Mutual fund managers are talented, but on average none of that skill enriches asset owners.

—Andrew Ang, Asset Management: A Saystematic Approach to Factor Investing

THERE ARE SOME TALENTED and skilled fund managers out there. As discussed in the previous chapter, the market has to be inefficient enough (i.e., possible to beat) that skilled investors have the incentive to spend resources looking for mispriced securities. If you do not possess special expertise or information, or if you simply have a full-time job that is not about money management, you may decide to delegate the management of your portfolio. The issue is to identify truly skilled managers by accounting for the potential impact of luck and, most importantly, to be able to do it in advance.

There may be no better example to illustrate luck than a 2006 contest between ten Playboy Playmates that were each asked to select five stocks.

1 The winner beat the S&P 500 Index by nearly 30 percent and did better than 90 percent of money managers. Although only four Playmates outperformed the S&P 500, it was still better than the third of active managers that did. When the investing horizon is short, luck dominates performance results.

Hence looking at short time series of performance data to identify good managers and strategies is unreliable. We need an understanding of the qualities that make an investment process sustainable. This brings us to a very important question: How can we properly select a manager if we do not have a proper understanding of the sources of sustainable performance? In the spring of 2012, two commodity managers debated their respective investment styles (fundamental and quantitative) at a hedge fund conference in Montreal. The moderator was a manager for a fund of funds group. The two commodity managers had performed exceptionally well over many years. After listening to both managers, we still could not decipher why one manager should be selected over the other. In fact, despite their financial successes (unsuccessful managers are rarely invited to speak at conferences), the justifications they provided for their superior expertise were not different from what we usually hear from most managers: superior research, greater capacity to adapt to a changing environment, long experience of team members, discipline, superior risk management, better technology, etc. (you’ve heard all of this before). We have yet to meet a manager that does not claim to have those qualities, even the ones with less favorable track records.

The best question at this conference came from a business colleague who asked the moderator how he would choose between these two styles/managers. The answer was a few minutes long, but it can be summarized as follows: “I do not really know, but I will make sure that the manager I choose has the risk management systems in place to protect my downside.” This answer seems to indicate that in the absence of a strong philosophy and a deep understanding of cause and effect, investors (even those specializing in manager selection) are stuck having to rely almost solely on past performances and on the risk-management processes of these managers to make investment decisions. Furthermore, we should not underestimate the natural attraction of investors toward managers that have interesting “stories” to tell.

Protecting the downside is important. Unfortunately, risk management has often become the main criterion by which a manager is judged. In our opinion, it is even more important to understand why a manager should be expected to perform appropriately. Professional risk management and a proper investment policy are the minimum standards that should be expected. The required standard of risk management should not be a reason to invest, but a justification not to invest.

We must address two issues. First, we will sort out the possibility that managers with no skill may outperform and that managers with skills may not, and try to establish the proportion of fund managers that are truly skilled. Second, we will discuss the evidence on performance persistence in the hopes of being able to identify those skilled managers.

The Impact of a Few Decisions

John Paulson, the hedge fund billionaire, delivered a 158 percent performance to investors through his Paulson Advantage Plus fund in 2007. He was again successful in 2008. His success in both years can be attributed to a few good dependent views: a substantial decline in the value of subprime debt and its subsequent contagion to financial institutions. However, if you were not invested with John Paulson in 2007 but, impressed by his 2007 performance, invested in the Paulson Advantage Plus fund in January 2008, your portfolio’s value would have declined cumulatively by more than 36 percent over the following seven years. What should we conclude about his skills and potential for long-term performance in this case?

