XXI:

21.1 Imperial Steel appears to be a pseudonym for a company whose shares Livermore was hired to manipulate, as no U.S. firms by that name were mentioned in contemporary media. Steelmakers were among the most popular and well-traded stocks of the 1910s and 1920s, as this was a period of rapid expansion of the industry. From 1875 to 1920, U.S. steel production rose to 60 million tons a year from 380,000 tons, with growth amounting to more than 7% a year. The jump stemmed from the rapid expansion of urban infrastructure in cities large and small, as office buildings, factories, bridges, cars, and railroads sprang up. Key to the success of the U.S. steelmaking industry was abundant high-quality iron ore in the hills of Michigan, Wisconsin, and Minnesota to serve as raw material, as well as abundant coal in Pennsylvania and Ohio to stoke the smelting furnaces. Because few native-born Americans wanted to work in the searing heat of the dangerous mills, they became a magnet for immigrants from England, Ireland, Germany, and Eastern Europe.

I am well aware that all these generalities do not sound especially impressive. Generalities seldom do. Possibly I may succeed better if I give a concrete example. I’ll tell you how I marked up the price of a stock 30 points, and in so doing accumulated only seven thousand shares and developed a market that would absorb almost any amount of stock.

It was Imperial Steel.

The stock had been brought out by reputable people and it had been fairly well tipped as a property of value. About 30 per cent of the capital stock was placed with the general public through various Wall Street houses, but there had been no significant activity in the shares after they were listed. From time to time somebody would ask about it and one or another insider—members of the original underwriting syndicate—would say that the company’s earnings were better than expected and the prospects more than encouraging. This was true enough and very good as far as it went, but not exactly thrilling. The speculative appeal was absent, and from the investor’s point of view the price stability and dividend permanency of the stock were not yet demonstrated. It was a stock that never behaved sensationally. It was so gentlemanly that no corroborative rise ever followed the insiders’ eminently truthful reports. On the other hand, neither did the price decline.

21.2 In most of Reminiscences, Lefevre depicts Livermore in his role as a trader. But in Chapters 21, 22, and 23, we see Livermore in a role he took on later in life: as an “operator,” a polite term for “manipulator.” We learn in great detail how corporate insiders and outside financiers pooled their shares in a company that was not moving fast enough for their liking and hired pros like Livermore to sell them to the public at higher prices.

Livermore takes pains to explain that he would not manipulate a stock unless he believed it was fi nancially sound. He explains that he demanded call options on the stock as a fee so that his interests were aligned with those of his customers, as he could sell his shares at a low, preset price once he had manipulated them higher. Livermore would order the pool shareholders to put their stock in an escrow account so that they could not interfere with his manipulation by selling at the wrong time. He often funded the manipulation himself for the same reason: He did not want anyone, even his customers, to know what he was doing.

There were no regulations prohibiting manipulation in the early 1900s, and it was not considered illegal unless false statements were made. Pools also were not permitted to buy and sell stock among themselves to make it look as if it were more active, a practice called “wash sales.”

Imperial Steel remained unhonoured and unsung and untipped, content to be one of those stocks that don’t go down because nobody sells and that nobody sells because nobody likes to go short of a stock that is not well distributed; the seller is too much at the mercy of the loaded-up inside clique. Similarly, there is no inducement to buy such a stock. To the investor Imperial Steel therefore remained a speculation. To the speculator it was a dead one—the kind that makes an investor of you against your will by the simple expedient of falling into a trance the moment you go long of it. The chap who is compelled to lug a corpse a year or two always loses more than the original cost of the deceased; he is sure to find himself tied up with it when some really good things come his way.

One day the foremost member of the Imperial Steel syndicate, acting for himself and associates, came to see me. They wished to create a market for the stock, of which they controlled the undistributed 70 per cent. They wanted me to dispose of their holdings

at better prices than they thought they would obtain if they tried to sell in the open market. They wanted to know on what terms I would undertake the job.

I told him that I would let him know in a few days. Then I looked into the property. I had experts go over the various departments of the company—industrial, commercial and financial. They made reports to me which were unbiased. I wasn’t looking for the good or the bad points, but for the facts, such as they were.

The reports showed that it was a valuable property. The prospects justified purchases of the stock at the prevailing market price—if the investor were willing to wait a little. Under the circumstances an advance in the price would in reality be the commonest and most legitimate of all market movements—to wit, the process of discounting the future. There was therefore no reason that I could see why I should not conscientiously and confidently undertake the bull manipulation of Imperial Steel.

I let my man know my mind and he called at my office to talk the deal over in detail. I told him what my terms were. For my services I asked no cash, but calls on one hundred thousand shares of the Imperial Steel stock. The price of the calls ran up from 70 to 100. That may seem like a big fee to some. But they should consider that the insiders were certain they themselves could not sell one hundred thousand shares, or even fifty thousand shares, at 70. There was no market for the stock. All the talk about wonderful earnings and excellent prospects had not brought in buyers, not to any great extent. In addition, I could not get my fee in cash without my clients first making some millions of dollars. What I stood to make was not an exorbitant selling commission. It was a fair contingent fee.

Knowing that the stock had real value and that general market conditions were bullish and therefore favourable for an advance in all good stocks, I figured that I ought to do pretty well. My clients were encouraged by the opinions I expressed, agreed to my terms at once, and the deal began with pleasant feelings all around.

