Chapter 4

Researching Your Customers, Competitors, and Industry

In This Chapter

Identifying creative new ideas for business success

Identifying creative new ideas for business success

Asking smart questions

Asking smart questions

Employing effective, inexpensive research techniques

Employing effective, inexpensive research techniques

Riding the tide of a growth trend

Riding the tide of a growth trend

Big businesses hire research firms to do extensive customer surveys and to run discussion groups with customers. The marketers then sit down to 50-page reports filled with tables and charts before making any decisions. I rarely recommend this traditional approach, because people usually have far less time and money, let alone patience, than this approach demands.

Instead, in this chapter, I help you better understand your customers and competitors and, in the process, better understand yourself. I show you how to adopt an inquisitive approach by sharing simple, efficient ways of learning about customers and competitors. As a marketer, you need to ask questions and seek useful answers — something you can do on any budget. Often a resourceful marketer can learn something useful for free on the web and may even manage to avoid an expensive custom survey (although exercise caution with web data and opinions because they’re not always accurate nor are they as likely to be relevant to your particular situation).

Knowing When and Why to Do Research

Research can tell you about your customers, competition, and industry. If you can get a better idea or make a better decision after conducting market research, then research is worth your while. Moreover, sometimes research helps you explore your identity to improve the way you position yourself in the market (see Chapter 2 for an explanation of positioning as a marketing strategy). Another key reason for conducting market research is to identify the attributes or prioritized needs your clients seek and/or value. Furthermore, research can tell you whether a communication strategy (the way an ad, website, or mailing talks to the customer) is appealing and clear. The following sections highlight the most common reasons for you to conduct market research.

Researching to find better ideas

Information can stimulate the imagination, suggest fresh strategies, or help you recognize great business opportunities. Always keep one ear open for interesting, surprising, or inspiring facts. Subscribe to a diverse range of publications, read interesting blogs, and make a point of talking to people of all sorts, both in your industry and beyond it, to keep you in the flow of new ideas and facts. Also, ask other people for their ideas.

Don’t fall into the trap of spending all your time online, though. Make a point of talking to people face to face, too. Carry an idea notebook in your pocket or purse and try to collect a few contributions from people every day. This habit gets you asking salespeople, employees, customers, and strangers on the street for their ideas and suggestions. You never know when a suggestion may prove valuable. Lee Iacocca kept an idea notebook in his early days as a marketing guy in the auto industry — and out of those jottings came the idea for the Ford Mustang, one of the biggest brand successes in history.

Researching to make better decisions

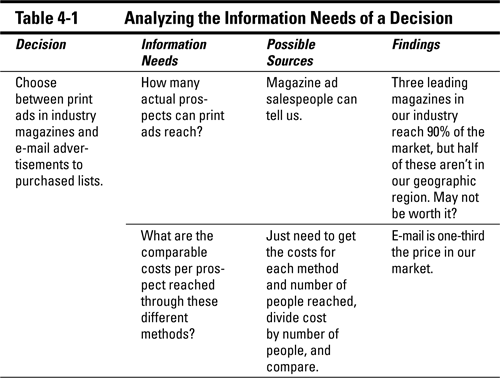

Do you have any situations that you want more information about before making a decision? Then take a moment to define the situation clearly and list the options you think are feasible. Choosing the winning ad design, making a more accurate sales projection, or figuring out what new services your customers want — these are the types of situations in which a little research can help you make important decisions. Table 4-1 shows what your notes may look like.

Researching to understand love and hate

Consumer reactions to your product or service determine your success and your product’s fate. Research can help you understand — and control — consumer reactions. Focus on the more extreme views that customers express — both positive and negative. If you collect a rating of all the descriptive features of your product from customers, many of those ratings will prove quite ordinary. A bank branch offers checking, savings, and money market accounts. So what? Every bank does. But a few of the features of that bank may be notably exceptional — for better or for worse. If the teller windows often have long lines at lunch when people rush out to do their banking, that notable negative stands out in customers’ minds. They remember those lines and tell others about them. Long lines at lunch may lead customers to switch banks and drive away other potential customers through bad word of mouth.