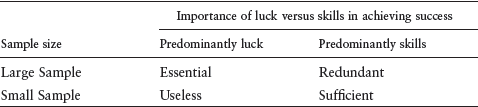

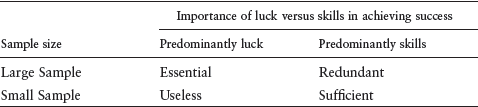

In a context where luck relative to skill plays a minor role in explaining performance, a small sample size may be enough to evaluate whether or not someone is skilled. However, if luck or a single glimpse of genius is a significant contributor to success, we need a large sample size to arrive at the same conclusion. In his book on the impact of skill and luck in different fields,

2 Michael Mauboussin explains the relations among skills, luck, and sample size as described in

table 3.1.

For example, chess is entirely about skill. A grand master will not lose against a bad player. We do not need to set a tournament of a hundred games to confirm this finding. However, when flipping a coin, it may require a large sample to conclude beyond a reasonable doubt that no one is skilled at flipping a coin. For example, if we ask one thousand individuals to flip a coin ten times, we will observe a wide distribution of results. The most common result will be five tails and five heads, but a few players will flip nine and ten heads or tails. Thus, some players may look skilled at flipping coins. However, if we ask those same players to each flip a coin a total of one thousand times, the distribution of heads and tails will narrow around 50 percent for all of them. No player will really look skilled. Because of the significant amount of noise in financial markets, success in portfolio management is closer to flipping a coin than to playing chess.

John Paulson had a great idea in shorting securities linked to subprime mortgages and then financial institutions. However, like any performance that is linked to a small sample of significant decisions, why should brilliance in recognizing and exploiting the mess in subprime translate to brilliance in trading gold, equity, or timing an economic recovery? Not only is Paulson’s successful performance in 2007 and 2008 linked to few major decisions, but these decisions are also linked to different skill domains than his more recent activities. A great play is not a long-term strategic process. After the big play in subprime was over, an investor would have done much better by investing in a low-cost 60/40 portfolio. In fact, even if we consider the strong 2007 performance, the fund did not outperform a 60/40 indexed portfolio from 2007 to 2014. However, few managers of balanced portfolios become billionaires.

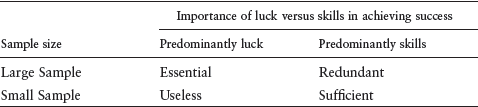

Furthermore, many successes in our industry are explained by the relative price cycles among securities, sectors, asset classes, and regions. These cycles can last for many years before eventually reversing. For example,

figure 3.1 illustrates the relative performance of the financial sector against the energy sector using three-year cumulative excess returns. A positive value indicates that the financial sector outperformed the energy sector over the previous three years. Although we never know ahead of time how long these cycles last, they are often very long.

FIGURE 3.1

Annualized rolling three-year excess performance of the energy sector over the financial sector

The figure shows that the financial sector almost systematically outperformed the energy sector in the 1990s. The reverse was observed between 2002 and 2013. Thus, if a manager had taken the view in the early 1990s that financials were to outperform, he would have been right for a very long time. Once we are proven right, it reinforces our belief in our own abilities, which may incite us to further increase our allocation bets. The spreads in relative performance between securities, sectors, and asset classes can be significant. A small deviation from benchmark allocations can lead to significant excess under- or overperformance. A single decision can create winners and losers for many years. Would you assume that a manager has broad and persistent expertise and will be successful in the future because he was right on a single or a few decisions that impacted his performance for many years? As we stated before, if one thousand individuals without expertise were asked to overweight or underweight the financial sector at the expense of the energy sector, many among them will likely be right for several years even if they have no expertise. How can we separate true experts from nonexperts if both can be wrong?

According to Grinold’s fundamental law of active management, confidence about a manager’s ability to outperform increases when performance is attributed to a large sample of independent decisions.

3 However, as the previous examples illustrate, the fact that a manager may have made a large number of trades does not mean that these trades are truly independent. An investment process can be driven by a narrow range of common requirements leading to specific and concentrated risks even if the portfolio appears diversified. For example, a value manager may own a hundred stocks, each carefully selected, but his outperformance may be explained by how the value segment performed against the growth segment. Clearly we need a more robust way to identify truly skilled managers than just looking at recent historical returns.

