IV

Well, I went home. But the moment I was back I knew that I had but one mission in life and that was to get a stake and go back to Wall Street. That was the only place in the country where I could trade heavily. Some day, when my game was all right, I’d need such a place. When a man is right he wants to get all that is coming to him for being right.

I didn’t have much hope, but, of course, I tried to get into the bucket shops again. There were fewer of them and some of them were run by strangers. Those who remembered me wouldn’t give me a chance to show them whether I had gone back as a trader or not. I told them the truth, that I had lost in New York whatever I had made at home; that I didn’t know as much as I used to think I did; and that there was no reason why it should not now be good business for them to let me trade with them. But they wouldn’t. And the new places were unreliable. Their owners thought twenty shares was as much as a gentleman ought to buy if he had any reason to suspect he was going to guess right.

I needed the money and the bigger shops were taking in plenty of it from their regular customers. I got a friend of mine to go into a certain office and trade. I just sauntered in to look them over. I again tried to coax the order clerk to accept a small order, even if it was only fifty shares. Of course he said no. I had rigged up a code with this friend so that he would buy or sell when and what I told him. But that only made me chicken feed. Then the office began to grumble about taking my friend’s orders. Finally one day he tried to sell a hundred St. Paul and they shut down on him.

We learned afterward that one of the customers saw us talking together outside and went in and told the office, and when my friend went up to the order clerk to sell that hundred St. Paul the guy said:

“We’re not taking any selling orders in St. Paul, not from you.”

“Why, what’s the matter, Joe?” asked my friend.

“Nothing doing, that’s all,” answered Joe.

“Isn’t that money any good? Look it over. It’s all there.” And my friend passed over the hundred—my hundred—in tens. He tried to look indignant and I was looking unconcerned; but most of the other customers were getting close to the combatants, as they always did when there was loud talking or the slightest semblance of a scrap between the shop and any customer. They wanted to get a line on the merits of the case in order to get a line on the solvency of the concern.

The clerk, Joe, who was a sort of assistant manager, came out from behind his cage, walked up to my friend, looked at him and then looked at me.

“It’s funny,” he said slowly—“it’s damned funny that you never do a single thing here when your friend Livingston isn’t around. You just sit and look at the board by the hour. Never a peep. But after he comes in you get busy all of a sudden. Maybe you are acting for yourself; but not in this office any more. We don’t fall for Livingston tipping you off.”

Well, that stopped my board money. But I had made a few hundred more than I had spent and I wondered how I could use them, for the need of making enough money to go back to New York with was more urgent than ever. I felt that I would do better the next time. I had had time to think calmly of some of my foolish plays; and then, one can see the whole better when one sees it from a little distance. The immediate problem was to make the new stake.

One day I was in a hotel lobby, talking to some fellows I knew, who were pretty steady traders. Everybody was talking stock market. I made the remark that nobody could beat the game on account of the rotten execution he got from his brokers, especially when he traded at the market, as I did.

4.1 From this casual introduction to cotton, an entirely new phase of Livermore’s trading career would later unfold as the budding trader soon became disenchanted with stock exchanges and infatuated instead with the fast action and ample margin of commodity exchanges.

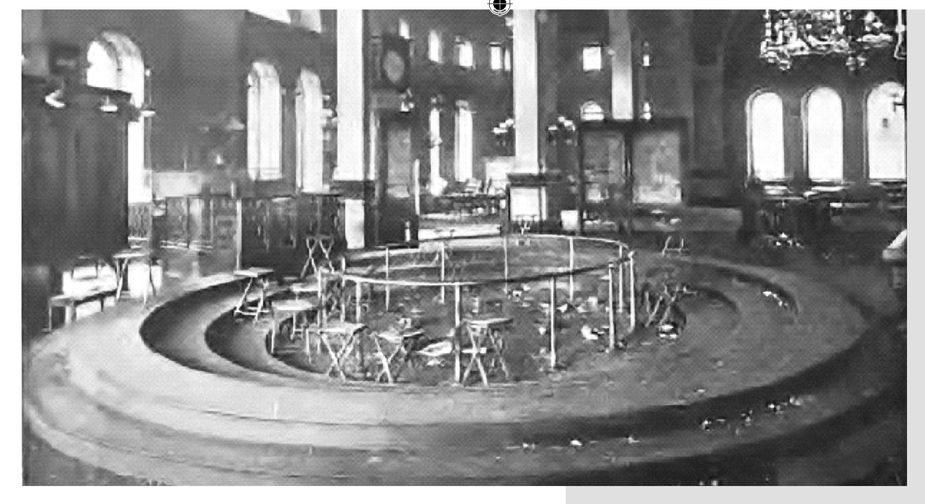

The New York Cotton Exchange was a commodity futures exchange founded in 1870 by a group of leading cotton merchants and brokers. The exchange initially helped market the southern U.S. cotton crop in the volatile years following the Civil War as trade routes reopened and prices fluctuated wildly. Later its auctions mainly offered a way for farmers and manufacturers to hedge price uncertainty and reduce risk. In time, its price quotes became the standard for all business conducted between textile mills and farmers.

1You can see the benefits of the exchange in the adjacent chart, which illustrates annual cotton price volatility from 1830 to 1909. After 1870, the NYCE helped reduce the magnitude of price movements, which helped farmers and textile makers alike. As an indication of the importance of the exchange, in 1916 the cost of membership was not far behind the cost of a seat on the New York Stock Exchange.

2 Eventually, the NYCE created subsidiaries to trade in other commercial goods such as wool, citrus, tomatoes and financial instruments.

New York was a popular spot market for cotton well before the NYCE was founded. Middlemen would bring great quantities of bulk cotton north from southern states to resell to textile factories throughout the Northeast. The NYCE’s formation and dominance of rival exchanges in places like New Orleans cemented the city’s role in the transfer of the delicate fibers from field to factory.

Innovation drove the development of the cotton exchanges. During the Civil War, trade blockades made it difficult to get cotton bales through Confederate battle lines. As a result, large premiums were offered to merchants for “staple to arrive” contracts—the predecessor to the modern futures contract.

