page 2

©BELCHONOCK/123RF

page 3

LO1.1

Identify social and economic influences on personal financial goals and decisions.

Making Financial Decisions

Every person has some money available. However, the amount, along with needs and financial choices, will vary from person to person. In this book, you will have the opportunity to assess your current situation, learn about varied financial paths, and move forward toward future financial security.

Most people want to handle their finances so that they get full satisfaction from each available dollar. Typical financial goals may include buying a new car or a larger home, pursuing advanced career training, contributing to charity, traveling extensively, and gaining self-sufficiency during working and retirement years. To achieve these and other goals, people need to identify and set priorities. Financial and personal satisfaction are the result of an organized process that is commonly referred to as personal money management or personal financial planning.

Your Life Situation and Financial Planning

Personal financial planning is the process of managing your money to achieve personal economic satisfaction. This planning process allows you to control your financial situation. Every person, family, or household has a unique situation; therefore, financial decisions must be planned to meet specific needs and goals.

A comprehensive financial program can enhance the quality of your life and increase your satisfaction by reducing uncertainty about your future. A financial plan is a formalized report that summarizes your current financial situation, analyzes your financial needs, and recommends future financial activities. You can create this document on your own (by using the sheets at the end of each chapter), or you can seek assistance from a financial planner or use money management software or an app.

page 4Advantages of effective personal financial planning include:

Increased effectiveness in obtaining, using, and protecting your financial resources throughout your life.

Increased control of your financial affairs by avoiding excessive debt, bankruptcy, and dependence on others.

Improved personal relationships resulting from well-planned and effectively communicated financial decisions.

A sense of freedom from financial worries obtained by looking to the future, anticipating expenses, and achieving personal economic goals.

Many factors influence financial decisions. People in their 20s spend money differently from those in their 50s. Personal factors such as age, income, household size, and personal beliefs influence your spending and saving patterns. Your life situation or lifestyle is created by a combination of factors.

As our society changes, different types of financial needs evolve. Today people tend to get married at a later age, and more households have two incomes. Many households are headed by single parents. More than 2 million women provide care for both dependent children and parents. We are also living longer with over 80 percent of all Americans now alive expected to live well past age 65.

As Exhibit 1–1 shows, the adult life cycle—the stages in the family situation and financial needs of an adult—is an important influence on your financial activities and decisions. Your life situation is also affected by events such as graduation, dependent children leaving home, changes in health, engagement and marriage, divorce, birth or adoption of a child, retirement, a career change or a move to a new area, or the death of a spouse, family member, or other dependent.

In addition to being defined by your family situation, you are defined by your values—the ideas and principles that you consider correct, desirable, and important. Values have a direct influence on such decisions as spending now versus saving for the future or continuing school versus getting a job.

Financial Planning in Our Economy

Daily economic transactions facilitate financial planning activities. Exhibit 1–2 shows the monetary flows among providers and users of funds that occur in a financial system. These financial activities affect personal finance decisions. Investing in a bond, which is a debt security, involves borrowing by a company or government. In contrast, investing in stock, called an equity security, represents ownership in a corporation. Other financial market activities include buying and selling mutual funds, certificates of deposit (CDs), and commodity futures.

Exhibit 1–2 The Financial System

In most societies, the forces of supply and demand set prices for securities, goods, and services. Economics is the study of how wealth is created and distributed. The economic environment includes business, labor, and government working together to satisfy needs and wants. As shown in Exhibit 1–2, government agencies regulate financial activities. The Federal Reserve System, the central bank of the United States, has significant economic responsibility. The Fed, as it is often called, attempts to maintain an adequate money supply to encourage consumer spending, business growth, and job creation.

