The following are excerpts from an example of an industrial facility appraisal with some related commentary. It includes office space as well as manufacturing space. Most industrial facilities will have both.

The subject was constructed in 1997, with some additions made up to 2004. The buildings are mostly engineered steel construction, which are classified by the Marshall Valuation Service as a standard Class S heavy industrial manufacturing construction. This type of structure includes construction materials and characteristics common among industrial buildings. The improvements consist of a heavy steel I-beam frame, steel panel walls, a steel roof frame, and a steel panel roof.

The main manufacturing facility includes crane runways for 12 cranes ranging in capacity from 6 to 55 tons. The crane bridges and hoists are valued with the personal property. The facility includes rooms of various dimensions and wall heights, and it has been labeled by Prosteel based on the operations conducted in those areas. We have utilized Prosteel’s nomenclature in discussing the subject improvements.

The subject consists of 472,334 square feet of improvements that are owned by Prosteel, and an additional 37,510 square feet of buildings leased from the Port. The leased buildings include a 5,010-square-foot office building and a 32,500-square-foot warehouse that are not part of this appraisal.

The main production facility is 434,506 square feet, and there is a freestanding two-story office building of 29,640 square feet. In addition, there is a freestanding training center of 1,848 square feet, a freestanding paint room of 4,830 square feet, and a freestanding paint intermix building of 1,510 square feet. The site improvements include concrete and asphalt paving, areas that have been graded and gravel covered, rail spurs, perimeter fencing, and so on.

The current use is for heavy industrial manufacturing that processes steel coils.

1997 for most of the facility.

Average to good. This property is in average to good condition by observation, but we have not inspected the property for hidden defects and cannot warranty or guarantee the condition. Our estimate of condition is based simply on basic observation.

Mostly one. The Administration Building and one of the electrical equipment rooms have two floors. This represents only a small percentage of the overall floor space. The Cold Mill Building also includes a basement area of approximately 10,865 square feet.

The dimensions of the entire complex are irregular. The dimension of each of the individual buildings is fairly regular.

472,334 square feet.

440,433 square feet, or 93 percent of the gross building area.

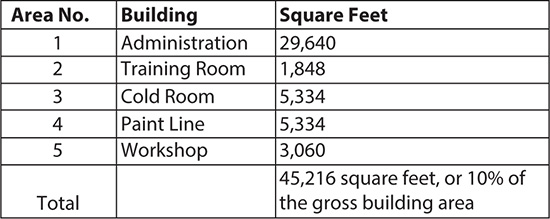

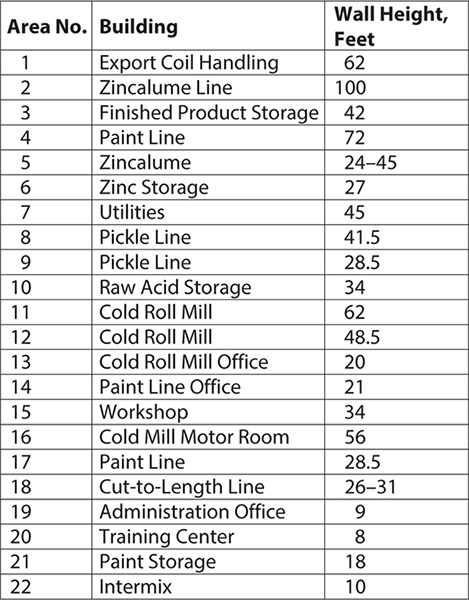

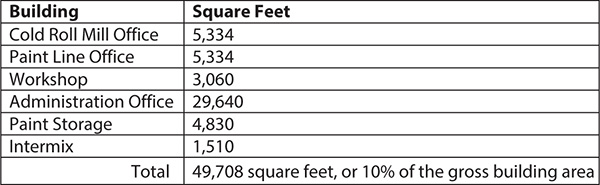

45,216 square feet, or 10 percent of the gross building area. See Exhibit 8.1.