3 The concept caught on and it was quickly realized that there was a need to centralize and regulate the trading of contracts.

The NYCE got its start in small quarters at 142 Pearl Street and traded about 15,000 bales per week in 1870 before moving to larger quarters at 1 Hanover Square that still stand today. (One bale equals 500 pounds). It was here that Dickson G. Watts, who wrote “Speculation as a Fine Art” and is frequently quoted by both Livermore in this text and Lefevre in his other works, was president of the exchange for a short time.

4 The photo above shows the interior of the exchange circa 1900. Tufts of cotton litter the floor, as various grades of the actual product were displayed and assessed by traders each day.

In 1923, the exchange moved to a new 24-story building as volume increased to 500,000 bales per day.

5 In 1998 the NYCE and the Coffee, Sugar & Cocoa Exchange merged to create the New York Board of Trade. This entity eventually relocated to 4 World Trade Center, which was destroyed in the September 11, 2001 terrorist attacks. The New York Board of Trade was then purchased in 2006 by IntercontinentalEx-change—an internet-based market maker.

A fellow piped up and asked me what particular brokers I meant.

I said, “The best in the land,” and he asked who might they be. I could see he wasn’t going to believe I ever dealt with first-class houses.

But I said, “I mean, any member of the New York Stock Exchange. It isn’t that they are crooked or careless, but when a man gives an order to buy at the market he never knows what that stock is going to cost him until he gets a report from the brokers. There are more moves of one or two points than of ten or fifteen. But the outside trader can’t catch the small rises or drops because of the execution. I’d rather trade in a bucket shop any day in the week, if they’d only let a fellow trade big.”

The man who had spoken to me I had never seen before. His name was Roberts. He seemed very friendly disposed. He took me aside and asked me if I had ever traded in any of the other exchanges, and I said no. He said he knew some houses that were members of the Cotton Exchange and the Produce Exchange and the smaller stock exchanges.

These firms were very careful and paid special attention to the execution. He said that they had confidential connections with the biggest and smartest houses on the New York Stock Exchange and through their personal pull and by guaranteeing a business of hundreds of thousands of shares a month they got much better service than an individual customer could get.

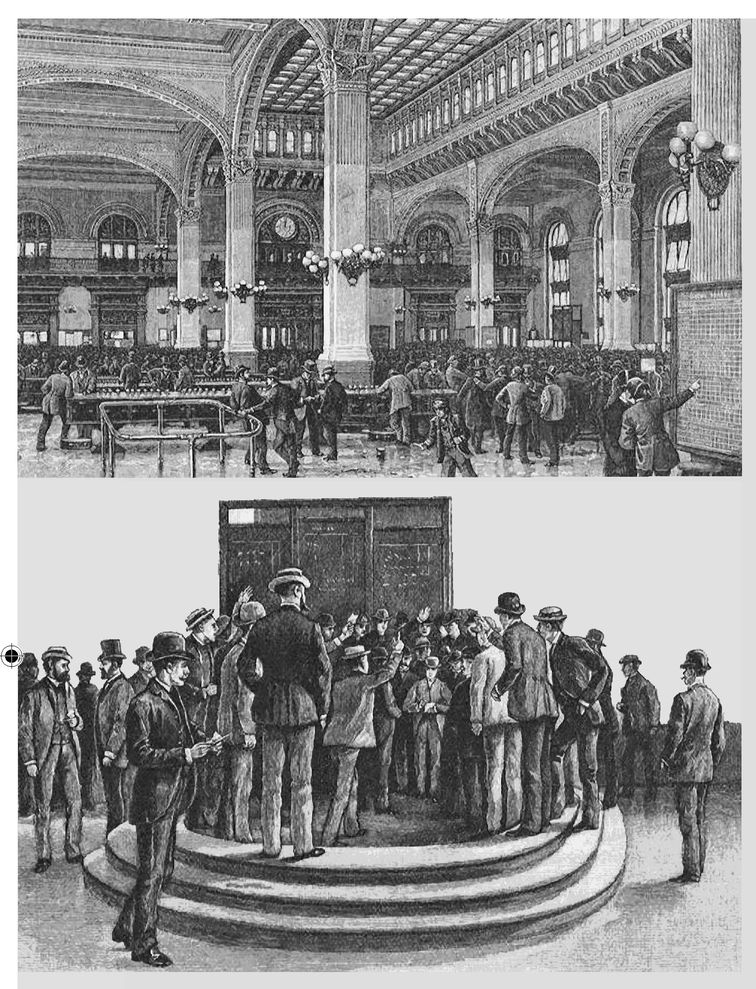

4.2 The origins of the New York Produce Exchange can be traced back to the original New Amsterdam colony on Manhattan. Governor Peter Stuyvesant established what was known as the Monday market in the fall of 1618. According to a newspaper account in 1901, “a number of hardy old traders assembled and made ‘puts’ and ‘calls’ in much the same fashion as is done today” outside near present-day Bowling Green park.

6As the country grew and the trading volume expanded, the first Produce Exchange building was erected in 1860. There all manner of goods were traded, including butter, cheese, hops, tar, cornmeal, oatmeal, rye, flour, buckwheat, corn, oats, barley, beef, pork, seeds, sweet cured meats, liquors and high wines, beans, flaxseed, malt, tongues, and ham.

7As the membership roll swelled from 700 to 2,500 by 1880, more room was required. In 1884, the New Produce Exchange building was built at the corner of Beaver Street and Broadway.

8In Livermore’s time, the pace of activity at the New York Produce Exchange was second only to the NYSE. It is likely that at some point, especially later in his career, as he began to heavily trade corn and wheat, Livermore ventured down to the bustling main exchange hall, as visitors were permitted if escorted by members. The hall, shown at left, was impressive to behold, measuring 220 feet by 144 feet, with a height of 60 feet. On one side, attached to pillars, were blackboards reporting the prices of refined petroleum at London, Antwerp, and Bremen and of naval stores, turpentine, and resin in London and Liverpool. Across the floor were long tables for merchants to display their goods for sample—one for flour, another for lard, and so on.

