If you want to succeed in your quest for sponsorship funds and strong sponsor relationships, you must ensure that you have access to people with the relevant marketing skills, sufficient resources, a good strategic plan, a marketing plan, market research information, and a commitment to applying that market research.

Your organization must be able to demonstrate to potential sponsors that it can capture and retain its audiences. Your products and services must be based on genuine market needs and values as opposed to what your staff think your clients want or what your organization thinks its clients need.

As part of your organization’s strategic planning process, you will need to create a marketing plan. This is not a plan for marketing the sponsorships but rather is a plan for marketing your organization and its events or products. In the case of an event or a property, every marketing plan must have a media plan and an evaluation plan to measure performance. Every marketing plan must be based on audience market research as it needs to reflect your audience profile, the number of people who will attend your event, and your ability to reach out and connect with your audiences. Developing your marketing plan will help you to determine what makes your organization valuable to sponsors.

This chapter will take you through a series of worksheets, many in a question and answer format, that will assist you in completing the marketing plan template found at the end of the chapter. Tip sheets and checklists are scattered throughout the worksheets to assist you in your planning. The result will be that you will be better placed to get more from your audience (more money, more participation, more heartshare) and create a far more valuable proposition for sponsors.

![]()

In previous editions, we started this chapter with developing your target market profile. While that is still an absolutely essential part of getting your marketing plan right, we have realized that many of the difficulties organizations have with getting their marketing plans right—including their target market definitions—go straight back to how they define their brand.

![]()

Companies have brand managers, there are brand marketing agencies, and many a magazine and website are dedicated to the cult of “the brand.” All of that makes it seem like brand development is terribly complicated and only for big corporations with a lot of money. Not so! Brand development isn’t complicated at all, is within reach of even the smallest organizations, and can be the difference between financial success and failure.

Going through this process will benefit your organization in many ways:

• You will differentiate yourself from your competition on every level.

• Your marketing messages will be more specific and compelling.

• Your sponsor hit list will be more concise and effective.

Unfortunately, most sponsorship seekers tend to define who they are and what they do in very general terms, creating virtually no differentiation in how they present themselves, even when there may be some very important differences. What strong brand development boils down to is understanding, in very specific terms, what constitutes the personalities of your organization and your events. The easiest way we’ve found to do this is to create brand bullseyes for each of your “brands.” There are a number of ways to do this, but we’ve developed a method that is effective and doesn’t overcomplicate the process.

Your organization is a brand, and so is each of your events. This process will need to be replicated for each of them, but for your first go at this, just pick one reasonably uncomplicated event to practice the skills. This is a directed brainstorming exercise, so it is much more effective if you do it in a group. Invite people from across your organization and, ideally, interested parties from outside, like your sponsors.

Before you start, rather than putting a lot of pressure on yourself, try to imagine this as a very straightforward process of describing the personality of your event or organization. It’s that simple. In fact, if you find yourself struggling with this process, try practicing all of the steps below using your best friend or spouse as the subject first, and then move on to your event.

Accept that, as much as you’d like to think you do, you don’t control your brand definition. Your audience does. Yes, we know, that’s a bit of a hit to the ego, but it’s true. Think about it this way: when the biggest bank in your country or region runs advertising that says they care about you, that they’re with you in good times and bad, and that they want to make your life better, do you believe them? If you’re like most people, the answer is probably no. So, what do you believe about that bank, and which is a more powerful brand definition—the one you’ve built based on your experience or the one they talk about in their advertising?

We hope there isn’t that much of a disconnect between your brand as you see it and your brand as your audience sees it, but there are probably some aspects that you haven’t really thought about that could create opportunities or obstacles for you and your marketing program.

![]()

Imagine someone has just left your event or otherwise finished an experience with your organization (such as making a donation, volunteering, becoming a member). What are the three things you would like them to think about that experience? Don’t spend more than a couple of minutes on this and then set those three things aside for later review.

On a whiteboard or piece of butcher’s paper, draw a large bullseye that looks like Figure 2.1. It may look a little complicated, but taking it step-by-step, you should find this quite a simple process.

Figure 2.1 Brand bullseye

On a brand bullseye, we work from the outside in. In our version, this outer circle is for perceptions—how people perceive your event or organization, whether they are involved in it or not. We want you to fill up this outer circle with perceptions. These perceptions may be good, bad, or ugly, accurate or untrue, complimentary or painful to admit. The point is, you want to capture it all.

You will notice that there is a horizontal line cutting your bullseye in half. The upper part is for emotional aspects, the lower part is for functional aspects. Do your best to put every perception into the correct half of the bullseye, as this will assist with your analysis later. A few examples are below:

You will notice that some of your functional aspects are also related to the emotional aspects, as with most that we’ve listed here. In some cases, you may even find an aspect that sits comfortably in both halves, like “inconvenient.” That’s fine. You can put it on the line, write it twice, or indicate that it is in both with arrows—whatever works for you. The point here isn’t that it’s neat—in fact, the best bullseye brainstorms end up very messy!—but that what you capture is as complete and powerful as possible.

You also want it to be very specific. There are some aspects of your event that may well be true, but they aren’t very useful. The end result of this exercise is that you will have a brand definition that really captures what your event or organization is all about, creating a strong differentiation from competitors. You will not achieve that if you allow yourself or your team to populate your bullseye with bland terms that could be used to describe hundreds or thousands of other events. Some examples are “fun,” “community,” “excellence/excellent,” “entertaining,” “family,” and “exciting.” Again, these may be true, but they aren’t really that useful. It’s like sending someone to the airport to pick up your brother and describing him as a male wearing blue jeans. It may be true, but it’s not going to help that person locate your brother. And neither are generic terms going to get you to the most powerful and useful brand definition.

If your team is stuck in these generic terms, just keep asking questions until they get specific. For instance, if someone wants to put “fun” on the bullseye, that’s fine, but be sure to ask the team for more detail. Ask, “What kind of fun?” “How do people feel when they are having fun at our event?” “How does our brand of fun differ from, say, going to a baseball game?” Keep drilling down and you will start to get much more powerful and specific perceptions.

Once you’ve captured as many perceptions as you can in the outer ring, it’s time to move in. The middle ring is for hot buttons—the aspects of your event or organization that actually motivated people to get involved, attend, buy a ticket, donate, volunteer, change their behavior (e.g., eat more vegetables or stop wasting water), or whatever you are trying to get them to do.

