Murali Manohar Bhupathi

This chapter examines product as a concept and addresses some core issues around products for managers to comprehend. Understanding the levels of products is a strong starting point, followed by a brief introduction to the Product Life Cycle concept, new product decisions, and the idea of a product mix. Subsequent chapters address new products in detail, explore branding and highlight issues in packaging. A special chapter is also devoted to services as a manifestation of intangible products.

Organizations offering products to the market can focus on a physical product or a service depending upon the line of business. In simple terms “a product is anything that the company offers to the market for a price,” but there are many additional factors to be considered in order to maximize its chances of success in the ever-competitive markets. Let us look at some of the definitions offered by leading scholars or agencies.

The American Marketing Association (AMA) defines a product as “the bundle of attributes (features, functions, benefits, and uses) capable of exchange or use; usually a mix of tangible and intangible forms.”a Thus, a product may be an idea, a physical entity (a good) or a service, or any combination of the three. It exists for the purpose of exchange to satisfy individual and organizational objectives.

Kotler, Armstrong, Brown, and Adam (2006) define the term product as “anything that can be offered to a market that might satisfy a want or need.”1 For them, a product is more than something physical; it is anything that can be offered to a market for attention, acquisition, or use, or something that can satisfy a need or want. Therefore, a product can be a physical good, a service, a retail store, a person, an organization, a place, or even an idea. Products are the means to an end wherein the end is the satisfaction of customer needs or wants.

Kotler et al. (2006)1 describes the three product-related characteristics in the following way:

• Need: any basic requirement

• Want: a specific requirement for products or services to match a need

• Demand: a set of wants plus the desire and ability to pay for the exchange

India’s largest industrial house TATA group* identifies customers and offers products which fulfill their basic needs such as potable water, food, and breweries. Within these categories, consumers will seek satisfy wants by requiring certain types of food or brewed products. In the transportation category, they would rather own a car instead of a two-wheeler.

*The TATA group comprises over 90 operating companies in seven business sectors: communications and information technology, engineering, materials, services, energy, consumer products; and chemicals. The group has operations in more than 80 countries across six continents, and its companies export products and services to 85 countries.

The total revenue of Tata companies, taken together, was $83.3 billion (around Rs. 379,675 crores) in 2010–2011, with 58 percent of this coming from business outside India. Tata companies employ over 425,000 people worldwide. The Tata name has been respected in India for 140 years for its adherence to strong values and business ethics.

Every Tata company or enterprise operates independently. Each of these companies has its own board of directors and shareholders, to whom it is answerable. There are 28 publicly listed Tata enterprises and they have a combined market capitalization of about $81.29 billion (as on October 13, 2011), and a shareholder base of 3.5 million. The major Tata companies are Tata Steel, Tata Motors, Tata Consultancy Services (TCS), Tata Power, Tata Chemicals, Tata Global Beverages, Indian Hotels and Tata Communications.

Tata Steel became the tenth-largest steelmaker in the world after it acquired Corus, later renamed Tata Steel Europe. Tata Motors is among the top five commercial vehicle manufacturers in the world and has recently acquired Jaguar and Land Rover. TCS is a leading global software company, with delivery centers in the United States, the United Kingdom, Hungary, Brazil, Uruguay, and China, besides India. Tata Global Beverages is the second-largest player in tea in the world. Tata Chemicals is the world’s second-largest manufacturer of soda ash and Tata Communications is one of the world’s largest wholesale voice carriers.

Source: Business Standard.

The TATA group identifies needs of the customers based on the basic principle of human survival reflected in the title of the classic Bollywood hit movie titled Roti, Kapda, and Makhan (i.e., food, clothing and shelter). The group offers the following products under the food category; that is, additives (various brands of salt), brewed products (tea, coffee, etc.), and consumables through restaurant chains like Ginger and luxury brand Taj group of hotels across the world. In a similar way, in the clothing category they are into retailing of ready-to-wear garments through their brand of stores “Westside” across the country. Finally, in the shelter category they are into developing residential and commercial properties across the country through their group, Tata Housing.

