page 186

©gstockstudio/123RF

page 187

LO6.1

Identify strategies for effective consumer buying.

Consumer Buying Activities

Buy now: cash or credit? Or save and buy later? Which path is for you? Daily buying decisions involve a trade-off between current spending and saving for the future. Economic, social, and personal factors will affect your daily buying habits. These factors are the basis for spending, saving, investing, and achieving personal financial goals. In very simple terms, the only way you can have long-term financial security is to not spend all of your current income. In addition, overspending leads to misuse of credit and financial difficulties.

Practical Purchasing Strategies

Comparison shopping is the process of considering alternative stores, brands, and prices. In contrast, impulse buying involves unplanned purchasing, which can result in financial problems. Several buying techniques are commonly suggested for wise buying.

TIMING PURCHASES Certain items go on sale the same time each year. You can obtain bargains by buying winter clothing in mid- or late winter, or summer clothing in mid- or late summer. Many people save by buying holiday items and other products at reduced prices in late December and early January.

PURCHASE LOCATION Your decision to use a particular retailer is probably influenced by location, price, product selection, and services available. Competition and technology have changed retailing with superstores, specialty shops, and online page 188buying. This expanded shopping environment provides consumers with greater choice, potentially lower prices, and the need to carefully consider buying alternatives.

BRAND COMPARISON Food and other products come in various brands. National-brand products are highly advertised items available in many stores. Store-brand and private-label products, sold by one chain of stores, are low-cost alternatives to famous-name products. Since store-brand products are frequently manufactured by the same companies that produce brand-name items, these lower-cost alternatives can result in extensive savings. The use of one or more of the many product comparison websites can assist you when comparing brands.

LABEL INFORMATION Certain label information is helpful; however, other information is nothing more than advertising. Federal law requires that food labels contain certain information. Product labeling for appliances includes information about operating costs to assist you in selecting the most energy-efficient models. Open dating describes the freshness or shelf life of a perishable product. Phrases such as “Use before May 25, 2019” or “Not to be sold after October 8” appear on most food products. However, these labels can be confusing. Most expiration dates relate to quality, not safety. Items used after the “sell by” date are likely to still be safe for consumption. Canned and packaged food items, if not opened, will usually be safe beyond the expiration date.

PRICE COMPARISON Unit pricing uses a standard unit of measurement to compare the prices of packages of different sizes. To calculate the unit price, divide the price of the item by the number of units of measurement, such as ounces, pounds, gallons, or number of sheets (for items such as paper towels and facial tissues). Then compare the unit prices for various sizes, brands, and stores.

Coupons and rebates also provide better pricing for wise consumers. A family saving about $8 a week on their groceries by using coupons will save $416 over a year and $2,080 over five years (not counting interest). Coupons are available online through websites such as www.coolsavings.com and www.couponsurfer.com and through apps such as Coupon Cloud and Grocery Smarts. A rebate is a partial refund of the price of a product.

When comparing prices, remember that:

More store convenience (location, hours, sales staff) usually means higher prices.

Ready-to-use products have higher prices.

Large packages are usually the best buy; however, compare using unit pricing.

“Sale” may not always mean saving money.

The use of online sources and shopping apps can save time.

Exhibit 6–1 summarizes techniques that can assist you in your online buying decisions.

page 189

Exhibit 6–1 Wise Online Buying Activities

Warranties

Most products come with some guarantee of quality. A warranty is a written guarantee from the manufacturer or distributor that specifies the conditions under which the product can be returned, replaced, or repaired. An express warranty, usually in written form, is created by the seller or manufacturer and has two forms: the full warranty and the limited page 190warranty. A full warranty states that a defective product can be fixed or replaced during a reasonable amount of time.

A limited warranty covers only certain aspects of the product, such as parts, or requires the buyer to incur part of the costs for shipping or repairs. An implied warranty covers a product’s intended use or other basic understandings that are not in writing. For example, an implied warranty of title indicates that the seller has the right to sell the product. An implied warranty of merchantability guarantees that the product is fit for the ordinary uses for which it is intended: A toaster must toast bread, and an MP3 player must play music or other recorded files. Implied warranties vary from state to state.

USED-CAR WARRANTIES The Federal Trade Commission (FTC) requires used cars to have a buyer’s guide sticker telling whether the vehicle comes with a warranty and, if so, what protection the dealer will provide. If no warranty is offered, the car is sold “as is,” and the dealer assumes no responsibility for any repairs, regardless of any oral claims. FTC used-car regulations do not apply to vehicles purchased from private owners.

While a used car may not have an express warranty, most states have implied warranties to protect used-car buyers. An implied warranty of merchantability means the product is guaranteed to do what it is supposed to do. The used car is guaranteed to run—at least for a while!

NEW-CAR WARRANTIES New-car warranties provide buyers with an assurance of quality. These warranties vary in the time, mileage, and parts they cover. The main conditions of a new-car warranty are (1) coverage of basic parts against defects; (2) power train coverage for the engine, transmission, and drive train; and (3) the corrosion warranty, which usually applies only to holes due to rust, not to surface rust. Other important conditions of a warranty are a statement regarding whether the warranty is transferable to other owners of the car and details about the charges, if any, that will be made for major repairs in the form of a deductible.

SERVICE CONTRACTS A service contract is an agreement between a business and a consumer to cover the repair costs of a product. Frequently called extended warranties, they are not warranties. For a fee, these agreements insure the buyer against losses due to the cost of certain repairs and losses. Beware of service contracts that offer coverage for three years but really only cover two since the item has a manufacturer’s one-year warranty.

Automotive service contracts can cover repairs not included in the manufacturer’s warranty. Service contracts range from $400 to more than $1,000; however, they do not always include everything you might expect. These contracts usually cover failure of the engine cooling system; however, some contracts exclude coverage of such failures if caused by overheating.

Because of costs and exclusions, service contracts may not be a wise financial decision. You can minimize your concern about expensive repairs by setting aside a fund of money to pay for them. Then, if you need repairs, the money to pay for them will be available.

Research-Based Buying

Major buying decisions should be based on a planned decision-making process, which may be viewed in four phases.