On the positive side of the ledger, if that bank branch has very friendly tellers and a beautifully decorated lobby with free gourmet coffee on a side table for its customers, plus a counter where a local deli sells to-go sandwiches and salads for hurried individuals to grab lunch while getting their banking done, the bank’s notable warmth and helpfulness sticks in customers’ minds, building loyalty and encouraging them to recruit new customers through word of mouth.

Do some research to understand your own brilliance curve (as I call it) by asking customers to rank you on a laundry list of descriptors for your business/product/service. The scale ranges from 1 to 10 (to get a good spread), with the following labels:

For example, the list of items to rate in a bank may include checking accounts (average), savings accounts (average), speed of service (poor), and friendliness of tellers (very good), along with many other factors you’d need to put on the list to describe the bank in detail. Getting customers to fill in a survey sheet is important enough that I’d consider offering them a reward for doing so. You can waive the fees on their checking account for the rest of the year if they mail in a completed form. Or (if you don’t mind honest feedback) you can ask them to fill in a rating form while standing in a potentially long line.

Your high-ranking attributes from the survey represent the features customers think you do brilliantly. The low scores represent the features you need some work on. Sometimes you find yourself with a fairly long list of things (product attributes) that you don’t score well on. To clarify which ones are most worthy of working on, you can ask customers to rate the importance of each listed item. Then you can focus your improvement efforts on the more important attributes.

Sometimes customers disagree about what’s more and less important (some customers may value speed or convenience over price, while others want quality at almost any price, for example). When you notice a rift with some customers clearly having different priorities from others, then you have an opportunity to segment the market by catering to one specific group of customers and its high priorities (see Chapter 2 for more on segmentation strategies). You can also notice new market segment opportunities as they first emerge in real time by tracking what customers are saying about brands on social networking sites.

Asking Really Good Questions

These days, you have an infinite amount of information at your fingertips. However, you probably don’t want a million-page report, even if it’s free. What you want is smart information that relates directly to important questions — questions that shape your marketing program and allow you to operate more successfully in the future.

Say you’re in charge of a 2-year-old software product that small businesses use to do their planning and financials. As the product manager, what questions should you be asking? The following are the most likely:

- Should we launch an upgrade or keep selling the current version?

- Is our current marketing program sufficiently effective, or should we redesign it?

- Is the product positioned properly, or do we need to change its image?

How do you go about answering your question? Creative information-gathering is the key, and sometimes it helps to follow a formal research process. Figure 4-1 depicts the market research process in flowchart form.

© John Wiley & Sons, Inc.

Figure 4-1: Follow this market research process to avoid common errors.

Paying Wisely for Market Research

Most mid-sized to larger businesses hire market research firms to gather information for them. I’m not saying that this approach is dumb, but as a first step, it usually isn’t the smartest because it guarantees an expensive, thick report when you probably just want a few clear answers.

Instead of doing a full-blown study of your own, try inserting a few questions into a panel — a regular survey of a group of people. A lot of vendors offer this option, including (in the United States) Darwin’s Data, PaidViewpoint, BzzAgent, Viewpoint Forum, tellwut, Opinion Outpost, MyView, KidzEyes, OpinionPlace, and Panelpolls. Browse the latest lists of survey panels through a Google search, or look at sites like www.surveypolice.com, which ranks polls based on feedback from users, and then collect price points and proposals from several before choosing one to run with.