On the principles of Business Opportunity Identification (BOI), Tata’s consumer products and chemicals group identified the problem of access to pure drinking water in most parts of urban/rural India. The problem of access to potable drinking water has given rise to revenues of Rs. 254 crores (i.e., Rs. 2.54 billion) as the size of the market today. Water shortages around the world and particularly in the developing countries have opened new doors for the bottled water industry. Bottled water is sold in a variety of packages right from 200 milliliter (ml) pouches and glasses, to 330 ml bottles, 500 ml bottles, one-liter bottles and even 20- to 50-litre bulk water packs. In terms of cost, the bottled water business in India can be divided broadly into three segments: premium natural mineral water, natural mineral water, and packaged drinking water.

TATA group offers bottled water to the natural mineral water segment under the brand name “Himalayan.” Enriched by nature, Himalayan, the only internationally accepted quality natural mineral water in India, is endowed with vital organic minerals.

Himalayan water is untouched by human hands, unprocessed, and has a unique taste acquired over years of filtration as it makes its way to the underground aquifers. The presence of natural minerals differentiates Himalayan from other bottled water brands and fortifies it with qualities that benefit the customer.

The packaging is uniquely enhanced with the creation of a myth around the brand, a tale about water, using an interesting narrative structure. The contemporary logo depicts a fountain of pure water, the elixir of life.

The TATA group, not satisfied with just launching bottled water, wanted to enter the purifier market, as most of the middle/lower classes of Indians cannot afford to buy water for meeting their daily need of drinking potable water. Most Indians by default collect water either through the public supply system or by boring wells; then the common citizen either boils the water or uses other methods of purification like using crystal/water filters operating either on power or non-power sources available in the market. To date, they are not offering any water purifiers which run on power. This segment of the market is dominated by brands like Aquaguard and Kent. The Tata group is planning to enter this segment in the near future.

Kotler et al. (2006) defined five levels of a product:

• Core Benefit: The fundamental need or want that consumers satisfy by consuming the product or service.

• Generic Product: A version of the product containing only those attributes or characteristics absolutely necessary for it to function.

• Expected Product: The set of attributes/characteristics that buyers normally expect and agree to when, they purchase a product.

• Augmented Product: Inclusion of additional features, benefits, attributes, or related services that serve to differentiate the product from its competitors.

• Potential Product: All the augmentations and transformations a product might undergo in the future

Kotler et al. (2006)1 also noted that much competition takes place at the augmented product level rather than at the core benefit level or, as Levitt (1960) put it: “New competition is not between what companies produce in their factories, but between what they add to their factory output in the form of packaging, services, advertising, customer advice, financing, delivery arrangements, warehousing, and other things that people value.”2 Kotler et al. (2006)’s model provides a tool to assess how the organization and their customers view their relationship and which aspects create value. Harvard professor Ted Levitt defined this development process 40 years ago in his article “Differentiation-of anything.” He described four categories of a product:b

• Generic — the “table stake” to get into the game

• Expected — the customer’s minimal expectation for the product

• Augmented — voluntary or unprompted improvements

• Potential — what is possible; what remains to be done.

To understand the concept of levels of product, let us look at what TATA group’s automobile division, Tata Motors, has done in designing its most hyped product “TATA NANO” across the globe as the cheapest car, costing Rs. 100,000 (less than USD 2500). The design team at the company needed to come up with a car within the targeted cost, that is, less than Rs. 100,000. The car also needed to meet the regulatory requirements of the Government of India with respect to passenger vehicle standards like emission, safety features, etc. In addition, the car also needed to meet the acceptable performance standards like mileage, pickup, etc. It took almost 10 years to design the car from its announcement by Ratan Tata until its official launch in 2009.