I proceeded to protect myself as thoroughly as I could. The syndicate owned or controlled about 70 per cent of the outstanding stock. I had them deposit their 70 per cent under a trust agreement. I didn’t propose to be used as a dumping ground for the big holders. With the majority holdings thus securely tied up, I still had 30 per cent of scattered holdings to consider, but that was a risk I had to take. Experienced speculators do not expect ever to engage in utterly riskless ventures. As a matter of fact, it was not much more likely that all the untrusteed stock would be thrown on the market at one fell swoop than that all the policyholders of a life-insurance company would die at the same hour, the same day. There are unprinted actuarial tables of stock-market risks as well as of human mortality.

21.3 A As a trader who had been around the block a few times, Livermore was a natural choice for pools looking for a manipulator. It was also relatively sure money, which traders who lived on the edge welcomed. He approached the job of pushing a stock higher with the perspective of his target audience in his mind, ensuring that traders would believe the path of least resistance was higher.

As Chapters 21 and 22 make clear, Livermore was leery of his pool partners; he feared that he would be double-crossed and left holding stocks at untenable prices. But when he leaned into the task, contemporary accounts suggest that his manipulations had the mark of artistry, as he painted the tape to make it look as if there were higher-than-natural demand for a stock—buying just enough to pique the unsuspecting public’s interest.

He would also sometimes let shares fall just enough below certain levels on high volume to entice a heavy round of short selling, then would pull the chain to force bears to cover, propelling the stock much higher. He makes clear that his efforts were oriented toward shoving a stock toward a predetermined top by any legal means and then selling the pool’s shares on the way down into a falling market. He did this by letting the price sink off the top and then buying just enough to make the public think it was witnessing a mere correction off the high.

The public’s attempt to buy this manufactured dip would then create a second, equivalent high—familiar to traders as a “double top”—that he would sell into with high volume. This is why old highs become formidable barriers: They represent a lot of supply overhang. And of course this was a key reason that Livermore says he liked to buy new highs, as they were largely possible only when a stock was free from the gravity of oversupply.

Having protected myself from some of the avoidable dangers of a stock-market deal of that sort, I was ready to begin my campaign.

Its objective was to make my calls valuable. To do this I must put up the price and develop a market in which I could sell one hundred thousand shares—the stock in which I held options.

The first thing I did was to find out how much stock was likely to come on the market on an advance. This was easily done through my brokers, who had no trouble in ascertaining what stock was for sale at or a little above the market. I don’t know whether the specialists told them what orders they had on their books or not. The price was nominally 70, but I could not have sold one thousand shares at that price. I had no evidence of even a moderate demand at that figure or even a few points lower. I had to go by what my brokers found out. But it was enough to show me how much stock there was for sale and how little was wanted.

As soon as I had a line on these points I quietly took all the stock that was for sale at 70 and higher. When I say “I” you will understand that I mean my brokers. The sales were for account of some of the minority holders because my clients naturally had cancelled whatever selling orders they might have given out before they tied up their stock.

I didn’t have to buy very much stock. Moreover, I knew that the right kind of advance would bring in other buying orders—and, of course, selling orders also.

I didn’t give bull tips on Imperial Steel to anybody. I didn’t have to. My job was to seek directly to influence sentiment by the best possible kind of publicity. I do not say that there should never be bull propaganda. It is as legitimate and indeed as desirable to advertise the value of a new stock as to advertise the value of woolens or shoes or automobiles. Accurate and reliable information should be given to the public. But what I meant was that the tape did all that was needed for my purpose. As I said before, the reputable newspapers always try to print explanations for market movements. It is news. Their readers demand to know not only what happens in the stock market but why it happens. Therefore without the manipulator lifting a finger the financial writers will print all the available information and gossip, and also analyse the reports of earnings, trade condition and outlook; in short, whatever may throw light on the advance. Whenever a newspaperman or an acquaintance asks my opinion of a stock and I have one I do not hesitate to express it. I do not volunteer advice and I never give tips, but I have nothing to gain in my operations from secrecy. At the same time I realise that the best of all tipsters, the most persuasive of all salesmen, is the tape.

When I had absorbed all the stock that was for sale at 70 and a little higher I relieved the market of that pressure, and naturally that made clear for trading purposes the line of least resistance in Imperial Steel. It was manifestly upward. The moment that fact was perceived by the observant traders on the floor they logically assumed that the stock was in for an advance the extent of which they could not know; but they knew enough to begin buying. Their demand for Imperial Steel, created exclusively by the obviousness of the stock’s rising tendency—the tape’s infallible bull tip!—I promptly filled. I sold to the traders the stock that I had bought from the tired-out holders at the beginning. Of course this selling was judiciously done; I contented myself with supplying the demand. I was not forcing my stock on the market and I did not want too rapid an advance. It wouldn’t have been good business to sell out the half of my one hundred thousand shares at that stage of the proceedings. My job was to make a market on which I might sell my entire line.

But even though I sold only as much as the traders were anxious to buy, the market was temporarily deprived of my own buying power, which I had hitherto exerted steadily. In due course the traders’ purchases ceased and the price stopped rising. As soon as that happened there began the selling by disappointed bulls or by those traders whose reasons for buying disappeared the instant the rising tendency was checked. But I was ready for this selling, and on the way down I bought back the stock I had sold to the traders a couple of points higher. This buying of stock I knew was bound to be sold in turn checked the downward course; and when the price stopped going down the selling orders stopped coming in.