Also look into survey sites like SurveyMonkey (www.surveymonkey.com), Zoomerang (www.zoomerang.com), PollDaddy (www.polldaddy.com), Constant Contact’s Listen Up option (www.constantcontact.com), and GutCheck (gutcheckit.com) for one-stop survey shopping. Working online, you can design survey questions, select a sample design, and (using your own database or, increasingly available, a sample arranged by the host site) send out your survey, collect data, and tabulate it. Does it make sense? Are you wiser as a result? Well, not every time. It takes practice and persistence to figure out how to extract useful findings from tables of survey responses, but at least it’s less expensive to trial balloon some questions through these sites than through traditional full-service survey research firms.

If your website gets at least a few dozen visitors a day, it can produce free survey results for you. A question with general appeal (something everyone’s invested in or curious about) may actually boost visitors at the same time it generates useful data for your marketing decisions. For instance, you could ask, “Should consumer product packages display honest information about the cost and environmental impact of the package?” A strong “yes” vote may really shake up packaging and display practices in your industry! The question would certainly attract interest from customers, bloggers, and the media in general.

Researching the Low-Cost (Or Free!) Way

Knowledge is power. Power to make smart decisions that bring in customers and profits. Who wants what? Which markets are going to grow and be hot, and which aren’t? It’s amazing how many businesses and other entities lumber along, working hard but not stopping to gather enough information to know how to work smarter. The following sections provide a lot of ways — some cheap and others free — to boost your marketing intelligence.

Observing your customers

Consumers are all around you, and they’re shopping for, buying, and using products. Observing consumers and finding something new and of value from doing so, isn’t hard. And even business-to-business marketers (who sell to other businesses rather than end-consumers) can find plenty of evidence about their customers at a glance. For example, the number and direction of a company’s trucks on various roads can tell you where its business is heaviest and lightest.

Despite all the opportunities to observe, most marketers are guilty of Sherlock Holmes’s accusation: “You have not observed, and yet you have seen.” Observation is the most underrated of all research methods. For example, when managers from the Boston Aquarium wanted to find out which attractions were most popular, they hired a researcher to develop a survey, but the researcher told them not to bother. Instead, he suggested that they examine the floors for wear and for tracks on wet days. The evidence pointed clearly to certain attractions as the most popular ones: The floors in front of those attractions had the most wear, and damp paths led to the attractions that visitors preferred to go to first. That was easy!

In business-to-business marketing, the first step in really seeing your customers clearly may be simply to clarify what professional titles your target customers are choosing and using these days. If you’re marketing technical tools for managing distributed databases, who should you target your message toward? Database managers, no doubt, but what if that function is being covered by people who don’t have “database” in their titles, like systems administrators or technology managers? And how do these people think, what are they talking about with their peers, and what kinds of concerns and new training are they interested in these days?

Professional social networks like LinkedIn (with 5.5 million high-tech managers and counting) can provide a window for your online investigations if you take time to study what people are posting and how their professional peer-to-peer networks are constructed. And when you’re clear as to which LinkedIn members are prospects, you can engage them through your own networking and also pay-per-click ads on LinkedIn.

Asking customers questions

Customer satisfaction changes with each new interaction between customer and product. If your product makes customers happy, they come back. If not, adios. Recruiting new customers costs anywhere from 4 to 20 times as much as retaining old ones (depending on your industry), so you can’t afford to lose customers — which means you can’t afford to dissatisfy them.

Find out (by asking or browsing) what social media your customers and prospects like and use. Do many of them use Flixster to watch movies or use Instagram to send photos and videos they make? Younger target audiences probably use both sites heavily. Or perhaps your prospects are older professional or academic people who use LinkedIn or Academia.edu. Wherever they’re networking, you may be able to observe or even interact with them about their needs, attitudes, and brand preferences. And, of course, your blog can attract comments and subscribers (whose e-mails you then capture so you can ask them to comment on future blogs). Maintain a presence on the social media sites where your customers are, and offer a link to your blog there to draw in comments and followers.

Keeping up with customer opinion is a never-ending race, and you need to make sure you’re measuring where you stand relative to those shifting customer expectations and competitor performances. The best way to do that is by asking questions directly of your customers. The next sections offer some advice for asking those questions and some sample questions you can use as models.

