“That's been one of my mantras–focus and simplicity. Simple can be harder than complex: You have to work hard to get your thinking clean to make it simple. But it's worth it in the end because once you get there, you can move mountains.”

—Steve Jobs

“A guerrilla is on his own. All you have is a rifle, some sneakers and a bowl of rice, and that's all you need–and a lot of heart.”

—Malcolm X

The world may feel like it's getting smaller, but the amount of complexity facing global brands is only becoming larger. Developing and emerging economies are growing twice as fast as developed ones.1 Much of that growth is fueled by the higher standard of living that comes along with rural-urban migration. It's estimated that by 2025, there will be an additional one billion new consumers living in emerging cities.2 Global brand builders need to be receptive to seeing the changes that are happening and develop the speed and agility needed to navigate the added complexity.

This emerging consumer class values innovation. According to Nielsen's Global New Product Innovation Survey, more than half of the respondents in Asia-Pacific (69 percent), Africa/Middle East (57 percent), and Latin America (56 percent) claim to have purchased a new product during their last grocery shopping trip, compared with only 44 percent of European and 31 percent of North Americans.3

To succeed in this kind of dynamic environment in which emerging market consumers have a voracious appetite for innovation, global brand builders need to find ways to connect the dots faster to create value propositions that will meet the needs of these growing populations.

Think again if you believe that you can create pan-regional products that will satisfy all of the countries in a given region. A single region like Asia-Pacific (APAC), for example, consists of roughly twenty-seven countries. To compete effectively, you need to employ a lean process that can help you identify local needs and develop differentiated value propositions quickly.

Figure 4.1 illustrates why it is difficult to create pan-regional products. If you look at the four largest markets in Asia (Japan, South Korea, China, and Indonesia), you will see how little they have in common. In fact, they are drastically different in terms of median age, average income, education, and religion.

Figure 4.1. Asians consumers are not all the same.

In my experience, even when shopping for basic necessities in an emerging market, quality is not always guaranteed; that's why brands matter. David Aaker writes that brands are “an organization's promise to a customer to deliver what the brand stands for.”4

According to GfK's Roper Reports, 79 percent of developing Asian market consumers and 61 percent of Latin American consumers “only buy products and services from a trusted brand.”5 This buying behavior is also supported by a McKinsey & Company study that found strong brands increasingly outperform the market (see Figure 4.2).6

Figure 4.2. Strong brands increasingly outperform the market. Copyright 2018 McKinsey & Company. All rights reserved. Reprinted with permission

Innovation is absolutely critical to global brand building. Essentially, an entire product portfolio can be categorized as new when entering an international market.

There was a time when global marketing basically meant taking standardized products that were designed for developed markets and trickling them down to developing markets, but that has changed. The traditional model has been turned on its head as more and more companies are starting to reverse the flow. Now we see that innovation efforts for local markets can have a much wider global impact on a company's total sales.

This is best described as “reverse innovation,” a term made popular by Vijay Govindarajan, a professor at the Tuck School of Business who is widely regarded as one of the world's leading experts on strategy and innovation.7 The idea behind reverse innovation is that game-changing ideas will increasingly come via developing markets where brands must be more nimble, faster, and innovative to deliver profitable growth. Consider the following examples:

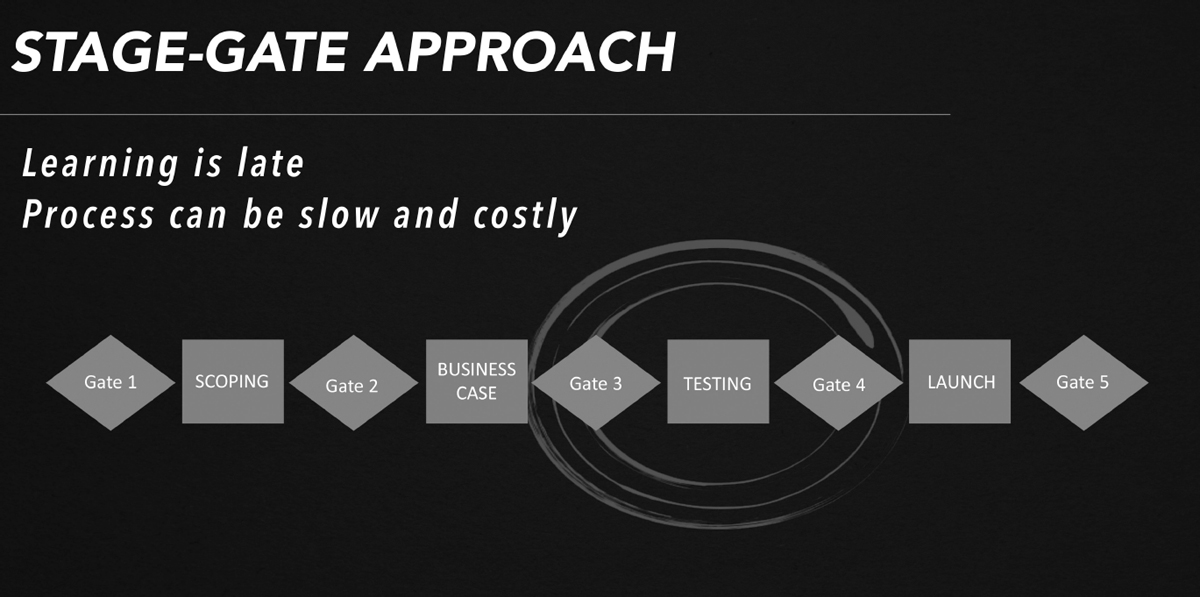

Stage Gate (Phase Gate) refers to a product management technique that requires product concepts to pass through distinct go/no-go gates before a product is allowed to launch. It works like this: When a project team completes a phase of work and reaches a gate, the team must obtain approval before the project can move forward (see Figure 4.3).

Figure 4.3. Stage-gate approach.

Most companies use some form of a stage-gate process to help them manage their innovation workstream. While the linear nature of the approach appeals to many managers, the straightforwardness can provide a false sense of security. Even though most companies embrace a stage-gate approach, at least 85 percent of new fast-moving consumer goods (FMCG) will fail in the marketplace.10

A major drawback of the stage-gate approach is that consumer validation typically doesn't happen until the end, when it is less actionable and after considerable resources have already been spent. Stage-gate projects are also notoriously slow to reach the market. Designed like a relay race, development can often take years to complete, depending on the complexity of the concept.

A lot of great books have been written regarding lean approaches and their usefulness in all kinds of business situations, ranging from tech startups to design projects to product manufacturing. Eric Ries, author of The Lean Startup, describes his popular methodology as “validated learning.”11

According to Ries, entrepreneurs should not begin their journey by writing detailed hypothetical business plans, but instead create a list of their best guesses of what they believe will work and then quickly test their hypotheses.

To borrow a phrase from Steve Blank, the author of The Startup Owner's Manual, when brand builders are constructing a value proposition, they should “get out of the building” to test their hypotheses and get feedback from real consumers in real-life situations.12 That way, they can make quick use of their learning and refine their hypotheses as needed.