Tata Nano can be best explained in terms of levels of product. The core product is the car middle class consumers in India desire to own but cannot afford. So, Tata Nano was figured out the solution to satisfy the need of the Indian passenger car market. The core benefit that Nano offered was a transportation solution that can carry four people easily which, otherwise, most Indians were fulfilling through their two-wheelers.

The product life cycle (PLC) theory is used to understand and analyze the various stages of evolution of products and industries. Product innovation and diffusion reflect long-term patterns of purchase. The term product life cycle was used for the first time in 1965 by Theodore Levitt in a Harvard Business Review article: “Exploit the Product Life Cycle.”c The basic idea inherent in the article is that irrespective of the kind of product consumed, all products introduced into the market go through life cycle stages.

PLC refers to the time period between the launch of a product into the market until it is finally withdrawn. In a nutshell, PLC is a product’s odyssey from being new and innovative to becoming old and outdated! This cycle is split into four different stages: from its entry to exit from the market.

A product’s entry or launching phase into the market corresponds to the introduction stage. As the product gains popularity and wins the trust of consumers its sales begins to grow. Further, with increasing sales and growth, the product captures enough market share and attains stability in the market. This is called the maturity stage. However, after some time, the product gets challenged and is finally replaced by the latest technological developments and entry of a superior product of a competitor in the market. Soon the product becomes obsolete and needs to be withdrawn from entering the decline phase. This is the crux of the PLC theory expressed in the rise and fall of India’s leading two-wheeler manufacturing company “Bajaj” in the case that follows:

Levitt (1960) in the article “Marketing Myopia” emphasized that “Sustained growth depends on how broadly you define your business — and how carefully you gauge your customers’ needs.” To meet growth needs companies need to make sure that they have a set of products with variants to meet the needs of different segments of customers through its product mix decisions. Let us look at the various products offered by Tata Motors under its product mix decisions.

To keep up with customers’ needs and the rival operators in the industry, the company needs to ensure a steady flow of new products. When aiming to be the first to market with new products, the need is to invest heavily in innovation. This is a high-cost, high-risk strategy, but the payoff can be immense especially if the innovation is patented.

How to develop new products?

The following represent a broad brush of ideas that go into NPD to be elucidated in Chapter 8.

• Generate ideas for new and modified products: for example, from customer feedback, employee suggestions, and technical developments.

• Assess how these ideas fit with your strategy, market position, and skills; confirm that you have the resources to devote to development.

• Research the market, assessing customer requirements and sales potential; identify key risks and plan your marketing strategy.

• Research the competition and potential competition; learn from competitors’ successes and failures.

• Form a project team covering all the key skills (e.g., marketing, design, production, purchasing, and finance) and led by a product champion.

• Plan the critical path, identifying which activities must be undertaken first and which can happen in parallel.

• Set budgets, objectives, and timescales; regularly assess progress during the product development project and, if necessary, modify plans.

• Assess other risks to the project such as technical hurdles and whether your intellectual property can be protected.

• Define the basic product specification and translate specific features into product requirements; identify your key selling points.

• Estimate the likely selling price and set target production costs; assess likely actual costs of development and production, allowing for contingencies.

• Design the product, taking into account marketing, production, and purchasing requirements.

• Develop a prototype: iron out technical and production issues and obtain test market reactions; make any necessary changes.

• Gear up for full-scale production and launch the product.

• Continue to monitor the product’s success and look for opportunities to further develop it.