What Do We Mean by Luck and Skills?

Once again, our return equation from

chapter 2 can help. Think of the return R as the return of an entire fund. Exactly as we had taken a weighted sum of the return equations of all assets to obtain the return of the market portfolio in the previous chapter, we can also compute the weighted sum of the returns of all assets held by a specific manager to examine its fund’s properties, more specifically its exposure to risk factors and its historical excess performance or alpha α. The fund’s alpha is often used as a measure of skill. Given the exposure of the manager’s portfolio to risk factors, the alpha provides a measure of the value added by the manager on a risk-adjusted basis.

However, historical alpha α is not proof of skills. Excess returns are also impacted by random shocks ε, otherwise known as good or bad luck. Luck refers to the possibility that these random shocks will falsely increase the estimated alpha in a small sample and therefore make a fund and his manager mistakenly look good. Thus, we use the terms noise and luck interchangeably. These shocks are random and unpredictable, hence the term noise. Luck is when these random shocks result in good performance purely by chance. Distinguishing alpha (skills) from random shocks (luck) is not a simple matter.

Luck is linked to the well-known phenomenon of regression to the mean, which has to do with the tendency of exceptional performances (good or bad) to become average over time rather than to remain exceptional. This can easily be understood by the random and unpredictable nature of shocks. If good performance is entirely caused by a random and unpredictable shock, it is less likely to be followed by another extreme favorable random shock. Thus, future performance will be less impressive and will appear to have regressed to the mean. For example, even if an individual flipped a coin ten times and got an unlikely result of ten heads, the most likely scenario if he were to flip the same coin ten more times would still be five heads and five tails.

There is already one important caveat to this aspect. We should look at

risk-adjusted returns, not raw returns of a fund; we should control for its exposure to risk factors because a manager could easily beat the market on average by adopting, for example, a high market risk exposure β

m. Clearly we do not need to hire a manager to simply take more market risk. We can do this by ourselves. We also need to be further convinced that the excess performance of a manager is attributed to his skills and not to a consistent and specific portfolio allocation bias, which adds an undisclosed risk to the portfolio or to a benchmark that does not recognize some of the risk factors that are present in the portfolio. The example cited in

chapter 2 of a large pension fund using a benchmark built from a standard global equity index and cash is a good example of this issue.

But one manager’s expertise may rely on knowing when to increase or when to decrease his exposure to the market portfolio. Fortunately, this is not a problem. When we estimate the alpha of a manager, we must simply control for his average exposure to market risk. Therefore his market timing ability, if any, will show up in the α. So far, so good.

The same reasoning applies when there are multiple risk factors out there. A manager’s expertise may rely on identifying these risk factors and knowing how to efficiently balance them in a portfolio. A popular mantra in the hedge fund community is “the exotic beta you don’t know about is my alpha.” Again, any factor allocation and timing skill will simply show up in the estimated alpha when we use standard statistical analysis that relies on constant factor exposures. Therefore we begin our investigation by looking at funds and controlling for their average exposures to risk factors. Then we will discuss factor timing abilities.

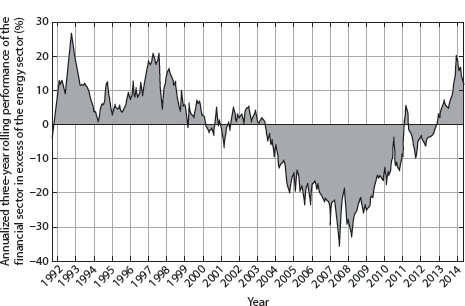

To illustrate these facts,

figure 3.2 reports the cumulative value of $100 invested in the Russell 1000 Growth and $100 invested in the Russell 1000 Value Indices over the ten years ending in 2006. The index with a growth tilt outperformed in the 1990s, whereas the index with a value tilt outperformed over the whole decade.

FIGURE 3.2

Russell 1000 growth versus Russell 1000 value.