Posing your questions

Survey research methods are the bread and butter of the market research industry and for good reason. You can often gain something of value just by asking people what they think. Of course, survey methods have their shortcomings: Customers don’t always know what they think or how they behave, and even when they do, getting them to tell you can be costly. Nonetheless, every marketer finds good uses for survey research on occasion.

Considering some sample questions

Your customer satisfaction must be high, relative to both customer expectations and competitors’ ratings, before that customer satisfaction has much of an effect on your customer-retention rates. Make sure you ask tough questions to find out whether you’re below or above customers’ current standards. You can ask customers revealing questions, similar to the following list:

- Which company (or product) is the best right now?

Give a long list with instructions to circle one, and give a write-in blank labeled Other as the final choice.

- Rate [your product] compared to its competitors:

- Rate [your product] compared to your expectations for it:

For example, you can ask the following questions about an overnight letter carrier:

- Rate Flash Deliveries compared to its competitors on speed of delivery.

- Rate Flash Deliveries compared to its competitors on reliability.

- Rate Flash Deliveries compared to its competitors on ease of use.

- Rate Flash Deliveries compared to its competitors on friendliness.

- How likely are you to recommend Flash Deliveries to an associate or friend?

The final question addresses word of mouth, what the customer is likely to tell other prospective customers about your service or product. If you do well on specific questions about attributes of importance to the customer, then the customer will likely recommend you to others, thereby helping you build your market share.

Many marketers also pose questions or prompts about awareness (List the brands you’ve heard of), intent (Which brands are you interested in trying?), and usage and repeat purchase (Did you like it? Would you use it again?) to flesh out their research. Compare rates across this set of questions to see where your biggest challenge lies. If most people are unaware, promote! If they aren’t repurchasing, then improve or retarget.

Comparing your approach to that of your competitors

Also gather information on your competitors’ marketing programs, especially how they’re getting their marketing messages out. Are they advertising a fast-growing social network you hadn’t considered? If you have even a modest budget, consider the options for online research by firms like WhatRunsWhere (www.whatrunswhere.com), AdClarity’s media intelligence (www.adclarity.com), Competitrack (www.competitrack.com), Adbeat (www.adbeat.com), or AdGooroo (www.adgooroo.com), all of which can help you benchmark your ads (especially online advertising) against top competitors or role-model marketers (larger companies with the resources to spot new opportunities and trends quicker than you).

Creating a customer profile

Collect or take photographs of people (from Facebook or e-mail thumbnails, and with the individuals’ permission) who you characterize as your typical customers. Post these pictures on a bulletin board — either a real one or a virtual one like Pinterest (set this board to private because it’s definitely not for sharing beyond your marketing team) — and add any facts or information you can collect about these people. Consider this board your customer database. Whenever you aren’t sure what to do about any marketing decision, sit down in front of your bulletin board and use it to help you tune in to your customers and what they do and don’t like. For example, make sure the art and wording you use in a letter or ad is appropriate to the customers on your board. Will they like it, or is the style wrong for them?

Entertaining customers to get their input

Entertaining your customers puts you in contact with them in a relaxed setting where they’re happy to share their views. Hold a customer appreciation event or invite good customers to a lunch or dinner. Use such occasions to ask for suggestions and reactions. Bounce a new product idea off these good customers, or find out what features they’d most like to see improved. Your customers can provide an expert panel for your informal research — you just have to provide the food! (After they get to know you, they may be happy to give you ongoing quick feedback via a chat room, Twitter, or a group text message, especially if they use these media routinely themselves.) Another effective way to do this is to create a customer advisory board that recognizes top customers and makes them feel appreciated and heard.

