page 246

©Erica Simone Leeds RF

page 247

LO8.1

Identify types of risks and risk management methods and develop a risk management plan.

Insurance and Risk Management

In today’s world of the “strange but true,” you can get insurance for just about anything. You might purchase a policy to protect yourself in the event that you’re abducted by aliens. Some insurance companies will offer you protection if you think that you have a risk of turning into a werewolf. If you’re a fast runner, you might be able to get a discount on a life insurance policy. Some people buy wedding disaster insurance just in case something goes wrong on the big day. You may never need these types of insurance, but you’ll certainly need insurance on your home, your vehicle, and your personal property. The more you know about insurance, the better able you will be to make decisions about buying it.

What Is Insurance?

Insurance is protection against possible financial loss. You can’t predict the future. However, insurance allows you to be prepared for the worst. It provides protection against many risks, such as unexpected property loss, illness, and injury. Many kinds of insurance exist, and they all share some common characteristics. They give you peace of mind, and they protect you from financial loss when trouble strikes.

An insurance company, or insurer, is a risk-sharing business that agrees to pay for losses that may happen to someone it insures. A person joins the risk-sharing group by purchasing a contract known as a policy. The purchaser of the policy is called a policyholder. Under the policy, the insurance company agrees to take on the risk. In return, the policyholder pays the company a premium, or fee. The protection provided by the terms of an page 248insurance policy is known as coverage, and the people protected by the policy are known as the insured.

Types of Risk

You face risks every day. You can’t cross the street without some danger that a motor vehicle might hit you. You can’t own property without running the risk that it will be lost, stolen, damaged, or destroyed.

Risk, peril, and hazard are important terms in insurance. In everyday use, these terms have almost the same meanings. In the insurance business, however, each has a distinct meaning.

Risk is the chance of loss or injury. In insurance, it refers to the fact that no one can predict trouble. This means that an insurance company is taking a chance every time it issues a policy. Insurance companies frequently refer to the insured person or property as the risk.

Peril is anything that may possibly cause a loss. It’s the reason someone takes out insurance. People buy policies for protection against a wide range of perils, including fire, windstorms, explosions, robbery, and accidents.

Hazard is anything that increases the likelihood of loss through some peril. For example, defective house wiring is a hazard that increases the chance that a fire will start.

The most common risks are personal risks, property risks, and liability risks. Personal risks involve loss of income or life due to illness, disability, old age, or unemployment. Property risks include losses to property caused by perils, such as fire or theft, and hazards. Liability risks involve losses caused by negligence that leads to injury or property damage. Negligence is the failure to take ordinary or reasonable care to prevent accidents from happening. If a homeowner doesn’t clear the ice from the front steps of her house, for example, she creates a liability risk because visitors could fall on the ice.

Personal risks, property risks, and liability risks are types of pure, or insurable, risk. The insurance company will have to pay only if some event that the insurance covers actually happens. Pure risks are accidental and unintentional. Although no one can predict whether a pure risk will occur, it’s possible to predict the costs that will accrue if one does.

A speculative risk is a risk that carries a chance of either loss or gain. Starting a small business that may or may not succeed is an example of speculative risk. Speculative risks are not insurable.

Risk Management Methods

Risk management is an organized plan for protecting yourself, your family, and your property. It helps reduce financial losses caused by destructive events. Risk management is a long-range planning process. Your risk management needs will change at various points in your life. If you understand how to manage risks, you can provide better protection for yourself and your family. Most people think of risk management as buying insurance. However, insurance is not the only way of dealing with risk. Four general risk management techniques are commonly used.

RISK AVOIDANCE You can avoid the risk of a traffic accident by not driving to work. A car manufacturer can avoid the risk of product failure by not introducing new cars. These are both examples of risk avoidance. They are ways to avoid risks, but they require serious trade-offs. You might have to give up your job if you can’t get there. The car manufacturer might lose business to competitors who take the risk of producing exciting new cars.

page 249In some cases, though, risk avoidance is practical. By taking precautions in high-crime areas, you might avoid the risk that you will be robbed.

RISK REDUCTION You can’t avoid risks completely. However, you can decrease the likelihood that they will cause you harm. For example, you can reduce the risk of injury in an automobile accident by wearing a seat belt. You can reduce the risk of developing lung cancer by not smoking. By installing fire extinguishers in your home, you reduce the potential damage that could be caused by a fire. Your risk of illness might be lower if you eat properly and exercise regularly.

RISK ASSUMPTION Risk assumption means taking on responsibility for the negative results of a risk. It makes sense to assume a risk if you know that the possible loss will be small. It also makes sense when you’ve taken all the precautions you can to avoid or reduce the risk.

When insurance coverage for a particular item is expensive, that item may not be worth insuring. For instance, you might decide not to purchase collision insurance on an older car. If an accident happens, the car may be wrecked, but it wasn’t worth much anyway. Self-insurance is setting up a special fund, perhaps from savings, to cover the cost of a loss. Self-insurance does not eliminate risks, but it does provide a way of covering losses as an alternative to an insurance policy. Some people self-insure because they can’t obtain insurance from an insurance company.

RISK SHIFTING The most common method of dealing with risk is to shift it. That simply means to transfer it to an insurance company. In exchange for the fee you pay, the insurance company agrees to pay for your losses.

Most insurance policies include deductibles. Deductibles are a combination of risk assumption and risk shifting. A deductible is the set amount that the policyholder must pay per loss on an insurance policy. For example, if a falling tree damages your car, you may have to pay $200 toward the repairs. Your insurance company will pay the rest.

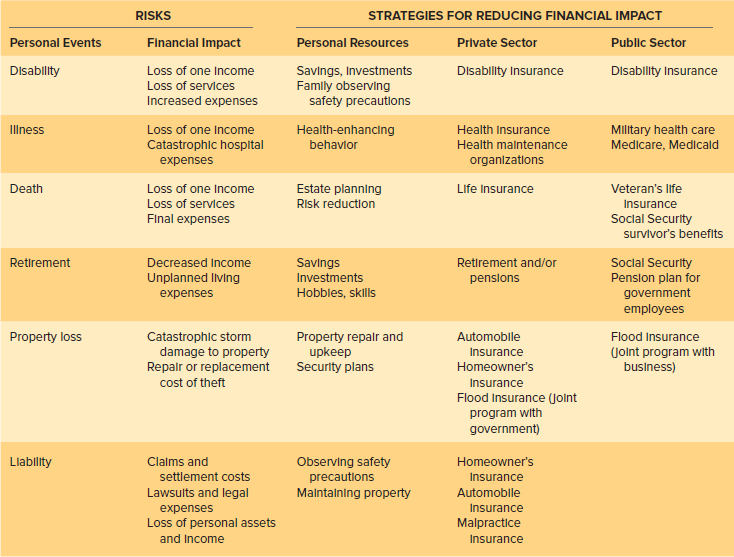

Exhibit 8–1 summarizes various risks and effective ways of managing them.

Exhibit 8–1 Examples of Risks and Risk Management Strategies

Planning an Insurance Program

Your personal insurance program should change along with your needs and goals. Dave and Ellen are a young couple. How will they plan their insurance program to meet their needs and goals?

Exhibit 8–2 outlines the steps in developing a personal insurance program.