At the same time, the company must make sure to avoid the following:

• Develop new ideas without adequate market research

• Overlook the threat of new competition

• Attempt over-ambitious projects

• Let your existing products become stale

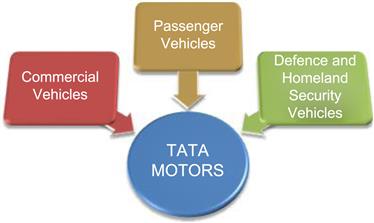

Tata Motors Limited is India’s largest automobile company and was established in 1945. Tata Motors’ presence indeed cuts across the length and breadth of India. Over 5.9 million Tata vehicles ply on Indian roads, since the first one rolled out in 1954. With consolidated revenues of USD 27 billion in 2010–2011, it is the leader in commercial vehicles in each segment, and among the top three in passenger vehicles with winning products in the compact, midsize car, and utility vehicle segments. The company is the world’s fourth largest truck manufacturer, and the world’s third largest bus manufacturer. Tata Motors offers its various products meant for various segments of the automobile industry both in India and across the world. Tata Motors offers its products under three major product lines: commercial vehicles, passenger vehicles, and defense and homeland security.

The commercial vehicles are again split into two categories: goods vehicles and passenger vehicles. Under goods vehicles, they offer Medium & Heavy Commercial Vehicles (MHCV), Intermediate CVs, Light CVs, and Small CVs. Under the passenger vehicles category, they offer buses and mini transport vehicles under various names like Magic, Winger, etc.

The Passenger vehicles are again split in to five categories viz., hatchbacks, sedans, pickup, crossover, and utility vehicles. Under hatchbacks, they offer Nano, Indica, and Vista. Under sedans, they offer Manza, Indigo, and several variants. Under pickups, they offer Xenon XT, and for crossovers they offer Aria. Under the utility vehicles, they offer Sumo Vista, Safari, and Grande Venture.

Every company should aim for a product mix that achieves synergies and fits the overall marketing strategy to fulfill the needs of different segments. Importantly, they should sell products which customer’s desire. Developing products that share the same underlying platform also result in cost-effective way of using the existing product expertise and expanding the offerings to the market.

Tata Motors also offers variants of Jaguar and Landover vehicles, as they have become part of the product portfolio of Tata Motors recently. Thus, the company offers different products depending on the need of the end-users. The company needs to track the consumer’s change of tastes and preferences continuously to come up new products through using market surveys and other techniques wherein they can come up with new products/variants in this competitive industry. As part of this strategy, Tata Motors has developed a new product meant for India’s masses who wish to move up from their traditional mode of transportation for the full family with a two-wheeler to a car. This was aptly called the Tata Nano.

CASE: PRODUCT DECISIONS

Tata Nano and Bajaj Scooter — Milestones in Indian Auto Market

Murali Manohar Bhupathi

The Nano was designed with basic features needed by any car like four wheels, windscreen, and seating for four people. Expected product features include basic pickup which is based on the engine capacity, mileage, etc. The base version sells for Rs. 100,000, without air-conditioning, audio system, power steering, power windows, etc. The augmented product is achieved through add-on features. The major attractive feature of the launch of the Nano was its unique funding/financing offer that they made to the millions of Indian consumers through TATA Finance. A customer can buy a car with a basic down payment option of as low as Rs. 15,000 for the standard version to Rs. 24,000 for its highest version, that is, LX model. Let us assume that a consumer wishes to buy the standard version of Nano by paying a base amount of Rs. 15,000 and for the balance he avails a loan from the Tata Finance; the consumer needs to avail Rs. 85,000 loan to buy the car with a repayment period of, let’s say, 60 months or 5 years with an interest rate of 15 percent per annum, then the Equated Monthly Installment (EMI) the consumer needs to pay will be Rs. 2023. This means the EMI is less than USD 40 a month. Nano’s standard version, however, did not gain the acceptance of many Indian customers, even though it was developed by India’s leading organization, Tata.d (Picture: Tata Nano on the streets in Tamil Nadu, India)

The Tata Nano offered an incredibly spacious passenger compartment, which allowed comfortable seating for four adults. With a length of just 3.1 meters, width of 1.5 meters, and height of 1.6 meters, the Tata Nano has the smallest exterior footprint for a car in India but is 21 percent more spacious than the smallest car available today. A high seating position makes entry and exit easy. Its small size coupled with a turning radius of just 4 meters, makes it extremely maneuverable in the smallest of parking spaces. Even though Tata Nano was designed for the Indian market, today it is being offered across the globe to the growing markets in South East Asian counties, Africa, and South American counties.