9Prices were determined in two places. In the pit, where futures contracts were traded, a reporter in the mid-1880s said buyers and sellers were “indiscriminately blended in the compact, throbbing, surging mass.”

10 The scene is not unlike what you would find on any futures exchange today. Behind the pit was the call room, a 500-seat amphitheater where spot commodities were sold through an auctioneer. In was in these areas that the young “Napoleon of finance,” Ferdinand Ward, who ruined Civil War hero and president Ulysses S. Grant in a Ponzi scheme, got his start.

The Produce Exchange failed in the aftermath of the Salad Oil Scandal of 1963. In this massive scam, wholesaler and commodity broker Anthony DeAngelis of New Jersey cornered the market for soybean oil—used in salad dressing—by fraudulently filling oil tanks held as collateral with water. When inspectors looked into the tanks, all they would see was oil, since it floated on top of the water. By inflating his true holdings, DeAngelis was able to secure additional lending and continue to buy futures contracts. Eventually, authorities were tipped off and the ruse collapsed.

11 As in Livermore’s day, the smart money managed to exploit one victim’s pain for a big gain: The scandal crushed the shares of DeAngelis’s collateral backer, American Express, allowing a young Warren Buffett to grab a cheap 5% stake in the firm.

“They really cater to the small customer,” he said. “They make a specialty of out-of-town business and they take just as much pains with a ten-share order as they do with one for ten thousand. They are very competent and honest.”

“Yes. But if they pay the Stock Exchange house the regular eighth commission, where do they come in?”

“Well, they are supposed to pay the eighth. But—you know!” He winked at me.

“Yes,” I said. “But the one thing a Stock Exchange firm will not do is to split commissions. The governors would rather a member committed murder, arson and bigamy than to do business for outsiders for less than a kosher eighth. The very life of the Stock Exchange depends upon their not violating that one rule.”

He must have seen that I had talked with Stock Exchange people, for he said, “Listen! Every now and then one of those pious Stock Exchange houses is suspended for a year for violating that rule, isn’t it? There are ways and ways of rebating so nobody can squeal.” He probably saw unbelief in my face, for he went on: “And besides, on certain kind of businesses we—I mean, these wire houses—charge a thirty-second extra, in addition to the eighth commission. They are very nice about it. They never charge the extra commission except in unusual cases, and then only if the customer has an inactive account. It wouldn’t pay them, you know, otherwise. They aren’t in business exclusively for their health.”

By that time I knew he was touting for some phony brokers.

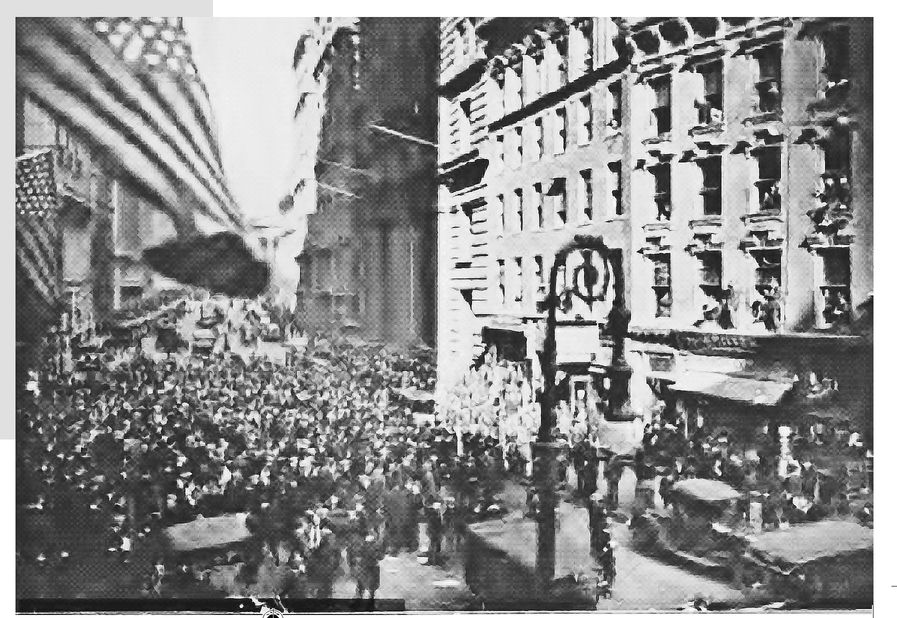

4.3 The New York Curb Exchange is being referred to here. It started as an outdoor, semiorganized venue for trading stocks that eventually grew into the American Stock Exchange. Although the two had long been fierce rivals, the American Stock Exchange was acquired by the parent company of the New York Stock Exchange in 2008 and today specializes in derivatives and exchange-traded funds.

The origins of the exchange date to the early 1820s, when NYSE board members who lost their seats mixed with outsiders to buy and sell securities and commodities.

12,

13In Livermore’s time, the curb market occupied a section of Broad Street just down the way from the NYSE. Brokers communicated with hand signals to men taking orders via telephones in adjacent office windows. Traders were supposed to remain inside a rope enclosure in the middle of the street, which would allow traffic to pass on either side. But during busy days, the action stretched from curb to curb.

14Until the formation of the New York Curb Agency in 1908, there was little government regulation of the market. Any securities could be traded by any broker. Brokers relied on reputation, as there was no official recording of sales and no ticker to track price changes. There was also no price advantage on the curb compared to the NYSE—the same one-eighth commission was charged to buy or sell. The main advantages of the curb were the extra trade liquidity it offered for listed securities and the ability to market securities that did not meet the NYSE’s listing requirements.

One of the more famous swindles on the curb involved the Electric Car Coupler Co. in 1899. At the time, electric stocks were the focus of speculative excitement. Criminals created the company in name only, faking patent documents, renting an office, appointing directors, and printing engraved stock certificates. The gang fanned out across the Northeast to place orders with brokerage offices, placing $4,000 on margin to secure a purchase of $16,400 worth of the fictitious stock on the curb. The crooks happily fed their certificates to the curb brokers filling the out-of-town orders. Pocketing the $8,400 difference, the criminals made off with a fortune and were never caught.