If you are struggling to understand the term “hot button,” try this:

1. Think of the last time you went to an event (not one of your events!).

2. Why did you attend that event and not some other event? What was the experience you wanted to have? Write down as many reasons as you can in one minute.

3. Now, circle the absolute most important one or two—the ones that really led you to making that choice. Those were your hot buttons.

The fact that a charity is tax deductible makes it a reasonably financial decision to donate to anyone. But why do you choose to donate to the one(s) that you do? Again, those reasons are your hot buttons.

Many of these things will be the same or related to perceptions in the outer ring. Use arrows to “move” perceptions into the middle ring and write anything else that comes to mind. If you get stuck, pretend your team are a bunch of people who just attended, donated, or whatever you wanted them to do, and ask them why they did it. Those were their hot buttons.

Before moving to the center, take a look at what you’ve accomplished. The bullseye you have just created will be invaluable in developing many aspects of your marketing plan, but it should be telling you a few things already:

• Functional hot buttons are threshold needs. The items that appear as functional hot buttons may be important, but they are probably not the primary reason someone got involved. For instance, your event may be safe, local, and have good parking—all important to parents of young children, and reasons for them not to go if you didn’t have those things covered—but they are not compelling enough to have made them choose your event over going to another event, the park or some other safe, local, convenient activity.

• The real motivations are emotional. Once you have ticked all of the functional boxes (the threshold needs), people make decisions about their time and money for emotional reasons.

• There is no one-size-fits-all marketing message. People make their decisions to attend your event, donate, or whatever it is that you want them to do, for very different reasons. The message that works on one group won’t even register a blip with another.

• Part of your job as a marketer is to manage the negatives. If there are negatives that are turning off key parts of your target audience, you need to determine if their perception is founded in reality. If the negative is a real problem with your event, you need to fix the problem and communicate that in your marketing messages (“Twice as much parking this year!”); if not, you need to address the misconception (“100 percent of funds raised benefit Canadian communities”).

• You can do an even better job creating a bullseye if you get feedback from your actual audience. We’re sure you’ve done a great job, and the bullseye you have created is probably miles ahead of your current brand understanding, but no one can tell you about their perceptions and motivations better than the audience itself. Resolve to spend a few hundred dollars (up to a couple thousand) for some focus group or interview research after your next event. Use the feedback to augment what you’ve already done and fine-tune it going forward.

The center of your bullseye is where you define the soul, or the essence, of your event. The “soul” of your event will consist of a maximum of three aspects or concepts around your event that capture what it is about in powerful, specific wording. Now is not the time to fall back on generic terms like “fun” and “family.” Imagine if you were trying to capture the essence of your very best friend using just three concepts, would you say “fun, smart, female”? Unlikely. We bet it would look more like, “irreverent, whip smart, fashion mad”—much more specific and much more powerful. That’s your aim.

After all of the fast-paced brainstorming leading up to this point, there is a tendency to rush this part of the process, but we don’t recommend it. If there is something that obviously needs to go in the center, by all means put it there. If you agree that a concept is 90 percent there, but not quite, put the concept in there with a question mark, so it operates as a placeholder while you mull it over. Even if they are all placeholders, put two or three concepts in the center and agree that you and your team will keep working on it.

Even if all you’ve got are placeholders, compare the bullseye to the three things you wrote down and put aside back in Step 2 of this process. We’ve found that there is usually a marked difference in the before and after. If not, you are more in touch with your brand essence than most.

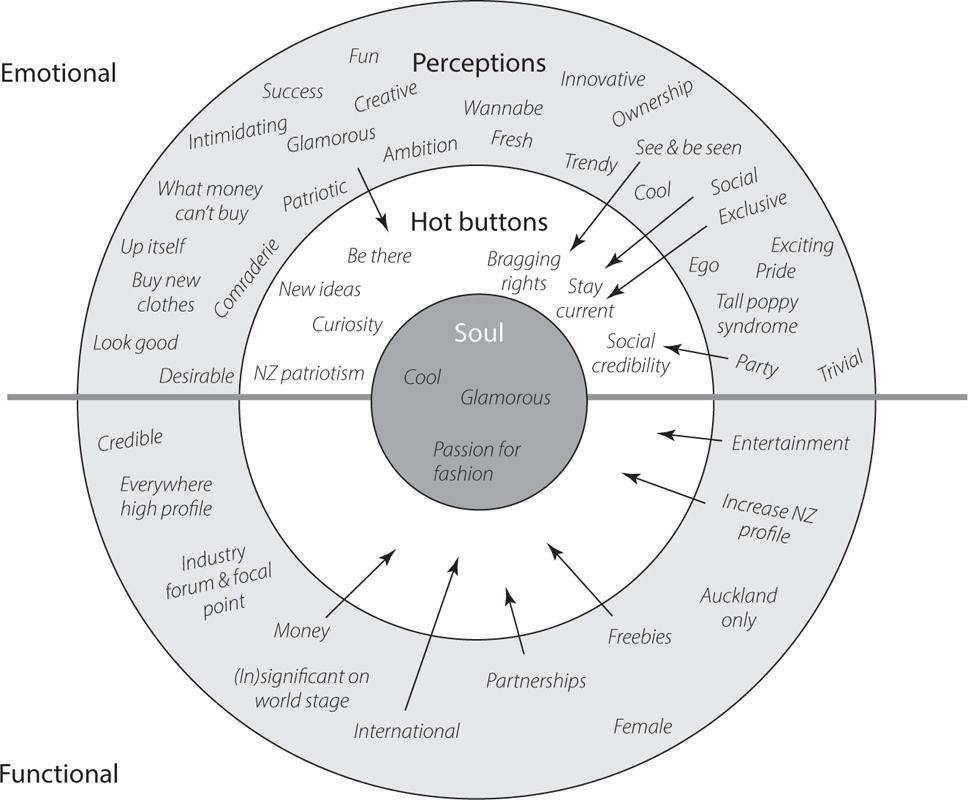

As an example, have a look at the brand bullseye developed by New Zealand Fashion Week in a brainstorming session with their sponsors (Figure 2.2). As the focus of that event has shifted from an industry-only event to one that involves the fashion-loving public, their brand has also changed. What you will notice is that the bullseye takes into account a variety of perceptions, opinions, and hot buttons—some counter to each other—all contributing to a brand soul and an understanding of their target markets that is far deeper than they had previously. For more about New Zealand Fashion Week, see www.nzfashionweek.com.