Using e-mail to do one-question surveys

If you market to businesses, you probably have e-mail addresses for many of your customers. Try e-mailing 20 or more of them for a quick opinion on a question. The result? Instant survey! If a clear majority of respondents say they prefer using a corporate credit card to being invoiced because the card is more convenient, well, you’ve just gotten a useful research result that may help you revise your marketing approach.

E-mailing your question to actual customers or users of your product is far better, by the way, than trying to poll users of social networking websites for their opinions. Sure, you may be able to get a bunch of responses from people on Twitter, but would those responses be representative of your actual customers? Probably not. Your best source for quick feedback about any marketing question is your in-house list of e-mails, especially if you market to businesses.

Surfing government databases

Many countries gather and post extensive data on individuals, households, and businesses, broken down into a variety of categories. In the United States, you can find out how many people earn above a certain amount of money a year and live in a specific city or state — useful if you’re trying to figure out how big the regional market may be for a luxury product. Similarly, you can find out how many businesses operate in your industry and what their sales are in a specific city or state — useful if you’re trying to decide whether that city has a market big enough to warrant you moving into it.

Another useful way to explore U.S. Census Bureau data is to go to factfinder2.census.gov, which has links on the navigation bar to the left. Click on People to see breakouts and trends by age, sex, disability, education, employment, income, relationships, and so forth, or click on Business and Government to find out how many of which types of employers, manufacturers, wholesalers, or retailers are where.

Establishing a trend report

Set up a trend report, a document that gives you a quick indication of a change in buying patterns, a new competitive move or threat, and any other changes that your marketing may need to respond to. You can compile one by e-mailing salespeople, distributors, customer service staff, repair staff, or friendly customers once a month, asking them for a quick list of any important trends they see in the market. (You flatter people by letting them know that you value their opinions, and e-mail makes giving those opinions especially easy.) Print and file these reports from the field and go back over them every now and then for a long-term view of the effectiveness of your marketing strategies.

Note: Researchers wanting to do their own competitor monitoring at no cost may use Google Alerts to create customized search criteria for tracking competitor online activity (www.google.com/alerts).

Analyzing competitors’ collateral

Compare your own claims with those of your competitors. Are you impressive by comparison, or does a more dominant and impressive competitor’s claims overshadow you? Do your claims stand out as unique, or are you a me-too marketer without clear points of difference? The claims table helps you see yourself as customers do — through the lens of your marketing materials and in comparison to your competitors. Using this table often delivers uncomfortable moments of truth that force you to rethink and improve your marketing approach. (But be careful to base your claims on genuine strengths, not just advertising fluff, by understanding what makes you strong — see the following section.)

Researching your strengths

Perhaps the most important element of any marketing plan or strategy is clearly recognizing what makes you especially good and appealing to customers. To research your strengths, find the simplest way to ask ten good customers this simple but powerful question: “What’s the best thing about our [fill in the name of your product or service], from your perspective?”

The answers to this question usually focus on one or, at most, a few features or aspects of your business. Finding out how your customers identify your strengths is a boon to your marketing strategy. After you know what you do best, you can focus on telling the story about that best feature whenever you advertise, do publicity, or communicate with your market in any way. You can also concentrate your spending and improvement efforts on the factors customers like most about you.

Probing your customer records

Most marketers fail to mine their own databases for all the useful information those databases may contain. Study your customers with the goal of identifying three common traits that make them different or special. This goal helps you focus on what your ideal customer looks like so you can look for more of them.

A computer store I’m a customer of went through its records and realized that its customers are

- More likely to be self-employed or entrepreneurs than average

- More sophisticated users of computers than most people

- Big spenders who care more about quality and service than the absolute cheapest price

This store revised its marketing goal to find more people who share these three qualities. What qualities do your customers have that make them special and that would make a good profile for you to use in pursuing more customers like them?

Testing your marketing materials

Whether you’re looking at a letter, catalog, web page, tear sheet, press release, or ad, you can improve the piece’s effectiveness by asking for reviews from a few customers, distributors, or others with knowledge of your business. Do they get the key message quickly and clearly? Do they think the piece is interesting and appealing? If they’re only lukewarm about it, then you know you need to edit or improve it before spending the money to publish and distribute it.