15 Livermore thrived on the fringe of this environment, depending on his wits and experience.

“Do you know any reliable house of that kind?” I asked him.

“I know the biggest brokerage firm in the United States,” he said. “I trade there myself. They have branches in seventy-eight cities in the United States and Canada. They do an enormous business. And they couldn’t very well do it year in and year out if they weren’t strictly on the level, could they?”

“Certainly not,” I agreed. “Do they trade in the same stocks that are dealt in on the New York Stock Exchange?”

“Of course; and on the curb and on any other exchange in this country, or Europe.

They deal in wheat, cotton, provisions; anything you want. They have correspondents everywhere and memberships in all the exchanges, either in their own name or on the quiet.”

I knew by that time, but I thought I’d lead him on.

“Yes,” I said, “but that does not alter the fact that the orders have to be executed by somebody, and nobody living can guarantee how the market will be or how close the ticker’s prices are to the actual prices on the floor of the Exchange. By the time a man gets the quotation here and he hands in an order and it’s telegraphed to New York, some valuable time has gone. I might better go back to New York and lose my money there in respectable company.”

“I don’t know anything about losing money; our customers don’t acquire that habit. They make money. We take care of that.”

“Your customers?”

“Well, I take an interest in the firm, and if I can turn some business their way I do so because they’ve always treated me white and I’ve made a good deal of money through them. If you wish I’ll introduce you to the manager.”

“What’s the name of the firm?” I asked him.

He told me. I had heard about them. They ran ads in all the papers, calling attention to the great profits made by those customers who followed their inside information on active stocks. That was the firm’s great specialty. They were not a regular bucket shop, but bucketeers, alleged brokers who bucketed their orders but nevertheless went through an elaborate camouflage to convince the world that they were regular brokers engaged in a legitimate business. They were one of the oldest of that class of firms.

They were the prototype at that time of the same sort of brokers that went broke this year by the dozen. The general principles and methods were the same, though the particular devices for fleecing the public differed somewhat, certain details having been changed when the old tricks became too well known.

These people used to send out tips to buy or sell a certain stock—hundreds of telegrams advising the instant purchase of a certain stock and hundreds recommending other customers to sell the same stock, on the old racing-tipster plan. Then orders to buy and sell would come in. The firm would buy and sell, say, a thousand of that stock through a reputable Stock Exchange firm and get a regular report on it. This report they would show to any doubting Thomas who was impolite enough to speak about bucketing customers’ orders.

4.4 The focus of this conversation was likely the Haight & Freese Co.—the largest of a particularly nasty breed of bucket shops that used a cloak of legitimacy to dupe small-time investors. The firm was large, well established, and famous for its complementary Guide to Investors that explained the finer points of speculation.

Bucketeers would join third-rate exchanges in cities like Philadelphia or St. Louis to give believability to their cover story of being legitimate brokers filling orders. Labeling their offices “bankers and brokers” in larger cities and “commissioned agent” in small towns, the bucketeers furnished their offices sumptuously with tickers, meals, cigars, and other comforts. Telegraph machines busily clacked in the corner, appearing to transmit customer orders to the trading floors of various exchanges.

In reality, the orders would go to central bookkeeping offices where orders would be “filled” at the next quotation that came over the ticker. Execution was completed by the initialing of the customer’s order slip by the filling clerk, not an actual transaction. To complete the scam, a “confirmation” slip would be mailed to the customer.

16The trap was set. From there, the traditional bucket-shop game of small margin positions and wash sales wiped out the victims. According to Merrill Teague, who wrote a lengthy exposé against these practices in 1906, the

bucket-shop keeper has no purpose other than to steal all the money you have, or can beg or borrow or steal, and when he has done this, to steal the home that houses your family, to steal the dress your wife will need next year, and to steal the food your baby will require as it

grows.17Fortunately for Livermore, the bucketeers’ system fit his method of trading perfectly. Since Haight & Freese wished to maintain an air of legitimacy, the company was not likely to limit his trading or kick him out for winning too frequently. Because traditional brokers benefit from additional commissions when their clients win, the bucketeers had to act the part. Moreover, since no actual transactions were taking place, Haight & Freese could tout their impressive order executions and promise fulfillment at the next quotation. It is ironic that a system that was the source of so much misery and hardship for uninitiated investors was exactly what Livermore needed to get back on his feet.

They also used to form discretionary pools in the office and as a great favor allowed their customers to authorize them, in writing, to trade with the customer’s money and in the customer’s name, as they in their judgment deemed best. That way the most cantankerous customer had no legal redress when his money disappeared. They’d bull a stock, on paper, and put the customers in and then they’d execute one of the old-fashioned bucket-shop drives and wipe out hundreds of shoestring margins. They did not spare anyone, women, schoolteachers and old men being their best bet.

“I’m sore on all brokers,” I told the tout. “I’ll have to think this over,” and I left him so he wouldn’t talk any more to me.

I inquired about this firm. I learned that they had hundreds of customers and although there were the usual stories I did not find any case of a customer not getting his money from them if he won any. The difficulty was in finding anybody who had ever won in that office; but I did. Things seemed to be going their way just then, and that meant that they probably would not welsh if a trade went against them. Of course most concerns of that kind eventually go broke. There are times when there are regular epidemics of bucketeering bankruptcies, like the old-fashioned runs on several banks after one of them goes up. The customers of the others get frightened and they run to take their money out. But there are plenty of retired bucket-shop keepers in this country.

Well, I heard nothing alarming about the tout’s firm except that they were on the make, first, last and all the time, and that they were not always truthful. Their specialty was trimming suckers who wanted to get rich quick. But they always asked their customers’ permission, in writing, to take their rolls away from them.

One chap I met did tell me a story about seeing six hundred telegrams go out one day advising customers to get aboard a certain stock and six hundred telegrams to other customers strongly urging them to sell that same stock, at once.

“Yes, I know the trick,” I said to the chap who was telling me.