Details of the Office Area

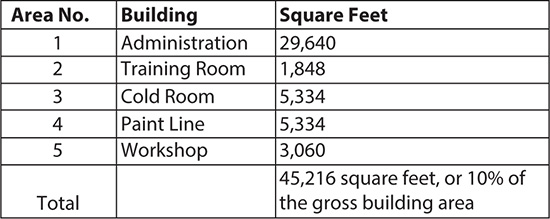

51,556 square feet, or 11 percent of the gross building area. See Exhibit 8.2.

Details of the Heated Floor Space

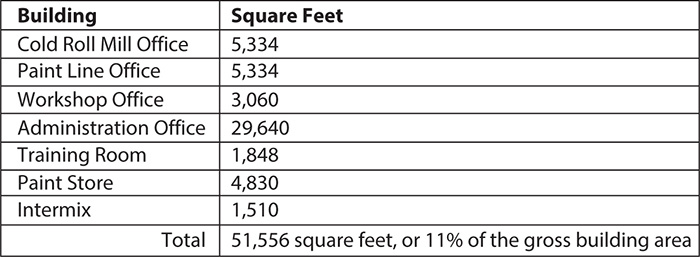

8 to 100 feet. See Exhibit 8.3.

Details of the Wall Height

49,708 square feet, or 10 percent of the gross building area. See Exhibit 8.4.

Details of the Fire Sprinklered Area

Truck-height docks: 1

Drive-in doors: 36

Rail doors: 2 (Export coil building has a pass-through rail line.)

Rail docks: 2

6 to 55 tons. See Exhibit 8.5.

Details of the Crane Capacity

The construction and finish details of the subject are described in Exhibit 8.6.

Details of the Construction and Finish

Deferred maintenance causes physical depreciation that is curable when repaired. A cursory inspection of the subject property did not reveal any deferred maintenance requirements. This facility appears to be adequately maintained.

The functional utility of the improvements affects the performance and usability of a building, and it is an important factor that will be considered by prospective purchasers. The Dictionary of Real Estate Appraisal defines functional utility as “the ability of a property or building to be useful and to perform the function for which it is intended according to current market tastes and standards; the efficiency of a building’s use in terms of architectural style, design, and layout, traffic patterns, and the size and type of rooms.” Items that limit functional utility have what is often referred to as functional obsolescence. Features and components that have functional obsolescence are generally those that result from deficiencies or superadequacies in the structure.

The subject was built for the manufacturing process that it employs, and the buildings are generally functional for this utilization. However, it does suffer from some functional obsolescence due to the superadequacy of the ceiling heights, which are excessive. Heavy industrial, crane-served buildings typically have wall heights that range from 40 to 60 feet. However, there are two sections of the subject building that have wall heights of 100 and 72 feet, respectively.

The salability of the property will probably not be hampered by this superadequacy because the building is unheated and the added maintenance attributable to the additional wall area would be insignificant. However, the costs to construct the building would be lower if the heights were lower, which would be considered in a cost approach. Nevertheless, this has been noted, but it is not adjusted for in the appraisal because the cost approach has not been utilized in this appraisal except in regard to trending, and the difference would be hard to estimate in the sales comparison approach adjustments.

According to the Clarkdale County Planning Department, there is no zoning for the subject site, but the county recommends a heavy industrial use for the land. Consequently, to obtain permits the use must still be approved by the county.

The four criteria the highest and best use must meet are legal permissibility, physical possibility, financial feasibility, and maximum profitability.

The conclusion is that the current use is the highest and best use and, alternatively, that another manufacturing use would be a possible highest and best use. However, since the building is somewhat specialized, it would not lend itself to every manufacturing use. And because the property is encumbered with the facility it now has, demolishing and rebuilding something different would not be financially feasible. In any event, the manufacturing facility on the subject property is presently the one that meets each of the highest and best use criteria.

As If Vacant. The site does not appear to have any drainage problems. Soil and subsoil conditions appear stable and suitable for development compatible with other properties in the area.

There appear to be no topographical problems that would hinder development of the site.