I then began all over again. I took all the stock that was for sale on the way up—it wasn’t very much—and the price began to rise a second time; from a higher starting point than 70. Don’t forget that on the way down there are many holders who wish to heaven they had sold theirs but won’t do it three or four points from the top. Such speculators always vow they will surely sell out if there is a rally. They put in their orders to sell on the way up, and then they change their minds with the change in the stock’s price-trend. Of course there is always profit taking from safe-playing quick runners to whom a profit is always a profit to be taken.

All I had to do after that was to repeat the process; alternately buying and selling; but always working higher.

Sometimes, after you have taken all the stock that is for sale, it pays to rush up the price sharply, to have what might be called little bull flurries in the stock you are manipulating. It is excellent advertising, because it makes talk and also brings in both the professional traders and that portion of the speculating public that likes action.

It is, I think, a large portion. I did that in Imperial Steel, and whatever demand was created by those spurts I supplied. My selling always kept the upward movement within bounds both as to extent and as to speed. In buying on the way down and selling on the way up I was doing more than marking up the price: I was developing the marketability of Imperial Steel.

After I began my operations in it there never was a time when a man could not buy or sell the stock freely; I mean by this, buy or sell a reasonable amount without causing over-violent fluctuations in the price. The fear of being left high and dry if he bought, or squeezed to death if he sold, was gone. The gradual spread among the professionals and the public of a belief in the permanence of the market for Imperial Steel had much to do with creating confidence in the movement; and, of course, the activity also put an end to a lot of other objections. The result was that after buying and selling a good many thousands of shares I succeeded in making the stocks sell at par. At one hundred dollars a share everybody wanted to buy Imperial Steel. Why not? Everybody now knew that it was a good stock; that it had been and still was a bargain. The proof was the rise. A stock that could go thirty points from 70 could go up thirty more from par. That is the way a good many argued.

In the course of marking up the price those thirty points I accumulated only seven thousand shares. The price on this line averaged me almost exactly 85. That meant a profit of fifteen points on it; but, of course, my entire profit, still on paper, was much more. It was a safe enough profit, for I had a market for all I wanted to sell. The stock would sell higher on judicious manipulation and I had graduated calls on one hundred thousand shares beginning at 70 and ending at 100.

21.4 Creating “bull flurries” was a common strategy for pool operators and market manipulators, and you can still see it occur today. Traders are always attracted by shiny objects, just like fish are attracted to silvery lures.

Keene famously used this technique with U.S. Steel, as historian Frederick Lewis Allen writes: “Keene’s manipulative operations were fulfilling the triple function of providing a steadying influence for the market price, of advertising Steel common on the ticker tape and in brokers’ offices and on financial pages and wherever speculators and investors gathered, and of providing plenty of buyers for those who had been allotted stock and wished to unload and gather in their cash.”

1Circumstances prevented me from carrying out certain plans of mine for converting my paper profits into good hard cash. It had been, if I do say so myself, a beautiful piece of manipulation, strictly legitimate and deservedly successful. The property of the company was valuable and the stock was not dear at the higher price. One of the members of the original syndicate developed a desire to secure the control of the property—a prominent banking house with ample resources. The control of a prosperous and growing concern like the Imperial Steel Corporation is possibly more valuable to a banking firm than to individual investors. At all events, this firm made me an offer for all my options on the stock. It meant an enormous profit for me, and I instantly took it. I am always willing to sell out when I can do so in a lump at a good profit. I was quite content with what I made out of it.

Before I disposed of my calls on the hundred thousand shares I learned that these bankers had employed more experts to make a still more thorough examination of the property. Their reports showed enough to bring me in the offer I got. I kept several thousand shares of the stock for investment. I believe in it.

There wasn’t anything about my manipulation of Imperial Steel that wasn’t normal and sound. As long as the price went up on my buying I knew I was O.K. The stock never got waterlogged, as a stock sometimes does. When you find that it fails to respond adequately to your buying you don’t need any better tip to sell. You know that if there is any value to a stock and general market conditions are right you can always nurse it back after a decline, no matter if it’s twenty points. But I never had to do anything like that in Imperial Steel.

In my manipulation of stocks I never lose sight of basic trading principles. Perhaps you wonder why I repeat this or why I keep on harping on the fact that I never argue with the tape or lose my temper at the market because of its behaviour. You would think—wouldn’t you?—that shrewd men who have made millions in their own business and in addition have successfully operated in Wall Street at times would realise the wisdom of playing the game dispassionately. Well, you would be surprised at the frequency with which some of our most successful promoters behave like peevish women because the market does not act the way they wish it to act. They seem to take it as a personal slight, and they proceed to lose money by first losing their temper.

21.5 Colonel John Wing Prentiss, a senior partner in the prominent New York brokerage

Hornblower & Weeks, became notorious for offering Henry Ford $1 billion three separate times from 1924 to 1927 for control of the Ford Motor Co.

2Born in Maine in 1875 and a graduate of Phillips Academy and Harvard University, he was described by the New York Times as a young man who attracted the attention of firm owner John W. Weeks for his strength as a bond salesman in Boston “at a time when the general public knew nothing and cared less about bond issues.”