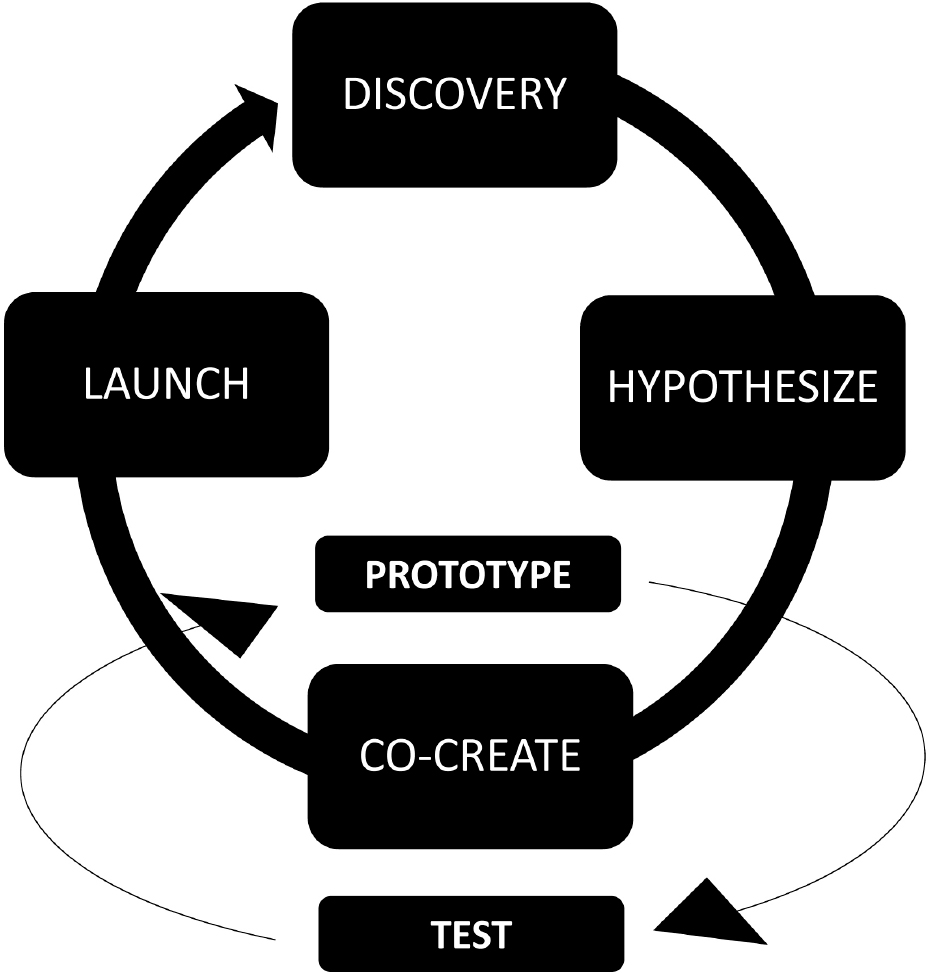

I adapted Eric Ries's Lean Startup methodology by creating a simple four-step process, which I use to launch new products in international markets (see Figure 4.4).

Figure 4.4. The four-step lean brand development process.

Discovery is where you will uncover what motivates your target consumers and identify their unmet needs. It's how you gain a clear understanding of the competitive environment and assess your company's strengths and weaknesses versus the competition. It's also the perfect occasion to use lean research techniques to find gaps in the solutions currently available to your target.

When you hypothesize, you take the insights you uncovered in discovery and build a differentiated value proposition that you will test later in co-creation. You can see the Lean Brand Canvas template in Figure 4.5. This canvas was adapted from Ash Maurya's one-page lean canvas and has been optimized specifically for global brand building.13 You will find that it is an easy-to-use template for clearly laying out each brand building block and its corresponding hypotheses. Simply fill in each box of the canvas with the hypotheses that you want to validate in co-creation.

Start by defining the target market and then work your way through each building block until you have defined the total product offering.

Co-creation is designed to help rapidly develop prototypes alongside consumers and industry experts to get instant feedback and validation. Your objective is to quickly incorporate learning and insights to improve your brand's value proposition.

Naturally you will want to invite creative stakeholders like marketers, designers, and agency partners to attend your co-creation sessions with the consumers. It will be important to also include some product developers and those responsible for manufacturing your product to ensure your concepts are feasible.

Because co-creation sessions are relatively quick to organize and execute, you should repeat sessions with new recruits until you feel confident you have validated the value proposition or need to pivot (change direction) and create new hypotheses to test.

Figure 4.5. Lean Brand Canvas.

DHL co-creates with key customers to improve its value proposition and drive incremental growth.

In 2017, DHL reported its eighth consecutive quarter of record-breaking results. A large contributing factor was the growth generated from international expansion and a strategic focus on high-growth sectors like international e-commerce.14

DHL uses innovation workshops to co-create with customers when it enters new markets because “The workshops provide the opportunity to share best practices, explore industry and cross-industry use, and examine the future of logistics. In these workshops, the customer and DHL are jointly engaged in developing ideas for new products, services, or processes.”15

The following list includes a few innovations that have come out of DHL co-creation sessions that have the potential to step-change DHL's growth trajectory.16

Figure 4.7. DHL Robotics: Sawyer 02. Source: Deutsche Post AG

Kerry co-creates with key opinion leaders to test prototypes and applications before launching them into the wider market.

I led the development of a new range of professional drink-making products for Kerry Group that became the foundation for the repositioning of the DaVinci Gourmet brand by elevating taste and quality perceptions among professional drink makers.

My team used the Lean Brand Development process from beginning to end. We organized co-creation sessions throughout the region, inviting well-known bartenders and baristas to join us at central locations. At these sessions, we shared prototypes with professional drink makers and encouraged them to play with the prototypes (hypothetical products) and test them in real drink applications.

The participants would create their own drink recipes using the prototypes provided, and then immediately share what they liked and didn't like with our cross-functional team of marketers and product developers. We would then take their feedback and use it to improve the prototypes on the spot. Afterward, we repeated this exercise in other markets throughout the region.

Every time we conducted subsequent co-ceation sessions, the performance of the prototypes improved considerably. After only a few months of work, our co-created final products consistently outperformed the competition in blind taste testing.