PHASE 1: PRESHOPPING ACTIVITIES

Start the buying process with actions that include:

Problem identification to set a goal and focus your purchasing activities.

Information gathering to benefit from the buying experiences of others.

page 191

PHASE 2: EVALUATING ALTERNATIVES

With every decision, consider various options:

Attribute assessment with a comparison of product features.

Price analysis including consideration of the costs at various buying locations.

Comparison shopping activities to evaluate shopping locations.

PHASE 3: SELECTION AND PURCHASE

When making your final choice, actions may include:

Negotiation activities to obtain lower price or added quality.

Payment alternatives including use of cash and various credit plans.

Assessment of acquisition and installation that might be encountered.

PHASE 4: POSTPURCHASE ACTIVITIES

After making a purchase, several actions are encouraged:

Proper maintenance and operation.

Identification and comparison of after-sale service alternatives.

Resolution of any purchase concerns that may occur.

LO6.2

Implement a process for making consumer purchases.

Major Consumer Purchases: Buying Motor Vehicles

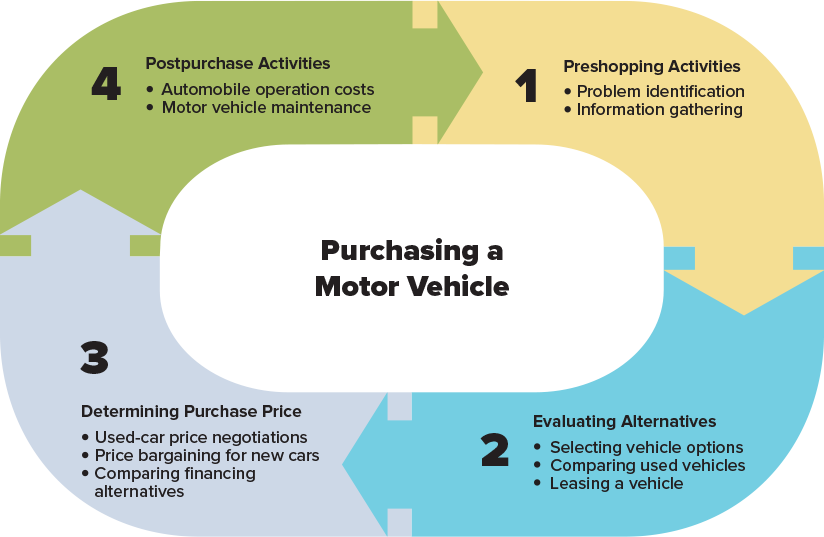

To make wise decisions in purchasing a vehicle, the steps in Exhibit 6–2 are recommended.

Exhibit 6–2 A Research-Based Approach for Purchasing a Motor Vehicle

Phase 1: Preshopping Activities

First define your needs and obtain relevant product information. These activities are the foundation for buying decisions to help you achieve your goals.

page 192PROBLEM IDENTIFICATION Effective decision making should start with an open mind. Some people always buy the same brand when another brand at a lower price would also serve their needs or when another brand at the same price may provide better quality. A narrow view of the problem is a weakness in problem identification. You may think the problem is “I need to have a car” when the real problem is “I need transportation.”

INFORMATION GATHERING Information is power. The better informed you are, the more effective you will be in making good decisions. Some people spend very little time gathering and evaluating information. At the other extreme are people who spend much time obtaining consumer information. While information is necessary for wise purchasing, too much information can create confusion and frustration. The most useful information sources include:

Personal contacts allow you to learn about product performance, brand quality, and prices from others.

Business organizations offer advertising, product labels, and packaging that provide information about price, quality, and availability.

Media information (websites, apps, television, magazines) can provide valuable information with purchasing advice.

Independent testing organizations, such as Consumers Union in its monthly Consumer Reports, provide information about the quality of products and services.

Government agencies, local, state, and federal, provide publications, toll-free telephone numbers, websites, and community programs.

Online reviews can provide buying guidance and shopping suggestions. However, be cautious since some may be fictitious online postings.

Basic information about car buying may be obtained at www.edmunds.com, www.caranddriver.com, www.autoweb.com, www.autotrader.com, and autos.msn.com. Consumers Union (www.consumerreports.org) offers a computerized car cost data service. page 193Car-buying services, such as www.acscorp.com and www.autobytel.com, allow you to order your vehicle online.

Phase 2: Evaluating Alternatives

Every purchasing situation will likely have several acceptable alternatives. Ask yourself: Is it possible to delay the purchase or to do without the item? Should I pay for the item with cash or buy it on credit? Which brands should I consider? How do the price, quality, and service compare at different stores? Is it possible to rent the item instead of buying it? Considering such alternatives will result in more effective purchasing decisions.

Research shows that prices can vary for all types of products. For a phone, prices may range from under $100 to well over $500. The price of 325 mg aspirin may range from less than $1 to over $3 for 100 tablets. While differences in quality and attributes may exist among the phones, the aspirin tablets are equivalent in quantity and quality.

Many people view comparison shopping as a waste of time. Although this may be true in some situations, comparison shopping can be beneficial when (1) buying expensive or complex items; (2) buying items that you purchase often; (3) shopping can be done easily, such as with ads, catalogs, or online; (4) different sellers offer different prices and services; and (5) product quality or prices vary greatly.

SELECTING VEHICLE OPTIONS Optional equipment for cars may be viewed in three categories: (1) mechanical devices to improve performance, such as power steering, power brakes, and cruise control; (2) convenience options, including power seats, air conditioning, audio systems, power locks, rear window defoggers, and tinted glass; and (3) aesthetic features that add to the vehicle’s visual appeal, such as metallic paint, special trim, and upholstery. The nearby Figure It Out! feature covers the net present value of buying a hybrid car.

COMPARING USED VEHICLES The average used car costs about $10,000 less than the average new car. Common sources of used cars include:

New-car dealers, which offer late-model vehicles and may include a warranty. Prices will likely be higher than at other sources.

Used-car dealers usually have older vehicles. Warranties, if offered, will be limited. However, lower prices may be available.