Figure 2.2 New Zealand Fashion Week bullseye

Post the bullseye somewhere obvious and invite anyone in your organization or visiting your offices to add their thoughts. Do this for a week, and we’re 99 percent sure your “soul” will have developed to a point where it really reflects what your organization does and who you are, powerfully and in a way that differentiates you from all or most of your competition.

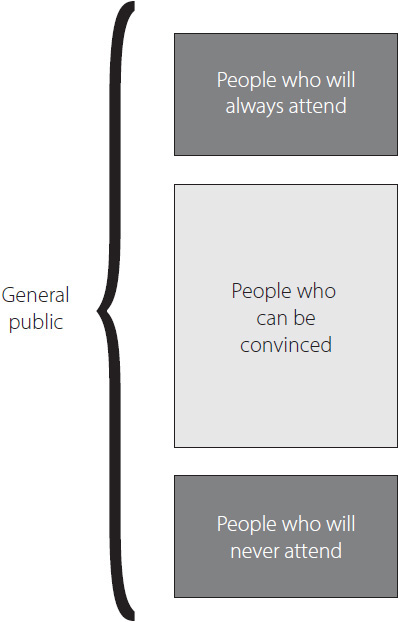

It is often a temptation to define your target market as a “general audience”—you want everyone to come to your event and you are sure that if they do they will enjoy themselves. You may even receive government funding or a grant that tells you that your event/organization or whatever has to serve the whole community.

Unfortunately, in a marketing sense, virtually no organization has the money or other resources to reach the entire marketplace effectively. The job, then, becomes how to determine and prioritize your target markets so that you maximize the effectiveness of your marketing program. Your target markets, sometimes called “segments,” are determined by two general criteria:

1. Demographics. This is the hard data about a person or a marketplace, such as age, sex, marital status, whether they have children, where they live, income, and employment status, as well as more specific information, such as whether they own a computer, how old their car is, or how often they travel on business.

2. Psychographics. This is the softer data on your market and relates to why people do what they do, what motivates them to prefer one product to another, and lifestyle questions. Examples of words used to describe a marketplace psychographically include “active,” “value-for-money oriented,” “quality oriented,” “feminist,” “risk taker,” “strong environmental responsibility,” “macho,” “saver” and “adrenalin junkie.” Psychographics have clearly overtaken demographics as the most important factor in defining a target market.

A target market is a group of people with very similar demographic and psychographic profiles. You will probably have several target markets, some of which will be very different from each other. All of your target markets put together are called your audience. Try not to confuse these terms, as the distinction will become very important when it comes time to targeting potential sponsors.

![]()

There are also two types of target market.

1. End users. These are the people we normally consider as customers—the people who come to the event or venue, buy tickets, join, donate, or use your service. These people could also be exhibitors, in the case of an expo, show, or convention, or event participants, such as runners registering for a marathon. The target market exercise below will help you to prioritize these markets.

2. Intermediary markets. Intermediary markets are the organizations that the end user will go through or take the advice of in order to participate. These are many and varied but could include

• Ticket sellers

• Venues

• Retailers (e.g., “get your entry form at Foot Locker”)

• Convention and visitor bureaus

• Schools

• Reviewers

• Public transportation and/or parking facilities.

The importance of intermediary markets will vary from one event to another. If you have a large number of intermediary markets, it may be useful to prioritize them using the following target market exercise.

Using your brand bullseye as a starting point, look for related terms in the emotional perceptions and hot buttons and pull out three or four types of people who attend your event. As an example, people who attend the Melbourne Cup or the Kentucky Derby could be segmented by the following perceptions/motivations:

• Segment 1 —See and be seen, ego, elite, bragging rights, “in” crowd

• Segment 2 —Excuse to party, social, drinking, group bonding, pilgrimage

• Segment 3 —Gambling, money, best races, best horses, winning

• Segment 4 —Glamor, fashion, excuse to shop, competitive (fashion-wise)

Using your brand bullseye as a starting place, segment your audience using their primary motivation(s) as the main differentiating factor (not factors such as gender or age). You should complete an assessment worksheet for each group, whether they are end users or intermediary markets. Leave naming your target market segments until last.

What is the prime motivation for this segment to attend your event?

![]()

What else makes your event appealing to this segment? (Note: Oftentimes, something that is a primary motivation for one target market will be a secondary motivation for another. Don’t worry if there is some crossover.)

![]()

![]()

What proportion of your audience does this segment make up? (Estimate, if required.)

![]()

Is this segment growing or shrinking? What is its potential for growth?

![]()

Who will this segment attend with (if it is an event)?

![]()

Does this segment influence the attendance or participation of others? (For example, highly social, well-connected people who will encourage their friends to donate.)

![]()

Do geographic or logistical challenges affect the appeal of your event to this segment? Get specific.

![]()

What are the five things that have to go right in order for this segment to consider their experience to be a success? (Note: You do not necessarily have control over every one of these things.)

Describe this segment as if it were one person. Be complete—name, job, family, lifestyle, etc. Don’t make it just a list of attributes. Tell a story, such as the example in the box. The more fun you have with this, the better. Really let yourself get to know this person.

![]()

![]()

What media are likely to appeal to this segment—specific newspapers and sections, radio and television programs, specialty pay TV channels, magazines, websites, social media?

![]()

What message(s) will this market be receptive to? (What will make them attend?)

![]()

![]()

![]()

Name this segment. Make it something that has meaning to you and something that you and your staff can use to refer to this segment.

![]()

Once you have completed these questions and analyzed your customer markets in depth, including research, you should have a more complete understanding of your current and potential customers. There are a number of ways to segment a marketplace. Some organizations see clear divisions between segments, while others see a lot of overlap.