Source: Bloomberg

Now consider a manager with a strong value tilt in his portfolio. Over the whole period, he would have outperformed a manager with a strong growth tilt. But at the end of the 1990s, he would have looked comparatively bad and likely lost a lot of clients to growth managers. Significant evidence exists that value stocks do outperform growth stocks in the long run and we often use value as a risk factor

F (more on this in

chapter 5). But fortunately we can still properly evaluate his skills. Controlling for the exposure to this risk factor, the estimated alpha of the manager would tell us whether he added value over the whole period despite the underperformance of value stocks early on.

What if another manager had the acumen to expose his portfolio to growth during the early period and focused on value after? His average exposure to the value factor might be close to zero over the whole period, having been negative in the early part and positive later on. But his

factor timing ability would have paid off considerably. In this case, the factor timing ability of the second manager would result in a higher estimated alpha than for the first manager, who had adopted a constant exposure to the value factor. A similar point can be made for securities like our energy and financial stocks in the previous example.

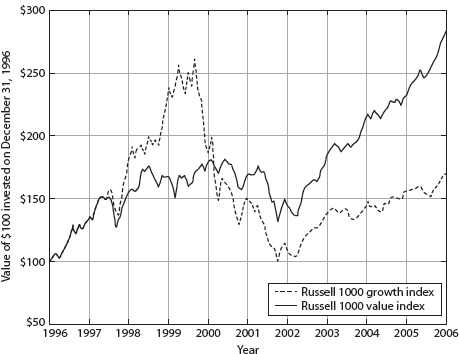

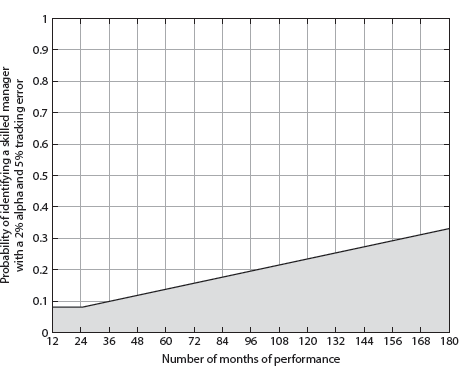

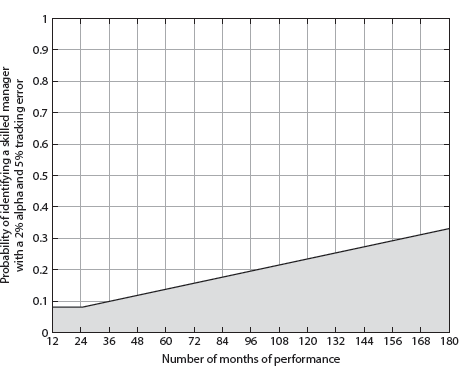

How hard is it to identify a positive alpha manager from historical performance?

Figure 3.3 presents the probability of identifying a skilled manager given the number of months of performance we observe. In this test, we simulate the market return F

m assuming a realistic average annual excess return of 5 percent and a volatility of 20 percent, and we simulate the performance of a large number of funds, all of which have alphas of 2 percent per year and volatility of noise of 5 percent per year. The results are humbling. When we observe only one year of monthly returns and estimate a fund’s alpha after the fact using standard statistical techniques, we have less than a 10 percent chance of correctly identifying a fund with a positive alpha. In other words, even though all funds in our simulation have positive alphas, we are unable to prove with reasonable statistical certainty that more than 10 percent of them have positive alphas after one year. Clearly, noise and luck play a large role in small samples. Even when we observe fifteen years’ worth of performance, we can only confirm the skill of managers in about one-third of all cases. Furthermore, we can see this as the best case scenario; in this simple test, we assume that returns are statistically well behaved and that funds’ alpha and market exposure are constant.

4 Reality is much less orderly. For example, funds’ alphas exhibit a fat-tailed and asymmetric distribution, which further complicates the identification of skilled managers.