3 Prentiss handled financing for Dodge, Chevrolet, General Motors, and Hudson Motors, and his daring attempt to capture Ford at a time when it was down on its luck was considered a spectacular, if ultimately unsuccessful, raid.

Weeks, who later became a U.S. senator from Massachusetts and served as secretary of war under presidents Warren Harding and Calvin Coolidge, described Prentiss’s application for his first job in this way: When Prentiss came into our office I told him there wasn’t a chance, because we had twice as many young men in the office as we could use. He said he didn’t care about salary, and when I asked him how soon he could go to work it we found a place for him he answered, “right now,” and took off his coat and hung it up. I had to give him a job.

3 Prentiss served in the U.S. Army as a logistics aide during World War I and was discharged as a lieutenant colonel. After the crash of 1929, the avid golfer and squash player served on many committees tasked with determining ways to improve Wall Street practices and help New York Stock Exchange members who had become unemployed. He was particularly noted for his role in unwinding the mess left after the Stutz Motor Co. pool was crushed.

Livermore’s diatribe against Prentiss in Reminiscences for exhibiting naïveté as a pool operator is indicative of the veteran trader’s contempt for the Wall Street establishment. It is a rare passage in which Livermore directly airs his side of a bitter grievance over a failed deal.

There has been much gossip about a disagreement between John Prentiss

and myself. People have been led to expect a dramatic narrative of a stock-market deal that went wrong or some double-crossing that cost me—or him—millions; or something of that sort. Well, it wasn’t.

21.6 Many small petroleum companies began popping up around this time in the wake of the breakup of the Standard Oil monopoly. Examples include King Petroleum, Cushing Petroleum, and Mexican Petroleum. Traders would affectionately abbreviate the names to “Pete” for convenience.

Although there is no record of a Petroleum Products Co., Livermore was famously involved in a pool focused on the shares of Mammoth Oil, a subsidiary of Sinclair Oil. The company was embroiled a short while later in the Teapot Dome scandal, which brought down the Harding administration’s secretary of the interior on a bribery conviction. Livermore told a Senate committee that he “made a market” by buying and selling $10 million worth of stock.

4Prentiss and I had been friendly for years. He had given me at various times information that I was able to utilise profitably, and I had given him advice which he may or may not have followed. If he did he saved money.

He was largely instrumental in the organisation and promotion of the Petroleum Products Company.

After a more or less successful market début general conditions changed for the worse and the new stock did not fare as well as Prentiss and his associates had hoped. When basic conditions took a turn for the better Prentiss formed a pool and began operations in Pete Products.

I cannot tell you anything about his technique. He didn’t tell me how he worked and I didn’t ask him. But it was plain that notwithstanding his Wall Street experience and his undoubted cleverness, whatever it was he did proved of little value and it didn’t take the pool long to find out that they couldn’t get rid of much stock. He must have tried everything he knew, because a pool manager does not ask to be superseded by an outsider unless he feels unequal to the task, and that is the last thing the average man likes to admit. At all events he came to me and after some friendly preliminaries he said he wanted me to take charge of the market for Pete Products and dispose of the pool’s holdings, which amounted to a little over one hundred thousand shares. The stock was selling at 102 to 103.

The thing looked dubious to me and I declined his proposition with thanks. But he insisted that I accept. He put it on personal grounds, so that in the end I consented. I constitutionally dislike to identify myself with enterprises in the success of which I cannot feel confidence, but I also think a man owes something to his friends and acquaintances. I said I would do my best, but I told him I did not feel very cocky about it and I enumerated the adverse factors that I would have to contend with. But all Prentiss said to that was that he wasn’t asking me to guarantee millions in profits to the pool. He was sure that if I took hold I’d make out well enough to satisfy any reasonable being.

Well, there I was, engaged in doing something against my own judgment. I found, as I feared, a pretty tough state of affairs, due in great measure to Prentiss’ own mistakes while he was manipulating the stock for account of the pool. But the chief factor against me was time. I was convinced that we were rapidly approaching the end of a bull swing and therefore that the improvement in the market, which had so encouraged Prentiss, would prove to be merely a short-lived rally. I feared that the market would turn definitely bearish before I could accomplish much with Pete Products. However, I had given my promise and I decided to work as hard as I knew how.

I started to put up the price. I had moderate success. I think I ran it up to 107 or thereabouts, which was pretty fair, and I was even able to sell a little stock on balance. It wasn’t much, but I was glad not to have increased the pool’s holdings. There were a lot of people not in the pool who were just waiting for a small rise to dump their stock, and I was a godsend to them. Had general conditions been better I also would have done better. It was too bad that I wasn’t called in earlier. All I could do now, I felt, was to get out with as little loss as possible to the pool.

I sent for Prentiss and told him my views. But he started to object. I then explained to him why I took the position I did. I said: “Prentiss, I can feel very plainly the pulse of the market. There is no follow-up in your stock. It is no trick to see just what the public’s reaction is to my manipulation. Listen: When Pete Products is made as attractive to traders as possible and you give it all the support needed at all times and notwithstanding all that you find that the public leaves it alone you may be sure that there is something wrong, not with the stock but with the market. There is absolutely no use in trying to force matters. You are bound to lose if you do. A pool manager should be willing to buy his own stock when he has company. But when he is the only buyer in the market he’d be an ass to buy it. For every five thousand shares I buy the public ought to be willing or able to buy five thousand more. But I certainly am not going to do all the buying. If I did, all I would succeed in doing would be to get soaked with a lot of long stock that I don’t want. There is only one thing to do, and that is to sell. And the only way to sell is to sell.”