Individuals selling their own cars. This can be a bargain if the vehicle was well maintained, but few consumer protection regulations apply to private-party sales. Caution is suggested.

Auctions and dealers that sell automobiles previously owned by businesses, auto rental companies, and government agencies.

Used-car superstores, such as CarMax, usually offer a large inventory of previously owned vehicles, as well as the convenience of online sales.

Certified pre-owned (CPO) vehicles are nearly new cars that come with the original manufacturer’s guarantee of quality. The rigorous inspection and repair process means a higher price than other used vehicles, usually an extra $1,500 to $2,500. CPO programs were originally created to generate demand for the many low-mileage vehicles returned at the end of a lease.

page 194

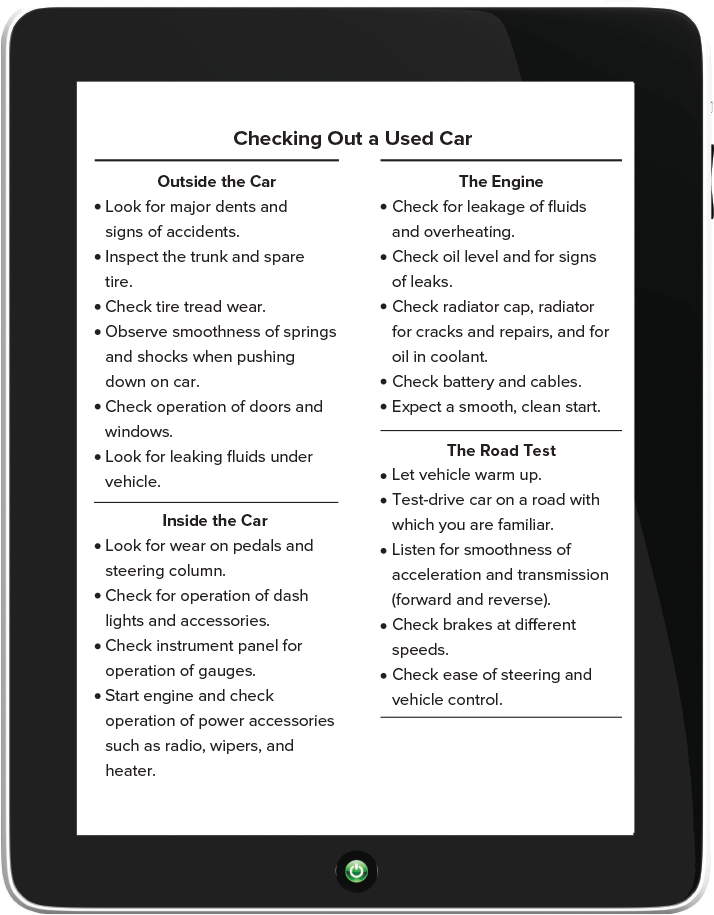

The appearance of a used car can be deceptive. A well-maintained engine may be inside a body with rust; a clean, shiny exterior may conceal major operational problems. Therefore, conduct a used-car inspection as outlined in Exhibit 6–3. Have a trained and trusted mechanic of your choice check the car to estimate the costs of potential repairs. This service will help you avoid surprises.

Exhibit 6–3 Checking Out a Used Car

LEASING A MOTOR VEHICLE Leasing is a contractual agreement with monthly payments for the use of an automobile over a set time period, typically three, four, or five years. At the end of the lease term, the vehicle is usually returned to the leasing company.

Leasing offers several advantages: (1) Only a small cash outflow may be required for the security deposit, whereas buying can require a large down payment; (2) monthly lease payments are usually lower than monthly financing payments; (3) the lease agreement page 195provides detailed records for business purposes; and (4) you are usually able to obtain a more expensive vehicle more often.

Leasing also has drawbacks: (1) You have no ownership interest in the vehicle; (2) you must meet requirements similar to qualifying for credit; and (3) additional costs may be incurred for extra mileage, certain repairs, turning the car in early, or even moving to another state.

When leasing, you arrange for the dealer to sell the vehicle through a financing company. As a result, be sure you know the true cost, including

The capitalized cost, which is the price of the vehicle. The average car buyer pays about 92 percent of the list price for a vehicle; the average leasing arrangement has a capitalized cost of 96 percent of the list price.

The money factor, which is the interest rate being paid on the capitalized cost.

The payment schedule, which is the amount paid monthly and the number of payments.

The residual value, or the expected value of the vehicle at the end of the lease.

After the final payment, you may return, keep, or sell the vehicle. If the current market value is greater than the residual value, you may be able to sell it for a profit. However, if the residual value is more than the market value (which is the typical case), returning the vehicle to the leasing company is usually the best decision. The nearby Figure It Out! feature provides an example comparing buying and leasing an motor vehicle

page 196

Phase 3: Determining Purchase Price

Once you’ve done your research and evaluations, other activities and decisions may be appropriate. Products such as real estate or automobiles may be purchased using price negotiation. Negotiation may also be used in other buying situations to obtain a lower price or additional features. Two vital factors in negotiation are (1) having all the necessary information about the product and the buying situation, and (2) dealing with a person who has the authority to give you a lower price or additional features, such as the owner or store manager.

USED-CAR PRICE NEGOTIATION Begin to determine a fair price by checking newspaper ads and online for the prices of comparable vehicles. Other sources of current used-car prices are Edmund’s Used Car Prices and the Kelley Blue Book.

page 197Various factors influence the price of a used car, such as the number of miles along with features and options. A low-mileage car will have a higher price than a comparable car with high mileage. The condition of the vehicle and the demand for the model also affect price.

PRICE BARGAINING FOR NEW CARS An important new-car price information source is the sticker price label, printed on the vehicle with the suggested retail price. This label presents the base price of the car with costs of added features. The dealer’s cost, or invoice price, is an amount less than the sticker price. The difference between the sticker price and the dealer’s cost is the range available for negotiation. This range is larger for more expensive vehicles; smaller cars usually do not have a wide negotiation range. Information about dealer’s cost is available from sources such as Edmund’s New Car Prices and Consumer Reports.