Exhibit 8–2 Creating a Personal Insurance Program

STEP 1: SET INSURANCE GOALS Dave and Ellen’s main goal should be to minimize personal, property, and liability risks. They also need to decide how they will cover costs resulting from a potential loss. Income, age, family size, lifestyle, experience, and responsibilities will be important factors in the goals they set. The insurance they buy must reflect those goals. Dave and Ellen should try to come up with a basic risk management plan that achieves the following:

Reduces possible loss of income caused by premature death, illness, accident, or unemployment.

Reduces possible loss of property caused by perils, such as fire or theft, or hazards.

Reduces possible loss of income, savings, and property because of personal negligence.

STEP 2: DEVELOP A PLAN TO REACH YOUR GOALS Planning is a way of taking control of life instead of just letting life happen to you. Dave and Ellen need to page 250determine what risks they face and what risks they can afford to take. They also have to determine what resources can help them reduce the damage that could be caused by serious risks.

Furthermore, they need to know what kind of insurance is available. The cost of different kinds of insurance and the way the costs vary among companies will be the key factors in their plan. Finally, this couple needs to research the reliability record of different insurance companies.

page 251

Dave and Ellen must ask four questions as they develop their risk management plan:

What do they need to insure?

How much should they insure it for?

What kind of insurance should they buy?

Whom should they buy insurance from?

STEP 3: PUT YOUR PLAN INTO ACTION Once they’ve developed their plan, Dave and Ellen need to follow through by putting it into action. During this process, they might discover that they don’t have enough insurance protection. If that’s the case, they could purchase additional coverage or change the kind of coverage they have. Another alternative would be to adjust their budget to cover the cost of additional insurance. Finally, Dave and Ellen might expand their savings or investment programs and use those funds in the case of an emergency.

The best risk management plans will be flexible enough to allow Dave and Ellen to respond to changing life situations. Their goal should be to create an insurance program that can grow or shrink as their protection needs change.

STEP 4: CHECK YOUR RESULTS Dave and Ellen should take the time to review their plan every two or three years, or whenever their family circumstances change.

Until recently, Dave and Ellen were satisfied with the coverage provided by their insurance policies. However, when the couple bought a house six months ago, the time had come for them to review their insurance plan. With the new house the risks became much greater. After all, what would happen if a fire destroyed part of their home?

The needs of a couple renting an apartment differ from those of a couple who own a house. Both couples face similar risks, but their financial responsibility differs greatly. When you’re developing or reviewing a risk management plan, ask yourself if you’re providing the financial resources you’ll need to protect yourself, your family, and your property. The nearby Financial Literacy in Practice feature suggests several guidelines to follow in planning your insurance programs.

page 252

Property and Liability Insurance in Your Financial Plan

Major natural disasters have caused catastrophic amounts of property loss in the United States and other parts of the world. According to the Insurance Information Institute, the first months of 2011 were violent in terms of catastrophes on a global scale. Mega-catastrophes worldwide caused an estimated $350 billion in economic losses, shattering the previous record of $230 billion set in 2005. In 2005, Hurricanes Katrina, Rita, and Wilma caused $50 billion in damages. In 1992, Hurricane Andrew resulted in $22.3 billion worth of insurance

claims, or requests for payment to cover financial losses. Superstorm Sandy, the deadliest and most destructive tropical cyclone of 2012, caused more than $18 billion in insured losses and became the third costliest hurricane in the history of the U.S. insurance industry. In 2016, 15 weather related disasters caused over $46 billion in damages and led to 138 fatalities. The 2016 total was the second highest annual number U.S. billion-dollar disasters, behind the 16 disasters in 2011. In the 2017 hurricane season, Harvey, Irma, Jose, and Maria caused over $100 billion in property damage, according to some estimates.

Most people invest large amounts of money in their homes and motor vehicles. Therefore, protecting these items from loss is extremely important. Each year homeowners and renters in the United States lose billions of dollars from more than 3 million burglaries, 1.3 million fires, and 200,000 cases of damage from other perils. The cost of injuries and property damage caused by vehicles is also enormous.

Think of the price you pay for home and motor vehicle insurance as an investment in protecting your most valuable possessions. The cost of such insurance may seem high. However, the financial losses from which it protects you are much higher.

Two main types of risk are related to your home and your car or other vehicle. One is the risk of damage to or loss of your property. The second type involves your responsibility for injuries to other people or damage to their property.

POTENTIAL PROPERTY LOSSES People spend a great deal of money on their houses, vehicles, furniture, clothing, and other personal property. Property owners face two basic types of risk. The first is physical damage caused by perils such as fire, wind, water, and smoke. These perils can damage or destroy property. For example, a windstorm might cause a large tree branch to smash the windshield of your car. You would have to find another way to get around while it was being repaired. The second type of risk is loss or damage caused by criminal behavior such as robbery, burglary, vandalism, and arson.

LIABILITY PROTECTION You also need to protect yourself from liability. Liability is legal responsibility for the financial cost of another person’s losses or injuries. You can be held legally responsible even if the injury or damage was not your fault. For example, suppose that Terry falls and gets hurt while playing in her friend Lisa’s yard. Terry’s family may be able to sue Lisa’s parents, even though Lisa’s parents did nothing wrong. Similarly, suppose that Sanjay accidentally damages a valuable painting while helping Ed move some furniture. Ed may take legal action against Sanjay to pay the cost of the painting.

Usually, if you’re found liable, or legally responsible in a situation, it’s because negligence on your part caused the mishap. Examples of such negligence include letting young children swim in a pool without supervision or cluttering a staircase with things that could cause someone to slip and fall.

page 253

LO8.2

Assess the insurance coverage and policy types available to homeowners and renters.

Home and Property Insurance

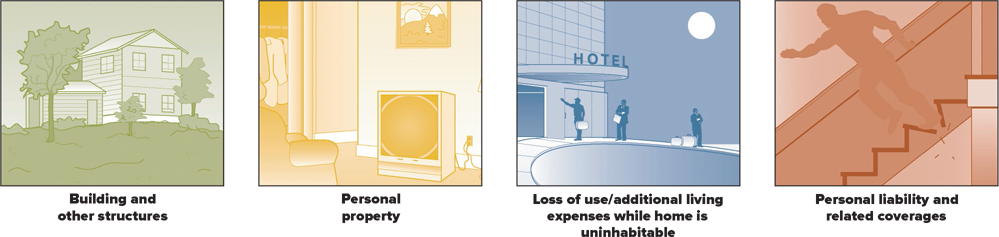

Your home and personal belongings are probably a major portion of your assets. Whether you rent or own a home, property insurance is vital. Homeowner’s insurance is coverage for your place of residence and its associated financial risks, such as damage to personal property and injuries to others (see Exhibit 8–3).

Exhibit 8–3 Home Insurance Coverage

Renter’s Insurance

For people who rent, home insurance coverage includes personal property protection, additional living expenses coverage, and personal liability and related coverage. Renter’s insurance does not provide coverage on the building or other structures.

There are two standard renter’s insurance policies. The broad form covers your personal property against perils specified in the policy, such as fires and thefts, and the comprehensive form protects your personal property against all perils not specifically excluded in the policy. When shopping for renter’s insurance, be aware that these policies:

Normally pay only the actual cash value of your losses. Replacement cost coverage is available for an extra premium.

Fully cover your personal property only at home. When traveling, your luggage and other personal items are protected up to a certain percentage of the policy’s total amount of coverage.