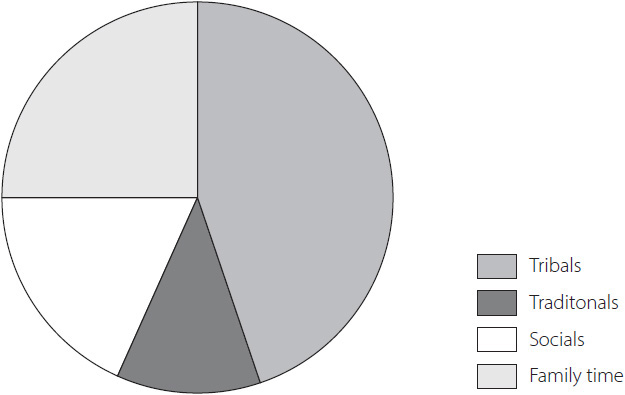

Following is an abbreviated sample of how a football team may segment and define its target markets (Figure 2.3). As you can see, the motivations and interests are very different from one segment to another. People don’t experience your event in the same way or for the same reasons, nor can you effectively reach them all with the same marketing message or mechanisms.

Figure 2.3 Target markets of a football team

Tribals—45 percent

• Motivated by atmosphere of the game

• Love being part of the crowd

• Very emotional about their experience

• Opportunities for participation are important, such as singing the team song

• If not at the game, prefer to view it in a crowd atmosphere, such as a pub

• Fickle—lose interest if the team doesn’t perform

• Equally divided between males and females

Traditionals—10 percent

• Supporting the team is a family tradition passed down from one generation to the next

• See attending and/or viewing the game as a duty

• Support the team through good times and bad

• Know a lot of detail about the team and the game

• Skewed toward male and older people, often having shifted over time from being Tribal or Social

• Strong loyalty

• Acknowledgment of their long-term support is very important to this group

• Interaction with the team and coaches is a big hot button

• If not attending game, tend to watch at home

Socials—20 percent

• Use games as an excuse for a social day with friends

• Day starts well before the game, often at a pub, and finishes long after the game, often at a pub

• Logistics of meeting and getting from one place to another is the biggest concern

• Attend games in groups

• If not attending, watch games in groups, often at a pub

• See strong team performance as a bonus, not a requirement for a good day

• Skewed to people who are male and under 35

Family time—25 percent

• Quality time with family is the strong motivating factor

• Have school-age children

• Attend games with family only, or possibly with another family

• Watch games together at home

• Make an effort to make games a “special time” for the family

• The whole experience is important, no matter where they see the game

• Cost is important—they see a cost approximately equivalent to a family movie pass and associated concessions as being acceptable

![]()

We have found the following exercise useful in prioritizing the key target markets that make up your audience.

Try to imagine that the entire marketplace is represented by the graph shown in Figure 2.4. You will see three things:

Figure 2.4 Who is your marketing plan targeting?

1. There is a certain percentage of people who will always come to your event—they just need to know when and where it is and they will be there.

2. There is also a certain percentage of people who will never come, no matter what you do.

3. The people in the middle—the people who can be convinced—are your opportunity. They haven’t made up their minds yet, so you can influence their decision. This is still a lot of people, though, so it needs to be assessed and prioritized.

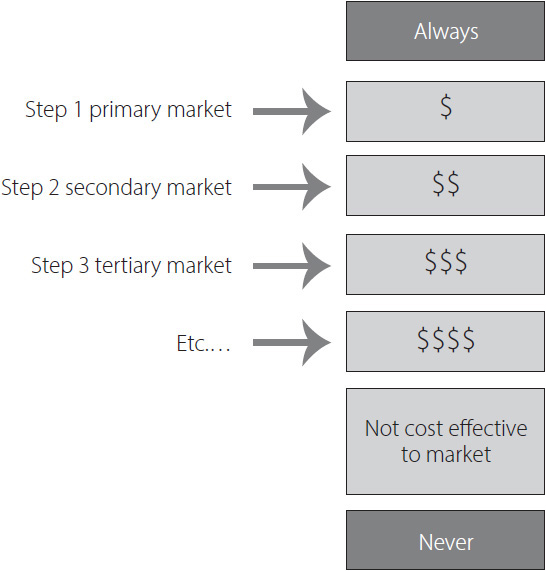

Some of these people can be convinced relatively easily. It makes sense that it is most cost-effective to address your marketing activities to this group first. The less likely people are to come, the more difficult and expensive it will be to market to them. You may choose not to market to people who probably won’t be convinced at all.

Imagine that the “always” group is already at your event. In front of you is a ballroom full of people—100 people from each of the target market segments that you’ve defined—and they haven’t decided whether they will go to your event or not. It will cost you $100 for the opportunity to speak to one of those target markets to convince them to attend. Which segment would you choose—the one where it will be easiest to convince all of them to attend or the one where you will be lucky to get 10 percent of them to attend? If you’re trying to get the most people to your event, you’ll pick the easiest to convince. That is your primary target market.

Congratulations, the whole group has been convinced and they are off enjoying themselves at your event. Now you can talk to another target market group of 100, but it will cost you $200 for the privilege. Which target market would you choose this time? This is your “secondary market.”

Keep doing this until you reach a point where you either run out of money or you determine that your marketing efforts will probably be very expensive for the return in terms of participants (Figure 2.5). Usually, you will hit this point somewhere between three and five markets. This is your “tertiary market.”

Figure 2.5 Prioritizing your markets based on relative costs

The goal is that, over time, your “always” group will grow by pulling in some of the people in your primary and secondary markets as they become what we call “true believers.” This will allow you to invest in the tertiary markets, expanding your audience year by year.

You need to know a lot about your audience in order to reach them effectively. The best way to gather that type of data is very simple—ask them. The benefits of conducting comprehensive research and truly understanding your markets are twofold.

1. Marketing plan. The research will give you not only an understanding of who your audience is but also of what motivates the different segments of it. This will enable you to create a marketing plan that will reach them effectively and at the lowest possible cost because you won’t be paying to reach people who are not in your catchment groups.

2. Targeting sponsors. The most powerful things you can deliver to a sponsor are your audience and information about how they can connect to the various target markets. Thus, it follows that the better you know your audience, the stronger your understanding of your audience, the more valuable that sponsorship will be to a sponsor. This will help you to target your sponsors more effectively.

When conducting research of your market you will need to ask a number of specific questions to obtain the type of information you will need to know. The questions you ask may relate to information from current customers and potential customers on any number of things.