Set-price dealers use no-haggling car selling with the prices presented to be accepted or rejected as stated. Car-buying services are businesses that help buyers obtain a specific new car at a reasonable price. Also referred to as an auto broker, these businesses offer desired models with options for prices ranging between $50 and $200 over the dealer’s cost. First, the auto broker charges a small fee for price information on desired models. Then, if you decide to buy a car, the auto broker arranges the purchase with a dealer near your home.

To prevent confusion in determining the true price of the new car, do not mention a trade-in vehicle until the cost of the new car has been settled. Then ask how much the dealer is willing to pay for your old car. If the offer price is not acceptable, sell the old car on your own. A typical negotiating conversation might go like this:

Customer: “I’m willing to give you $25,600 for the car. That’s my top offer.”

Auto salesperson: “Let me check with my manager.” After returning, “My manager says $26,200 is the best we can do.”

Customer (who should be willing to walk out at this point): “I can go to $25,650.”

Auto salesperson: “We have the car you want, ready to go. How about $25,700?”

If the customer agrees, the dealer receives $100 more than the customer’s “top offer.” Other sales techniques you should avoid include:

Lowballing, when quoted a very low price that increases when add-on costs are included at the last moment.

Highballing, when offered a very high amount for a trade-in vehicle, with the extra amount made up by increasing the new-car price.

The question “How much can you afford per month?” Be sure to also ask how many months.

The offer to hold the vehicle for a small deposit only. Never leave a deposit unless you are ready to buy a vehicle or are willing to lose that amount.

Unrealistic statements, such as “Your price is only $100 above our cost.” Usually, hidden costs have been added in to get the dealer’s cost.

Sales agreements with preprinted amounts. Cross out numbers you believe are not appropriate for your purchase.

COMPARING FINANCING ALTERNATIVES You may pay cash; however, many people buy cars on credit. Auto loans are available from banks, credit unions, consumer finance companies, and other financial institutions. Many lenders will preapprove you for a certain loan amount, which separates financing from negotiating the car price. Until the new-car price is set, you should not indicate that you intend to use the dealer’s credit plan.

The lowest interest rate or the lowest payment does not necessarily mean the best credit plan. Also consider the loan length. Otherwise, after two or three years, the value of your car may be less than the amount you still owe; this situation is referred to as upside-down or negative equity. If you default on your loan or sell the car at this time, you will have to pay the difference.

page 198

What actions would you take when considering the purchase of a new car?

How might financing affect your decision to buy a new car?

Based on your research and experiences, which web sites and apps are most useful when buying a motor vehicle?

Source: Muhlbaum, David, “How to Get a Great Deal on a New Car.” Reprinted by permission from Kiplinger’s Personal Finance, May 2017. Copyright ©2017 The Kiplinger Washington Editors, Inc.

page 199

Automobile manufacturers frequently present opportunities for low-interest financing. They may offer rebates at the same time, giving buyers a choice between a rebate and a low-interest loan. Carefully compare low-interest financing and the rebate. Special rebates are sometimes offered to students, teachers, credit union members, real estate agents, and other groups.

Phase 4: Postpurchase Activities

Maintenance and ownership costs are associated with most major purchases. Proper operation will usually result in improved performance and fewer repairs. When you need repairs not covered by a warranty, follow a pattern similar to that used when making the original purchase. Investigate, evaluate, and negotiate a variety of servicing options.

In the past, when major problems occurred with a new car and the warranty didn’t solve the difficulty, many consumers lacked a course of action. As a result, all 50 states and the District of Columbia enacted lemon laws that require a refund for the vehicle after the owner has made repeated attempts to obtain servicing. These laws apply when four attempts are made to get the same problem corrected or when the vehicle has been out of service for more than 30 days within 12 months of purchase or the first 12,000 miles. The terms of the state laws vary. You can find additional information “lemon laws” online.

AUTOMOBILE OPERATION COSTS Over your lifetime, you can expect to spend more than $200,000 on automobile-related expenses. Your driving costs will vary based on two main factors: the size of your automobile and the number of miles you drive. These costs involve two categories:

1. Fixed Ownership Costs |

2. Variable Operating Costs |

Depreciation |

Gasoline and oil |

Interest on auto loan |

Tires |

Insurance |

Maintenance and repairs |

License, registration, taxes, and fees |

Parking and tolls |

The largest fixed expense associated with a new automobile is depreciation, the loss in the vehicle’s value due to time and use. Since money is not paid out for depreciation, many people do not consider it an expense. However, this decreased value is a cost that owners incur. Well-maintained vehicles and certain high-quality, expensive models, such as BMW and Lexus, depreciate at a slower rate.

Costs such as gasoline, oil, and tires increase with the number of miles driven. Planning expenses is easier if the number of miles you drive is fairly constant. Unexpected trips and vehicle age will increase such costs.

MOTOR VEHICLE MAINTENANCE People who sell, repair, or drive automobiles for a living stress the importance of regular vehicle care. While owner’s manuals and articles suggest mileage or time intervals for certain servicing, more frequent oil changes or tune-ups can minimize major repairs and maximize vehicle life. Exhibit 6–4 suggests maintenance areas to consider.

page 200

Exhibit 6–4 Extending Vehicle Life with Proper Maintenance

|

|

|

|

|

|

|

|

|

|

|

(Note: Service times will vary based on type and age of vehicle as well as driving habits.)

AUTOMOBILE SERVICING SOURCES The following businesses offer automobile maintenance and repair service:

Car dealers have service departments with a wide range of car care services. Service charges at a car dealer may be higher than those of other repair businesses.

Service stations and independent auto repair shops can service your vehicle at fairly competitive prices. Since the quality of these repair shops varies, talk with previous customers.

Mass merchandise retailers, such as Sears and Walmart, may emphasize sale of tires and batteries as well as brakes, oil changes, and tune-ups.

Specialty shops offer brakes, tires, automatic transmissions, and oil changes at a reasonable price with fast service.

To avoid unnecessary expenses, be aware of the common repair frauds presented in Exhibit 6–5. Remember to deal with reputable auto service businesses. Be sure to get a written, detailed estimate in advance as well as a detailed, paid receipt for the service completed. Studies of consumer problems consistently rank auto repairs as one of the top consumer ripoffs. Many people avoid problems and minimize costs by working on their own vehicles.