“You mean, sell for what you can get?” asked Prentiss.

“Right!” I said. I could see he was getting ready to object. “If I am to sell the pool’s stock at all you can make up your mind that the price is going to break through par and——”

“Oh, no! Never!” he yelled. You’d have imagined I was asking him to join a suicide club.

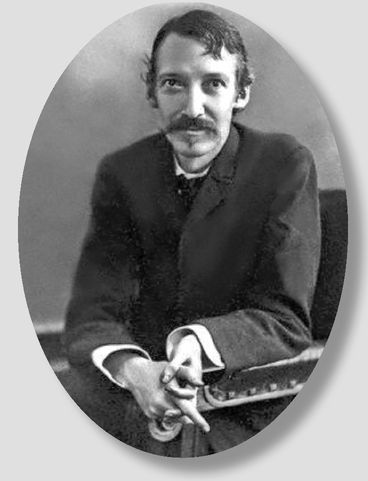

21.7The term was popularized in 1878 by a series of macabre detective fiction from Scottish nov elist Robert Louis Stevenson called, “The Suicide Club.” In the stories, the characters of Prince Florizel of Bohemia and sidekick Colonel Geraldine sneak into a secret society of people who are set on killing themselves but don’t have to courage to do it themselves. Set in the gas-lit streets of Victorian-era London, the work begins with the characters dining at an oyster bar when a man starts handing out cream tarts for free. Intrigued by such odd behavior, the two protagonists invite the man to dinner, whereupon they learn of the suicide club.

Lefevre actually wrote about the stories in the context of the stock boom of 1901. In an article for Munsey’s Magazine, he said: “Stevenson, you remember, had a coward in his ’Suicide Club’ who threw dice with Death to enjoy the delights of fear, because when he escaped he tasted the intense joys of living.”

5He continued: “It is the same in stock gambling—the delightful uncertainty; the grim ’now you see it and now you don’t’ of luck; the little chills of pleasure; the leaden sinking of disappointment; the magnifi ed joys of anticipation; the exquisite expectancy—all this fi res the blood of the young, as does love, and of the old, as love no longer can.”

6The stories were later adapted into plays, movies, and television shows. In Lefevre’s time, the sobriquet “Suicide Club” was also given to the Tank Corps commanded in France during World War I by Col. George Patton in 1918.

“Prentiss,” I said to him, “it is a cardinal principle of stock manipulation to put up a stock in order to sell it. But you don’t sell in bulk on the advance. You can’t. The big selling is done on the way down from the top. I cannot put up your stock to 125 or 130. I’d like to, but it can’t be done. So you will have to begin your selling from this level. In my opinion all stocks are going down, and Petroleum Products isn’t going to be the one exception. It is better for it to go down now on the pool’s selling than for it to break next month on selling by some one else. It will go down anyhow.”

I can’t see that I said anything harrowing, but you could have heard his howls in China. He simply wouldn’t listen to such a thing. It would never do. It would play the dickens with the stock’s record, to say nothing of inconvenient possibilities at the banks where the stock was held as collateral on loans, and so on.

I told him again that in my judgment nothing in the world could prevent Pete Products from breaking fifteen or twenty points, because the entire market was headed that way, and I once more said it was absurd to expect his stock to be a dazzling exception. But again my talk went for nothing. He insisted that I support the stock.

Here was a shrewd business man, one of the most successful promoters of the day, who had made millions in Wall Street deals and knew much more than the average man about the game of speculation, actually insisting on supporting a stock in an incipient bear market. It was his stock, to be sure, but it was nevertheless bad business. So much so that it went against the grain and I again began to argue with him. But it was no use. He insisted on putting in supporting orders.

Of course when the general market got weak and the decline began in earnest Pete Products went with the rest. Instead of selling I actually bought stock for the insiders’ pool—by Prentiss’ orders.

The only explanation is that Prentiss did not believe the bear market was right on top of us. I myself was confident that the bull market was over. I had verified my first surmise by tests not alone in Pete Products but in other stocks as well. I didn’t wait for the bear market to announce its safe arrival before I started selling. Of course I didn’t sell a share of Pete Products, though I was short of other stocks.

The Pete Products pool, as I expected, was hung up with all they held to begin with and with all they had to take in their futile effort to hold up the price. In the end they did liquidate; but at much lower figures than they would have got if Prentiss had let me sell when and as I wished. It could not be otherwise. But Prentiss still thinks he was right—or says he does. I understand he says the reason I gave him the advice I did was that I was short of other stocks and the general market was going up. It implies, of course, that the break in Pete Products that would have resulted from selling out the pool’s holdings at any price would have helped my bear position in other stocks.

That is all tommyrot. I was not bearish because I was short of stocks. I was bearish because that was the way I sized up the situation, and I sold stocks short only after I turned bearish. There never is much money in doing things wrong end to; not in the stock market. My plan for selling the pool’s stock was based on what the experience of twenty years told me alone was feasible and therefore wise. Prentiss ought to have been enough of a trader to see it as plainly as I did. It was too late to try to do anything else.