We have divided this list into psychographic and demographic factors, which are both important for different reasons. Understanding a target market’s psychographic profile is essential in knowing how to market to them—to convince them to do what you want them to do—and providing meaningful opportunities for sponsors to connect with them. Demographic factors are great for excluding markets. If you are trying to get people to have regular mammograms, it is unlikely that your target market will include men; if you’re running a local festival, it’s probably a waste of time marketing to people overseas or even in the next state; and if you’re trying to sell tickets to a $1,500 a plate fundraising dinner, there is no use in targeting people who could never afford to pay that much.

Psychographic

• How would they describe themselves? (A valuable open-ended question best asked in qualitative research, but possibly using multiple choices on a survey.)

• Top three priorities in their lives? (Ditto above.)

• What do they do for recreation and/or hobbies?

• Do they donate or volunteer? How much and to whom?

• What are their travel and vacation preferences?

• Are they investors, savers, or spenders?

• Are they trendsetters/opinion leaders or followers?

• Are they active in social media? What are their main reasons? (E.g., staying in touch with far-flung friends and family, sharing their adventures, or staying in touch with the latest news, jokes, etc.)

• Are they fashion-conscious?

• Are they sports fans? Favorite teams?

• Are they involved in their community? How?

• Are they interested in gardening or do-it-yourself activities?

• Are they fit and healthy? Do they exercise?

• What is their interest in the arts?

• What is their attitude toward corporate sponsorship

• How would they describe your event to a friend or colleague?

• Why did they or didn’t they attend your most recent event?

The last two are very important to understand a target market’s specific perceptions and motivations concerning your event. Again, this is probably a quantitative question, but far too valuable not to ask.

Demographic

• Age and/or life stage (kids in school, grown-up kids, retired, etc.)

• Marital status

• Income

• Renter or homeowner

• Number and ages of children

• Occupation

• Education

• Car ownership—age of car, make, and model

• Location (often the easiest way is to get a postcode or zip code)

• Length of time at present address

• Internet use and type (dial-up, broadband, wireless)

• Mail order and online buying

• Television viewing preferences

• Club, organization, and affiliation memberships

• Public transportation use

• Purchasing habits

• Frequent flyer membership

• Pet ownership

• Political activity

• Movie- or theater-going habits

• Beverage preferences

• Food preferences

Remember that information on product usage, propensity to buy, and sponsorship attitudes may greatly assist your sponsorship sales process. If you can demonstrate that your customers actively seek out a sponsor’s product, a potential sponsor is likely to be far more interested in you. If you approach a car manufacturer with research on the average age of your customers’ cars, their car purchasing habits, and their attitudes toward the car manufacturer, your potential sponsor is far more likely to consider your proposal seriously.

Before conducting your research, you must understand that it will require an investment of time, money, or both, although newer web-based applications have reduced the cost for some kinds of research by quite a lot. Once you have decided what information you are seeking, be sure to create a strategy and budget to achieve your research goals.

Three of the most valuable questions you can ask are often the most overlooked:

• What were the three best things about your experience with [event/program] today?

• What were the three worst things about your experience with [event/program] today?

• What were the three main reasons you decided to attend/participate?

These questions will net you a ton of useful information. As they are qualitative, they are fantastic for helping you flesh out your brand bullseye. You could identify positives about the experience that may be great marketing hooks for you. You could identify issues that you weren’t aware of. You can use the answers to help you build sponsor offers . . . but more on that later!

So, how do you get all of that information about your target markets so that you can create the strongest possible marketing plan? There are two main sources—primary and secondary.

Primary information is research that you conduct (or commission) with your target markets. Secondary information comes from an outside resource—such as a tourism body, governing body, media, and industry research firms. Secondary information is aggregated from across a whole sector, so while it may have some general relevance, it isn’t going to be nearly as useful as research that is specific to your property and your target market.

Also important to take on is that sponsors are looking for primary research. They don’t need to know about all festivals in Oregon, they need to know about your festival, your target markets, and what that means to them. If you’ve got some compelling secondary figures, you can always include them, but they are support players only.

As we stated earlier, if you want information about people in your target markets, ask them. Your potential audience is the best possible source for information about what will appeal to them and what kind of marketing will interest them enough to bring them to your event. This is primary information.

![]()

Primary information can be obtained by conducting: interviews with participants (such as runners in a 10K race), attendees, and potential attendees; surveys, including web-based and telephone surveys, entrance and exit surveys, target market perception surveys, and focus groups.

Target Market Surveys. Target market surveys are done across your identified target market segments, whether they participate in your event or program or not. This is great for understanding perceptions and hot buttons alongside other key demographic and psychographic information.

Entrance and Exit Surveys. Entrance and exit surveys are used to gather demographic and psychographic data, and other sponsorship-related data, as outlined earlier.

Focus Groups. Focus groups are a highly effective method for gaining qualitative information on target markets and they are really easy and inexpensive to do. They involve getting together a group of 10 to 18 people who are representative of your target audience and asking them a range of questions about their opinions, preferences, and lifestyles. This is a goldmine for information that will help you to develop your brand (and fill in your brand bullseye). If you do embark upon a program of focus groups, be sure to enlist an experienced moderator and preplan all questions to ensure you find out everything you need to know.

Interviews. Conducting a series of interviews with competitors, peers, industry specialists, and individual customers is a valuable way of gathering primary information on your markets that will assist in the development of your brand, your event, your overall marketing plan, and your sponsorship strategy.

A well-executed survey program need not be expensive. One of the cheapest ways to gather information is to utilize the services of a class at a business school, technical school, or university. As part of their studies, they need the opportunity to gather and analyze data, as well as presenting it, and you can provide that opportunity. The key here is not to treat them like research slaves but to work with them on both the methodology and reporting of results.

If you are going to use students, do make the commitment to rent tablet computers and software, allowing for easy collection, automated collation of data, and professionalism.

The cheapest way to get primary information is to use online survey sites, such as SurveyMonkey.com. You can fully customize a survey, and even make it a mix of multiple-choice (quantitative) and open-ended (qualitative) questions. The trick is always how you get people to participate. You’ll often find that your more committed fans are happy to participate, while your less committed fans, or a target market that doesn’t consider themselves fans yet, may need an incentive, such as a discount to your next event or other token, for their time.

![]()

Here is an example of a survey that could be carried out on people who have just attended a women’s professional basketball game to determine the demographic and psychographic features of the audience market.