“Yes,” he said. “But the next day they sent telegrams to the same people advising them to close out their interest in everything and buy—or sell—another stock. I asked the senior partner, who was in the office, ‘Why do you do that? The first part I understand. Some of your customers are bound to make money on paper for a while, even if they and the others eventually lose. But by sending out telegrams like this you simply kill them all. What’s the big idea?’

“Well,’ he said, ‘the customers are bound to lose their money anyhow, no matter what they buy, or how or where or when. When they lose their money I lose the customers. Well, I might as well get as much of their money as I can—and then look for a new crop.’ ”

Well, I admit frankly that I wasn’t concerned with the business ethics of the firm. I told you I felt sore on the Teller concern and how it tickled me to get even with them. But I didn’t have any such feeling about this firm. They might be crooks or they might not be as black as they were painted. I did not propose to let them do any trading for me, or follow their tips or believe their lies. My one concern was with getting together a stake and returning to New York to trade in fair amounts in an office where you did not have to be afraid the police would raid the joint, as they did the bucket shops, or see the postal authorities swoop down and tie up your money so that you’d be lucky to get eight cents on the dollar a year and a half later.

4.5 The e-mail stock spam scandals of the early 2000s had their origin in the days of the telegraph. In both eras, criminal operators preyed via electronic communication on a gullible public eager to try to make a quick buck.

Anyhow, I made up my mind that I would see what trading advantages this firm offered over what you might call the legitimate brokers. I didn’t have much money to put up as margin, and firms that bucketed orders were naturally much more liberal in that respect, so that a few hundred dollars went much further in their offices.

I went down to their place and had a talk with the manager himself. When he found out that I was an old trader and had formerly had accounts in New York with Stock Exchange houses and that I had lost all I took with me he stopped promising to make a million a minute for me if I let them invest my savings. He figured that I was a permanent sucker, the ticker-hound kind that always plays and always loses; a steady-income provider for brokers, whether they were the kind that bucket your orders or modestly content themselves with the commissions.

I just told the manager that what I was looking for was decent execution, because I always traded at the market and I didn’t want to get reports that showed a difference of a half or a whole point from the ticker price.

He assured me on his word of honor that they would do whatever I thought was right. They wanted my business because they wanted to show me what high-class brokering was. They had in their employ the best talent in the business. In fact, they were famous for their execution. If there was any difference between the ticker price and the report it was always in favor of the customer, though of course they didn’t guarantee that. If I opened an account with them I could buy and sell at the price which came over the wire, they were so confident of their brokers.

Naturally that meant that I could trade there to all intents and purposes as though I were in a bucket shop—that is, they’d let me trade at the next quotation. I didn’t want to appear too anxious, so I shook my head and told him I guessed I wouldn’t open an account that day, but I’d let him know. He urged me strongly to begin right away as it was a good market to make money in. It was—for them; a dull market with prices seesawing slightly, just the kind to get customers in and then wipe them out with a sharp drive in the tipped stock. I had some trouble in getting away.

I had given him my name and address, and that very same day I began to get prepaid telegrams and letters urging me to get aboard of some stock or other in which they said they knew an inside pool was operating for a fifty-point rise.

I was busy going around and finding out all I could about several other brokerage concerns of the same bucketing kind. It seemed to me that if I could be sure of getting my winnings out of their clutches the only way of my getting together some real money was to trade in these near bucket-shops.

When I had learned all I could I opened accounts with three firms. I had taken a small office and had direct wires run to the three brokers.

I traded in a small way so they wouldn’t get frightened off at the very start. I made money on balance and they were not slow in telling me that they expected real business from customers who had direct wires to their offices. They did not hanker for pikers. They figured that the more I did the more I’d lose, and the more quickly I was wiped out the more they’d make. It was a sound enough theory when you consider that these people necessarily dealt with averages and the average customer was never long-lived, financially speaking. A busted customer can’t trade. A half-crippled customer can whine and insinuate things and make trouble of one or another kind that hurts business.

I also established a connection with a local firm that had a direct wire to its New York correspondent, who were also members of the New York Stock Exchange. I had a stock ticker put in and I began to trade conservatively. As I told you, it was pretty much like trading in bucket shops, only it was a little slower.

4.6 A telegram could be sent either collect, in which the receiver pays, or prepaid, in which the sender pays. The distinction was the focal point of frequent scams by telegraph messenger boys looking to pad their meager wages by unfairly charging recipients for prepaid messages. These telegrams were the equivalent of what traderslater would recognize as fax, text or social-media messages promoting penny stocks.

18It was a game that I could beat, and I did. I never got it down to such a fine point that I could win ten times out of ten; but I won on balance, taking it week in and week out. I was again living pretty well, but always saving something, to increase the stake that I was to take back to Wall Street. I got a couple of wires into two more of these bucketing brokerage houses, making five in all—and, of course, my good firm.

There were times when my plans went wrong and my stocks did not run true to form, but did the opposite of what they should have done if they had kept up their regard for precedent. But they did not hit me very hard—they couldn’t, with my shoestring margins. My relations with my brokers were friendly enough. Their accounts and records did not always agree with mine, and the differences uniformly happened to be against me. Curious coincidence—not! But I fought for my own and usually had my way in the end. They always had the hope of getting away from me what I had taken from them. They regarded my winnings as temporary loans, I think.

They really were not sporty, being in the business to make money by hook or by crook instead of being content with the house percentage. Since suckers always lose money when they gamble in stocks—they never really speculate—you’d think these fellows would run what you might call a legitimate illegitimate business. But they didn’t. “Copper your customers and grow rich” is an old and true adage, but they did not seem ever to have heard of it and didn’t stop at plain bucketing.

Several times they tried to double-cross me with the old tricks. They caught me a couple of times because I wasn’t looking. They always did that when I had taken no more than my usual line. I accused them of being short sports or worse, but they denied it and it ended by my going back to trading as usual. The beauty of doing business with a crook is that he always forgives you for catching him, so long as you don’t stop doing business with him. It’s all right as far as he is concerned. He is willing to meet you more than halfway. Magnanimous souls!