I suppose Prentiss shares the delusion of thousands of outsiders who think a manipulator can do anything. He can’t. The biggest thing Keene did was his manipulation of U. S. Steel common and preferred in the spring of 1901. He succeeded not because he was clever and resourceful and not because he had a syndicate of the richest men in the country back of him. He succeeded partly because of those reasons but chiefly because the general market was right and the public’s state of mind was right.

It isn’t good business for a man to act against the teachings of experience and against common sense. But the suckers in Wall Street are not all outsiders. Prentiss’ grievance against me is what I have just told you. He feels sore because I did my manipulation not as I wanted to but as he asked me to.

There isn’t anything mysterious or underhanded or crooked about manipulation designed to sell a stock in bulk provided such operations are not accompanied by deliberate misrepresentations. Sound manipulation must be based on sound trading principles. People lay great stress on old-time practices, such as wash sales. But I can assure you that the mere mechanics of deception count for very little. The difference between stock-market manipulation and the over-the-counter sale of stocks and bonds is in the character of the clientele rather than in the character of the appeal. J. P. Morgan & Co. sell an issue of bonds to the public—that is, to investors. A manipulator disposes of a block of stock to the public—that is, to speculators. An investor looks for safety, for permanence of the interest return on the capital he invests. The speculator looks for a quick profit.

21.8 Here Livermore is referring to the boom times of 1901, a period marked by intense public participation in stock speculation as new industrial combinations were formed, new shares issued, and business prospered in the wake of President McKinley’s reaffirmation of the gold standard.

He wants the reader to understand the stark difference between the enthusiasm seen in a real bull market and the torpor of the sideways market in which he found himself entombed with Prentiss.

It’s impossible to overstate the craze for stocks that en tranced the public in 1901, helping Keene unload his U.S. Steel shares. Henry Clews compared amateur stock bulls at the time to drunkards in an epitaph that could be applied again to every subsequent bull cycle:

They have been engaged now for such a prolonged period in buying, buying, buying, making profits on all their ventures, as to make them like the inebriate, callous to all adverse factors whenever they come up. High prices don’t frighten them; scarcity and high rates for money don’t frighten them; strikes don’t frighten them. Buying and holding on have simply become chronic with them.

7A history of the New York Stock Exchange added: “From Maine to Texas small-bore investors rushed to the savings bank or the woolen stocking and appears as buyers of the new securities. What prices they were paying they seemed not even to care to understand.”

8Surveying the frenzy, historian Alexander Dana Noyes wrote that “old and experienced capitalists lost their heads, asserted publically that the old traditions of finance no longer held and that a new order of things must now be reckoned with, and joined the dance.” As for everyone else, he said, “The ’outside public,’ meantime, seemed to lose all restraint. A stream of excited customers, of every description, brought their money down to Wall Street, and spent their days in offices near the Stock Exchange.”

9 The manipulator necessarily finds his primary market among speculators—who are willing to run a greater than normal business risk so long as they have a reasonable chance to get a big return on their capital. I myself never have believed in blind gambling. I may plunge or I may buy one hundred shares. But in either case I must have a reason for what I do.

I distinctly remember how I got into the game of manipulation—that is, in the marketing of stocks for others. It gives me pleasure to recall it because it shows so beautifully the professional Wall Street attitude toward stock-market operations. It happened after I had “come back”—that is, after my Bethlehem Steel trade in 1915 started me on the road to financial recovery.

I traded pretty steadily and had very good luck. I have never sought newspaper publicity, but neither have I gone out of my way to hide myself. At the same time, you know that professional Wall Street exaggerates both the successes and the failures of whichever operator happens to be active; and, of course, the newspapers hear about him and print rumors. I have been broke so many times, according to the gossips, or have made so many millions, according to the same authorities, that my only reaction to such reports is to wonder how and where they are born. And how they grow! I have had broker friend after broker friend bring the same story to me, a little changed each time, improved, more circumstantial.

All this preface is to tell you how I first came to undertake the manipulation of a stock for someone else. The stories the newspapers printed of how I had paid back in full the millions I owed did the trick. My plungings and my winnings were so magnified by the newspapers that I was talked about in Wall Street. The day was past when an operator swinging a line of two hundred thousand shares of stock could dominate the market. But, as you know, the public always desires to find successors to the old leaders. It was Mr. Keene’s reputation as a skilful stock operator, a winner of millions on his own hook, that made promoters and banking houses apply to him for selling large blocks of securities. In short, his services as manipulator were in demand because of the stories the Street had heard about his previous successes as a trader.

But Keene was gone—passed on to that heaven where he once said he wouldn’t stay a moment unless he found Sysonby

there waiting for him. Two or three other men who made stock-market history for a few months had relapsed into the obscurity of prolonged inactivity. I refer particularly to certain of those plunging Westerners who came to Wall Street in 1901 and after making many millions out of their Steel holdings remained in Wall Street. They were in reality superpromoters rather than operators of the Keene type. But they were extremely able, extremely rich and extremely successful in the securities of the companies which they and their friends controlled. They were not really great manipulators, like Keene or Governor Flower.

Still, the Street found in them plenty to gossip about and they certainly had a following among the professionals and the sportier commission houses. After they ceased to trade actively the Street found itself without manipulators; at least, it couldn’t read about them in the newspapers.

