The following are excerpts with some related commentary from the appraisal of an apartment complex, which used a form rather than a narrative format. Exhibit 6.1, the first portion of the form, shows the entries for expenses, followed by the income approach information.

Annual Expense Analysis

Note that the appraiser has made some notes explaining why the forecast may differ from the actual expenses. Here the forecast is about $11,000 lower than the actual expenses. The explanations for the reason that the forecast is lower are important. It appears that the appraiser has adequately explained them in the comments.

In order to estimate the rent for the subject property, the appraiser has researched other rentals and has found three comparable properties, as shown in Exhibit 6.2, from which to determine the market rent for the subject. Note that the property is located in a small town outside Portland, Oregon, and since there were few rentals in the area, rents from Portland are being used. The appraiser also notes that asking rents in the specific city were researched on Craigslist.

Comparable Rental Data

Since rents are rarely negotiated for apartments, the asking rent range is good evidence for the market rent estimate, which is shown in Exhibit 6.3. However, the rents from a more highly populated area would normally be suspect without the Craigslist information because often rents are lower in less urban areas. In this appraisal, the rents on the apartments are restricted, and this is noted in the comments. The value is therefore hypothetical.

Monthly Rent Schedule

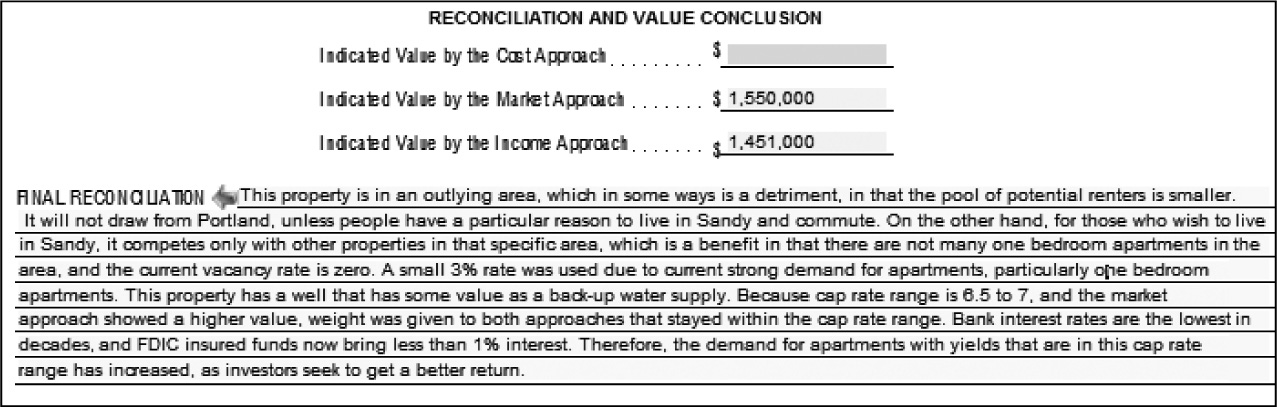

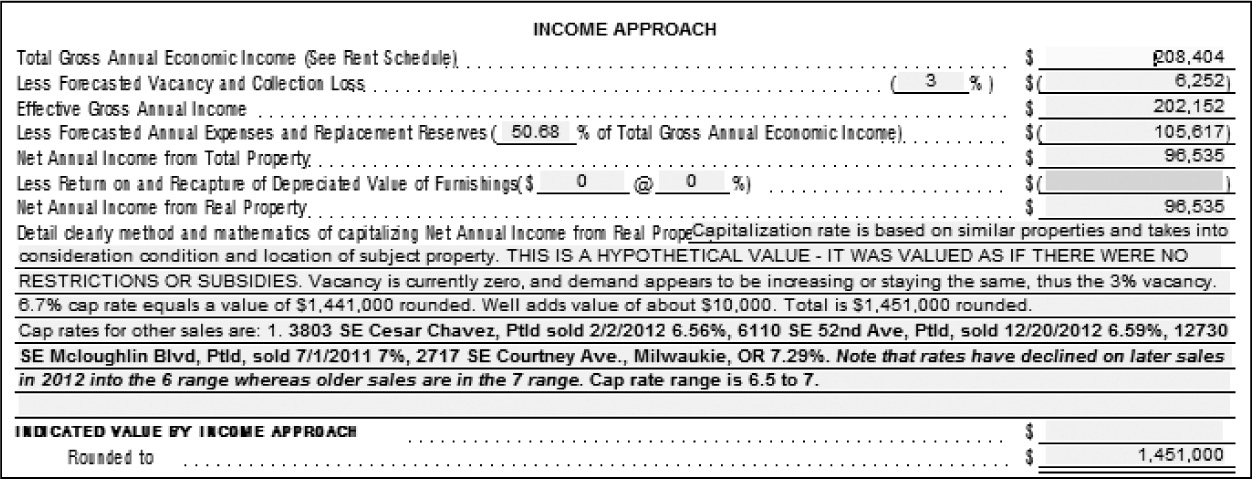

The final value for the income approach on the form in Exhibit 6.4 shows the impact of the expense ratio, vacancy rate, and collection loss percentage.