Automatically provide liability coverage if someone is injured on your premises.

May duplicate other coverage. For instance, if you are still a dependent, your personal property may be covered by your parents’ homeowner’s policy. This coverage is limited, however, to an amount equal to a certain percentage of the total personal property coverage provided by the policy.

The most important part of renter’s insurance is the protection it provides for your personal property. Many renters believe that they are covered under the landlord’s insurance. In fact, that’s the case only when the landlord is proved liable for some damage. For example, if bad wiring causes a fire and damages a tenant’s property, the tenant may be able to collect money from the landlord. Renter’s insurance is relatively inexpensive and provides many of the same kinds of protection as a homeowner’s policy.

page 254

Homeowner’s Insurance Coverages

A homeowner’s insurance policy provides coverage for the following:

The building in which you live and any other structures on the property.

Additional living expenses.

Personal property.

Personal liability and related coverage.

Specialized coverage.

BUILDING AND OTHER STRUCTURES The main purpose of homeowner’s insurance is to protect you against financial loss in case your home is damaged or destroyed. Detached structures on your property, such as a garage or toolshed, are also covered. Homeowner’s coverage even includes trees, shrubs, and plants.

ADDITIONAL LIVING EXPENSES If a fire or other event damages your home, additional living expense coverage pays for you to stay somewhere else. For example, you may need to stay in a motel or rent an apartment while your home is being repaired. These extra living expenses will be paid by your insurance. Some policies limit additional living expense coverage to 10 to 20 percent of the home’s coverage amount. They may also limit payments to a maximum of six to nine months. Other policies may pay additional living expenses for up to a year.

PERSONAL PROPERTY Homeowner’s insurance covers your household belongings, such as furniture, appliances, and clothing, up to a portion of the insured value of the home. That portion is usually 55, 70, or 75 percent. For example, a home insured for $160,000 might have $112,000 (70 percent) worth of coverage for household belongings.

Personal property coverage typically limits the payout for the theft of certain items, such as $5,000 for jewelry. It provides protection against the loss or damage of articles that you take with you when you are away from home. For example, items you take on vacation or use at college are usually covered up to the policy limit. Personal property coverage even extends to property that you rent, such as a rug cleaner, while it’s in your possession.

Most homeowner’s policies include optional coverage for personal computers, including stored data, up to a certain limit. Your insurance agent can determine whether the equipment is covered against data loss and damage from spilled drinks or power surges.

If something does happen to your personal property, you must prove how much it was worth and that it belonged to you. To make the process easier, you can create a household inventory. A household inventory is a list or other documentation of personal belongings, with purchase dates and cost information. You can get a form for such an inventory from an insurance agent. Exhibit 8–4 provides a list of items you might include if you decide to compile your own inventory. For items of special value, you should have receipts, serial numbers, brand names, and proof of value.

Exhibit 8–4 Household Inventory Contents

Your household inventory can include a video recording or photographs of your home and its contents. Make sure that the closet and storage area doors are photographed open. On the back of the photographs, indicate the date and the value of the objects. Update your inventory, photos, and related documents on a regular basis. Keep a copy of each document in a secure location, such as a safe deposit box.

If you own valuable items, such as expensive musical instruments, or need added protection for computers and related equipment, you can purchase a personal property floater. A personal property floater is additional property insurance that covers the damage or loss of a specific item of high value. The insurance company will require a detailed description page 255of the item and its worth. You’ll also need to have the item appraised, or evaluated by an expert, from time to time to make sure that its value hasn’t changed.

PERSONAL LIABILITY AND RELATED COVERAGE Every day people face the risk of financial loss due to injuries to other people or their property. The following are examples of this risk:

A guest falls on a patch of ice on the steps to your home and breaks his arm.

A spark from the barbecue in your backyard starts a fire that damages a neighbor’s roof.

Your son or daughter accidentally breaks an antique lamp while playing at a neighbor’s house.

In each of these situations, you could be held responsible for paying for the damage. The personal liability portion of a homeowner’s policy protects you and members of your page 256family if others sue you for injuries they suffer or damage to their property. This coverage includes the cost of legal defense.

Not all individuals who come to your property are covered by your liability insurance. Friends, guests, and babysitters are probably covered. However, if you have regular employees, such as a housekeeper, a cook, or a gardener, you may need to obtain worker’s compensation coverage for them.

Most homeowner’s policies provide basic personal liability coverage of $100,000, but often that’s not enough. An umbrella policy, also called a personal catastrophe policy, supplements your basic personal liability coverage. This added protection covers you for all kinds of personal injury claims. For instance, an umbrella policy will cover you if someone sues you for saying or writing something negative or untrue or for damaging his or her reputation. Extended liability policies are sold in amounts of $1 million or more and are useful for wealthy people. If you are a business owner, you may need other types of liability coverage as well.

Medical payments coverage pays the cost of minor accidental injuries to visitors on your property. It also covers minor injuries caused by you, members of your family, or even your pets, away from home. Settlements under medical payments coverage are made without determining who was at fault. This makes it fast and easy for the insurance company to process small claims, generally up to $5,000. If the injury is more serious, the personal liability portion of the homeowner’s policy covers it. Medical payments coverage does not cover injury to you or the other people who live in your home.

If you or a family member should accidentally damage another person’s property, the supplementary coverage of homeowner’s insurance will pay for it. This protection is usually limited to $500 or $1,000. Again, payments are made regardless of fault. If the damage is more expensive, however, it’s handled under the personal liability coverage.

SPECIALIZED COVERAGE FOR PSYCHOLOGICAL and Financial Well-Being Homeowner’s insurance usually doesn’t cover losses from floods and earthquakes. If you live in an area that has frequent floods or earthquakes, you need to purchase special coverage. In some places the National Flood Insurance Program makes flood insurance available. This protection is separate from a homeowner’s policy. An insurance agent or the Federal Emergency Management Agency of the Federal Insurance Administration can give you additional information about this coverage. Read the nearby Financial Literacy in Practice feature to learn more about flood insurance.

You may be able to get earthquake insurance as an endorsement—addition of coverage—to a homeowner’s policy or through a state-run insurance program. The most serious earthquakes occur in the Pacific Coast region. However, earthquakes can happen in other regions, too. If you plan to buy a home in an area that has a high risk of floods or earthquakes, you may have to buy the necessary insurance in order to be approved for a mortgage loan.

Home Insurance Policy Forms

Home insurance policies are available in several forms. The forms provide different combinations of coverage. Some forms are not available in all areas.

The basic form (HO-1) protects against perils such as fire, lightning, windstorms, hail, volcanic eruptions, explosions, smoke, theft, vandalism, glass breakage, and riots.

The broad form (HO-2) covers an even wider range of perils, including falling objects and damage from ice, snow, or sleet.

The special form (HO-3) covers all basic- and broad-form risks, plus any other risks except those specifically excluded from the policy. Common exclusions are flood, page 257earthquake, war, and nuclear accidents. Personal property is covered for the risks listed in the policy.

The tenant’s form (HO-4) protects the personal property of renters against the risks listed in the policy. It does not include coverage on the building or other structures.

The comprehensive form (HO-5) expands the coverage of the HO-3. The HO-5 includes endorsements for items such as replacement cost coverage on contents and guaranteed replacement cost coverage on buildings.