Another benefit of organizing co-creation sessions is finding brand ambassadors. The ideal scenario when recruiting participants for a co-creation session is to select partners that have the potential to become advocates for your brand. It's beneficial to retain key opinion leaders (KOL) who are in a position to influence your target market. KOL who have participated in the product development process are much more likely to become aspirational product users in the future.

Launch follows the co-creation phase, after you have identified authentic pain points and worked through solutions with real end-users. It is important to note that when using a lean process, you may decide to initially reduce the scale of your launch to continue the learning process. Often, brands will select a city or geographic region to launch a “beta” version before releasing a final version to the general public.

Zara uses a lean development process to quickly bring new products to market in a matter of weeks.

Ranked twenty-fifth by Interbrand Brand Rankings, Zara is considered to be one of the world's most valuable brands. With more than 2,200 stores in more than ninety countries, much of Zara's international success is rooted in a lean development process. This process enables Zara to launch on-trend clothing that has been adapted to meet local needs in only a matter of weeks.17

Walk into Zara's headquarters in Spain and you will find product managers and designers busily communicating with markets like China and Chile to gain a better understanding of what's selling in local markets (see Figure 4.8).18 Prior to the big designer shows in the major fashion capitals, Zara's design teams have already scanned the trends and have a good feel for the fabrics and colors that are becoming popular. This allows them to preselect designers they want to emulate in the following seasons.19

Based on learning and insights, Zara's design teams produce very limited quantities of their initial design ideas, sometimes only shipping three or four dresses or shirts in each style to a store to get an initial read.20

Zara's employees are trained to observe and listen to customers, helping identify consumer needs and spot trends (see Figure 4.9). Store employees provide feedback and sales data to the headquarter design teams in order to address problems quickly. Designs are altered based on feedback, and new inventory is shipped almost immediately to replenish what has been sold.

Zara has fourteen highly automated factories located in Spain where it creates unfinished component pieces that are used as the foundation for multiple final products. This approach allows Zara to react quickly while remaining efficient. “If an item looks like a winner, Zara can quickly ramp up manufacturing and get items to their stores in a matter of days.”21

Figure 4.8. Design area in a Zara factory. Photo credit: Xurxo Lobato/Cover/Getty Images

Figure 4.9. Customers shopping for clothes inside a Zara shop. Photo credit: Viorel Dudau|Dreamstime

Adidas uses a lean process to speed up its new product launches for strategic global markets.

Taking an idea from concept to store is traditionally a very long process. The industry standard is about eighteen months for launching a new shoe style, but Adidas is able to reach markets faster.22 Company insiders say Adidas has two defined phases in its innovation process: 1) co-create and 2) launch. I have broken those phases down into the four steps of the Lean Brand Development Model.

Adidas discovered differences in the running styles of runners from different cities. For example, in London, people often run early in the morning and late at night to get to and from work. Londoners also have to run in the rain a lot. New York City's runners, however, run longer and faster, primarily on asphalt and concrete. So global Adidas designers began traveling to cities like London and Paris to spend more time with local runners. The design teams recruited running influencers (KOL) to collaborate with them, collecting information on their running routines: how, why, where, and when they run.23

The company's key city journey began with the launch of the AM4LDN, made specifically for Londoners. The brand then moved on to other key cities such as Paris, Los Angeles, New York, Tokyo, and Shanghai. This new way of sequentially designing shoes allows the innovation process to remain in constant beta mode, with insights gleaned from consumers used to create hypotheses for the next city launch.

Adidas works with running influencers in each city to test the products designed for the unique demands for the city. Its shoes are evaluated by real runners using devices that analyze every aspect of how the athletes run. Metrics include fit and function, biometric data (forces, speeds, angles, mass, ergonomics), personal preferences (materials, colors, graphics) and usage requirements for conditions like terrain and weather. Each subsequent design idea is based on prior test data, ensuring that each iteration is continuously improved.24

When the design is ready for launch, the shoes are produced in larger batches by high-speed, automated robots located in an Adidas state-of-the-art SPEEDFACTORY location. At the time of this writing, Adidas has two SPEEDFACTORY locations, one in the United Sates and one in Germany (see Figures 4.10 and Figure 4.11).

Figure 4.10. AM4PAR, the Adidas shoe created specifically for Paris. Source: Adidas, used with permission

Figure 4.11. AM4LDN, the Adidas shoe created specifically for London. Source: Adidas, used with permission