1. Is this your first visit to a women’s professional basketball game?

![]() Yes

Yes

![]() No

No

2. How many games have you attended this season?

![]() This is my first

This is my first

![]() 2–4

2–4

![]() 5–10

5–10

![]() More than 10

More than 10

3. Where did you hear about tonight’s game? Check all that apply:

![]() I have season tickets

I have season tickets

![]() Friend or relative

Friend or relative

![]() Radio ad

Radio ad

![]() TV ad

TV ad

![]() Newspaper ad

Newspaper ad

![]() Internet

Internet

![]() Another sporting event

Another sporting event

![]() TV or radio program or print article (please specify)

TV or radio program or print article (please specify)

![]() TV

TV

![]() Radio

Radio

![]() Press

Press

![]() Magazine

Magazine

![]() Other (please specify)

Other (please specify) ![]()

4. What did you think of the stadium? Check all that apply:

![]() Good visibility

Good visibility

![]() Comfortable

Comfortable

![]() Easy to get to

Easy to get to

![]() Good food/drinks

Good food/drinks

![]() Too many sponsor signs

Too many sponsor signs

![]() Not enough food outlets or staff

Not enough food outlets or staff

![]() Parking difficult/expensive

Parking difficult/expensive

![]() Public transportation difficult

Public transportation difficult

![]() Food/drinks too expensive

Food/drinks too expensive

![]() Food/drinks poor quality

Food/drinks poor quality

![]() Adequate food outlets and staff

Adequate food outlets and staff

5. What are the top three reasons you decided to attend this game?

![]()

![]()

6. What were the three best things about attending the game tonight?

![]()

![]()

7. What were the three worst things about attending the game tonight?

![]()

![]()

8. Did the game live up to your expectations?

![]() Yes

Yes

![]() Mostly

Mostly

![]() No

No

9. If you could change one thing about your experience, what would it be?

![]()

![]()

10. Including yourself, how many people are in your group today?

![]() 1

1

![]() 2

2

![]() 3–4

3–4

![]() 5–9

5–9

![]() 10 or more

10 or more

11. Who are you here with?

![]() Family adult(s)

Family adult(s)

![]() Nonfamily adult(s)

Nonfamily adult(s)

![]() Child/children

Child/children

![]() School group

School group

![]() Other organized group

Other organized group

12. What is your post/zip code?

Questions 13–16 for Non-Tri-State residents only

13. How long are you staying in the Tri-State area?

14. Are you staying in paid accommodation?

![]() Yes

Yes

![]() No

No

15. What other activities have you done/do you plan to do during your stay?

![]() Attend another sporting event

Attend another sporting event

![]() Football

Football

![]() Baseball

Baseball

![]() Ice hockey

Ice hockey

![]() Other

Other

![]() Attend a non-sporting event

Attend a non-sporting event

![]() Basketball

Basketball

![]() Visit a museum or gallery

Visit a museum or gallery

![]() See a concert, play or show

See a concert, play or show

![]() Sightseeing

Sightseeing

![]() Shopping

Shopping

![]() Other (please specify)

Other (please specify) ![]()

16. What are your three favorite ways of spending your free time?

![]()

![]()

17. If you could use three words to describe yourself, what would they be?

![]()

![]()

18. Are you in paid employment? What is your occupation?

![]() Yes

Yes

![]() No

No

![]() Occupation

Occupation ![]()

19. How old are you?

![]() Under 18 years

Under 18 years

![]() 18–24 years

18–24 years

![]() 25–34 years

25–34 years

![]() 35–49 years

35–49 years

![]() 50+ years

50+ years

20. What is the highest level of school you have completed?

![]() High school

High school

![]() Trade/technical or business college

Trade/technical or business college

![]() University degree (undergraduate)

University degree (undergraduate)

![]() Advanced university degree

Advanced university degree

21. Which of these categories does your total annual household income fall into?

![]() Under $25,000

Under $25,000

![]() $25,001–$40,000

$25,001–$40,000

![]() $40,001–$60,000

$40,001–$60,000

![]() $60,001–$80,000

$60,001–$80,000

![]() $80,001–$100,000

$80,001–$100,000

![]() Over $100,000

Over $100,000

22. How likely are you to attend a women’s professional basketball game again in the next 12 months?

![]() Very likely

Very likely

![]() Somewhat likely

Somewhat likely

![]() Not very likely

Not very likely

![]() Not at all likely

Not at all likely

![]() Do not know

Do not know

Thank you for your help.

23. Record gender of respondent

![]() Female

Female

![]() Male

Male

Date of interview _______ I certify that this interview was conducted in accordance with briefing instructions and the Code of Professional Behavior, and that the information gathered is true and accurate.

Signed by interviewer: ![]()

Now that you understand who your audience is, it is time to create a plan that will bring them to your event, venue, organization, or service.

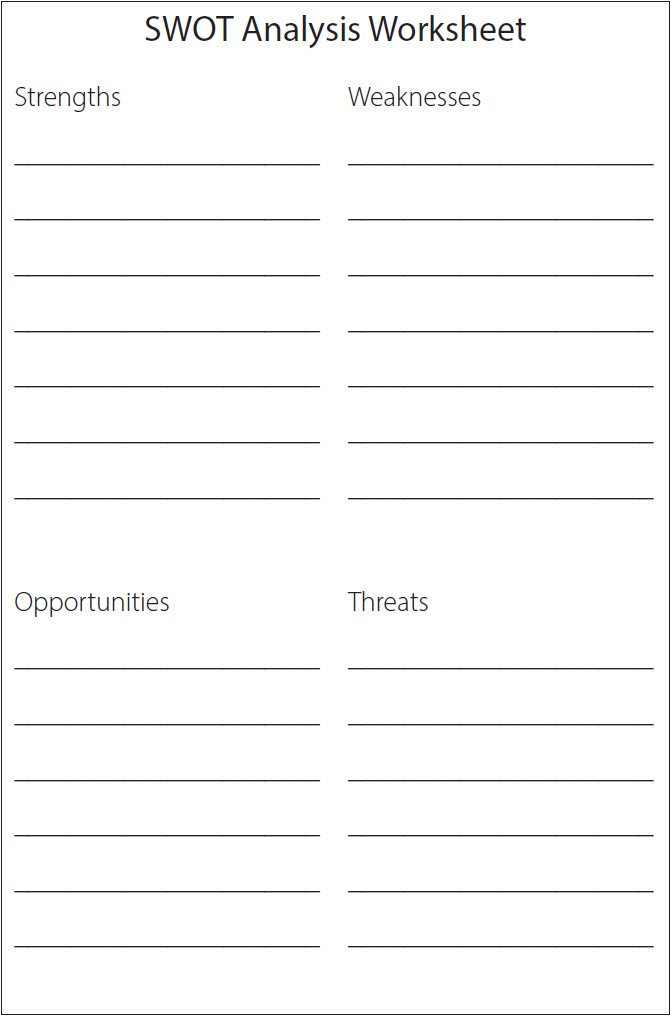

SWOT stands for Strengths, Weaknesses, Opportunities, and Threats. The SWOT analysis is a tool that allows you to identify the internal and external issues that may impact on your ability to market your event or product.

