delusional. Sellers who are emotionally attached to their homes can be difficult in negotiations. Keep an eye on the property to see whether the price drops.

- Super cheap: Either something is terribly wrong with the property or somebody made a typo. (However, don’t assume that the price is too good to be true. Check it out for yourself.)

- Flowery description of the property: Under the Property Description or Remarks section of the MLS, watch out for phrases like “nicest home in the neighborhood” or “a real show stopper.” When you’re flipping a house to make some quick cash, the nicest, highest-priced house on the block isn’t the best investment.

- Neighborhood that’s outside your farm area: Don’t be tempted by properties outside your farm area — the neighborhood you decided to focus on. These properties may look like great deals at first glance, but if the property is on the wrong side of the tracks, it may not be such a great deal in that area. Stick with the market you know best — your farm area.

Scanning the classifieds for key words

Local newspapers (and the websites of local newspapers), along with online classified services such as Craigslist, typically carry classified advertisements of homes for sale. When scanning these ads, look for words or phrases that clue you in to the fact that the property is a dontwanner, as in “The owner don’t want ’er.” As a flipper, you want the houses that current homeowners don’t want because the homeowner is more motivated to sell and is likely to offer you a better deal. Phrases like “needs work,” “must sell, owner relocating,” and “fixer-upper” are like billboards broadcasting that the owners want to get out, move on, and cut their losses. These billboards are telling you to “Look at this house!” (See the section “Mining Special Markets for Dontwanners” later in this chapter for details on finding dontwanners.)

Beware of the following subliminal messages that warn you of potential trouble ahead:

Beware of the following subliminal messages that warn you of potential trouble ahead:

- Glitzy $100 ads: The more money the seller invests in advertising, the less likely the person is to negotiate price. Give more consideration to the tiny $10 ads.

- Words indicating a reluctance to negotiate: If the ad includes the word “Firm,” the owner has probably set a steep asking price and is unwilling to haggle. Don’t waste your time with an owner who thinks his bungalow is worth a million bucks.

- Ads that promise “cash back at closing”: Translated into plain English, this phrase means “con artist at work.” The property owner or the front man is using the house as a pawn in a scam. Don’t be the sucker who gets hooked into an illegal transaction. Don’t even call. (See Chapter 1 for information about additional real estate scams.)

Poring over real estate magazines

Walk into just about any grocery store, restaurant, or gas station, and you see a rack of homes-for-sale magazines. Grab an armful of these publications and head to your local café to peruse the offerings. Most magazines organize the homes by area — such as north, south, east, and west — and may contain listings for well-known areas, such as homes around a local lake or reservoir.

Although homes-for-sale magazines may point you in the direction of a hidden gem, listings are often two to three weeks old — after all, printing and distributing the magazine takes time. Other real estate investors very likely have picked over the properties already. These ads, however, can help you locate a quality real estate agent, check out the asking prices for comparable properties in your target area, and acquire tips on how to make a property more marketable.

Although homes-for-sale magazines may point you in the direction of a hidden gem, listings are often two to three weeks old — after all, printing and distributing the magazine takes time. Other real estate investors very likely have picked over the properties already. These ads, however, can help you locate a quality real estate agent, check out the asking prices for comparable properties in your target area, and acquire tips on how to make a property more marketable.

Scoping out FSBOs: For Sale By Owner properties

Drive through any neighborhood, and you’re likely to see some crummy-looking signs that say “For Sale” or “For Sale By Owner.” No self-respecting real estate agent would ever think of planting one of these signs on a client’s lawn, but for aspiring real estate flippers, these signs are like flashing Vegas neon. People who sell their own homes are often highly motivated and willing to deal with a serious buyer.

People commonly try to sell their own homes for one of three reasons:

- To save the sales commission they would have to pay a real estate agent

- To get rid of a house when they don’t really know or care about its value

- To sell the house for a price that’s so far above a realistic market value that no agent in her right mind would consider listing it

If you like the property, pull over and jot down the number or grab your cellphone and start dialing. If you’re not comfortable approaching the property owner yourself, call your agent. The only wrong way to approach a FSBO (often pronounced “fizz-boh”) that catches your eye is not to approach it at all.

Avoid overpriced properties. If you run into a seller who’s convinced that his run-of-the-mill shack is the neighborhood Taj Mahal, don’t waste your time trying to convince him it’s not. Just keep an eye on the property and approach the owner after the home has been on the market for a long time. The longer it lingers on the market, the more desperate the seller is to sell.

Avoid overpriced properties. If you run into a seller who’s convinced that his run-of-the-mill shack is the neighborhood Taj Mahal, don’t waste your time trying to convince him it’s not. Just keep an eye on the property and approach the owner after the home has been on the market for a long time. The longer it lingers on the market, the more desperate the seller is to sell.

For Sale By Owner (

For Sale By Owner (www.forsalebyowner.com) is a commercial website where property owners can list their properties without going through a real estate agent. If you’re interested in FSBOs, check this site and similar websites.

Mining Special Markets for Dontwanners

As a house flipper, you’re essentially a house recycler — you convert trash into cash. By trash, I mean properties that nobody wants — properties I call dontwanners. Real estate investors can score big profits on dontwanners by investing the time and effort into transforming them into dowanners — homes that prospective buyers find appealing.