Customer reviewers can tell you quickly whether you have real attention-getting wow-power in any marketing piece. Big companies do elaborate, expensive tests of ads’ readability and pulling power, but you can get a pretty good idea for much less money. Just ask a half dozen people to review a new marketing piece while it’s still in draft form. An even simpler (and very effective) technique is to make a list of possible headlines for an ad on a piece of paper and ask potential customers (or anyone in the industry whom you can talk into helping) to check the one they like best.

Interviewing defectors

Tracking down lost customers and getting them on the phone or setting up an appointment with them may prove difficult, but don’t give up! These lost customers hold the key to a valuable piece of information: what you do wrong that can drive customers away. Talk to enough lost customers and you see a pattern emerge. Probably three-fourths of them left you for the same reason (which can be pricing, poor service, inconvenient hours, and so on). That reason is for you to find out.

When your research reveals the most common reason for customers to defect from your product or service, do something about it. Plug that hole so you lose fewer customers down it. Keeping those customers means you don’t have to waste valuable marketing resources replacing them. You can keep the old ones and grow every time you add a new one.

Asking kids about trends

In consumer marketing, it’s best if customers think you’re cool and your competitors aren’t. Because kids lead the trends in modern society, why not ask them what those trends are? Ask them simple questions like, “What will the next big thing be in [name your product or service here]?” Or try asking kids this great question: “What’s cool and what’s not cool this year?” Why? Because they know, and you don’t. For example, if teenage girls know what the next cool color combo will be, the way to find out is simple: Ask them what colors they want their room to be. (Or visit social media sites that skew toward younger members and see how they’re decorating their pages.)

Even in business-to-business and industrial markets, kids and their sense of what’s happening in society can be helpful, often giving you early indicators of shifts in demand that may have an impact all the way up the line, from consumers to the businesses that ultimately serve them.

Creating custom web analytics

Web analytics are readily available for your websites and blogs, but they’re mostly traffic counts of various kinds. You probably want to know about sales, not just visitors. What are the most meaningful indicators of success on the web? Just as you (hopefully) do off-line, track online sales, repeat sales, lead collection, quality of leads (measured by rate of conversion), sign-ups, use of offers (such as you may post on a business site on Facebook, for example), and overall revenue and returns from e-marketing. These numbers tell the story of your marketing successes and failures online and give you something to learn from as you go.

Riding a Rising Tide with Demographics

Demographics — statistics about a population — are kind of boring to most people. Yet trends in the ethnic makeup of your market, its average age, its spending power, and its family structure provide you with good clues as to how your marketing ought to change. Aside from major new technologies, demographic trends are the biggest source of opportunities for businesses, yet they’re not regular reading for marketers or managers. Here are some opportunity-laden demographic shifts or trends concerning women in the United States (by way of illustration, but you can find more trends by doing your own research):

- The pay gap between men and women is closing, and women in their 20s are making 93 percent of the income of men of the same age. Still a gap but far smaller than in previous decades, which suggests growing purchasing power for women and an opportunity to reorient marketing toward them in financial services, realty, travel, continuing education, and many other markets. (My source: a widely web-available press release from PewResearch, dated December 11, 2013.)

- More women than men are going to college, and the trend is growing over time. Add this to a slower trend toward pay parity, and the suggestion is that women will outpace men as the educated and leading gender at some point in the not-too-distant future. Headhunter firms, makers of power suits, and just about everybody else, are you aware of and ready for this shift in gender roles? (My source: a free-on-the-web chart from a Forbes.com article, which shows the trends in enrollment for men and women over several decades.)