The subject has access to all utilities typically found in this location.

Since the site qualified for heavy industrial use, this use appears to be the one that best meets all four highest and best use criteria for this property. Therefore, any industrial use that would meet the highest and best use criteria and need this amount of land would be the highest and best use for this land if it were vacant.

As Improved. The subject is currently improved with a large industrial building and office space. The location is near Route I-5, and it is functioning profitably as a steel processing facility.

Because the highest return on investment appears to be a continued industrial use, its current use is considered its highest and best use.

The improved property sales indicate that exposure time (that is, the length of time the subject property would have been exposed for sale in the market had it sold at the market value concluded in this analysis as of the date of this valuation) would have been from 24 to 48 months. The estimated marketing time (that is, the amount of time it would probably take to sell the subject property if exposed in the market beginning on the date of this valuation) is estimated to be about 24 to 48 months.

Three basic approaches are typically used to estimate market value for buildings and structures. The approaches have been previously mentioned in conjunction with the machinery and equipment, but they are explained a little differently here, as they apply to real property. The approaches are these:

1. Cost approach

2. Sales comparison (market) approach

3. Income approach

The cost approach involves deducting accrued depreciation from the cost new of the improvements. Cost new is estimated on the basis of current prices for components of the improvements. Depreciation is computed after analyzing any disadvantages or deficiencies of the improvements. Land value and entrepreneurial profit are added to improvement cost new. Land value is developed using sales of similar sites. Entrepreneurial profit is the difference between the market value of the subject and the cost to develop (cost of the improvements plus land value).

The sales comparison approach involves gathering data on sales of comparable properties and analyzing the nature and condition of each sale and providing logical adjustments for differing characteristics. Typically, a common denominator is found. For land value, this is usually a price per square foot (SF) or price per acre; for improved properties, it may be the price per square foot, price per unit, or a gross income multiplier. The market approach can be a good value indicator when sales of similar properties are available.

The income approach is predicated on the assumption that there is a definite relationship between the income a property will earn and its value. The anticipated annual net income is computed to an indication of value. Net income is the income generated before payment of any debt service. The process of converting it into value is called capitalization. Net income is then divided by a capitalization rate to get an indicated value. Factors such as risk, time, interest on the capital investment, and recapture of the depreciating asset are considered in the rate. Applying a capitalization rate based on indications from comparable sales reflects expectations and actions of buyers and sellers in the market.

Since the subject property is 10 years old, the cost approach was not used for this appraisal because it would not have provided good evidence for the value. If the cost new of the property were estimated, the depreciation would need to be market driven to be accurate, which would render it irrelevant since it would be derived from the same information that was used for the market approach. The appraisal process therefore involved no departure from Standards Rule 1-4.

Because of the large size of the main building and the specific configuration of the buildings, the income approach was not utilized. Buildings of this size are generally not rented or leased, and no income data could be found that could be used to value this property utilizing this approach. The appraisal process therefore involved no departure from Standards Rule 1-4.

The comparable sales approach was considered to be the only approach applicable to the subject. The subject is around 472,000 square feet, and buildings of this size are not common, so a wide search was made. Some buildings were found in the Northwest, and a national search was also performed. Buildings found nationally are only presented to buttress the value determination that was made from the more local sales; therefore, adjustments were not made to the national sales.

The Northwest sales were mostly in Oregon, with one in Washington. Most of them were within 100 miles of the subject. Generally, the smaller the property, the higher the price per square foot, and some of the sales were smaller than the subject. Consequently, the smaller properties would typically represent the upper end of value. Exhibits 8.7 and 8.8 show the comparable sales, and they are followed by a discussion of the sales.

Sales of Jumbo Industrial Buildings Nationally

Sales of Jumbo Industrial Buildings in the Northwest

The national sales show a range of value from $7.71 to $37.36 per foot before an estimate for the land value is deducted from the price per square foot, with the exception of one property that was also on leased land. The deduction for the land is an estimate of 30 percent, which was derived from the percentage of land value noted in Exhibit 8.8, which shows the jumbo sales for the Northwest. Those sales show an average of about 36 percent for the land, and it was rounded down to 30 percent for the national sales. Other than the land adjustment, adjustments have not been made for the national sales because they are included to buttress the Northwest sales, and the Northwest sales are considered the primary evidence for the building value.