GLOBAL INFLUENCES The global economy can influence financial activities. The U.S. economy is affected by both foreign investors and competition from foreign companies. American businesses compete against foreign companies for the spending dollars of American consumers. When the level of exports of U.S.-made goods is lower than the level of imported goods, more U.S. dollars leave the country than the dollar value of foreign currency coming into the United States. This reduces the funds available for domestic spending and investment. Also, if foreign companies decide not to invest in the United States, the domestic money supply is reduced. This reduced money supply can cause higher interest rates.

page 5

Exhibit 1–1 Financial Planning Influences, Goals, and Activities

Life Situation Factors Affect Financial Planning Activities

|

Age |

Marital Status |

Number and Age of Household Members |

Employment Situation |

|---|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

TIME TO TAKE ACTION . . . COMMON FINANCIAL GOALS AND ACTIVITIES |

||

|---|---|---|

|

|

|

|

|

|

|

|

|

SPECIALIZED FINANCIAL GOALS AND ACTIVITIES FOR VARIOUS LIFE SITUATIONS |

|||

|---|---|---|---|

| Young, Single (18–35) | Young Couple with Children under 18 | Single Parent with Children under 18 | Young, Dual-Income Couple, No Children |

|

|

|

|

|

|

|

|

|

|

|

|

| Unmarried Couple, No Children | Older Couple (50+), No Dependent Children | Mixed-Generation Elderly Individuals and Children under 18 | Older (50+) Single Person, No Dependent Children |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

page 6INFLATION Most people are concerned with the buying power of their money. Inflation is a rise in the general level of prices. In times of inflation, the buying power of the dollar decreases. For example, if prices increased 5 percent during the last year, items that previously cost $100 would now cost $105. This means more money is needed to buy the same amount of goods and services.

Inflation is most harmful to people with fixed incomes. Due to inflation, retired people and others whose incomes do not change can only afford fewer goods and services. Inflation can also adversely affect lenders of money. Unless an adequate interest rate is charged, amounts repaid by borrowers in times of inflation have less buying power than the money they borrowed.

Inflation rates vary. During the late 1950s and early 1960s, the annual inflation rate was in the 1 to 3 percent range. During the late 1970s and early 1980s, the cost of living increased 10 to 12 percent annually. At a 12 percent annual inflation rate, prices double (and the value of the dollar is cut in half) in about six years. To find out how fast prices (or your savings) will double, use the Rule of 72: Just divide 72 by the annual inflation (or interest) rate.

More recently, the reported annual price increase for goods and services as measured by the consumer price index has been in the 2 to 4 percent range. The consumer price index (CPI), computed and published by the Bureau of Labor Statistics, is a measure of the average change in the prices urban consumers pay for a fixed “basket” of goods and services.

page 7Inflation rates can be deceptive since the index is based on items calculated in a predetermined manner. Many people face hidden inflation since the cost of necessities (food, gas, health care), on which they spend the greatest proportion of their money may rise at a higher rate than nonessential items, which could be dropping in price. This results in a reported inflation rate much lower than the actual cost-of-living increase being experienced by consumers.

Deflation, a decline in prices, can also have damaging economic effects. As prices drop, consumers expect they will go even lower. As a result, consumers cut their spending, which causes damaging economic conditions. While widespread deflation is unlikely, certain items may be affected and their prices will drop.

INTEREST RATES In simple terms, interest rates represent the cost of money. Like everything else, money has a price. The forces of supply and demand influence interest rates. When consumer saving and investing increase the supply of money, interest rates tend to decrease. However, as borrowing by consumers, businesses, and government increases, interest rates are likely to rise.

Interest rates can have a major effect on financial planning. The earnings you receive as a saver or an investor reflect current interest rates as well as a risk premium based on such factors as the length of time your funds will be used by others, expected inflation, and the extent of uncertainty about getting your money back. Risk is also a factor in the interest rate you pay as a borrower. People with poor credit ratings pay a higher interest rate than people with good credit ratings. Interest rates influence many financial decisions.

Financial Planning Activities

To achieve a successful financial situation, you must coordinate various components through an organized plan and wise decision making.

OBTAINING (CHAPTER 1) You obtain financial resources from employment, investments, or ownership of a business. Obtaining financial resources is the foundation of financial planning, since these resources are used for all financial activities.