![]()

In order to identify the strengths and weaknesses of your event or products, you must examine the issues within your organization that impact on your ability to sell your event or property to your target markets and to sponsors.

An important area to explore is how your organization perceives the value of the event or product. If your organization sees your event as a priority and an opportunity to raise the profile of the organization, the event is considered a strength. However, if your board sees your event as a drain on resources, then the event is a weakness.

Exercise. Consider the following list of internal organizational factors and determine how these will affect the success of your event. For each factor, determine whether its effect is a strength or a weakness and place your specific factors under either the strengths or weaknesses headings in the SWOT Analysis Worksheet later in this section.

The internal factors that may influence your event include

• Staff attitudes and opinions

• Staff experience and expertise

• The organization’s track record in staging and promoting similar events

• Booster clubs, membership programs, databases

• How your corporate plan and your corporate objectives impact on your event

• Key stakeholder analysis

• Resources—money, people, assets, facilities, volunteers

• Existing media profile

• Media partners

• New organizational initiatives

• Board and/or head office support

• Your location

![]()

The next step is to analyze all factors outside your organization that may affect your event. The external analysis will assist you in identifying the opportunities and threats related to your event. Once you have determined the threats to your event, you can reassess the situation and analyze how you can make these threats into opportunities.

For example, if you are holding an outdoor children’s community festival, the following external factors may influence your event:

• Weather

• Major sporting finals on the same day

• Poor attendance at last year’s event

• Fewer children in the relevant age group in your community

It is imperative that you address each threat to your event when conducting your planning to ensure the success of your event. Each threat can be further categorized into one of four types of threat to help you determine its importance to your event’s success. Categorizing the threat determines how you will respond to the threat to minimize its effect.

![]()

1. Monitor. You may decide only to monitor some threats for which there is little that you can do to change or plan for, nevertheless you want to know what is happening. Examples might include any low-risk threats.

2. Monitor and analyze. You may decide to monitor and analyze threats that you can do little to reduce but you need to determine how they might impact on your event.

3. Prepare contingency strategies. You should prepare a contingency strategy for threats whose impact you can reduce with planning. For example, if bad weather is a threat to your outdoor event, you can determine how you will handle it—postpone the event, move to an indoor facility, or take out insurance.

4. Prepare in-depth analysis and strategy development. You will want to prepare an in-depth analysis and strategy development for those threats that have the greatest likelihood of impacting on your event. Technological, competitor, and legislative factors are examples of threats that may require more detailed analysis and strategy development.

Exercise. Look at the following list of external factors that may influence your event and consider how these offer opportunities and threats to your event. Place your specific factors under either the opportunities or threats headings in the SWOT Analysis Worksheet later in this section. Keep in mind that threats can often be turned into opportunities.

The external factors that may affect your event may be:

• Political

• Competitor related

• Environmental

• Customer perception related

• Geographic

• Economic

• Demographic

• Consumer confidence related

• Historical

• Technological

• Industrial

• Legal

• International

• Natural

• Local

Look at the list of threats you have compiled in the SWOT Analysis Worksheet. Determine which of these threats require your attention. What do you need to do in order to maximize or minimize the effects of each factor?

As with any company, you have competitors. It used to be that events only really competed for their audience against other events, but as more leisure options have come into play and leisure time has become more limited, this is no longer the case. In fact, you are competing against anything that potential customers could do with their leisure time and money.

Use the following worksheet to analyze your competition.

1. Who are my direct competitors (similar events or organizations)?

![]()

2. Who are my indirect competitors (other activities or events that are compelling to your audience)?

![]()

3. What do my potential and existing customers like about my competitors’ events, products, and services?

![]()

4. How much are customers paying for my competitors’ events, products, or services?

![]()

5. What makes my competitors successful and why? What are they doing right?

![]()

6. How do my competitors communicate with their customers?

![]()

7. How do my competitors position their events, products, and services within the market?

![]()

8. Who are my least successful competitors and why? What are they doing wrong?

![]()

9. What are my competitors’ major strengths and weaknesses?

![]()

10. Are my competitors implementing any changes to their fees, products, marketing programs, or operations?

![]()

11. Who are my potential competitors in the short and long term?

![]()

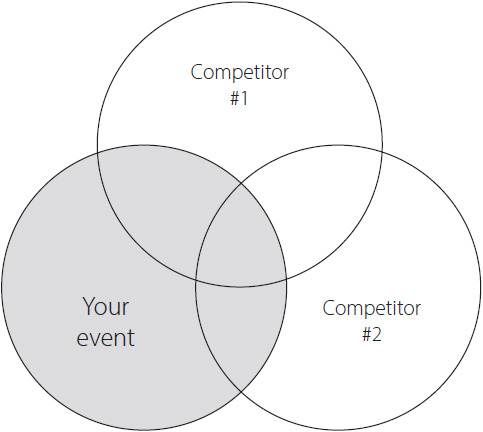

12. How does my product or service differ from my competitors’ events, products, and services? This is your unique selling point! A great way to find it is to do a quick competitor footprint.

![]()

![]()

Create a Venn diagram with your organization and your two biggest competitors (you can add other competitors later) showing attributes you share and those you don’t. We recommend that you use butcher’s paper—you need some space—and work in a group setting. You already have most of the content for this—just pull the information straight off of your brand bullseye to start.