21.9 Sysonby, a racehorse born in Kentucky in 1902, is ranked 30th in a list of the top 100 Thoroughbred champions of the twentieth century. Upon his death in June 1906, the New York Times ran a long obituary, calling Sysonby “possibly the greatest race horse of the American turf.”

10

Keene had bought Sysonby’s mother at an auction, bred her in Kentucky, and then reaped the benefi t of careful development by top trainer James G. Rowe.

11 Sysonby won all but one of the major stakes races in which he was entered—and that single loss stemmed from being drugged by a corrupt stable hand. Sysonby was inducted into the National Museum of Racing and Hall of Fame in Saratoga, New York, in 1956.

12 When the horse’s life was cut short by blood poisoning, the New York Times reported that Keene was “greatly shocked by the news of his loss, as Sysonby was his favorite above all the great horses that he had ever owned.”

21.10Roswell Pettibone Flower, born in 1835, was the governor of New York from 1892 to 1894 and also served two terms in the U.S. Congress. He was best remembered by Livermore, however, as a legendary Wall Street financier and operator who owned the banking firm R. P. Flower & Co.

The sixth of nine boys born to a wool carder in upstate New York, Flower worked at a store for $5 a month to earn enough to attend high school, then launched his first career as teacher who boarded with his pupils.

13 He later became a deputy postmaster at $50 a month and loved to tell trader friends later that after buying a gold watch for $50 one day, he turned around and sold it to another man for $53. After six years, Roswell had saved enough money to buy a half interest in a jewelry store for $1,000 and soon managed to buy out his partner and expand the business. He made a strong impression on a wealthy railroad president, Henry Keep, who married his wife’s sister, and when that man died, Flower found himself the trustee of the widow’s $4 million estate.

Flower moved to Manhattan to manage the funds and accumulated his own fortune as a stock operator in the 1870s. He spent the next two and a half decades in politics and returned to Wall Street in the late 1880s. The New York Times reported that he made a fortune in 1898 by wading confi dently into the panic that resulted from the sinking of the USS Maine in Havana Harbor—the incident that sparked the Spanish-American War. The report said: “He came into the market with a vigor and showed such confidence that he became apparently the master of the situation. Under his leadership the markets started upward, and gains in market value were tremendous.”

14The Times reported that Flower declared himself bullish on U.S. stocks with this statement:

“I am a believer in American stocks and a buyer of American stocks because I am a believer in our country.” The newspaper said he faced “violent opposition” from the powerful speculators James Keene and Russell Sage, but his stocks rose by $100 million and “have since been continually strong and have been more popular than any other group in the Street.” When his optimism won out, the Times crowed that the former governor had “whipped the enemy entire.”

15Following his death in the evening of May 12, 1899, from heart disease, a mini panic ensued as the stocks he frequently bulled fell by as much as 30 points on the loss of such a strident supporter. The lows came in the opening minutes of trading, with New York Air Brake falling from $185 to $125 with declines of $5 to $10 between transactions before recovering to close at $164.

16 But the damage was done as the bull market of 1899 died along with Flower. Henry Clews writes that Flower had “a very plain exterior” and “used language that was noticeable more for its force and directness and emphasis, than it was for polish.”

17You remember the big bull market that began when the Stock Exchange resumed business in 1915. As the market broadened and the Allies’ purchases in this country mounted into billions we ran into a boom. As far as manipulation went, it wasn’t necessary for anybody to lift a finger to create an unlimited market for a war bride. Scores of men made millions by capitalizing contracts or even promises of contracts. They became successful promoters, either with the aid of friendly bankers or by bringing out their companies on the Curb market. The public bought anything that was adequately touted.

When the bloom wore off the boom, some of these promoters found themselves in need of help from experts in stock salesmanship. When the public is hung up with all kinds of securities, some of them purchased at higher prices, it is not an easy task to dispose of untried stocks. After a boom the public is positive that nothing is going up. It isn’t that buyers become more discriminating, but that the blind buying is over. It is the state of mind that has changed. Prices don’t even have to go down to make people pessimistic. It is enough if the market gets dull and stays dull for a time.

In every boom companies are formed primarily if not exclusively to take advantage of the public’s appetite for all kinds of stocks. Also there are belated promotions. The reason why promoters make that mistake is that being human they are unwilling to see the end of the boom. Moreover, it is good business to take chances when the possible profit is big enough. The top is never in sight when the vision is vitiated by hope. The average man sees a stock that nobody wanted at twelve dollars or fourteen dollars a share suddenly advance to thirty—which surely is the top—until it rises to fifty. That is absolutely the end of the rise. Then it goes to sixty; to seventy; to seventy-five. It then becomes a certainty that this stock, which a few weeks ago was selling for less than fifteen, can’t go any higher. But it goes to eighty; and to eighty-five. Whereupon the average man, who never thinks of values but of prices, and is not governed in his actions by conditions but by fears, takes the easiest way—he stops thinking that there must be a limit to the advances. That is why those outsiders who are wise enough not to buy at the top make up for it by not taking profits. The big money in booms is always made first by the public—on paper. And it remains on paper.

ENDNOTES

1 Frederick Lewis Allen,

The Lords of Creation (1935), 34.

2 “Prentiss’ Rise Spectacular,”

New York Times, February 3, 1927, 2.

3 “Col. J.W. Prentiss, Broker, Dies at 62,”

New York Times, March 19, 1938, 15.