PLANNING (CHAPTERS 2, 3) Planned spending through budgeting is the key to achieving goals and future financial security. Efforts to anticipate expenses along with making certain financial decisions can reduce taxes, increase savings, and result in less financial stress.

SAVING (CHAPTERS 2, 4) Long-term financial security starts with a regular savings plan for emergencies, unexpected bills, replacement of major items, and the purchase of special goods and services, such as a college education, a boat, or a vacation home. Once you have established a basic savings plan, you may use additional money for investments that offer greater financial growth.

BORROWING (CHAPTER 5) Maintaining control over your use of credit will contribute to your financial goals. The overuse and misuse of credit may cause a situation in page 8which a person’s debts far exceed the resources available to pay those debts. Bankruptcy is a set of federal laws allowing you to either restructure your debts or remove certain debts. The people who declare bankruptcy each year may have avoided this trauma with wise spending and borrowing decisions. Chapter 5 discusses bankruptcy in detail.

SPENDING (CHAPTERS 6, 7) Financial planning is not designed to prevent your enjoyment of life but to help you obtain the items you want. Too often, however, people make purchases without considering the financial consequences. Some people shop compulsively, creating financial difficulties. You should detail your living expenses and your other financial obligations in a spending plan. Spending less than you earn is the only way to achieve long-term financial security.

MANAGING RISK (CHAPTERS 8, 9, 10) Adequate insurance coverage is another component of personal financial planning. Certain types of insurance are commonly overlooked in financial plans. For example, the number of people who suffer disabling injuries or diseases at age 50 is greater than the number who die at that age, so people may need disability insurance more than they need life insurance. Yet research reveals that most people have adequate life insurance but few have adequate disability insurance.

INVESTING (CHAPTERS 11, 12, 13) Although many types of investments are available, people invest for two primary reasons. Those interested in current income select investments that pay regular dividends or interest. In contrast, investors who desire long-term growth choose stocks, mutual funds, real estate, and other investments with potential for increased value in the future. You can achieve investment diversification by including a variety of assets in your portfolio: may include stocks, bond mutual funds, real estate, and collectibles such as rare coins.

RETIREMENT AND ESTATE PLANNING (CHAPTER 14) Most people desire financial security upon completion of full-time employment. But retirement planning also involves thinking about your housing situation, your recreational activities, and possible part-time or volunteer work.

Transfers of money or property to others should be timed, if possible, to minimize the tax burden and maximize the benefits for those receiving the financial resources. Knowledge of property transfer methods can help you select the best course of action for funding current and future living costs, educational expenses, and retirement needs of dependents.

page 9

Developing and Achieving Financial Goals

Why do so many Americans—living in one of the richest countries in the world—have money problems? The answer can be found in two main factors. The first is poor planning and weak money management habits in areas such as spending and the use of credit. The other factor is extensive advertising, selling efforts, and product availability that encourage overbuying. Achieving personal financial satisfaction starts with clear financial goals.

LO1.2

Develop personal financial goals.

Types of Financial Goals

What would you like to do tomorrow? Believe it or not, that question involves goal setting, which may be viewed in three time frames:

Short-term goals will be achieved within the next year or so, such as saving for a vacation or paying off small debts.

Intermediate goals have a time frame of two to five years.

Long-term goals involve financial plans that are more than five years off, such as retirement, money for children’s college education, or the purchase of a vacation home.

Long-term goals should be planned in coordination with short-term and intermediate goals. Setting and achieving short-term goals is commonly the basis for moving toward success of long-term goals. For example, saving for a down payment to buy a house is a short-term goal that can be a foundation for a long-term goal: owning your own home.

A goal of obtaining increased career training is different from a goal of saving money to pay a semiannual auto insurance premium. Consumable-product goals usually occur on a periodic basis and involve items that are used up relatively quickly, such as food, clothing, and entertainment. Durable-product goals usually involve infrequently purchased, expensive items such as appliances, cars, and sporting equipment; these consist of tangible items. In contrast, many people overlook intangible-purchase goals. These goals may relate to personal relationships, health, education, community service, and leisure.