What this process will show is whether you are marketing yourself in ways that you share with your competitors, or whether you are (or could be) marketing yourself based on your unique selling points (Figure 2.6).

Figure 2.6 Competitor footprint

Now that you have completed your SWOT analysis and you know who your competition is, it’s time to plan your marketing strategy.

In order to ensure your marketing strategy remains on track, you need to include the following information:

• Objectives

• Rationale for each objective

• Strategies for achieving each objective

• Measurement mechanisms to determine the outcome of each objective

Your objectives indicate what you want to achieve. They should be SMART objectives:

• Specific

• Measurable

• Achievable

• Results oriented

• Time bound

For example, if your stated objective is to obtain media coverage of your event, you have not been specific enough. Try, instead, “to obtain a major article in The Daily Express and two major news stories on Channel 8 News and Radio Station 9CN by the second week of the festival.”

![]()

The rationale must be a brief statement outlining why a particular objective or strategy has been chosen.

Strategies indicate how you will meet an objective. Strategies are the specific actions that will be undertaken to achieve a desired outcome.

Measurement mechanisms are ways in which you will determine whether you have achieved your objectives and your audience’s critical success factors. Measurement mechanisms may include, but are not limited to:

• Sales figures (tickets, donations, memberships, etc.)

• Sales growth

• Propensity to buy or preference

• Customer intent to return to the next event

• Advance ticket sales

• Wholesale ticket sales

• Group bookings

• Quality of media coverage

• Number of attendees

• Fan opinion and satisfaction

• Social media activity (shares, views, retweets, comments)

• Social media followers

• Sponsorship sales (new, renewals)

• Database growth

• Database activity

• Profit or revenue

• Number and quality of cross-promotions

All plans require resources. The resources required to implement your plan might include information, time, advertising expertise, graphic design skills, media talent, equipment, office space, and staff, as well as funds. In many cases, your marketing and promotional plans will be designed with a specific budget in mind.

Ask yourself the following questions to ensure you have addressed all your resource requirements.

1. What resources do you need to implement the marketing strategies? Sponsors can often provide nonmonetary resources to a project. These should be clearly identified in your marketing plan.

2. How much funding do you require for these items? Include the number of hours, space required, training, and administration support when budgeting for resources. Some examples include

• Staff time (include overtime)

• Advertising

• Equipment

• Office space

• Maintenance and storage

• Printing

• Distribution

• Volunteer costs

• Travel

3. What sources of information, data, knowledge, and research do you need?

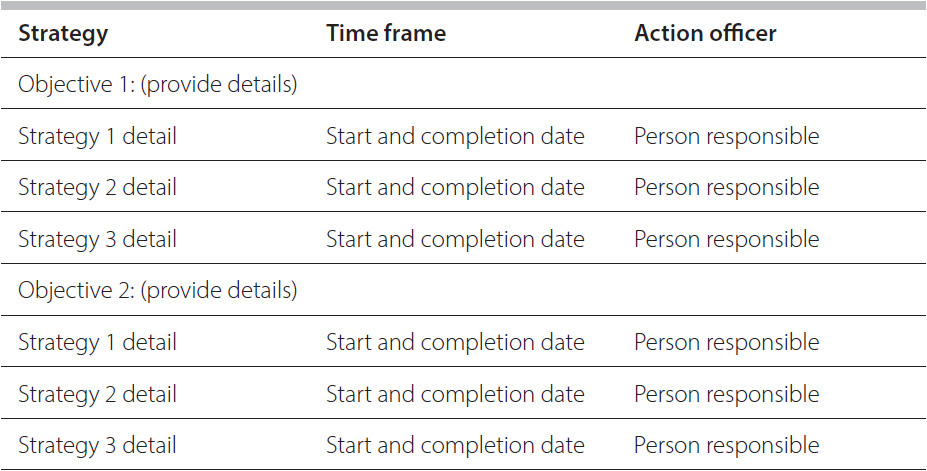

Having a plan does not mean anything unless you put it into action. These points are designed to enable you to create a master timeline and action list for your marketing plan.

1. Phase the strategies and timeline for each and every strategy. Ensure that each strategy has specific start and stop dates.

2. Identify who will be responsible for each step of every strategy.

3. Determine how each strategy will be evaluated, measured, and reported. Identify who will be responsible for these tasks. Schedule all evaluations, approvals, meetings, and reports into your master timeline and action list.

Remember to consider reports, in-house experience, surveys, and consultant studies that already exist within your organization. No one needs to reinvent the wheel.

This template can be used to develop your own marketing plan. In the worksheets in this chapter you have been asked key questions and should have answered them comprehensively. If you haven’t, go back to these worksheets and your research and do so now. Summarize and transfer this information by answering the questions in this template to develop your marketing plan.

Why are we preparing this document? What do we want this document to achieve?

Who are we trying to reach? What do we know about them?

What are the key things we need to achieve in order for this plan to be a success?

What are our strategies based on? (Summarize your research in bullet points.)

What within my organization can affect this plan, both positively and negatively?

What factors in my environment can affect my purpose? What changes must we plan for? (State the assumptions you are making about the future.)

Who are our competitors?

What factors are hindering or restraining our purpose? What environmental factors are driving or assisting our purpose? (List here your strengths, weaknesses, opportunities, and threats.)

Where do we want to go?

How are we going to get there? (Put these in bullet points underneath your objectives; follow the “Sample” earlier in this section.)

How will we know that we have achieved our objective? (Indicate how you will evaluate, measure, and report against your key quantification mechanisms.)

When will we get there? (Complete the following table to assist you in your planning.)

How much is it going to cost us to get there? How much time? What other resources do we need?

Now that your plan is complete, you need to look back on it to double-check that you have covered all of the key aspects. Consider the following questions as you review your marketing plan. Do you have a clear vision of what the completed marketing campaign will look like? Have you identified the critical success factors and measurement mechanisms? Have you identified the key elements that need to be organized within your master timetable and action plan? Have you clearly identified all resources, including financial, human, and training, that need to be planned for? Do you have a contingency strategy if parts of the plan don’t work? Have you addressed all possible threats to your plan and event? Have you identified internal communication strategies within your plan? How will you report on progress to staff, members, and your Board?

A marketing plan is a living document. Ensure that you have scheduled review periods into your plan so that you can fine-tune your plan throughout the implementation phase.