Condominium owner’s insurance (HO-6) protects personal property and any additions or improvements made to the living unit. These might include bookshelves, electrical fixtures, wallpaper, or carpeting. The condominium association purchases insurance on the building and other structures.

Manufactured housing units and mobile homes usually qualify for insurance coverage with conventional policies. However, some mobile homes may need special policies with higher rates because the way they are built increases their risk of fire and wind damage. The cost of mobile home insurance coverage depends on the home’s location and the way it’s attached to the ground. Mobile home insurance is quite expensive: A $40,000 mobile home can cost as much to insure as a $120,000 house.

page 258In addition to the risks previously discussed, home insurance policies include coverage for:

Credit card fraud, check forgery, and counterfeit money.

The cost of removing damaged property.

Emergency removal of property to protect it from damage.

Temporary repairs after a loss to prevent further damage.

Fire department charges in areas with such fees.

Not everything is covered by home insurance (see Exhibit 8–5). Read the nearby Kiplinger’s Personal Finance feature for more information.

Exhibit 8–5 Not Everything Is Covered

CERTAIN PERSONAL PROPERTY IS NOT COVERED BY HOMEOWNER’S INSURANCE: |

|

|

|

Separate coverage may be available for personal property that is not covered by a homeowner’s insurance policy.

page 259

Block, Sandra, “Insurance Coverage for Summer Storm Damage,” Reprinted by permission from Kiplinger’s Personal Finance, June 2014. Copyright © 2014. The Kiplinger Washington Editors, Inc.

How can you protect yourself from flood-related damage to your home?

Should you consider purchasing flood-related insurance if you don’t live in a coastal area?

Can you be held responsible if your tree damages your neighbor’s property?

page 260

LO8.3

Analyze the factors that influence the amount of coverage and cost of home insurance.

Home Insurance Cost Factors

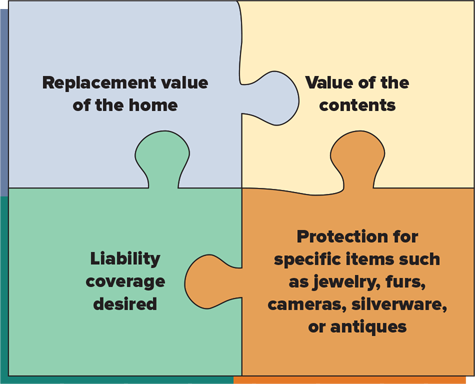

How Much Coverage Do You Need?

You can get the best insurance value by choosing the right coverage amount and knowing the factors that affect insurance costs (see Exhibit 8–6). Your insurance should be based on the amount of money you would need to rebuild or repair your house, not the amount you paid for it. As construction costs rise, you should increase the amount of coverage. In fact, today most insurance policies automatically increase coverage as construction costs rise.

Exhibit 8–6 Determining the Amount of Home Insurance You Need

In the past, many homeowner’s policies insured the building for only 80 percent of the replacement value. If the building were destroyed, the homeowner would have to pay for part of the cost of replacing it, which could be expensive. Today most companies recommend full coverage.

If you are borrowing money to buy a home, the lender will require that you have property insurance. Remember, too, that the amount of insurance on your home determines the coverage on your personal belongings. Coverage for personal belongings is usually from 55 to 75 percent of the insurance amount on your home.

Insurance companies base claim settlements on one of two methods. Under the actual cash value (ACV) method, the payment you receive is based on the replacement cost of an item minus depreciation. Depreciation is the loss of value of an item as it gets older. This means you would receive less for a five-year-old bicycle than you originally paid for it.

Under the replacement value method for settling claims, you receive the full cost of repairing or replacing an item. Depreciation is not considered. Many companies limit the replacement cost to 400 percent of the item’s actual cash value. Replacement value coverage is more expensive than actual cash value coverage.

page 261

Factors That Affect Home Insurance Costs

The cost of your home insurance will depend on several factors, such as the location of the building and the type of building and construction materials. The amount of coverage and type of policy you choose will also affect the cost of home insurance. Furthermore, different insurance companies offer different rates.

LOCATION OF HOME The location of your home affects your insurance rates. Insurance companies offer lower rates to people whose homes are close to a water supply or fire hydrant or located in an area that has a good fire department. On the other hand, rates are higher in areas where crime is common. People living in regions that experience severe weather, such as tornadoes and hurricanes, may also pay more for insurance.

TYPE OF STRUCTURE The type of home and its construction influence the price of insurance coverage. A brick house, for example, will usually cost less to insure than a similar structure made of wood. However, earthquake coverage is more expensive for a brick house than for a wood dwelling because a wooden house is more likely to survive an earthquake. Also, an older house may be more difficult to restore to its original condition. That means that it will cost more to insure.

COVERAGE AMOUNT AND POLICY TYPE The policy and the amount of coverage you select affect the premium you pay. Obviously, insuring a $300,000 home costs more than insuring a $100,000 home.

The deductible amount in your policy also affects the cost of your insurance. If you increase the amount of your deductible, your premium will be lower because the company will pay out less in claims. The most common deductible amount is $250. Raising the deductible from $250 to $500 or $1,000 can reduce the premium you pay by 15 percent or more.

HOME INSURANCE DISCOUNTS Most companies offer discounts if you take action to reduce risks to your home. Your premium may be lower if you have smoke detectors or a fire extinguisher. If your home has dead-bolt locks and alarm systems, which make breaking in harder for thieves, insurance costs may be lower. Some companies offer discounts to people who don’t file any claims for a certain number of years.

COMPANY DIFFERENCES You can save more than

30 percent on homeowner’s insurance by comparing rates from several companies. Some insurance agents work for only one company. Others are independent agents who represent several different companies. Talk to both types of agent. You’ll get the information you need to compare rates.

Don’t select a company on the basis of price alone; also consider service and coverage. Not all companies settle claims in the same way. Suppose that all homes on Evergreen Terrace are dented on one side by large hail. They all have the same kind of siding. Unfortunately, the homeowners discover that this type page 262of siding is no longer available, so all the siding on all of the houses will need to be replaced. Some insurance companies will pay to replace all the siding. Others will pay only to replace the damaged parts.

State insurance commissions and consumer organizations can give you information about different insurance companies. Consumer Reports rates insurance companies on a regular basis.

Remember, insurance companies are just like any other businesses. Do your own research to obtain the best option at the best cost. Read the nearby Financial Literacy in Practice feature to learn how you can lower the cost of homeowner’s and renter’s insurance.

LO8.4

Identify the important types of automobile insurance coverage.

Automobile Insurance Coverages

According to Insurance Institute for Highway Safety, motor vehicle crashes cause more than 35,000 deaths and cost over $242 billion in lost wages and medical bills every year. Traffic accidents can destroy people’s lives physically, financially, and emotionally. Buying insurance can’t eliminate the pain and suffering that vehicle accidents cause. It can, however, reduce the financial impact.

Every state in the United States has a financial responsibility law, a law that requires drivers to prove that they can pay for damage or injury caused by an automobile accident. All states have laws requiring people to carry motor vehicle insurance. These laws impose heavy fines, suspension of a driver’s license, community service, and even imprisonment if you don’t carry motor vehicle insurance. Indeed, opportunity costs of driving without insurance can be very high. Very few people have the money they would need to meet financial responsibility requirements on their own.