Exhibit 6–5 Common Automobile Repair Frauds

The majority of automobile servicing sources are fair and honest. Sometimes, however, consumers waste dollars when they fall prey to the following unethical actions: |

|

|

Dealing with reputable businesses and a basic knowledge of your automobile are the best ways to avoid deceptive repair practices. |

page 201

LO6.3

Describe steps to take to resolve consumer problems.

Resolving Consumer Complaints

Common customer complaints result from defective products, low quality, short product lives, unexpected costs, deceptive pricing, and poor repairs. Federal consumer agencies estimate annual consumer losses from fraudulent business activities at $10 billion to $40 billion for telemarketing and mail order, $3 billion for credit card fraud and credit “repair” scams, and $10 billion for investment swindles.

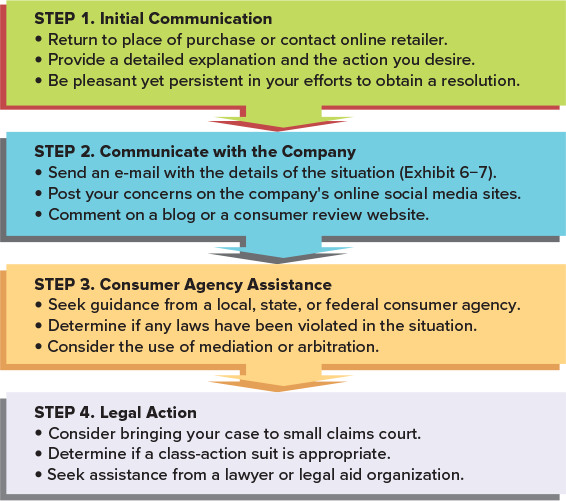

While you may not anticipate problems with purchases, you should be prepared for them. To minimize consumer problems, before making a purchase (1) obtain recommendations from friends, family members, and online reviews; (2) verify company affiliations, certifications, and licenses; and (3) understand the sale terms, return policies, and warranty provisions. To be prepared when encountering a consumer problem, consider the process for resolving differences between buyers and sellers presented in Exhibit 6–6.

Exhibit 6–6 Resolving Consumer Complaints

Before starting this process, know your rights and the laws that apply to your situation. Information on consumer rights is available online and through phone apps, such as the one that allows airline passengers to monitor the status of their flights. Information on delays, cancellations, and other situations can be submitted to keep airlines accountable.

To help ensure success when you make a complaint, keep a file of receipts, names of people you talked to, dates of attempted repairs, copies of letters and e-mails, and costs incurred. These documents can help to resolve a problem in your favor. An automobile owner kept detailed records and receipts for all gasoline purchases, oil changes, and repairs. page 202When a warranty dispute occurred, the owner was able to prove proper maintenance and received a refund for the defective vehicle. Your perseverance is vital since companies might ignore your request or delay their response.

Step 1: Initial Communication

Most consumer complaints are resolved at the original sales location. As you talk with the salesperson, customer service person, or store manager, avoid talking loudly, threatening a lawsuit, or demanding unreasonable action. A calm, rational, yet persistent approach is recommended.

Step 2: Communicate with the Company

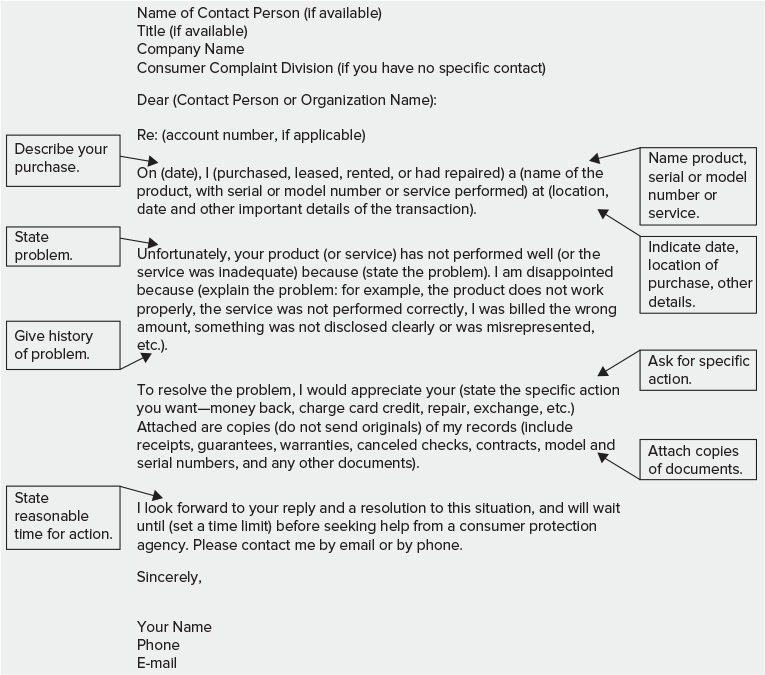

Express your dissatisfaction to the corporate level if a problem is not resolved at the local level. Use a letter or e-mail such as the one in Exhibit 6–7. You can obtain contact information for companies through an online search or at www.usa.gov. This information is also commonly included on product packages.

Exhibit 6–7 Sample Complaint E-mail

NOTE: Keep copies of your email, letters, and related documents.

Source: Consumer’s Resource Handbook (publications.usa.gov).

Step 3: Consumer Agency Assistance

If you do not receive satisfaction from the company, organizations are available to assist with automobiles, appliances, health care, and other consumer concerns. Mediation page 203involves the use of a third party to settle grievances. In mediation, an impartial person—the mediator—tries to resolve a conflict between a customer and a business through discussion and negotiation. Mediation is a nonbinding process. This action can save time and money compared to other dispute settlement methods.

Arbitration is the settlement of a difference by a third party—the arbitrator—whose decision is legally binding. After both sides agree to arbitration, each side presents its case. Arbitrators are selected from volunteers trained for this purpose. Most major automobile manufacturers and many industry organizations have arbitration programs to resolve consumer complaints.