Well, I made up my mind that I couldn’t afford to have the normal rate of increase of my stake impaired by crooks’ tricks, so I decided to teach them a lesson. I picked out some stock that after having been a speculative favorite had become inactive. Water-logged. If I had taken one that never had been active they would have suspected my play. I gave out buying orders on this stock to my five bucketeering brokers. When the orders were taken and they were waiting for the next quotation to come out on the tape, I sent in an order through my Stock Exchange house to sell a hundred shares of that particular stock at the market. I urgently asked for quick action. Well, you can imagine what happened when the selling order got to the floor of the Exchange; a dull inactive stock that a commission house with out-of-town connections wanted to sell in a hurry. Somebody got cheap stock. But the transaction as it would be printed on the tape was the price that I would pay on my five buying orders. I was long on balance four hundred shares of that stock at a low figure. The wire house asked me what I’d heard, and I said I had a tip on it. Just before the close of the market I sent an order to my reputable house to buy back that hundred shares, and not waste any time; that I didn’t want to be short under any circumstances; and I didn’t care what they paid. So they wired to New York and the order to buy that hundred quick resulted in a sharp advance. I of course had put in selling orders for the five hundred shares that my friends had bucketed. It worked very satisfactorily.

Still, they didn’t mend their ways, and so I worked that trick on them several times. I did not dare punish them as severely as they deserved, seldom more than a point or two on a hundred shares. But it helped to swell my little hoard that I was saving for my next Wall Street venture. I sometimes varied the process by selling some stock short, without overdoing it. I was satisfied with my six or eight hundred clear for each crack.

One day the stunt worked so well that it went far beyond all calculations for a ten-point swing. I wasn’t looking for it. As a matter of fact it so happened that I had two hundred shares instead of my usual hundred at one broker’s, though only a hundred in the four other shops. That was too much of a good thing—for them. They were sore as pups about it and they began to say things over the wires. So I went and saw the manager, the same man who had been so anxious to get my account, and so forgiving every time I caught him trying to put something over on me. He talked pretty big for a man in his position.

“That was a fictitious market for that stock, and we won’t pay you a damned cent!” he swore.

“It wasn’t a fictitious market when you accepted my order to buy. You let me in then, all right, and now you’ve got to let me out. You can’t get around that for fairness, can you?”

“Yes, I can!” he yelled. “I can prove that somebody put up a job.”

“Who put up a job?” I asked.

“Somebody!”

“Who did they put it up on?” I asked.

“Some friends of yours were in it as sure as pop,” he said.

But I told him, “You know very well that I play a lone hand. Everybody in this town knows that. They’ve known it ever since I started trading in stocks. Now I want to give you some friendly advice: you just send and get that money for me. I don’t want to be disagreeable. Just do what I tell you.”

“I won’t pay it. It was a rigged-up transaction,” he yelled.

I got tired of his talk. So I told him: “You’ll pay it to me right now and here.”

Well, he blustered a little more and accused me flatly of being the guilty thimblerigger; but he finally forked over the cash. The others were not so rambunctious. In one office the manager had been studying these inactive-stock plays of mine and when he got my order he actually bought the stock for me and then some for himself in the Little Board,

and he made some money. These fellows didn’t mind being sued by customers on charges of fraud, as they generally had a good technical legal defense ready. But they were afraid I’d attach the furniture—the money in the bank was not available because they took care not to have any funds exposed to that danger. It would not hurt them to be known as pretty sharp, but to get a reputation for welshing was fatal. For a customer to lose money at his broker’s is no rare event. But for a customer to make money and then not get it is the worst crime on the speculators’ statute books.

I got my money from all; but that ten-point jump put an end to the pleasing pastime of skinning skinners. They were on the lookout for the little trick that they themselves had used to defraud hundreds of poor customers. I went back to my regular trading; but the market wasn’t always right for my system—that is, limited as I was by the size of the orders they would take, I couldn’t make a killing.

I had been at it over a year, during which I used every device that I could think of to make money trading in those wire houses. I had lived very comfortably, bought an automobile and didn’t limit myself about my expenses. I had to make a stake, but I also had to live while I was doing it. If my position on the market was right I couldn’t spend as much as I made, so that I’d always be saving some. If I was wrong I didn’t make any money and therefore couldn’t spend. As I said, I had saved up a fair-sized roll, and there wasn’t so much money to be made in the five wire houses; so I decided to return to New York.

4.7 This is the nickname of the American Stock Exchange, which at the time was the New York Curb Exchange.

4.8 In 1905, Haight & Freese was forced into bankruptcy after authorities uncovered the company’s illicit order room and it became clear that trade orders were not being filled legitimately. Members of the Consolidated Stock Exchange proved to be complicit in the scam. At the end of the trading day, Haight & Freese would send over a list of trading activity; insiders used those lists to forge the exchange’s official documents to make it appear as if those orders had been taken to the trading floor.

194.9 The early 1900s were an exciting period for young men with a fancy for speed. It was the dawn of the motoring era. In 1902, Ransom E. Olds—founder of the now-defunct Oldsmobile brand—made his Curved Dash model (which cost $650 at the time), the first mass-produced automobile. Henry Ford’s Model T would not arrive until 1908. This was a considerable achievement since the first American-made self-propelled vehicle had been created just nine years earlier, in 1893, by the Duryea brothers.

20Livermore would have had the opportunity to select from the three different propulsion types that were in use at the time: steam, electric, and gasoline. Given his obvious preference for something sporty, he would have decided on a model with a gas engine. The benefits were longer range (important for a road trip from Boston to New York City), more power, and greater speed.

I had my own automobile and I invited a friend of mine who also was a trader to motor to New York with me. He accepted and we started. We stopped at New Haven for dinner. At the hotel I met an old trading acquaintance, and among other things he told me there was a shop in town that had a wire and was doing a pretty good business.

We left the hotel on our way to New York, but I drove by the street where the bucket shop was to see what the outside looked like. We found it and couldn’t resist the temptation to stop and have a look at the inside. It wasn’t very sumptuous, but the old blackboard was there, and the customers, and the game was on.