Income Approach

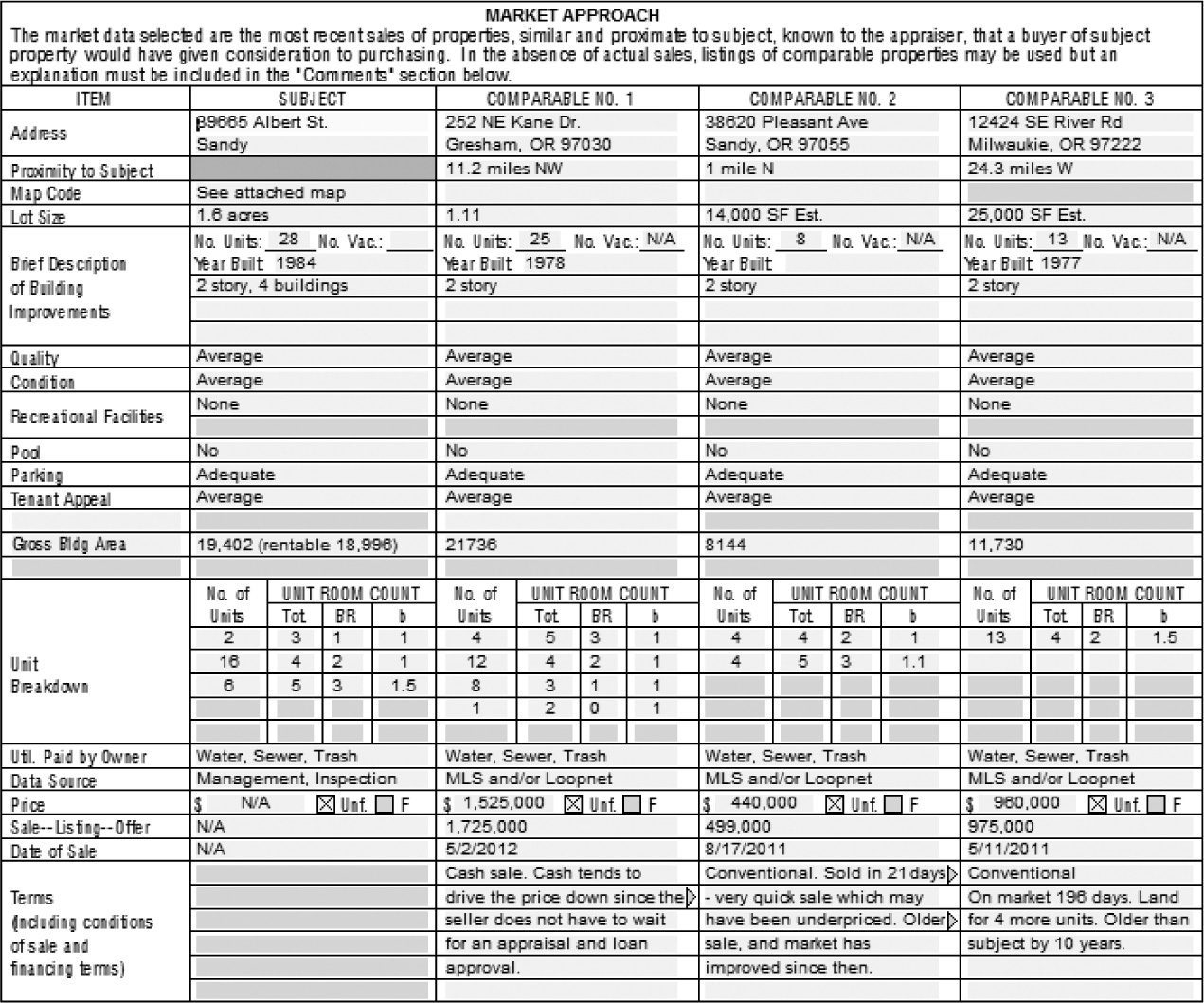

The form in Exhibit 6.5 shows the market approach, also called the comparable sales approach. (The one-page form is shown over two pages for easy viewing.) Exhibit 6.6 provides the appraisal reconciliation.

Market Approach

Reconciliation and Value Conclusion