4 “Jesse Livermore Ends Life in Hotel.”

New York Times, November 29, 1940, 1.

5 Edwin Lefevre, “Boom Days in Wall Street.”

Munsey’s Magazine, 1901, 39.

7 Henry Clews,

Fifty Years in Wall Street (1907), 757.

8 Edmund Clarence Stedman, ed.,

The New York Stock Exchange (1905), 394.

9 Alexander Dana Noyes,

Forty Years of American Finance (1909), 301.

10 “Famous Sysonby Dead of Blood Poisoning,”

New York Times, June 18, 1906, 1.

13 “Roswell P. Flower Dies Suddenly,”

New York Times, May 13, 1899, 1.

16 Stedman,

The New York Stock Exchange, 384.

17 Clews,

Fifty Years in Wall Street, 703.

The stock had been brought out by reputable people and it had been fairly well tipped as a property of value. About 30 per cent of the capital stock was placed with the general public through various Wall Street houses, but there had been no significant activity in the shares after they were listed. From time to time somebody would ask about it and one or another insider—members of the original underwriting syndicate—would say that the company’s earnings were better than expected and the prospects more than encouraging. This was true enough and very good as far as it went, but not exactly thrilling. The speculative appeal was absent, and from the investor’s point of view the price stability and dividend permanency of the stock were not yet demonstrated. It was a stock that never behaved sensationally. It was so gentlemanly that no corroborative rise ever followed the insiders’ eminently truthful reports. On the other hand, neither did the price decline.

The stock had been brought out by reputable people and it had been fairly well tipped as a property of value. About 30 per cent of the capital stock was placed with the general public through various Wall Street houses, but there had been no significant activity in the shares after they were listed. From time to time somebody would ask about it and one or another insider—members of the original underwriting syndicate—would say that the company’s earnings were better than expected and the prospects more than encouraging. This was true enough and very good as far as it went, but not exactly thrilling. The speculative appeal was absent, and from the investor’s point of view the price stability and dividend permanency of the stock were not yet demonstrated. It was a stock that never behaved sensationally. It was so gentlemanly that no corroborative rise ever followed the insiders’ eminently truthful reports. On the other hand, neither did the price decline. at better prices than they thought they would obtain if they tried to sell in the open market. They wanted to know on what terms I would undertake the job.

at better prices than they thought they would obtain if they tried to sell in the open market. They wanted to know on what terms I would undertake the job. Its objective was to make my calls valuable. To do this I must put up the price and develop a market in which I could sell one hundred thousand shares—the stock in which I held options.

Its objective was to make my calls valuable. To do this I must put up the price and develop a market in which I could sell one hundred thousand shares—the stock in which I held options. It is, I think, a large portion. I did that in Imperial Steel, and whatever demand was created by those spurts I supplied. My selling always kept the upward movement within bounds both as to extent and as to speed. In buying on the way down and selling on the way up I was doing more than marking up the price: I was developing the marketability of Imperial Steel.

It is, I think, a large portion. I did that in Imperial Steel, and whatever demand was created by those spurts I supplied. My selling always kept the upward movement within bounds both as to extent and as to speed. In buying on the way down and selling on the way up I was doing more than marking up the price: I was developing the marketability of Imperial Steel.

and myself. People have been led to expect a dramatic narrative of a stock-market deal that went wrong or some double-crossing that cost me—or him—millions; or something of that sort. Well, it wasn’t.

and myself. People have been led to expect a dramatic narrative of a stock-market deal that went wrong or some double-crossing that cost me—or him—millions; or something of that sort. Well, it wasn’t.

After a more or less successful market début general conditions changed for the worse and the new stock did not fare as well as Prentiss and his associates had hoped. When basic conditions took a turn for the better Prentiss formed a pool and began operations in Pete Products.

After a more or less successful market début general conditions changed for the worse and the new stock did not fare as well as Prentiss and his associates had hoped. When basic conditions took a turn for the better Prentiss formed a pool and began operations in Pete Products.

there waiting for him. Two or three other men who made stock-market history for a few months had relapsed into the obscurity of prolonged inactivity. I refer particularly to certain of those plunging Westerners who came to Wall Street in 1901 and after making many millions out of their Steel holdings remained in Wall Street. They were in reality superpromoters rather than operators of the Keene type. But they were extremely able, extremely rich and extremely successful in the securities of the companies which they and their friends controlled. They were not really great manipulators, like Keene or Governor Flower.

there waiting for him. Two or three other men who made stock-market history for a few months had relapsed into the obscurity of prolonged inactivity. I refer particularly to certain of those plunging Westerners who came to Wall Street in 1901 and after making many millions out of their Steel holdings remained in Wall Street. They were in reality superpromoters rather than operators of the Keene type. But they were extremely able, extremely rich and extremely successful in the securities of the companies which they and their friends controlled. They were not really great manipulators, like Keene or Governor Flower. Still, the Street found in them plenty to gossip about and they certainly had a following among the professionals and the sportier commission houses. After they ceased to trade actively the Street found itself without manipulators; at least, it couldn’t read about them in the newspapers.

Still, the Street found in them plenty to gossip about and they certainly had a following among the professionals and the sportier commission houses. After they ceased to trade actively the Street found itself without manipulators; at least, it couldn’t read about them in the newspapers.