5

FIGURE 3.3

Probability of identifying a truly skilled manager using past performance alone

This simple simulation shows the shortfalls of relying on a short window of performance—say three to five years—to identify skilled managers. Investing is plagued by a lot of noise, and we tend to have small samples. Yet many investors use a three-year window to evaluate whether or not to fire a manager. Investors truly underestimate the horizon (or sample size) required to derive confidence about a manager’s expertise from historical returns. Firms that offer dozens or even hundreds of funds on their mutual fund platform understand this. They offer many funds because they know few of their funds are likely to remain winners for more than a few years, and having many funds ensures that there will always be some that have performed well recently. Offering too many funds may be an indication of an absence of investment philosophy.

Finally, as peculiar as this may seem, the significance of luck on outcome increases when the players are more uniformly skilled. Michael Mauboussin reports that the time spread between the first- and twentieth-rank marathon runners was about forty minutes in 1932. Today, it is no more than five to seven minutes. Eighty years ago, the best marathon runner may have dominated in almost all circumstances. Today, considering the greater pool of potential athletes and access to the best training techniques and diet, it may require more than a single race to determine who is best. Similarly, it takes more than a few years of returns to identify good managers.

How Many Skilled Managers Are There Really?

In

chapter 2, we discussed a study by Eugene Fama and Kenneth French that showed that in aggregate U.S. mutual fund managers do not outperform the market at the expense of other groups of investors. Fortunately, this study also provided a statistical methodology that can distinguish skill from luck. Controlling for the amount of noise in the data, they concluded that once fees are added to the mix, very few funds have enough skills to cover their costs and provide positive net alpha to investors.

Laurent Barras of McGill University, Olivier Scaillet of the University of Geneva, and Russ Wermers of the University of Maryland provide an even more sophisticated methodology to control for luck in performance data.

6 In a sample of more than two thousand U.S. domestic equity mutual funds over the period from 1975 to 2006, they can identify only 0.6 percent of them as having a positive alpha net of fees and costs. This result appears at first damning for managers, but in fact their results show that about one out of ten managers are identified as being skilled. It is simply that despite their value added, they do not outperform a simple index once costs and fees are taken into account.

It is important to contrast these results with the evolution of the active management industry as a whole. Lubos Pastor of the Chicago Booth School of Business and Robert Stambaugh and Lucian Taylor, both at the Wharton School, examine the relations among the performance of equity fund managers, the size of their funds, and the size of their industry.

7 In the fund management industry, there may be diseconomies of scale: a larger fund may suffer from market impact when trying to execute its larger trades, and a larger size of the industry implies that more managers are chasing the same alpha opportunities.

They find evidence, though weak, that the size of a fund’s assets under management seems to impede a manager’s ability to outperform. This is consistent with an increasing cost structure: as a manager outperforms, he attracts new money inflows from clients, but it becomes harder for him to continue outperforming. They find strong evidence, however, that the size of the mutual fund industry negatively impacts outperformance. Managers may have become better over time, but the increase in the size of the industry implies more competition among fund managers, so it takes more skills just to keep up. The level of skill may have increased over time, there is learning on the job, and new entrants seem more skilled than incumbents, but as the industry grows, there is more competition and it becomes harder to outperform and provide investors with positive net alpha. As individual skills improve, so do the skills of the entire industry.

The results mentioned previously, that many fund managers have skills, are echoed in this study, albeit based on a different methodology. Here results show that about three-quarters of managers have skills before costs and fees and before their fund performance is impacted by their own size and by the size of the industry. But again, not much of this value added trickles down to investors’ pockets.

The presence of diseconomies of scale reminds us of a meeting with a manager in New York in the summer of 2011. This manager benefitted from the subprime debacle, but his spectacular performance in 2007 and 2008 quickly turned negative and strong redemptions ensued. Much to our surprise, this manager said that “the problem with producing a greater than 100 percent return in a short period of time is first that your assets double [from performance] and second that they increase further [because everyone suddenly wants to invest with you] but it does not mean you know what to do with all this capital.” Unfortunately, they did not.

