U

nderstanding what is really happening to your company in a developing crisis is no easy task. It is vastly different than prudently planning for the next general economic downward cycle. To survive, you must commit to developing the plans and near-term performance necessary to be in business one more day! Start by finding and applying the power of your business. Once you know what you want to do and what you can do, it is much easier to know what to avoid.

Careful reviewing of the following three principles can help you and your business weather the storms in an economic crisis. This is true whether the problems are broad-based or more unique to your business. To survive in a highly disruptive period, you will have to do things you have never done before. All of which will be difficult … and necessary! Here are the three most important operating survival principles to take to heart.

It is axiomatic that you should never run out of cash in your business. However, what is critical is to understand exactly what happens to most businesses in a deep drop in economic activity. There certainly are differences between retail, distribution, manufacturing, and service businesses. In practice, however, the problems are the same. The cash flow needs and cycles do vary in these diverse business models. Each one may require a degree of renewed understanding in a crisis.

When you are in the middle of a crisis caused by a disruption in your business, it is easy to say after the fact, that you should have planned ahead.

Yes, you should have sufficient reserves to handle most expected declines in business volume. And … yes … you should have arranged the largest possible line-of-credit (LOC) with your financial institution in advanced. You can use a LOC as needed to handle growth in good times and to sustain the business in bad times. But you cannot go back to put those reserves and plans in place now. It is too late after you are plunged into a deep business hole with the corresponding huge drop in revenue.

Once in the wilderness with no clear vision ahead, where there is little if any cash in-flow, the first step is to stop all cash outflows. No payments should be made until you can prioritize exactly what should be paid and when. Concurrent with the stopping of all payments, you should be communicating with the key players in your operation. Here are some ideas and an approach that, once adopted, can make a measurable difference:

Take care of your employees first.

Set aside the cash needed to pay the currently due payroll and associated taxes. Then project the level of staffing needed in the very short-term. Develop your initial survive and thrive plans. Once those rough amounts are known, reserve the existing cash for specific purposes for at least thirty days.

Furlough employees who cannot be directly productive with customer services and production. If at all possible, maintain all employee benefits. Advise them that you are making new plans that you will share with them as soon as they are completed and proven viable.

Make an extra effort to be aware of any special government programs that might help your employees. Sometimes when things are bad, the government develops meaningful support for small businesses. Your bank, accountant, and attorney should be of some assistance in navigating this option. Do not use any such programs until you understand all their contingencies and their related regulatory applications.

Communicate with your major vendors.

Contact all of your critical vendors. Ask for new dating on all outstanding invoices. Negotiate some partial payments as needed to get this courtesy. Be firm and convincing that you just need some time to respond to the newly presented problems. Once you accomplish this, ask for dating on any new purchases in the next sixty days. Most vendors will squawk! But, if you have been faithfully paying them for years, they should allow some new deliveries to occur. They know how important it is to support you so you can resume more normal operations.

Make a tentative plan, to the extent that is possible, to pay all the smaller local vendors’ invoices in a timely manner.

These companies may be in exactly the same place you are. They all have families and employees who may be your current or future customers. Act on this portion of your payables as soon as you have your cash flow plan completed. Be sure that these allocated funds are not required for payroll or to keep a reluctant major vendor in the supplier mix.

Prioritize utilities, insurance, and similar critical invoices.

When developing a cash allocation plan for your total package of payables, be sure to recognize utilities and insurances as high priorities. You must keep the lights on and your risks covered to survive.

Talk personally with all of your landlords.

Landlords will be very hesitant to permit you to delay your rent payment. Ask with some solid feeling about the importance of this deferral to your recovery plan. Advise the lessors that you will catch up on the rent payments at a certain time in the not-too-distant future. Twelve months will probably be as long as you can reasonably defer one or two months’ rent payments. Ask for what you need for survival. Communicate the reasons for the request and the plans you are developing to transition from a survival mode.

Call your banker and ask for loan-payment deferrals.

You may need a ninety-day period with no mortgage or other loan payments. Again, ask for the flexibility you think you need to be able to allocate your limited cash to other uses. Detail out for them the limited cash flow to the priority payments you are establishing. To the extent that government action in desperate times are set up to backstop the banks, ask about these options. Follow your banker’s lead in this area. You may be pleasantly surprised at how helpful a good long-time personal banker can be to you and your business situation. They really do want you to survive and thrive!

For a business that sells on thirty-day terms, as the economy turns down and sales drop, accounts receivable are collected from prior periods. This anomaly can cause many people to feel they are in a much better cash position than they really are. Be aware of this fact and conserve cash.