The manager was a chap who looked as if he had been an actor or a stump speaker. He was very impressive. He’d say good morning as though he had discovered the morning’s goodness after ten years of searching for it with a microscope and was making you a present of the discovery as well as of the sky, the sun and the firm’s bank roll. He saw us come up in the sporty-looking automobile, and as both of us were young and careless—I don’t suppose I looked twenty—he naturally concluded we were a couple of Yale boys. I didn’t tell him we weren’t. He didn’t give me a chance, but began delivering a speech. He was very glad to see us. Would we have a comfortable seat? The market, we would find, was philanthropically inclined that morning; in fact, clamoring to increase the supply of collegiate pocket money, of which no intelligent undergraduate ever had a sufficiency since the dawn of historic time. But here and now, by the beneficence of the ticker, a small initial investment would return thousands. More pocket money than anybody could spend was what the stock market yearned to yield.

Well, I thought it would be a pity not to do as the nice man of the bucket shop was so anxious to have us do, so I told him I would do as he wished, because I had heard that lots of people made lots of money in the stock market.

I began to trade, very conservatively, but increasing the line as I won. My friend followed me.

We stayed overnight in New Haven and the next morning found us at the hospitable shop at five minutes to ten. The orator was glad to see us, thinking his turn would come that day. But I cleaned up within a few dollars of fifteen hundred. The next morning when we dropped in on the great orator, and handed him an order to sell five hundred Sugar he hesitated, but finally accepted it—in silence! The stock broke over a point and I closed out and gave him the ticket. There was exactly five hundred dollars coming to me in profits, and my five hundred dollar margin. He took twenty fifties from the safe, counted them three times very slowly, then he counted them again in front of me. It looked as if his fingers were sweating mucilage the way the notes seemed to stick to him, but finally he handed the money to me. He folded his arms, bit his lower lip, kept it bit, and stared at the top of a window behind me.

I told him I’d like to sell two hundred Steel. But he never stirred. He didn’t hear me. I repeated my wish, only I made it three hundred shares. He turned his head. I waited for the speech. But all he did was to look at me. Then he smacked his lips and swallowed—as if he was going to start an attack on fifty years of political misrule by the unspeakable grafters of the opposition.

Finally he waved his hand toward the yellow-backs in my hand and said, “Take away that bauble!”

“Take away what?” I said. I hadn’t quite understood what he was driving at.

“Where are you going, student?” He spoke very impressively.

4.10 As mentioned in Chapter 2, A. R. Fullerton was in reality Edward Francis Hutton. Born and raised in New York, Hutton eventually felt the gravitational pull of Wall Street. After rising from mailroom clerk to check writer at a brokerage, he tired of the mundane and enrolled in business school before purchasing a seat on the Consolidated Stock Exchange with friend Arthur Harris and starting Harris, Hutton & Co. in 1900.

21,

22 The Consolidated was located in an unimpressive little red building across New Street from the NYSE and its Big Board. In 1905, when a seat on the NYSE cost upward of $100,000, a seat on the Consolidated could be had for just $1,000. A secondary market, which depended in large part on the quotations that originated on the other side of the street and specialized in offering fraction-lot trades below the 100-share minimum required on the NYSE, the Consolidated still had enough volume to settle orders as large as 1,000 shares at a time.

23

After falling in love with Blanche Horton, Hutton asked her father, H. L. Horton, an NYSE member, for his daughter’s hand in marriage—only to be rebuffed due to his association with what one journalist called “a street bazaar for third-rate brokers.” Hutton promptly dissolved his firm and sold his seat on the Consolidated before marrying Blanche in June 1902.

While honeymooning on the West Coast, Hutton was struck by the dismal quality of brokerage service in San Francisco. In a spark of entrepreneurial energy, he joined with his uncle William D. Hutton, another NYSE member, to start a new firm with the goal of stringing the nation’s first privately leased transcontinental telegraph wire. As a result, the firm E. F. Hutton was born in October 1903. Offices were opened in April 1904 at 33 New Street, just one block from the NYSE. By December, a San Francisco office with direct service to the New York markets was opened. One of the first clients was none other than John “Bet-a-Million” Gates.

24The scarcity of historical evidence and the incongruity of many of the statements, dates, and ages given in Reminiscences make an exact reconstruction of all the steps and venues of Livermore’s early years in Manhattan impossible. Livermore may have frequented the old Harris,

“New York,” I told him.

“That’s right,” he said, nodding about twenty times. “That is exactly right. You are going away from here all right, because now I know two things—two, student! I know what you are not, and I know what you are. Yes! Yes! Yes!”

“Is that so?” I said very politely.

“Yes. You two—” He paused; and then he stopped being in Congress and snarled: “You two are the biggest sharks in the United States of America! Students? Ye-eh! You must be Freshmen! Ye-eh!”

We left him talking to himself. He probably didn’t mind the money so much. No professional gambler does. It’s all in the game and the luck’s bound to turn. It was his being fooled in us that hurt his pride.

That is how I came back to Wall Street for a third attempt. I had been studying, of course, trying to locate the exact trouble with my system that had been responsible for my defeats in A. R. Fuller ton & Co.’s office.

I was twenty when I made my first ten thousand, and I lost that. But I knew how and why—because I traded out of season all the time; because when I couldn’t play according to my system, which was based on study and experience, I went in and gambled. I hoped to win, instead of knowing that I ought to win on form. When I was about twenty-two I ran up my stake to fifty thousand dollars; I lost it on May ninth. But I knew exactly why and how. It was the laggard tape and the unprecedented violence of the movements that awful day. But I didn’t know why I had lost after my return from St. Louis or after the May ninth panic. I had theories—that is, remedies for some of the faults that I thought I found in my play. But I needed actual practice.

There is nothing like losing all you have in the world for teaching you what not to do. And when you know what not to do in order not to lose money, you begin to learn what to do in order to win. Did you get that? You begin to learn!