The national sale that is on leased land is Sale 3, and it also has the lowest value per square foot. Although it is not in the exhibit, the average adjusted price per square foot before the land is deducted is $23.14, which would indicate a value of $10,930,000 for the subject. With adjustments, the final value is $7,720,173, which is the indicated value from the national sales for the subject building.

We deducted the land value from the comparables for the national and Northwest properties. However, please note that a larger reduction for the land value for the subject could be justified because it has a much higher percentage of land, at 75 acres, than most of the comparable properties. That is the case because the manufacturing process requires a long building and because the extra land is needed for storing metal outside that is kept as inventory for production. An analysis of the land value follows this section.

The Northwest properties were mostly within 100 miles of the subject property. Sale 5, in Washougal, Washington, was smaller than the other sales, but it was included due to the lack of jumbo sales in the area. The land value for the sales was computed based on comparable land sales (see Exhibit 8.8).

Sale 1. This sale consists of five buildings on 181st Avenue and Morrison Street in Portland. This is a location superior to the subject location, which is not located in or near a metropolitan area. Morrison Street is a busy area in Portland, and this property also has commercial value as well as industrial value. The buildings are older—they were built in 1960 and renovated in 1983, and they were adjusted for condition due to their age.

These buildings vary from 22 to 26 feet in height, which is a typical height for industrial buildings. However, the fact that there are several buildings increases their value in at least one way: it is easier to lease smaller buildings, and they would bring more money per square foot than larger buildings. They were adjusted down for location and up for quality and condition because even though they are masonry buildings, the older age warranted the adjustment.

Sale 2. This is a multiproperty sale that consists of nine buildings in the same complex. This property was once owned by Mitsubishi Silicon America, and the appraiser has toured this facility. The construction date is 1982, but the construction is superior to the metal construction of the subject. These buildings would be categorized as Class B, instead of C and S for the subject.

The buildings are heavy concrete, but because of age have been adjusted for condition compared to the subject, which was built in 1997. This property is in Salem, Oregon, and it is the farthest away of all the sales. It may have more commercial value than the subject, but the location is rated as similar because the Salem area is not a strong manufacturing area.

Sale 3. This property was built in 1943. It has some deferred maintenance, and it was adjusted for condition. This building varies in height from 14 to 50 feet, making it similar in that characteristic to the subject. It is composed of one 293,978-square-foot building, and the building is a Class C structure. It is located on Hayden Island in Portland, which is superior to the location of the subject property.

Sale 4. This is a sale of the Coe Manufacturing plant. The building has 105,952 square feet and 701,315 square feet of site area, which would allow additions to the building. It is a mix of steel frame and concrete tilt-up construction. This is an older sale, and it was weighted accordingly. The building was started in 1965, but it was added on to since that time. The condition is considered average.

Sale 5. This is a sale of the Hambleton Brothers Lumber Company in Washougal, Washington. The buyer was Washougal Investors II LLC. It includes several tax lots covering 8.08 acres of land. The 90,660 square feet of improvements includes six structures of mixed construction that were built over many years. The average age is estimated to be about 1977 to 1985. These buildings are mostly metal.

Although not the subject of this appraisal, the land lease that Prosteel pays annual rent on was analyzed to determine how it affects the building value. We adjusted for the land values for each of the Northwest comparable sales, which reduced those sales to make them more comparable to the subject’s buildings. However, the subject has more land than the typical industrial facility, and it has more land than most of the comparable properties that we could find. The largest comparable property in terms of land size was national Sale 14, which had 93.26 acres of land, and the next largest were national Sale 16 and Northwest Sale 2, both of which had 55 acres. National Sale 3 was on leased land, and its square footage was very close to the subject’s size.