A vast network of government agencies is available. Problems with local restaurants or food stores may be handled by a city or county health department. Every state has agencies to handle problems involving deceptive advertising, fraudulent business practices, banking, insurance companies, and utility rates. Federal agencies are available to help with consumer concerns (see Appendix C).

Step 4: Legal Action

The next section considers various legal alternatives available to resolve consumer problems.

LO6.4

Evaluate legal alternatives available to consumers.

Legal Options for Consumers

If the actions discussed previously fail to resolve your complaint, what would you do next? One of the following options may be appropriate.

Small Claims Court

In small claims court, a person may file a claim involving amounts below a set dollar limit. The maximum varies from state to state, ranging from $500 to $10,000; most states have a limit of between $1,500 and $3,000. The process usually takes place without a lawyer, although in many states, attorneys are allowed in small claims court. To effectively use small claims court, experts suggest that you:

Become familiar with court procedures and filing fees (usually from $5 to $50).

Observe other cases to learn about the process.

page 204Present your case in a polite, calm, and concise manner.

Submit evidence such as photographs, contracts, receipts, and other documents.

Use witnesses who can testify on your behalf.

For additional details about small claims court, see the nearby Financial Literacy in Practice feature.

Class-Action Suits

Occasionally a number of people have the same complaint. A class-action suit is a legal action taken by a few individuals on behalf of all the people who have suffered the same alleged injustice. These people are represented by one or more lawyers. Once a situation qualifies as a class-action suit, all of the affected parties must be notified. A person may decide not to participate in the class-action suit and instead file an individual lawsuit. Recent class-action suits included auto owners who were sold unneeded replacement parts for their vehicles and a group of investors who sued a brokerage company for unauthorized buy-and-sell transactions that resulted in high commission charges.

Using a Lawyer

In some situations, you may seek the services of an attorney. Common sources of lawyers are referrals from friends, online research, and the local division of the American Bar Association.

In general, straightforward legal situations such as appearing in small claims court, renting an apartment, or defending yourself on a minor traffic violation will usually not need legal counsel. More complicated matters such as writing a will, settling a real estate purchase, or suing for injury damages will likely require the services of an attorney.

When selecting a lawyer, consider several questions: Is the lawyer experienced in your type of case? Will you be charged on a flat fee basis, at an hourly rate, or on a contingency basis? Is there a fee for the initial consultation? How and when will you be required to make payment for services?

Other Legal Alternatives

Legal services can be expensive. A legal aid society is one of a network of publicly supported community law offices that provide legal assistance to people who cannot afford their own attorney. These community agencies provide this assistance at a minimal cost or without charge.

Prepaid legal services provide unlimited or reduced-fee legal assistance for a set fee. Some programs provide basic services, such as telephone consultation and preparation of a simple will, for an annual fee. Prepaid legal programs are designed to prevent minor troubles from becoming complicated legal problems.

Personal Consumer Protection

While many laws, agencies, legal tools, and online sources are available to protect your rights, none will be of value unless you use them. Consumer protection experts suggest that to prevent being taken by deceptive business practices, you should

page 205

Do business only with reputable companies with a record of satisfying customers.

Avoid signing contracts and other documents you do not understand.

Be cautious about offerings that seem too good to be true—they probably are!

Compare the cost of buying on credit with the cost of paying cash; also, compare the interest rates the seller offers with those offered by a bank or a credit union.

Avoid rushing to get a good deal; successful con artists depend on impulse buying.

page 206

page 207

Chapter Summary

LO6.1 Timing purchases, comparing stores and brands, using label information, computing unit prices, and evaluating warranties are common strategies for effective purchasing.

LO6.2 A research-based approach to consumer buying involves (1) preshopping activities, such as problem identification and information gathering; (2) evaluating alternatives; (3) determining the purchase price; and (4) postpurchase activities, such as proper operation and maintenance.

LO6.3 Most consumer problems can be resolved by following these steps: (1) return to the place of purchase; (2) contact the company’s main office; (3) obtain assistance from a consumer agency; and (4) take legal action.

LO6.4 Small claims court, class-action suits, the services of a lawyer, legal aid societies, and prepaid legal services are legal means for handling consumer problems that cannot be resolved through communication with the company involved or with help from a consumer protection agency.

Key Terms

Self-Test Problems

An item was bought on credit with a $60 down payment and monthly payments of $70 for 36 months. What was the total cost of the item?

A food package with 32 ounces costs $1.76. What is the unit cost of the package?

Solutions

36 × $70 = $2,520 plus the $60 down payment for a total of $2,580.

$1.76 ÷ 32 = 5.5 cents an ounce.

Problems

An online buying club offers a membership for $300, for which you will receive a 10 percent discount on all brand-name items you purchase. How much would you have to buy to cover the cost of the membership? (LO6.1)

John Walters is comparing the cost of credit to the cash price of an item. If John makes an $80 down payment and pays $35 a month for 24 months, how much more will that amount be than the cash price of $685? (LO6.1)

Calculate the unit price of each of the following items: (LO6.1)

Motor oil—2.5 quarts for $1.95

Cereal—15 ounces for $2.17

Canned fruit—13 ounces for 89 cents

Facial tissue—300 tissues for $2.25

cents/quart

cents/ounce

cents/ounce

cents/100 tissues

A service contract for a video projection system costs $70 a year. You expect to use the system for five years. Instead of buying the service contract, what would be the future value of these annual amounts after five years if you earn 3 percent on your savings? (LO6.1)

A work-at-home opportunity is available in which you will receive 3 percent of the sales for customers you refer to the company. The cost of your “franchise fee” is $600. How much would your customers have to buy to cover the cost of this fee? (LO6.1)

What would be the net present value of a microwave oven that costs $159 and will save you $68 a year in time and food away from home? Assume an average return on your savings of 4 percent for five years. (Hint: Calculate the present value of the annual savings, then subtract the cost of the microwave.) (LO6.1)

page 208If a person saves $62 a month by using coupons and doing comparison shopping, (a) what is the amount for a year? (b) What would be the future value of this annual amount over 10 years, assuming an interest rate of 4 percent? (LO6.1)

Based on the following data, prepare a financial comparison of buying and leasing a motor vehicle with a $24,000 cash price:

What other factors should a person consider when choosing between buying and leasing? (LO6.2)

Down payment (to finance vehicle), $4,000

Monthly loan payment, $560

Length of loan, 48 months

Value of vehicle at end of loan, $7,200

Down payment for lease, $1,200

Monthly lease payment, $440

Length of lease, 48 months

End-of-lease charges, $600

Based on the data provided here, calculate the items requested: (LO6.2)

Annual depreciation, $2,500

Current year’s loan interest, $650

Insurance, $680

Average gasoline price, $3.50 per gallon

Parking/tolls, $420

Annual mileage, 13,200

Miles per gallon, 24

License and registration fees, $65

Oil changes/repairs, $370

The total annual operating cost of the motor vehicle.