Hutton brokerage when he was first learning to trade on the exchanges between 1900 and 1901. It is also possible that Livermore started his account at W. E. Hutton & Co., a Cincinnati-based bond house run by Edward Hutton’s cousin that got its start in 1886. W. E. Hutton had a seat on the NYSE, and E. F. Hutton worked at the firm’s New York office for a time immediately after business school.

25What is clear is that Livermore had a close relationship with E. F. Hutton that eventually soured. In 1909, the New York Times wrote that Livermore had been missing for several weeks from “his accustomed place” at the E. F. Hutton offices at 35 New Street. His name had been erased from one of the inner office doors, and the reporter’s inquiries about Livermore were met with impatience.

26 Over the next 70 years, E. F. Hutton became one of the largest and most respected brokerages on Wall Street, but it was brought down by a check-kiting scandal and losses associated with the stock market crash in 1987. It was sold to Shearson Lehman American Express, which ultimately spun it off to Primerica, which merged it with Smith Barney, which later itself became part of Citigroup.

ENDNOTES

1 United States House of Representatives, “Cotton Futures: Hearing before the Committee on Agriculture,” February 13-14, 1922.

2 Melvin Thomas Copeland, The

Cotton Manufacturing Industry of the United States (Cambridge, Massachusetts: Harvard University, 1912), 185-192.

3 Louis Guenther,

Investment and Speculation (Chicago: LaSalle Extension University, 1916), 225.

4 “Business & Finance: New Cotton Exchange,”

Time, July, 30, 1923.

5 Edwin Lefevre, “Stock Manipulation,”

Saturday Evening Post, March 20, 1909, 5.

6 “The New York Produce Exchange,”

New York Times, September 22, 1901, magazine supplement.

8 Moses Smith,

Plain Truths about Stock Speculation (Brooklyn, New York: E.V. Smith, 1887), 148-151.

9 Richard Wheatly, “The New York Produce Exchange,”

Harper’s Magazine (June-September 1886): 191.

11 Jerry W. Markham,

A Financial History of the United States (2002), p. 332. Armonk, NY: M.E. Sharpe.

12 Robert Sobel,

The Curbstone Brokers (2000), 17. New York: Beard Books.

13 Samuel Armstrong Nelson,

The ABC of Wall Street (1900), 69.

14 Guenther,

Investment and Speculation, 228-230.

15 Nelson,

ABC of Wall Street, 72.

16 Merrill Teague, “Bucket-Shop Sharks,”

Everybody’s Magazine (June 1906): 733.

18 Gregory John Downey. “Telegraph Messenger Boys: Labor, Technology, and Geography, 1850-1950.” (2002) 29.

19 “Haight & Freese Co. in Receiver’s Hands,”

New York Times, May 10, 1905, 1.

20 Michael Berger,

The Automobile in American History and Culture (Westport, Connecticut: Greenwood Press, 2002), xvii-xix.

21 Mark Stevens,

Sudden Death: The Rise and Fall of E. F. Hutton, (New York: New American Library, 1989), 12.

22 “Stock Exchange News,”

Wall Street Journal, November 19, 1900, 6.

23 “The ‘Little Board,”

New York Times, December 31, 1905, Business Section, 12.

24 Stevens,

Sudden Death, 17.

26 “Livermore’s Office Vacant,”

New York Times, July 21, 1909, 1.

These firms were very careful and paid special attention to the execution. He said that they had confidential connections with the biggest and smartest houses on the New York Stock Exchange and through their personal pull and by guaranteeing a business of hundreds of thousands of shares a month they got much better service than an individual customer could get.

These firms were very careful and paid special attention to the execution. He said that they had confidential connections with the biggest and smartest houses on the New York Stock Exchange and through their personal pull and by guaranteeing a business of hundreds of thousands of shares a month they got much better service than an individual customer could get.

They deal in wheat, cotton, provisions; anything you want. They have correspondents everywhere and memberships in all the exchanges, either in their own name or on the quiet.”

They deal in wheat, cotton, provisions; anything you want. They have correspondents everywhere and memberships in all the exchanges, either in their own name or on the quiet.”

and he made some money. These fellows didn’t mind being sued by customers on charges of fraud, as they generally had a good technical legal defense ready. But they were afraid I’d attach the furniture—the money in the bank was not available because they took care not to have any funds exposed to that danger. It would not hurt them to be known as pretty sharp, but to get a reputation for welshing was fatal. For a customer to lose money at his broker’s is no rare event. But for a customer to make money and then not get it is the worst crime on the speculators’ statute books.

and he made some money. These fellows didn’t mind being sued by customers on charges of fraud, as they generally had a good technical legal defense ready. But they were afraid I’d attach the furniture—the money in the bank was not available because they took care not to have any funds exposed to that danger. It would not hurt them to be known as pretty sharp, but to get a reputation for welshing was fatal. For a customer to lose money at his broker’s is no rare event. But for a customer to make money and then not get it is the worst crime on the speculators’ statute books.

I was twenty when I made my first ten thousand, and I lost that. But I knew how and why—because I traded out of season all the time; because when I couldn’t play according to my system, which was based on study and experience, I went in and gambled. I hoped to win, instead of knowing that I ought to win on form. When I was about twenty-two I ran up my stake to fifty thousand dollars; I lost it on May ninth. But I knew exactly why and how. It was the laggard tape and the unprecedented violence of the movements that awful day. But I didn’t know why I had lost after my return from St. Louis or after the May ninth panic. I had theories—that is, remedies for some of the faults that I thought I found in my play. But I needed actual practice.

I was twenty when I made my first ten thousand, and I lost that. But I knew how and why—because I traded out of season all the time; because when I couldn’t play according to my system, which was based on study and experience, I went in and gambled. I hoped to win, instead of knowing that I ought to win on form. When I was about twenty-two I ran up my stake to fifty thousand dollars; I lost it on May ninth. But I knew exactly why and how. It was the laggard tape and the unprecedented violence of the movements that awful day. But I didn’t know why I had lost after my return from St. Louis or after the May ninth panic. I had theories—that is, remedies for some of the faults that I thought I found in my play. But I needed actual practice.