Bajaj Auto Limited is India’s largest manufacturer of scooters and motorcycles. The precursor to Bajaj Auto was established on November 29, 1945 as M/s Bachraj Trading Ltd. It began selling imported two- and three-wheeled vehicles in 1948 and obtained a manufacturing license from the government in 1960.e

Introduction Stage: Bajaj Auto developed its Vespa scooter with the technical support of the leading two-wheeler maker from Italy in 1960. Once the product was ready, a test market was carried out to check the viability of the product in the actual market, before it could set foot into the mass market. Results of the test market were used to make corrections, if any, and then launched into the market during 1961. When the product was just introduced, growth was very slight, market size was small, and marketing costs were steep (promotional cost, costs of setting up distribution channels). This introduction stage was clearly an awareness creating stage and was not associated with profits. However, strict vigilance is required to ensure that the product enters the growth stage. Identifying hindering factors and nipping them off at the bud is crucial for the product’s future success. If corrections cannot be made or are impractical, the marketer would need to withdraw the product from the market.

Growth Stage: Once the introductory stage goes as per expected, the product is on its way to growth. By 1970 the company produced and sold 100,000 vehicles with an annual turnover of Rs. 72 million. The oil crisis during this time sparked the growth of sales for scooters. Many Indian car users shifted to scooters as they were cheaper to buy and many times more fuel efficient. As output increased, economies of scale and better prices resulted, contributing to profits at this stage. At this stage, the marketers must maintain the quality and features of the product (and may even add additional features) and seek to build the brand. During this time Bajaj Auto introduced many new models like Bajaj Chetak, Bajaj Super. As sales increased, distribution channels were added and the product was marketed to a broader set of customers. Thus, rapid sales and profits were characteristics of this stage. By the end of 1977, Bajaj Auto was able to manufacture and sell various brands of two-wheelers as indicated above along with three-wheelers (Picture: Popular brand of Bajaj scooter among the youths in India).

Maturity Stage: This stage attracts the most competition as different companies struggle to maintain their respective market shares. New two-wheelers entered the Indian market by 1980 including Japanese and Italian scooters. Bajaj introduced more fuel-efficient M-50 model in 1981 to counter the increasing competition from other companies. It also introduced another model M-80 and motorcycle Kawasaki Bajaj by 1986–1987. The company also introduced a niche product, Bajaj Sunny, by 1990 to counter the ever-increasing competition in the two-wheeler segment. During this period, Bajaj was monitoring its product’s value to the consumers and its sales. Most of the profits are to be made during this stage with research costs at a minimum. In the midst of stiff competition at this stage, companies may even reduce their prices in response to the tough times. The maturity stage is the stabilizing stage, where sales are high but the pace of growth is slow; however, brand loyalty keeps generating profits.

Decline Stage: After a period of stable growth, the revenue generated from sales of the product starts dipping due to market saturation, stiff competition and new technological developments. The consumer loses interest in this product and begins to seek other options like motorcycles with greater fuel efficiency. This stage is characterized by shrinking market share, dwindling product popularity, and plummeting profits. This stage is also a very delicate stage and needs to be handled wisely. The type of response contributes to the future of the product. By 1997, intense competition was beginning to hurt sales of Bajaj at home and abroad.

Bajaj’s low-tech, low-cost cycles were not faring as well as its rivals’ higher-end offerings, particularly in high-powered motorcycles, since consumers were withstanding the worst of the recession. Several new designs and a dozen upgrades of existing scooters came out in 1998 and 1999. These, and a surge in consumer confidence, propelled Bajaj to sales records, and it began to regain market share in the fast-growing motorcycle segment. Sales of three-wheelers fell as some states, citing traffic and pollution concerns, limited the number of permits issued for them. The company needed to make a special effort to raise the product’s popularity in the market once again by reducing cost, tapping new markets, or by withdrawing the product.