Goal-Setting Guidelines

An old saying goes, “If you don’t know where you’re going, you might end up somewhere else and not even know it.” Goal setting is central to financial decision making. Your financial goals are the basis for planning, implementing, and measuring the progress of your spending, saving, and investing activities. Exhibit 1–1 offers typical goals and financial activities for various life situations.

Your financial goals should take a SMART approach, in that they are:

S—specific, so you know exactly what your goals are and can create a plan designed to achieve those objectives.

M—measurable, by a specific amount. For example, “Accumulate $5,000 in an investment fund within three years” is more measurable than “Put money into an investment fund.”

page 10A—action-oriented, providing the basis for the personal financial activities you will undertake. For example, “Reduce credit card debt” will usually mean actions to pay off amounts owed.

R—realistic, involving goals based on your income and life situation. For example, it is probably not realistic to expect to buy a new car each year if you are a full-time student.

T—time-based, indicating a time frame for achieving the goal, such as three years. This allows you to measure your progress toward your financial goals.

The Financial Literacy in Practice feature “Planning Goals and Assessing Financial Health” can guide your goal-setting activities.

page 11

Opportunity Costs and the Time Value of Money

In every financial decision, you sacrifice something to obtain something else that you consider more desirable. For example, you might forgo current buying now to save funds for future purchases or long-term financial security. Or you might gain the use of an expensive item now by making credit payments from future earnings.

LO1.3

Calculate time value of money situations to analyze personal financial decisions.

Opportunity cost is what you give up by making a choice. This cost, commonly referred to as the trade-off of a decision, cannot always be measured in dollars. Opportunity costs should be viewed in terms of both personal and financial resources.

Personal Opportunity Costs

An important personal opportunity cost involves time that when used for one activity cannot be used for other activities. Time used for studying, working, or shopping will not be available for other uses. Other personal opportunity costs relate to health. Poor eating habits, lack of sleep, or avoiding exercise can result in illness, time away from school or work, increased health care costs, and reduced financial security. Like financial resources, your personal resources (time, energy, health, abilities, knowledge) require planning and wise management.

Financial Opportunity Costs

Would you rather have $100 today or $103 a year from now? How about $120 a year from now instead of $100 today? Your choice among these alternatives will depend on several factors including current needs, future uncertainty, and current interest rates. If you wait to receive your money in the future, you want to be rewarded for the risk. The time value of money involves the increases in an amount of money as a result of interest earned. Saving or investing a dollar instead of spending it today results in a future amount greater than a dollar. Every time you spend, save, invest, or borrow money, you should consider the time value of that money as an opportunity cost. Spending money from your savings account means lost interest earnings; however, what you buy with that money may have a higher priority than those earnings.

INTEREST CALCULATIONS Three amounts are used to calculate the time value of money for savings in the form of interest earned:

The amount of the savings (commonly called the principal).

The annual interest rate.

The length of time the money is on deposit.

These three items are multiplied to obtain the amount of interest. Simple interest is calculated as follows:

For example, $500 on deposit at 6 percent for six months would earn $15 ($500 × 0.06 × 6/12 or ½ year).

The increased value of money from interest earned involves two types of time value of money calculations, future value and present value. The amount that will be available at a later date is called the future value. In contrast, the current value of an amount desired in the future is the present value. Five methods are available for calculating time value of money:

Formula calculation. With this conventional method, math notations are used for computing future value and present value.