- In the 2008 U.S. Presidential election, 70.4 million women voted, compared to 60.7 million men (my source: the Center for American Women and Politics [CAWP], which posts such data freely on their website). The pattern emerged again in 2012 gubernatorial races, with women outvoting men by between 3 and 11 percentage points, depending on the particular race (also sourced for free from CAWP in a November 9, 2012, press release).

Women outvote men, and they’re also more likely to be socially liberal, which is producing (especially among younger voters) a big advantage for the Democratic Party, reinforced by the advantage it has with most minority voting blocks. But beyond politics, the voting power of women supports a general trend toward more active social and economic involvement and the likelihood that an emerging female social leadership trend is beginning that will have wide-reaching impacts on how people live, work, and shop.

- Women are having their first child (if they choose to have children) later than they used to, the mean age being 25.1 years. Record numbers are waiting to have children until their 30s or 40s. Also, births are declining slowly from year to year. These statistics are consistent with women going to college and pursuing professional careers at record rates. This tells you that you’re better off introducing products for professional women than new mothers if you want to enjoy a growth market. (My source: “The Changing Demographic Profile of the United States,” freely posted on the web by Congressional Research Service and a rich source of insight into dozens of interesting trends, from population growth to immigration to longevity.)

I’ve highlighted trends in one area, women in the United States, by way of example, but your demographic research should zoom in on a topic of your own choice. (For example, the U.S. Census Bureau projects a rapid increase in Hispanic Americans to 30 percent of the population by 2050, one of the hottest demographic trends.) Pick a growing group you think you may be able to tailor your offerings and message to. Back out of shrinking categories and regions. Go where the growth is, and you’ll ride the tide to demographic success. For example, start a professional club or association for women in a growing urban or regional market in the United States, and you’re guaranteed a fast-growing market for your services, which makes everything else about your marketing a lot easier!

Take advantage of the growing world of online social networking to talk to people about your product and how they view it. If you’re on Facebook, Twitter, or a blog website, chat up your friends and virtual friends for opinions, suggestions, and ideas. Much of what you get back will be chaff, but you may find the grain of a great new marketing idea in there, too. Pinterest, Flickr, and Instagram are highly visual, with members’ selections of photos, graphics, and other visual art rich in insights into how people are thinking, feeling, and living and how trends, needs, and concerns are evolving. A whole new art and practice of studying such websites is emerging, and you, too, can be an anthropologist of sorts, studying your own culture to seek business and marketing needs and opportunities, or even just to update the vocabulary (visual and verbal) you use in your marketing communications.

Take advantage of the growing world of online social networking to talk to people about your product and how they view it. If you’re on Facebook, Twitter, or a blog website, chat up your friends and virtual friends for opinions, suggestions, and ideas. Much of what you get back will be chaff, but you may find the grain of a great new marketing idea in there, too. Pinterest, Flickr, and Instagram are highly visual, with members’ selections of photos, graphics, and other visual art rich in insights into how people are thinking, feeling, and living and how trends, needs, and concerns are evolving. A whole new art and practice of studying such websites is emerging, and you, too, can be an anthropologist of sorts, studying your own culture to seek business and marketing needs and opportunities, or even just to update the vocabulary (visual and verbal) you use in your marketing communications. When asking for input and information on websites and in virtual web communities, be honest about who you are and why you’re asking for advice. If you tell people you’re in charge of marketing your product and want to know what they think of your new ad, many people will offer their views freely. If, however, you pretend to be someone outside the company who’s just trying to insert business questions into an innocent chat, people will sniff you out and be angry with you for subverting their social network for business purposes. Honesty and transparency are the keys to successful research in online communities.

When asking for input and information on websites and in virtual web communities, be honest about who you are and why you’re asking for advice. If you tell people you’re in charge of marketing your product and want to know what they think of your new ad, many people will offer their views freely. If, however, you pretend to be someone outside the company who’s just trying to insert business questions into an innocent chat, people will sniff you out and be angry with you for subverting their social network for business purposes. Honesty and transparency are the keys to successful research in online communities.