A recent study by Jonathan Berk at Stanford University and Jules van Binsbergen at the Wharton School argues that neither gross nor net (after fees have been removed) alpha are appropriate measures of skill.

8 Instead, they use gross dollar value added. Net alpha can be driven to zero due to competition, and the link between skill and gross alpha is not obvious. For example, Peter Lynch, while managing the highly successful Magellan fund, generated a 2 percent gross

monthly alpha on average assets under management of $40 million during his first five years of tenure and a 0.20 percent alpha per month during his last five years on assets of about $10 billion. Looking at gross alpha would imply he may have lost his edge, while in fact he went from creating $1 million per month to more than $20 million per month in value.

This study is noteworthy for many reasons. First, it looks at a large sample of all actively managed mutual funds based in the United States, including those that invest in international stocks. Second, it uses not only standard risk factors to control for risk, but also alternatively Vanguard Index funds that were available in the market at the time when the fund performances were realized. Standard risk factors, such as value or momentum (to be discussed in

chapter 5), are subject to criticisms: they involve both a large number of long and short positions that may be difficult to trade and it is likely that most investors did not fully know about their existence a few decades ago. Hence they recognize that it may be unfair to measure funds’ net alpha using risk factors that were not genuinely part of their investment opportunity set then.

Beyond confirming that the average manager is skilled, the analysis also shows that the difference across managers in their measure of skills (dollar value added) persists for up to ten years. Therefore it may be possible to identify them well in advance, which is a task we examine more closely in the next section.

Can We Identify Skilled Managers in Advance?

Now that we have established that there are skilled fund managers out there, although few outperform after fees, can we identify them in advance? We could compute their alpha using past performances and invest in high alpha funds. But this method assumes past alpha is indicative of future alpha. Therefore we first need to determine if there is persistence in managers’ skills. Of course, tracking funds that show persistence in returns may appear profitable, but it may also incur a significant amount of manager turnover and transition costs.

As alluded to in the previous section, α is also not the whole story. We also care about the risk embedded in the random idiosyncratic shocks ε. We usually quantify this risk by computing the standard error (i.e., a measure of risk) of these shocks, which is usually referred to in the industry as the tracking error. Tracking error expresses the volatility of the performance unexplained by the exposure to the market factor. A fund with a 1 percent annual tracking error would have performance that would remain within ±2 percent of the index most of the time. Funds that track an appropriately defined index will have an annualized tracking error lower than 1 percent, and highly active funds’ tracking error can easily reach 5 to 10 percent per year. Some managers called themselves active but have tracking errors as low as 2 percent. They are often referred to as benchmark huggers or closet indexers. They get paid significant fees for holding portfolios that are very much like the index.

Again, we would like to identify a manager that truly has a positive alpha, but given his alpha, we prefer a manager who can achieve this outperformance without taking significant risk relative to his benchmark (i.e., a lower tracking error). Furthermore, for a given level of fees, we prefer a manager that takes more tracking error than less assuming the same alpha efficiency per unit of tracking error. To summarize these two effects, we can compute the ratio of the alpha to the tracking error—the

information ratio—of which a higher value indicates a better manager. Unfortunately, because the performance related to idiosyncratic shocks (i.e., luck) in a specific fund can be confused with alpha, a high information ratio can also be partly explained by luck. Therefore it may not be indicative of high future risk-adjusted returns.

Nevertheless, the same sophisticated econometric techniques mentioned in the previous section can help successfully identify future well-performing funds based on past performance alone.

9 But we are faced with two problems. First, there is little evidence of performance persistence based on fund returns alone. If anything, it seems to be mostly concentrated among poorly performing funds that tend to underperform again in the future. Second, in addition to the knowledge and expertise required to handle these econometric techniques, investors should carefully assess the costs of switching their investment across funds.