The story of scooters in India should have ended there, but it did not. Suddenly, scooters began making a comeback in a big way in the country. Last year, more than two million scooters were sold in India — far more than sales in the heydays of Bajaj scooters. The market is growing at over 40 percent and suddenly every other manufacturer wants to play in it. So, how did a market which was once given up for dead suddenly make a comeback?

1. Do you suggest the Tata group’s consumer products and chemicals to enter the powered water purifier segment? If so, what should be the strategy of the company to enter the market, that is, through the acquiring an existing product/brand or creating a new product?

2. Suggest the possible countries where Tata Nano can be introduced with the details regarding the potential size of the market, existing competition, entry strategy like exporting/setting up a dedicated manufacturing facility, etc.

3. Do you think Tata Nano can be exported to European Markets also? If so what are the changes they need to carry out in the product in terms of positioning, segment to target, etc.?

4. What do you think about the future for the scooters segment in India and other developing countries? Suggest a suitable strategy for Bajaj Auto to revive the scooter segment for the company both in India and abroad?

5. Does Innovation lead to the creation of new products? If so, do you see any innovative processes adopted in the development of Tata Nano?

Tata group can determine to enter the powered water purifier segment only, if they shift their basic idea from serving the masses to a middle-high income groups. The company can acquire an existing brand, as they have done with some leading brands like Tetly for tea, JLR in automobile segment. The decision to acquire/create a new brand or product depends purely based on the market opportunities locally and globally for the powered water purifier.

Tata Nano, the compact common man’s car as perceived by Mr. Ratan Tata, can be launched in all those countries, where common man do not have access to better transportation systems as in case of most of the developed countries and their metro/major cities across the globe. So, Tata Nano can easily be introduced in most parts of the developing world where the socio-economic conditions of the citizens are like African countries, South-Asian countries, South-American countries and Middle-East.

Yes, they can serve these developing counties either by setting up their manufacturing facility, either by them self or through contract manufacturing route, or by franchise/license manufacturing route also.

Yes, Tata Nano can be launched in developed counties like Europe and North America, etc. The product can be positioned as an easy urban transport option at a cost of a bike. To make this happen, they need to re-engineer their car with basic safety standards, features, etc. Here, cost may not be the critical component than safety and standards of the car.

The car can be positioned as a car suitable for young, first time owners, compact parking solution seekers, etc.

The future for scooter segment in India is declining as the changes in the attitude of the customer segment. But Bajaj can revive the status of their scooter segment by modifying the product design like from geared scooters to un-geared/auto geared scooters. If they incorporate this change, they can easily target urban women and young kids for their product, as this segment is also a growing segment of automobile users in India. The success of many other two-wheeler companies like TVS, Honda, Suzuki in this segment can be a lesson for Bajaj also.

Yes, Bajaj can introduce the modified version of their scooters in most parts of the South Asian countries, African continent, South American countries and in Middle-East too.

Yes, Innovation can lead to new products which is already proven with many of the Apple products like I-Pad, I-Phone, Tabs, etc.

Tata Nano, has adopted many of the innovative practices as part of developing the car, in terms of re-engineering the design process from standard costing model to target costing model, that is, based on the selling price, the designers worked backed words to understand the capacity of the engine, features, style, and comfort components for the car. They have also re-invented the auto industry standard practice of assembly line production to CKD assembly model as it happens with bi-cycle industry. The dealer can assemble the car at his work shop instead of getting a completely built unit from the factory. By doing this, Tata could able to bring down the cost of transportation of their car, etc.

a. https://www.ama.org/resources/Pages/Dictionary.aspx?dLetter=P

b. http://www.provenmodels.com/16

c. http://www.buzzle.com/articles/product-life-cycle-theory.html

e. http://www.fundinguniverse.com/company-histories/bajaj-auto-limited-company-history.html