Every neighborhood has its share of these trash-into-cash opportunities — “Your trash is my cash” — but finding them can be a bit challenging, especially if you don’t know where to hunt for these hidden treasures. Here I show you how to spot the dontwanners in your neighborhood.

Cruising the neighborhood for dontwanners

Drive, walk, or bicycle around your neighborhood in a search for dontwanners. Some of the best properties may not even be for sale, so look for the following signs and symptoms:

- Overstuffed mailbox

- Porch littered with newspapers

- Overgrown lawn

- House looks vacant inside

- Cheap “For Sale” or “For Sale By Owner” sign

If you spot a dontwanner, try to contact the owners to see whether they want to sell the house. If someone’s living in the house, knock on the front door and spark up a conversation. If the house is vacant, ask the neighbors if they know who owns it.

If you spot a dontwanner, try to contact the owners to see whether they want to sell the house. If someone’s living in the house, knock on the front door and spark up a conversation. If the house is vacant, ask the neighbors if they know who owns it.

One good way to approach a prospective seller is to say: “Do you know anybody in the subdivision who’s considering selling? I have a family member who’s looking to buy a home.”

Tapping into special markets

Some of the best opportunities don’t show up in property listings or even in the classifieds. You need to scope them out yourself by researching and networking in special markets, including the following:

- Foreclosures: Easy credit and an unpredictable job market have led many homeowners to assume more debt than they can handle. If the homeowner misses one or more mortgage payments, the bank or other lending institution that holds the mortgage typically begins the process of foreclosing — taking possession of the property. You can purchase properties at various stages in the foreclosure process: pre-foreclosure (from the homeowners), foreclosure (at auction), or post-foreclosure (from the bank that foreclosed on the property or at an auction).

- Bankruptcies: Homeowners who file for bankruptcy rarely get to keep their house, and even if they do, they may not want it. As an investor, you may have the opportunity to purchase the property at any stage in the bankruptcy process: prior to the bankruptcy filing (directly from the homeowners), filing (directly from the homeowners, but creditors must approve the sale), liquidation (with approval of the trustee and creditors), and post liquidation (from one of the creditors).

- Probate properties: When someone who owns some stuff dies, the stuff often goes into probate, where the courts decide what happens to it. Because a house divided cannot stand, probate often results in the process of selling a house to turn it into liquid assets (cash), which the courts can more easily use to pay off outstanding debts, taxes, and administration fees. The court divides any remaining crumbs among the unsecured creditors, funeral expenses, and credit-card debt. Anyone with a claim has the chance to pick up a few leftover scraps.

-

Divorce: When couples divorce, they often sell the property and split the proceeds, or one of them gets the house and doesn’t want it or can’t afford it. You may be able to purchase a property for well below the market price either pre-divorce, during divorce proceedings, or after the divorce.

Sometimes members of divorcing couples try so hard to hurt their partners that they hurt themselves. For example, if a spouse is awarded the house but ordered to split the proceeds with the ex when she sells the home, and if she hates her ex more than she needs the money, she may sell for significantly less than market value so the ex gets less money.

Sometimes members of divorcing couples try so hard to hurt their partners that they hurt themselves. For example, if a spouse is awarded the house but ordered to split the proceeds with the ex when she sells the home, and if she hates her ex more than she needs the money, she may sell for significantly less than market value so the ex gets less money.

- Government-owned properties: Various government agencies at the federal, state, and county levels frequently acquire properties they must dispose of. For example, the departments of Housing and Urban Development (HUD) and Veterans Affairs (VA) obtain houses when borrowers fail to make their mortgage payments. In addition, states and counties often seize homes for the nonpayment of property taxes. If you know where to look, you can find government-owned properties at bargain-basement prices.

See Chapter 8 for more information about foreclosure properties and Chapter 9 for details about finding properties in the other special markets: bankruptcy, probate, divorce, and government-owned properties.

Staying focused on a certain price range

Staying focused on a certain price range Exploring key resources for information on bargain properties

Exploring key resources for information on bargain properties Spotting potential flips in special areas of the market

Spotting potential flips in special areas of the market Specializing can help you master a narrow market, search more efficiently, and establish an edge over your competition. The fewer houses you have to look at, the more quickly you can inspect prospective properties, make your offer, and begin renovations.

Specializing can help you master a narrow market, search more efficiently, and establish an edge over your competition. The fewer houses you have to look at, the more quickly you can inspect prospective properties, make your offer, and begin renovations. Don’t overextend yourself, especially on your first deal. Calculate the total amount of money you need with enough padding to cover the costs of buying, holding, renovating, and selling the property. You need enough money to cover:

Don’t overextend yourself, especially on your first deal. Calculate the total amount of money you need with enough padding to cover the costs of buying, holding, renovating, and selling the property. You need enough money to cover:  Your agent should be able to set up a search with exactly what you’re looking for and configure options to automatically send you an e-mail or text message as soon as a match comes on the market. With many listing services, agents can add terms like “as is,” “bank owned,” “fixer-upper,” “short sale,” and so forth to the search criteria to search for bargains. If your agent can’t do this for you, find one who’s more tech savvy or has access to better tools.

Your agent should be able to set up a search with exactly what you’re looking for and configure options to automatically send you an e-mail or text message as soon as a match comes on the market. With many listing services, agents can add terms like “as is,” “bank owned,” “fixer-upper,” “short sale,” and so forth to the search criteria to search for bargains. If your agent can’t do this for you, find one who’s more tech savvy or has access to better tools.