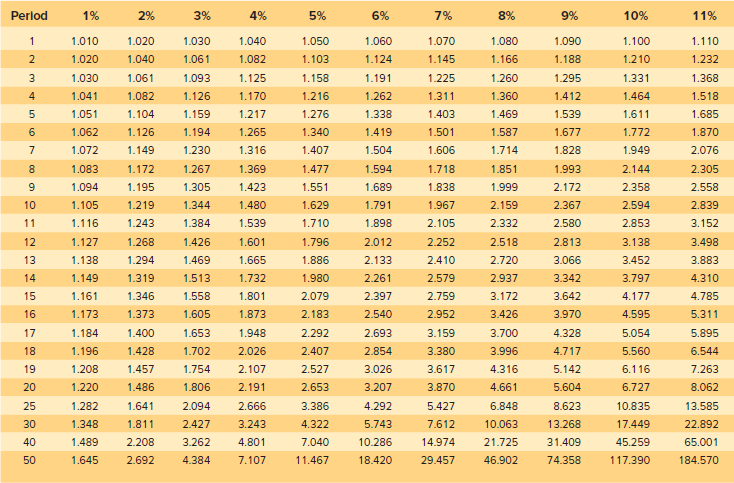

Time value of money tables. Traditionally, before calculators and computers, future value and present value tables were used (see the Chapter 1 Appendix) to provide for easier computations.

Financial calculator. A variety of calculators are programmed with financial functions. Both future value and present value calculations are performed using appropriate keystrokes.

Spreadsheet software. Excel and other spreadsheet programs have built-in formulas for financial computations, including future value and present value.

Websites and apps. Many time value of money calculators are available online and through mobile devices. These programs may be used to calculate the future value of savings as well as loan payment amounts.

FUTURE VALUE OF A SINGLE AMOUNT Deposited money earns interest that will increase over time. Future value is the amount to which current savings will grow based on a certain interest rate and a certain time period. For example, $100 deposited in a 6 percent account for one year will grow to $106. This amount is computed as follows:

The same process could be continued for a second, third, and fourth year; however, the computations would be time-consuming. The previously mentioned calculation methods make the process easier.

page 13An example of the future value of a single amount might involve an investment of $650 earning 8 percent for 10 years. This situation would be calculated as follows:

Formula |

Time Value of Money Table |

Financial Calculator |

Spreadsheet Software |

FV = PV (1 + i)n FV = 650(1 + 0.08)10 FV = $1,403.30 i—interest rate n—number of time periods |

Using Exhibit 1–A in the Chapter 1 Appendix, multiply the amount deposited by the factor for the interest rate and time period. 650 × 2.159 = $1,403.35 (The slight difference in this answer is the result of rounding the decimal places.) |

PV, I/Y, N, PMT, CPT FV 650 PV, 8 I/Y, 10 N, 0 PMT, CPT FV $1,403.30 (Different financial calculators will require different keystrokes.) |

= FV(rate, periods, amount per period, single amount) = FV(0.08,10,0,–650) = $1,403.30 |

NOTE: Expanded explanations of these time value of money calculation methods are presented in the appendix following this chapter.

Future value computations are often referred to as compounding, since interest is earned on previously earned interest. Compounding allows the future value of a deposit to grow faster than it would if interest were paid only on the original deposit. The sooner you make deposits, the greater the future value will be. Depositing $1,000 in a 5 percent account at age 40 will give you $3,387 at age 65. However, making the $1,000 deposit at age 25 would result in an account balance of $7,040 at age 65.

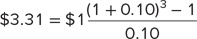

FUTURE VALUE OF A SERIES OF DEPOSITS Many savers and investors make regular deposits. An annuity is a series of equal deposits or payments. To determine the future value of equal yearly savings deposits, time value of money tables can be used (see Exhibit 1–B in the Chapter 1 Appendix). For this table to be used, and for an annuity to exist, the deposits must earn a constant interest rate. For example, if you deposit $50 a year at 7 percent for six years, starting at the end of the first year, you will have $357.65 at the end of that time ($50 × 7.153). The nearby Figure It Out! feature presents examples of using future value to achieve financial goals.

PRESENT VALUE OF A SINGLE AMOUNT Another aspect of the time value of money involves determining the current value of an amount desired in the future. Present value is the current value for a future amount based on a particular interest rate for a certain period of time. Present value computations, also called discounting, allow you to determine how much to deposit now to obtain a desired total in the future. For example, using the present value table (Exhibit 1–C in the Chapter 1 Appendix), if you want $1,000 five years from now and you earn 5 percent on your savings, you need to deposit $784 ($1,000 × 0.784).