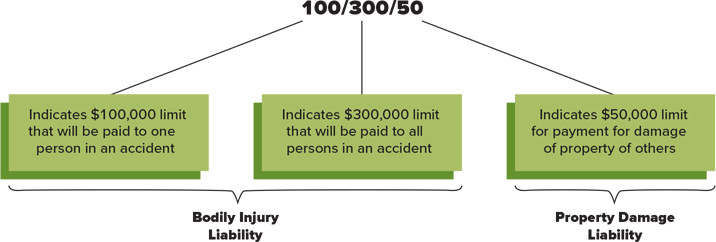

The coverage provided by motor vehicle insurance falls into two categories. One is protection for bodily injury. The other is protection for property damage (see Exhibit 8–7).

Exhibit 8–7 Two Major Categories of Automobile Insurance

Buying bodily injury and property damage coverage can reduce the financial impact of an accident. What type of expenses would be paid for by bodily injury liability coverage?

page 263

Motor Vehicle Bodily Injury Coverages

Most of the money that motor vehicle insurance companies pay out in claims goes for legal expenses, medical expenses, and other costs that arise when someone is injured. The main types of bodily injury coverage are bodily injury liability, medical payments, and uninsured motorist protection.

BODILY INJURY LIABILITY Bodily injury liability is insurance that covers physical injuries caused by a vehicle accident for which you were responsible. If pedestrians, people in other vehicles, or passengers in your vehicle are injured or killed, bodily injury liability coverage pays for expenses related to the crash.

Liability coverage is usually expressed by three numbers, such as 100/300/50. These amounts represent thousands of dollars of coverage. The first two numbers refer to bodily injury coverage. In this example, $100,000 is the maximum amount that the insurance company will pay for the injuries of any one person in any one accident. The second number, $300,000, is the maximum amount the company will pay all injured parties

(two or more) in any one accident. The third number, $50,000, indicates the limit for payment for damage to the property of others (see Exhibit 8–8).

Exhibit 8–8 Automobile Liability Insurance Coverage

The three numbers used to describe liability coverage refer to the limits on different types of payments. Why do you think the middle number is the highest?

MEDICAL PAYMENTS COVERAGE Medical payments coverage is insurance that applies to the medical expenses of anyone who is injured in your vehicle, including you. This type of coverage also provides additional medical benefits for you and members of your family; it pays medical expenses if you or your family members are injured while riding in another person’s vehicle or if any of you are hit by a vehicle.

UNINSURED MOTORIST PROTECTION Unfortunately, you cannot assume that everyone who is behind the wheel is carrying insurance. How can you guard yourself and page 264your passengers against the risk of getting into an accident with someone who has no insurance? The answer is uninsured motorist protection.

Uninsured motorist protection is insurance that covers you and your family members if you are involved in an accident with an uninsured or hit-and-run driver. In most states, it does not cover damage to the vehicle itself. Penalties for driving uninsured vary by state, but they generally include stiff fines and suspension of driving privileges.

Underinsured motorist coverage protects you when another driver has some insurance but not enough to pay for the injuries he or she has caused.

Motor Vehicle Property Damage Coverage

One afternoon, during a summer storm, Carrie was driving home from her job as a hostess at a pancake house. The rain was coming down in buckets, and she couldn’t see very well. As a result, she didn’t realize that the car in front of her had stopped to make a left turn, and she hit the car. The crash totaled Carrie’s new car. Fortunately, she had purchased property damage coverage. Property damage coverage protects you from financial loss if you damage someone else’s property or if your vehicle is damaged. It includes property damage liability, collision, and comprehensive physical damage. (See the nearby Financial Literacy in Practice feature, “Are You Covered?”)

PROPERTY DAMAGE LIABILITY Property damage liability is motor vehicle insurance that applies when you damage the property of others. In addition, it protects you when you’re driving another person’s vehicle with the owner’s permission. Although the damaged property is usually another vehicle, the coverage also extends to buildings and to equipment such as street signs and telephone poles.

COLLISION Collision insurance covers damage to your vehicle when it is involved in an accident. It allows you to collect money no matter who was at fault. However, the amount you can collect is limited to the actual cash value of your vehicle at the time of the accident. If your vehicle has many extra features, make sure that you have a record of its condition and value.

COMPREHENSIVE PHYSICAL DAMAGE Comprehensive physical damage coverage protects you if your vehicle is damaged in a nonaccident situation. It covers your vehicle against risks such as fire, theft, falling objects, vandalism, hail, floods, tornadoes, earthquakes, and avalanches.

No-Fault Insurance

To reduce the time and cost of settling vehicle injury cases, various states are trying a number of alternatives. Under the no-fault system, drivers who are involved in accidents collect money from their own insurance companies. It doesn’t matter who caused the accident. page 265Each company pays the insured up to the limits of his or her coverage. Because no-fault systems vary by state, you should investigate the coverage of no-fault insurance in your state.

Other Automobile Insurance Coverages

Several other kinds of motor vehicle insurance are available to you. Wage loss insurance pays for any salary or income you might have lost because of being injured in a vehicle accident. Wage loss insurance is usually required in states with a no-fault insurance system. In other states, it’s available by choice.

Towing and emergency road service coverage pays for mechanical assistance in the event that your vehicle breaks down. This can be helpful on long trips or during bad weather. If necessary, you can get your vehicle towed to a service station. However, once your vehicle arrives at the repair shop, you are responsible for paying the bill. If you belong to an automobile club, your membership may include towing coverage. If that’s the case, paying for emergency road service coverage could be a waste of money. Rental reimbursement coverage pays for a rental car if your vehicle is stolen or being repaired.

LO8.5

Evaluate factors that affect the cost of automobile insurance.

Automobile Insurance Costs

Motor vehicle insurance is not cheap. The average household spends more than $1,200 for motor vehicle insurance yearly. The premiums are related to the amount of claims insurance companies pay out each year. Your automobile insurance cost is directly related to coverage amounts and factors such as the vehicle, your place of residence, and your driving record.

Amount of Coverage

The amount you will pay for insurance depends on the amount of coverage you require. You need enough coverage to protect yourself legally and financially.

LEGAL CONCERNS As discussed earlier, most people who are involved in motor vehicle accidents cannot afford to pay an expensive court settlement with their own money. For this reason, most drivers buy liability insurance.

In the past, bodily injury liability coverage of 10/20 was usually enough. However, some people have been awarded millions of dollars in recent cases, so coverage of 100/300 is usually recommended.

PROPERTY VALUES Just as medical expenses and legal settlements have increased, so has the cost of vehicles. Therefore, you should consider a policy with a limit of $50,000 or even $100,000 for property damage liability.

Motor Vehicle Insurance Premium Factors

Vehicle type, rating territory, and driver classification are three other factors that influence insurance costs.

VEHICLE TYPE The year, make, and model of a vehicle will affect insurance costs. Vehicles that have expensive replacement parts and complicated repairs will cost more to insure. Also, premiums will probably be higher for vehicle makes and models that are frequently stolen.

page 267

RATING TERRITORY In most states, your rating territory is the place of residence used to determine your vehicle insurance premium. Different locations have different costs. For example, rural areas usually have fewer accidents and less frequent occurrences of theft. Your insurance would probably cost less there than if you lived in a large city.