The operating cost per mile.

Based on the following, calculate the costs of buying versus leasing a motor vehicle. (LO6.2)

Purchase Costs

Down payment, $1,500

Loan payment, $450 for 48 months

Estimated value at end of loan, $4,000

Opportunity cost interest rate, 4 percent

Leasing Costs

Security deposit, $500

Lease payment, $450 for 48 months

End-of-lease charges, $600

A class-action suit against a utility company resulted in a settlement of $1.4 million for 62,000 customers. If the legal fees, which must be paid from the settlement, are $300,000, what amount will each plaintiff receive? (LO6.4)

|

To reinforce the content in this chapter, more problems are provided at connect.mheducation.com. |

Apply Yourself for Financial Literacy

Talk with shoppers, such as friends, relatives, and others, to learn more about their buying habits or tips to save time and money. Ask about their brand loyalty. For what products are people most brand loyal? What factors (price, location, information) may influence a person to change brands? (LO6.1)

Using an online search, print ads, and store visits, compare the prices charged by different automotive service locations for a battery, tune-up, oil change, and tires. (LO6.2)

Conduct online research to determine the most frequent sources of consumer complaints. What are potential concerns associated with obtaining furniture, appliances, and other items from a rent-to-own business? (LO6.3)

Interview someone who has had a consumer complaint. What was the basis of the complaint? What actions were taken? Was the complaint resolved in a satisfactory manner? (LO6.4)

Conduct an online search to learn about small claims court procedures and other types of consumer legal actions available in your state. (LO6.4)

page 209

REAL LIFE PERSONAL FINANCE

ONLINE CAR BUYING

With a click of the mouse, Mackenzie enters the auto “showroom.” In the past few months, she had realized that the repair costs for her 11-year-old car were accelerating. She thought it was time to start shopping for a new car online and decided to start her internet search for a vehicle by looking at small and mid-sized SUVs.

Her friends suggested that Mackenzie research more than one type of vehicle. They reminded her that comparable models were available from various auto manufacturers.

In her online car-buying process, Mackenzie next did a price comparison. She obtained more than one price quote by using various online sources. She then prepared an overview of her online car-buying experiences.

Mackenzie’s next step was to make her final decision. After selecting what she planned to buy, she finalized the purchase online and decided to take delivery at a local dealer.

While the number of motor vehicles being sold over the internet is increasing, car-buying experts strongly recommend that you make a personal examination of the vehicle before taking delivery.

Online Car-Buying Action |

Online Activities |

Websites Consulted |

|---|---|---|

Information gathering |

|

|

Comparing prices |

|

|

Finalizing purchase |

|

Questions

Based on Mackenzie’s experience, what benefits and drawbacks are associated with online car buying?

What additional actions might Mackenzie consider before buying a motor vehicle?

What do you consider to be the benefits and drawbacks of shopping online for motor vehicles and other items?

What actions might a car buyer take if a lemon is purchased?

Continuing Case

CONSUMER PURCHASING STRATEGIES AND WISE BUYING OF MOTOR VEHICLES

It sputtered and squeaked, and with a small hesitation followed by an exaggerated shudder, it was finally over. Ol’ Reliable, the car Jamie Lee had driven since she first earned her driver’s license at the age of 17, completed its last mile. Thirteen years and 140,000 miles later, it was time for a new vehicle.

page 210After skimming the Sunday newspaper and browsing the online advertisements, Jamie Lee was ready to visit car dealers to see what vehicles would interest her. She was unsure if she would purchase a new car or used and how she would pay for the car. “No money down and only $219 a month,” Jamie Lee read, “with approved credit.” It sounded like an offer she would be interested in. Jamie Lee knew she had a good credit rating, as she made sure she paid all of her bills on time each month and had kept a close eye on her credit score ever since she was the victim of identity theft several years ago. The more she thought about the brand-new car, the more excited she became. That new car fit her personality perfectly!

As Jamie Lee inquired about the advertised vehicle with the salesperson, her excitement quickly turned to dismay. The automobile advertised was available for $219 a month with no money down, based on approved credit, but Jamie Lee unexpectedly found that there were further qualifications in order to get the advertised price. The salesman explained that the information in the fine print of the newspaper advertisement stated that the price was based on all of the following criteria: being active in the military, a college graduate within the last three months, a current lessee of the automobile company, and having a top-tier credit score, which, he noted, was above 800. If Jamie Lee did not meet all of the qualifications, she would not receive the price advertised in the promotion. He could get her in that vehicle, but it would cost her an additional $110 per month. Jamie budgeted a maximum of $275 for her monthly car payment. She could not afford the vehicle.

Jamie Lee had to start over from scratch. She decided that she must fully research the vehicle purchase process before browsing at another dealership. She felt she was getting caught up in the moment and vowed to do her research before speaking with another salesperson.

Questions

Jamie Lee is considering a used vehicle but cannot decide where to begin her search. Using Your Personal Financial Plan sheet 19, name the sources available to Jamie Lee for a used-car purchase. What are the advantages and disadvantages of each?

Jamie Lee is attracted to the low monthly payment advertised for a vehicle lease. She may well be able to afford a more expensive car than she originally thought. Jamie Lee really needs to think this through. What are the advantages and disadvantages to leasing a vehicle?