PRESENT VALUE OF A SERIES OF DEPOSITS You may also use present value computations to determine how much you need to deposit now so that you can take a certain amount out of the account for a desired number of years. For example, if you want to take $400 out of an investment account each year for nine years and your money is earning an annual rate of 8 percent, you can see from Exhibit 1–D (Chapter 1 Appendix) that you would need to make a current deposit of $2,498.80 ($400 × 6.247).

Additional details for the formulas, tables, and other methods for calculating time value of money are presented in the appendix at the end of this chapter.

page 14

page 15

A Plan for Personal Financial Planning

We all make hundreds of decisions each day. Most of these decisions are quite simple and have few consequences. However, some are complex and have long-term effects on our personal and financial situations, as shown here:

LO1.4

Implement a plan for making personal financial and career decisions.

While everyone makes decisions, few people consider how to make better decisions. As Exhibit 1–3 shows, the financial planning process can be viewed as a six-step procedure that can be adapted to any life situation.

Exhibit 1–3 The Financial Planning Process

Step 1: Determine Your Current Financial Situation

In this first step, determine your current financial situation regarding income, savings, living expenses, and debts. Preparing a list of current asset and debt balances and amounts spent for various items gives you a foundation for financial planning activities. The personal financial statements discussed in Chapter 2 will provide the information needed in this phase of financial decision making.

page 16

Step 2: Develop Your Financial Goals

You should periodically analyze your financial values and goals. The purpose of this analysis is to differentiate your needs from your wants. Specific financial goals are vital to financial planning. Others can suggest financial goals for you; however, you must decide which goals to pursue. Your financial goals can range from spending all of your current income to developing an extensive savings and investment program for your future financial security.

Step 3: Identify Alternative Courses of Action

Developing alternatives is crucial when making decisions. Although many factors will influence the available alternatives, possible courses of action usually fall into these categories:

Continue the same course of action. For example, you may determine that the amount you have saved each month is still appropriate.

Expand the current situation. You may choose to save a larger amount each month.

Change the current situation. You may decide to use a money market account instead of a regular savings account.

Take a new course of action. You may decide to use your monthly saving budget to pay off credit card debts.

Not all of these categories will apply to every decision; however, they do represent possible courses of action. For example, if you want to stop working full-time to go to school, page 17you must generate several alternatives under the category “Take a new course of action.” Creativity in decision making is vital to effective choices. Considering all of the possible alternatives will help you make more effective and satisfying decisions. For instance, most people believe they must own a car to get to work or school. However, they should consider other alternatives such as public transportation, carpooling, renting a car, shared ownership of a car, or a company car.

Remember, when you decide not to take action, you elect to “do nothing,” which can be a dangerous alternative.

Step 4: Evaluate Your Alternatives

You need to evaluate possible courses of action, taking into consideration your life situation, personal values, and current economic conditions. How will the ages of dependents affect your saving goals? How do you like to spend leisure time? How will changes in interest rates affect your financial situation?

CONSEQUENCES OF CHOICES Every decision closes off alternatives. For example, a decision to invest in stock may mean you cannot take a vacation. A decision to go to school full-time may mean you cannot work full-time. Opportunity cost is what you give up by making a choice. These trade-offs cannot always be measured in dollars. However, the resources you give up (money or time) have a value that is lost.

EVALUATING RISK Uncertainty is also a part of every decision. Selecting a college major and choosing a career field involve risk. What if you don’t like working in this field or cannot obtain employment in it? Other decisions involve a very low degree of risk, such as putting money in an insured savings account or purchasing items that cost only a few dollars. Your chances of losing something of great value are low in these situations.

In many financial decisions, identifying and evaluating risk are difficult. Common risks to consider include:

Inflation risk, due to rising or falling (deflation) prices that cause changes in buying power.