We can improve our chances of identifying a good manager in advance by exploiting what we know about skilled managers. For example, we know that managers that have displayed skills historically were good stock pickers during bull markets

and exhibited good factor timing skills during recessions.

10 During booms, these skilled managers focus on analyzing companies and choosing their investments, and during recessions they adequately hold more cash and emphasize defensive sectors. Characterizing funds according to their stock-picking ability during booms and their factor-timing ability during recessions allows us to pick funds that will outperform up to one year in the future. Note that we are also still subject to small sample biases as there are very few economic cycles to evaluate their performance and many organizational changes may have occurred even if they have a twenty-year track record.

There are also other measures based on holdings rather than returns that can be used to forecast managers’ outperformance. For example, the

active share measure

11 captures the total absolute weight deviation of a fund from its benchmark weights (multiplied by one-half to avoid double counting). In essence, it is a measure of the degree of similarity between a portfolio and its benchmark. An active share of zero indicates that a portfolio is identical to its benchmark, while an active share of one indicates a portfolio whose structure is totally different from its benchmark. Imagine, for example, that the benchmark is composed of two stocks, Walmart and Amazon, with respective weights of 40 percent and 60 percent. A manager allocating an equal amount to both would have an active share of 10 percent (0.5 × (50 percent – 40 percent + 60 percent – 50 percent)), whereas one investing only in Walmart would have an active share of 60 percent (0.5 × (100 percent – 40 percent + 60 percent – 0 percent)).

Results suggest that outperformance is strong for funds with a high level of active share (such as 0.80 or above), that is, for benchmark-agnostic managers. It could be that high active share funds exhibit knowingly or unknowingly some of the forms of diversification that will be discussed in

chapter 5. Because active share is persistent across time for a fund, it could be used to forecast a fund’s future outperformance.

This measure has come under scrutiny lately as high active share funds tend to be funds that invest in small-capitalization stocks whose index has had a negative risk-adjusted performance over the study’s period.

12 In other words, the link between active share and fund performance may simply be due to the poor performance of U.S. small-cap indexes during this period, not to the outperformance of funds benchmarked on these indexes. Computing active share with respect to the market-cap weighted portfolio of the stocks chosen by the manager avoids having to identify the benchmark and robustly predicts future outperformance.

13 Nevertheless, active share is an efficient way to distinguish between genuine stock pickers and closet indexers. For example, a portfolio with a 20 percent active share is similar to investing 80 percent of the assets in the index and 20 percent in something that is different from the index. Hence if you are paying significant fees to this manager, you are paying to have only one-fifth of your portfolio actively managed!

Finally, there is a wide variety of other characteristics linked to outperformance. They are the ones you would intuitively expect: longer education and experience (SAT scores, better MBA program, PhD, CFA title), managers’ experience in large funds, funds operating within a flatter organizational structure, a higher amount of manager’s money invested into their fund, a more widespread network of the fund managers, funds that invest locally or concentrate in specific industries, etc.

14However, identifying performing managers from statistical analyses of past performances or from other indicators such as active share or organizational structure still remains a challenge. There is simply too much noise that can impact the performance of a single manager, even over longer periods—five years, for example. This is why

chapter 5 is dedicated to identifying the relevant skills and structural causes of outperformance of top managers and products.

The Reasons Investors Still Invest with Active Managers

The previous section suggests that identifying good managers in advance requires an advanced knowledge of economics, econometrics, and precise data about a fund’s characteristics and holdings. If an investor has such expertise, maybe he is also in a position to apply such knowledge to building his own portfolio instead of identifying good managers!

It is not necessarily surprising that a large fraction of our wealth remains invested in actively managed funds. This fact is consistent with a context in which investors learn slowly about the level of managers’ skills and in which there are diseconomies of scale. As the size of the active management industry increases, competition makes it harder for fund managers to outperform. But as its size decreases, more market inefficiencies appear, and active managers outperform passive indexes.