Jamie Lee sat down with a salesperson to discuss a new vehicle and its $24,000 purchase price. Jamie Lee has heard that “no one really pays the vehicle sticker price.” What guidelines may be suggested for negotiating the purchase price of a vehicle?

Jamie Lee has decided to purchase a certified pre-owned vehicle. What might she expect as far as reliability and a warranty on the used car?

Spending Diary

“USING THE DAILY SPENDING DIARY HAS HELPED ME CONTROL IMPULSE BUYING. WHEN I HAVE TO WRITE DOWN EVERY AMOUNT, I’M MORE CAREFUL WITH MY SPENDING. I CAN NOW PUT MORE IN SAVINGS.”

Directions Start (or continue) your Daily Spending Diary or use your own format to record and monitor spending in various categories. Most people who have participated in this activity have found it beneficial for monitoring and controlling their spending habits. The Daily Spending Diary sheets are located in Appendix D at the end of the book and in Connect Finance.

Questions

What daily spending items are amounts that might be reduced or eliminated to allow for higher savings amounts?

How might a Daily Spending Diary result in wiser consumer buying and more saving for the future?

page 211

YOUR PERSONAL FINANCIAL PLAN 18

Name: Date:

Consumer Purchase Comparison

Purpose: To research and evaluate brands and store services for purchase of a major consumer item.

Financial Planning Activities: When considering the purchase of a major consumer item, use ads, catalogs, an internet search, store visits, and other sources to obtain the information below.

This sheet is also available in an Excel spreadsheet format in Connect Finance.

Suggested Websites: www.consumerreports.org, www.consumerworld.org, www.clarkhoward.com

Product

Exact description (size, model, features, etc.)

Research the item in consumer periodicals and online for information regarding your product

article/periodical ________________ website ________________

date/pages _____________________ date ___________________

What buying suggestions are presented in the articles?

Which brands are recommended in these articles? Why?

Contact or visit two or three stores that sell the product to obtain the following information:

Store 1 |

Store 2 |

Store 3 |

|

Company |

|||

Address |

|||

Phone/website |

|||

Brand name/cost |

|||

Product difference from item above |

|||

Warranty (describe) |

|||

Which brand and at which store would you buy this product? Why? |

What’s Next for Your Personal Financial Plan?

Which consumer information sources are most valuable for your future buying decisions?

List guidelines to use in the future when making major purchases.

page 212

YOUR PERSONAL FINANCIAL PLAN 19

©McGraw-Hill Education

Name: Date:

Used-Car Purchase Comparison

Purpose: To research and evaluate different types and sources of used vehicles.

Financial Planning Activities: When considering a used-car purchase, use advertisements, online sources, and visits to new- and used-car dealers to obtain the information below. This sheet is also available in an Excel spreadsheet format in Connect Finance.

Suggested Websites: www.carbuyingtips.com, www.kbb.com, www.safercar.gov

Automobile (year, make, model) |

|||

Name |

|||

Address |

|||

Phone |

|||

Website (if applicable) |

|||

Cost |

|||

Mileage |

|||

Condition of auto |

|||

Condition of tires |

|||

Radio |

|||

Air conditioning |

|||

Other options |

|||

Warranty (describe) |

|||

Items in need of repair |

|||

Inspection items:

|

|||

|

|||

|

|||

|

|||

Other information |

What’s Next for Your Personal Financial Plan?

Maintain a record of automobile operating costs.

Prepare a plan for regular maintenance of your vehicle.

page 213

YOUR PERSONAL FINANCIAL PLAN 20

©McGraw-Hill Education

Name: Date:

Buying versus Leasing a Vehicle

Purpose: To compare costs of buying or leasing an automobile or other vehicle. This analysis should compare two situations with comparable payment amounts, even though the length of the agreements may differ.

Financial Planning Activities: Obtain costs related to leasing and buying a vehicle. This sheet is also available in an Excel spreadsheet format in Connect Finance.

Suggested Websites: www.leasesource.com, www.kiplinger.com/tools

Purchase Costs

Total vehicle cost, including sales tax ($ ) |

|

Down payment (or full amount if paying cash) |

$ ________ |

Monthly loan payment: $ times month loan (this item is zero if vehicle is not financed) |

$ |

Opportunity cost of down payment (or total cost of the vehicle if bought for cash): |

|

$ times number of years of financing/ownership times percent (interest rate which funds could earn) |

$ |

Less: estimated value of vehicle at end of loan term/ownership |

$ |

Total cost to buy ......................................... |

$ |

Leasing Costs

Security deposit |

$ |

Monthly lease payments: $ times months |

$ |

Opportunity cost of security deposit: $ times years times percent |

$ |

End-of-lease charges (if applicable)* |

$ |

Total cost to lease ....................................... |

$ |

*With a closed-end lease, charges for extra mileage or excessive wear and tear; with an open-end lease, end-of-lease payment if appraised value is less than estimated ending value.

What’s Next for Your Personal Financial Plan?

Prepare a list of future actions to use when buying, financing, and leasing a car.

Maintain a record of operating costs and maintenance actions for your vehicle.

page 214

YOUR PERSONAL FINANCIAL PLAN 21

©McGraw-Hill Education

Name: Date:

Legal Services Cost Comparison

Purpose: To compare cost of services from various sources of legal assistance.

Financial Planning Activities: Contact various sources of legal services (lawyer, prepaid legal service, legal aid society) to compare costs and available services. This sheet is also available in an Excel spreadsheet format in Connect Finance.

Suggested Websites: www.nolo.com, www.abanet.org

Type of legal service |

|||

Organization name |

|||

Address |

|||

Phone |

|||

Website |

|||

Contact person |

|||

Recommended by |

|||

Areas of specialization |

|||

Maximum initial deposit |

|||

Cost of initial consultation |

|||

Cost of simple will |

|||

Cost of real estate closing |

|||

Cost method for other services—flat fee, hourly rate, or contingency basis |

|||

Other information |

What’s Next for Your Personal Financial Plan?

Determine the best alternative for your future legal needs.

Maintain a file of legal documents and other financial records.

page 215