DRIVER CLASSIFICATION Driver classification is based on age, sex, marital status, driving record, and driving habits. In general, young drivers (under 25) and elderly drivers (over 70) have more frequent and more serious accidents. As a result, these groups pay higher premiums. Your driving record will also influence your insurance premiums. If you have accidents or receive tickets for traffic violations, your rates will increase.

The cost and number of claims that you file with your insurance company will also affect your premium. If you file expensive claims, your rates will increase. If you have too many claims, your insurance company may cancel your policy. You will then have more difficulty getting coverage from another company. To deal with this problem, every state has an assigned risk pool. An assigned risk pool includes all the people who can’t get motor vehicle insurance. Some of these people are assigned to each insurance company operating in the state. These policyholders pay several times the normal rates, but they do get coverage. Once they establish a good driving record, they can reapply for insurance at regular rates.

Insurance companies may also consider your credit score when deciding whether to sell, renew, or cancel a policy and what premium to charge. However, an insurer cannot refuse to issue you a home or auto insurance policy solely based on your credit report. Read the nearby Financial Literacy in Practice feature to understand how insurance companies use credit information.

page 268

Reducing Vehicle Insurance Premiums

Two ways in which you can reduce your vehicle insurance costs are by comparing companies and taking advantage of discounts.

COMPARING COMPANIES Rates and services vary among motor vehicle insurance companies. Even among companies in the same area, premiums can vary by as much as 100 percent. You should compare the service and rates of local insurance agents. Most states publish this type of information. Furthermore, you can check a company’s reputation with sources such as Consumer Reports or your state insurance department.

PREMIUM DISCOUNTS The penalties of poor driving behavior can be severe. For example, car insurance premiums increased 18 percent if you had only one moving violation in 2010; for two moving violations, the average premium increased 34 percent compared to drivers with no violations. Annual premiums jumped to 53 percent higher if you had three violations.

The best way for you to keep your rates down is to maintain a good driving record by avoiding accidents and traffic tickets. In addition, most insurance companies offer various discounts. If you are under 25, you can qualify for reduced rates by taking a driver training program or maintaining good grades in college.

Furthermore, installing security devices will decrease the chance of theft and lower your insurance costs. Being a nonsmoker can qualify you for lower motor vehicle insurance premiums as well. Discounts are also offered for insuring two or more vehicles with the same company.

Increasing the amounts of deductibles will also lead to a lower premium. If you have an old car that’s not worth much, you may decide not to pay for collision and comprehensive coverage. However, before you make this move, you should compare the value of your car for getting to college or work with the cost of these coverages.

Choose your car carefully. Some makes and models are more costly to insure than others. Contact your insurance agent before purchasing your car. And finally, maintain a good credit history. Many insurers are now examining your credit reports.

The nearby Figure It Out! feature presents motor vehicle insurance cost comparison.

page 269

Finally, the nearby Financial Literacy in Practice feature provides suggestions on how to file an insurance claim for home or automobile.

page 270

page 271

page 272

Chapter Summary

LO8.1 The main types of risk are personal risk, property risk, and liability risk. Risk management methods include avoidance, reduction, assumption, and shifting.

Planning an insurance program is a way to manage risks.

Property and liability insurance protect your homes and motor vehicles against financial loss.

LO8.2 Renter's insurance provides many of the same kinds of protection as homeowner's policies. A homeowner’s policy provides coverage for buildings and other structures, additional living expenses, personal property, personal liability and related coverages, and specialized coverages.

LO8.3 The factors that affect home insurance coverage and costs include the location, the type of structure, the coverage amount and policy type, discounts, and the choice of insurance company.

LO8.4 Motor vehicle bodily injury coverages include bodily injury liability, medical payments coverage, and uninsured motorist protection.

Motor vehicle property damage coverages include property damage liability, collision, and comprehensive physical damage.

LO8.5 Motor vehicle insurance costs depend on the amount of coverage you need as well as vehicle type, rating territory, and driver classification.

Key Terms

financial responsibility law 262

medical payments coverage 256, 263

uninsured motorist protection 264

Self-Test Problems

Eric and Susan Fowler just purchased their first home, which cost $130,000. They purchased a homeowner’s policy to insure the home for $120,000 and personal property for $75,000. They declined any coverage for additional living expenses. The deductible for the policy is $500.

Soon after Eric and Susan moved into their new home, a strong windstorm caused damage to their roof. They reported the roof damage to be $17,000. While the roof was under repair, the couple had to live in a nearby hotel for three days. The hotel bill amounted to $320. Assuming the insurance company settles claims using the replacement value method, what amount will the insurance company pay for the damages to the roof?

Eric’s Ford Mustang and Susan’s Toyota Prius are insured with the same insurance agent. They have 50/100/15 vehicle insurance coverage. The very week of the windstorm, Susan had an accident. She lost control of her car, hit a parked car, and damaged a storefront. The damage to the parked car was $4,300 and the damage to the store was $15,400. What amount will the insurance company pay for Susan’s car accident?

page 273

Solutions

Home damages:

Home value: $130,000

Insured amount: $120,000

Damage amount reported: $17,000

Additional living expenses incurred: $320

Total expenses incurred from windstorm: $17,320

Deductible on the policy: $500

Insurance company covered amount ($17,000 – $500 deductible): $16,500

Eric and Susan’s costs ($500 + $320 hotel bill): $820

Car accident:

Store damage amount: $15,400

Parked car damage amount: $4,300

Total damages: $19,700

Insurance company covered amount (50/100/15): $15,000

Eric and Susan’s costs ($19,700 – $15,000): $4,700

Problems

Most home insurance policies cover jewelry for $1,000 and silverware for $2,500 unless items are covered with additional insurance. If $4,500 worth of jewelry and $6,000 worth of silverware were stolen from a family, what amount of the claim would not be covered by insurance? (LO8.2)

What amount would a person with actual cash value coverage receive for two-year-old furniture destroyed by a fire? The furniture would cost $2,000 to replace today and had an estimated life of five years. (LO8.2)

What would it cost an insurance company to replace a family’s personal property that originally cost $25,000? The replacement costs for the items have increased 15 percent. (LO8.2)

If Carissa Dalton has a $130,000 home insured for $100,000, based on the 80 percent coinsurance provision, how much would the insurance company pay on a claim of $5,000? Assume there is no deductible. (LO8.2)

For each of the following situations, what amount would the insurance company pay? (LO8.2)

Wind damage of $835; the insured has a deductible of $500.

Theft of a stereo system worth $1,150; the insured has a deductible of $250.

Vandalism that does $425 of damage to a home; the insured has a deductible of $500.