15 Again, there is a delicate balance.

Although the evidence against net outperformance is strong, firms are skilled at marketing their products in a much more favorable light. For example, Andrew Ang refers to a survey by PERACS (a provider of private equity fund analytics and track record certification) indicating that 77 percent of private equity firms declare to have top-quartile performance, an observation that defies the numbers. Charles Ellis, the well-known investor and founder of Greenwich Associates, rounded up the parties responsible for the current state of affairs

16 as follows.

Investment managers are skilled at presenting their performance in a favorable light. For example, they may choose the historical period for performance that makes the best impression (five years, seven years, or ten years) depending on what looks best. In the case of firms offering a multifund platform, they may concentrate their marketing on those funds that performed best in recent years. Finally, even simple investment processes are presented in a compelling fashion, giving the impression that some managers have developed a true competitive advantage when in fact there may be little that differentiates them from others.

Also, the consultant business model is based on maximizing the present value of future advisory fees, which is in many cases inconsistent with advising clients not to make significant changes to their portfolios and to remain consistent. Furthermore, consultants are known to shift their recommendations toward managers that have performed well recently. As Ellis mentioned, how often have you heard a consultant say the following:

While this manager’s recent performance record certainly does not look favorable, our professional opinion is that this manager has weathered storms in a market that was not hospitable to her style and has a particularly strong team that we believe will achieve superior results in the future.

Finally, within investment committees and senior management, there is often the belief that when performances are disappointing, something must be done. The pressure on internal management to act can be significant. When consultants are hired, they will often support the need for change, as many consultants will find proper justification for what management wants. Lussier has witnessed this many times. After all, this is how advisory fees are generated. Because most investment committee members do not have the depth of understanding required to challenge those advisors and consultants (a subject that will be discussed in

chapter 7), they can easily be impressed and influenced by forty-page binders of data and charts.

To support this point, consider the results from a study by Amit Goyal at HEC Lausanne and Sunil Wahal at Arizona State University, who look at the performance of fund managers before and after plan sponsors fired them (

table 3.2). Most managers that had performed poorly prior to being fired performed much better after they were fired.

Source: Amit Goyal and Sunil Wahal, “The Selection and Termination of Investment Management Firms by Plan Sponsors,” Journal of Finance 63 (2008): 805–47.

We mentioned in the introduction that fewer than 30 percent of active managers outperform over horizons such as five to ten years. This level is independent of the level of expertise that exists in the market. It is structural. As long as fees stay at similar levels, our likelihood of identifying performing managers will likely remain below 30 percent. However, we also concluded in this chapter that it is a challenge to identify which managers will be part of the winning group. Historical performances are not an efficient guideline of future performance.

The industry is certainly aware of the reality that few managers outperform their own fees. Many asset managers fear that more and more investors will turn to cheaper indexed and passive investment solutions. As decades have passed, the alignment of interests between investors and service providers has declined. The SEC used to believe that public ownership of mutual fund companies was a violation of fiduciary duties. Today, following a 1958 ruling that overruled the SEC position, more than 80 percent of the largest forty mutual fund complexes are public. Consequently, more and more asset management firms have a dual role of seeking a return on corporate capital and upholding their mandate to serve the interests of investors. Consequently, the number of funds has exploded, as has the failure rate, which increased from 1 percent per year in the 1960s to 6 percent per year in the last decade. Furthermore, even though the average size of mutual funds has increased, the average expense ratio of equity funds doubled from 1960 to 2010.

17As we started this chapter with a quote from Andrew Ang, we will close it with another from him. In his book on asset management, he mentions that “killing or merging poorly performing funds is the only way the marketing team of the firm Janus can say with a straight face, ‘100 percent of Janus equity funds have beaten their benchmark since inception.’” The objective of many fund complexes is often to kill underperforming funds and to have enough funds so that some of them will always have good historical performances. This is not a basis to build a business that will confidently serve investors better.