As the economy and your revenues recover, Accounts Receivable and Work-in-Process will also increase. These normal and other current asset changes are going to have a dramatic increase as your business improves at the sales line. Be prepared! Plan for this cash utilization to occur.

What is often difficult to understand is just how much cash is consumed by working capital in a growth cycle. In normal times, growth in excess of 15% per annum will put a strain on most businesses. In a recovery cycle, percentage growth can be buried by what appears to be smaller absolute growth in working capital requirements. It is these incremental changes that happen faster than normal and put a lot of pressure on the business. They can put a business owner in exactly the place they do not want to be.

To avoid this situation, every business owner should first understand the “cash conversion cycle” in their business. With precise knowledge of the cash conversion cycle, and some basic estimating skills, it is easy to predict the amount of working capital required for a “normal” growth cycle. What is less clear is how much difference there will be in the historic customers’ payment processing as they too rebound.

Sales improvements will end when the cash required to support that growth is not available. Without this knowledge in hand and without the support of financial institutions, a business can get into a debilitating cash position at the wrong time.

So, plan for the growth you want and understand the cash you need to support that growth. Ask your banker and vendors for the flexibility required to regain your previous revenue operating levels. Otherwise, you may find yourself running out of cash, which is something you always must avoid.

You should have some expectation that the pressure banks are under will change on the upside of any downturn. Consequently, borrowing will eventually become more difficult. Expect to see more of the lending problems business customers may have experienced in the past.

In summary on this point, know how much cash you will require to survive and reinvent your business and then ask for what you need! Do not be shy! Ask with sensory acuity. Ask with a confident smile. Keep asking until you make the required combination of arrangements to “not run out of cash”!

It is surprising how many business owners expect to operate their businesses without written business plans. Hopefully, you are not in that group. But, if you are, that can now be in the past. Businesses without effective plans will never know how much greater results they would have had if they had taken the time to do some additional thinking and planning. A well-thought-out plan is a required document to know where you want to go and how to get there. That is really the essence of business planning: determining what the businesses will look like at a certain point in the future and what must be done to achieve that end.

When you see your business declining, it is hard to engage in a formal planning process. It is not the formality that makes the planning process valuable. It is the work behind the plan. That is the journey that is needed to initiate a rebound when you find yourself in a deeply depressed business environment.

Each step of the way should be planned to make sure that the results are achieved. You will need to specify short-term survival objectives and long-term strategy implementations to survive and thrive. All major objectives can best be realized by developing a detailed set of projects with clear responsibility and scheduled target dates identified. (Projects may be independent or combine both short-term survival objectives … and long-term thrive goals.) One of the many things that is critical to success with business planning and operations is to have a measurement system in place or at least in development to assure progress is actually being made.

We will address some of the diagnostic steps; the judicious changes in thinking required; and the planning techniques you can use to develop your shorter-term plans in the balance of this book. In addition, the associated cash flow schedules and inputs to help you figure out how to best address a changing market will be discussed.

Measured systems have proven over time to outperform unmeasured systems by approximately 20%.

The key to success for the business owner is to determine what things should be done and how to measure the actions to accelerate movement along the path. Without doing the work required to effectively develop and implement a business plan, most businesses will underperform. And in difficult economic periods, they could unexpectedly be at significantly increased risk. So, to survive and thrive you need a series of measurable outcomes.

As soon as you lay a foundation for planning, take the following three steps as you read and review the balance of this book:

First, develop a survival plan

with projected cash flows. Set up a specific cash weekly outflow for each of the first four to eight weeks. Set an ending cash balance objective for week four. Figure out how to operate to end the period with that amount of cash in hand. The key sections to this planning document are the sources and uses of funds and staffing strategies for this short four to eight-week time frame.

Second, prepare a six-month business plan

based on all the required changes needed to use your company’s strengths to take advantage of the disruption in the marketplace. This is a foundation-building phase. A major objective in this interval, after the survival period, is to establish and lower the “cash flow” break-even point for your business. If you have never determined your business’s breakeven operating level this exercise should yield some new insights. This new information can help drive necessary reductions of costs through operating modifications.