Becky Fenton has 25/50/10 automobile insurance coverage. If two other people are awarded $35,000 each for injuries in an auto accident in which Becky was judged at fault, how much of this judgment would the insurance cover? (LO8.4)

Kurt Simmons has 50/100/15 auto insurance coverage. One evening, he lost control of his vehicle, hitting a parked car and damaging a storefront along the street. Damage to the parked car was $5,400, and damage to the store was $12,650. What amount will the insurance company pay for the damages? What amount will Kurt have to pay? (LO8.4)

Karen and Mike currently insure their cars with separate companies, paying $700 and $900 a year. If they insured both cars with the same company, they would save 10 percent on the annual premiums. What would be the future value of the annual savings over 10 years based on an annual interest rate of 4 percent? (LO8.5)

When Carolina’s house burned down, she lost household items worth a total of $50,000. Her house was insured for $160,000, and her homeowner’s policy provided coverage for personal belongings up to 55 percent of the insured value of the house. Calculate how much insurance coverage Carolina’s policy provides for her personal possessions and whether she will receive payment for all of the items destroyed in the fire. (LO8.2)

page 274Dave and Ellen are newly married and living in their first house. The yearly premium on their homeowner’s insurance policy is $450 for the coverage they need. Their insurance company offers a discount of 5 percent if they install dead-bolt locks on all exterior doors. The couple can also receive a discount of 2 percent if they install smoke detectors on each floor. They have contacted a locksmith, who will provide and install dead-bolt locks on the two exterior doors for $60 each. At the local hardware store, smoke detectors cost $8 each, and the new house has two floors. Dave and Ellen can install them themselves. What discount will Dave and Ellen receive if they install the dead-bolt locks? If they install smoke detectors? (LO8.2)

In the preceding example, assuming their insurance rates remain the same, how many years will it take Dave and Ellen to earn back in discounts the cost of the dead-bolts? The cost of the smoke detectors? Would you recommend Dave and Ellen invest in the safety items if they plan to stay in the house for about 5 years? Why or why not? (LO8.2)

Shaan and Anita currently insure their cars with separate companies, paying $650 and $575 a year. If they insure both cars with the same company, they would save 10 percent on their annual premiums. What would be the future value of the annual savings over 10 years based on an annual interest rate of 6 percent? (LO8.5)

|

To reinforce the content in this chapter, more problems are provided at connect.mheducation.com. |

Apply Yourself for Financial Literacy

Survey friends and relatives to determine the types of insurance coverages they have. Also, obtain information about the process used to select these coverages. (LO8.1)

Outline a personal insurance plan with the following phases: (a) Identify personal, financial, and property risks; (b) set goals you might achieve when obtaining needed insurance coverages; and (c) describe actions you might take to achieve these insurance goals. (LO8.1)

Talk to a financial planner or an insurance agent about the financial difficulties faced by people who lack adequate home and auto insurance. What common coverages do many people overlook? (LO8.2)

Contact two or three insurance agents to obtain information about home or renter’s insurance. Use Your Personal Financial Plan sheet 29 to compare the coverages and costs. (LO8.2)

Examine a homeowner’s or renter’s insurance policy. What coverages does the policy include? Does the policy contain unclear conditions or wording? (LO8.3)

Contact two or three insurance agents to obtain information about automobile insurance. Use Your Personal Financial Plan sheet 30 to compare costs and coverages for various insurance companies. (LO8.5)

REAL LIFE PERSONAL FINANCE

WE RENT, SO WHY DO WE NEED INSURANCE?

“Have you been down in the basement?” Nathan asked his wife, Erin, as he entered their apartment.

“No, what’s up?” responded Erin.

“It’s flooded because of all that rain we got last weekend!” he exclaimed.

“Oh no! We have the extra furniture my mom gave us stored down there. Is everything ruined?” Erin asked.

“The couch and coffee table are in a foot of water; the love seat was the only thing that looked OK. Boy, I didn’t realize the page 275basement of this building wasn’t waterproof. I’m going to call our landlady to complain.”

As Erin thought about the situation, she remembered that when they moved in last fall, Kathy, their landlady, had informed them that her insurance policy covered the building but not the property belonging to each tenant. Because of this, they had purchased renter’s insurance. “Nathan, I think our renter’s insurance will cover the damage. Let me give our agent a call.”

When Erin and Nathan purchased their insurance, they had to decide whether they wanted to be insured for cash value or for replacement costs. Replacement was more expensive, but it meant they would collect enough to go out and buy new household items at today’s prices. If they had opted for cash value, the couch for which Erin’s mother had paid $1,000 five years ago would be worth less than $500 today.

Erin made the call and found out their insurance did cover the furniture in the basement and at replacement value after they paid the deductible. The $300 they had invested in renter’s insurance last year was well worth it!

Not every renter has as much foresight as Erin and Nathan. About 4 in 10 renters have renter’s insurance. Some aren’t even aware they need it. They may assume they are covered by the landlord’s insurance, but they aren’t. This mistake can be costly.

Think about how much you have invested in your possessions and how much it would cost to replace them. Start with your stereo equipment or the flat screen television and DVD player that you bought last year. Experts suggest that people who rent start thinking about these things as soon as they move into their first apartment. Your policy should cover your personal belongings and provide funds for living expenses if you are dispossessed by a fire or other disaster.

Questions

Why is it important for people who rent to have insurance?

Does the building owner’s property insurance ever cover the tenant’s personal property?

What is the difference between cash value and replacement value?

When shopping for renter’s insurance, what coverage features should you look for?

Continuing Case

HOME AND AUTOMOBILE INSURANCE

Jamie Lee and Ross have had several milestones in the past year. They got married, recently purchased their first home, and now have twins on the way!

Jamie Lee and Ross have to seriously consider their insurance needs. Since they have family, a home, and, now, babies on the way, they need to develop a risk management plan to help them should an unexpected event arise.

Current Financial Situation

Assets (Jamie Lee and Ross combined):

Checking account, $4,300

Savings account, $22,200

Emergency fund savings account, $20,500

IRA balance, $26,000

Cars, $10,000 (Jamie Lee) and $18,000 (Ross)

Liabilities (Jamie Lee and Ross combined):

Student loan balance, $0

Credit card balance, $2,000

Car loans, $6,000

Income:

Jamie Lee, $50,000 gross income ($37,500 net income after taxes)

Ross, $75,000 gross income ($64,000 net income after taxes)

page 276

Monthly Expenses (Jamie Lee and Ross combined):

Mortgage, $1,252

Property taxes and insurance, $500

Utilities, $195

Food, $400

Gas/Maintenance, $275

Credit card payment, $250

Car loan payment, $289

Entertainment, $300

Questions

Based on their current life status, what are some of the goals Jamie Lee and Ross should set to achieve when developing their insurance plan?

What four questions should Jamie Lee and Ross ask themselves as they develop the risk management plan?

Once Jamie Lee and Ross put their insurance plan into action, what should they do to maintain their plan?

Jamie and Ross decided to conduct a checkup on their homeowner’s insurance policy. They noticed that they had omitted covering Jamie Lee’s diamond wedding band set from their policy. What if it got lost or stolen? It was a major purchase, and besides the emotional value, the cost to replace the diamond jewelry would be very high. What type of policy should Jamie Lee and Ross consider to cover the diamond wedding rings?

Mr. Ferrell, Jamie Lee and Ross’s insurance agent, suggested a flood insurance policy in addition to their regular homeowner’s policy. Jamie Lee and Ross looked quizzically at the agent, as they do not live within two miles of a body of water. What is the basis for Mr. Ferrell’s claim for the necessity of the flood policy?

Using Your Personal Financial Plan sheet 27, create a home inventory for Jamie Lee and Ross. Consider items of value that may be located in each of the rooms of the house and determine a dollar amount for each item. What is the total cost of the items?

Considering the value of Jamie Lee and Ross’s automobiles, what type of automobile insurance coverage would you suggest for them?

What financial strategy would you suggest to Jamie Lee and Ross to enable them to save money on their insurance premiums?

Spending Diary

“MY SPENDING TAKES MOST OF MY MONEY. SO AFTER PAYING FOR CAR INSURANCE, MY BUDGET IS REALLY TIGHT.”