Interest rate risk, resulting from changes in the cost of money, which can affect your costs (when you borrow) and benefits (when you save or invest).

Income risk may result from loss of a job or encountering illness.

page 18Personal risk involves tangible and intangible factors that create a less than desirable situation, such as health or safety concerns.

Liquidity risk occurs when savings and investments that have potential for higher earnings are difficult to convert to cash or to sell without significant loss in value.

The best way to consider risk is to gather information based on your experience and the experiences of others and to use financial planning information sources.

FINANCIAL PLANNING INFORMATION SOURCES Relevant information is required at each stage of the decision-making process. In addition to this book, common sources available to help you with your financial decisions include (1) online sources and apps; (2) financial institutions, such as banks, credit unions, and investment companies; (3) media sources, such as newspapers, magazines, television, radio, podcasts, and online videos; and (4) financial specialists, such as financial planners, insurance agents, investment advisors, credit counselors, lawyers, and tax preparers.

page 19

Step 5: Create and Implement Your Financial Action Plan

You are now ready to develop an action plan to identify ways to achieve your goals. For example, you can increase your savings by reducing your spending or by increasing your income through extra time on the job. If you are concerned about year-end tax payments, you may increase the amount withheld from each paycheck, file quarterly tax payments, or shelter current income in a tax-deferred retirement program.

To implement your financial action plan, you may need assistance from others. For example, you may use the services of an insurance agent to purchase property insurance or the services of an investment broker to purchase stocks, bonds, or mutual funds. Exhibit 1–4 offers a framework for developing and implementing a financial plan, along with examples for several life situations. Also, Appendix A provides information on financing your education.

Exhibit 1–4 Financial Planning in Action

According to AICPA Insights, common mistakes related to implementing a financial plan are:

Unrealistic expectations. Be sure your plan is based on sensible assumptions for income, spending, and saving amounts.

Emotional decision making. Do not let feelings and emotional reactions guide your actions.

Inflexibility. Be ready for unexpected events with an emergency fund and a contingency plan.

Inaction. Failing to deal with insurance needs or a tax situation will make any financial plan worthless.

Unclear values and priorities. Taking the wrong path will result in an inappropriate financial destination.

The Financial Literacy in Practice feature, “Which Path Will You Choose?,” provides guidelines for choosing your financial planning direction.

page 20

Step 6: Review and Revise Your Plan

Financial planning is a dynamic process that does not end when you take a particular action. You need to regularly assess your financial decisions. You should do a complete review of your finances at least once a year. Changing personal, social, and economic factors may require more frequent assessments.

When life events affect your financial needs, this financial planning process will provide a vehicle for adapting to those changes. A regular review of this decision-making process will help you adjust priorities to bring your financial goals and activities in line with your current life situation.

page 21

SOURCE: Kiplinger’s Personal Finance, May 2017, p. 72. Clark, Jane Bennett, “Merging their Money and Their Goals” Reprinted by permission from Kiplinger’s Personal Finance, May 2017. Copyright ©2017. The Kiplinger Washington Editors, Inc..

What actions resulted in achieving financial goals?

What financial decisions might be the basis of conflicts between couples?

What additional information is available at www.kiplinger.com to assist you with your financial decisions?

page 22

Career Choice and Financial Planning

Have you ever wondered why some people find great satisfaction in their work, while others only put in their time? As with other personal financial decisions, career selection and professional growth require planning. The lifework you select is a key to your financial well-being and personal satisfaction.

Like other decisions, career choice and professional development alternatives have risks and opportunity costs. In recent years, many people have placed family and personal fulfillment above monetary reward and professional recognition. Career choices require periodic evaluation of trade-offs related to personal, social, and economic factors.

In addition, changing personal and social factors will require you to continually assess your work situation. The steps of the financial planning process can guide your career planning, advancement, and career change. Your career goals will affect how you use this process. If you desire more responsibility on the job, for example, you may decide to obtain advanced training or change career fields. Appendix B provides guidance for obtaining employment and professional advancement.

page 23