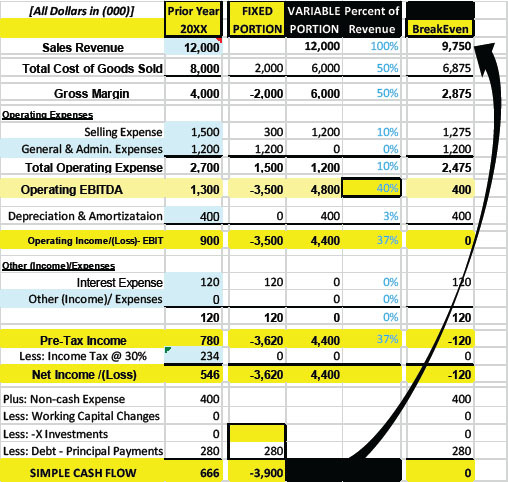

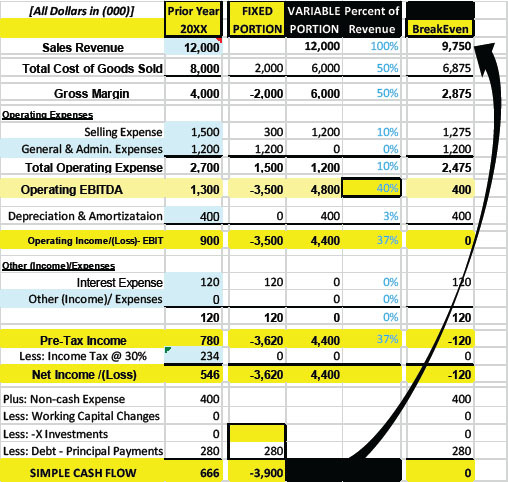

A review of the template provided here, with model figures, should help you understand the operation of the analysis. The first step is to determine the breakeven point for your business without any changes.

To do this analysis, study your different operating expenses to see what portion is “fixed.” Separate those expenses from the variable expenses in each category, as shown in the template above.

Be sure to recognize that depreciation is a “non-cash” expense and conversely that capital investments (CAP-X) are cash uses not shown on the income statement. Work up the “pre-tax” cash required to make your debt principal payments and compute the total “fixed payments” exhibited in your business. (Your accounting staff or another outside professional can help you do this analysis to keep all the moving parts in proper order. They can do this work in a relatively short time if asked.)

Compute the percentage relationship to revenue for the variable expenses in your system. Observe the variable percentage relationship of the EBITDA (Earnings before interest, depreciation, and amortization) to total revenue. (In the example, this is forty percent (40%). Divide the total “fixed expenses” ($3.9M in the example) by the EBITDA percent to compute the company’s break-even revenue level with the current “fixed expenses” in place before adjustment.

Once that is accomplished, the next step is to aggressively review every “fixed” expense to see what portion is partly discretionary and should be reduced. The second step in this restructuring effort is to reduce those expenses and reassess the lowered break-even point. If this new level still exceeds the anticipated revenue and gross margin projection, more work is indicated, both to gain revenue to bounce faster and to change the operation to further reduce the break-even point.

To emphasize this major action, let us look at the situation for this example company. If the projected revenue for the next six months is going to be at a lower annual revenue equivalent of only eight million dollars ($8M), more action is required. This projection should, in turn, prompt the owner to figure out how to reduce the “fixed expenses” down to three million two hundred thousand dollars ($3.2M). This is how the analysis affords the business owner the information required to re-plan operations.

Achieving a “cash flow break-even” position will buy you time and give you some peace of mind as you work toward the larger “bounce back” for your business. Exercising your thinking on the financial side of this picture should help you as you work “on your business” to change it to meet new market challenges.

Third

, once you have a foundation plan in place, adopt a strategy to thrive over the next two to three years

. This starts by preparing a strategic plan and a one-year business plan that fully exercises this identified strategy to foster growth in a fast-changing marketplace. (Suggestions on how to do this strategic planning in a shorter-than-traditional period will be presented later in this book.)

Too many business owners look at mounting problems and get stalled in what is the worst possible mental place. There is almost always a path forward if you have the right mindset, the right people to help you, and something of value for your customers. It takes an oversized measure of determination and perseverance to keep moving. Search for the critical inputs to a workable plan and put your thinking cap on. Once plans are in place, it is action and the maintenance of a positive attitude that will make the final difference. Don’t let fear and concerns about the unknown control your actions. Ask for the help you need. Plan effectively. Feel the fear and do it anyway … as the commercial says.

Buy time with prudent, creative actions … think and rethink before you act. But act in the time frame necessary to resolve the problems in front of you so you can get to the ones you cannot yet see!

The great basketball coach, John Wooden, insisted that his players understand and apply the following principle. It applies to both basketball and management decision-making. You will find that this approach is never more important than at times of crisis and mounting troubles.

Be quick … but don’t hurry!