Directions As you continue (or start) using your Daily Spending Diary sheets, you should be able to make better choices for your spending priorities. The financial data you develop will help you better understand your spending patterns and help you plan for achieving financial goals. The Daily Spending Diary sheets are located in Appendix D at the end of the book and in Connect Finance.

Questions

What information from your Daily Spending Diary might encourage you to use your money differently?

How can your spending habits be altered to ensure that you will be able to afford appropriate home and motor vehicle insurance coverage?

page 277

YOUR PERSONAL FINANCIAL PLAN 26

Name: Date:

Current Insurance Policies and Needs

Purpose: To establish a record of current and needed insurance coverage.

Financial Planning Activities: List current insurance policies and areas where new or additional

coverage is needed. This sheet is also available in an Excel spreadsheet format in Connect Finance.

Suggested Websites: www.insure.com, www.accuquote.com

Current Coverage |

Needed Coverage |

Property Insurance Company _______________ Policy no. _______________ Coverage amounts _______________ Deductible _______________ Annual premium _______________ Agent _______________ Address _______________ Phone _______________ Website _______________ |

|

Automobile Insurance Company _______________ Policy no. _______________ Coverage amounts _______________ Deductible _______________ Annual premium _______________ Agent _______________ Address _______________ Phone _______________ Website _______________ |

|

Disability Income Insurance Company _______________ Policy no. _______________ Coverage _______________ Contact _______________ Phone _______________ Website _______________ |

|

Health Insurance Company _______________ Policy no. _______________ Policy provisions _______________ Contact _______________ Phone _______________ Website _______________ |

|

Life Insurance Company _______________ Policy no. _______________ Type of policy _______________ Amount of coverage _______________ Cash value _______________ Agent _______________ Phone _______________ Website _______________ |

What’s Next for Your Personal Financial Plan?

Talk with friends and relatives to determine the types of insurance coverage they have.

Conduct a web search for various types of insurance on which you need additional information.

page 278

YOUR PERSONAL FINANCIAL PLAN 27

©McGraw-Hill Education

Name: Date:

Home Inventory

Purpose: To create a record of personal belongings for use when settling home insurance claims.

Financial Planning Activities: For each area of the home, list your possessions, including a

description (model, serial number), cost, and date of acquisition. Also consider taking

photographs and videos of your possessions. This sheet is also available in an Excel

spreadsheet format in Connect Finance.

Suggested Websites: www.money.com, www.ambest.com

Item, Description |

Cost |

Date Acquired |

|

Attic _________________________________________________ _________________________________________________ Bathroom _________________________________________________ _________________________________________________ Bedrooms _________________________________________________ _________________________________________________ Family room _________________________________________________ _________________________________________________ Living room _________________________________________________ _________________________________________________ Hallways _________________________________________________ _________________________________________________ Kitchen _________________________________________________ _________________________________________________ Dining room _________________________________________________ _________________________________________________ Basement _________________________________________________ _________________________________________________ Garage _________________________________________________ _________________________________________________ Other items _________________________________________________ _________________________________________________ |

||

What’s Next for Your Personal Financial Plan?

Determine common items that may be overlooked when preparing a home inventory.

Talk to a local insurance agent to determine the areas of protection that many people tend to overlook.

page 279

YOUR PERSONAL FINANCIAL PLAN 28

Name: Date:

Determining Needed Property Insurance

Purpose: To determine property insurance needed for a home or apartment.

Financial Planning Activities: Estimate the value and your needs for the categories below.

This sheet is also available in an Excel spreadsheet format in Connect Finance.

Suggested Websites: www.iii.org, ;www.quicken.com, www.naic.org

Real Property (this section not applicable to renters)

Current replacement value of home |

$ |

Personal Property

Estimated value of appliances, furniture, clothing, and other household items (conduct an inventory) |

$ |

Type of coverage for personal property (check one)

Actual cash value |

|

Replacement value |

Additional coverage for items with limits on standard personal property coverage such as jewelry; firearms; silverware; and photographic, electronic, and computer equipment

Item |

Amount |

|

____________________________________________ ____________________________________________ ____________________________________________ |

|

Personal Liability

Amount of additional personal liability coverage desired for possible personal injury claims |

$ |

Specialized Coverages

If appropriate, investigate flood or earthquake coverage excluded from home insurance policies |

$ |

Note: Use Your Personal Financial Plan sheet 29 to compare companies, coverages, and costs for apartment or home insurance.

What’s Next for Your Personal Financial Plan?

Outline the steps involved in planning an insurance program.

Outline special types of property and liability insurance such as personal computer insurance, trip cancellation insurance, and liability insurance.

page 280

YOUR PERSONAL FINANCIAL PLAN 29

Name: Date:

Apartment/Home Insurance Comparison

Purpose: To research and compare companies, coverages, and costs for apartment or home insurance.

Financial Planning Activities: Contact three insurance agents to obtain the information requested

below. This sheet is also available in an Excel spreadsheet format in Connect Finance.

Suggested Websites: www.freeinsurancequotes.com, www.insure.com, www.insureuonline.org

Type of building |

apartment |

home |

condominium |

Location _____________________ Type of construction _______ Age of building _______________

|

|||

Company name |

|||

Agent’s name, address, and phone |

|||

Coverage: |

Premium |

Premium |

Premium |

|

Dwelling $ Other structure $ |

|||

(does not apply to apartment/condo coverage) |

|

|

|

Personal property $ |

|||

Additional living expenses $ |

|||

Personal liability Bodily injury $ Property damage $ |

|||

Medical payments Per person $ Per accident $ |

|||

Deductible amount |

|||

Other coverage $ |

|||

Service charges or fees |

|||

Total Premium |

|||

What’s Next for Your Personal Financial Plan?

List the reasons most commonly given by renters for not having renter’s insurance.

Determine cost differences for home insurance among various local agents and online providers.

page 281

YOUR PERSONAL FINANCIAL PLAN 30

©McGraw-Hill Education

Name: Date:

Automobile Insurance Cost Comparison

Purpose: To research and compare companies, coverages, and costs for auto insurance.

Financial Planning Activities: Contact three insurance agents to obtain the information requested below. This sheet is also available in an Excel spreadsheet format in Connect Finance.

Suggested Websites: www.autoinsuranceindepth.com, www.progressive.com, www.standardandpoors.com

Vehicle (year, make, model, engine size) _____________________________________________ |

|||

Driver’s age _______________ Sex _______________ |

Total miles driven in a year _______________ |

||

Full- or part-time driver? _______________ Driver’s education completed? _______________ Accidents or violations within the past three years? _______________ |

|||

Company name |

|||

Agent’s name, address, and phone |

|||

E-mail, website |

|||

Policy length (6 months, 1 year) |

|||

Coverage: |

Premium |

Premium |

Premium |

Bodily injury liability Per person $ Per accident $ |

|||

Property damage liability per accident $ |

|||

Collision deductible $ |

|||

Comprehensive deductible $ |

|||

Medical payments per person $ |

|||

Uninsured motorist liability Per person $ Per accident $ |

|||

Other coverage |

|||

Service charges |

|||

Total Premium |

|||

What’s Next for Your Personal Financial Plan?

Research actions that you might take to reduce motor vehicle insurance costs.

Talk to friends, relatives, and insurance agents to determine methods of reducing the cost of motor vehicle insurance.